0001682639

false

0001682639

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): August 10, 2023

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| |

Item 2.02. |

Results of Operations and Financial Condition. |

On August 10, 2023, Eyenovia,

Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2023. A

copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained

in this Item 2.02, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability

of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information

contained in this Item 2.02, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated

in any such filing.

| |

Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

| Date: August 10, 2023 |

/s/ John Gandolfo |

| |

John Gandolfo |

| |

Chief Financial Officer |

Exhibit 99.1

Eyenovia Reports Second Quarter 2023 Financial

Results and Provides Business Update

Announced FDA approval of and first commercial

sale of Mydcombi™, the only fixed dose combination of tropicamide and phenylephrine for mydriasis and the first FDA approved product

to utilize the Optejet®

Continued to advance its Phase 3 Apersure™

(Microline) presbyopia candidate following receipt of guidance from FDA that establishes an efficient path forward for the program

Company to host conference call and webcast

today, August 10, at 4:30 pm ET

NEW YORK—August 10, 2023—Eyenovia,

Inc. (NASDAQ: EYEN), an ophthalmic technology company commercializing Mydcombi™ (tropicamide+phenylephrine ophthalmic spray) for

mydriasis and developing the Optejet® device for use both in connection with its own drug-device therapeutic product candidates for

presbyopia and pediatric progressive myopia as well as out-licensing for additional indications, today announced its financial and operating

results for the second quarter ended June 30, 2023.

Second Quarter 2023 and Recent Business Developments

| · | Announced first commercial sale of Mydcombi to world-renowned board-certified ophthalmologist Dr. Nathan

M. Radcliffe, who becomes first to incorporate Mydcombi into his daily practice. The company will be following up with sales to key physicians

in the upcoming weeks and preparing for national launch in early 2024. |

| · | Advanced its pre-NDA presbyopia program, Apersure (Microline), and anticipates commencing the manufacture

of registration batches in the fourth quarter of 2023. |

| · | Continued to build out its manufacturing facilities in Redwood City, CA and Reno, NV, the former having

a PDUFA date in November 2023 for use as a commercial facility. |

| · | Delivered presentation at the annual OCTANE Ophthalmology Tech Forum 2023 reviewing the recent FDA approval

of Mydcombi. |

| · | Licensing partners Bausch+Lomb and Arctic Vision continued to enroll patients in their respective Phase

3 studies of Micropine (US and China) and Microline (China). |

| · | Announced addition to widely followed Russell 2000 and Russell 3000 Indexes. |

Michael Rowe, Chief Executive Officer, commented,

“We achieved very significant milestones since our last quarterly update, notably the FDA approval and first commercial sale of

Mydcombi, officially transitioning us to a commercial stage company. We are now executing a targeted launch of Mydcombi while in parallel

ramping up our internal manufacturing capabilities in anticipation of a broader campaign incorporating our Gen 2 Optejet device beginning

in 2024.

"Regarding our pre-NDA presbyopia candidate,

Apersure, we continue to advance this important program following receipt of feedback from FDA that established a clear and efficient

path forward. The addressable presbyopia market for topical ophthalmic medications is a nearly one-billion-dollar market opportunity in

the US alone, and we believe an effective solution that leverages our novel Optejet drug delivery platform and fits within the business

model of optometrists will be highly differentiated in the marketplace. We plan to initiate the manufacture of registration batches of

Apersure during the fourth quarter.

“We believe the approval and commercial

availability of Mydcombi will fundamentally transform the way that topical eye drugs are developed and delivered, as we now have critical

validation of our Optejet platform that will benefit not only our proprietary development programs, most notably Apersure, but current

and future partnerships as well. To that end, we continue to have very productive discussions with potential partners that could ultimately

see the Optejet incorporated into additional large market ophthalmology indications with persistent unmet needs.

“I am extremely pleased with our progress

to date and look forward to a productive back half of the year,” Mr. Rowe concluded.

Second Quarter 2023 Financial Review

For the second quarter of 2023, net loss was approximately

$(6.2) million, or $(0.16) per share compared to a net loss of approximately $(7.2) million, or $(0.22) per share, for the second quarter

of 2022.

Research and development expenses totaled approximately

$2.8 million for the second quarter of 2023 as compared to $3.6 million for the second quarter of 2022.

For the second quarter of 2023, general and administrative

expenses were approximately $3.1 million, compared to $3.5 million for the second quarter of 2022.

Total operating expenses for the second quarter

of 2023 were approximately $6.0 million compared to $7.1 million for the second quarter of 2022.

As of June 30, 2023, the Company’s cash

and cash equivalents were approximately $17.5 million compared to $22.9 million as of December 31, 2022.

Conference Call and Webcast

The conference call is scheduled to begin at 4:30

pm ET today, August 10. Participants should dial 1-877-407-9039 (domestic) or 1-201-689-8470 (international), and reference conference

ID 13739696.

To access the Call me™ feature, which avoids

having to wait for an operator, click here.

A live webcast of the conference call will also

be available on the investor relations page of the Company's corporate website at www.eyenovia.com. After the live webcast, the

event will be archived on Eyenovia’s website for one year.

IMPORTANT SAFETY INFORMATION for MYDCOMBI™ (tropicamide

and phenylephrine hydrochloride ophthalmic spray) 1%/2.5%

INDICATIONS

MYDCOMBI is indicated to induce mydriasis

for diagnostic procedures and in conditions where short term pupil dilation is desired

CONTRAINDICATIONS: In patients

with known hypersensitivity to any component of the formulation

WARNINGS AND PRECAUTIONS

FOR TOPICAL OPHTHALMIC

USE. NOT FOR INJECTION

This preparation may

cause CNS disturbances which may be dangerous in pediatric patients. The possibility of psychotic reaction and behavioral disturbance

due to hypersensitivity to anticholinergic drugs should be considered.

Mydriatics may produce

a transient elevation of intraocular pressure.

Significant elevations

in blood pressure have been reported. Caution in patients with elevated blood pressure.

Rebound miosis has been

reported one day after installation.

Remove contact lenses

before using.

DRUG INTERACTIONS

Atropine-like Drugs:

May exaggerate the adrenergic pressor response

Cholinergic Agonists

and Ophthalmic Cholinesterase Inhibitors: May interfere with the antihypertensive action of carbachol, pilocarpine, or ophthalmic

cholinesterase inhibitors

Potent Inhalation

Anesthetic Agents: May potentiate cardiovascular depressant effects of some inhalation anesthetic agents

ADVERSE REACTIONS

| · | Most common ocular adverse reactions include transient blurred vision, reduced visual acuity, photophobia, superficial punctate keratitis,

and mild eye discomfort. Increased intraocular pressure has been reported following the use of mydriatics. |

| · | Systemic adverse reactions including dryness of the mouth, tachycardia, headache, allergic reactions, nausea, vomiting, pallor, central

nervous system disturbances and muscle rigidity have been reported with the use of tropicamide. |

To report SUSPECTED ADVERSE REACTIONS,

contact Eyenovia, Inc. At 1-833-393-6684 or FDA at 1-800-FDA-1088 (www.fda.gov/medwatch)

Please go to www.mydcombi.com

for FULL PRESCRIBING INFORMATION

About Eyenovia, Inc.

Eyenovia, Inc. (NASDAQ:

EYEN) is an ophthalmic pharmaceutical technology company developing a pipeline of microdose array print therapeutics. Eyenovia is

currently focused on the commercialization of Mydcombi and the late-stage development of microdosed medications for presbyopia and myopia

progression. For more information, visit www.eyenovia.com.

The Eyenovia Corporate Information slide

deck may be found at ir.eyenovia.com/events-and-presentations.

Forward-Looking Statements

Except for historical

information, all of the statements, expectations and assumptions contained in this press release are forward-looking statements. Forward-looking

statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or

any other statements relating to our future activities or other future events or conditions, including estimated market opportunities

for our products, product candidates and platform technology. These statements are based on current expectations, estimates and projections

about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and in some cases are

likely to, differ materially from what is expressed or forecasted in the forward-looking statements. In addition, such statements could

be affected by risks and uncertainties related to, among other things: risks of our clinical trials, including, but not limited to, the

costs, design, initiation and enrollment, timing, progress and results of such trials; the timing of, and our ability to submit applications

for, obtaining and maintaining regulatory approvals for our product candidates; the potential impacts of any disruptions on our supply

chain, including the availability of sufficient components and materials used in our products and product candidates; the potential advantages

of our products, product candidates and platform technology; the rate and degree of market acceptance and clinical utility of our products

and product candidates; our estimates regarding the potential market opportunity for our products and product candidates; reliance on

third parties to develop and commercialize our products and product candidates; the ability of us and our partners to timely develop,

implement and maintain manufacturing, commercialization and marketing capabilities and strategies for our products and product candidates;

intellectual property risks; changes in legal, regulatory and legislative environments in the markets in which we operate and the impact

of these changes on our ability to obtain regulatory approval for our products; our competitive position; and other risks described from

time to time in the “Risk Factors” section of our filings with the U.S. Securities and Exchange Commission, including those

described in our Annual Report on Form 10-K as well as our Quarterly Reports on Form 10-Q, and supplemented from time to time by our Current

Reports on Form 8-K. Any forward-looking statements speak only as of the date on which they are made, and except as may be required under

applicable securities laws, Eyenovia does not undertake any obligation to update any forward-looking statements.

Eyenovia Contact:

Eyenovia, Inc.

John Gandolfo

Chief Financial Officer

jgandolfo@eyenovia.com

Eyenovia Investor Contact:

Eric Ribner

LifeSci Advisors, LLC

eric@lifesciadvisors.com

(646) 751-4363

Eyenovia

Media Contact:

Eyenovia, Inc.

Norbert Lowe

Vice President, Commercial Operations

nlowe@eyenovia.com

EYENOVIA, INC.

Condensed Balance Sheets

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 17,468,088 | | |

$ | 22,863,520 | |

| Deferred clinical supply costs | |

| 3,578,326 | | |

| 2,284,931 | |

| License fee and expense reimbursements receivable | |

| 429,006 | | |

| 1,183,786 | |

| Security deposits, current | |

| - | | |

| 119,550 | |

| Prepaid expenses and other current assets | |

| 1,801,373 | | |

| 1,190,719 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 23,276,793 | | |

| 27,642,506 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 3,698,421 | | |

| 1,295,115 | |

| Security deposits, non-current | |

| 198,674 | | |

| 80,874 | |

| Operating lease right-of-use asset | |

| 1,915,061 | | |

| 1,291,592 | |

| Equipment deposits | |

| 257,950 | | |

| 726,326 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 29,346,899 | | |

$ | 31,036,413 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,312,749 | | |

$ | 1,428,283 | |

| Accrued compensation | |

| 1,013,118 | | |

| 1,747,191 | |

| Accrued expenses and other current liabilities | |

| 363,431 | | |

| 503,076 | |

| Operating lease liabilities - current portion | |

| 427,749 | | |

| 484,882 | |

| Notes payable - current portion, net of debt discount of $91,621 | |

| | | |

| | |

| and $33,885 as of June 30, 2023 and December 31, 2022, respectively | |

| 947,163 | | |

| 174,448 | |

| Convertible notes payable - current portion, net of debt discount of $0 | |

| | | |

| | |

| and $33,885 as of June 30, 2023 and December 31, 2022, respectively | |

| - | | |

| 174,448 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 4,064,210 | | |

| 4,512,328 | |

| | |

| | | |

| | |

| Operating lease liabilities - non-current portion | |

| 1,584,218 | | |

| 907,644 | |

| Notes payable - non-current portion, net of debt discount of $1,120,372 | |

| | | |

| | |

| and $813,229 as of June 30, 2023 and December 31, 2022, respectively | |

| 8,683,794 | | |

| 4,190,938 | |

| Convertible notes payable - non-current portion, net of debt discount of $507,270 | |

| | | |

| | |

| and $813,229 as of June 30, 2023 and December 31, 2022, respectively | |

| 4,492,730 | | |

| 4,190,938 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 18,824,952 | | |

| 13,801,848 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' Equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 6,000,000 shares authorized; | |

| | | |

| | |

| 0 shares issued and outstanding as of June 30, 2023 and | |

| | | |

| | |

| December 31, 2022 | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 90,000,000 shares authorized; | |

| | | |

| | |

| 38,169,398 and 36,668,980 shares issued and outstanding | |

| | | |

| | |

| as of June 30, 2023 and December 31, 2022, respectively | |

| 3,817 | | |

| 3,667 | |

| Additional paid-in capital | |

| 140,703,819 | | |

| 135,461,361 | |

| Accumulated deficit | |

| (130,185,689 | ) | |

| (118,230,463 | ) |

| | |

| | | |

| | |

| Total Stockholders' Equity | |

| 10,521,947 | | |

| 17,234,565 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 29,346,899 | | |

$ | 31,036,413 | |

EYENOVIA, INC.

Condensed Statements of Operations

(unaudited)

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 2,811,061 | | |

$ | 3,586,866 | | |

$ | 5,333,011 | | |

$ | 7,299,450 | |

| General and administrative | |

| 3,149,809 | | |

| 3,534,590 | | |

| 6,086,695 | | |

| 7,009,555 | |

| Total Operating Expenses | |

| 5,960,870 | | |

| 7,121,456 | | |

| 11,419,706 | | |

| 14,309,005 | |

| Loss From Operations | |

| (5,960,870 | ) | |

| (7,121,456 | ) | |

| (11,419,706 | ) | |

| (14,309,005 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 119,450 | | |

| 33,376 | | |

| 190,443 | | |

| 26,303 | |

| Interest expense | |

| (558,003 | ) | |

| (153,436 | ) | |

| (1,012,006 | ) | |

| (298,673 | ) |

| Interest income | |

| 183,563 | | |

| 2,416 | | |

| 286,043 | | |

| 2,610 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (6,215,860 | ) | |

$ | (7,239,100 | ) | |

$ | (11,955,226 | ) | |

$ | (14,578,765 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share - Basic and Diluted | |

$ | (0.16 | ) | |

$ | (0.22 | ) | |

$ | (0.32 | ) | |

$ | (0.46 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Common | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| - Basic and Diluted | |

| 38,093,826 | | |

| 33,644,867 | | |

| 37,753,694 | | |

| 31,836,582 | |

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

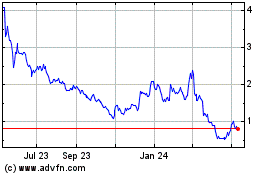

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

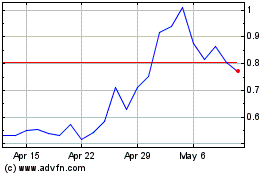

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Apr 2023 to Apr 2024