0000798941falseFirst Citizens BancShares Inc /DE/00007989412024-01-262024-01-260000798941us-gaap:CommonClassAMember2024-01-262024-01-260000798941us-gaap:SeriesAPreferredStockMember2024-01-262024-01-260000798941us-gaap:SeriesCPreferredStockMember2024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2024

_________________________________________________________________

First Citizens BancShares, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-16715 | 56-1528994 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 4300 Six Forks Road | Raleigh | North Carolina | 27609 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (919) 716-7000

________________________________________________________________________________

(Former name or former address, if changed since last report)

| | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

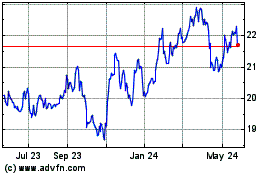

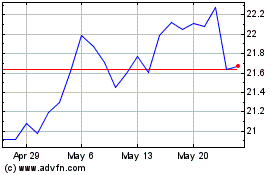

| Class A Common Stock, Par Value $1 | FCNCA | Nasdaq Global Select Market |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 5.375% Non-Cumulative Perpetual Preferred Stock, Series A | FCNCP | Nasdaq Global Select Market |

5.625% Non-Cumulative Perpetual Preferred Stock, Series C | FCNCO | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 26, 2024, First Citizens BancShares, Inc. (“BancShares”) announced its results of operations for the quarter ended December 31, 2023. A copy of BancShares’ press release and financial supplement containing this information is attached to this Current Report on Form 8-K (this “Report”) as Exhibit 99.1 and Exhibit 99.3, respectively, and is incorporated herein by reference. The press release and financial supplement are available on BancShares’ Internet site at http://www.ir.firstcitizens.com.

Item 7.01. Regulation FD Disclosure.

As previously announced, BancShares will host a conference call at 9a.m. Eastern time on Friday, January 26, 2024, to discuss its financial results for the quarter ended December 31, 2023. The slides that will be made available in connection with the presentation are attached as Exhibit 99.2 hereto and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein pursuant to Item 2.02, “Results of Operations and Financial Condition” and Item 7.01, “Regulation FD Disclosure,” including Exhibits 99.1, 99.2 and 99.3, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall the information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibits accompany this Report.

| | | | | | | | |

| Exhibit No. | | Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Disclosures About Forward-Looking Statements

This Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans, asset quality, future performance, and other strategic goals of BancShares. Words such as “anticipates,” “believes,” “estimates,” “expects,” “predicts,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will,” “potential,” “continue”, “aims” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BancShares’ current expectations and assumptions regarding BancShares’ business, the economy, and other future conditions.

Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other risk factors that are difficult to predict. Many possible events or factors could affect BancShares’ future financial results and performance and could cause the actual results, performance or achievements of BancShares to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, general competitive, economic, political, geopolitical events (including conflicts in Ukraine, Israel and the Gaza Strip) and market conditions, including changes in competitive pressures among financial institutions and the impacts related to or resulting from recent bank failures and other volatility, the financial success or changing conditions or strategies of BancShares’ vendors or customers, including changes in demand for deposits, loans and other financial services, fluctuations in interest rates, changes in the quality or composition of BancShares’ loan or investment portfolio, actions of government regulators, including the recent interest rate hikes by the Board of Governors of the Federal Reserve Board (the “Federal Reserve”), changes to estimates of future costs and benefits of actions taken by BancShares, BancShares’ ability to maintain adequate sources of funding and liquidity, the potential impact of decisions by the Federal Reserve on BancShares’ capital plans, adverse developments with respect to U.S. or global economic conditions, including the significant turbulence in the capital or financial markets, the impact of the current inflationary environment, the impact of implementation and compliance with current or proposed laws, regulations and regulatory interpretations, including potential increased regulatory requirements, limitations, and costs, such as FDIC special assessments and the interagency proposed rule

on regulatory capital, along with the risk that such laws, regulations and regulatory interpretations may change, the availability of capital and personnel, and the failure to realize the anticipated benefits of BancShares’ previous acquisition transactions, including the FDIC-assisted transaction with Silicon Valley Bridge Bank, N.A. (the “Acquisition”) and the previously completed transaction with CIT Group Inc. (“CIT”), which acquisition risks include (1) disruption from the transactions with customer, supplier or employee relationships, (2) the possibility that the amount of the costs, fees, expenses and charges related to the transactions may be greater than anticipated, including as a result of unexpected or unknown factors, events or liabilities or increased regulatory compliance obligations or oversight, (3) reputational risk and the reaction of the parties’ customers to the transactions, (4) the risk that the cost savings and any revenue synergies from the transactions may not be realized or take longer than anticipated to be realized, (5) difficulties experienced in completing the integration of the businesses, (6) the ability to retain customers following the transactions and (7) adjustments to BancShares’ estimated purchase accounting impacts of the Acquisition.

Except to the extent required by applicable laws or regulations, BancShares disclaims any obligation to update forward-looking statements or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Additional factors which could affect the forward-looking statements can be found in BancShares’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in BancShares’ subsequent quarterly reports on Form 10-Q and its other filings with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | First Citizens BancShares, Inc. | |

| | | (Registrant) | |

| | | | |

| | | | |

Date: | January 26, 2024 | | By: /s/ Craig L. Nix | |

| | | Name: Craig L. Nix | |

| | | Title: Chief Financial Officer | |

NEWS RELEASE

NEWS RELEASE

| | | | | | | | | | | | | |

| For Immediate Release | Contact: | Deanna Hart | | | Barbara Thompson |

| January 26, 2024 | | Investor Relations | | | Corporate Communications |

| | 919-716-2137 | | | 919-716-2716 |

|

FIRST CITIZENS BANCSHARES REPORTS FOURTH QUARTER 2023 EARNINGS

RALEIGH, N.C. -- First Citizens BancShares, Inc. (“BancShares”) (Nasdaq: FCNCA) reported earnings for the fourth quarter ended December 31, 2023.

Chairman and CEO Frank B. Holding, Jr. said: “Our fourth quarter financial results remained solid as we completed what was a truly exceptional year. While celebrating our bank’s 125th anniversary, we completed our integration with CIT and finished strong with the stabilization of SVB, all while our teams continued to support our clients. We now look forward to 2024, remaining focused on prudent risk management, growing our core lines of business, and maintaining solid capital and liquidity positions. We continue to be well-positioned to deliver strong financial results and long-term tangible book value growth for our stockholders.”

FINANCIAL HIGHLIGHTS

Measures referenced as adjusted below are non-GAAP financial measures (refer to the Financial Supplement available at ir.firstcitizens.com or www.sec.gov for a reconciliation of each non-GAAP measure to the most directly comparable GAAP measure). Net income for the three months ended December 31, 2023 was $514 million compared to $752 million for the three months ended September 30, 2023. Net income available to common stockholders for the three months ended December 31, 2023 was $499 million, or $34.33 per diluted common share, a $238 million decrease from $737 million, or $50.67 per diluted common share, in the third quarter of 2023.

For the fourth quarter, adjusted net income available to common stockholders was $678 million, or $46.58 per diluted common share, a $135 million decrease from $813 million, or $55.92 per diluted common share, in the third quarter of 2023.

Fourth quarter 2023 results were impacted by the following notable items to arrive at adjusted net income available to common stockholders:

•Acquisition-related expenses of $116 million,

•Decrease in the preliminary gain on acquisition of $83 million,

•FDIC insurance special assessment of $64 million,

•Intangible asset amortization of $17 million,

•Fair value adjustment on marketable equity securities of $9 million.

Financial highlights comparing significant components of net income and adjusted net income from the fourth quarter of 2023 to the third quarter of 2023 are summarized below:

•Net interest income totaled $1.91 billion compared to $1.99 billion in the third quarter. The $79 million decrease in net interest income was due to a $86 million increase in interest expense, partially offset by a $7 million increase in interest income.

•Interest income was $3.12 billion compared to $3.11 billion in the third quarter. The $7 million increase in interest income was due to an increase of $61 million in interest on investment securities from a higher average balance and increased yield, partially offset by a $35 million decrease in interest on loans and a $19 million decrease in interest on interest-earning deposits at banks. The decline in interest on loans was due to a $77 million decrease in loan accretion, primarily related to the acquisition of Silicon Valley Bridge Bank, N.A. (the “Acquisition”), partially offset by a $42 million increase in interest income on loans due to a higher yield. The $19 million decline in interest income on interest-earning deposits at banks was due to a lower average balance resulting from purchases of short duration investment securities.

•Interest expense was $1.21 billion compared to $1.12 billion in the third quarter. The $86 million increase in interest expense was due to a $96 million increase in interest expense on deposits, primarily from growth in the Direct Bank and a higher rate paid, partially offset by a $10 million decrease in borrowing costs from a lower rate paid and a lower average balance.

•Net interest margin was 3.86%, a decrease of 21 basis points compared to the third quarter. The yield on interest-earning assets was 6.30%, a decrease of 7 basis points from the third quarter. The decrease in yield on interest-earning assets was primarily due to a decrease of 9 basis points in the yield on loans, including a decrease of 16 basis points from lower loan accretion, which was partially offset by higher yields on loans. The rate on interest-bearing liabilities increased 17 basis points, primarily due to higher rates paid and average balances for interest-bearing deposits.

•Noninterest income totaled $543 million, a decrease of $72 million compared to the third quarter. The decrease was mainly due to a fourth quarter reduction of $83 million in the gain on acquisition as we further refined income tax estimates related to the Acquisition. This decrease was partially offset by the $12 million realized loss in the prior quarter from the sale of the municipal bond portfolio acquired in the Acquisition and a $10 million increase in the net fair value adjustment on marketable equity securities.

•Adjusted noninterest income totaled $455 million in the fourth quarter compared to $468 million in the third quarter, a decrease of $13 million. The decrease was primarily driven by an $11 million decrease in other noninterest income from a decline in the fair value of customer derivative positions as a result of declining interest rates, a $5 million decrease in adjusted rental income on operating lease equipment due to higher maintenance costs, and a $5 million decrease in cardholder services due to lower volume and higher rewards expense. The declines were partially offset by higher capital markets fees that led to a $9 million increase in fee income and other service charges.

•Noninterest expense totaled $1.49 billion compared to $1.42 billion in the third quarter, an increase of $76 million. The increase was largely related to the FDIC insurance special assessment in the amount of $64 million. Adjusted noninterest expense totaled $1.14 billion compared to $1.13 billion in the third quarter, an increase of $3 million. The increases in adjusted noninterest expense were primarily due to increases of $12 million in professional fees, $12 million in other noninterest expense, and $11 million in third-party processing fees, partially offset by an $18 million decrease in FDIC insurance expense and a $13 million decrease in salaries and benefits.

BALANCE SHEET SUMMARY

•Loans and leases totaled $133.30 billion at December 31, 2023, an increase of $100 million compared to $133.20 billion as of September 30, 2023. The increase was mostly related to $1.25 billion of growth in the General Bank (10.8% annualized) and $716 million of growth in the Commercial Bank (9.4% annualized). General Bank growth was primarily related to commercial and business loan growth in the branch network. Commercial Bank growth was driven primarily by strong performance in many of our industry verticals and middle market banking. The increases were partially offset by a $1.85 billion decline in the Silicon Valley Banking segment (the “SVB segment”), mostly concentrated in Global Fund Banking and Technology and Healthcare Banking portfolios.

•Total investment securities were $30.00 billion at December 31, 2023, an increase of $3.18 billion since September 30, 2023. The increase was primarily due to purchases of approximately $4.33 billion in short

duration U.S. Treasury and U.S. agency mortgage-backed investment securities available for sale during the quarter, which were partially offset by paydowns and maturities.

•Deposits totaled $145.85 billion at December 31, 2023, a decrease of $379 million, or 1.0% on an annualized basis, since September 30, 2023. Deposits grew by $1.63 billion in the General Banking segment, mainly due to a $2.02 billion increase in the Direct Bank, partially offset by a $492 million decrease in the branch network as a result of seasonal outflows. Deposits in the SVB segment declined by $1.49 billion, primarily due to continued client cash burn and muted fund raising activity in the innovation economy.

•Noninterest-bearing deposits represented 27.3% of total deposits as of December 31, 2023, compared to 29.5% at September 30, 2023. The cost of average total deposits was 2.35% for the fourth quarter, compared to 2.12% for the third quarter. While the cost of deposits increased 23 basis points, the pace decelerated from prior quarters.

•Funding mix remained stable with 79.5% of the total funding composed of deposits.

PROVISION FOR CREDIT LOSSES AND CREDIT QUALITY

•Provision for credit losses totaled $249 million for the fourth quarter compared to $192 million in the third quarter, an increase of $57 million. Fourth quarter provision for credit losses included $251 million for loan and lease losses, partially offset by a $2 million benefit for off-balance sheet credit exposure.

•The provision for loan and lease losses increased $39 million, primarily related to a net reserve build driven by specific reserves on individually evaluated loans as net charge-offs were flat over the prior quarter.

•The benefit for off-balance sheet credit exposure decreased $15 million, primarily due to a higher decline in unfunded commitments during the prior quarter.

•The benefit for credit losses for investment securities available for sale decreased $3 million compared to the third quarter.

•Net charge-offs totaled $177 million during the fourth quarter, representing 0.53% of average loans, compared to $176 million, or 0.53% of average loans, during the third quarter. Net charge-offs in the Commercial Bank were $94 million, an increase of $36 million from the third quarter, and were primarily in Equipment Finance, real estate finance and the energy vertical. Net charge-offs in the SVB segment were $65 million, a decrease of $35 million from the third quarter, and were primarily concentrated in the investor dependent portfolios. Net charge-offs in the General Bank were unchanged at $18 million.

•Nonaccrual loans were $969 million, or 0.73% of loans, at December 31, 2023, compared to $899 million, or 0.68% of loans, at September 30, 2023.

•The allowance for loan and lease losses totaled $1.75 billion, or 1.31% of total loans, at December 31, 2023, an increase of $74 million compared to the third quarter of 2023. The $74 million reserve build for the quarter was primarily the result of mild credit quality deterioration in our commercial portfolios, including general office, increases in specific reserves in the investor dependent portfolio and changes in the macroeconomic forecasts.

CAPITAL AND LIQUIDITY

•Capital position remains strong and capital ratios are well above regulatory requirements. The estimated total risk-based capital, Tier 1 risk-based capital, Common equity Tier 1 risk-based capital, and Tier 1 leverage ratios were 15.74%, 13.94% , 13.36% , and 9.83%, respectively, at December 31, 2023.

•During the fourth quarter, a dividend of $1.64 per share of common stock was declared.

•Liquidity position remains strong as liquid assets were $57.28 billion at December 31, 2023 compared to $57.02 billion at September 30, 2023.

EARNINGS CALL/ WEBCAST DETAILS

BancShares will host a conference call to discuss the company's financial results on Friday, January 26, 2024, at 9:00 a.m. Eastern time.

The call may be accessed via webcast on the company’s website at ir.firstcitizens.com, or through the dial in details below:

United States: 1-833-470-1428

Canada: 1-833-950-0062

All other locations: 1-929-526-1599

Access code: 268898

Our earnings release, investor presentation, and financial supplement are available at ir.firstcitizens.com. In addition, these materials will be furnished to the Securities and Exchange Commission (the “SEC”) on a Form 8-K and will be available on the SEC website at www.sec.gov. After the event, a replay of the call will be available via webcast at ir.firstcitizens.com.

ABOUT FIRST CITIZENS BANCSHARES

First Citizens BancShares, Inc., a top 20 U.S. financial institution with more than $200 billion in assets, is the financial holding company for First-Citizens Bank & Trust Company ("First Citizens Bank"). Headquartered in Raleigh, N.C., First Citizens Bank has built a unique legacy of strength, stability and long-term thinking that has spanned generations. First Citizens offers an array of general banking services including a network of more than 500 branches and offices in 30 states; commercial banking expertise delivering best-in-class lending, leasing and other financial services coast to coast; innovation banking serving businesses at every stage; and a nationwide direct bank. Discover more at firstcitizens.com.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans, asset quality, future performance, and other strategic goals of BancShares. Words such as “anticipates,” “believes,” “estimates,” “expects,” “predicts,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will,” “potential,” “continue,” “aims” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BancShares’ current expectations and assumptions regarding BancShares’ business, the economy, and other future conditions.

Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other risk factors that are difficult to predict. Many possible events or factors could affect BancShares’ future financial results and performance and could cause the actual results, performance or achievements of BancShares to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, general competitive, economic, political, geopolitical events (including conflicts in Ukraine, Israel and the Gaza Strip) and market conditions, including changes in competitive pressures among financial institutions and the impacts related to or resulting from recent bank failures and other volatility, the financial success or changing conditions or strategies of BancShares’ vendors or customers, including changes in demand for deposits, loans and other financial services, fluctuations in interest rates, changes in the quality or composition of BancShares’ loan or investment portfolio, actions of government regulators, including the recent interest rate hikes by the Board of Governors of the Federal Reserve Board (the “Federal Reserve”), changes to estimates of future costs and benefits of actions taken by BancShares, BancShares’ ability to maintain adequate sources of funding and liquidity, the potential impact of decisions by the Federal Reserve on BancShares’ capital plans, adverse developments with respect to U.S. or global economic conditions, including the significant turbulence in the capital or financial markets, the impact of the current inflationary environment, the impact of implementation and compliance with current or proposed laws, regulations and regulatory interpretations, including potential increased regulatory requirements, limitations, and

costs, such as FDIC special assessments and the interagency proposed rule on regulatory capital, along with the risk that such laws, regulations and regulatory interpretations may change, the availability of capital and personnel, and the failure to realize the anticipated benefits of BancShares’ previous acquisition transactions, including the Acquisition and the previously completed transaction with CIT Group Inc. (“CIT”), which acquisition risks include (1) disruption from the transactions with customer, supplier or employee relationships, (2) the possibility that the amount of the costs, fees, expenses and charges related to the transactions may be greater than anticipated, including as a result of unexpected or unknown factors, events or liabilities or increased regulatory compliance obligations or oversight, (3) reputational risk and the reaction of the parties’ customers to the transactions, (4) the risk that the cost savings and any revenue synergies from the transactions may not be realized or take longer than anticipated to be realized, (5) difficulties experienced in completing the integration of the businesses, (6) the ability to retain customers following the transactions and (7) adjustments to BancShares’ estimated purchase accounting impacts of the Acquisition.

Except to the extent required by applicable laws or regulations, BancShares disclaims any obligation to update forward-looking statements or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Additional factors which could affect the forward-looking statements can be found in BancShares’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in BancShares’ subsequent quarterly reports on Form 10-Q and its other filings with the SEC.

NON-GAAP MEASURES

Certain measures in this release and supporting tables, including those referenced as “Adjusted,” are “non-GAAP”, meaning they are not presented in accordance with generally accepted accounting principles in the U.S. and also are not codified in U.S. banking regulations currently applicable to BancShares. BancShares believes that non-GAAP financial measures, when reviewed in conjunction with GAAP financial information, can provide transparency about or an alternative means of assessing its operating results and financial position to its investors, analysts and management. Each non-GAAP measure is reconciled to the most comparable GAAP measure in the non-GAAP reconciliation. This information can be found in the Financial Supplement located in the Quarterly Results section of our website at https://ir.firstcitizens.com/financial-information/quarterly-results/default.aspx.

First Citizens BancShares, Inc. Fourth Quarter 2023 Earnings Conference Call January 26, 2024

2 Agenda Pages Section I – Fourth Quarter Overview & Strategic Priorities 4 – 7 Section II – Fourth Quarter 2023 Financial Results 8 – 29 Financial Highlights 9 – 10 Earnings Highlights 11 Net interest income, margin and betas 12 – 14 Noninterest income and expense 15 – 16 Balance Sheet Highlights 17 Loans and Leases 18 – 19 Deposits and Funding Mix 20 – 22 Credit Quality Trends and Allowance 23 – 27 Capital 28 Regulatory Proposal Update 29 Section III – Financial Outlook 30 – 31 Section IV – Appendix 32 – 45 Section V – Non-GAAP Reconciliations 46 – 51

3 Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans, asset quality, future performance and other strategic goals of First Citizens BancShares, Inc. ("BancShares” or “First Citizens”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “predicts,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will,” “potential,” “continue”, “aims” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on BancShares’ current expectations and assumptions regarding BancShares’ business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other risk factors that are difficult to predict. Many possible events or factors could affect BancShares’ future financial results and performance and could cause the actual results, performance or achievements of BancShares to differ materially from any anticipated results expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others, general competitive, economic, political, geopolitical events (including conflicts in Ukraine, Israel and the Gaza Strip) and market conditions, including changes in competitive pressures among financial institutions and the impacts related to or resulting from recent bank failures and other volatility, the financial success or changing conditions or strategies of BancShares’ vendors or clients, including changes in demand for deposits, loans and other financial services, fluctuations in interest rates, changes in the quality or composition of BancShares’ loan or investment portfolio, actions of government regulators, including the recent interest rate hikes by the Board of Governors of the Federal Reserve Board (the “Federal Reserve”), changes to estimates of future costs and benefits of actions taken by BancShares, BancShares’ ability to maintain adequate sources of funding and liquidity, the potential impact of decisions by the Federal Reserve on BancShares’ capital plans, adverse developments with respect to U.S. or global economic conditions, including the significant turbulence in the capital or financial markets, the impact of the current inflationary environment, the impact of implementation and compliance with current or proposed laws, regulations and regulatory interpretations, including potential increased regulatory requirements, limitations, and costs, such as FDIC special assessment and the interagency proposed rule on regulatory capital, along with the risk that such laws, regulations and regulatory interpretations may change, the availability of capital and personnel, and the failure to realize the anticipated benefits of BancShares’ previous acquisition transactions, including the previously completed FDIC-assisted transaction with Silicon Valley Bridge Bank, N.A. (“SVB acquisition”) and the previously completed transaction with CIT Group Inc. (“CIT”), which acquisition risks include (1) disruption from the transactions with client, supplier or employee relationships, (2) the possibility that the amount of the costs, fees, expenses and charges related to the transactions may be greater than anticipated, including as a result of unexpected or unknown factors, events or liabilities or increased regulatory compliance obligations or oversight, (3) reputational risk and the reaction of the parties’ clients to the transactions, (4) the risk that the cost savings and any revenue synergies from the transactions may not be realized or take longer than anticipated to be realized, (5) difficulties experienced in completing the integration of the businesses, (6) the ability to retain clients following the transactions and (7) adjustments to BancShares’ estimated purchase accounting impacts of the SVB acquisition. The statements herein speak only as of the date of this presentation and, except to the extent required by applicable laws or regulations, BancShares disclaims any obligation to update forward- looking statements or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Additional factors which could affect the forward-looking statements can be found in BancShares’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and in BancShares’ subsequent quarterly reports on Form 10-Q and its other filings with the Securities and Exchange Commission (the “SEC”). Readers should not place undue reliance on any forward-looking statements and are encouraged to review BancShares’ annual Report on Form 10-K and its other filings with the SEC for a more complete discussion of risks and other factors that could affect any forward-looking statement. Non-GAAP Measures Certain measures in this presentation are “Non-GAAP,” meaning they are numerical measures of BancShares’ financial performance, financial position or cash flows and are not presented in accordance with generally accepted accounting principles in the U.S. because they exclude or include amounts so as to be different than the most direct comparable measures calculated and presented in accordance with GAAP in BancShares’ statements of income, balance sheets or statements of cash flows and also are not codified in U.S. banking regulations currently applicable to BancShares. BancShares believes that Non-GAAP financial measures, when reviewed in conjunction with GAAP financial information, can provide transparency about or an alternative means of assessing its operating results and financial position to its investors, analysts and management. Certain financial results referenced as “Adjusted” in this presentation exclude notable items. The Adjusted financial measures are Non-GAAP. Refer to Section V of this presentation for a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP measure. Reclassifications In certain instances, amounts reported in prior period consolidated financial statements have been reclassified to conform to the current financial statement presentation. Such reclassifications had no effect on previously reported stockholders’ equity or net income. The methodologies that we use to allocate items among our segments are dynamic and may be updated periodically to reflect enhanced expense base allocation drivers, changes in the risk profile of a segment or changes in our organizational structure. Accordingly, financial results may be revised periodically to reflect these enhancements. Important Notices

Fourth Quarter Overview & Strategic Priorities Section I

5 Fourth Quarter 2023 Snapshot First Citizens continued to deliver strong performance demonstrating the benefits that increased scale and diversified offerings bring to the franchise. Key Accomplishments: ■ Solid financial results driven by strong NIM and an adjusted efficiency ratio (1) of 48%. ■ Experienced strong loan growth in the General and Commercial Bank. ■ Continued stabilization in the SVB franchise with loan and deposit balances ahead of forecast. ■ Capital and liquidity positions remained strong. ■ Strengthened our leadership and governance with the appointment of a new board member and the expansion of our executive leadership team with the addition of a new Chief Information and Operations Officer, both of which were effective in January 2024. Financial Highlights: Adjusted EPS (1) $46.58 Adjusted ROE / ROA (1) 13.53% / 1.28% NIM 3.86% Adjusted Efficiency Ratio (1) 48.00% CET1 Ratio 13.36% (1) Non-GAAP metric. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures.

6 Strategic Priorities First Citizens Strategic Priorities Risk Management • Maximize growth opportunities in our core lines of business and optimize funding by growing core deposits. • Deliver specialized business solutions across all business lines and channels. • Remain a key partner to the innovation economy. • Attract, retain and develop associates who align with our long-term direction and culture while scaling for continued growth. • Continue to build a leading culture based on behaviors that demonstrate our shared values, regardless of the legacy organization. • Execute on SVB integration to optimize revenue and deliver integration synergies, while retaining and growing client base. • Remain focused on balance sheet management to optimize our long- term liquidity position through core deposit growth. • Support regulatory readiness and successfully implement enhanced regulatory requirements. • Continue to enhance program to support compliance and position the Bank for future growth. Client-Focused Business Model Talent & Culture Operational Efficiency Regulatory Readiness

7 • Completed first full year of monitoring and examination under the large bank regulatory framework. • Expect continued investment to support regulatory readiness as we are committed to meeting regulatory expectations. Regulatory Readiness (Large Bank Program) Key Activities 1 2 3Maintain & grow market position as an important partner in the innovation economy Continue to build trust with client base & defend against competition Retain key talent and optimize the workforce to drive revenue growth Integration Priorities • Conducted robust client outreach program to stabilize deposits. • Established leadership team at SVB and set initial strategic priorities. • Stabilized key talent and began workforce optimization. Stabilization Strategic Assessment • Completed initial round of business unit strategic assessments. • Established key integration initiatives. • Completed initial strategic planning cycle as a combined company. • Developed integration roadmap and expect the majority of integration efforts to be completed in 2024. • On track to complete legacy SVB Private conversion in 1Q24. • Continue to make progress on cost saving initiatives. Integration IN PROGRESS Maintain sound risk management practices COMPLETE Continued Progress on SVB Integration Initiatives

Fourth Quarter 2023 Financial Results Section II

9 4Q23 Financial Results - Takeaways Quarter-to-date Year-to-date Mar 23 Dec 22 Mar 22 Mar 23 Dec 21 EPS $ 16.67 $ 20.94 $ 19.25 $ 20.77 $ 12.09 $ 12.82 $ 67.40 $ 77.24 $ 53.88 $ 51.88 ROE 11.05 % 13.89 % 12.49 % 13.47 % 10.96 % 11.63 % 11.15 % 12.78 % 12.84 % 12.36 % ROTCE 11.70 % 14.71 % 13.17 % 14.20 % 12.00 % 12.72 % 11.78 % 13.50 % 14.12 % 13.60 % ROA 0.93 % 1.15 % 1.16 % 1.24 % 1.20 % 1.09 % 1.01 % 1.15 % 1.33 % 1.10 % PPNR ROA 1.70 % 1.81 % 1.72 % 1.86 % 1.33 % 1.17 % 1.84 % 1.64 % 1.41 % 1.11 % NIM 3.36 % 3.36 % 3.40 % 3.40 % 2.56 % 2.56 % 3.14 % 3.14 % 2.55 % 2.55 % Net charge-off ratio 0.14 % 0.14 % 0.10 % 0.10 % 0.04 % 0.04 % 0.12 % 0.12 % 0.08 % 0.08 % Efficiency ratio 61.74 % 54.08 % 61.91 % 53.32 % 65.40 % 62.51 % 60.50 % 56.40 % 64.43 % 64.34 % Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Achieved solid adjusted EPS, ROE and ROA results in line with our forecast.1 While net interest margin declined during the quarter as anticipated, PPNR exceeded expectations on favorable net revenue and expenses in line with forecast. 2 Continued low levels of private equity / venture capital activity remained a headwind for loan and deposit growth in the SVB segment. 6 Maintained strong capital and liquidity positions.7 Client outreach efforts continue to be successful as SVB deposit balances remained relatively stable and exceeded our expectations. 5 Credit cost normalization continued with the net charge-off ratio flat with the previous quarter. The reserve build was driven primarily by mild credit quality deterioration in the commercial portfolio. 3 Loan growth was strong in the General and Commercial Bank. 4 Continued to build-out and execute on new regulatory capabilities that position us to meet the requirements of the large financial institutions’ framework. 8

10 4Q23 3Q23 4Q22 EPS $ 34.33 $ 46.58 $ 50.67 $ 55.92 $ 16.67 $ 20.94 ROE 9.97 % 13.53 % 15.20 % 16.77 % 11.05 % 13.89 % ROTCE 10.32 14.00 15.76 17.39 11.70 14.71 ROA 0.95 1.28 1.41 1.55 0.93 1.15 PPNR ROA 1.78 2.27 2.23 2.48 1.70 1.81 NIM 3.86 3.86 4.07 4.07 3.39 3.39 Net charge-off ratio 0.53 0.53 0.53 0.53 0.14 0.14 Efficiency ratio 60.80 48.00 54.34 46.04 61.74 54.08 Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Financial Highlights Quarter-to-date Year-to-date Mar 23 Dec 22 Mar 22 Mar 23 Dec 21 EPS $ 16.67 $ 20.94 $ 19.25 $ 20.77 $ 12.09 $ 12.82 $ 67.40 $ 77.24 $ 53.88 $ 51.88 ROE 11.05 % 13.89 % 12.49 % 13.47 % 10.96 % 11.63 % 11.15 % 12.78 % 12.84 % 12.36 % ROTCE 11.70 % 14.71 % 13.17 % 14.20 % 12.00 % 12.72 % 11.78 % 13.50 % 14.12 % 13.60 % ROA 0.93 % 1.15 % 1.16 % 1.24 % 1.20 % 1.09 % 1.01 % 1.15 % 1.33 % 1.10 % PPNR ROA 1.70 % 1.81 % 1.72 % 1.86 % 1.33 % 1.17 % 1.84 % 1.64 % 1.41 % 1.11 % NIM 3.36 % 3.36 % 3.40 % 3.40 % 2.56 % 2.56 % 3.14 % 3.14 % 2.55 % 2.55 % Net charge-off ratio 0.14 % 0.14 % 0.10 % 0.10 % 0.04 % 0.04 % 0.12 % 0.12 % 0.08 % 0.08 % Efficiency ratio 61.74 % 54.08 % 61.91 % 53.32 % 65.40 % 62.51 % 60.50 % 56.40 % 64.43 % 64.34 % Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Reported Adjusted (Non-GAAP) Note – Adjusted ratios exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures.

11 Reported Increase (decrease) 4Q23 vs. 3Q23 4Q23 vs. 4Q22 4Q23 3Q23 4Q22 $ % $ % Net interest income $ 1,911 $ 1,990 $ 802 $ (79) (3.9) % $ 1,109 138.4 % Noninterest income 543 615 429 (72) (11.6) 114 26.7 Net revenue 2,454 2,605 1,231 (151) (5.8) 1,223 99.4 Noninterest expense 1,492 1,416 760 76 5.5 732 96.4 Pre-provision net revenue 962 1,189 471 (227) (19.1) 491 104.2 Provision for credit losses 249 192 79 57 29.3 170 217.6 Income before income taxes 713 997 392 (284) (28.4) 321 81.9 Income taxes 199 245 135 (46) (18.6) 64 47.0 Net income 514 752 257 (238) (31.6) 257 100.3 Preferred stock dividends 15 15 14 — 0.6 1 14.5 Net income available to common stockholders $ 499 $ 737 $ 243 $ (238) (32.2) % $ 256 105.0 % Adjustment for notable items 4Q23 3Q23 4Q22 Noninterest income $ (88) $ (147) $ (139) Noninterest expense (357) (284) (170) Provision for credit losses — 3 — Income taxes 90 58 (32) Adjusted (Non-GAAP) Increase (decrease) 4Q23 vs. 3Q23 4Q23 vs. 4Q22 4Q23 3Q23 4Q22 $ % $ % Net interest income $ 1,911 $ 1,990 $ 802 $ (79) (3.9) % $ 1,109 138.4 % Noninterest income 455 468 290 (13) (2.8) 165 56.9 Net revenue 2,366 2,458 1,092 (92) (3.7) 1,274 116.7 Noninterest expense 1,135 1,132 590 3 0.4 545 92.5 Pre-provision net revenue 1,231 1,326 502 (95) (7.2) 729 145.2 Provision for credit losses 249 195 79 54 27.5 170 217.6 Income before income taxes 982 1,131 423 (149) (13.2) 559 131.9 Income taxes 289 303 103 (14) (4.5) 186 179.3 Net income 693 828 320 (135) (16.4) 373 116.6 Preferred stock dividends 15 15 14 — 0.6 1 14.5 Net income available to common stockholders $ 678 $ 813 $ 306 $ (135) (16.7) % $ 372 121.0 % Quarterly Earnings Highlights ($ in millions) Note – Adjusted amounts exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures.

12 $802 $850 $1,961 $1,990 $1,911 3.39% 3.41% 4.11% 4.07% 3.86% NII NIM 4Q22 1Q23 2Q23 3Q23 4Q23 $2,441 $2,946 2.55% 3.14% YTD Dec 21 YTD Dec 22 4Q23 vs 3Q23 Net interest income decreased by $79 million due to a $86 million increase in interest expense, partially offset by a $7 million increase in interest income. The significant components of the changes follow: • $96 million increase in interest expense on deposits due to a higher rate paid and a higher average balance, • $35 million decrease in interest income on loans. Accretion on loans declined by $77 million, partially offset by a $42 million increase in interest income on loans due to a higher yield, and a • $19 million decrease in interest income on overnight investments due to lower average balances; partially offset by a • $62 million increase in interest on investment securities due to a higher average balance and yield as we continued to shift balances from cash into short duration investment securities. NIM contracted by 21 basis points from 4.07% to 3.86%. See the following page for a rollforward of NIM between 3Q23 and 4Q23. YTD December 2022 vs YTD December 2021 Net interest income increased by $505 million due to a $483 million increase in interest income and a $22 million decrease in interest expense. The change in net interest income was primarily due to the following: ◦ $256 million increase on interest income on loans due to a higher yield and growth offset by lower SBA- PPP interest and fee income and lower accretion income, ◦ $138 million increase in interest income on investment securities due to higher yield and average balance, ◦ $118 million decline in interest expense on borrowings due to a lower rate and average balance, ◦ $89 million increase in interest income on overnight investments due to a higher yield despite a lower average balance; partially offset by a ◦ $96 million increase in interest expense on deposits due to a higher rate paid. NIM expanded from 2.55% to 3.14%. $505 million & 59 bps Highlights $(79) million & (-21 bps) 4Q23 vs 4Q22 Net interest income increased by $1.1 billion due to a $2.1 billion increase in interest income, partially offset by a $1.0 billion increase in interest expense. The significant components of the changes follow: • $1.5 billion increase in interest income on loans due to a higher average balance and increased loan accretion of $181 million, both as a result of the SVB acquisition, an increase in loan yield, and loan growth in the General Bank and Commercial Bank, • $429 million increase in interest on overnight investments due to a higher average balance resulting from the SVB acquisition and a higher yield; partially offset by a • $689 million increase in interest expense on deposits due to a higher average balance resulting from the SVB acquisition, deposit growth, and a higher rate paid, and a • $279 million increase in interest expense on borrowings primarily due to the Purchase Money Note related to the SVB acquisition. NIM expanded 47 basis points from 3.39% to 3.86%. See the following page for a rollforward of NIM between 4Q22 and 4Q23. Net interest income and margin (NIM) ($ in millions)

13 3.39% 1.06% 0.33% 0.24% 0.22% (1.13)% (0.25)% 3.86% 4Q22 Loan yield Yield on FFS Purchase accounting Investment yield Deposit rate Funding mix 4Q23 4Q22 to 4Q23 (+47 bps) NIM Rollforward 4.07% 0.10% 0.06% 0.02% (0.16)% (0.13)% (0.06)% (0.04)% 3.86% 3Q23 Loan yield Investment yield Debt volume Purchase accounting Deposit rate Earning asset mix Deposit volume 4Q23 3Q23 to 4Q23 (-21 bps) (1) (1) Includes purchase accounting impact between March 27, 2023 and March 31, 2023. (1) FFS represents Fed Funds Sold. (1) NIM rollforward has not been finalized. Will be provided in the next draft Craig - We added in earning asset mix on the current quarter roll as the straight math was showing a decline in loans due to volume despite stable average balances. The reason is really because loans as a percentage of interest earning assets declined so we discussed with Tom and decided the best approach was to net with the changes in investment and FFS volume and call earning asset mix.

14 Historical and Forecasted Cumulative Deposit Beta Highlights • We are forecasting our cumulative deposit beta to increase to a terminal beta of approximately 44% as a result of higher for longer interest rates. Actual betas will be dependent on liquidity needs, behavior of acquired deposits, deposit mix and levels of overall competition. • The increase in the mid/high beta categories in the third quarter was primarily driven by balance growth in the Direct Bank as part of our liquidity management activities. • Mid/higher beta categories: ◦ > 30% beta on Direct Bank and SVB money market, savings and time deposit accounts. ◦ 10 to 30% beta on branch network money market accounts and Community Association Banking checking with interest and money market accounts. • Lower beta categories: ◦ 0 to 10% beta on total noninterest bearing deposits and branch network checking with interest and savings accounts. 56% 58% 54% 43% 43% 44% 42% 46% 57% 57% Mid/higher beta categories Lower beta categories 4Q22 1Q23 2Q23 3Q23 4Q23 23% 30% 37% 42% 44% 42% 40% Actual cumulative beta Expected cumulative beta 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Actual Forecast Terminal beta 1.68% 2.12% 2.35% Rate paid on deposits 1.24%

15 $10,259 $429 $658 $615 $543 $290 $309 $462 $468 $455 $139 $141 $135 $171 $55 $12 $(83) 4Q22 1Q23 2Q23 3Q23 4Q23 $295 $171 1Q23 SVB contribution $1,940 $2,136 $996 $1,141 $944 $995 YTD Dec 21 YTD Dec 22 4Q23 vs 3Q23 Noninterest income decreased by $72 million. Adjusted noninterest income (1) decreased by $13 million. Significant components included: • $11 million decrease in other noninterest income driven primarily by a $12 million decline in the fair value of customer derivative positions as a result of declining interest rates, • $5 million decrease in net rental income on operating lease equipment due to higher maintenance expenses, partially offset by higher rental income, and a • $5 million decrease in cardholder services due to lower volume and higher rewards expenses; partially offset by a • $9 million increase in fee income and other service charges resulting from higher capital markets fees. Notable items total $88 million compared to $147 million in the prior quarter. Refer to Section V of this presentation for notable item details. YTD22 vs YTD21 Noninterest income increased $196 million. Significant components of the change were: ◦ Rental income on operating leases increased $91 million due to the same reasons as in the linked quarter. Expenses on operating lease equipment declined $16 million resulting in a $107 million increase in adjusted rental income. ◦ Cardholder services income, net increased $15 million due to higher volume and fee income and other service charges increased $14 million, primarily due to higher capital markets and portfolio servicing fees. ◦ Wealth management services increased $13 million due to increased brokerage transactions and higher assets under management. ◦ Other noninterest income increased $63 million spread among various line items, including a $431 million bargain purchase gain, partially offset by a $147 million decline in investment gains and a $188 million decline in gains on asset and loan sales. Highlights Noninterest income ($ in millions) Core: ### increase 4Q23 vs 4Q22 Noninterest income increased by $114 million. Adjusted noninterest income (1) increased by $165 million. Significant components included: • $51 million increase in client investment fees earned for managing off-balance sheet client funds primarily in the SVB segment, • $37 million increase in fee income and other service charges primarily due to the SVB segment, • $27 million increase in international fees which are FX fees primarily in the SVB segment, and a • $22 million increase in service charges on deposits primarily due to the SVB segment. Notable items totaled $88 million compared to $139 million in the prior year quarter. Refer to Section V of this presentation for notable item details. (1) Adjusted amounts exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures. (2) Excludes gain on acquisition as it is broken out separately. $126 Adjusted (Non-GAAP) (1) Notable items (2) Gain on acquisition $9,824 $139 - total notable items $88 - total notable items $455 - total adjusted (Non-GAAP) (1) $9,950 - total notable items $147 - total notable items $196 - total notable items $88 - total notable items

16 Notable items $760 $855 $1,572 $1,416 $1,492 $590 $677 $1,202 $1,132 $1,135 $170 $178 $370 $284 $357 4Q22 1Q23 2Q23 3Q23 4Q23 4Q23 vs 4Q22 Noninterest expense increased by $732 million. Adjusted noninterest expense (1) increased by $545 million primarily due to the impacts of the SVB acquisition. Significant components included: • $360 million increase in salaries and benefits, • $59 million increase in equipment expense, • $41 million increase in other noninterest expense spread among various accounts, and a • $39 million increase in third-party processing fees. Notable items totaled $357 million compared to $170 million in the prior year quarter. Refer to Section V of this presentation for notable items details. Adjusted efficiency ratio (1) improved from 54.08% to 48.00%. 4Q23 vs 3Q23 Noninterest expense increased by $76 million. Adjusted noninterest expense (1) increased by $3 million. Significant components included: • $12 million increase in professional fees, • $12 million increase in other noninterest expense spread amongst various accounts, and a • $11 million increase in third party processing fees; partially offset by a • $18 million decrease in FDIC insurance expense, and a • $13 million decrease in salaries and benefits. Notable items totaled $357 million compared to $284 million in the prior quarter. Refer to Section V of this presentation for notable item details. Adjusted efficiency ratio (1) increased from 46.04% to 48.00%. YTD22 vs YTD21 Noninterest expense increased $252 million. Significant components of the change were: ◦ Merger-related expenses increased $194 million. ◦ Salaries and benefits expense increased $53 million as a result of merger-related costs, wage increases, revenue- based incentives and temporary personnel costs, partially offset by net staff reductions. ◦ Marketing costs increased $23 million due to the same reasons as the quarterly increases. ◦ Third-party processing expenses increased $14 million and other operating expenses increased $14 million; ◦ Partially offset by an $18 million reduction in FDIC insurance premiums, a $16 million decline in expenses on operating leases, and a $12 million reduction in professional fees. Efficiency ratio improved from 64.43% to 60.50%. Adjusted efficiency ratio improved from 64.34% to 56.40% as adjusted net revenue grew 19% and adjusted noninterest expense grew 4%. Noninterest expense ($ in millions) $2,823 $3,075 $2,212 $2,305 $611 $770 YTD Dec 21 YTD Dec 22 Adjusted (Non-GAAP) (1) (1) Adjusted noninterest expense and adjusted efficiency ratio are Non-GAAP and exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures. Highlights

17 17 Increase (decrease) 4Q23 vs 3Q23 4Q23 vs 4Q22 SELECT PERIOD END BALANCES 4Q23 3Q23 4Q22 $ % $ % Interest-earning deposits at banks $ 33,609 $ 36,704 $ 5,025 $ (3,095) (33.5) % $ 28,584 568.9 % Investment securities 29,999 26,818 19,369 3,181 47.1 10,630 54.9 Loans and leases 133,302 133,202 70,781 100 0.3 62,521 88.3 Operating lease equipment, net (2) 8,746 8,661 8,156 85 3.9 590 7.2 Deposits 145,854 146,233 89,408 (379) (1.0) 56,446 63.1 Noninterest-bearing deposits 39,799 43,141 24,922 (3,342) (30.7) 14,877 59.7 Borrowings 37,654 37,712 6,645 (58) (0.6) 31,009 466.7 Tangible common stockholders’ equity (non-GAAP) (3) 19,716 18,833 8,295 882 18.6 11,419 137.6 Common stockholders' equity 20,374 19,508 8,781 865 17.6 11,592 132.0 Total stockholders' equity 21,255 20,389 9,662 866 16.8 11,593 120.0 Increase (decrease) KEY METRICS 4Q23 3Q23 4Q22 4Q23 vs 3Q23 4Q23 vs 4Q22 Common equity Tier 1 (CET1) capital ratio 13.36 % 13.24 % 10.08 % 0.12 % 3.28 % Book value per common share $ 1,403.12 $ 1,343.52 $ 605.36 $ 59.60 $ 797.76 Tangible book value per common share (non-GAAP) (3) 1,357.77 1,297.00 571.89 60.77 785.88 Tangible capital to tangible assets (non-GAAP) (3) 9.25 % 8.84 % 7.62 % 0.41 % 1.63 % Loan to deposit ratio 91.39 91.09 79.17 0.30 12.22 ALLL to total loans and leases 1.31 1.26 1.30 0.05 0.01 Noninterest-bearing deposits to total deposits 27.29 29.50 27.87 (2.21) (0.58) Total liquid assets (available cash + HQLS) $ 57,284 $ 57,019 $ 18,244 $ 265 $ 39,040 Total liquidity (liquid assets & contingent sources) 91,228 95,042 31,765 (3,814) 59,463 Total liquidity / uninsured deposits (4) 168 % 170 % 110 % (2.00) % 58.00 % Balance Sheet Highlights ($ in millions, except per share data) (1) Percent change is annualized (where applicable) and is calculated using unrounded numbers. (2) Operating lease equipment, net includes $8.0 billion of rail assets. (3) Refer to the Non-GAAP Section V of this presentation for a reconciliation of the Non-GAAP to GAAP measures. (4) Total liquidity for 4Q23 and 3Q23 includes immediately available capacity under the FDIC line of credit as of each period end totaling $15.1 billion and $19.4 billion, respectively. For 3Q23, the immediately available capacity is calculated in accordance with the Advance Facility Agreement with the FDIC as if it were in effect at such time for comparability between period. The FDIC credit facility has a maximum capacity of $70 billion which may be used for liquidity coverage ratios. If calculated using the maximum capacity, these ratios would be 270% and 261% for 4Q23 and 3Q23, respectively. To access the full amount, additional collateral would have to be pledged. (1) (1)

18 $70,781 $138,288 $133,015 $133,202 $133,302 $43,212 $43,632 $44,978 $46,077 $47,330 $27,569 $28,485 $29,234 $30,261 $30,959 $66,171 $58,803 $56,864 $55,013 General Bank Commercial Bank SVB Yield on Loans 4Q22 1Q23 2Q23 3Q23 4Q23 Highlights 4Q23 vs 3Q23 • Total loans increased $100 million driven primarily by a $1.3 billion (10.8% annualized) and $716 million (9.4% annualized) increase in the General Bank and Commercial Bank, respectively; partially offset by a $1.9 billion decline in the SVB segment. • General Bank growth was driven primarily by business and commercial loans, while Commercial Bank growth reflected strong performance in industry verticals and Middle Market Banking. The reduction in the SVB portfolio was driven by declines in Global Fund Banking and Technology and Healthcare Banking. 4Q23 vs 4Q22 • Total loans increased $62.5 billion due primarily to the SVB acquisition which contributed $55.0 billion in loans as of December 31, 2023. • General Bank loans grew by $4.1 billion (9.5%) due primarily to business, commercial and mortgage loans. • Commercial Bank loans grew by $3.4 billion (12.5%) due to growth in industry verticals, Middle Market Banking and Real Estate Finance. Loans and Leases ($ in millions, period end balances) (1) Commercial Bank includes a small amount of Rail loans (less than $100 million in all periods). Rail operating lease assets are not included in the loan totals. 7.30% 7.08% 5.59% 5.14% 7.21% 10.1% (1)

19 13% 5% 4% 2% 25% 8% 3% 19% 10% 7% 4% Commercial Finance ($16.9) Real Estate Finance ($6.1) Equipment Finance ($5.6) Commercial Services - Factoring ($2.3) Branch Network & Wealth ($33.2) Mortgage ($10.0) Other ($4.1) Global Fund Banking ($25.6) Technology & Healthcare Banking ($14.0) Private Bank ($9.8) Other ($5.7) 25% 22% 19% 12% 11% 7% 4% Commercial mortgage ($33.3) Commercial and industrial ($29.1) Global Fund Banking ($25.6) 1-4 family residential ($16.4) Innovation lending ($14.0) Private Bank ($9.8) Other ($5.1) Type Segment 4Q23 Loans and Leases Composition ($ in billions, period end balances) Note - Rail operating lease assets are not included in the loan totals. The Commercial Banking segment includes Commercial Finance, Real Estate Finance, Equipment Finance and Commercial Services (factoring). The General Banking segment includes Branch Network & Wealth, Mortgage, Consumer Indirect, Community Association Banking and Other General Banking. The SVB segment includes Global Fund Banking, Technology & Healthcare Banking, Private Bank and Other. Commercial Banking: General Banking: SVB:

20 $89,408 $140,050 $141,164 $146,233 $145,854 $64,486 $66,686 $77,133 $83,608 $85,813 $24,922 $24,105 $23,171 $22,655 $21,564 $18,715 $19,484 $19,484 $20,242 $30,544 $21,376 $20,486 $18,235 4Q22 1Q23 2Q23 3Q23 4Q23 $39,970 2.12% 1.68% 1.24% 0.78% 2.35% $107,377 $38,477 $106,263 $40,860 $100,304 Highlights Deposits ($ in millions, period end balances) $140,050 $66,686 $24,105 $18,715 $30,544 1Q23 SVB Interest-bearing SVB Noninterest-bearing Interest-bearing Noninterest-bearing Cost of deposits 4Q23 vs. 3Q23 • Total deposits decreased $379 million (-1.0% annualized) driven by a $1.5 billion decline in the SVB segment due primarily to client cash burn and muted fundraising activity and a $492 million decline in the Branch Network from seasonable outflows, partially offset by a $2.0 billion increase in the Direct Bank. 4Q23 vs. 4Q22 • Total deposits grew $56.4 billion (63.1%) driven primarily by the SVB acquisition which contributed $38.5 billion in deposits as of December 31, 2023 and a $21.2 billion increase in the Direct Bank. $49,259 $90,791

21 40% 26% 5% 2% 1% 26% Branch Network, Wealth & Other ($57.8) Direct Bank ($37.7) Community Association Banking ($7.2) Commercial Bank ($3.2) Corporate ($1.5) SVB ($38.5) 45% 28% 16% 11% Money market & savings ($65.9) Noninterest-bearing demand ($39.8) Checking with interest ($23.8) Time deposits ($16.4) General Banking: Commercial Banking and Corporate: Type Segment 4Q23 Deposit Composition (period end balances, $ in billions, except average account size) Note – Totals may not foot due to rounding. (1) Corporate consists primarily of brokered deposits which are pooled into one account then associated with multiple customers who have balances under FDIC insurance limits. Insured vs Uninsured 63% 37% Insured Uninsured Average Account Size and Insured by Segment Total deposits Average size Insured % General Bank $ 102.6 $ 38,307 76 % Commercial Bank 3.2 272,107 14 % Corporate & Other (1) 1.5 6,921,659 96 % Sub-total $ 107.4 $ 39,893 75 % SVB 38.5 307,789 29 % Sub-total $ 38.5 $ 307,789 29 % Total $ 145.9 $ 51,783 63 % SVB:

22 1.35% 1.94% 2.98% 3.20% 3.37% 1.12% 1.73% 2.56% 3.02% 3.28% 0.78% 1.24% 1.68% 2.12% 2.35% Cost of interest-bearing liabilities Cost of interest-bearing deposits Cost of deposits 4Q22 1Q23 2Q23 3Q23 4Q23 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% 2.40% 2.80% 3.20% Cost of funds Additional sources of liquidity Categories $ in millions FHLB $ 9,218 FRB 4,203 Line of credit 100 Total $ 13,521 Period End Balances Increase (decrease) 4Q23 3Q23 2Q23 1Q23 4Q22 4Q23 vs. 3Q23 4Q23 vs. 4Q22 Total deposits $ 145,854 79.5 % $ 146,233 79.5 % $ 141,164 77.9 % $ 140,050 75.2 % $ 89,408 93.1 % $ (379) $ 56,446 Securities sold under customer repurchase agreements 485 0.3 453 0.2 454 0.3 509 0.3 436 0.5 32 49 Purchase money note 35,846 19.5 35,833 19.5 35,817 19.8 35,151 18.9 — — 13 35,846 Federal Home Loan Bank borrowings — — — — 2,425 1.3 8,500 4.6 4,250 4.4 — (4,250) Subordinated debt 938 0.5 1,040 0.6 1,043 0.6 1,046 0.6 1,049 1.1 (102) (111) Senior unsecured borrowings 377 0.2 377 0.2 393 0.2 881 0.5 885 0.9 — (508) Other borrowings 8 — 9 — 7 — 7 — 25 — (1) (17) Total deposits and borrowed funds $ 183,508 100 % $ 183,945 100 % $ 181,303 100 % $ 186,144 100 % $ 96,053 100 % $ (437) $ 87,455 Funding Mix ($ in millions) Highlights 4Q23 vs 3Q23 • Funding mix remained stable with 79.5% composed of deposits. • The decline in subordinated debt was due to the redemption of smaller issuances given excess capital and liquidity positions. • While the cost of deposits increased by 23 basis points, the pace decelerated from previous quarters. Note – Funding mix percentages may not foot due to rounding.

23 $79 $63 $152 $195 $249 Provision for credit losses 4Q22 1Q23 2Q23 3Q23 4Q23 Credit Quality Trends and Allowance ($ in millions) Net charge-offs (NCO) & NCO ratio Adjusted provision for credit losses (1) $24 $50 $157 $176 $177 0.14% 0.27% 0.47% 0.53% 0.53% NCO $ QTD NCO ratio YTD NCO ratio 4Q22 1Q23 2Q23 3Q23 4Q23 $627 $828 $929 $899 $969 0.89% 0.60% 0.70% 0.68% 0.73% Nonaccrual loans Nonaccrual loans to total loans 4Q22 1Q23 2Q23 3Q23 4Q23 Nonaccrual loans / total loans & leases Allowance (ALLL) & ALLL ratio $922 $1,605 $1,637 $1,673 $1,747 1.30% 1.16% 1.23% 1.26% 1.31% ALLL ALLL ratio 4Q22 1Q23 2Q23 3Q23 4Q23 (1) Adjusted provision for credit losses excludes CECL Day 2 charges and provision (benefit) expense for credit losses on available for sale securities. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures. 0.47%0.12% 0.27% 0.39% 0.45% Please see addition of the YTD NCO totals. Note that we did not move the coverage ratios here as the rollforward slide looked bare without another metric included on that slide.

24 $1,673 $49 $18 $12 $(5) $1,747 3Q23 Credit quality Change in specific reserves Economic outlook Portfolio mix 4Q23 Highlights 4Q23 vs 3Q23 • ALLL increased $74 million compared to the linked quarter. • The increase over the prior quarter was driven primarily by mild credit quality deterioration in our commercial portfolios, including general office. Additionally contributing to the increase was an increase in specific reserves in the investor dependent portfolio and changes in the macroeconomic forecasts. • These factors were partially offset by a mix/shift to higher credit quality segments in the portfolio. • The ALLL covered annualized quarterly net charge-offs 2.5 times and provided 1.8 times coverage of nonaccrual loans. These metrics were relatively stable from the prior quarter. ALLL Coverage 9.3x 4.4x 2.6x 2.4x 2.5x 1.5x 1.9x 1.8x 1.9x 1.8x ALLL ratio / NCO ratio ALLL / Nonaccrual loans 4Q22 1Q23 2Q23 3Q23 4Q23 3Q23 to 4Q23 Allowance for loan and lease losses (ALLL) ($ in millions)

25 Loan Portfolios in Focus ($ in billions, as of December 31, 2023) Total Loans $133.3 Total Loans CRE $21.3 Commercial Real Estate (CRE) Portfolio Composition Balance % of total loans Multi-Family $ 4.4 3.3 % Medical Office 3.5 2.6 General Office 2.9 2.2 General Bank 1.3 1.0 Commercial Bank 1.2 0.9 SVB 0.4 0.3 Industrial / Warehouse 2.9 2.1 Retail 1.8 1.4 Hotel/Motel 0.8 0.6 Other 5.0 3.7 Total $ 21.3 15.9 % Note - The definition of CRE in these tables is aligned with supervisory guidance on commercial real estate and includes the following: construction loans (1.a.1 and 1.a.2), loans where the primary repayment is from 3rd party rental income (1.d and 1.e.2), and loans not secured by real estate but for the purpose of real estate (4.a, 8, and 9). Innovation Portfolio Composition Balance % of total loans Innovation C&I and cash flow dependent $ 9.7 7.2 % Investor dependent - growth stage 2.9 2.2 Investor dependent - early stage 1.4 1.1 Total $ 14.0 10.5 % Innovation $14.0

26 General Office CRE Portfolio (as of December 31, 2023) CA 22% NC / SC 17% FL 9%AZ 7% MA 5% NY 4% TX 4% VA 4% WA 4% Other 24% Total General Office $2.9 B Geographic Diversification $383 $552 $384 $1,608 2023 2024 2025 2026 & Beyond Loan Maturity Schedule ($ in millions) 13% 19% 13% 55% (1) There are approximately $1.2 billion of general office loans in the Commercial Bank with an ALLL ratio of 9.37%. Top 5 MSAs ($ in millions) Los Angeles $ 408 Phoenix $ 201 Boston $ 136 San Francisco $ 130 New York $ 126 Percent of Total Loans 0.8 % General Office Portfolio Metrics % of total loans 2.2 % % of CRE loans 13.8 % Average loan amount $2 MM NCO ratio (4Q23) 3.56 % Delinquencies/Loans 13.56 % NPLs/Loans 11.38 % Criticized loans/Loans 24.85 % ALLL ratio (1) 4.77 % Please do not review. Data not yet provided. To be included in subsequent draft

27 SVB Investor Dependent (ID) Portfolio (as of December 31, 2023) Portfolio Metrics Early Stage Growth Stage Loan balance $1.4 B $2.9 B % of Innovation loans 10.1 % 20.8 % % of ID loans 32.6 % 67.4 % Avg. loan size $306 K $3.47 MM Median loan size $30 K $800 K NCO ratio (4Q23) 9.63% 1.31% NPLs/Loans 2.74 % 1.29 % Criticized loans/Loans 24.10 % 15.37 % ALLL ratio 6.84 % 4.40 % Client Industry Concentration Portfolio Characteristics • Early Stage - Loans to development-stage innovation companies with $0-5 million in revenues. Historically SVB’s highest risk portfolio which experienced an average ~6% NCO ratio over 2008-2010. • Growth Stage - Loans to mid and later-stage innovation companies with over $5 million in revenues. • Continued pressure in public and private markets negatively impacts borrowers’ ability to raise funds and execute exit strategy. • Large loan sizes in the Growth Stage portfolio may contribute to lumpiness in quarterly net charge-offs and credit metrics. • SVB credit leadership team remains intact with an average tenure at SVB of 25 years. 58% 14% 11% 9% 8% Software Life Science - Products Life Science - Services Hardware Energy & Resource Innovation

28 8.99% 16.72% 9.50% 9.73% 9.83% Tier 1 Leverage ratio 4Q22 1Q23 2Q23 3Q23 4Q23 Risk-based capital ratios Capital ratio rollforward Tier 1 Leverage ratio Tangible book value per share (Non-GAAP) Capital Risk-Based Capital Tier 1 Leverage Total Tier 1 CET1 December 31, 2022 13.18 % 11.06 % 10.08 % 8.99 % SVB acquisition - net 1.59 % 1.88 % 2.25 % 0.03 % Net income 1.65 % 1.65 % 1.65 % 1.43 % Change in risk-weighted/average assets 0.66 % 0.59 % 0.57 % -0.58 % Sub debt phase-out -0.10 % 0.00 % 0.00 % 0.00 % Shared loss agreement coverage runoff -1.34 % -1.19 % -1.14 % 0.00 % Common dividends -0.04 % -0.04 % -0.04 % -0.04 % Preferred dividends -0.05 % -0.05 % -0.04 % -0.04 % Other 0.19 % 0.04 % 0.03 % 0.04 % December 31, 2023 15.74 % 13.94 % 13.36 % 9.83 % Change since December 31, 2022 2.56 % 2.88 % 3.28 % 0.84 % Note – The above capital ratios represent BancShares ratios and are preliminary pending completion of quarterly regulatory filings. Refer to Section V of this presentation for a reconciliation of Non-GAAP measures to the most directly comparable GAAP measure. (1) The Tier 1 Leverage ratio for 1Q23 only includes the impact of SVB for five days. 10.08% 12.53% 13.38% 13.24% 13.36% 11.06% 13.13% 14.00% 13.83% 13.94%13.18% 14.86% 15.84% 15.64% 15.74% CET1 Tier 1 Total 4Q22 1Q23 2Q23 3Q23 4Q23 $571.89 $623.98 $149.03 $16.76 ($3.89) $1,357.77 4Q22 SVB acquisition Retained earnings AOCI Common dividends 4Q23(1) Please do not review. Data not updated.

29 13.4% (1.2)% (0.4)% 11.8% 4Q23 CET1 SLA AOCI Pro Forma CET1 First Citizens Remains Well Positioned for Regulatory Proposals Strong Capital Position Long Term Debt (LTD) Needs are Manageable • First Citizens' binding constraint is expected to be LTD as a percentage of Risk-Weighted Assets (RWA). • Under terms of the proposed rule, we estimate the LTD shortfall to be approximately $8 - $11 billion. • We expect to begin a programmatic issuance of qualifying LTD in 2024 to ensure compliance by phase-in deadlines once a final rule is issued. • Along with our deposit growth strategies, we anticipate these funding actions will facilitate the funding needs of First Citizens as the FDIC Purchase Money Note matures in March 2028. • Our capital position remains strong and well above regulatory minimums both as reported and when considering the impacts of the FDIC shared loss agreement and net unrealized losses in the AFS portfolio. • Our loss position continues to improve in the current rate environment and declined $312 million or by 35% in the fourth quarter. Expected to contract another $230 million or 40% in 2024 based on the forward curve. • We continue to assess the full impact of regulatory changes on our capital position, but remain well- positioned for proposed changes to the rules. Impact of RWA treatment on shared loss assets Impact of including net unrealized losses on the AFS portfolio

Financial Outlook Section III

31 Metric 4Q23 1Q24 - Projected FY24 - Projected Loans and leases - EOP $133.3 billion $133 billion - $135 billion $139 billion - $143 billion Deposits - EOP $145.9 billion $146 billion - $148 billion $152 billion - $156 billion Interest rates One 25 bps cut in March Six interest rate cuts in 2024; with the first in March, Fed funds ending 2024 at 4.00%; NII below shows range of 3 cuts to 6 cuts (or FFR ‘24 ending between 4.00 – 4.75%) Net interest income $1.9 billion $1.75 billion - $1.85 billion $6.9 billion - $7.1 billion Net charge-off ratio (annualized where applicable) 53 bps 50 - 60 bps 45 - 55 bps Adjusted noninterest income (1) $455 million $440 million - $470 million $1.8 billion - $1.9 billion Adjusted noninterest expense (2) $1.14 billion $1.15 billion - $1.17 billion $4.6 billion - $4.7 billion Effective tax rate 27.9% 27.0% - 28.0% 27.0% - 28.0% Key Earnings Estimate Assumptions (1) Adjusted noninterest income includes net rental income on operating lease assets (net of depreciation and maintenance) and excludes fair value adjustments on marketable equity securities, realized gains/losses on sales of AFS securities, realized gains/losses on sales of leasing equipment, realized gains/losses on extinguishment of debt and acquisition accounting gains. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures. (2) Adjusted noninterest expense excludes depreciation and maintenance on operating lease assets, acquisition-related expenses and amortization of intangibles. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures. Note - Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of BancShares’ control, or cannot be reasonably predicted. For the same reasons, management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. PLEASE DO NOT REVIEW Data Unavailable

Appendix Section IV

33 Dec 31, 2023 Sep 30, 2023 Jun 30, 2023 Mar 31, 2023 Dec 31, 2022 ASSETS Cash and due from banks $ 908 $ 791 $ 917 $ 1,598 $ 518 Interest-earning deposits at banks 33,609 36,704 37,846 38,522 5,025 Securities purchased under agreements to resell 473 549 298 — — Investment in marketable equity securities 84 75 76 85 95 Investment securities available for sale 19,936 16,661 11,894 9,061 8,995 Investment securities held to maturity 9,979 10,082 10,201 10,381 10,279 Assets held for sale 76 58 117 94 60 Loans and leases 133,302 133,202 133,015 138,288 70,781 Allowance for loan and lease losses (1,747) (1,673) (1,637) (1,605) (922) Loans and leases, net of allowance for loan and lease losses 131,555 131,529 131,378 136,683 69,859 Operating lease equipment, net 8,746 8,661 8,531 8,331 8,156 Premises and equipment, net 1,877 1,768 1,782 1,743 1,456 Goodwill 346 346 346 346 346 Other intangible assets 312 329 347 364 140 Other assets 5,857 6,212 5,769 7,450 4,369 Total assets $ 213,758 $ 213,765 $ 209,502 $ 214,658 $ 109,298 LIABILITIES Deposits: Noninterest-bearing $ 39,799 $ 43,141 $ 44,547 $ 54,649 $ 24,922 Interest-bearing 106,055 103,092 96,617 85,401 64,486 Total deposits 145,854 146,233 141,164 140,050 89,408 Credit balances of factoring clients 1,089 1,282 1,067 1,126 995 Short-term borrowings 485 453 454 1,009 2,186 Long-term borrowings 37,169 37,259 39,685 45,085 4,459 Total borrowings 37,654 37,712 40,139 46,094 6,645 Other liabilities 7,906 8,149 7,361 8,172 2,588 Total liabilities 192,503 193,376 189,731 195,442 99,636 STOCKHOLDERS’ EQUITY Preferred stock 881 881 881 881 881 Common stock 15 15 15 15 15 Additional paid in capital 4,108 4,106 4,106 4,104 4,109 Retained earnings 16,742 16,267 15,541 14,885 5,392 Accumulated other comprehensive (loss) income (491) (880) (772) (669) (735) Total stockholders’ equity 21,255 20,389 19,771 19,216 9,662 Total liabilities and stockholders’ equity $ 213,758 $ 213,765 $ 209,502 $ 214,658 $ 109,298 BancShares Balance Sheets (unaudited) ($ in millions)