0001591890

false

--12-31

0001591890

2024-02-29

2024-02-29

0001591890

us-gaap:PreferredStockMember

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 29, 2024

FUNDAMENTAL

GLOBAL INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-36366 |

|

46-1119100 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

108 Gateway Blvd, Suite 204

Mooresville,

NC |

|

28117 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (847) 773-1665

FG

Financial Group, Inc.

104

S. Walnut Street, Unit 1A

Itasca,

IL 60143

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

FGF |

|

The

Nasdaq Stock Market LLC |

| |

|

|

|

|

| 8.00%

Cumulative Preferred Stock, Series A, $25.00 par value per share |

|

FGFPP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY

NOTE

On

February 29, 2024, FG Financial Group, Inc., a Nevada corporation (“FGF” or the “Company”), and FG Group Holdings

Inc., a Nevada corporation (“FGH”), completed the previously announced merger transaction pursuant to the Plan of Merger,

dated as of January 3, 2024 (the “Merger Agreement”), by and among the Company, FGH and FG Group LLC, a Nevada limited liability

company and wholly owned subsidiary of FGF (the “Merger Sub”). Pursuant to the terms of the Merger Agreement and in accordance

with the Nevada Revised Statutes, FGH merged with and into the Merger Sub (the “Merger”), with the Merger Sub as the surviving

entity and wholly owned subsidiary of FGF. Following the Merger, on February 29, 2024, the Company amended its Amended and Restated Articles

of Incorporation to change its name to Fundamental Global Inc.

| Item

2.01 | Completion

of Acquisition or Disposition of Assets. |

The

information set forth in the Introductory Note above is incorporated herein by reference.

In

the Merger, each share of common stock, par value $0.01 per share, of FGH (the “FGH Common Stock”) that was issued and outstanding

immediately prior to the effective time of the Merger (the “Effective Time”) was converted into one (the “Exchange

Ratio”) share of common stock, par value $0.001 per share, of FGF (the “FGF Common Stock”).

In

addition, pursuant to the terms of the Merger Agreement, at the Effective Time:

| ● | each

outstanding option to purchase shares of FGH Common Stock (each, an “Existing Rollover

Stock Option”) automatically converted into an option to acquire the number of shares

of FGF Common Stock (rounded down to the nearest whole share) equal to the product obtained

by multiplying (i) the number of shares subject to the Existing Rollover Stock Option immediately

prior to the Effective Time, by (ii) the Exchange Ratio, with such option having an exercise

price per share of FGF Common Stock equal to the quotient (rounded up to the nearest whole

cent) obtained by dividing (x) the exercise price per share of FGH Common Stock of such Existing

Rollover Stock Option in effect immediately prior to the Effective Time by (y) the Exchange

Ratio; and |

| ● | each

outstanding restricted share unit of FGH (each, an “FGH RSU”) automatically converted

into and became rights with respect to FGF Common Stock, and FGF assumed the FGH RSUs, on

the same terms and conditions (including any forfeiture provisions or repurchase rights,

and treating for this purpose any performance-based vesting conditions as provided for in

the award agreement by which each FGH RSU is evidenced), except that from and after the Effective

Time, (i) FGF and the compensation committee of the board of directors of FGF, respectively,

were substituted for FGH and the compensation committee of the board of directors of FGH

administering FGH’s 2017 Omnibus Equity Compensation Plan (the “FGH Stock Plan”),

(ii) the FGH RSUs assumed by FGF represent the right to receive FGF Common Stock upon settlement

of such FGH RSU promptly after vesting (except to the extent the terms of the applicable

restricted share unit agreement provide for deferred settlement, in which case settlement

shall be in accordance with the specified terms), and (iii) the number of shares of FGF Common

Stock subject to each award of FGH RSUs assumed by FGF is equal to the number of shares of

FGH Common Stock subject to such award immediately prior to the Effective Time multiplied

by the Exchange Ratio, rounded down to the nearest whole share (except that in no event will

any vesting restrictions applicable to an FGH RSU be accelerated unless so provided under

the terms of such FGH RSU or the FGH Stock Plan). |

The

Company’s registration statement on Form S-4 (the “Registration Statement”), filed with the Securities and Exchange

Commission (“SEC”) on January 8, 2024 (as amended), contains a description of certain relationships and related transactions

in the section entitled “The Merger – Interests of FGF’s Directors and Executive Officers in the Merger”

beginning on page 45 and a description of the evaluation of the Exchange Ratio in the section entitled “The Merger – Background

of the Merger” beginning on page 31 and “– FGF’s Reasons for the Merger; Recommendation of the FGF Board”

beginning on page 35, which descriptions are incorporated herein by reference.

The

foregoing descriptions of the Merger and the Merger Agreement do not purport to be complete and are qualified in their entirety by reference

to the full text of the Merger Agreement, a copy of which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K,

filed with the SEC on January 4, 2024, which is incorporated herein by reference.

| Item

5.02 | Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

Board

of Directors

Effective

immediately following the closing of the Merger, the Board of Directors of the Company (the “Board”) increased in size from

six to seven directors. In connection with the closing of the Merger, E. Gray Payne and Larry G. Swets, Jr., resigned from the Board.

In addition, in accordance with the terms of the Plan of Merger and effective immediately following the closing of the Merger each of

Michael C. Mitchell, Ndamukong Suh, and Robert J. Roschman were appointed to the Board. The Board has determined that all of its directors,

except for D. Kyle Cerminara, are “independent directors” as such term is defined by the applicable rules and regulations

of the SEC and Nasdaq.

The

description of certain relationships and related transactions in the section entitled “The Merger – Interests of FGF’s

Directors and Executive Officers in the Merger” beginning on page 45 of the Registration Statement is incorporated herein by

this reference. Other than as described in this Current Report on Form 8-K, there are no transactions to which the Company is a party

in which any of the Company’s directors have a material interest subject to disclosure under Item 404(a) of Regulation S-K.

Committee

Appointments

Effective

February 29, 2024, the Board appointed the following individuals to the Audit Committee, the Compensation and Management Resources Committee,

and the Nominating and Corporate Governance Committee:

| |

● |

Audit

Committee: Scott Wollney (Chair), Rita Hayes, Robert Roschman. |

| |

|

|

| |

● |

Compensation

and Management Resources Committee: Michael Mitchell (Chair), Rita Hayes, Scott Wollney. |

| |

|

|

| |

● |

Nominating

and Corporate Governance Committee: Richard Govignon (Chair), Michael Mitchell, Ndamukong Suh. |

Executive

Officers

In

connection with the Merger, Larry G. Swets, President and Chief Executive Officer of the Company prior to the closing of the Merger,

and Hassan R. Baqar, Executive Vice President, Chief Financial Officer and Secretary of the Company prior to the closing of the Merger,

resigned from their respective positions with the Company. Messrs. Swets and Baqar will remain with the Company leading the Company’s

merchant banking and SPAC businesses.

Effective

as of the closing of the Merger, the Board appointed Mr. Cerminara as the Chief Executive Officer of the Company, and Mark D. Roberson

as Chief Financial Officer and Secretary of the Company.

Biographical

information for Mr. Cerminara is set forth in the Company’s definitive proxy statement filed by the Company with the SEC on November 1, 2023. The description of certain relationships and related transactions in the section entitled “The Merger – Interests

of FGF’s Directors and Executive Officers in the Merger” beginning on page 45 of the Registration Statement is incorporated

herein by this reference. Other than as described in this Current Report on Form 8-K, there are no transactions to which the Company

is a party in which Mr. Cerminara has a material interest subject to disclosure under Item 404(a) of Regulation S-K.

Mr.

Roberson, 59, served as the Chief Executive Officer of FGH from April 2020 until the closing of the Merger, and served as Executive Vice

President, Chief Financial Officer and Treasurer of FGH from November 2018 to April 2020. Mr. Roberson brings an extensive background

in executive leadership, operations, corporate finance, SEC reporting, treasury, and mergers and acquisitions. Mr. Roberson has also

served as Chief Executive Officer of Strong Global Entertainment, Inc. (NYSE American: SGE), a majority owned subsidiary of the Company

which conducted its initial public offering in May 2023, since November 2021. He previously served as Chief Operations Officer of Chanticleer

Holdings, Inc., a Nasdaq-listed restaurant operating company, from May 2015 to November 2018, and as Chief Executive Officer of PokerTek,

Inc., a then-Nasdaq-listed gaming technology company, from February 2010 to October 2014 (having served as Acting Chief Executive Officer

from May 2009 until February 2010). He also served as Chief Financial Officer and Treasurer of PokerTek, Inc. from October 2007 until

October 2014. Mr. Roberson previously held positions of increasing responsibility at Curtiss-Wright, Inc., a NYSE-listed aerospace and

defense contractor, Krispy Kreme Doughnut Corporation, a then-NYSE-listed fast-casual restaurant franchisor and operator, and LifeStyle

Furnishings International, a $2 billion private equity backed furniture manufacturer. Mr. Roberson is a Certified Public Accountant who

started his career with Ernst & Young and PricewaterhouseCoopers. He earned an MBA from Wake Forest University, a B.S. in Accounting

from UNC-Greensboro and a B.S. in Economics from Southern Methodist University. He served on the Board of Directors of CynergisTek, Inc.

(NYSE American: CTEK), a cybersecurity and information management consulting firm, from May 2016 to September 2022, where he chaired

the Audit Committee. There are no transactions to which the Company is a party in which Mr. Roberson has a material interest subject

to disclosure under Item 404(a) of Regulation S-K.

Indemnification

Agreements

Following

the Merger, the Company’s directors and officers will enter into indemnification agreements, in substantially the form attached

to the Registration Statement as Exhibit 10.1.

| Item

5.03 | Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On

February 29, 2024, the Company amended its Amended and Restated Articles of Incorporation to change its name to Fundamental Global Inc.

The

foregoing description of the amendment to the Company’s Amended and Restated Articles of Incorporation does not purport to be complete

and is qualified in its entirety by reference to the full text of the amendment, a copy of which is filed as Exhibit 3.1 to this Current

Report on Form 8-K and incorporated herein by reference.

| Item

7.01 | Regulation

FD Disclosure. |

On

February 29, 2024, the Company and FGH issued a joint press release in connection with the completion of the Merger. A copy of that press

release is furnished on Exhibit 99.1 hereto and is incorporated herein by reference.

The

information in this Item 7.01 and in Exhibit 99.1 attached hereto is furnished pursuant to the rules and regulations of the SEC and shall

not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

| Item

9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits.

†

Exhibits and schedules to this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(5). The Registrant agrees to furnish

supplementally a copy of any omitted schedule or exhibit to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FUNDAMENTAL

GLOBAL INC. |

| |

|

|

| Date:

February 29, 2024 |

By: |

/s/

Mark D. Roberson |

| |

Name: |

Mark

D. Roberson |

| |

Title: |

Chief

Financial Officer |

Exhibit

3.1

Exhibit

99.1

FG

Financial Group, Inc. and FG Group Holdings Inc. Complete Merger

FG

Financial Group, Inc. Renamed to Fundamental Global Inc.

New

Leadership and Governance Structure in Place

Mooresville,

NC – February 29, 2024 –

FG Financial Group, Inc. (Nasdaq: FGF, FGFPP) (“FG Financial”) and FG Group Holdings Inc. (“FG Group Holdings”)

today announced that they have completed the previously announced merger pursuant to which FG Group Holdings merged with and into FG

Group LLC, with FG Group LLC surviving as a wholly-owned subsidiary of FG Financial. In connection with the merger, FG Group Holdings’

stockholders received one share of FG Financial common stock in exchange for each share of FG Group Holdings common stock. Following

the merger, FG Financial changed its name to Fundamental Global Inc. (“Fundamental Global” or the “Company”).

The Company’s common stock and Series A cumulative preferred stock will continue to trade on the Nasdaq under the tickers “FGF”

and “FGFPP,” respectively.

D.

Kyle Cerminara, Chairman and CEO of Fundamental Global, commented, “We are pleased to announce the completion of the merger and

the resulting creation of Fundamental Global Inc. as a unified public company. Our goal is to consolidate and simplify all of our operations,

reduce public company costs and focus our efforts on a few highly scalable and high ROIC businesses. FG Group Holdings shareholders

were resoundingly in favor of this transaction, with 99.9% of the consents returned voting in favor of the plan of merger. We look forward

to implementing our plans with a focus on shareholder returns.”

Business

Post Combination:

With

the completion of the merger, Fundamental Global operates in the following primary lines of business:

| |

● |

FG

Reinsurance, Ltd. (“FGRe”): FGRe is a licensed insurance company domiciled in the Cayman Islands that participates

in the global reinsurance market through the Funds at Lloyds syndicate, traditional reinsurance contracts and industry loss warranties. |

| |

|

|

| |

● |

Strong

Global Entertainment, Inc. (“Strong Global”): Strong Global is a leader in the entertainment industry providing

mission critical products and services to entertainment venues for over 90 years. |

| |

|

|

| |

● |

Merchant

Banking and SPACs: Fundamental Global co-sponsors newly formed SPACs and other merchant banking interests and provides strategic,

administrative, and regulatory support services in exchange for both ownership and cash fees. |

| |

|

|

| |

● |

Asset

Management: Asset Management consists of activities that generate net investment income (loss), the management of third-party

reinsurance capital and other future asset management activities. |

Governance

and Leadership:

Following

the merger, the Board of Directors of Fundamental Global

consists of seven members, with Mr. Cerminara serving as chair, along with three legacy FG Financial directors, Richard E. Govignon,

Jr., Rita Hayes, and Scott D. Wollney, and three legacy FG Group Holdings directors, Michael C. Mitchell, Ndamukong Suh, and Robert J.

Roschman, all of whom are expected to serve until the next annual meeting of stockholders of Fundamental Global.

The

management team is as follows:

| |

● |

CEO:

D. Kyle Cerminara |

| |

|

|

| |

● |

CFO:

Mark D. Roberson |

| |

|

|

| |

● |

Merchant

Banking and SPACs: Larry Swets and Hassan Baqar will lead Merchant Banking and SPACs. |

| |

|

|

| |

● |

Reinsurance:

Tom Heise will continue to serve as CEO of FGRe. |

| |

|

|

| |

● |

Strong

Global: Mark Roberson and Todd Major will continue to serve as CEO and CFO, respectively, of Strong Global. |

About

Fundamental Global Inc.

Fundamental

Global Inc. (Nasdaq: FGF, FGFPP) and its subsidiaries engage in diverse business activities including reinsurance, asset management,

merchant banking, manufacturing and managed services.

The

FG® logo and Fundamental Global® are registered trademarks of Fundamental Global LLC.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are

therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified by the use of forward-looking

terminology such as “anticipate,” “believe,” “budget,” “can,” “contemplate,”

“continue,” “could,” “envision,” “estimate,” “expect,” “evaluate,”

“forecast,” “goal,” “guidance,” “indicate,” “intend,” “likely,”

“may,” “might,” “outlook,” “plan,” “possibly,” “potential,” “predict,”

“probable,” “probably,” “pro-forma,” “project,” “seek,” “should,”

“target,” “view,” “will,” “would,” “will be,” “will continue,”

“will likely result” or the negative thereof or other variations thereon or comparable terminology. In particular, discussions

and statements regarding the Company’s future business plans and initiatives are forward-looking in nature. We have based these

forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these to be reasonable,

such forward-looking statements are only predictions and involve a number of risks and uncertainties, many of which are beyond our control.

These and other important factors may cause our actual results, performance, or achievements to differ materially from any future results,

performance or achievements expressed or implied by these forward-looking statements, and may impact our ability to implement and execute

on our future business plans and initiatives. Management cautions that the forward-looking statements in this release are not guarantees

of future performance, and we cannot assume that such statements will be realized or the forward-looking events and circumstances will

occur. Factors that might cause such a difference include, without limitation: risks associated with our inability to identify and realize

business opportunities, and the undertaking of any new such opportunities; our lack of operating history or established reputation in

the reinsurance industry; our inability to obtain or maintain the necessary approvals to operate reinsurance subsidiaries; risks associated

with operating in the reinsurance industry, including inadequately priced insured risks, credit risk associated with brokers we may do

business with, and inadequate retrocessional coverage; our inability to execute on our investment and investment management strategy,

including our strategy to invest in the risk capital of special purpose acquisition companies (SPACs); our ability to maintain and

expand our revenue streams to compensate for the lower demand for our digital cinema products and installation services; potential interruptions

of supplier relationships or higher prices charged by suppliers in connection with our Strong Global business; our ability to successfully

compete and introduce enhancements and new features that achieve market acceptance and that keep pace with technological developments;

our ability to maintain Strong Global’s brand and reputation and retain or replace its significant customers; challenges associated

with Strong Global’s long sales cycles; the impact of a challenging global economic environment or a downturn in the markets; the

effects of economic, public health, and political conditions that impact business and consumer confidence and spending, including rising

interest rates, periods of heightened inflation and market instability; potential loss of value of investments; risk of becoming

an investment company; fluctuations in our short-term results as we implement our new business strategy; risks of being unable to attract

and retain qualified management and personnel to implement and execute on our business and growth strategy; failure of our information

technology systems, data breaches and cyber-attacks; our ability to establish and maintain an effective system of internal controls;

our limited operating history as a public company; the requirements of being a public company and losing our status as a smaller reporting

company or becoming an accelerated filer; any potential conflicts of interest between us and our controlling stockholders and different

interests of controlling stockholders; potential conflicts of interest between us and our directors and executive officers; risks associated

with our related party transactions and investments; and risks associated with our investments in SPACs, including the failure of any

such SPAC to complete its initial business combination. Our expectations and future plans and initiatives may not be realized. If one

of these risks or uncertainties materializes, or if our underlying assumptions prove incorrect, actual results may vary materially from

those expected, estimated or projected. You are cautioned not to place undue reliance on forward-looking statements. The forward-looking

statements are made only as of the date hereof and do not necessarily reflect our outlook at any other point in time. We do not undertake

and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any such

statements to reflect new information, future events or developments.

Investor

Contact:

investors@fundamentalglobal.com

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 29, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-36366

|

| Entity Registrant Name |

FUNDAMENTAL

GLOBAL INC.

|

| Entity Central Index Key |

0001591890

|

| Entity Tax Identification Number |

46-1119100

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

108 Gateway Blvd,

|

| Entity Address, Address Line Two |

Suite 204

|

| Entity Address, City or Town |

Mooresville

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28117

|

| City Area Code |

(847)

|

| Local Phone Number |

773-1665

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

FGF

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Preferred Stock [Member] |

|

| Title of 12(b) Security |

8.00%

Cumulative Preferred Stock, Series A, $25.00 par value per share

|

| Trading Symbol |

FGFPP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

FGF_PreferredStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

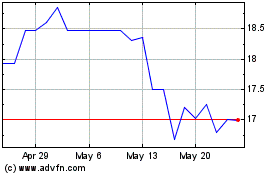

Fundamental Global (NASDAQ:FGFPP)

Historical Stock Chart

From Apr 2024 to May 2024

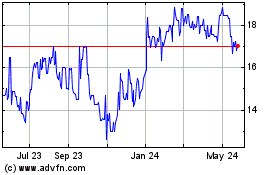

Fundamental Global (NASDAQ:FGFPP)

Historical Stock Chart

From May 2023 to May 2024