FTAI Infrastructure Inc. (NASDAQ:FIP) (the “Company” or “FTAI

Infrastructure”) today reported financial results for the third

quarter 2024. The Company’s consolidated comparative financial

statements and key performance measures are attached as an exhibit

to this press release.

Financial Overview

| (in thousands, except

per share data) |

| Selected Financial

Results |

Q3’24 |

|

Net Loss Attributable to Stockholders |

$ |

(49,971 |

) |

| Basic and Diluted Loss per Share

of Common Stock |

$ |

(0.45 |

) |

| Adjusted EBITDA (1) |

$ |

36,928 |

|

| Adjusted EBITDA - Four core

segments (1)(2) |

$ |

42,543 |

|

| |

|

|

|

_______________________________

(1) For definitions and

reconciliations of non-GAAP measures, please refer to the exhibit

to this press release.(2) Excludes Sustainability

and Energy Transition and Corporate and Other segments.

Third Quarter 2024

Dividends

On October 30, 2024, the Company’s Board of

Directors (the “Board”) declared a cash dividend on its common

stock of $0.03 per share for the quarter ended September 30,

2024, payable on November 19, 2024 to the holders of record on

November 12, 2024.

Business Highlights

- Signed long-term

contract and additional LOI at Repauno and commenced construction

for phase 2 transloading system.

- Construction

projects at Jefferson progressing on schedule, on budget for

contracts commencing in 2025.

- Long Ridge power

plant operated at a 99% capacity factor; new capacity pricing for

2025-26 season represents $16 million of incremental annual Adj.

EBITDA and expected to continue for foreseeable future(1).

(1) Represents management’s estimates; actual

results may vary.

Additional Information

For additional information that management

believes to be useful for investors, please refer to the

presentation posted on the Investor Relations section of the

Company’s website, www.fipinc.com, and the Company’s Quarterly

Report on Form 10-Q, when available on the Company’s website.

Nothing on the Company’s website is included or incorporated by

reference herein.

Conference Call

In addition, management will host a conference

call on Thursday, October 31, 2024 at 8:00 A.M. Eastern Time. The

conference call may be accessed by registering via the following

link

https://register.vevent.com/register/BI0831790884ec4e0b9c259fbb54b3c628.

Once registered, participants will receive a dial-in and unique pin

to access the call.

A simultaneous webcast of the conference call

will be available to the public on a listen-only basis at

www.fipinc.com. Please allow extra time prior to the call to visit

the site and download the necessary software required to listen to

the internet broadcast.

A replay of the conference call will be

available after 11:30 A.M. on Thursday, October 31, 2024 through

11:30 A.M. on Thursday, November 7, 2024 on

https://ir.fipinc.com/news-events/events.

The information contained on, or accessible

through, any websites included in this press release is not

incorporated by reference into, and should not be considered a part

of, this press release.

About FTAI Infrastructure

Inc.

FTAI Infrastructure primarily invests in

critical infrastructure with high barriers to entry across the

rail, ports and terminals, and power and gas sectors that, on a

combined basis, generate strong and stable cash flows with the

potential for earnings growth and asset appreciation. FTAI

Infrastructure is externally managed by an affiliate of Fortress

Investment Group LLC, a leading, diversified global investment

firm.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements in this press release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including, but

not limited to, Transtar’s continued momentum, and Long Ridge’s

potential ability to add substantial EBITDA for mid-2025 to

mid-2026 period. These statements are based on management's current

expectations and beliefs and are subject to a number of trends and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements, many of

which are beyond the Company’s control. The Company can give no

assurance that its expectations will be attained and such

differences may be material. Accordingly, you should not place

undue reliance on any forward-looking statements contained in this

press release. For a discussion of some of the risks and important

factors that could affect such forward-looking statements, see the

sections entitled “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in the

Company’s most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q, which are available on the Company’s website

(www.fipinc.com). In addition, new risks and uncertainties emerge

from time to time, and it is not possible for the Company to

predict or assess the impact of every factor that may cause its

actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. The Company expressly

disclaims any obligation to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based. This release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities.

For further information, please

contact:

Alan AndreiniInvestor RelationsFTAI Infrastructure Inc.(646)

734-9414aandreini@fortress.com

Exhibit - Financial Statements

|

FTAI INFRASTRUCTURE INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) |

|

(Dollar amounts in thousands, except share and per share data) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues |

|

|

|

|

|

|

|

|

Total revenues |

$ |

83,311 |

|

|

$ |

80,706 |

|

|

$ |

250,733 |

|

|

$ |

239,032 |

|

| |

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

| Operating expenses |

|

62,766 |

|

|

|

68,416 |

|

|

|

188,566 |

|

|

|

196,353 |

|

| General and

administrative |

|

2,989 |

|

|

|

2,485 |

|

|

|

10,690 |

|

|

|

9,388 |

|

| Acquisition and transaction

expenses |

|

2,526 |

|

|

|

649 |

|

|

|

4,373 |

|

|

|

1,554 |

|

| Management fees and incentive

allocation to affiliate |

|

2,807 |

|

|

|

3,238 |

|

|

|

8,584 |

|

|

|

9,304 |

|

| Depreciation and

amortization |

|

19,492 |

|

|

|

20,150 |

|

|

|

60,176 |

|

|

|

60,577 |

|

| Asset impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

743 |

|

| Total

expenses |

|

90,580 |

|

|

|

94,938 |

|

|

|

272,389 |

|

|

|

277,919 |

|

| |

|

|

|

|

|

|

|

| Other (expense)

income |

|

|

|

|

|

|

|

| Equity in losses of

unconsolidated entities |

|

(14,308 |

) |

|

|

(9,914 |

) |

|

|

(38,998 |

) |

|

|

(7,173 |

) |

| Gain (loss) on sale of assets,

net |

|

2,758 |

|

|

|

(263 |

) |

|

|

2,595 |

|

|

|

260 |

|

| Gain (loss) on modification or

extinguishment of debt |

|

747 |

|

|

|

(2,020 |

) |

|

|

(8,423 |

) |

|

|

(2,020 |

) |

| Interest expense |

|

(31,513 |

) |

|

|

(25,999 |

) |

|

|

(88,796 |

) |

|

|

(73,431 |

) |

| Other income |

|

6,537 |

|

|

|

2,387 |

|

|

|

15,865 |

|

|

|

3,978 |

|

| Total other

expense |

|

(35,779 |

) |

|

|

(35,809 |

) |

|

|

(117,757 |

) |

|

|

(78,386 |

) |

| Loss before income

taxes |

|

(43,048 |

) |

|

|

(50,041 |

) |

|

|

(139,413 |

) |

|

|

(117,273 |

) |

| (Benefit from) provision for

income taxes |

|

(92 |

) |

|

|

8 |

|

|

|

1,980 |

|

|

|

2,560 |

|

| Net loss |

|

(42,956 |

) |

|

|

(50,049 |

) |

|

|

(141,393 |

) |

|

|

(119,833 |

) |

| Less: Net loss attributable to

non-controlling interests in consolidated subsidiaries |

|

(9,963 |

) |

|

|

(9,932 |

) |

|

|

(32,053 |

) |

|

|

(30,101 |

) |

| Less: Dividends and accretion

of redeemable preferred stock |

|

16,978 |

|

|

|

15,984 |

|

|

|

51,563 |

|

|

|

45,811 |

|

| Net loss attributable

to stockholders |

$ |

(49,971 |

) |

|

$ |

(56,101 |

) |

|

$ |

(160,903 |

) |

|

$ |

(135,543 |

) |

| |

|

|

|

|

|

|

|

| Loss per

share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.45 |

) |

|

$ |

(0.55 |

) |

|

$ |

(1.51 |

) |

|

$ |

(1.32 |

) |

| Diluted |

$ |

(0.45 |

) |

|

$ |

(0.55 |

) |

|

$ |

(1.51 |

) |

|

$ |

(1.32 |

) |

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

109,723,831 |

|

|

|

102,820,651 |

|

|

|

106,317,677 |

|

|

|

102,800,818 |

|

| Diluted |

|

109,723,831 |

|

|

|

102,820,651 |

|

|

|

106,317,677 |

|

|

|

102,800,818 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FTAI INFRASTRUCTURE INC. |

|

CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

(Dollar amounts in thousands, except share and per share data) |

| |

| |

(Unaudited) |

|

|

| |

September 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

20,295 |

|

|

$ |

29,367 |

|

|

Restricted cash |

|

124,338 |

|

|

|

58,112 |

|

|

Accounts receivable, net |

|

55,168 |

|

|

|

55,990 |

|

|

Other current assets |

|

47,266 |

|

|

|

42,034 |

|

|

Total current assets |

|

247,067 |

|

|

|

185,503 |

|

| Leasing equipment, net |

|

36,173 |

|

|

|

35,587 |

|

| Operating lease right-of-use

assets, net |

|

68,859 |

|

|

|

69,748 |

|

| Property, plant, and

equipment, net |

|

1,624,906 |

|

|

|

1,630,829 |

|

| Investments |

|

54,148 |

|

|

|

72,701 |

|

| Intangible assets, net |

|

47,237 |

|

|

|

52,621 |

|

| Goodwill |

|

275,367 |

|

|

|

275,367 |

|

| Other assets |

|

83,732 |

|

|

|

57,253 |

|

|

Total assets |

$ |

2,437,489 |

|

|

$ |

2,379,609 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

152,957 |

|

|

$ |

130,796 |

|

|

Operating lease liabilities |

|

7,270 |

|

|

|

7,218 |

|

|

Other current liabilities |

|

13,449 |

|

|

|

12,623 |

|

|

Total current liabilities |

|

173,676 |

|

|

|

150,637 |

|

| Debt, net |

|

1,535,679 |

|

|

|

1,340,910 |

|

| Operating lease

liabilities |

|

61,651 |

|

|

|

62,441 |

|

| Other liabilities |

|

46,379 |

|

|

|

87,530 |

|

|

Total liabilities |

|

1,817,385 |

|

|

|

1,641,518 |

|

| |

|

|

|

| Commitments and

contingencies |

|

— |

|

|

|

— |

|

| |

|

|

|

| Redeemable preferred

stock ($0.01 par value per share; 200,000,000 shares

authorized; 300,000 shares issued and outstanding as of

September 30, 2024 and December 31, 2023; redemption

amount of $436.8 million and $446.5 million at

September 30, 2024 and December 31, 2023) |

|

366,913 |

|

|

|

325,232 |

|

| |

|

|

|

| Equity |

|

|

|

| Common stock ($0.01 par value

per share; 2,000,000,000 shares authorized; 113,745,115 and

100,589,572 shares issued and outstanding as of September 30,

2024 and December 31, 2023, respectively) |

|

1,137 |

|

|

|

1,006 |

|

| Additional paid in

capital |

|

785,734 |

|

|

|

843,971 |

|

| Accumulated deficit |

|

(291,513 |

) |

|

|

(182,173 |

) |

| Accumulated other

comprehensive loss |

|

(124,587 |

) |

|

|

(178,515 |

) |

| Stockholders' equity |

|

370,771 |

|

|

|

484,289 |

|

| Non-controlling interest in

equity of consolidated subsidiaries |

|

(117,580 |

) |

|

|

(71,430 |

) |

|

Total equity |

|

253,191 |

|

|

|

412,859 |

|

|

Total liabilities, redeemable preferred stock and equity |

$ |

2,437,489 |

|

|

$ |

2,379,609 |

|

| |

|

|

|

|

|

|

|

|

FTAI INFRASTRUCTURE INC. |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) |

|

(Dollar amounts in thousands, unless otherwise noted) |

| |

| |

Nine Months Ended September 30, |

| |

2024 |

|

2023 |

| Cash flows from

operating activities: |

|

|

|

|

Net loss |

$ |

(141,393 |

) |

|

$ |

(119,833 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

| Equity in losses of

unconsolidated entities |

|

38,998 |

|

|

|

7,173 |

|

| Gain on sale of assets,

net |

|

(2,595 |

) |

|

|

(260 |

) |

| Loss on modification or

extinguishment of debt |

|

8,423 |

|

|

|

2,020 |

|

| Gain on sale of easement |

|

(3,486 |

) |

|

|

— |

|

| Equity-based compensation |

|

6,768 |

|

|

|

5,814 |

|

| Depreciation and

amortization |

|

60,176 |

|

|

|

60,577 |

|

| Asset impairment |

|

— |

|

|

|

743 |

|

| Change in deferred income

taxes |

|

1,187 |

|

|

|

2,148 |

|

| Change in fair value of

non-hedge derivative |

|

— |

|

|

|

1,125 |

|

| Amortization of deferred

financing costs |

|

6,370 |

|

|

|

4,910 |

|

| Amortization of bond

discount |

|

4,419 |

|

|

|

3,472 |

|

| Provision for credit

losses |

|

569 |

|

|

|

1,661 |

|

| Change in: |

|

|

|

|

Accounts receivable |

|

253 |

|

|

|

(5,547 |

) |

|

Other assets |

|

(5,982 |

) |

|

|

17,387 |

|

|

Accounts payable and accrued liabilities |

|

17,676 |

|

|

|

15,130 |

|

|

Other liabilities |

|

1,394 |

|

|

|

1,266 |

|

| Net cash used in

operating activities |

|

(7,223 |

) |

|

|

(2,214 |

) |

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Investment in unconsolidated

entities |

|

(2,273 |

) |

|

|

(6,070 |

) |

| Investment in convertible

promissory notes |

|

(31,500 |

) |

|

|

(51,044 |

) |

| Acquisition of business, net

of cash acquired |

|

— |

|

|

|

(4,448 |

) |

| Acquisition of leasing

equipment |

|

(1,627 |

) |

|

|

— |

|

| Acquisition of property, plant

and equipment |

|

(53,322 |

) |

|

|

(78,712 |

) |

| Investment in equity

instruments |

|

(5,000 |

) |

|

|

— |

|

| Proceeds from sale of leasing

equipment |

|

— |

|

|

|

116 |

|

| Proceeds from sale of

property, plant and equipment |

|

598 |

|

|

|

1,148 |

|

| Proceeds from sale of

easement |

|

3,486 |

|

|

|

— |

|

| Net cash used in

investing activities |

|

(89,638 |

) |

|

|

(139,010 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Proceeds from debt, net |

|

449,689 |

|

|

|

162,100 |

|

| Repayment of debt |

|

(247,594 |

) |

|

|

(75,131 |

) |

| Payment of financing

costs |

|

(10,397 |

) |

|

|

(6,472 |

) |

| Cash dividends - common

stock |

|

(9,707 |

) |

|

|

(9,254 |

) |

| Cash dividends - redeemable

preferred stock |

|

(9,723 |

) |

|

|

— |

|

| Settlement of equity-based

compensation |

|

(3,214 |

) |

|

|

(90 |

) |

| Distributions to

non-controlling interests |

|

(15,039 |

) |

|

|

(1,647 |

) |

| Net cash provided by

financing activities |

|

154,015 |

|

|

|

69,506 |

|

| |

|

|

|

| Net increase

(decrease) in cash and cash equivalents and restricted

cash |

|

57,154 |

|

|

|

(71,718 |

) |

| Cash and cash equivalents and

restricted cash, beginning of period |

|

87,479 |

|

|

|

149,642 |

|

| Cash and cash

equivalents and restricted cash, end of period |

$ |

144,633 |

|

|

$ |

77,924 |

|

| |

|

|

|

|

|

|

|

Key Performance Measures

The Chief Operating Decision Maker (“CODM”)

utilizes Adjusted EBITDA as our key performance measure.

Adjusted EBITDA provides the CODM with the

information necessary to assess operational performance, as well as

make resource and allocation decisions. Adjusted EBITDA is defined

as net income (loss) attributable to stockholders, adjusted (a) to

exclude the impact of provision for (benefit from) income taxes,

equity-based compensation expense, acquisition and transaction

expenses, losses on the modification or extinguishment of debt and

capital lease obligations, changes in fair value of non-hedge

derivative instruments, asset impairment charges, incentive

allocations, depreciation and amortization expense, interest

expense, interest and other costs on pension and other pension

expense benefits (“OPEB”) liabilities, dividends and accretion of

redeemable preferred stock, and other non-recurring items, (b) to

include the impact of our pro-rata share of Adjusted EBITDA from

unconsolidated entities, and (c) to exclude the impact of equity in

earnings (losses) of unconsolidated entities and the

non-controlling share of Adjusted EBITDA.

The following table sets forth a reconciliation

of net loss attributable to stockholders to Adjusted EBITDA for the

three and nine months ended September 30, 2024 and 2023:

| |

Three Months Ended September 30, |

|

Change |

|

Nine Months EndedSeptember

30, |

|

Change |

| (in thousands) |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Net loss attributable to stockholders |

$ |

(49,971 |

) |

|

$ |

(56,101 |

) |

|

$ |

6,130 |

|

|

$ |

(160,903 |

) |

|

$ |

(135,543 |

) |

|

$ |

(25,360 |

) |

| Add: (Benefit from) provision

for income taxes |

|

(92 |

) |

|

|

8 |

|

|

|

(100 |

) |

|

|

1,980 |

|

|

|

2,560 |

|

|

|

(580 |

) |

| Add: Equity-based compensation

expense |

|

2,629 |

|

|

|

4,277 |

|

|

|

(1,648 |

) |

|

|

6,768 |

|

|

|

5,814 |

|

|

|

954 |

|

| Add: Acquisition and

transaction expenses |

|

2,526 |

|

|

|

649 |

|

|

|

1,877 |

|

|

|

4,373 |

|

|

|

1,554 |

|

|

|

2,819 |

|

| Add: (Gains) losses on the

modification or extinguishment of debt and capital lease

obligations |

|

(747 |

) |

|

|

2,020 |

|

|

|

(2,767 |

) |

|

|

8,423 |

|

|

|

2,020 |

|

|

|

6,403 |

|

| Add: Changes in fair value of

non-hedge derivative instruments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,125 |

|

|

|

(1,125 |

) |

| Add: Asset impairment

charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

743 |

|

|

|

(743 |

) |

| Add: Incentive

allocations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Depreciation and

amortization expense (1) |

|

20,725 |

|

|

|

20,150 |

|

|

|

575 |

|

|

|

63,418 |

|

|

|

60,577 |

|

|

|

2,841 |

|

| Add: Interest expense |

|

31,513 |

|

|

|

25,999 |

|

|

|

5,514 |

|

|

|

88,796 |

|

|

|

73,431 |

|

|

|

15,365 |

|

| Add: Pro-rata share of

Adjusted EBITDA from unconsolidated entities (2) |

|

5,625 |

|

|

|

5,554 |

|

|

|

71 |

|

|

|

15,090 |

|

|

|

20,630 |

|

|

|

(5,540 |

) |

| Add: Dividends and accretion

of redeemable preferred stock |

|

16,978 |

|

|

|

15,984 |

|

|

|

994 |

|

|

|

51,563 |

|

|

|

45,811 |

|

|

|

5,752 |

|

| Add: Interest and other costs

on pension and OPEB liabilities |

|

(248 |

) |

|

|

480 |

|

|

|

(728 |

) |

|

|

214 |

|

|

|

1,440 |

|

|

|

(1,226 |

) |

| Add: Other non-recurring

items (3) |

|

— |

|

|

|

1,131 |

|

|

|

(1,131 |

) |

|

|

— |

|

|

|

2,470 |

|

|

|

(2,470 |

) |

| Less: Equity in losses of

unconsolidated entities |

|

14,308 |

|

|

|

9,914 |

|

|

|

4,394 |

|

|

|

38,998 |

|

|

|

7,173 |

|

|

|

31,825 |

|

| Less: Non-controlling share of

Adjusted EBITDA (4) |

|

(6,318 |

) |

|

|

(5,410 |

) |

|

|

(908 |

) |

|

|

(20,305 |

) |

|

|

(15,577 |

) |

|

|

(4,728 |

) |

| Adjusted EBITDA

(non-GAAP) |

$ |

36,928 |

|

|

$ |

24,655 |

|

|

$ |

12,273 |

|

|

$ |

98,415 |

|

|

$ |

74,228 |

|

|

$ |

24,187 |

|

_______________________________

|

(1) |

Includes the following items for the three months ended September

30, 2024 and 2023: (i) depreciation and amortization expense of

$19,492 and $20,150 and (ii) capitalized contract costs

amortization of $1,233 and $—, respectively. Includes the following

items for the nine months ended September 30, 2024 and 2023: (i)

depreciation and amortization expense of $60,176 and $60,577 and

(ii) capitalized contract costs amortization of $3,242 and $—,

respectively. |

|

|

|

|

(2) |

Includes

the following items for the three months ended September 30, 2024

and 2023: (i) net loss of $(14,352) and $(9,941),

(ii) interest expense of $10,826 and $8,830,

(iii) depreciation and amortization expense of $6,911 and

$6,965, (iv) acquisition and transaction expenses of $47 and $50,

(v) changes in fair value of non-hedge derivative instruments of

$(2,572) and $(352), (vi) equity-based compensation of $— and $2,

(vii) asset impairment of $24 and $—, (viii) equity method basis

adjustments of $17 and $— and (ix) loss on modification or

extinguishment of debt of $4,724 and $—, respectively. Includes the

following items for the nine months ended September 30, 2024 and

2023: (i) net loss of $(39,132) and $(7,283),

(ii) interest expense of $32,901 and $25,166,

(iii) depreciation and amortization expense of $20,091 and

$20,598, (iv) acquisition and transaction expenses of $97 and $307,

(v) changes in fair value of non-hedge derivative instruments of

$(4,394) and $(18,162), (vi) equity-based compensation of $2 and

$4, (vii) asset impairment of $274 and $—, (viii) equity method

basis adjustments of $49 and $—, (ix) loss on modification or

extinguishment of debt of $4,724 and $— and (x) other non-recurring

items of $478 and $—, respectively. |

|

|

|

|

(3) |

Includes

the following item for the three and nine months ended September

30, 2023: certain non-cash expenses related to cancellation of RSUs

and Railroad severance expense of $1,131 and $2,470,

respectively. |

|

|

|

|

(4) |

Includes

the following items for the three months ended September 30, 2024

and 2023: (i) equity-based compensation of $240 and $718, (ii)

benefit from income taxes of $(98) and $(19), (iii) interest

expense of $3,078 and $1,821, (iv) depreciation and amortization

expense of $3,274 and $2,870, (v) acquisition and transaction

expense of $— and $19, (vi) interest and other costs on pension and

OPEB liabilities of $(1) and $1 and (vii) loss on modification or

extinguishment of debt of $(175) and $—, respectively. Includes the

following items for the nine months ended September 30, 2024 and

2023: (i) equity-based compensation of $939 and $904, (ii) (benefit

from) provision for income taxes of $(374) and $69, (iii) interest

expense of $7,906 and $5,558, (iv) depreciation and amortization

expense of $9,855 and $8,950, (v) changes in fair value of

non-hedge derivative instruments of $— and $61, (vi) acquisition

and transaction expense of $3 and $27, (vii) interest and other

costs on pension and OPEB liabilities of $1 and $3, (viii) asset

impairment of $— and $2, (ix) loss on modification or

extinguishment of debt of $1,975 and $— and (x) other non-recurring

items of $— and $3, respectively. |

| |

|

The following tables sets forth a reconciliation of net income

(loss) attributable to stockholders to Adjusted EBITDA for our four

core segments for the three months ended September 30,

2024:

| |

Three Months Ended September 30, 2024 |

| (in thousands) |

Railroad |

|

Jefferson Terminal |

|

Repauno |

|

Power and Gas |

|

Four Core Segments |

|

Net income (loss) attributable to

stockholders |

$ |

14,528 |

|

|

$ |

(8,009 |

) |

|

$ |

(4,987 |

) |

|

$ |

(8,562 |

) |

|

$ |

(7,030 |

) |

| Add: Provision for (benefit

from) income taxes |

|

1,174 |

|

|

|

(426 |

) |

|

|

(73 |

) |

|

|

— |

|

|

|

675 |

|

| Add: Equity-based compensation

expense |

|

547 |

|

|

|

673 |

|

|

|

1,306 |

|

|

|

— |

|

|

|

2,526 |

|

| Add: Acquisition and

transaction expenses |

|

95 |

|

|

|

— |

|

|

|

— |

|

|

|

1,681 |

|

|

|

1,776 |

|

| Add: Gains on the modification

or extinguishment of debt and capital lease obligations |

|

— |

|

|

|

(747 |

) |

|

|

— |

|

|

|

— |

|

|

|

(747 |

) |

| Add: Changes in fair value of

non-hedge derivative instruments |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Asset impairment

charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Incentive

allocations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Depreciation and

amortization expense (1) |

|

4,936 |

|

|

|

13,221 |

|

|

|

2,489 |

|

|

|

— |

|

|

|

20,646 |

|

| Add: Interest expense |

|

78 |

|

|

|

13,107 |

|

|

|

92 |

|

|

|

— |

|

|

|

13,277 |

|

| Add: Pro-rata share of

Adjusted EBITDA from unconsolidated entities (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,512 |

|

|

|

7,512 |

|

| Add: Dividends and accretion

of redeemable preferred stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add: Interest and other costs

on pension and OPEB liabilities |

|

(248 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(248 |

) |

| Add: Other non-recurring

items |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Less: Equity in losses of

unconsolidated entities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,474 |

|

|

|

10,474 |

|

| Less: Non-controlling share of

Adjusted EBITDA (3) |

|

(30 |

) |

|

|

(6,055 |

) |

|

|

(233 |

) |

|

|

— |

|

|

|

(6,318 |

) |

| Adjusted EBITDA

(non-GAAP) |

$ |

21,080 |

|

|

$ |

11,764 |

|

|

$ |

(1,406 |

) |

|

$ |

11,105 |

|

|

$ |

42,543 |

|

_______________________________

| (1) |

Jefferson

Terminal |

| |

Includes the following items for the three months ended

September 30, 2024: (i) depreciation and amortization expense

of $11,988 and (ii) capitalized contract costs amortization of

$1,233. |

| |

|

| (2) |

Power and Gas |

| |

Includes the following items for the three months ended

September 30, 2024: (i) net loss of $(10,489), (ii) interest

expense of $9,544, (iii) depreciation and amortization expense of

$6,217, (iv) acquisition and transaction expenses of $47, (v)

changes in fair value of non-hedge derivative instruments of

$(2,572), (vi) asset impairment of $24, (vii) equity method basis

adjustments of $17 and (viii) loss on modification or

extinguishment of debt of $4,724. |

| |

|

| (3) |

Railroad |

| |

Includes the following items for the three months ended

September 30, 2024: (i) equity-based compensation of $3, (ii)

provision for income taxes of $6, (iii) depreciation and

amortization expense of $22 and (iv) interest and other costs on

pension and OPEB liabilities of $(1). |

| |

|

| |

Jefferson Terminal |

| |

Includes the following items for the three months ended

September 30, 2024: (i) equity-based compensation of $157,

(ii) benefit from income taxes of $(100), (iii) interest expense of

$3,073, (iv) depreciation and amortization expense of $3,100, and

(v) loss on modification or extinguishment of debt of $(175). |

| |

|

| |

Repauno |

| |

Includes the following items for the three months ended

September 30, 2024: (i) equity-based compensation of $80, (ii)

benefit from income taxes of $(4), (iii) interest expense of $5 and

(iv) depreciation and amortization expense of $152. |

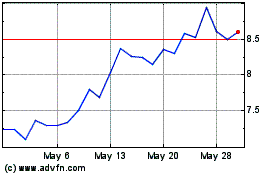

FTAI Infrastructure (NASDAQ:FIP)

Historical Stock Chart

From Oct 2024 to Nov 2024

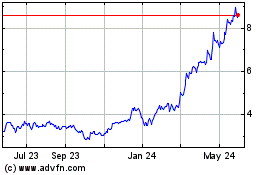

FTAI Infrastructure (NASDAQ:FIP)

Historical Stock Chart

From Nov 2023 to Nov 2024