Forian Inc. (Nasdaq: FORA),

a provider of data science driven information and analytics

solutions to the healthcare and life sciences industries, today

announced results for the quarter ended June 30, 2024.

“We continued to invest in our information assets in the second

quarter to further differentiate our offerings and the insights

they power for our customers. We remain confident that our

combination of thoughtful productization, diversification of data

sources and prudent cost containment put us in solid position to

manage through recent industry challenges and to continue our

contribution to our customers’ success,” stated Max Wygod, Chairman

and Chief Executive Officer of Forian.

Second Quarter 2024 Financial Results

- Forian delivered the following results for the second quarter

of 2024:

| |

|

|

Three Months EndedJune 30, |

|

Period-over-Period %

Change |

|

|

|

|

|

|

|

|

|

2024Unaudited |

|

2023Unaudited |

|

| Revenue |

|

$ |

4,777,101 |

|

|

$ |

4,893,542 |

|

|

-2 |

% |

|

|

|

|

|

|

|

|

|

| Loss from

continuing operations, net of tax |

|

$ |

(2,553,259 |

) |

|

$ |

(1,090,400 |

) |

|

-134 |

% |

| (Loss) income from

discontinued operations, net of tax |

|

$ |

- |

|

|

$ |

(32,426 |

) |

|

-100 |

% |

| Net (loss)

income |

|

$ |

(2,553,259 |

) |

|

$ |

(1,122,826 |

) |

|

-127 |

% |

|

|

|

|

|

|

|

|

|

| Loss from

continuing operations, net of tax per share – basic and

diluted |

$ |

(0.08 |

) |

|

$ |

(0.03 |

) |

|

-167 |

% |

| Income from

discontinued operations, net of tax per share – basic and

diluted |

$ |

- |

|

|

$ |

- |

|

|

0 |

% |

| (Loss) Income per

share – basic and diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.03 |

) |

|

-167 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (a

non-GAAP financial measure defined below) |

|

$ |

78,202 |

|

|

$ |

417,368 |

|

|

-81 |

% |

- Revenue for the quarter was $4.8 million, a $0.1 million

decrease from $4.9 million in the prior year

- Net loss from continuing operations for the quarter was $2.6

million, or $0.08 per share, compared to a net loss of $1.1

million, or $0.03 per share, in the prior year

- Adjusted EBITDA for the quarter was $0.08 million, compared to

$0.4 million in the prior year

- Cash, cash equivalents and marketable securities at June 30,

2024 totaled $48.0 million

Highlights

- Continued expansion of Chronos™ data lake through license of

additional data to offset the reduction and expected 2025 loss of

certain data from one data supplier

- Maintained positive Adjusted EBITDA despite revenue impact

resulting from financing challenges of two early-stage

customers

Full Year 2024 Outlook

Based on information as of August 14, 2024, the Company is

updating its outlook for the year ending December 31, 2024 as

follows:

- Revenue is expected to be in the range of $19 to $20

million

- Adjusted EBITDA is expected to be in the range of negative $0.5

million to $0.5 million

This release uses non-GAAP financial measures

that are adjusted for the impact of various U.S. GAAP items. See

the section titled “Non-GAAP Financial Measures”

and the table entitled “Reconciliation of U.S. GAAP to

Non-GAAP Financial Measures” below for details.

Quarterly Conference Call and Webcast

Forian will host a conference call and webcast at 4:30 p.m. ET

on August 14, 2024 to discuss its financial results with the

investment community. To register for the conference call, click

here. The webcast will be available live at

https://edge.media-server.com/mmc/p/c5ot6k5y. This information is

also available on our website at www.forian.com/investors. To

be included on the Company’s email distribution list, please sign

up at www.forian.com/investors.

About ForianForian provides a unique suite of

data management capabilities and proprietary information and

analytics solutions to optimize and measure operational, clinical

and financial performance for customers within the traditional and

emerging life sciences and healthcare payer and provider segments.

Forian has industry leading expertise in acquiring, integrating,

normalizing and commercializing large scale healthcare data assets.

Forian’s information products overlay sophisticated data management

and data science capabilities on top of a comprehensive clinical

data lake to identify unique relationships, create distinctive

information assets and generate proprietary insights. For more

information, please visit the Company’s website

at www.forian.com.

Cautionary Statements Regarding Forward-Looking

StatementsThis release contains “forward-looking

statements” within the meaning of the federal securities laws,

including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

In this context, forward-looking statements often address expected

future business and financial performance and financial condition,

which may include GAAP and non-GAAP financial measures, and often

contain words such as “expect,” “anticipate,” “intend,” “plan,”

“believe,” “seek,” “see,” “will,” “would,” “target,” similar

expressions and variations or negatives of these words.

Forward-looking statements by their nature address matters that

involve risks and uncertainties, many of which are beyond our

control and are not guarantees of future results, such as

statements about future financial and operating results, company

strategy and intended product offerings and market positioning.

These and other forward-looking statements are not guarantees of

future results and are subject to risks, uncertainties and

assumptions that could cause actual results to differ materially

from those expressed in any forward-looking statements.

Accordingly, there are or will be important factors that could

cause actual results to differ materially from those indicated in

such statements and, therefore, you should not place undue reliance

on any such statements and caution must be exercised in relying on

forward-looking statements. Our updated 2024 outlook contained in

this release is based on current estimates as of today’s date that

are subject to such factors. Factors that could cause actual

results to differ include, but are not limited to, those risks and

uncertainties associated with operations, strategy and goals, our

ability to execute on our strategy and the additional risks and

uncertainties set forth more fully under the caption “Risk Factors”

in Forian’s Annual Report on Form 10-K for the year ended December

31, 2023, as filed with the SEC on March 29, 2024, and elsewhere in

Forian’s filings and reports with the SEC. Forward-looking

statements contained in this release are made as of the date

hereof, and we undertake no duty to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable law.

Media and Investor

Contact:forian.com/investorsir@forian.com267-225-6263SOURCE: Forian

Inc.

| FORIAN

INC. |

|

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

| |

|

|

|

|

| |

|

|

|

|

| |

June

30, |

|

December

31, |

|

| |

|

2024 |

|

|

|

2023 |

|

|

| |

(UNAUDITED) |

|

|

|

|

ASSETS |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

1,999,118 |

|

|

$ |

6,042,986 |

|

|

|

Marketable securities |

|

46,011,230 |

|

|

|

42,296,589 |

|

|

|

Accounts receivable, net |

|

3,670,368 |

|

|

|

2,572,931 |

|

|

|

Proceeds receivable from sale of discontinued operation, net |

|

- |

|

|

|

1,645,954 |

|

|

|

Contract assets |

|

955,355 |

|

|

|

1,126,713 |

|

|

|

Prepaid expenses |

|

1,015,985 |

|

|

|

1,077,233 |

|

|

|

Other assets |

|

2,783,185 |

|

|

|

2,515,509 |

|

|

|

Total current assets |

|

56,435,241 |

|

|

|

57,277,915 |

|

|

| |

|

|

|

|

| Property and

equipment, net |

|

59,309 |

|

|

|

76,085 |

|

|

| Right of use

assets, net |

|

46,876 |

|

|

|

10,664 |

|

|

| Deposits and

other assets |

|

1,828,425 |

|

|

|

1,523,948 |

|

|

|

Total assets |

$ |

58,369,851 |

|

|

$ |

58,888,612 |

|

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

$ |

1,489,766 |

|

|

$ |

161,590 |

|

|

|

Accrued expenses |

|

3,320,571 |

|

|

|

4,252,257 |

|

|

|

Short-term operating lease liabilities |

|

22,872 |

|

|

|

10,664 |

|

|

|

Warrant liability |

|

20 |

|

|

|

563 |

|

|

|

Deferred revenues |

|

3,202,703 |

|

|

|

2,413,551 |

|

|

|

Total current liabilities |

|

8,035,932 |

|

|

|

6,838,625 |

|

|

| |

|

|

|

|

| Long-term

liabilities: |

|

|

|

|

|

Other liabilities |

|

524,004 |

|

|

|

1,000,000 |

|

|

|

Convertible notes payable, net of debt issuance costs ($6,000,000

in principal is held by a related party) |

|

24,175,094 |

|

|

|

24,870,181 |

|

|

|

Total long-term liabilities |

|

24,699,098 |

|

|

|

25,870,181 |

|

|

| |

|

|

|

|

|

Total liabilities |

|

32,735,030 |

|

|

|

32,708,806 |

|

|

| |

|

|

|

|

| Commitments

and contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred Stock; par value $0.001; 5,000,000 Shares authorized; 0

issued and outstanding as of June 30, 2024 and December 31,

2023 |

|

- |

|

|

|

- |

|

|

|

Common Stock; par value $0.001; 95,000,000 Shares authorized;

31,110,187 issued and outstanding as of March 31, 2024 and

30,920,450 issued and outstanding as of December 31, 2023 |

|

31,110 |

|

|

|

30,920 |

|

|

|

Additional paid-in capital |

|

77,054,999 |

|

|

|

73,834,300 |

|

|

|

Accumulated deficit |

|

(51,451,288 |

) |

|

|

(47,685,414 |

) |

|

|

Total stockholders' equity |

|

25,634,821 |

|

|

|

26,179,806 |

|

|

|

Total liabilities and stockholders' equity |

$ |

58,369,851 |

|

|

$ |

58,888,612 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| FORIAN

INC. |

|

|

|

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4,777,101 |

|

|

$ |

4,893,542 |

|

|

$ |

9,654,479 |

|

|

$ |

9,763,929 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

1,806,918 |

|

|

|

1,276,712 |

|

|

|

3,510,275 |

|

|

|

2,528,927 |

|

|

|

| Research and

development |

|

307,201 |

|

|

|

304,187 |

|

|

|

697,090 |

|

|

|

835,876 |

|

|

|

| Sales and

marketing |

|

1,017,659 |

|

|

|

1,237,327 |

|

|

|

2,072,800 |

|

|

|

2,433,519 |

|

|

|

| General and

administrative |

|

3,665,601 |

|

|

|

3,198,290 |

|

|

|

6,949,090 |

|

|

|

6,753,765 |

|

|

|

| Separation

expenses |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

599,832 |

|

|

|

| Depreciation

and amortization |

|

7,889 |

|

|

|

15,257 |

|

|

|

16,776 |

|

|

|

53,687 |

|

|

|

| Litigation

settlements and related expenses |

|

942,311 |

|

|

|

350,309 |

|

|

|

1,151,276 |

|

|

|

434,660 |

|

|

|

| Total costs

and expenses |

|

7,747,579 |

|

|

|

6,382,082 |

|

|

|

14,397,307 |

|

|

|

13,640,266 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating loss From Continuing Operations |

|

(2,970,478 |

) |

|

|

(1,488,540 |

) |

|

|

(4,742,828 |

) |

|

|

(3,876,337 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

|

| Change in

fair value of warrant liability |

|

430 |

|

|

|

8,053 |

|

|

|

543 |

|

|

|

2,494 |

|

|

|

| Interest and

investment income |

|

618,316 |

|

|

|

637,032 |

|

|

|

1,293,473 |

|

|

|

1,019,954 |

|

|

|

| Gain on sale

of investment |

|

- |

|

|

|

- |

|

|

|

48,612 |

|

|

|

- |

|

|

|

| Interest

expense |

|

(193,306 |

) |

|

|

(210,758 |

) |

|

|

(392,269 |

) |

|

|

(419,214 |

) |

|

|

| Gain on debt

redemption |

|

- |

|

|

|

- |

|

|

|

137,356 |

|

|

|

- |

|

|

|

| Total other

income (expense), net |

|

425,440 |

|

|

|

434,327 |

|

|

|

1,087,715 |

|

|

|

603,234 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss from

continuing operations before income taxes |

|

(2,545,038 |

) |

|

|

(1,054,213 |

) |

|

|

(3,655,113 |

) |

|

|

(3,273,103 |

) |

|

|

| Income

taxes |

|

(8,221 |

) |

|

|

(36,187 |

) |

|

|

(110,761 |

) |

|

|

(66,096 |

) |

|

|

| Loss from

continuing operations, net of tax |

|

(2,553,259 |

) |

|

|

(1,090,400 |

) |

|

|

(3,765,874 |

) |

|

|

(3,339,199 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

| Loss from

discontinued operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(94,427 |

) |

|

|

| Gain on sale

of discontinued operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11,531,849 |

|

|

|

| Income tax

effect on discontinued operations |

|

- |

|

|

|

(32,426 |

) |

|

|

- |

|

|

|

(2,722,570 |

) |

|

|

| Income from

discontinued operations, net of tax |

|

- |

|

|

|

(32,426 |

) |

|

|

- |

|

|

|

8,714,852 |

|

|

|

| Net

(loss) income |

$ |

(2,553,259 |

) |

|

$ |

(1,122,826 |

) |

|

$ |

(3,765,874 |

) |

|

$ |

5,375,653 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net (loss)

income per share |

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

$ |

(0.08 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.10 |

) |

|

|

|

Discontinued operations |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

0.27 |

|

|

|

| Net (loss)

income per share - basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.12 |

) |

|

$ |

0.17 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding |

|

31,098,497 |

|

|

|

32,260,992 |

|

|

|

31,049,647 |

|

|

|

32,369,904 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| FORIAN

INC. |

|

|

|

|

|

|

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

|

|

|

|

(UNAUDITED) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

For the Period Ended June 30, |

|

|

|

|

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

| CASH

FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(3,765,874 |

) |

|

$ |

5,375,653 |

|

|

|

|

|

|

|

|

Less: Income from discontinued operations |

|

|

- |

|

|

|

8,714,852 |

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

|

(3,765,874 |

) |

|

|

(3,339,199 |

) |

|

|

|

|

|

|

|

Adjustments to reconcile net (loss) income to net cash provided by

(used in) operating activities - continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

16,776 |

|

|

|

53,687 |

|

|

|

|

|

|

|

|

Amortization on right of use asset |

|

|

10,664 |

|

|

|

11,724 |

|

|

|

|

|

|

|

|

Amortization of debt issuance costs |

|

|

2,667 |

|

|

|

2,667 |

|

|

|

|

|

|

|

|

Accrued interest on convertible Notes |

|

|

389,602 |

|

|

|

416,548 |

|

|

|

|

|

|

|

|

Amortization of discount - proceeds from sale of discontinued

operations |

|

|

(20,712 |

) |

|

|

(245,041 |

) |

|

|

|

|

|

|

|

Accretion of discount - marketable securities |

|

|

(1,237,337 |

) |

|

|

(767,533 |

) |

|

|

|

|

|

` |

|

Gain on sale of investment |

|

|

(48,612 |

) |

|

|

- |

|

|

|

|

|

|

|

|

Gain on debt redemption |

|

|

(137,356 |

) |

|

|

- |

|

|

|

|

|

|

|

|

Provision for doubtful accounts |

|

|

168,750 |

|

|

|

- |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

3,321,551 |

|

|

|

3,368,575 |

|

|

|

|

|

|

|

|

Change in fair value of warrant liability |

|

|

(543 |

) |

|

|

(2,494 |

) |

|

|

|

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(1,266,187 |

) |

|

|

(2,030,800 |

) |

|

|

|

|

|

|

|

Contract assets |

|

|

171,358 |

|

|

|

442,616 |

|

|

|

|

|

|

|

|

Prepaid expenses |

|

|

61,248 |

|

|

|

(132,344 |

) |

|

|

|

|

|

|

|

Changes in lease liabilities during the period |

|

|

(21,624 |

) |

|

|

(11,724 |

) |

|

|

|

|

|

|

|

Deposits and other assets |

|

|

(572,153 |

) |

|

|

(235,656 |

) |

|

|

|

|

|

|

|

Accounts payable |

|

|

1,328,176 |

|

|

|

605,437 |

|

|

|

|

|

|

|

|

Accrued expenses |

|

|

(931,686 |

) |

|

|

(236,088 |

) |

|

|

|

|

|

|

|

Deferred revenues |

|

|

789,152 |

|

|

|

681,476 |

|

|

|

|

|

|

|

|

Other liabilities |

|

|

(489,040 |

) |

|

|

- |

|

|

|

|

|

|

|

|

Net cash used in operating activities - continuing operations |

|

|

(2,231,180 |

) |

|

|

(1,418,149 |

) |

|

|

|

|

|

|

|

Net cash used in operating activities - discontinued

operations |

|

|

- |

|

|

|

(59,075 |

) |

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

(2,231,180 |

) |

|

|

(1,477,224 |

) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| CASH

FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

Additions to property and equipment |

|

|

- |

|

|

|

(75,493 |

) |

|

|

|

|

|

|

|

Purchase of marketable securities |

|

|

(87,732,380 |

) |

|

|

(61,573,237 |

) |

|

|

|

|

|

|

|

Sale of marketable securities |

|

|

85,255,076 |

|

|

|

41,392,821 |

|

|

|

|

|

|

|

|

Proceeds from sale of investment |

|

|

48,612 |

|

|

|

- |

|

|

|

|

|

|

|

|

Cash from sale of discontinued operations |

|

|

1,666,666 |

|

|

|

21,967,193 |

|

|

|

|

|

|

|

|

Net cash (used in) provided by investing activities - continuing

operations |

|

|

(762,026 |

) |

|

|

1,711,284 |

|

|

|

|

|

|

|

|

Net cash (used in) provided by investing

activities |

|

|

(762,026 |

) |

|

|

1,711,284 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| CASH

FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

Cash used to redeem convertible notes |

|

|

(950,000 |

) |

|

|

- |

|

|

|

|

|

|

|

|

Tax payments related to shares withheld for vested restricted stock

units |

|

|

(100,662 |

) |

|

|

(127,357 |

) |

|

|

|

|

|

|

|

Net cash used in financing activities- continuing operations |

|

|

(1,050,662 |

) |

|

|

(127,357 |

) |

|

|

|

|

|

|

|

Net cash used in financing activities |

|

|

(1,050,662 |

) |

|

|

(127,357 |

) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net change

in cash |

|

|

(4,043,868 |

) |

|

|

106,703 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents, beginning of period |

|

|

6,042,986 |

|

|

|

2,795,743 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Cash

and cash equivalents, end of period |

|

$ |

1,999,118 |

|

|

$ |

2,902,446 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

|

|

|

|

|

| Cash for

paid for taxes |

|

$ |

48,492 |

|

|

$ |

1,423,000 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

In this press release, we have provided certain non-GAAP

measures, which we define as financial information that has not

been prepared in accordance with U.S. GAAP. The non-GAAP financial

measure provided herein is earnings before interest, taxes,

non-cash and other items (“Adjusted EBITDA”), which should be

viewed as supplemental to, and not as an alternative for, net

income or loss calculated in accordance with U.S. GAAP (referred to

below as “net loss”).

Adjusted EBITDA is used by our management as an additional

measure of our Company’s performance for purposes of business

decision-making, including developing budgets, managing

expenditures and evaluating potential acquisitions or divestitures.

Period-to-period comparisons of Adjusted EBITDA help our management

identify additional trends in our Company’s financial results that

may not be shown solely by period-to-period comparisons of net

income. In addition, we may use Adjusted EBITDA in the incentive

compensation programs applicable to some of our employees in order

to evaluate our Company’s performance. Our management recognizes

that Adjusted EBITDA has inherent limitations because of the

excluded items, particularly those items that are recurring in

nature. In order to compensate for those limitations, management

also reviews the specific items that are excluded from Adjusted

EBITDA, but included in net income, as well as trends in those

items.

We believe that the presentation of Adjusted EBITDA is useful to

investors in their analysis of our results for reasons similar to

the reasons why our management finds it useful and because it helps

facilitate investor understanding of decisions made by management

in light of the performance metrics used in making those decisions.

In addition, as more fully described below, we believe that

providing Adjusted EBITDA, together with a reconciliation of net

loss to Adjusted EBITDA, helps investors make comparisons between

our Company and other companies that may have different capital

structures, different effective income tax rates and tax

attributes, different capitalized asset values and/or different

forms of employee compensation. However, Adjusted EBITDA is not

intended as a substitute for comparisons based on net loss. In

making any comparisons to other companies, investors need to be

aware that companies use different non-GAAP measures to evaluate

their financial performance. Investors should pay close attention

to the specific definition being used and to the reconciliation

between such measures and the corresponding U.S. GAAP measures

provided by each company under applicable SEC rules.

The following is an explanation of the items excluded by us from

Adjusted EBITDA but included in net loss:

- Depreciation and Amortization. Depreciation

and amortization expense is a non-cash expense relating to capital

expenditures and intangible assets arising from acquisitions that

are expensed on a straight-line basis over the estimated useful

life of the related assets. The Company excludes depreciation and

amortization expense from Adjusted EBITDA because management

believes that (i) the amount of such expenses in any specific

period may not directly correlate to the underlying performance of

the business operations and (ii) such expenses can vary

significantly between periods as a result of new acquisitions and

full amortization of previously acquired tangible and intangible

assets. Accordingly, management believes that this exclusion

assists management and investors in making period-to-period

comparisons of operating performance. Investors should note that

the use of tangible and intangible assets contributed to revenue in

the periods presented and will contribute to future revenue

generation and should also note that such expense will recur in

future periods.

- Stock-Based Compensation Expense. Stock-based

compensation expense is a non-cash expense arising from the grant

of stock-based awards to employees. Management believes that

excluding the effect of stock-based compensation from Adjusted

EBITDA assists management and investors in making period-to-period

comparisons in the Company’s operating performance because (i) the

amount of such expenses in any specific period may not directly

correlate to the underlying performance of business operations and

(ii) such expenses can vary significantly between periods as a

result of the timing of grants of new stock-based awards, including

grants in connection with acquisitions. Stock-based compensation

expense includes certain separation expenses related to the vesting

of stock options. Effective February 10, 2023, the Company’s Chief

Executive Officer, President and Class II member of the Board of

Directors resigned. In connection with the resignation, the Company

entered into a separation agreement providing for, among other

things, accelerated vesting of 106,656 unvested restricted shares

of the Company common stock. Stock based compensation expense for

2023 includes $349,832 related to the accelerated vesting of stock,

which is recognized in separation expenses in the condensed

consolidated statements of operations. These expenses were incurred

during the three months ended March 31, 2023, and there were no

additional related expenses incurred during the three months ended

June 30, 2023. Management believes that excluding stock-based

compensation from Adjusted EBITDA assists management and investors

in making meaningful comparisons between the Company’s operating

performance and the operating performance of other companies that

may use different forms of employee compensation or different

valuation methodologies for their stock-based compensation.

Investors should note that stock-based compensation is a key

incentive offered to employees whose efforts contributed to the

operating results in the periods presented and are expected to

contribute to operating results in future periods. Investors should

also note that such expenses will recur in the future.

- Interest Expense. Interest expense is

associated with the convertible notes entered into on September 1,

2021 in the amount of $24,000,000. The Notes are due on September

1, 2025, and accrue interest at an annual rate of 3.5%. Management

excludes interest expense from Adjusted EBITDA (i) because it is

not directly attributable to the performance of business operations

and, accordingly, its exclusion assists management and investors in

making period-to-period comparisons of operating performance and

(ii) to assist management and investors in making comparisons to

companies with different capital structures. Investors should note

that interest expense associated with the Notes will recur in

future periods.

- Investment Income. Investment income is

associated with the level of marketable debt securities and other

interest-bearing accounts in which the Company invests. Interest

and investment income can vary over time due to changes in interest

rates and level of investments. Management excludes interest and

investment income from Adjusted EBITDA (i) because these items are

not directly attributable to the performance of business operations

and, accordingly, their exclusion assists management and investors

in making period-to-period comparisons of operating performance and

(ii) to assist management and investors in making comparisons to

companies with different capital structures. Investors should note

that interest income will recur in future periods.

- Other Items. The Company engages in other

activities and transactions that can impact net income (loss). In

the periods reported, these other items included (i) change in fair

value of warrant liability relating to warrants assumed in the

acquisition of Helix; (ii) gain on sale of investment relating to

the sale of a minority equity interest; and (iii) gain on debt

redemption which relates to a gain on the early retirement of a

portion of the convertible notes. Management excludes these other

items from Adjusted EBITDA because management believes these

activities or transactions are not directly attributable to the

performance of business operations and, accordingly, their

exclusion assists management and investors in making

period-to-period comparisons of operating performance. Investors

should note that some of these other items may recur in future

periods.

- Severance expenses. Effective February 10,

2023, the Company’s Chief Executive Officer, President and Class II

member of the Board of Directors resigned. In connection with the

resignation, the Company entered into a separation agreement

providing for, among other things, (i) salary continuation for

twelve months and (ii) accelerated vesting of 106,656 unvested

restricted shares of the Company common stock. Severance expenses

for the six months ended June 30, 2023 includes $250,000 related to

the salary continuation. Managements excludes these other items

from Adjusted EBITDA because management believes these costs are

not recurring and not directly attributable to the performance of

business operations and, accordingly, their exclusion assists

management and investors in making period-to-period comparisons of

operating performance. In addition, the Company records normal

course of business severance expenses in the operating expense line

item related to its employees’ activities.

- Litigation related expenses. Management

excludes litigation expenses that are extraordinary in nature and

are unrelated to the Company’s day-to-day business operations. The

nature of these expenses is primarily related to direct and

incremental third-party legal expenses associated with such

litigation, which pertains to entities acquired in the Helix

merger.

- Strategic review related expenses. Management

excludes certain professional expenses that are extraordinary in

nature and are unrelated to the Company’s day-to-day business

operations. The nature of these expenses is primarily related to a

strategic review of the Company’s operations.

- Income tax expense. Management excludes the

income tax expense from Adjusted EBITDA (i) because management

believes that the income tax expense is not directly attributable

to the underlying performance of business operations and,

accordingly, its exclusion assists management and investors in

making period-to-period comparisons of operating performance and

(ii) to assist management and investors in making comparisons to

companies with different tax attributes.

There are limitations to using non-GAAP financial measures

because non-GAAP financial measures are not prepared in accordance

with U.S. GAAP and may be different from non-GAAP financial

measures provided by other companies.

The non-GAAP financial measures are limited in value because

they exclude certain items that may have a material impact upon our

reported financial results. In addition, they are subject to

inherent limitations as they reflect the exercise of judgments by

management about which items are adjusted to calculate our non-GAAP

financial measures. We compensate for these limitations by

analyzing current and future results on a U.S. GAAP basis as well

as a non-GAAP basis and also by providing U.S. GAAP measures in our

public disclosures.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with U.S. GAAP. We encourage investors and

others to review our financial information in its entirety, not to

rely on any single financial measure to evaluate our business and

to view our non-GAAP financial measures in conjunction with the

most directly comparable U.S. GAAP financial measures.

The following table reconciles the specific

items excluded from U.S. GAAP metrics in the calculation of

non-GAAP metrics for the periods shown below:

| FORIAN

INC. |

|

RECONCILIATION OF US GAAP TO NON-GAAP FINANCIAL

MEASURES |

|

(UNAUDITED) |

| |

|

|

|

|

|

|

|

| |

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

4,777,101 |

|

|

$ |

4,893,542 |

|

|

$ |

9,654,479 |

|

|

$ |

9,763,929 |

|

| |

|

|

|

|

|

|

|

| Net

loss from continuing operations |

$ |

(2,553,259 |

) |

|

$ |

(1,090,400 |

) |

|

$ |

(3,765,874 |

) |

|

$ |

(3,339,199 |

) |

| |

|

|

|

|

|

|

|

| Depreciation

and amortization |

|

7,889 |

|

|

|

15,257 |

|

|

|

16,776 |

|

|

|

53,687 |

|

| Stock based

compensation expense |

|

1,662,636 |

|

|

|

1,540,342 |

|

|

|

3,321,551 |

|

|

|

3,368,575 |

|

| Change in

fair value of warrant liability |

|

(430 |

) |

|

|

(8,053 |

) |

|

|

(543 |

) |

|

|

(2,494 |

) |

| Interest and

investment income |

|

(618,316 |

) |

|

|

(637,032 |

) |

|

|

(1,293,473 |

) |

|

|

(1,019,954 |

) |

| Interest

expense |

|

193,306 |

|

|

|

210,758 |

|

|

|

392,269 |

|

|

|

419,214 |

|

| Gain on sale

of investment |

|

- |

|

|

|

- |

|

|

|

(48,612 |

) |

|

|

- |

|

| Gain on debt

redemption |

|

- |

|

|

|

- |

|

|

|

(137,356 |

) |

|

|

- |

|

| Severance

expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

250,000 |

|

| Litigation

settlement and related expenses |

|

942,311 |

|

|

|

350,309 |

|

|

|

1,151,276 |

|

|

|

434,660 |

|

| Strategic

review related expenses |

|

435,844 |

|

|

|

|

|

435,844 |

|

|

|

| Income tax

expense |

|

8,221 |

|

|

|

36,187 |

|

|

|

110,761 |

|

|

|

66,096 |

|

| |

|

|

|

|

|

|

|

|

Adjusted EBITDA - continuing operations |

$ |

78,202 |

|

|

$ |

417,368 |

|

|

$ |

182,619 |

|

|

$ |

230,585 |

|

| |

|

|

|

|

|

|

|

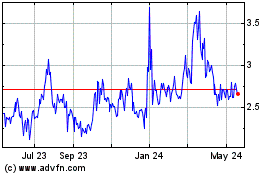

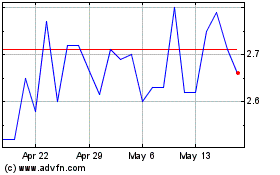

Forian (NASDAQ:FORA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Forian (NASDAQ:FORA)

Historical Stock Chart

From Nov 2023 to Nov 2024