FTAI Aviation Agrees to Purchase Lockheed Martin Commercial Engines Solutions

30 May 2024 - 10:30PM

FTAI Aviation Ltd. (NASDAQ: FTAI) announces entry into an

agreement to purchase Lockheed Martin Commercial Engine Solutions

(“LMCES”) from Lockheed Martin Canada for a purchase price of $170

million. The acquisition is subject to customary regulatory

approvals and is anticipated to close in the second half of 2024.

LMCES is a 526,000-square-foot aircraft engine

maintenance repair facility located in Montréal, Quebec, with

extensive engine and piece-part repair capabilities for CFM56

engines. FTAI, LMCES’s largest customer, and LMCES established The

Module Factory™ at the facility in 2020 to distribute CFM56 modules

globally. The facility has a capacity for up to 900 CFM56 modules

per year and houses three test cells on-site.

This acquisition will further enhance FTAI’s

Maintenance, Repair, and Exchange (MRE) business, and create

permanent engine and module manufacturing capabilities in Canada.

FTAI will continue to expand its module customer base, which

currently includes over 50 airlines and lessors globally.

Additionally, FTAI expects to establish a center of excellence in

Montréal for piece-part repairs, serving both its own operations,

including the Used Serviceable Material business, and third-party

customers.

“Acquiring Lockheed Martin Commercial Engine

Solutions represents a significant milestone for FTAI as we expand

our MRE offerings,” said Joe Adams, CEO of FTAI. “We know the

facility well and greatly value the team’s technical expertise and

commitment to quality. We are excited to grow the shop’s piece-part

repair capabilities and continue delivering modules and engines to

the aftermarket from a world class facility in Montréal.”

About FTAI Aviation

Ltd.

FTAI owns and maintains commercial jet engines

with a focus on CFM56 and V2500 engines. FTAI’s proprietary

portfolio of products, including The Module Factory and a joint

venture to manufacture engine PMA, enables it to provide cost

savings and flexibility to its airline, lessor, and maintenance,

repair, and operations customer base. Additionally, FTAI owns and

leases jet aircraft which often facilitates the acquisition of

engines at attractive prices. FTAI invests in aviation assets and

aerospace products that generate strong and stable cash flows with

the potential for earnings growth and asset appreciation.

Cautionary Note Regarding

Forward-Looking Statements

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including but not limited to the anticipated

timing for closing the acquisition and ability to close such

acquisition, expectations regarding FTAI’s ability to further

enhance our MRE business and create permanent engine and module

manufacturing capabilities, continued expansion of our module

customer base and the ability to establish and grow a center of

excellence for piece-part repairs. You can identify these

forward-looking statements by the use of forward-looking words such

as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “should,” “could,” “seeks,” “approximately,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates,”

“target,” “projects,” “contemplates” or the negative version of

those words or other comparable words. Any forward-looking

statements contained in this communication are based upon our

historical performance and on our current plans, estimates and

expectations in light of information currently available to us. The

inclusion of this forward-looking information should not be

regarded as a representation by us that the future plans, estimates

or expectations contemplated by us will be achieved. Such

forward-looking statements are subject to various risks and

uncertainties and assumptions relating to our operations, financial

results, financial condition, business, prospects, growth strategy

and liquidity. Accordingly, there are or will be important factors

that could cause our actual results to differ materially from those

indicated in these statements, including, but not limited to, the

risk factors set forth in Item 1A. “Risk Factors” of FTAI’s Annual

Report on Form 10-K for the fiscal year ended December 31,

2023 and FTAI’s Quarterly Reports on Form 10-Q, as updated by

annual, quarterly and other reports FTAI files with

the SEC.

For further information, please contact:

Alan AndreiniInvestor RelationsFTAI Aviation

Ltd.(646) 734-9414aandreini@fortress.com

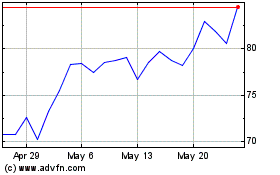

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Dec 2024 to Jan 2025

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Jan 2024 to Jan 2025