FitLife Brands, Inc. (“FitLife” or the “Company”) (NASDAQ: FTLF), a

provider of innovative and proprietary nutritional supplements and

wellness products, today announced financial results for the first

quarter ended March 31, 2024.

Highlights for the first quarter ended March 31, 2024

include:

-

Total revenue was $16.5 million, an increase of 54% compared to the

first quarter of 2023.

-

Online sales were $10.8 million, representing 65% of total revenue

and an increase of 116% compared to the first quarter of 2023.

-

Gross margin was 44.0% compared to 41.1% during the first quarter

of 2023.

-

Net income for the first quarter of 2024 was $2.2 million compared

to $0.2 million during the same period last year.

-

Basic earnings per share and diluted earnings per share were $0.47

and $0.43, respectively, compared to $0.03 during the first quarter

of 2023.

-

Adjusted EBITDA was $3.6 million, a 62% increase compared to the

first quarter of 2023.

-

The Company ended the quarter with $16.5 million outstanding on its

term loans and cash of $3.3 million, or total net debt of $13.2

million.

For the first quarter ended March 31, 2024, total revenue was

$16.5 million, an increase of 54% compared to $10.7 million during

the same period last year. Online revenue for the quarter was $10.8

million, an increase of 116% compared to the quarter ended March

31, 2023. Online sales for legacy FitLife increased 3% during the

quarter compared to the same period last year. Online revenue

accounted for 65% and 47% of the Company’s total revenue during the

quarters ended March 31, 2024 and 2023, respectively.

Wholesale revenue for the quarter ended March 31, 2024 was $5.7

million, flat when compared to the same period last

year. The Company’s recent acquisitions contributed

$1.2 million of wholesale revenue during the first quarter of 2024,

while Legacy FitLife wholesale revenue was down $1.2 million, or

21%, compared to the same period last year.

Gross margin for the quarter ended March 31, 2024 was 44.0%

compared to 41.1% during the same period in the prior year.

Excluding the impact of the inventory step-up resulting from the

acquisition of Mimi’s Rock Corp (“MRC”), gross margin during the

quarter ended March 31, 2023 would have been 42.1%.

Net income for the first quarter of 2024 was $2.2 million

compared to $0.2 million during the quarter ended March 31, 2023.

Basic earnings per share and diluted earnings per share were $0.47

and $0.43 respectively, compared to $0.03 during the first quarter

of 2023. Net income during the first quarter of 2023 was adversely

impacted by a number of acquisition-related items that did not

recur in 2024 including transaction expenses of $1.4 million,

amortization of the inventory step-up valuation of $0.1 million,

and a loss on a currency hedge of $0.1 million.

Adjusted EBITDA for the quarter ended March 31, 2024 was $3.6

million, an increase of 62% compared to the same period in

2023.

The Company ended the quarter with $16.5 million outstanding on

its term loans and cash of $3.3 million, or total net debt of $13.2

million. As previously disclosed, the Company made a voluntary

paydown on its term loan of $2.5 million during the first quarter

of 2024 in addition to the scheduled amortization payment of $1.1

million.

Dayton Judd, the Company’s Chairman and CEO, commented “The

Company is off to a solid start in 2024 and there are many bright

spots in our business. At MRC, I am encouraged that the Dr. Tobias

brand—which represents approximately 90% of the MRC

business—returned to growth during the quarter despite advertising

spend that was 39% lower than in the first quarter of 2023. And

although the skin care brands continue to struggle on the top line,

they are more profitable now than they were at the time of the

acquisition. In total, MRC is significantly more profitable than

when we made the acquisition.

“Our legacy FitLife brands continue to face headwinds in the

wholesale channel due to declining foot traffic at our

brick-and-mortar retail partners. Although the declines were

partially offset by growth in the legacy FitLife online business,

the online growth rate we experienced during the first quarter was

lower than anticipated. We are encouraged, though, that the growth

rate for legacy FitLife online sales was much stronger during April

with a 13% year-over-year increase.

“In addition, I am excited about a number of new products that

we will be introducing this year across several of our brands. Of

note, we recently re-launched the MusclePharm Combat Sport protein

bar in April 2024. We believe the MusclePharm brand is our most

significant organic growth opportunity. Both online and wholesale

revenue for MusclePharm ramped up throughout the quarter, and we

hope to continue the momentum. Overall, our first quarter results

demonstrate that we are continuing to execute our goal of

profitably growing revenue and paying down debt.”

The Company will hold an investor conference call on Tuesday,

May 14, 2024 at 4:30 pm ET. Investors interested in participating

in the live call can dial (833) 492-0064 from the U.S. and provide

the conference identification code of 629005. International

participants can dial (973) 528-0163 and provide the same code.

About FitLife BrandsFitLife Brands is a

developer and marketer of innovative and proprietary nutritional

supplements and wellness products for health-conscious consumers.

FitLife markets more than 250 different products primarily online,

but also through domestic and international GNC® franchise

locations as well as through approximately 16,000 additional

domestic retail locations. FitLife is headquartered in Omaha,

Nebraska. For more information, please visit our website at

www.fitlifebrands.com.

Forward-Looking StatementsStatements in this

release that are forward looking involve known and unknown risks

and uncertainties, which may cause the Company's actual results in

future periods to be materially different from any future

performance that may be suggested in this news release. Such

factors may include, but are not limited to, the ability of the

Company to continue to grow revenue, and the Company's ability to

continue to achieve positive cash flow given the Company's existing

and anticipated operating and other costs. Many of these risks and

uncertainties are beyond the Company's control. Reference is made

to the discussion of risk factors detailed in the Company's filings

with the Securities and Exchange Commission including its reports

on Form 10-K and 10-Q. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the dates on which they are made.

Non-GAAP Financial

Measures The financial presentation below

contains certain financial measures defined as “non-GAAP financial

measures” by the SEC, including non-GAAP EBITDA and non-GAAP

adjusted EBITDA. These measures may be different from non-GAAP

financial measures used by other companies. The presentation of

this financial information, which is not prepared under any

comprehensive set of accounting rules or principles, is not

intended to be considered in isolation or as a substitute for the

financial information prepared and presented in accordance with

GAAP. As presented below, non-GAAP EBITDA excludes

interest, income taxes, and depreciation and amortization and

foreign currency gain/loss. Adjusted non-GAAP

EBITDA excludes—in addition to interest, taxes, depreciation

and amortization—equity-based compensation, M&A/integration

expense, restatement-related expense and non-recurring gains or

losses. The Company believes the non-GAAP measures provide useful

information to both management and investors by excluding certain

expense and other items that may not be indicative of its core

operating results and business outlook. The Company believes that

the inclusion of non-GAAP measures in the financial presentation

below allows investors to compare the Company’s financial results

with the Company’s historical financial results and is an important

measure of the Company’s comparative financial

performance.

FITLIFE BRANDS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands, except per share

data)

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

| ASSETS: |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,540 |

|

|

$ |

1,139 |

|

|

Restricted cash |

|

|

750 |

|

|

|

759 |

|

|

Accounts receivable, net of allowance of doubtful accounts of $18

and $17, respectively |

|

|

2,269 |

|

|

|

2,046 |

|

|

Inventories, net of allowance for obsolescence of $139 and $162,

respectively |

|

|

8,869 |

|

|

|

9,091 |

|

|

Sales tax receivable |

|

|

113 |

|

|

|

1,019 |

|

|

Prepaid expense and other current assets |

|

|

451 |

|

|

|

639 |

|

|

Total current assets |

|

|

14,992 |

|

|

|

14,693 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

121 |

|

|

|

137 |

|

| Right of use asset |

|

|

96 |

|

|

|

121 |

|

| Intangibles, net of

amortization of $124 and $113, respectively |

|

|

26,325 |

|

|

|

26,309 |

|

| Goodwill |

|

|

13,340 |

|

|

|

13,294 |

|

| Deferred tax asset |

|

|

612 |

|

|

|

792 |

|

|

TOTAL ASSETS |

|

$ |

55,486 |

|

|

$ |

55,346 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,978 |

|

|

$ |

3,261 |

|

|

Accrued expense and other liabilities |

|

|

1,397 |

|

|

|

1,026 |

|

|

Income taxes payable |

|

|

1,356 |

|

|

|

892 |

|

|

Product returns |

|

|

524 |

|

|

|

571 |

|

|

Term loan – current portion |

|

|

4,500 |

|

|

|

4,500 |

|

|

Lease liability - current portion |

|

|

73 |

|

|

|

87 |

|

|

Total current liabilities |

|

|

11,828 |

|

|

|

10,337 |

|

| |

|

|

|

|

|

|

|

|

|

Term loan, net of current portion and unamortized deferred finance

costs |

|

|

11,894 |

|

|

|

15,509 |

|

|

Long-term lease liability, net of current portion |

|

|

34 |

|

|

|

51 |

|

|

Deferred tax liability |

|

|

2,353 |

|

|

|

2,413 |

|

|

TOTAL LIABILITIES |

|

|

26,109 |

|

|

|

28,310 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000 shares authorized, none

outstanding as of March 31, 2024 and December 31, 2023 |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.01 par value, 60,000 shares authorized; 4,598

issued and outstanding as of March 31, 2024 and December 31,

2023 |

|

|

46 |

|

|

|

46 |

|

|

Additional paid-in capital |

|

|

30,801 |

|

|

|

30,699 |

|

|

Accumulated deficit |

|

|

(1,257 |

) |

|

|

(3,417 |

) |

|

Foreign currency translation adjustment |

|

|

(213 |

) |

|

|

(292 |

) |

|

TOTAL STOCKHOLDERS' EQUITY |

|

|

29,377 |

|

|

|

27,036 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

$ |

55,486 |

|

|

$ |

55,346 |

|

FITLIFE BRANDS,

INC.CONDENSED CONSOLIDATED STATEMENTS

OF INCOME AND COMPREHENSIVE

INCOMEFOR THE THREE MONTHS ENDED MARCH 31, 2024

AND 2023(In thousands, except per share

data)(Unaudited)

| |

|

Three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

16,549 |

|

|

$ |

10,738 |

|

| Cost of goods sold |

|

|

9,262 |

|

|

|

6,330 |

|

| Gross profit |

|

|

7,287 |

|

|

|

4,408 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING EXPENSE: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

3,736 |

|

|

|

2,344 |

|

|

Merger and acquisition related expense |

|

|

134 |

|

|

|

1,372 |

|

|

Depreciation and amortization |

|

|

36 |

|

|

|

19 |

|

|

Total operating expense |

|

|

3,906 |

|

|

|

3,735 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

3,381 |

|

|

|

673 |

|

| |

|

|

|

|

|

|

|

|

| OTHER EXPENSE (INCOME) |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

(5 |

) |

|

|

(84 |

) |

|

Interest expense |

|

|

414 |

|

|

|

98 |

|

|

Foreign exchange (gain) loss |

|

|

5 |

|

|

|

82 |

|

|

Total other expense (income) |

|

|

414 |

|

|

|

96 |

|

| |

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAX

PROVISION |

|

|

2,967 |

|

|

|

577 |

|

| |

|

|

|

|

|

|

|

|

| PROVISION FOR INCOME

TAXES |

|

|

807 |

|

|

|

421 |

|

| |

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

2,160 |

|

|

$ |

156 |

|

| |

|

|

|

|

|

|

|

|

| NET INCOME PER SHARE |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.47 |

|

|

$ |

0.03 |

|

|

Diluted |

|

$ |

0.43 |

|

|

$ |

0.03 |

|

|

Basic weighted average common shares |

|

|

4,598 |

|

|

|

4,483 |

|

|

Diluted weighted average common shares |

|

|

5,030 |

|

|

|

4,935 |

|

| |

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME: |

|

|

|

|

|

|

|

|

|

NET INCOME |

|

$ |

2,160 |

|

|

$ |

156 |

|

|

Foreign currency translation adjustment |

|

|

79 |

|

|

|

- |

|

|

Comprehensive income |

|

$ |

2,239 |

|

|

$ |

156 |

|

FITLIFE BRANDS,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWSFOR THE THREE MONTHS

ENDED MARCH 31, 2024 AND 2023(In

thousands)(Unaudited)

| |

|

Three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

2,160 |

|

|

$ |

156 |

|

|

Adjustments to reconcile net income to net cash provided

by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

36 |

|

|

|

19 |

|

|

Allowance for doubtful accounts |

|

|

1 |

|

|

|

(14 |

) |

|

Allowance for inventory obsolescence |

|

|

(23 |

) |

|

|

2 |

|

|

Stock compensation expense |

|

|

102 |

|

|

|

42 |

|

|

Amortization of deferred financing costs |

|

|

10 |

|

|

|

1 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable - trade |

|

|

(242 |

) |

|

|

(917 |

) |

|

Inventories |

|

|

218 |

|

|

|

1,501 |

|

|

Deferred tax asset |

|

|

180 |

|

|

|

251 |

|

|

Prepaid expense, other assets and sales tax receivable |

|

|

1,067 |

|

|

|

(44 |

) |

|

Right of use asset |

|

|

21 |

|

|

|

16 |

|

|

Accounts payable |

|

|

727 |

|

|

|

(1,045 |

) |

|

Lease liability |

|

|

(30 |

) |

|

|

(16 |

) |

|

Accrued liabilities, other liabilities and income taxes

payable |

|

|

856 |

|

|

|

289 |

|

|

Product returns |

|

|

(47 |

) |

|

|

(9 |

) |

|

Net cash provided by operating activities |

|

|

5,036 |

|

|

|

232 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(10 |

) |

|

|

- |

|

|

Cash paid for acquisition of Mimi’s Rock Corp. |

|

|

- |

|

|

|

(17,099 |

) |

|

Net cash used in investing activities |

|

|

(10 |

) |

|

|

(17,099 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Payments on term loans |

|

|

(3,625 |

) |

|

|

- |

|

|

Borrowings on term loan |

|

|

- |

|

|

|

12,500 |

|

|

Net cash provided by (used in) financing activities |

|

|

(3,625 |

) |

|

|

12,500 |

|

| |

|

|

|

|

|

|

|

|

|

Foreign currency impact on cash |

|

|

(9 |

) |

|

|

17 |

|

| |

|

|

|

|

|

|

|

|

| CHANGE IN CASH AND RESTRICTED

CASH |

|

|

1,392 |

|

|

|

(4,350 |

) |

| CASH, BEGINNING OF PERIOD |

|

|

1,898 |

|

|

|

13,277 |

|

| CASH AND RESTRICTED CASH, END

OF PERIOD |

|

$ |

3,290 |

|

|

$ |

8,927 |

|

investor@fitlifebrands.com

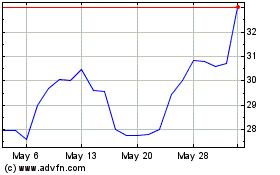

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Dec 2024 to Jan 2025

FitLife Brands (NASDAQ:FTLF)

Historical Stock Chart

From Jan 2024 to Jan 2025