Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 May 2024 - 11:03AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May, 2024

Commission File Number: 0-30852

GRUPO FINANCIERO GALICIA S.A.

(the “Registrant”)

Galicia Financial Group S.A.

(translation of Registrant’s name into English)

Tte. Gral. Juan D. Perón 430, 25th Floor

(CP1038AAJ) Buenos Aires, Argentina

(address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the information contained in this form, the Registrant is also thereby furnishing the information to the Securities and Exchange Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-

FORM 6-K

Commission File No. 0-30852

| | | | | | | | | | | | | | |

| Month Filed | | Event and Summary | | Exhibit No. |

| May, 2024 | | Notice of Material Event, dated April 29, 2024, regarding an administrative procedure filed by the Argentine Securities Commission. | | 99.1 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | GRUPO FINANCIERO GALICIA S.A. |

| | (Registrant) |

| | |

| Date: May 22, 2024 | By: | /s/ |

| | Name: [•] |

| | Title: [•] |

| | |

| | |

| | |

| | |

Grupo Financiero Galicia S.A.

CUIT: 30-70496280-7

Autonomous City of Buenos Aires, May 22, 2024.

To: Comisión Nacional de Valores (Argentine Securities Commission)

Ref.: Notice of Material Event, dated April 30, 2024, regarding an administrative procedure filed by the Argentine Securities Commission.

To whom it may concern,

We are writing to inform you regarding the administrative procedure initiated on April 30, 2024, by the Comisión Nacional de Valores (the “CNV”), the Argentine Securities Commission, under case file number 87/2024 (the “Administrative Procedure”), against our subsidiary, Banco de Galicia y Buenos Aires S.A.U. (the “Bank”), six of its directors and three of its trustees; Galicia Securities S.A.U. and its directors and trustees; and Inviú S.A.U. and its directors and trustees.

We inform that, on such date, the Bank was notified of the commencement of the Administrative Procedure which alleges that, through a series of transactions that occurred on February 19, 2024 and February 20, 2024, conducted by and among the Bank, Galicia Securities S.A.U. and Inviú S.A.U., (all entities under the control of the Registrant), the Bank manipulated the market for the Dual Bond that matures on January 25, 2025 (“TDE25”). Specifically, according to the allegations set forth in the Administrative Procedure, the consummation of the noted transactions resulted in the Bank exercising its put right in respect of the TDE25 at an alleged inflated value of VN$ 113 million on February 21, 2024, allegedly exceeding the amount that would have otherwise been payable to the Bank had the transactions on February 19th and 20th not occurred. The CNV alleges that the arranged transactions infringed Article 117, subsection "b" of the Argentine Capital Market Law No. 26,831, Article 2, subsections "a," "b," and "c" of Section II of Chapter III of Title XII of the CNV Standards, and Article 59 of the Argentine Commercial Companies Law No. 19,550. The Administrative Procedure estimates the fine to be due and payable by the Bank, to the extent that the position of the CNV prevails, at AR$ 23,072 million.

The Bank and the other defendants are currently analyzing the substance of the Administrative Procedure both internally and with external counsel and are in the process of preparing their respective response to such allegations. Additionally, the Bank expects to book a reserve in connection with the potential outcome of such a proceeding.

Any unfavorable resolution of the Administrative Procedure is not expected to have a material adverse effect on the Registrant’s results of operations.

Yours faithfully,

A. Enrique Pedemonte Attorney in fact

Grupo Financiero Galicia S.A.

This constitutes an unofficial English translation of the original Spanish document. The Spanish document shall govern all respects, including interpretation matters.

Tte. Gral. Perón 430, 25° piso (C1038AAJ) Buenos Aires – Argentina Tel. 4343-7528 Fax 4331-9183

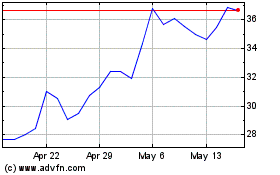

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From May 2024 to Jun 2024

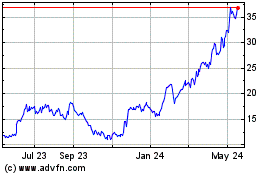

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Jun 2023 to Jun 2024