Current Report Filing (8-k)

19 June 2020 - 8:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported):

June

15, 2020

Commission

File Number 001-38308

Greenpro

Capital Corp.

(Exact

name of registrant issuer as specified in its charter)

|

Nevada

|

|

98-1146821

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

Room

1701-1703, 17/F.,

The

Metropolis Tower,

10

Metropolis Drive, Hung Hom,

Hong

Kong

(Address

of principal executive offices, including zip code)

Registrant’s

phone number, including area code (852) 3111 -7718

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Stock, $0.0001 par value

|

|

GRNQ

|

|

NASDAQ

Capital Market

|

Item

1.01. Entry into a Material Definitive Agreement.

On

June 15, 2020, Greenpro Capital Corp. (the “Company”) entered into a loan agreement (the “Loan Agreement”)

with an institutional investor (the “Lender”) pursuant to which the Company will issue in a private placement a five

(5) year convertible promissory note (the “Note”) in the principal amount of $5 million. Pursuant to the Loan Agreement,

the Company will pay a coupon equal to 3% annually. At the maturity date, the Lender may (i) demand repayment of the unpaid principal

and interest under the loan, or (ii) subject to the Company’s consent, elect to convert the unpaid principal and interest

under the loan into restricted shares of the Company’s common stock. The conversion price will be based on the average of

the closing price of the common stock of the Company as agreed upon between the Lender and the Company on the date of conversion.

The Company intends to use the proceeds of the loan for commercial expansion and business development.

A

copy of the Loan Agreement is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing summary of

the terms of the Loan Agreement is subject to, and qualified in its entirety by, such agreement. On June 16, 2020, the Company

issued a press release announcing the signing of the Loan Agreement. A copy of the press release is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation.

The

disclosure set forth under Item 1.01 above is hereby incorporated in its entirety under this Item 2.03.

Item

3.02. Unregistered Sales of Equity Securities.

As

described more fully in Item 1.01 above, on the closing date of the transaction, the Company shall issue to the Lender the Note

convertible into restricted shares of the Company’s common stock in a private placement, which Note, when issued, will be

exempt from registration pursuant to Section 4(2) of, and/or Rule 506 under Regulation D promulgated under the Securities Act

of 1933, as amended (the “Securities Act”), or Regulation S promulgated under the Securities Act.

Item

9.01. Financial Statement and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

GREENPRO

CAPITAL CORP.

|

|

|

|

|

|

Date:

June 19, 2020

|

By:

|

/s/

Lee Chong Kuang

|

|

|

Title:

|

President

and Chief Executive Officer

|

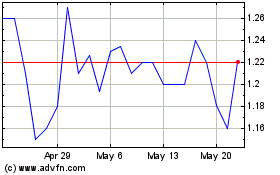

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

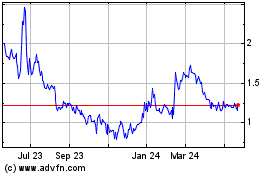

Greenpro Capital (NASDAQ:GRNQ)

Historical Stock Chart

From Feb 2024 to Feb 2025