U.S. Global Investors, Inc. (Nasdaq: GROW) (“the Company”), a

registered investment advisory firm[1] known for its thematic

investment products, is pleased to share that its smart beta 2.0

ETFs ended positively in 2024, highlighting the effectiveness of

the Company’s quantitative strategy for selecting high-quality

stocks and building robust portfolios.

Below are the ETFs and their positive total returns for

2024:

- U.S. Global Jets

ETF (NYSE: JETS): +33.21%

- U.S. Global GO

GOLD and Precious Metal Miners ETF (NYSE: GOAU):

+13.80%

- U.S. Global Sea

to Sky Cargo ETF (NYSE: SEA): +2.23%, which

included a $2.10-per-share dividend

The U.S. Global Technology and Aerospace & Defense ETF

(NYSE: WAR), the Company’s first actively managed

ETF, was launched on December 30, 2024, so performance data for

2024 is not yet available.

Performance shown as of 12/31/24 at market price. Assumes

reinvestment of all dividends and/or distributions before taxes.

Market performance does not represent the returns you would receive

if you traded shares at other times. Performance for SEA would have

been lower without fee waivers in effect.

The performance data quoted represents past performance. Past

performance does not guarantee future results. The investment

return and principal value of an investment will fluctuate so that

an investor's shares, when sold or redeemed, may be worth more or

less than their original cost and current performance may be lower

or higher than the performance quoted. For each of the Fund’s

holdings, standardized returns and performance current to the most

recent month-end, please click on the respective fund ticker

symbols: JETS, GOAU and SEA.

SEA ETF Closes 2024 on a High Note

The Company is particularly pleased to see that SEA ended the

year in positive territory, with dividends reinvested.

Frank Holmes, the Company’s CEO and Chief Investment Officer,

commented on the industry’s resilience: “Cargo shipping companies

have been known to pay out consistent dividends, even in a slow

economy. [2] The industry faced a number of challenges in 2024,

from geopolitical instability to labor disputes[3]. Despite these

headwinds, I’m pleased to see how agile the industry has been in

rolling with the punches, so to speak. Companies adapted quickly to

rerouted trade routes, managed rates proactively and continued

investing in sustainability,[4] even under immense pressure. The

SEA ETF’s positive performance, up 2.23% with dividends reinvested,

underscores the strength and adaptability of this critical

sector.”

GOAU Achieves Double-Digit Returns Amid Gold’s Historic

Rise

2024 was a milestone year for gold, with prices soaring from

approximately $2,000 per ounce to an all-time high of $2,787 on

October 30. The yellow metal finished the year up 27.22%, while

silver also posted strong gains, rising 21.46%, according to

Bloomberg data. Total gold demand in the third quarter exceeded

$100 billion for the first time,[5] reinforcing the metal’s

investment appeal. Reflecting this strength, GOAU achieved a total

return of 13.80% in 2024, marking its second consecutive year of

positive annual performance.

Driving these results were global central banks, which

collectively added 186 metric tons of gold in the third quarter

alone, extending nearly 15 years of net purchases.[6] Interest rate

cuts by the Federal Reserve also provided additional support,

bolstering gold’s safe-haven status.

JETS ETF Outpaces the Market in 2024 on Record-High Travel

Demand

The airlines industry soared in 2024, fueled by a favorable

economic backdrop and record-high passenger traffic. The

Transportation Security Administration (TSA) reporting screening

over 900 million passengers in U.S. airports during the year,

representing a 5% increase over 2023 figures.[7] Declining global

oil prices further supported the sector.

The U.S. Global Jets ETF (JETS) reflected this robust

performance, delivering 33.21% in total returns for the year,

outpacing the broader market, which itself saw strong gains. Mr.

Holmes remarked: “The airlines industry demonstrated remarkable

agility in 2024. Strong travel demand, strategic capacity

management and lower fuel costs have helped position airlines for

sustained success. United Airlines exemplified the industry's

achievements in 2024, with its stock soaring approximately 135%,

making it the fifth-best performance in the S&P 500.”

To receive email updates on our thematic ETFs, please

click here.

####

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years

when it began as an investment club. Today, U.S. Global Investors,

Inc. (www.usfunds.com) is a registered investment adviser that

focuses on niche markets around the world. Headquartered in San

Antonio, Texas, the Company provides money management and other

services to U.S. Global Investors Funds and U.S. Global ETFs.

Please consider carefully a fund’s investment objectives,

risks, charges and expenses. For this and other important

information, obtain a statutory and summary prospectus by

visiting www.usglobaletfs.com. Read it carefully

before investing.

Fund Disclosures

Investing involves risk, including the possible loss of

principal. ETF shares are bought and sold at market price (not

NAV), may trade at a discount or premium to NAV and are not

individually redeemed from the fund. Brokerage commissions will

reduce returns.

Each ETF concentrates its investments in specific industries and

may be subject to greater risks and fluctuations than a portfolio

representing a broader range of industries. The Funds are

non-diversified, meaning they may concentrate more of their assets

in a smaller number of issuers than a diversified fund.

The ETFs invest in foreign securities, which involve greater

volatility and political, economic and currency risks and

differences in accounting methods. These risks are greater for

investments in emerging markets and pose additional risks and be

more volatile due to less information, limited government oversight

and lack of uniform standards. The funds may invest in the

securities of smaller and mid-capitalization companies, which may

be more volatile than funds that invest in larger, more established

companies.

JETS, GOAU and SEA are not actively managed and may be affected

by a general decline in market segments related to their indices

they track. The performance of these ETFs may diverge from that of

their indices. Because the funds may employ a representative

sampling strategy and may also invest in securities that are not

included in the index, the funds may experience tracking errors to

a greater extent than a fund that seeks to replicate an index.

For GOAU - Gold, precious metals and precious minerals funds may

be susceptible to adverse economic, political or regulatory

developments due to concentrating in a single theme. The prices of

gold, precious metals and precious minerals are subject to

substantial price fluctuations over short periods of time and may

be affected by unpredicted international monetary and political

policies. We suggest investing no more than 5% to 10% of your

portfolio in these sectors.

For JETS - Airline companies may be adversely affected by a

downturn in economic conditions that can result in decreased demand

for air travel and may also be significantly affected by changes in

fuel prices, labor relations and insurance costs.

For SEA - Cargo companies may be adversely affected by a

downturn in economic conditions that can result in decreased demand

for sea shipping and freight.

WAR is actively-managed, and there is no guarantee the

investment objective will be met. The fund is new and has a limited

operating history to evaluate. WAR is non-diversified, meaning it

may concentrate its assets in fewer individual holdings than a

diversified fund.

The S&P 500 Stock Index is a widely recognized

capitalization-weighted index of 500 common stock prices in U.S.

companies. The NYSE Arca Global Airline Index is a modified

equal-dollar weighted index designed to measure the performance of

highly capitalized and liquid global airline companies.

All opinions expressed and data provided are subject to change

without notice. Some of these opinions may not be appropriate to

every investor. By clicking the link(s) above, you will be directed

to a third-party website(s). U.S. Global Investors does not endorse

all information supplied by this/these website(s) and is not

responsible for its/their content.

Distributed by Quasar Distributors, LLC. U.S. Global Investors

is the investment advisor to JETS, GOAU, SEA and WAR.

[1] Registration does not imply a certain level of skill or

training.[2] Miller, G. (2023, August 21). Container lines paid out

billions in boom-time profits via dividends: Hapag-Lloyd’s dividend

was 68% of 2022 net income, Cosco’s was 50%. FreightWaves.

Retrieved from

https://www.freightwaves.com/news/container-lines-paid-out-billions-in-boomtime-profits-via-dividends[3]

LaRocco, L. A. (2024, November 13). U.S. port, union talks break

down again over automation, with two months to go before potential

strike. CNBC. Retrieved from

https://www.cnbc.com/2024/11/13/port-automation-fight-breakdown-talks-new-strike.html[4]

Scott, M. (2024, December 3). A sea-change for seafarers as the

shipping industry gears up to decarbonise. Reuters. Retrieved from

https://www.reuters.com/sustainability/climate-energy/sea-change-seafarers-shipping-industry-gears-up-decarbonise-2024-12-03/[5]

World Gold Council. (2024, October 30). Global gold demand reaches

a record high value of over US$100 billion. World Gold Council.

Retrieved from

https://www.gold.org/news-and-events/press-releases/global-gold-demand-reaches-record-high-value-over-us100-billion[6]

World Gold Council. (2024, October 30). Gold demand trends Q3 2024.

World Gold Council. Retrieved from

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2024/central-banks[7]

TSA. (2024, December 31). BREAKING NEWS: As of Monday, December 30,

#TeamTSA has surpassed screening 900 million individuals at TSA

airport security checkpoints, representing an approximate increase

of about 5% over the 858M individuals screened in all of 2023.

(1/2) Twitter. https://x.com/TSA/status/1874097860381405684

Holly Schoenfeldt

U.S. Global Investors, Inc.

210.308.1268

hschoenfeldt@usfunds.com

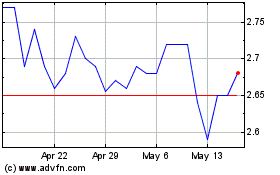

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Jan 2024 to Jan 2025