U.S. Global Investors, Inc. (Nasdaq: GROW) (“the Company”), a

registered investment advisory firm[1] known for its thematic ETFs,

is excited to announce the launch of its first actively managed

exchange-traded fund, the

U.S. Global Technology and Aerospace

& Defense ETF (NYSE: WAR) [this will link to

the WAR fund page]

, which begins trading today on the New

York Stock Exchange (NYSE). The launch builds on the Company’s

success with its billion-dollar U.S. Global Jets ETF (NYSE: JETS)

and emphasizes its ability to create resilient, dynamic products.

The WAR ETF is designed to address the increasing global demand

for defense and protection through technological advancements.

Focusing on sectors like semiconductors, artificial intelligence

(AI), data centers, cybersecurity, aerospace and electronic

warfare, WAR offers diversified exposure to the industries that

help prevent and protect from the threat of war.

Like the Company’s other ETFs, WAR applies a smart beta 2.0

investment strategy, combining quantitative and fundamental

analysis to identify opportunities for long-term outperformance

while managing risk.[2]

“The WAR ETF is more than just an investment in defense,” says

Frank Holmes, CEO and Chief Investment Officer of U.S. Global

Investors. “From the ‘war on drugs’ to the iconic movie Star Wars,

history has shown us the importance of defense against the forces

that threaten peace. With advances in robotics, drones, satellites,

AI and cybersecurity, the ETF aims to capture opportunities in

these critical sectors that are transforming how we think about

defense and security in the modern world.”

A Smart Beta 2.0 Approach to Investing in the Future of

Global Security and Advanced Technologies

Global military expenditures reached a record $2.4 trillion in

2023 after increasing for nine consecutive years,[3] driven by

rising geopolitical tensions and modernization efforts across the

globe. That’s especially true in Europe, where European Union (EU)

member states are estimated to spend a collective €326 billion

($342 billion) this year on aerospace and defense, representing a

record-breaking 1.9% of the bloc’s gross domestic product

(GDP).[4]

Additionally, the global semiconductor market is projected to

surpass $1 trillion by 2030, fueled by growth in defense

applications, AI integration and automotive technologies.[5] The

value of the global AI market alone is estimated to hit

approximately $826 billion by 2030, according to calculations made

by Statista.[6]

Complementing Our Suite of Thematic ETFs

WAR joins the Company’s growing lineup of thematic ETFs,

including:

- U.S. Global Jets ETF

(NYSE: JETS), focused on airlines and air travel

- U.S. Global GO GOLD

and Precious Metal Miners ETF (NYSE: GOAU), focused on gold

mining

- U.S. Global Sea to

Sky Cargo ETF (NYSE: SEA), focused on global shipping and

logistics

To sign up for updates and learn more about the U.S. Global

Technology and Aerospace & Defense ETF (WAR), click

here.

####

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years

when it began as an investment club. Today, U.S. Global Investors,

Inc. (www.usfunds.com) is a registered investment adviser that

focuses on niche markets around the world. Headquartered in San

Antonio, Texas, the Company provides money management and other

services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a statutory and summary prospectus by visiting

www.usglobaletfs.com. Read it carefully before investing.

Investing involves risk including the possible loss of

principal.

The Fund is actively-managed and there is no guarantee the

investment objective will be met. The fund is new and has a limited

operating history to evaluate. The Fund is non-diversified, meaning

it may concentrate its assets in fewer individual holdings than a

diversified fund.

The Fund’s concentration in the securities of a particular

industry namely Aerospace and Defense, Cybersecurity and

Semi-conductor industries as well as geographic concentration may

cause it to be more susceptible to greater fluctuations in share

price and volatility due to adverse events that affect the Fund’s

investments.

Aerospace and Defense companies are subject to numerous risks,

including fierce competition, adverse political, economic and

governmental developments, substantial research and development

costs. Aerospace and defense companies rely heavily on the U.S.

Government, political support and demand for their products and

services.

Companies in the cybersecurity field face intense competition,

both domestically and internationally, which may have an adverse

effect on profit margins. The products of cybersecurity companies

may face obsolescence due to rapid technological development.

Companies in the cybersecurity field are heavily dependent on

patent and intellectual property rights.

Competitive pressures may have a significant effect on the

financial condition of semiconductor companies and may become

increasingly subject to aggressive pricing, which hampers

profitability. Semiconductor companies typically face high capital

costs and can be highly cyclical, which may cause the operating

results to vary significantly. The stock prices of companies in the

semiconductor sector have been and likely will continue to be

extremely volatile.

Investments in the securities of non-U.S. issuers may subject

the Fund to more volatility and less liquidity due to currency

fluctuations, political instability, economic and geographic

events. Emerging markets may pose additional risks and be more

volatile due to less information, limited government oversight and

lack of uniform standards.

Distributed by Quasar Distributors, LLC. U.S. Global Investors

is the investment advisor to WAR.

[1] Registration does not imply a certain level of skill or

training.[2] There is no guarantee that the desired outcome will be

achieved.[3] Tian, N., Lopes da Silva, D., Liang, X., &

Scarazzato, L. (2024, April). Trends in world military expenditure,

2023. Stockholm International Peace Research Institute (SIPRI).

https://doi.org/10.55163/BQGA2180[4] European Defence Agency.

(2024). Coordinated annual review on defence (CARD) report 2024.

https://eda.europa.eu/docs/default-source/documents/card-report-2024.pdf[5]

Burm, G. (2024, November 28). State of the semiconductor industry.

PwC.

https://www.pwc.com/gx/en/industries/technology/state-of-the-semicon-industry.html

[6] Thormundsson, B. (2024, November 28). Artificial

intelligence (AI) market size worldwide from 2020 to 2030.

Statista.

https://www.statista.com/forecasts/1474143/global-ai-market-size

- Global Defense Spending Has Risen for Nine Consecutive

Years

- Artificial Intelligence (AI) Market Size, 2020 - 2030

Holly Schoenfeldt

U.S. Global Investors, Inc.

210.308.1268

hschoenfeldt@usfunds.com

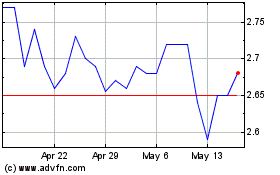

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Jan 2024 to Jan 2025