false

0001360214

0001360214

2023-12-28

2023-12-28

0001360214

HROW:CommonStock0.001ParValuePerShareMember

2023-12-28

2023-12-28

0001360214

HROW:Sec8.625SeniorNotesDue2026Member

2023-12-28

2023-12-28

0001360214

HROW:Sec11.875SeniorNotesDue2027Member

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 28, 2023

HARROW,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35814 |

|

45-0567010 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 102

Woodmont Blvd., Suite 610 |

|

|

| Nashville,

Tennessee |

|

37205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (615) 733-4730

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

HROW |

|

The

Nasdaq Stock Market LLC |

| 8.625%

Senior Notes due 2026 |

|

HROWL |

|

The

Nasdaq Stock Market LLC |

| 11.875%

Senior Notes due 2027 |

|

HROWM |

|

The

Nasdaq Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Act of 1934: Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.02. Termination of a Material Definitive Agreement.

To

the extent required, the information contained in Item 8.01 hereof is incorporated herein by reference.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective

January 2, 2024, Harrow, Inc. (the “Company”) appointed John P. Saharek as the President and Chief Executive Officer of the

Company’s ImprimisRx division, in addition to his current role as Chief Commercial Officer of the Company. Mr.

Saharek’s annual base salary was adjusted to $450,000 and his target bonus will remain at 50% of his annual base salary. Mr. Saharek

will continue to report to Mark L. Baum, Chief Executive Officer and Chairman of the Company.

Item

5.05. Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

Effective

December 28, 2023, the Board of Directors of the Company approved certain amendments to the Company’s Code of Business Conduct

and Ethics (the “Code”) upon the recommendation of the Nomination and Corporate Governance Committee of the Board. The amendments

to the Code update the Company’s corporate name and revise and clarify the Company’s obligations with respect to political

activities. The amendments to the Code do not relate to or result in any waiver, explicit or implicit, of any provision of the Code in

effect prior to the amendments. Each of the Company’s directors, employees and officers, including the Company’s Chief Executive

Officer, Chief Financial Officer, and all of its other principal executive officers, are required to comply with the Code.

The

Code is available for review on the Investors section of the Company’s website, www.harrow.com, under Corporate Governance, and

is also available in print, without charge, to any stockholder who requests a copy by writing to Harrow, Inc., 102 Woodmont Blvd., Suite

610, Nashville, TN 37205, Attention: Investor Relations.

Item

8.01. Other Events.

On

December 28, 2023, the Company terminated the Loan and Security Agreement (the “Loan Agreement”), dated as of September 1,

2021, as amended, by and between the Company, as lender, and Melt Pharmaceuticals, Inc. (“Melt”), as borrower, which provided

for a senior secured term loan with an initial aggregate principal amount of $13.5 million bearing interest at 12.50% per annum. As of

the date of termination, approximately $18.4 million remained outstanding under the Loan Agreement. Pursuant to the terms of a Settlement

and Payoff Agreement, dated as of December 28, 2023, by and between the Company and Melt (the “Settlement Agreement”), the

Company received 2,260,000 shares of Melt’s Series B-1 Preferred Stock and 74,256 shares of Melt’s Series B Preferred Stock

in consideration for the full payment of all amounts outstanding under the Loan Agreement (other than contingent indemnification obligations

for which no claim has been made). The Settlement Agreement contains customary representations, warranties and releases of the parties

and requires the parties to enter into a registration rights agreement providing the Company with rights consistent with other holders

of preferred stock of Melt.

In

addition to the preferred stock acquired by the Company upon settlement of all amounts outstanding under the Loan Agreement, the Company

owns 3,500,000 shares of common stock of Melt. The equity of Melt held by the Company following the settlement represents an aggregate

of approximately 47% of the outstanding equity interests of Melt. The Company also owns royalty rights in certain drug candidates being

developed by Melt following the termination date of the Loan Agreement.

The

press release announcing the transactions described herein is filed as Exhibit 99 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HARROW,

INC. |

| |

|

|

| Dated:

January 3, 2024 |

By:

|

/s/

Andrew R. Boll |

| |

|

Andrew

R. Boll |

| |

|

Chief

Financial Officer |

Exhibit

99

Melt

Pharmaceuticals Provides Corporate Update

NASHVILLE,

Tenn. (January 3, 2024) – Melt Pharmaceuticals, Inc. (“Melt”), a clinical-stage pharmaceutical company developing

novel approaches for procedural sedation, today provided a corporate update. The Company previously announced that MELT-300 achieved

the primary sedation endpoint in its Phase 2 Pivotal Efficacy and Safety Study in subjects undergoing cataract surgery. MELT-300, a non-IV,

non-opioid tablet that combines fixed doses of midazolam (3mg) and ketamine (50mg), is administered sublingually using Catalent Inc.’s

proprietary fast-dissolving Zydis® delivery technology to rapidly dissolve the tablet for absorption across the

very thin sublingual mucosa.

Melt

Pharmaceuticals recently received a written response from the U.S. Food and Drug Administration (FDA) regarding its planned MELT-300

Phase 3 program. Based on the FDA’s response, Melt Pharmaceuticals expects to begin Phase 3 program activities, which will consist

of a single pivotal study comparing MELT-300 to sublingual midazolam and placebo in subjects undergoing cataract surgery, in the first

quarter of 2024.

Additionally,

Melt has now reached an agreement with and paid in full all the outstanding principal and accrued and unpaid interest under its loan

facility with Harrow, Inc. (Nasdaq: HROW), Melt’s largest shareholder, through the issuance of shares of Melt’s Series

B and Series B-1 Preferred Stock. Following this transaction, in addition to certain royalty rights, Harrow’s equity ownership

percentage of Melt is approximately 47%.

“We

are very pleased to have received a response from the FDA that supports the investment we are making in our proposed MELT-300 Phase 3

program,” said Dr. Dillaha. “This was the last step needed to finalize our program design, paving the way for the commencement

of Phase 3 program activities in early 2024. Following the debt settlement with Harrow and our successful efforts to date to secure sufficient

funding to commence the Phase 3 program, we can now focus on the advancement of our non-IV, non-opioid MELT-300 product candidate, which

we believe has the potential to revolutionize short-duration procedural sedation for more than 100 million U.S. medical procedures, enhancing

the surgical patient experience by providing greater comfort and reducing reliance on opioids.”

About

Melt Pharmaceuticals

Melt

Pharmaceuticals, Inc. is a clinical-stage pharmaceutical company focused on developing proprietary non-opioid, non-IV, sedation, and

analgesia therapeutics for human medical procedures in the hospital, outpatient, and in-office settings. Melt intends to seek regulatory

approval through the FDA’s 505(b)(2) regulatory pathway for its proprietary, patented small-molecule product candidates, where

possible. Melt’s core intellectual property is the subject of multiple granted patents in North America, Europe, Asia, and the

Middle East. Melt Pharmaceuticals, Inc. is a former subsidiary of Harrow, Inc. (Nasdaq: HROW) and was carved out as a separately managed

business in 2019. To learn more about Melt, please visit their website, www.meltpharma.com.

| Investor

Contact: |

Media

Contact: |

| |

|

| Larry

Dillaha, M.D. |

Deb

Holliday |

| Chief

Executive Officer |

Holliday

Communications, Inc. |

| ldillaha@meltpharma.com |

deb@hollidaycommunications.net |

| |

412-877-4519 |

-END-

v3.23.4

Cover

|

Dec. 28, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity File Number |

001-35814

|

| Entity Registrant Name |

HARROW,

INC.

|

| Entity Central Index Key |

0001360214

|

| Entity Tax Identification Number |

45-0567010

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

102

Woodmont Blvd.

|

| Entity Address, Address Line Two |

Suite 610

|

| Entity Address, City or Town |

Nashville

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37205

|

| City Area Code |

(615)

|

| Local Phone Number |

733-4730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

HROW

|

| Security Exchange Name |

NASDAQ

|

| 8.625% Senior Notes due 2026 |

|

| Title of 12(b) Security |

8.625%

Senior Notes due 2026

|

| Trading Symbol |

HROWL

|

| Security Exchange Name |

NASDAQ

|

| 11.875% Senior Notes due 2027 |

|

| Title of 12(b) Security |

11.875%

Senior Notes due 2027

|

| Trading Symbol |

HROWM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_CommonStock0.001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_Sec8.625SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_Sec11.875SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

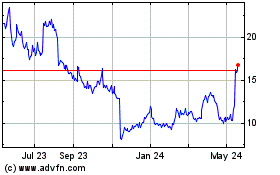

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Nov 2024 to Dec 2024

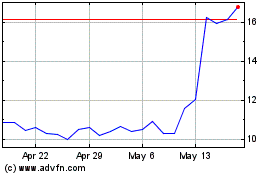

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Dec 2023 to Dec 2024