0000046250FALSE00000462502025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 29, 2025

Hawkins, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Minnesota | | 0-7647 | | 41-0771293 |

| (State of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| | | | | | | | | | | | | | |

| 2381 Rosegate, | Roseville, | Minnesota | | 55113 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code (612) 331-6910

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $.01 per share | HWKN | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b 2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2025, Hawkins, Inc. issued a press release announcing financial results for its fiscal 2025 third quarter ended December 29, 2024. A copy of the press release issued by the Registrant is furnished herewith as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | Method of Filing |

| | |

| | Press Release, dated January 29, 2025, announcing financial results of Hawkins, Inc. for its fiscal 2025 third quarter ended December 29, 2024. | | Filed Electronically |

| 104 | | | Cover Page Interactive Data File (embedded within the inline XBRL document) | | Filed Electronically |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | HAWKINS, INC. |

| | |

Date: January 29, 2025 | | By: | | /s/ Jeffrey P. Oldenkamp |

| | | | Jeffrey P. Oldenkamp |

| | | | Executive Vice President and Chief Financial Officer |

Hawkins, Inc. Reports

Third Quarter Fiscal 2025 Results

Roseville, Minn., January 29, 2025 – Hawkins, Inc. (Nasdaq: HWKN) today announced results for the nine months ended December 29, 2024, its third quarter of fiscal 2025.

Third Quarter Fiscal Year 2025 Highlights:

•Record third quarter results for revenue, gross profit, operating income, and adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“adjusted EBITDA”), a non-GAAP measure.

•Overall revenue growth of 8%, once again driven by the Water Treatment segment growth of 22% over the same period of the prior year.

•Gross profit growth of 15% over the same period of the prior year, with double-digit percentage growth for both the Water Treatment and Health and Nutrition segments.

•Third quarter operating income of $21.1 million, our 27th consecutive quarter of year-over-year operating income growth.

•Income before income taxes grew 12% over the same period of the prior year.

•Diluted earnings per share (“EPS”) of $0.72 compared to $0.71 in the prior year.

•Adjusted EBITDA, a non-GAAP measure, of $33.6 million, a 13% increase over the same period of the prior year. Trailing 12-month adjusted EBITDA was $162 million.

•Year to date, revenue was up 5% over the prior year and EPS was up 11%.

Executive Commentary – Patrick H. Hawkins, Chief Executive Officer and President:

“For each of the last four quarters, we have achieved record year-over-year performance for several of our key metrics. In the third quarter, our record performance was once again driven by the Water Treatment business, as we realized the benefits of the seven acquisitions we have completed over the last 18 months. Within the quarter we saw strong revenue growth of 22% in our Water Treatment business, with this growth driven by both revenue from our recent acquisitions as well as strong organic volume growth of 9%. Revenue in our Industrial segment declined year over year, as expected, due primarily to reduced selling prices driven by lower commodity costs and product mix, offset slightly by overall volumes being up. Health and Nutrition revenues increased due to growth of our manufactured product sales. Overall, we saw 8% revenue growth with gross profit increasing 15%, operating income increasing 14% and pretax income increasing 12%.”

Mr. Hawkins continued, “Our balance sheet continues to be strong. In the quarter, our net borrowings of $10 million helped fund our acquisition of Water Guard, our first water treatment site in North Carolina. Our leverage ratio was 0.7x trailing 12-month proforma adjusted EBITDA at the end of the quarter. As we close out our fiscal year, we expect continued growth within the Water Treatment and Health and Nutrition segments. We expect to see our Industrial segment continue to perform similar to the first nine months of fiscal 2025.”

Third Quarter Financial Highlights:

NET INCOME

For the third quarter of fiscal 2025, the Company reported net income of $15.0 million, or $0.72 per diluted share, compared to net income for the third quarter of fiscal 2024 of $14.9 million, or $0.71 per diluted share. The prior year EPS was positively impacted by $0.08 per share due to an unusual favorable tax adjustment.

REVENUE

Sales were $226.2 million for the third quarter of fiscal 2025, an increase of $17.7 million, or 8%, from sales of $208.5 million in the same period a year ago. Water Treatment segment sales increased $17.8 million, or 22%, to $99.8 million for the current quarter, from $82.0 million in the same period a year ago. Water Treatment sales increased as a result of added sales from our acquired businesses as well as increased sales volumes in our legacy business. Despite showing sequential improvement, Industrial segment sales decreased $1.0 million, or 1%, to $92.0 million for the current quarter, from $93.0 million in the same period a year ago. Sales decreased as a result of lower selling prices on certain products, driven by lower raw material costs and product mix changes. Health and Nutrition segment sales increased $1.0 million, or 3%, to $34.5 million for the current quarter, from $33.5 million in the same period a year ago. Health and Nutrition sales increased due to increased sales of our manufactured products.

GROSS PROFIT

Gross profit increased $6.2 million, or 15%, to $48.4 million, or 21% of sales, for the current quarter, from $42.2 million, or 20% of sales, in the same period a year ago. During the current quarter, the LIFO reserve decreased, and gross profit increased, by $0.8 million, primarily due to lower anticipated year-end prices on certain products. In the same quarter a year ago, the LIFO reserve decreased, and gross profit increased, by $2.5 million.

Gross profit for the Water Treatment segment increased $5.8 million, or 29%, to $26.0 million, or 26% of sales, for the current quarter, from $20.2 million, or 25% of sales, in the same period a year ago. During the current quarter, the LIFO reserve decreased, and gross profit increased, by $0.1 million. In the same quarter a year ago, the LIFO reserve decreased, and gross profit increased, by $0.4 million. Water Treatment segment gross profit increased as a result of increased sales, including the incremental sales from our acquired businesses.

Gross profit for the Industrial segment decreased $1.3 million, or 8%, to $15.2 million, or 17% of sales, for the current quarter, from $16.5 million, or 18% of sales, in the same period a year ago. During the current quarter, the LIFO reserve decreased, and gross profit increased, by $0.6 million. In the same quarter a year ago, the LIFO reserve decreased, and gross profit increased, by $2.1 million. Industrial segment gross profit decreased primarily as a result of product mix changes and the change in the LIFO reserve.

Gross profit for our Health and Nutrition segment increased $1.7 million, or 31%, to $7.2 million, or 21% of sales, for the current quarter, from $5.5 million, or 16% of sales, in the same period a year ago. Health and Nutrition segment gross profit increased as a result of the increased sales.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses increased $3.6 million, or 15%, to $27.4 million, or 12% of sales, for the current quarter, from $23.8 million, or 11% of sales, in the same period a year ago. Expenses increased primarily due to $1.9 million in added costs from the acquired businesses in our Water Treatment segment, including amortization of intangibles of $0.8 million, as well as other increased variable costs.

ADJUSTED EBITDA

Adjusted EBITDA, a non-GAAP financial measure, is an important performance indicator and a key compliance measure under the terms of our credit agreement. An explanation of the computation of adjusted EBITDA is presented below. Adjusted EBITDA for the three months ended December 29, 2024 was $33.6 million, an increase of $3.9 million, or 13%, from $29.7 million in the same period a year ago.

INCOME TAXES

Our effective income tax rate was 26% for the current quarter and 18% for the same period a year ago. The effective tax rate in the third quarter of both years was impacted by favorable tax provision adjustments recorded, with the prior year being unusually beneficial and the current year being more in line with expectations. The effective tax rate is impacted by projected levels of annual taxable income, permanent items, and state taxes. Our effective tax rate for the full year is currently expected to be approximately 26-27%.

BALANCE SHEET

At the end of the third quarter, our working capital was $27 million higher than the end of fiscal 2024 due primarily to seasonally lower liabilities as well as increased inventories. During the quarter, we paid down $10 million on our line of credit. Our total debt outstanding at the end of the third quarter was $114.0 million and our leverage ratio was 0.70x our trailing 12-month proforma adjusted EBITDA, as compared to 0.66x of trailing twelve-month adjusted EBITDA at the end of fiscal 2024.

About Hawkins, Inc.

Hawkins, Inc. was founded in 1938 and is a leading water treatment and specialty ingredients company that formulates, distributes, blends, and manufactures products for its Industrial, Water Treatment, and Health & Nutrition customers. Headquartered in Roseville, Minnesota, the Company has 61 facilities in 28 states and creates value for its customers through superb customer service and support, quality products and personalized applications. Hawkins, Inc. generated $919 million of revenue in fiscal 2024 and has approximately 1,000 employees. For more information, including registering to receive email alerts, please visit www.hawkinsinc.com/investors.

Reconciliation of Non-GAAP Financial Measures

We report our consolidated financial results in accordance with U.S. generally accepted accounting principles (GAAP). To assist investors in understanding our financial performance between periods, we have provided certain financial measures not computed according to GAAP, including adjusted EBITDA. This non-GAAP financial measure is not meant to be considered in isolation or as a substitute for comparable GAAP measures. The method we use to produce non-GAAP results is not computed according to GAAP and may differ from the methods used by other companies.

Management uses this non-GAAP financial measure internally to understand, manage and evaluate our business and to make operating decisions. Management believes that this non-GAAP financial measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP results, provides a more complete understanding of the factors and trends affecting our financial condition and results of operations.

We define adjusted EBITDA as GAAP net income adjusted for the impact of the following: net interest expense resulting from our net borrowing position; income tax expense; non-cash expenses including amortization of intangibles, depreciation and charges for the employee stock purchase plan and restricted stock grants; and non-recurring items of income or expense, if applicable.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | Three Months Ended | | Nine months ended | | Trailing 12-months ended |

| (In thousands) | December 29, 2024 | | December 31, 2023 | | December 29, 2024 | | December 31, 2023 | | December 29, 2024 |

| Net Income (GAAP) | $ | 15,021 | | | $ | 14,885 | | | $ | 68,018 | | | $ | 61,531 | | | $ | 81,851 | |

| Interest expense, net | 1,216 | | | 1,168 | | | 3,906 | | | 3,033 | | | 5,155 | |

| Income tax expense | 5,262 | | | 3,274 | | | 23,943 | | | 20,289 | | | 29,435 | |

| Amortization of intangibles | 3,213 | | | 2,392 | | | 9,211 | | | 5,786 | | | 11,963 | |

| Depreciation expense | 6,899 | | | 5,951 | | | 20,157 | | | 17,063 | | | 26,358 | |

| | | | | | | | | |

| Non-cash compensation expense | 1,723 | | | 1,287 | | | 5,022 | | | 3,506 | | | 6,396 | |

| Non-recurring acquisition expenses | 298 | | | 710 | | | 580 | | | 832 | | | 664 | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 33,632 | | | $ | 29,667 | | | $ | 130,837 | | | $ | 112,040 | | | $ | 161,822 | |

HAWKINS, INC.

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(In thousands, except share and per-share data) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | December 29, 2024 | | December 31, 2023 | | December 29, 2024 | | December 31, 2023 |

| Sales | | $ | 226,205 | | | $ | 208,496 | | | $ | 729,113 | | | $ | 696,142 | |

| Cost of sales | | (177,781) | | | (166,248) | | | (555,812) | | | (548,017) | |

| | | | | | | | |

| Gross profit | | 48,424 | | | 42,248 | | | 173,301 | | | 148,125 | |

| Selling, general and administrative expenses | | (27,361) | | | (23,774) | | | (78,702) | | | (64,173) | |

| Operating income | | 21,063 | | | 18,474 | | | 94,599 | | | 83,952 | |

| Interest expense, net | | (1,216) | | | (1,168) | | | (3,906) | | | (3,033) | |

| Other income | | 436 | | | 853 | | | 1,268 | | | 901 | |

| Income before income taxes | | 20,283 | | | 18,159 | | | 91,961 | | | 81,820 | |

| Income tax expense | | (5,262) | | | (3,274) | | | (23,943) | | | (20,289) | |

| Net income | | $ | 15,021 | | | $ | 14,885 | | | $ | 68,018 | | | $ | 61,531 | |

| | | | | | | | |

| Weighted average number of shares outstanding - basic | | 20,766,764 | | | 20,781,632 | | | 20,780,213 | | | 20,864,349 | |

| Weighted average number of shares outstanding - diluted | | 20,875,387 | | | 20,907,321 | | | 20,902,456 | | | 21,004,077 | |

| Basic earnings per share | | $ | 0.72 | | | $ | 0.72 | | | $ | 3.27 | | | $ | 2.95 | |

| Diluted earnings per share | | $ | 0.72 | | | $ | 0.71 | | | $ | 3.25 | | | $ | 2.93 | |

| Cash dividends declared per common share | | $ | 0.18 | | | $ | 0.16 | | | $ | 0.52 | | | $ | 0.47 | |

HAWKINS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In thousands, except share data) | | | | | | | | | | | | | | |

| | December 29,

2024 | | March 31,

2024 |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | | $ | 8,305 | | | $ | 7,153 | |

| Trade accounts receivables, net | | 111,521 | | | 114,477 | |

| Inventories | | 81,634 | | | 74,600 | |

| | | | |

| Prepaid expenses and other current assets | | 8,895 | | | 6,596 | |

| Total current assets | | 210,355 | | | 202,826 | |

| PROPERTY, PLANT, AND EQUIPMENT: | | 410,427 | | | 386,648 | |

| Less accumulated depreciation | | 189,984 | | | 177,774 | |

| Net property, plant, and equipment | | 220,443 | | | 208,874 | |

| OTHER ASSETS: | | | | |

| Right-of-use assets | | 13,096 | | | 11,713 | |

| Goodwill | | 116,738 | | | 103,399 | |

| Intangible assets, net of accumulated amortization | | 130,474 | | | 116,626 | |

| Deferred compensation plan asset | | 11,892 | | | 9,584 | |

| Other | | 4,242 | | | 4,912 | |

| Total other assets | | 276,442 | | | 246,234 | |

| Total assets | | $ | 707,240 | | | $ | 657,934 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| CURRENT LIABILITIES: | | | | |

| Accounts payable — trade | | $ | 39,891 | | | $ | 56,387 | |

| Accrued payroll and employee benefits | | 18,371 | | | 19,532 | |

| Income tax payable | | — | | | 1,943 | |

| Current portion of long-term debt | | 9,913 | | | 9,913 | |

| | | | |

| Environmental remediation | | 7,700 | | | 7,700 | |

| Other current liabilities | | 8,379 | | | 7,832 | |

| Total current liabilities | | 84,254 | | | 103,307 | |

| LONG-TERM LIABILITIES: | | | | |

| Long-term debt, less current portion | | 103,884 | | | 88,818 | |

| Long-term lease liability | | 10,613 | | | 9,530 | |

| Pension withdrawal liability | | 3,252 | | | 3,538 | |

| Deferred income taxes | | 22,120 | | | 22,406 | |

| Deferred compensation liability | | 13,413 | | | 11,764 | |

| Earnout liability | | 12,262 | | | 11,235 | |

| Other long-term liabilities | | 461 | | | 1,310 | |

| Total long-term liabilities | | 166,005 | | | 148,601 | |

| Total liabilities | | 250,259 | | | 251,908 | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

Common stock; authorized: 60,000,000 shares of $0.01 par value; 20,766,764 and 20,790,261 shares issued and outstanding as of December 29, 2024 and March 31, 2024, respectively | | 208 | | | 208 | |

| Additional paid-in capital | | 32,783 | | | 38,154 | |

| Retained earnings | | 421,682 | | | 364,549 | |

| Accumulated other comprehensive income | | 2,308 | | | 3,115 | |

| Total shareholders’ equity | | 456,981 | | | 406,026 | |

| Total liabilities and shareholders’ equity | | $ | 707,240 | | | $ | 657,934 | |

HAWKINS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In thousands)

| | | | | | | | | | | | | | |

| | | Nine Months Ended |

| | | December 29,

2024 | | December 31,

2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income | | $ | 68,018 | | | $ | 61,531 | |

| Reconciliation to cash flows: | | | | |

| Depreciation and amortization | | 29,368 | | | 22,849 | |

| Change in fair value of earnout liability | | 1,027 | | | — | |

| Operating leases | | 2,557 | | | 1,884 | |

| | | | |

| Gain on deferred compensation assets | | (1,268) | | | (901) | |

| | | | |

| Stock compensation expense | | 5,022 | | | 3,506 | |

| | | | |

| Other | | (4) | | | 70 | |

| Changes in operating accounts providing (using) cash: | | | | |

| Trade receivables | | 6,157 | | | 22,500 | |

| Inventories | | (5,682) | | | 25,665 | |

| Accounts payable | | (16,026) | | | (14,334) | |

| Accrued liabilities | | (1,698) | | | (610) | |

| Lease liabilities | | (2,565) | | | (1,804) | |

| Income taxes | | (2,636) | | | (1,824) | |

| Other | | (2,018) | | | (922) | |

| Net cash provided by operating activities | | 80,252 | | | 117,610 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Purchases of property, plant, and equipment | | (30,008) | | | (28,248) | |

| | | | |

| | | | |

| Acquisitions | | (43,400) | | | (78,855) | |

| Other | | 586 | | | 723 | |

| Net cash used in investing activities | | (72,822) | | | (106,380) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Cash dividends declared and paid | | (10,885) | | | (9,886) | |

| New shares issued | | 1,297 | | | 2,243 | |

| Payroll taxes paid in exchange for shares withheld | | (2,541) | | | (2,140) | |

| | | | |

| | | | |

| Shares repurchased | | (9,149) | | | (11,272) | |

| | | | |

| Payments on revolving loan | | (50,000) | | | (67,000) | |

| | | | |

| Proceeds from revolving loan borrowings | | 65,000 | | | 75,000 | |

| Net cash used in financing activities | | (6,278) | | | (13,055) | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | 1,152 | | | (1,825) | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | | 7,153 | | | 7,566 | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 8,305 | | | $ | 5,741 | |

| | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | |

| Cash paid for income taxes | | $ | 26,566 | | | $ | 22,125 | |

| Cash paid for interest | | $ | 4,208 | | | $ | 3,252 | |

| Noncash investing activities - capital expenditures in accounts payable | | $ | 1,152 | | | $ | 2,887 | |

HAWKINS, INC.

REPORTABLE SEGMENTS (UNAUDITED)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Water

Treatment | | Industrial | | Health and Nutrition | | Total |

| Three months ended December 29, 2024: | | | | | | | |

| Sales | $ | 99,752 | | | $ | 91,997 | | | $ | 34,456 | | | $ | 226,205 | |

| Gross profit | 26,027 | | | 15,180 | | | 7,217 | | | 48,424 | |

| Selling, general, and administrative expenses | 16,054 | | | 7,058 | | | 4,249 | | | 27,361 | |

| Operating income | 9,973 | | | 8,122 | | | 2,968 | | | 21,063 | |

| Three months ended December 31, 2023: | | | | | | | |

| Sales | $ | 82,019 | | | $ | 92,990 | | | $ | 33,487 | | | $ | 208,496 | |

| Gross profit | 20,241 | | | 16,495 | | | 5,512 | | | 42,248 | |

| Selling, general, and administrative expenses | 12,470 | | | 7,292 | | | 4,012 | | | 23,774 | |

| Operating income | 7,771 | | | 9,203 | | | 1,500 | | | 18,474 | |

| Nine months ended December 29, 2024: | | | | | | | |

| Sales | $ | 341,456 | | | $ | 285,135 | | | $ | 102,522 | | | $ | 729,113 | |

| Gross profit | 96,572 | | | 55,324 | | | 21,405 | | | 173,301 | |

| Selling, general and administrative expenses | 45,732 | | | 20,649 | | | 12,321 | | | 78,702 | |

| Operating income | 50,840 | | | 34,675 | | | 9,084 | | | 94,599 | |

| Nine months ended December 31, 2023: | | | | | | | |

| Sales | $ | 276,595 | | | $ | 312,398 | | | $ | 107,149 | | | $ | 696,142 | |

| Gross profit | 75,957 | | | 53,645 | | | 18,523 | | | 148,125 | |

| Selling, general and administrative expenses | 31,741 | | | 20,673 | | | 11,759 | | | 64,173 | |

| Operating income | 44,216 | | | 32,972 | | | 6,764 | | | 83,952 | |

Forward-Looking Statements. Various remarks in this press release constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include those relating to consumer demand for products containing our ingredients and the impacts of those demands, expectations for results in our business segments and the timing of our filings with the Securities and Exchange Commission. These statements are not historical facts, but rather are based on our current expectations, estimates and projections, and our beliefs and assumptions. Forward-looking statements may be identified by terms, including “anticipate,” “believe,” “can,” “could,” “expect,” “intend,” “may,” “predict,” “should,” or “will” or the negative of these terms or other comparable terms. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Actual results may vary materially from those contained in forward looking statements based on a number of factors, including, but not limited to, changes in competition and price pressures, changes in demand and customer requirements or processes for our products, availability of product and disruptions to supplies, interruptions in production resulting from hazards, transportation limitations or other extraordinary events outside our control that may negatively impact our business or the supply chains in which we participate, changes in imported products and tariff levels, the availability of products and the prices at which they are available, the acceptance of new products by our customers and the timing of any such acceptance, and changes in product supplies. Additional information concerning potential factors that could affect future financial results is included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024, as updated from time to time in amendments and subsequent reports filed with the SEC. Investors should take such risks into account when making investment decisions. Shareholders and other readers are cautioned not to place undue reliance on forward-looking statements, which reflect our management’s view only as of the date hereof. We do not undertake any obligation to update any forward-looking statements.

Contacts: Jeffrey P. Oldenkamp

Executive Vice President and Chief Financial Officer

612/331-6910

ir@HawkinsInc.com

v3.24.4

Cover

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

Hawkins, Inc.

|

| Entity Incorporation, State or Country Code |

MN

|

| Entity File Number |

0-7647

|

| Entity Tax Identification Number |

41-0771293

|

| Entity Address, Address Line One |

2381 Rosegate,

|

| Entity Address, City or Town |

Roseville,

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55113

|

| City Area Code |

612

|

| Local Phone Number |

331-6910

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.01 per share

|

| Trading Symbol |

HWKN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000046250

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

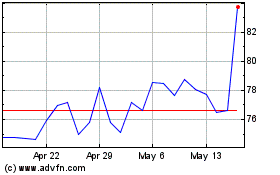

Hawkins (NASDAQ:HWKN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hawkins (NASDAQ:HWKN)

Historical Stock Chart

From Feb 2024 to Feb 2025