IBEX Limited Announces $70 Million Repurchase from The Resource Group International, Exiting Controlled Company Status

20 November 2024 - 2:11AM

IBEX Limited (“ibex”, or “the Company”) (Nasdaq: IBEX), a leading

global provider of business process outsourcing (BPO) and

AI-powered customer engagement technology solutions, today

announced that it repurchased an aggregate of 3,562,341 of the

Company’s common shares beneficially owned by The Resource Group

International, Limited (“TRGI”), which represents approximately 20%

of the diluted shares outstanding. These shares were unregistered

and were not part of the public float. The purchase price was

$19.65 per share, which was the last closing price, as well as the

five-day volume weighted average trading price, for ibex common

shares on the Nasdaq Global Market. The total transaction

consideration is $70 million consisting of $45 million in cash and

$25 million in seller financing. Subsequent to this transaction,

Ibex will have a proforma net debt position of approximately $9

million based on Ibex’s most recently released balance sheet dated

September 30, 2024.

Following the repurchase, TRGI will retain ownership of 1.8

million common shares of the Company, and ibex will no longer be a

“controlled company” within the meaning of the Nasdaq Stock Market

Rules. In addition, a majority of the Company’s eight person board

will consist of independent directors after the repurchase. Five

current directors appointed by TRGI shall continue to serve until

the 2025 Annual General Meeting of Shareholders, and one of the two

current ibex directors employed by TRGI will resign from the

Company’s Board of Directors before the end of the year.

Additionally, as part of the share repurchase, ibex will have the

right to repurchase the remaining shares owned by TRGI within 4

years, if certain conditions are met.

“We are very pleased to announce this agreement with TRGI, which

comes in addition to the more than $27 million in share repurchases

we have made since September last year, reflecting the continued

confidence in our business and growth trajectory,” said Bob

Dechant, ibex CEO. “We believe that share repurchases are a prudent

use of capital as we continue to generate free cash flow and

maintain a strong balance sheet. Additionally, this transaction

helps to further decrease our shareholder concentration and we will

no longer be defined as a controlled company, as we will transition

in full to NASDAQ’s corporate governance requirements to have

independent board and committee composition. We believe this will

give ibex the potential to broaden our shareholder base. TRGI has

been a key partner to ibex for nearly 20 years for which we are

deeply appreciative and will remain a meaningful investor as we

move forward.”

Mohammed Khaishgi, TRGI CEO and Non-Executive Chairman of the

Board of ibex, said, “Over the last two decades, we have been

staunch believers in the vision and execution of ibex as it has

grown its revenues nearly ten-fold over that period. In particular,

we have been big supporters of the strategy that Bob and the ibex

team have executed on for over a decade. We believe that now is the

right time for ibex to pivot to the next stage of its evolution and

move beyond the structure of a controlled company. We of course

remain fervent in our support of the company’s future and look

forward to continuing as non-controlling shareholders of ibex.”

The transaction was unanimously approved by a Special

Transaction Committee comprised of members who were independent

from TRGI. The Special Transaction Committee was advised by

independent legal and financial advisors, and a fairness opinion

was furnished by those financial advisors supporting the

transaction. The entire Board, except for members employed by TRGI,

who recused themselves from the vote, also ratified the

transaction.

Lincoln International, LLC acted as financial advisor and

Gibson, Dunn & Crutcher, LLC served as independent legal

counsel to the Special Transaction Committee.

With the consummation of this transaction, ibex will pause its

existing share repurchase program. Any decision in relation to a

resumption of the existing or any future buyback program will be

based on an ongoing assessment of the capital needs of the business

and general market conditions.

About ibexibex delivers innovative business

process outsourcing (BPO), smart digital marketing, online

acquisition technology, and end-to-end customer engagement

solutions to help companies acquire, engage and retain valuable

customers. Today, ibex operates a global CX delivery center model

consisting of 31+ operations facilities around the world, while

deploying next generation technology to drive superior customer

experiences for many of the world’s leading companies across

retail, e-commerce, healthcare, fintech, utilities and

logistics.

ibex leverages its diverse global team of over 31,000 employees

together with industry-leading technology, including the AI-powered

ibex Wave iX solutions suite, to manage nearly 200 million critical

customer interactions, adding over $2.2B in lifetime customer

revenue each year and driving a truly differentiated customer

experience. To learn more, visit our website at ibex.co and connect

with us on LinkedIn.

Investor ContactMichael

DarwalibexMichael.Darwal@ibex.co

Media ContactDan

BurrisibexDaniel.Burris@ibex.co

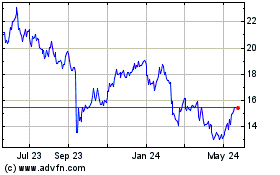

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

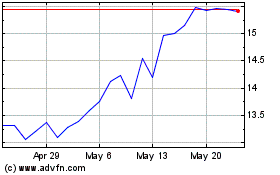

IBEX (NASDAQ:IBEX)

Historical Stock Chart

From Dec 2023 to Dec 2024