As filed with the Securities and Exchange Commission on February 24, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IES HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 76-0542208 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

2 Riverway

Suite 1730

Houston, Texas |

77056 |

| (Address of Principal Executive Offices) | (Zip Code) |

IES HOLDINGS, INC.

AMENDED AND RESTATED 2006 EQUITY INCENTIVE PLAN

(Full title of the plan)

Mary Newman, Esq.

Vice President, General Counsel and Secretary

2 Riverway

Suite 1730

Houston, Texas 77056

(Name and address of agent for service)

(713) 860-1500

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer ¨ | |

| Non-accelerated filer | ¨ | | Smaller reporting company

Emerging growth company | ¨ ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

REGISTRATION OF ADDITIONAL SECURITIES PURSUANT TO GENERAL INSTRUCTION E OF FORM S-8

EXPLANATORY NOTE

This registration statement on Form S-8 (this “Registration Statement”) is filed by IES Holdings, Inc., a Delaware corporation (the “Company”), to register the offer and sale of 825,000 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (“Common Stock”), authorized for issuance under the IES Holdings, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 20, 2025) (the “Amended Plan”). The Shares comprise (i) 750,000 additional shares of Common Stock authorized for issuance under the Amended Plan and (ii) 75,000 shares of Common Stock that may again become available for delivery with respect to awards under the Amended Plan pursuant to the share counting, share recycling, and other terms and conditions of the Amended Plan.

The Amended Plan was approved by the Company’s stockholders at the Company’s annual stockholders’ meeting on February 20, 2025 (the “2025 Annual Meeting”). In addition to increasing the number of shares of Common Stock authorized for issuance under the Amended and Restated 2006 Equity Incentive Plan (as of February 9, 2016) (the “Existing Plan”) by 750,000 shares, the Amended Plan also (i) eliminates the limits on awards that may be granted to an award recipient in any one year, (ii) incorporates the clawback provisions of the Company’s Incentive Recoupment Policy adopted in fiscal year 2024, and (iii) extends the term of the Existing Plan to February 19, 2035.

This Registration Statement is submitted in accordance with General Instruction E to Form S-8 regarding the Registration of Additional Securities. The Shares registered hereby are securities of the same class and relate to the same employee benefit plan as the securities registered on the Company’s registration statements on Form S-8 (File No. 333-209483) and Form S-8 (File No. 333-134100) (together, the “Prior Registration Statements”). Each of the Prior Registration Statements is currently effective. In accordance with General Instruction E to Form S-8, the contents of the Prior Registration Statements (including documents deemed to be incorporated by reference therein and to be part thereof), are incorporated herein by reference and made a part of this Registration Statement, except to the extent supplemented, superseded, or modified by the information set forth below (including the information incorporated by reference herein) or the exhibits attached hereto.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents have been filed by the Company with the Securities and Exchange Commission (the “Commission”) and are incorporated herein by reference:

| | | | | |

| (a) | The Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2024, including the portions of the Company’s Definitive Proxy Statement on Schedule 14A, filed with the Commission on January 7, 2025, that are incorporated by reference therein. |

| (b) | The Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2024. |

| (c) | |

| (d) | The description of the Company’s Common Stock contained in Exhibit 4.4 to the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2023, including any amendment or report filed for the purpose of updating that description. |

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended, after the date of this Registration Statement and prior to the filing of a post-effective amendment that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the respective dates of filing of such documents (other than any documents or portions thereof that are furnished to, and not filed with, the Commission, including any information furnished under Item 2.02 or Item 7.01 of Form 8-K and any exhibits related thereto and furnished under Item 9.01 of Form 8-K).

Any statement contained herein or in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| | |

| | |

| 4.1 | | |

| |

| |

| 4.3 | | |

| |

| 4.4 | | |

| 4.5 | | |

| |

| *5.1 | | |

| |

| *23.1 | | |

| |

| *23.2 | | |

| |

| *24.1 | | |

| *107 | | |

_________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on February 24, 2025.

| | | | | | | | | | | |

| | | IES HOLDINGS, INC. |

| | | |

| | | By: /s/ Mary K. Newman |

| | | Name: Mary K. Newman |

| | | Title: Vice President, General Counsel and Corporate Secretary |

POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated. Each person whose signature appears below authorizes and appoints Jeffrey L. Gendell, Matthew A. Simmes, Tracy A. McLauchlin and Mary K. Newman, and each of them individually, as his or her attorney-in-fact to execute in the name of such person and to file any amendments to this Registration Statement necessary or advisable to enable the registrant to comply with the Securities Act of 1933 and any rules, regulations and requirements of the registration of the securities that are the subject of this Registration Statement, which amendments may make such changes in the Registration Statement as such attorney-in-fact may deem appropriate.

| | | | | | | | | | | | | | |

| | | | |

| Signature | | Title | | Date |

| | |

| /s/ Jeffrey L. Gendell | | Chief Executive Officer and Chairman of the Board | | February 24, 2025 |

| Jeffrey L. Gendell | | (Principal Executive Officer) | | |

| | |

| /s/ Tracy A. McLauchlin | | Senior Vice President, Chief Financial Officer and Treasurer | | February 24, 2025 |

| Tracy A. McLauchlin | | (Principal Financial Officer)

(Principal Accounting Officer) | | |

| | | | |

| /s/ Jennifer A. Baldock | | Director | | February 24, 2025 |

Jennifer A. Baldock

| | | | |

| | |

| /s/ Todd M. Cleveland | | Director | | February 24, 2025 |

Todd M. Cleveland

| | | | |

| | |

| /s/ John L. Fouts | | Director | | February 24, 2025 |

John L. Fouts

| | | | |

| | | | |

| /s/ David B. Gendell | | Director | | February 24, 2025 |

David B. Gendell

| | | | |

| | |

| /s/ Joe D. Koshkin | | Director | | February 24, 2025 |

Joe D. Koshkin

| | | | |

| | |

S-8

S-8

EX-FILING FEES

0001048268

IES Holdings, Inc.

Fees to be Paid

0001048268

2025-02-21

2025-02-21

0001048268

1

2025-02-21

2025-02-21

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

IES Holdings, Inc.

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Stock, par value $0.01 per share

|

Other

|

825,000

|

$

205.22

|

$

169,306,500.00

|

0.0001531

|

$

25,920.83

|

|

Total Offering Amounts:

|

|

$

169,306,500.00

|

|

$

25,920.83

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

25,920.83

|

|

1

|

Amount registered represents shares of common stock, par value $0.01 per share ("Common Stock"), of IES Holdings, Inc. (the "Registrant") reserved and authorized for issuance under the IES Holdings, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 20, 2025) (the "Amended Plan"), including (i) 750,000 additional shares of Common Stock authorized for issuance under the Amended Plan and (ii) 75,000 shares of Common Stock that may again become available for delivery with respect to awards under the Amended Plan pursuant to the share counting, share recycling, and other terms and conditions of the Amended Plan.

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the "Securities Act"), this registration statement also covers any additional shares of Common Stock that become issuable under the Amended Plan by reason of any stock dividend, stock split, recapitalization or similar transactions.

Proposed Maximum Offering Price Per Share is estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(h)(1) under the Securities Act, based on the average of the high and low prices for the Common Stock, as reported on the Nasdaq Global Market, on February 20, 2025.

|

|

|

HUNTON ANDREWS KURTH LLP

HUNTON ANDREWS KURTH LLPFILE NO: 102963.0074239

February 24, 2025

IES Holdings, Inc.

2 Riverway, Suite 1730

Houston, Texas 77056

Re: IES Holdings, Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have acted as counsel to IES Holdings, Inc., a Delaware corporation (the “Company”), in connection with the Company’s Registration Statement on Form S-8 (the “Registration Statement”) to be filed on the date hereof with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement registers the offer and sale of 825,000 shares (the “Shares”) of the Company’s common stock, $0.01 par value per share (“Common Stock”), under the IES Holdings, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 20, 2025) (the “Amended Plan”). The Shares comprise (i) 750,000 additional shares of Common Stock authorized for issuance under the Amended Plan and (ii) 75,000 shares of Common Stock that may again become available for issuance pursuant to Awards (as defined in the Amended Plan) under the Amended Plan in accordance with Section 4(b) of the Amended Plan.

The Amended Plan amended, restated and renamed the Integrated Electrical Services, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 9, 2016) (the “2016 Plan”), which amended and restated the Integrated Electrical Services, Inc. Amended and Restated 2006 Equity Incentive Plan (as of October 9, 2007) (the “2007 Plan”), which amended and restated the Integrated Electrical Services, Inc. 2006 Equity Incentive Plan (Effective as of May 12, 2006) (the “2006 Plan”).

This opinion letter is being furnished in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act.

ATLANTA AUSTIN BANGKOK BEIJING BOSTON BRUSSELS CHARLOTTE DALLAS DUBAI HOUSTON

LONDON LOS ANGELES MIAMI NEW YORK RICHMOND SAN FRANCISCO TOKYO TYSONS WASHINGTON, DC

www.Hunton.com

IES Holdings, Inc.

February 24, 2025

Page 2

In rendering the opinion set forth herein, we have examined and relied on originals or copies, certified or otherwise identified to our satisfaction, of such records of the Company and such agreements, certificates of public officials, certificates of officers or other representatives of the Company and others, and such other documents, certificates and records, as we have deemed necessary or appropriate as a basis for the opinion set forth herein, including, among other things, (i) the Registration Statement, (ii) the Amended Plan, the 2016 Plan, the 2007 Plan, and the 2006 Plan, (iii) the Second Amended and Restated Certificate of Incorporation of the Company, as amended, (iv) the Company’s Amended and Restated Bylaws, and (v) certain resolutions of the Board of Directors of the Company certified to us to be true and correct by the Company.

In our examination, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity of all documents submitted to us as originals, and the conformity to authentic original documents of all documents submitted to us as certified or photostatic copies. As to any facts material to the opinion expressed herein that we did not independently establish or verify, we have relied, to the extent we deem appropriate, upon (i) oral or written statements and representations of officers and other representatives of the Company and (ii) statements and certifications of public officials and others.

For purposes of rendering the opinion expressed below, we have assumed that, at the time of issuance of the Shares pursuant to the Amended Plan, (i) any conditions to the issuance of the Shares under to the Amended Plan and the applicable Award Agreements (as defined in the Amended Plan) will be satisfied in full; (ii) the Amended Plan will remain in effect and will not have been amended or modified in any manner that affects adversely the validity of the Shares upon issuance thereunder; (iii) there will be no agreements or understandings between or among the Company and any participant in the Amended Plan that would expand, modify, or otherwise affect the terms of the Amended Plan or the respective rights or obligations of the participants thereunder; and (iv) the applicable Award Agreements will not contain any provisions inconsistent with such opinion.

Based upon the foregoing, and subject to the limitations, qualifications and assumptions set forth herein, we are of the opinion that the Shares have been duly authorized by all necessary corporate action of the Company, and subject to the Registration Statement becoming effective under the Securities Act, when issued and sold against consideration therefor in accordance with the terms of the Amended Plan and the applicable Award Agreements, and registered on the Company’s stock transfer records in the name or on behalf of the persons acquiring such Shares pursuant to the Amended Plan and the applicable Award Agreements, the Shares that are original issuance securities, will be validly issued, fully paid and nonassessable.

IES Holdings, Inc.

February 24, 2025

Page 3

The foregoing opinion is limited to the General Corporation Law of the State of Delaware.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are included in the category of persons whose consent is required by Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

The opinion and statements expressed herein are as of the date hereof only and are based on laws, orders, contract terms and provisions, and facts as of such date, and we disclaim any obligation to advise you of facts, circumstances, events or developments that hereafter may be brought to our attention and that may affect the opinion expressed herein.

Very truly yours,

/s/ Hunton Andrews Kurth LLP

102963.0151904 DMS 310014745v

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the IES Holdings, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 20, 2025) of our reports dated November 22, 2024, with respect to the consolidated financial statements of IES Holdings, Inc. and subsidiaries and the effectiveness of internal control over financial reporting of IES Holdings, Inc. and subsidiaries included in its Annual Report (Form 10-K) for the year ended September 30, 2024, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Houston, Texas

February 24, 2025

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Feb. 21, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Stock, par value $0.01 per share

|

| Amount Registered | shares |

825,000

|

| Proposed Maximum Offering Price per Unit |

205.22

|

| Maximum Aggregate Offering Price |

$ 169,306,500.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 25,920.83

|

| Offering Note |

Amount registered represents shares of common stock, par value $0.01 per share ("Common Stock"), of IES Holdings, Inc. (the "Registrant") reserved and authorized for issuance under the IES Holdings, Inc. Amended and Restated 2006 Equity Incentive Plan (as of February 20, 2025) (the "Amended Plan"), including (i) 750,000 additional shares of Common Stock authorized for issuance under the Amended Plan and (ii) 75,000 shares of Common Stock that may again become available for delivery with respect to awards under the Amended Plan pursuant to the share counting, share recycling, and other terms and conditions of the Amended Plan.

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the "Securities Act"), this registration statement also covers any additional shares of Common Stock that become issuable under the Amended Plan by reason of any stock dividend, stock split, recapitalization or similar transactions.

Proposed Maximum Offering Price Per Share is estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(h)(1) under the Securities Act, based on the average of the high and low prices for the Common Stock, as reported on the Nasdaq Global Market, on February 20, 2025.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

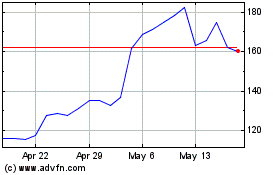

IES (NASDAQ:IESC)

Historical Stock Chart

From Feb 2025 to Mar 2025

IES (NASDAQ:IESC)

Historical Stock Chart

From Mar 2024 to Mar 2025