Company pays-down $9.5 million, or 49%, of

short-term loan to further reduce debt and improve Balance Sheet;

Company also signs agreement to exchange additional $5 million of

Convertible Notes into long-term debt and equity

Inseego Corp. (Nasdaq: INSG) (the “Company” or “Inseego”), a

technology leader in 5G mobile and fixed wireless solutions for

mobile network operators, Fortune 500 enterprises, and SMBs, is

continuing to improve its capital structure and reduce its total

debt. Today, Inseego announced that it has (i) voluntarily

paid-down an aggregate of $9.5 million, or approximately 49%, of

the Company’s outstanding short-term loan, and (ii) entered into a

binding agreement (the “Exchange Term Sheet”) with another holder

of $5 million in principal amount of the Company’s outstanding

3.25% convertible notes due 2025 (the “2025 Convertible Notes”) to

exchange the 2025 Convertible Notes into long-term debt and

equity.

“We’re executing on our commitment to reduce our total debt and

improve our capital structure,” said Inseego Chief Financial

Officer, Steven Gatoff. “The business is generating strong cash

flow and with the improved liquidity, we’re glad to be able to pay

down total debt. The Company continues to engage with convertible

bondholders and right-size the capital structure through these

exchanges.”

The Company has also voluntarily prepaid, at no premium, an

aggregate of $9.5 million to-date of the Company’s obligations

under the Loan and Security Agreement, dated June 28, 2024 (the

“Loan Agreement”), among the Company, South Ocean Funding, LLC

(“South Ocean,” an affiliate of Tavistock Group), certain

participant lenders (the “Participating Lenders”) and certain

subsidiaries of the Company. As a result of these repayments, the

amount outstanding under the Loan Agreement has been reduced to $10

million.

Pursuant to the Exchange Term Sheet, the convertible note holder

agreed to exchange its 2025 Convertible Notes for (i) $4.25 million

in principal amount of new long-term senior secured notes (the “New

Notes”), and (ii) warrants (the “Exchange Warrants”) to purchase an

aggregate of 370,000 shares of the Company’s common stock.

The New Notes and the Exchange Warrants to be issued pursuant to

the Exchange Term Sheet will be the same as the new long-term

senior secured notes and warrants, respectively, to be issued

pursuant to the separate binding exchange term sheets previously

entered into between the Company and certain other holders of 2025

Convertible Notes, as described in the current report filed by the

Company on July 1, 2024, except that the exercise price of the

Exchange Warrants will be $13.77. The Exchange Term Sheet expires

on December 31, 2024, and it is anticipated that the transactions

contemplated by the Exchange Term Sheet will be consummated by that

time.

To date, the Company has repurchased or entered into binding

agreements to repurchase and/or exchange approximately $147

million, or 91%, of face value of the outstanding 2025 Convertible

Notes. As a result, the remaining balance of the 2025 Convertible

Notes that are not subject to an exchange agreement is

approximately $14.9 million, which the Company expects to repay or

refinance by May 2025.

As previously disclosed, affiliates of South Ocean and North

Sound Ventures, LP, one of the Participating Lenders, may be deemed

to beneficially own more than 5% of the Company’s outstanding

Common Stock, and Philip Brace, the Company’s Executive Chairman,

is the other Participating Lender. James B. Avery, a member of the

Company’s Board of Directors, currently serves as Senior Managing

Director of Tavistock Group, an affiliate of Lender.

About Inseego Corp.

Inseego Corp. (Nasdaq: INSG) is the industry leader in 5G

Enterprise cloud WAN solutions, with millions of end customers and

thousands of enterprise and SMB customers on its 4G, 5G, and cloud

platforms. Inseego's 5G Edge Cloud combines the industry's best 5G

technology, rich cloud networking features, and intelligent edge

applications. Inseego powers new business experiences by connecting

distributed sites and workforces, securing enterprise data, and

improving business outcomes with intelligent operational

visibility---all over a 5G network. For more information on

Inseego, visit www.inseego.com #Putting5GtoWork

Cautionary Note Regarding Forward-Looking Statements

Some of the information presented in this news release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. In this context,

forward-looking statements often address expected future business

and financial performance and often contain words such as “may,”

“estimate,” “anticipate,” “believe,” “expect,” “intend,” “plan,”

“project,” “will” and similar words and phrases indicating future

results. The information presented in this news release related to

the planned exchange of a portion of our 2025 Convertible Notes and

other statements that are not purely historical facts are

forward-looking. These forward-looking statements are based on

management’s current expectations, assumptions, estimates, and

projections. They are subject to significant risks and

uncertainties that could cause results to differ materially from

those anticipated in such forward-looking statements. We,

therefore, cannot guarantee future results, performance, or

achievements. Actual results could differ materially from our

expectations.

Factors that could cause actual results to differ materially

from the Company’s expectations include: (1) the Company’s ability

to negotiate, execute and complete exchange transactions with

respect to its convertible notes, (2) the Company’s ability to make

payments on or to refinance its indebtedness; (3) the Company’s

dependence on a small number of customers for a substantial portion

of our revenues; (4) the future demand for wireless broadband

access to data and asset management software and services and our

ability to accurately forecast; (5) the growth of wireless

wide-area networking and asset management software and services;

(6) customer and end-user acceptance of the Company’s current

product and service offerings and market demand for the Company’s

anticipated new product and service offerings; (7) our ability to

develop sales channels and to onboard channel partners; (8)

increased competition and pricing pressure from participants in the

markets in which the Company is engaged; (9) dependence on

third-party manufacturers and key component suppliers worldwide;

(10) the impact of fluctuations of foreign currency exchange rates;

(11) the impact of supply chain challenges on our ability to source

components and manufacture our products; (12) unexpected

liabilities or expenses; (13) the Company’s ability to introduce

new products and services in a timely manner, including the ability

to develop and launch 5G products at the speed and functionality

required by our customers; (14) litigation, regulatory and IP

developments related to our products or components of our products;

(15) the Company’s ability to raise additional financing when the

Company requires capital for operations or to satisfy corporate

obligations; (16) the Company’s plans and expectations relating to

acquisitions, divestitures, strategic relationships, international

expansion, software and hardware developments, personnel matters,

and cost containment initiatives, including restructuring

activities and the timing of their implementations; (17) the global

semiconductor shortage and any related price increases or supply

chain disruptions, (18) the potential impact of COVID-19 or other

global public health emergencies on the business, (19) the impact

of high rates of inflation and rising interest rates, and (20) the

impact of geopolitical instability on our business.

These factors, as well as other factors set forth as risk

factors or otherwise described in the reports filed by the Company

with the SEC (available at www.sec.gov), could cause results to

differ materially from those expressed in the Company’s

forward-looking statements. The Company assumes no obligation to

update publicly any forward-looking statements, even if new

information becomes available or other events occur in the future,

except as otherwise required under applicable law and our ongoing

reporting obligations under the Securities Exchange Act of 1934, as

amended.

©2024. Inseego Corp. All rights reserved. Inseego is a trademark

of Inseego Corp. Other Company, product, or service names mentioned

herein are the trademarks of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911809046/en/

Inseego Corp. Jodi Ellis pr@inseego.com

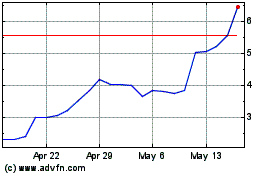

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inseego (NASDAQ:INSG)

Historical Stock Chart

From Nov 2023 to Nov 2024