Delivers $6.1 Million Q2 Revenue and Announces

Strategic Plan to Reshape Biotech and AI-Driven Drug Discovery

IMMUNOPRECISE ANTIBODIES LTD. (the “Company” or “IPA”) (NASDAQ:

IPA), an AI-driven biotherapeutic research and technology company,

today reported financial results for the second quarter (“Q2”) of

its 2025 fiscal year (“FY25”), which ended October 31, 2024. All

numbers are expressed in Canadian dollars, unless otherwise

noted.

"This quarter marks a pivotal chapter for IPA as we unveil our

cutting-edge in silico drug discovery tools, designed to

revolutionize the landscape of novel therapeutic development. These

advanced platforms offer unprecedented insights and precision,

aimed at significantly reducing the time and cost associated with

traditional drug discovery methods. By harnessing the power of

data-driven analytics, we're ushering in a new era of efficiency

and innovation in the pharmaceutical industry. From our upcoming

strategic relocation to Austin, Texas, to the continued progress

with our LENSai™ platform and partnerships with world-class

organizations like BioNTech and InterSystems, we have focused on

driving meaningful impact in the biotech and life sciences

sectors," stated Dr. Jennifer Bath, President and CEO.

Second Quarter Corporate Update and Recent Business

Highlights

- Corporate headquarters is relocating to Austin, Texas:

Expanding IPA’s U.S. footprint in the heart of a thriving AI,

biotech, and semiconductor ecosystem.

- Showcased LENSai Platform at AI-Driven Drug Discovery Summit

USA 2024 and TECHday Highlighted unique AI capabilities for

accelerating therapeutic antibody discovery.

- First public demonstration of five AI-driven LENSai analytical

tools for use in drug discovery, development and optimization –

demonstrating how LENSai’s unprecedented analytical tools transform

the time and cost of novel drug discovery programs.

- IPA hosted fireside chat with guest Adam Root, Vice President

and Head of Protein Sciences at Generate Biomedicines, live at the

Boston AI-Driven Drug Discovery Summit USA 2024.

- The first annual TECHday hosted at InterSystems’ headquarters

and featured a fireside chat with Jeff Fried, Director of Platform

Strategy and Innovation at InterSystems, titled Disruptive

Dialogue: Empowering Drug Discovery Through Seamless Data

Integration and AI-Powered Insights. The discussion highlighted how

smart search technology drives the LENSai platform, seamlessly

integrated with the InterSystems IRIS platform to accelerate

antibody discovery with greater speed, accuracy, and

diversity.

- Achieved Breakthrough in ADC Cancer Research: Progressed

TATX-112 program with antibodies targeting TrkB-expressing cells

for next-generation ADC therapies.

- Entered into Material Transfer and Evaluation Agreement with

Biotheus, now part of BioNTech, for the transfer of AI-enhanced

bispecific antibody candidates for hypoxic solid tumors.

- Partnered with Mayo Clinic on anti-aging research: Developed

antibodies targeting mitochondrial damage markers to advance

understanding of neurodegenerative diseases such as Parkinson’s and

Alzheimer’s.

- Announced clinical progress with IPA-generated rabbit

monoclonal antibodies: Two novel antibodies developed using IPA’s B

Cell Select ® platform advancing in clinical-stage programs.

- Achieved revenues of $6.1 million: Represents a 16% increase

over the previous quarter with strong quarter over quarter growth

achieved at each of our wet lab sites. BioStrand achieved $0.9

million to date with strong second quarter revenue of $0.4

million.

Second Quarter FY25 Financial Results

- Revenue: Total revenue was $6.1 million, compared to

revenue of $6.1 million in fiscal year 2024 (“FY24”) Q2. Project

revenue generated $5.4 million, including projects using IPA’s

proprietary B Cell Select® platform and IPA’s proprietary LENSai

platform, compared to $5.5 million in FY24 Q2. Product sales and

cryostorage revenue were $0.7 million, compared to $0.6 million in

FY24 Q2.

- Research & Development (R&D) Expenses: R&D

expenses were $1.2 million, compared to $0.8 million in FY24 Q2,

with the increase reflecting increased expenditures related to the

build of the Company's LENSai platform.

- Sales & Marketing (S&M) Expenses: S&M

expenses were $1.2 million, compared to $0.9 million in FY24 Q2 and

include S&M costs related to BioStrand LENSai.

- General & Administrative (G&A) Expenses: G&A

expenses were $3.3 million, compared to $3.3 million in FY24

Q2.

- Net Loss: Net loss of $2.6 million, or $(0.09) per share

on a basic and diluted basis, compared to a net loss of $2.4

million or $(0.10) on a basic and diluted basis in FY24 Q2.

- Liquidity: Cash totaled $3.6 million as of October 31,

2024, compared to $3.5 million as of April 30, 2024.

Conference Call and Webcast Details

The Company will host a live conference call and webcast to

discuss these results and provide a corporate update on Tuesday,

December 10, 2024, at 10:30AM ET.

The conference call will be webcast live and available for

replay via a link provided in the Events section of the Company’s

IR pages at

https://ir.ipatherapeutics.com/events-and-presentations/default.aspx.

***Participant Dial-In Details***

Participants call one of the allocated dial-in numbers (below)

and advise the Operator of either the Conference ID 3224490 or

Conference Name.

USA / International Toll +1 (646) 307-1963 USA - Toll-Free (800)

715-9871 Canada - Toronto (647) 932-3411 Canada - Toll-Free (800)

715-9871

***Webcast Details***

Attendee URL: https://events.q4inc.com/attendee/560160139

Please call the conference telephone number five minutes prior

to the start time. An operator will register your name and

organization.

Anyone listening to the call is encouraged to read the company's

periodic reports available on the company’s profile at

www.sedarplus.com and www.sec.gov, including the discussion of risk

factors and historical results of operations and financial

condition in those reports.

About ImmunoPrecise Antibodies Ltd.

ImmunoPrecise Antibodies Ltd. is a biotechnology company that

leverages multi-omics modeling and complex artificial intelligence

through a series of proprietary and patented technologies. The

Company owns an integrated end-to-end suite of capabilities to

support the development of therapeutic antibodies and are known for

solving very complex industry challenges. IPA has several

subsidiaries in North America and Europe including entities such as

Talem Therapeutics LLC, BioStrand BV, ImmunoPrecise Antibodies

(Canada) Ltd. and ImmunoPrecise Antibodies (Europe) B.V.

(collectively, the “IPA Family”).

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of applicable United States securities laws and

Canadian securities laws. Forward-looking statements are often

identified by the use of words such as “expects”, “estimates”,

“intends”, “anticipates”, or “believes”, or variations of such

words and phrases, or state that certain actions, events, or

results “may”, “would”, “might”, or “will” be taken, occur, or be

achieved. Forward-looking statements include, but are not limited

to, statements relating to our expectations related to business

operations, financial performance, results of operations, our

expectations and guidance related to the success of our

partnerships, the gross use of cash, our projected cash usage,

needs, and runway, our technology development efforts and the

application of those efforts, out-licensing and new client

opportunities, strategic partnerships, expansion strategy, the

efficacy and integration of new service and product offerings, our

ability to market our platform technologies to potential partners,

and our internal asset programs, and our ability to create

long-term value for customers. Although the Company believes that

we have a reasonable basis for each forward-looking statement, we

caution you that these statements are based on a combination of

facts and factors currently known by us and our expectations of the

future, about which we cannot be certain. Actual future results may

be materially different from what we expect due to factors largely

outside our control, including risks and uncertainties related to

market and other conditions and the impact of general economic,

industry or political conditions in the United States, Canada or

internationally. You should also consult our quarterly and annual

filings with the Canadian and U.S. securities commissions for

additional information on risks and uncertainties.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause actual results,

performance or achievements stated herein to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Actual

results could differ materially from those currently anticipated

due to several factors and risks, as discussed in the Company’s

Annual Report on Form 20-F for the year ended April 30, 2024 (which

may be viewed on the Company’s SEDAR+ profile at www.sedarplus.ca

and EDGAR profile at www.sec.gov/edgar). Should one or more of

these risks or uncertainties materialize, or should assumptions

underlying the forward-looking statements prove incorrect, actual

results, performance, or achievements may vary materially from

those expressed or implied by the forward-looking statements

contained in this release. Accordingly, readers should not place

undue reliance on forward-looking statements contained in this

release. The forward-looking statements contained in this release

are made as of the date of this release and, accordingly, are

subject to change after such date. The Company does not assume any

obligation to update or revise any forward-looking statements,

whether written or oral, that may be made from time to time by us

or on our behalf, except as required by applicable law.

IMMUNOPRECISE ANTIBODIES

LTD.

CONDENSED INTERIM CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited - Expressed in

Canadian dollars)

Three months ended October

31,

Six months ended October

31,

(in thousands, except share data)

2024 $

2023 $

2024 $

2023 $

REVENUE

6,125

6,150

11,388

11,837

COST OF SALES

2,688

3,196

5,595

6,090

GROSS PROFIT

3,437

2,954

5,793

5,747

EXPENSES

Research and development

1,155

835

2,797

1,781

Sales and marketing

1,237

921

1,955

1,984

General and administrative

3,273

3,308

7,436

7,295

Amortization of intangible assets

613

711

1,219

1,558

6,278

5,775

13,407

12,618

Loss before other income (expenses) and

income taxes

(2,841

)

(2,821

)

(7,614

)

(6,871

)

OTHER INCOME (EXPENSES)

Accretion

(3

)

(5

)

(5

)

(10

)

Grant income

22

16

168

299

Interest and other expense (income)

(117

)

10

(116

)

23

Unrealized foreign exchange loss

(gain)

(120

)

209

(265

)

136

(218

)

230

(218

)

448

Loss before income taxes

(3,059

)

(2,591

)

(7,832

)

(6,423

)

Income taxes

506

182

1,280

596

NET LOSS FOR THE PERIOD

(2,553

)

(2,409

)

(6,552

)

(5,827

)

OTHER COMPREHENSIVE INCOME

(LOSS)

Items that will be reclassified

subsequently to loss

Exchange difference on translating foreign

operations

169

462

689

(708

)

COMPREHENSIVE LOSS FOR THE

PERIOD

(2,384

)

(1,947

)

(5,863

)

(6,535

)

LOSS PER SHARE – BASIC AND

DILUTED

(0.09

)

(0.10

)

(0.24

)

(0.23

)

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

28,132,055

25,050,260

27,481,210

25,050,260

IMMUNOPRECISE ANTIBODIES

LTD.

CONDENSED INTERIM CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

(Unaudited - Expressed in

Canadian dollars)

(in thousands)

October 31, 2024 $

April 30, 2024 $

ASSETS

Current assets

Cash

3,534

3,459

Amounts receivable, net

4,104

3,790

Tax receivable

267

414

Inventory

2,010

2,139

Unbilled revenue

932

277

Prepaid expenses

1,655

1,408

12,502

11,487

Restricted cash

87

86

Deposit on equipment

490

475

Property and equipment

15,958

16,696

Intangible assets

23,007

23,557

Goodwill

7,919

7,687

Total assets

59,963

59,988

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

5,383

4,372

Deferred revenue

1,717

1,353

Income taxes payable

257

553

Leases

1,661

1,563

Deferred acquisition payments

298

284

Debentures, net

3,093

—

12,409

8,125

Leases

11,669

12,118

Deferred income tax liability

3,208

4,067

Total liabilities

27,286

24,310

SHAREHOLDERS' EQUITY

Share capital

122,313

119,773

Contributed surplus

12,709

12,387

Accumulated other comprehensive loss

2,767

2,078

Accumulated deficit

(105,112

)

(98,560

)

32,677

35,678

Total liabilities and shareholders’

equity

59,963

59,988

IMMUNOPRECISE ANTIBODIES

LTD.

CONDENSED INTERIM CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the six months ended October

31, 2024 and 2023

(Unaudited - Expressed in

Canadian dollars)

(in thousands)

2024 $

2023 $

Operating activities:

Net loss for the period

(6,552

)

(5,826

)

Items not affecting cash:

Amortization and depreciation

2,810

2,847

Deferred income taxes

(975

)

(416

)

Accretion

5

10

Foreign exchange

(16

)

49

Gain on investment

266

—

Share-based expense

322

1,120

(4,140

)

(2,216

)

Changes in non-cash working capital

related to operations:

Amounts receivable

(259

)

(45

)

Inventory

172

(75

)

Unbilled revenue

(639

)

(429

)

Prepaid expenses

(220

)

150

Accounts payable and accrued

liabilities

1,019

679

Sales and income taxes payable and

receivable

(352

)

736

Deferred revenue

352

630

Net cash used in operating activities

(4,067

)

(570

)

Investing activities:

Purchases of property and equipment

(328

)

(435

)

Security deposit on leases

—

(49

)

Deferred acquisition payments

—

(146

)

Sale of QVQ Holdings BV shares

—

121

Net cash used in investing activities

(328

)

(509

)

Financing activities:

Proceeds on share issuance, net of

transaction costs

1,507

—

Repayment of leases

(801

)

(715

)

Proceeds on debenture issuance, net of

transaction costs

4,059

—

Net cash provided by (used in) financing

activities

4,765

(715

)

Increase (decrease) in cash during the

period

370

(1,794

)

Foreign exchange

(294

)

(468

)

Cash – beginning of the period

3,545

8,366

Cash – end of the period

3,621

6,104

Cash is comprised of:

Cash

3,534

6,017

Restricted cash

87

87

3,621

6,104

Cash paid for interest

—

—

Cash paid for income tax

—

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210683224/en/

Investor Relations Contact

investors@ipatherapeutics.com

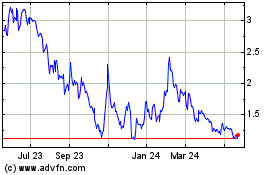

ImmunoPrecise Antibodies (NASDAQ:IPA)

Historical Stock Chart

From Dec 2024 to Jan 2025

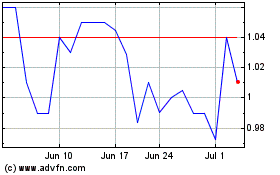

ImmunoPrecise Antibodies (NASDAQ:IPA)

Historical Stock Chart

From Jan 2024 to Jan 2025