Professional Diversity Network, Inc. (NASDAQ:IPDN), (“IPDN” or the

“Company”), a global developer and operator of online and in-person

networks that provides access to networking, training, educational

and employment opportunities for diverse individuals, today

announced its financial results for the quarter ended September 30,

2022.

“We believe that the services that we provide to

our customers, in all our business lines, continue to represent

discretionary spending items and through the second and third

quarters of fiscal 2022, these services have been scrutinized by

the consumer as a result of the financial and economic impact of

the current economy, as well as lingering effects of COVID-19. The

entire industry has been affected in some way. However, the need

for diversification in the workforce will continue, it’s just a

matter of waiting out these economic situations.” said Adam He, CEO

of Professional Diversity Network. “We look forward to a

historically stronger fourth quarter and we are prepared to meet

the market demand as our clients begin budgeting processes for

their fiscal 2023 needs. We still maintain focused on building up

core operations, capitalizing on strategic opportunities, and

maximizing shareholder value.”

Third Quarter Financial

Highlights:

- Total consolidated revenues for the three months ended

September 30, 2022 increased $0.4 million, or 25 percent, as

compared to the same period in the prior year. The RemoteMore

segment recorded $0.8 million in revenues in the period compared to

$19,000 in the same period of the prior year. PDN Network segment

revenues decreased $0.2 million, or 15 percent compared to revenues

during the same period in the prior year. This was predominantly

due to there being 2 fewer local and 1 fewer national events as

compared to the same period in the prior year. The NAPW segment

decreased approximately $0.1 million as compared to the same period

in the prior year.

- Basic and diluted net loss per share was $0.07 during the three

months ended September 30, 2022, as compared to $0.01 for the same

period in 2021.

- On September 30, 2022, cash balances were approximately $1.5

million as compared to $3.4 million on December 31, 2021. Working

capital (deficit) surplus from continuing operations on September

30, 2022, was approximately $(0.4) million as compared to $0.4

million on December 31, 2021.

- On September 27, 2022, the Company entered into a Stock

Purchase Agreement with Koala Malta Limited (“Seller”). Under this

agreement, the Company purchased 65,700 issued ordinary shares of

Koala Crypto Limited (“KCL”) from Seller, representing 9 percent of

the total issued share capital of KCL, and in exchange, the Company

issued 1,726,784 shares of its common stock, valued at $1,350,000

in the aggregate, to Seller in a private placement.

Financial Results for the Three Months

Ended September 30, 2022

Revenues

Total revenues for the three months ended

September 30, 2022 increased approximately $432,000, or 25.7%, to

approximately $2,115,000 from approximately $1,683,000 during the

same period in the prior year. The increase was predominately

attributable to approximately $738,000 of contracted software

development related to RemoteMore, as compared to the same period

in the prior year.

During the three months ended September 30,

2022, our PDN Network generated approximately $1,206,000 in

revenues compared to approximately $1,424,000 in revenues during

the three months ended September 30, 2021, a decrease of

approximately $218,000 or 15.3 percent. The decrease in revenues

was primarily driven by the aforementioned lesser number of events

held in the quarter, as compared to the same period in the prior

year, resulting in a decrease of event revenues of $117,000.

During the three months ended September 30,

2022, NAPW Network revenues were approximately $152,000, compared

to revenues of approximately $240,000 during the same period in the

prior year, a decrease of approximately $88,000 or 36.7

percent.

During the three months ended September 30,

2022, RemoteMore revenue was approximately $757,000, compared to

revenues of approximately $19,000 during the same period in the

prior year, an increase of approximately $738,000. This is due to

the current period having a full three months of operations versus

the same period in 2021 which only had 10 days of operations from

the acquisition date of September 20, 2021.

Costs and Expenses

Cost of revenues during the three months ended

September 30, 2022 was approximately $1,229,000, an increase of

approximately $882,000, or 254.2 percent, from approximately

$347,000 during the same period of the prior year. The increase was

predominately attributed to approximately $667,000 of contracted

software development costs related to RemoteMore, for which there

was no material comparable activity in the same period of the prior

year.

General and administrative expenses increased by

approximately $130,000, or 15.0 percent, to approximately

$1,003,000 during the three months ended September 30, 2022, as

compared to the same period in the prior year.

Net Loss from Continuing

Operations

As the result of the factors discussed above,

during the three months ended September 30, 2022, we incurred a net

loss of approximately $1,095,000 from continuing operations, an

increase in the net loss of approximately $1,007,000 or 1144.3

percent, compared to a net loss of approximately $88,000 during the

three months ended September 30, 2021.

Financial Results for the Nine Months

Ended September 30, 2022

Revenues

Total revenues for the nine months ended

September 30, 2022 increased approximately $1,735,000, or 37.5%, to

approximately $6,363,000 from approximately $4,628,000 during the

same period in the prior year. The increase was predominately

attributable to an approximate $1,863,000 of contracted software

development related to RemoteMore, as compared to the same period

in the prior year.

During the nine months ended September 30, 2022,

our PDN Network generated approximately $3,971,000 in revenues

compared to approximately $3,845,000 in revenues during the nine

months ended September 30, 2021, an increase of approximately

$126,000 or 3.3 percent..

During the nine months ended September 30, 2022,

NAPW Network revenues were approximately $510,000, compared to

revenues of approximately $764,000 during the same period in the

prior year, a decrease of approximately $254,000 or 33.2

percent.

During the nine months ended September 30, 2022,

RemoteMore revenue was approximately $1,882,000, compared to

revenues of approximately $19,000 during the same period in the

prior year, an increase of approximately $1,863,000. This is due to

the current period having a full nine months of operations versus

the same period in 2021 which only had 10 days of operations from

the acquisition date of September 20, 2021.

Costs and Expenses

Cost of revenues during the nine months ended

September 30, 2022 was approximately $3,023,000, an increase of

approximately $2,155,000, or 248.3 percent, from approximately

$868,000 during the same period of the prior year. The increase was

predominately attributed to approximately $1,675,000 of contracted

software development costs related to RemoteMore, for which there

was no material comparable activity in the same period of the prior

year.

General and administrative expenses decreased by

approximately $834,000, or 25.2 percent, to approximately

$2,469,000 during the nine months ended September 30, 2022, as

compared to the same period in the prior year. The decrease was

predominately due to settlement of litigation resulting in a

one-time, non-cash gain of approximately $908,000.

Net Loss from Continuing

Operations

During the nine months ended September 30, 2022,

we incurred a net loss of approximately $2,038,000 from continuing

operations, an increase in the net loss of approximately $605,000

or 42.2 percent, compared to a net loss of approximately $1,433,000

during the same period in the prior year.

Summary of the Quarter’s Financial

Information

Amounts in following tables are in thousands

except for per share amounts and outstanding shares.

Summary of Financial Position

|

|

|

September 30,2022 |

|

|

December 31,2021 |

|

|

Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,463 |

|

|

$ |

3,403 |

|

| Other current assets |

|

|

1,979 |

|

|

|

2,194 |

|

| Total current assets |

|

$ |

3,442 |

|

|

$ |

5,597 |

|

| Long-term assets |

|

|

3,626 |

|

|

|

3,388 |

|

| Total Assets |

|

$ |

7,068 |

|

|

$ |

8,985 |

|

| |

|

|

|

|

|

|

|

|

| Total current liabilities |

|

$ |

3,794 |

|

|

$ |

5,180 |

|

| Total long-term

liabilities |

|

|

593 |

|

|

|

697 |

|

| Total liabilities |

|

$ |

4,387 |

|

|

$ |

5,877 |

|

| |

|

|

|

|

|

|

|

|

| Total stockholders’

equity |

|

|

2,872 |

|

|

|

2,791 |

|

| Total stockholders’ equity –

noncontrolling interests |

|

|

(191 |

) |

|

|

317 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

7,068 |

|

|

$ |

8,985 |

|

Summary of Financial Operations

|

|

|

Nine Months EndedSeptember

30, |

|

|

Change |

|

|

Change |

|

|

|

|

2022 |

|

|

2021 |

|

|

(Dollars) |

|

|

(Percent) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Membership fees and related services |

|

$ |

510 |

|

|

$ |

764 |

|

|

$ |

(255 |

) |

|

|

(33.3 |

)% |

|

Recruitment services |

|

|

3,840 |

|

|

|

3,695 |

|

|

|

144 |

|

|

|

3.9 |

% |

|

Contracted software development |

|

|

1,882 |

|

|

|

19 |

|

|

|

1,863 |

|

|

|

9802.4 |

% |

|

Consumer advertising and marketing solutions |

|

|

131 |

|

|

|

149 |

|

|

|

(18 |

) |

|

|

(12.3 |

)% |

| Total revenues |

|

$ |

6,363 |

|

|

$ |

4,628 |

|

|

$ |

1,735 |

|

|

|

37.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

$ |

3,023 |

|

|

$ |

868 |

|

|

$ |

2,155 |

|

|

|

248.3 |

% |

| Sales and marketing |

|

|

2,179 |

|

|

|

1,826 |

|

|

|

353 |

|

|

|

19.3 |

% |

| General and

administrative |

|

|

2,469 |

|

|

|

3,303 |

|

|

|

(834 |

) |

|

|

(25.3 |

)% |

| Depreciation and

amortization |

|

|

746 |

|

|

|

88 |

|

|

|

658 |

|

|

|

744.4 |

% |

| Total pre-tax cost and

expenses: |

|

$ |

8,417 |

|

|

$ |

6,086 |

|

|

$ |

2,331 |

|

|

|

38.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations, net of tax |

|

$ |

(2,038 |

) |

|

$ |

(1,433 |

) |

|

$ |

(605 |

) |

|

|

(42.2 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.13 |

) |

|

$ |

(0.11 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average outstanding

shares used in computing net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

16,390,563 |

|

|

|

13,830,777 |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedSeptember

30, |

|

|

Change |

|

|

Change |

|

|

|

|

2022 |

|

|

2021 |

|

|

(Dollars) |

|

|

(Percent) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Membership fees and related services |

|

$ |

153 |

|

|

$ |

241 |

|

|

$ |

(88 |

) |

|

|

(36.6 |

)% |

|

Recruitment services |

|

|

1,166 |

|

|

|

1,368 |

|

|

|

(203 |

) |

|

|

(14.8 |

)% |

|

Products sales and other |

|

|

757 |

|

|

|

19 |

|

|

|

739 |

|

|

|

3957.1 |

% |

|

Consumer advertising and marketing solutions |

|

|

39 |

|

|

|

55 |

|

|

|

(15 |

) |

|

|

(27.9 |

)% |

| Total revenues |

|

$ |

2,115 |

|

|

$ |

1,683 |

|

|

$ |

432 |

|

|

|

25.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

$ |

1,229 |

|

|

$ |

347 |

|

|

$ |

882 |

|

|

|

254.5 |

% |

| Sales and marketing |

|

|

760 |

|

|

|

526 |

|

|

|

234 |

|

|

|

44.5 |

% |

| General and

administrative |

|

|

1,004 |

|

|

|

873 |

|

|

|

130 |

|

|

|

15.0 |

% |

| Depreciation and

amortization |

|

|

233 |

|

|

|

29 |

|

|

|

204 |

|

|

|

684.5 |

% |

| Total pre-tax cost and

expenses: |

|

$ |

3,225 |

|

|

$ |

1,775 |

|

|

$ |

1,450 |

|

|

|

81.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing

operations, net of tax |

|

$ |

(1,095 |

) |

|

$ |

(88 |

) |

|

$ |

(1,007 |

) |

|

|

(1144.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.07 |

) |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average outstanding

shares used in computing net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

16,922,988 |

|

|

|

15,115,167 |

|

|

|

|

|

|

|

|

|

Summary of Cash Flows from Continuing

Operations

| |

|

Nine Months Ended September 30, |

|

| Cash

(used in) provided by continuing operations |

|

2022 |

|

|

2021 |

|

|

Operating activities |

|

$ |

(1,394 |

) |

|

$ |

(1,160 |

) |

| Investing activities |

|

|

(31 |

) |

|

|

(1,279 |

) |

| Financing activities |

|

|

(515 |

) |

|

|

4,445 |

|

| Net increase in cash and cash

equivalents from continuing operations |

|

$ |

(1,940 |

) |

|

$ |

2,006 |

|

Professional Diversity Network, Inc. and

Subsidiaries

Non-GAAP (Adjusted) Financial

Measures

We believe Adjusted EBITDA provides a meaningful

representation of our operating performance that provides useful

information to investors regarding our financial condition and

results of operations. Adjusted EBITDA is commonly used by

financial analysts and others to measure operating performance.

Furthermore, management believes that this non-GAAP financial

measure may provide investors with additional meaningful

comparisons between current results and results of prior periods as

they are expected to be reflective of our core ongoing business.

However, while we consider Adjusted EBITDA to be an important

measure of operating performance, Adjusted EBITDA and other

non-GAAP financial measures have limitations, and investors should

not consider them in isolation or as a substitute for analysis of

our results as reported under GAAP. Further, Adjusted EBITDA, as we

define it, may not be comparable to EBITDA, or similarly titled

measures, as defined by other companies.

The following non-GAAP financial information in

the tables that follow are reconciled to comparable information

presented using GAAP, derived by adjusting amounts determined in

accordance with GAAP for certain items presented in the

accompanying selected operating statement data.

The adjustments for the three and nine months

ended September 30, 2021 relate to stock-based compensation, loss

attributable to noncontrolling interest, depreciation and

amortization, interest and other income and income tax benefit.

The adjustments for the three and nine months

ended September 30, 2022 relate to stock-based compensation,

litigation settlement reserves, loss attributable to noncontrolling

interest, depreciation and amortization, interest and other income

and income tax benefit.

| |

|

Three Months Ended September 30, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(in thousands) |

|

|

Loss from Continuing Operations |

|

$ |

(1,095 |

) |

|

$ |

(88 |

) |

|

Stock-based compensation |

|

|

34 |

|

|

|

127 |

|

|

Loss attributable to noncontrolling interest |

|

|

149 |

|

|

|

19 |

|

|

Depreciation and amortization |

|

|

233 |

|

|

|

30 |

|

|

Other (expense) income, net |

|

|

(1 |

) |

|

|

(2 |

) |

|

Income tax expense (benefit) |

|

|

(25 |

) |

|

|

(2 |

) |

| Adjusted

EBITDA |

|

$ |

(705 |

) |

|

$ |

84 |

|

| |

|

Nine Months Ended September 30, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(in thousands) |

|

|

Loss from Continuing Operations |

|

$ |

(2,038 |

) |

|

$ |

(1,434 |

) |

|

Stock-based compensation |

|

|

440 |

|

|

|

436 |

|

|

Litigation settlement reserve |

|

|

(909 |

) |

|

|

75 |

|

|

Loss attributable to noncontrolling interest |

|

|

508 |

|

|

|

19 |

|

|

Depreciation and amortization |

|

|

746 |

|

|

|

88 |

|

|

Other (expense) income, net |

|

|

(5 |

) |

|

|

(5 |

) |

|

Income tax benefit |

|

|

(36 |

) |

|

|

(19 |

) |

| Adjusted

EBITDA |

|

$ |

(1,294 |

) |

|

$ |

(840 |

) |

About Professional Diversity

Network

Professional Diversity Network, Inc. (NASDAQ:

IPDN) is a global developer and operator of online and in-person

networks that provides access to networking, training, educational

and employment opportunities for diverse professionals. We operate

subsidiaries in the United States including National Association of

professional Women (NAPW) and its brand, International Association

of Women (IAW), which is one of the largest, most recognized

networking organizations of professional women in the country,

spanning more than 200 industries and professions. Through an

online platform and our relationship recruitment affinity groups,

we provide our employer clients a means to identify and acquire

diverse talent and assist them with their efforts to comply with

the Equal Employment Opportunity Office of Federal Contract

Compliance Program. Our mission is to utilize the collective

strength of our affiliate companies, members, partners and unique

proprietary platform to be the standard in business diversity

recruiting, networking and professional development for women,

minorities, veterans, LGBTQ+ and disabled persons globally.

Forward-Looking Statements

This press release contains certain

forward-looking statements based on our current expectations,

forecasts and assumptions that involve risks and uncertainties.

Forward-looking statements in this release are based on information

available to us as of the date hereof. Our actual results may

differ materially from those stated or implied in such

forward-looking statements, due to risks and uncertainties

associated with our business, which include the risk factors

disclosed in our most recently filed Annual Report on Form 10-K and

in our subsequent filings with the Securities and Exchange

Commission. Forward-looking statements include statements regarding

our expectations, beliefs, intentions or strategies regarding the

future and can be identified by forward-looking words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “should,” and “would” or similar words. We assume no

obligation to update the information included in this press

release, whether as a result of new information, future events or

otherwise. Our most recently filed Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q, together with this press release

and the financial information contained herein, are available on

our website, www.prodivnet.com. Please click on “Investor

Relations.”

Investor Inquiries:

investors@ipdnusa.com+1 (312) 614-0950Source:

Professional Diversity Network, Inc.Released November 14, 2022

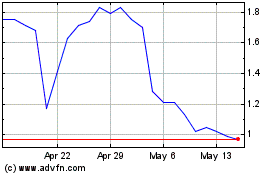

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Professional Diversity N... (NASDAQ:IPDN)

Historical Stock Chart

From Nov 2023 to Nov 2024