As filed with the Securities and Exchange Commission on October 25, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PROFESSIONAL DIVERSITY NETWORK, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction

of incorporation or organization)

|

|

80-0900177

(I.R.S. Employer

Identification Number)

|

| |

|

|

| |

55 E. Monroe Street, Suite 2120

Chicago, Illinois 60603

(312) 614-0950

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Xin (Adam) He

Chief Executive Officer

Professional Diversity Network, Inc.

55 E. Monroe Street, Suite 2120

Chicago, Illinois 60603

(312) 614-0950

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Charles Wu

Locke Lord LLP

111 South Wacker Drive, Suite 4100

Chicago Illinois 60606

(312) 443-0700

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

Pursuant to Rule 415(a)(6) under the Securities Act, the Registrant is registering on this registration statement an aggregate of $21,403,983 of unsold securities (the “Unsold Securities”) previously registered under the Registrant’s prior registration statement on Form S-3 (File No. 333-260316) filed on October 18, 2021 and declared effective on October 26, 2021 (the “Prior Registration Statement”). Filing fees of $1,984.15 were previously paid with respect to the Unsold Securities. Pursuant to Rule 415(a)(5) under the Securities Act, the Registrant intends to continue to offer and sell the Unsold Securities under the Prior Registration Statement until the earlier of (i) the date on which this registration statement is declared effective by the Securities and Exchange Commission, and (ii) April 24, 2025, which is 180 days after the third-year anniversary of the effective date of the Prior Registration Statement (the “Expiration Date”). Until the Expiration Date, the Registrant may continue to use the Prior Registration Statement and related prospectus supplements for its offerings thereunder. In particular, the Registrant may continue to offer and sell under the Prior Registration Statement its shares of common stock in its committed equity line program with Tumim Stone Capital LLC, which offerings shall remain registered under the Prior Registration Statement using the prospectus supplement dated June 30, 2023 until the Expiration Date. The Prior Registration Statement and all offers and sales thereunder will be deemed terminated on the Expiration Date, except to the extent covered by this registration statement.

Pursuant to Rule 415(a)(6), on or before the Expiration Date, the Registrant may file a pre-effective amendment to this registration statement to update the amount of unsold securities previously registered by the Prior Registration Statement being registered hereby, and continue to offer and sell such unsold securities under this registration statement, including without limitation by continuing to conduct sales under the committed equity line program referenced above. If applicable, such pre-effective amendment shall identify such unsold securities to be included in this registration statement, and the amount of any new securities to be registered on this registration statement.

EXPLANATORY NOTE

This registration statement contains two documents:

| |

●

|

a base prospectus, which covers the offering, issuance and sale by us of up to $25,000,000 of our securities; and

|

| |

●

|

a prospectus supplement covering the issuance and sale by us of up to a maximum aggregate price of $2,171,758 of our common stock that may be issued and sold after the effective date of this registration statement under our purchase agreement with Tumim Stone Capital LLC.

|

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The purchase agreement prospectus supplement immediately follows the base prospectus. The $2,171,758 of common stock that may be issued and sold under the prospectus supplement relating to the purchase agreement is included in the $25,000,000 of securities that may be offered, issued and sold by us under the base prospectus, and if no shares are sold under the purchase agreement after the effective date of this registration statement, the full $25,000,000 of common stock may be sold in other offerings pursuant to the base prospectus and a corresponding prospectus supplement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to these securities that has been filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated October 25, 2024

PROSPECTUS

Professional Diversity Network, Inc.

$25,000,000

Common Stock, par value $0.01

Preferred Stock, par value $0.01

Warrants

Rights

Units

We may offer and sell from time to time, in one or more offerings, together or separately, any combination of the securities described in this prospectus, which we refer to as the “securities.” The aggregate offering price of the securities will not exceed $25,000,000. This prospectus describes some of the general terms that may apply to the securities and the general manner in which they may be offered. We will describe the specific terms of the securities that we offer, and the specific manner in which they may be offered, in one or more supplements to this prospectus at the time of each offering and sale.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

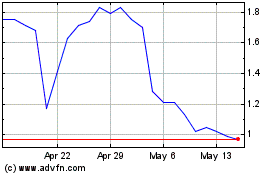

Our common stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IPDN.” On October 22, 2024, the closing price of our common stock was $0.90 per share. You are urged to obtain current market quotations of our common stock. There is currently no market for other securities we may offer; however, we will provide information in any applicable prospectus supplement regarding any listing of securities other than shares of our common stock on any securities exchange. As of October 22, 2024, the aggregate market value of our common stock held by our non-affiliates (or our “public float”), as calculated pursuant to the rules of the Securities and Exchange Commission, was approximately $9,053,325, which was calculated based upon 9,053,325 shares of our outstanding common stock held by non-affiliates at a price of $1.00 per share, the closing price of our common stock on Nasdaq on October 3, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. We have sold $846,017 in securities in reliance on General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus.

INVESTING IN OUR SECURITIES INVOLVES SIGNIFICANT RISKS. SEE THE “RISK FACTORS” ON PAGE 15 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

Page

|

| |

|

|

ABOUT THIS PROSPECTUS

|

1

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

2

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

2

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

3

|

|

ABOUT THE COMPANY

|

4

|

|

RISK FACTORS

|

13

|

|

USE OF PROCEEDS

|

26

|

|

DILUTION

|

26

|

|

DESCRIPTION OF OUR CAPITAL STOCK

|

27

|

|

DESCRIPTION OF WARRANTS

|

31

|

|

DESCRIPTION OF RIGHTS

|

33

|

|

DESCRIPTION OF UNITS

|

34

|

|

PLAN OF DISTRIBUTION

|

35

|

|

LEGAL MATTERS

|

37

|

|

EXPERTS

|

37

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $25,000,000 as described in this prospectus.

Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

When used in this prospectus, the terms the “Company,” “we,” “our” and “us” refer to Professional Diversity Network, Inc., and its consolidated subsidiaries, unless otherwise specified or the context otherwise requires.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov. Our SEC filings are available there.

Our website address is www.ipdnusa.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus and before the date that the offering of securities by means of this prospectus and a prospectus supplement is terminated will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus.

We incorporate by reference into this prospectus the following documents or information filed with the SEC (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with the SEC’s rules):

| |

●

|

Our Quarterly Reports on Form 10-Q for the periods ended March 31, 2024, and June 30, 2024, filed with the SEC on May 15, 2024, and August 13, 2024, respectively.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

We will provide, without charge, copies of all documents incorporated by reference in this prospectus, other than exhibits to those documents that have not been specifically incorporated by reference into this prospectus. You may obtain documents incorporated by reference in this prospectus on our website at www.ipdnusa.com or by requesting them in writing or by telephone from us at the following address and telephone number:

Professional Diversity Network, Inc.

55 E. Monroe Street, Suite 2120

Chicago, Illinois 60603

(312) 614-0950

The information on our website is not incorporated by reference in this prospectus or any prospectus supplement and you should not consider it a part of this prospectus or any prospectus supplement.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

ABOUT THE COMPANY

Overview

The Company is a dynamic operator of professional networks with a focus on diversity. We use the term “diversity” (or “diverse”) to describe communities, or “affinities,” that are distinct based on a wide array of criteria, which may change from time to time, including ethnic, national, cultural, racial, religious or gender classification. We serve a variety of such communities, including Women, Hispanic-Americans, African-Americans, Asian-Americans, persons with disabilities, Military Professionals, and Lesbian, Gay, Bisexual, Transgender and Queer (LGBTQ+) persons. Our goal is (i) to assist our registered users and members in their efforts to connect with like-minded individuals and identify career opportunities within the network and (ii) connect members with prospective employers while helping the employers address their workforce diversity needs. We believe that the combination of our solutions allows us to approach recruiting and professional networking in a unique way and thus create enhanced value for our members and clients.

Our Strategy

We provide services for employers who want to hire diverse talent, to individuals seeking to network on a professional level and to job seekers who desire to improve their professional situation.

Our diversity recruitment business provides additional value for our other business segments by providing our registered users and members with access to employment opportunities at leading companies. We have focused our efforts on placing talent in IT, Finance, and similarly related fields. The core diversity recruitment business also includes executive placement services for leading companies seeking to hire diverse talent. This business line addresses a need for employers who want to secure leading diverse talent in management, senior management and executive capacities.

Our strategy encompasses the following key elements:

| |

●

|

Grow and diversify our member and client base;

|

| |

●

|

Improve branding and brand awareness;

|

| |

●

|

Utilize social media to effectively engage with the community;

|

| |

●

|

Maximize revenue through synergies among the segments;

|

| |

●

|

Launch new products and services;

|

| |

●

|

Streamline infrastructure to capture efficiency; and

|

| |

●

|

Continue to expand in diversity recruitment by growing our core offerings of recruitment advertising, Office of Federal Contract Compliance Programs (OFCCP) compliance offerings and our new diversity placement services.

|

We remain interested in pursuing acquisition and/or development opportunities that would increase returns of capital to our shareholders, such as our recent purchase of Expo Experts LLC and the purchase of an additional equity stake in RemoteMore USA, Inc. The timing, size, success and associated potential future capital commitments related to such opportunities are unknown at this time. Accordingly, a material acceleration of our growth strategy could require us to obtain additional capital through debt and/or equity financings. There can be no assurance that adequate debt and equity financing will be available on satisfactory terms.

Industry Overview

The diversity recruitment market is highly fragmented and is characterized by the following trends:

| |

●

|

Regulatory Environment Favorable to Promoting Diversity in the Workplace. In August 2011, President Obama signed Executive Order 13583 to establish a coordinated government-wide initiative to promote diversity and inclusion in the federal workforce. This Executive Order requires companies considering contracting with the federal government to be prepared to demonstrate the diversity of their workforce. Certain companies that have federal contracts are subject to this Executive Order. In the public sector, the Dodd–Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) mandated that each of the eight U.S. financial agencies, including the Department of the Treasury, the Securities and Exchange Commission, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency, and twelve Federal Reserve banks create Offices of Minority and Women Inclusion (“OMWI”) to be responsible for all agency matters relating to diversity in management, employment and business activities. The OMWI monitor diversity within their ranks, as well as within the pool of contractors who provide goods and services to the government.

|

| |

●

|

Growing Ethnic Diversity of the U.S. Population and Labor Force. Diversity recruitment is increasingly becoming a common, if not standard, business practice by major employers. Multicultural groups are the fastest growing segment of the U.S. population. Hispanics, African-Americans, Asian-Americans, and all other multicultural groups were estimated by the U.S. Census Bureau to make up 41.1% of the U.S. population in 2023. According to the U.S. Census Bureau, 2020 National Projections, the multicultural population is expected to increase 89% between 2016 and 2060. In sheer numbers, Hispanic-Americans are expected to experience the most growth among diversity groups, growing from 18% of the total population in 2014 to 28% by 2060. The African-American population is expected to increase from 13% in 2014 to 15% in 2060, and the Asian-American population from 6% in 2014 to 9% in 2060. According to the Current Population Survey conducted by the Bureau of Census for the Bureau of Labor Statistics, of the 2023 annual average of approximately 161 million employees nationwide (an increase from approximately 158 million in prior year), ages 16 and older, approximately 47% were women (approximately the same as prior year) and approximately 39% (an increase of approximately 1% from prior year) were Hispanic, African American or Asian American.

|

| |

●

|

Demographic Trend Toward Women’s Career Advancement. According to the U.S. Bureau of Labor Statistics, the number of women in the labor force in 2021 was approximately 75.7 million and is expected to increase to 77.2 million by 2024. Women accounted for 51.8% of all workers employed in management, professional, and related occupations in 2023, somewhat more than their share of total employment (46.9%). The share of women in specific occupations within this large category varied. For example, 30.6% of chief executives and 39.5% of lawyers were women, all increases from 2022, whereas 87.4% of registered nurses, 78.6% of elementary and middle school teachers, 57.0% of accountants and auditors, and 20.2% of software developers were women.

|

| |

●

|

Rising Spending Power of Diverse Population. Our segments are focused on providing professional enhancement tools to diverse Americans including women. We believe diverse professionals are underserved and represent a very strong opportunity to enhance our shareholders’ value. The Selig Center for Economic Growth, using data provided by the U.S. Census Bureau, the U.S. Bureau of Economic Analysis and other sources, estimates the nation’s total buying power (defined as total income after taxes) reached $13.9 trillion in 2016 and grew to $17.5 trillion by 2020 with minority groups making the fastest gains. For example, between 2010 and 2020, Asian-American buying power grew by 111% to $1.3 trillion; the buying power for those of Hispanic ethnicity grew by 87% to $1.9 trillion, Native American buying power grew by 67% to $140 billion, and African American buying power grew by 61% to $1.6 trillion. The Selig Center estimates the buying power for African American, Asian American and Native American consumers is up from $458 billion in 1990 to $3.2 trillion in 2021.

|

| |

●

|

Increasing Socialization of the Internet. The Internet has revolutionized how information is created and communicated - a wealth of information is readily accessible by browsing the Internet anonymously. However, we believe the social aspect of the Internet is emerging as an increasingly powerful influence on our lives. While an individual’s interpersonal connections traditionally have not been visible to others, social and professional networking websites enable members to share, and thereby unlock, the value of their connections by making them visible. Today, personal connections and other information, such as online social and professional networking websites, are increasingly becoming a powerful tool for a growing population of users to connect with one another.

|

Our Solutions

We currently operate in three business segments comprised of: (i) Professional Diversity Network (“PDN Network”), which includes online professional networking communities with career resources tailored to the needs of various diverse cultural groups; (ii) National Association of Professional Women (“NAPW Network”), a women-only professional networking organization, and (iii) RemoteMore USA (“RemoteMore”) which provides companies with talented engineers to provide solutions to their software needs. In 2018, we started transacting new NAPW Network memberships under the International Association of Women (“IAW”) brand in the USA.

In 2023, our PDN Network, NAPW Network and RemoteMore business units represented approximately 61%, 7%, and 32% of our gross revenues, respectively.

In August 2024, we announced the rebranding of our job board and related operations, formerly conducted under our PDN Network business unit, to TalentAlly in order to focus on our job board recruitment business and advance our commitment to diversity recruitment and inclusive hiring practices.

For financial information about our operating segments please see Note 15 of our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as our Quarterly Reports for the periods ended March 31, 2024 and June 30, 2024, each of which is incorporated by reference into this prospectus.

PDN Network

Recruitment Solutions. The PDN Network consists of several online professional job seeker communities dedicated to serving diverse professionals in the United States and employers seeking to hire diverse talent. We use the word “professional” to describe any person interested in the Company’s websites or career fairs presumably for the purpose of career advancement or related benefits offered by the Company, whether or not such person is employed and regardless of the level of education or skills possessed by such person. Leveraging the power of our affinity job seeker groups, these professionals harness the Company’s relationships with employers and recruiters to help advance their careers. We operate these recruitment affinity groups within the following sectors: Women, Hispanic-Americans, African-Americans, Asian-Americans, persons with disabilities, Military Professionals, and LGBTQ+ persons. In addition, the Company also manages the job seeker websites and career fairs for prominent diverse membership-based organizations including but not limited to NAACP, National Urban League, and Kappa Alpha Psi. Employers and recruiters benefit from the Company’s relationship with these organizations and allows them to access a large pool of diverse jobs seekers in a centralized manner.

Our PDN Network has registered users for our recruitment services. We use the term “registered user” to describe a consumer who has affirmatively visited one of our properties, opted into an affinity group and provided us with demographic or contact information enabling us to match them with employers and/or jobs, and to sell them ancillary products and services. We expect that continued registered user growth of the PDN Network will enable us to further develop our list of online professional diversity networking and career placement solutions. We currently provide access to our PDN Network websites to registered users at no cost. The Company is always exploring various partnerships with other service providers to increase their offerings to both job seekers and employers. Our goal is to use an asset light approach to provide quality products and services, to increase our value to those we serve and drive additional capital without significant capital investments. For example, we announced our partnership with Web Scribble, the leading provider of career technology for professional and trade associations. Leveraging our existing assets through relationships with other technology firms allows us to grow our relationships with employers without investing in sophisticated, proprietary resources.

We offer employers of all sizes seeking to diversify their employment ranks, and to third-party recruiters (i) real-time solutions that deliver diverse talent, (ii) advertising and promotion of their job opportunities to our networks of diverse professionals and (iii) assistance with posting their job opportunities to career agencies in a manner compliant with the regulations and requirements of the Equal Employment Opportunity OFCCP, including those of state and local governments. Our recruitment advertising solutions promote hiring and retention success by providing job seekers with information that we believe allows them to look beyond a corporate brand, deeper into employers’ core values. We use sophisticated technology to deliver recruitment advertising using internet banner ads and email marketing targeted by geography and occupation, based upon data from our audiences’ profiles and job searches on our websites. As of December 31, 2023, we had approximately 300 enterprise companies and 1450 total customers utilizing our products and services.

Career Fairs. Through our events business, a part of our PDN Network business segment, we produce premier face-to-face and virtual recruiting events we call Professional Diversity Career Fairs. The Company’s diversity events help employers connect with a new marketplace of diverse professionals. We believe our events are the only events of their type endorsed by leading organizations such as the NAACP, National Urban League, Phi Beta Sigma and others. Participating employers range from Fortune 500 companies to federal, state and local agencies and from smaller employers to non-profit organizations, all of which seek a proactive approach to diversity recruiting. We also produce virtual and in-person career fairs as part of high-profile national events such as the NAACP National Convention, the Urban League National Conference and historically black sorority and fraternity conferences.

In January 2023, through a newly formed wholly-owned subsidiary, we purchased the assets and operations of Expo Experts LLC (“Expo Experts”), an Ohio limited liability company. Expo Experts specializes in producing premier face-to-face and virtual recruiting events for Engineering, Technology and Security Clearance positions. We believe that this acquisition complements our current career fair business.

PDN Recruits. We use matching and targeting technology to match members with our clients’ open jobs on a renewing month-to-month license basis, designed to provide the Company with increasing residual income as we add new clients and sell additional licenses. The PDNRecruits product is a significant step towards increasing online sales in a scalable and residual manner.

PDN Diversity Placement. As part of our robust suite of recruitment offerings for employers, the Company offers a contingent hiring solution. It is a pay-per-hire offering that charges a percentage of the first year’s annual salary plus bonus for candidates we source and they hire. We believe our superior brand positioning, large network of diverse talent and our vast employer relationships position us well for continued growth in this segment.

NAPW Networking

The NAPW Network is a professional networking organization for women. We use the terms “member” or “membership” to describe a consumer who has viewed our marketing material, opted into membership with the NAPW Network, provided demographic information and engaged in an onboarding call with a membership coordinator. Paid memberships provide greater access to networking opportunities and other membership perks, including access to upgraded packages. Members of the NAPW Network enjoy a wealth of resources dedicated to developing their professional networks, furthering their education and skills and promoting their businesses and career accomplishments.

We provide NAPW Network members with opportunities to network and develop valuable business relationships with other professionals through NAPW’s website, as well as at events hosted at local chapters across the United States. In March 2020, due to the COVID-19 pandemic, all events shifted to a virtual format hosted on third-party electronic platforms, such as Zoom. In October 2021, NAPW launched a Global virtual chapter to expand its audience outside of the United States. PDN Network products and services are being deployed to provide enhanced value to the NAPW membership experience, which we believe will be an important component in increasing both the number of new memberships and renewals of existing memberships.

IAW Leadership Lab. In 2020, IAW launched the Leadership Lab platform as an enhancement to the NAPW eCoaching platform. IAW also offers virtual networking roundtable events throughout the month where members who are established experts in their field provide participants insight and tips on how to overcome career and business challenges. Hosted by NAPW’s President, our unique platform connects our members with professional life and career coaches from within the NAPW membership base. Through these events, members gain insight, guidance and inspiration to help them maximize their personal and professional potential. Topics include the Power of Intentionality - Turning Good Intentions Into Actions, The Power of Authentic Communication, and Confident Steps To Create a Thriving Life. The on-line events also include the opportunity for members to network with other participants in the live chat room. Members are also able to access a recording of these events in the NAPW website.

Professional Identity Management. Through the NAPW Network website, NAPW Network members are able to create, manage and share their professional identity online and promote themselves and their businesses. NAPW Network members can also promote their career achievements and their businesses through placement on the NAPW Network website’s home page, in proprietary press releases, in the online Member Marketplace and in monthly newsletter publications. In addition, the PDN Network provides members with direct access to employers seeking to hire professional women at a high level of connectivity and efficiency.

Networking Events. Historically, NAPW Network’s offline networking opportunities included monthly local chapter events and a large National Networking Conference. Because PDN Network networking career events are already being conducted we have the ability to add an additional event for NAPW at the same venue, one hour after the PDN Network event ends, at a substantially lower cost compared to hosting a stand-alone NAPW event. Employers who sponsor the PDN Network career networking events will have the opportunity to participate in the NAPW event and meet with members to discuss employment opportunities in what we believe is an inviting and upscale networking environment. We believe that providing the opportunity for NAPW Registered Users to meet, outside of the monthly local chapter events and the single national event, will add value to all NAPW Registered Users through allowing them to attend any or all of our PDN Network events. Non-members may also attend, subject to certain restrictions.

Access to Knowledge. In addition to networking and promotional opportunities, NAPW Network also provides to its members the ability to further develop their skills and expand their knowledge base through monthly newsletters, online and in-person seminars, webinars and certification courses.

Upgraded Memberships and Ancillary Products. Upgraded packages include additional promotional and publicity tools, as well as free access for the member to National Summits and continuing education programs and the press release package, which provides members with the opportunity to work with professional writers to publish personalized press releases and thereby secure valuable online presence.

Partner Discounts. We also offer to NAPW Network members exclusive discounts on third-party products and services.

IAW Global Women’s Network. This network offers in-person and online networking with like-minded women to foster enhanced career connections and opportunities. Members can promote their brands, identify new career opportunities, and build lasting relationships at monthly meetings and events. These interactive events allow members to improve their verbal resumes, expand their networks, and hear from inspiring speakers. Regional and national conferences provide inspirational panels, unique networking opportunities, and the chance for members to promote their business or services. Our partners allow members to explore events outside the United States and create opportunities to network with women around the world.

RemoteMore USA

RemoteMore USA is an innovative, global entity that provides remote-hiring marketplace services for software developers and companies. Companies are connected with reliable, cost-efficient, vetted developers, and software developers are empowered to find meaningful jobs regardless of their location. As of June 30, 2024, we owned an approximate 73% interest in RemoteMore USA.

Operations: Sales, Marketing and Customer Support

Sales and Marketing

Our PDN sales resources for recruitment and recruitment advertising products and services include a sales force with 7 sales professionals, third-party strategic partners who deliver employers with demand for our products, and technology, which facilitates e-commerce transactions. We market directly to employers and third-party recruiters. Our sales team uses a combination of telephone, email and face-to-face marketing, including personal visits to companies or their recruitment agencies, as well as appearances at industry and trade group events where diversity recruitment recruiters are in attendance. We have also formed strategic alliances with parties who are able to help extend our organic reach. In addition, we are developing purely online marketing channels to bring recruiters to us in bulk and use products based on a matching and targeting technology to facilitate sales. We have specialty units within our sales force dedicated to serving: (i) federal, state and local governments and companies and contractors who serve these governmental entities, (ii) small and medium sized businesses as defined by companies with less than 2,500 employees, and (iii) large enterprises with greater than 2,500 employees.

We sell NAPW/IAW Network membership subscriptions offline through our NAPW/IAW Network sales force, which currently includes two sales professionals, each of whom sells initial membership services. We also support online membership subscriptions through online sales via our website. We developed a secure, work-from-home technology along with a training and supervision platform aimed at reducing the overhead costs, increasing per-representative profitability, and offering our sales professionals flexible working arrangements. All sales representatives are capable of selling upgraded memberships and ancillary products.

RemoteMore contracts with companies that are in need of customized software development and pairs them with developers from a database of developers. Services vary from simple software solutions to detailed programming where teams of developers work together.

Customer Support, Compliance and Testing

In addition to our sales professionals, we also employ support teams to provide customer support, compliance and enhance member experience. Our customer support teams work together to improve engagement with our members and to ensure a high degree of member satisfaction and retention. Our customer support teams also work with our Development and Executive teams to identify new lead-generation, sales and membership product opportunities, and to test those, as well as new approaches to our current sales. Our compliance team focuses on ensuring the integrity of the NAPW Network sales process. The team works closely with customer support and sales management to ensure that sales are conducted in an ethical manner and to identify sales representatives who would benefit from enhanced training.

Our Strengths

We believe the following elements give us a competitive advantage to accomplish our mission:

| |

●

|

Dedicated Focus on Diverse Professionals. Our focus on providing career opportunities for diverse professionals differentiates us from other online job seeker websites, such as Indeed or ZipRecruiter. We provide a platform that allows employers to recruit and attract from a targeted pool of diverse candidates rather than a pool of general market candidates. It provides employers unique advantages in terms of costs savings and time and allows employers to advance their corporate DEI strategy. Additionally, our strategic partnerships with diversity-based membership organizations such as TechLatino.org, Kappa Alpha Psi, etc., provide our clients enhanced access to specialized talent using the PDN platform.

|

| |

●

|

Online and Offline Diversity Career Services. The Company has a comprehensive and coordinated method of connecting diverse job seekers with companies seeking to hire diverse employees using virtual and brick and mortar career fairs. The fairs allow us to connect with local employers, recruiters, and job seekers in specific cities across the U.S. Our career fair services allow the Company to diversity its offerings and complement its online job board services.

|

| |

●

|

Platform That Harnesses the Power of Web Socialization. We believe that our membership base will continue to grow and that our platform will be an increasingly powerful tool that enables our members to leverage their connections and shared information for the collective benefit of all of the participants on our platform. We believe that we are the first online professional network to focus on the diversity recruitment sector.

|

| |

●

|

Relationships with Strategic Partners. We consider our partner alliances to be a key value to our clients because they enable us to expand our job distribution and outreach efforts. We continue to expand our relationships with key strategic partners that we believe are valuable to our core clients. Websites for the PDN Network are hosted by a third party, who provides hosting and customization for the Company’s job boards. and also provides sales resources to help promote our PDN Network and our partners’ products. Our websites have backup and contingency plans in place in the event that an unexpected circumstance occurs.

|

| |

●

|

Relationships with Professional Entities & Organizations. Our team has experience working with multicultural professional organizations. We partner with a number of leading minority professional organizations, including:

|

| |

o

|

Job Opportunities for Disabled American Veterans (JOFDAV)

|

| |

o

|

National Association for the Advancement of Colored People (NAACP)

|

| |

o

|

The National Urban League

|

| |

●

|

Customized Technology Platform. The current technology platform being used has been custom-designed and built to facilitate engagement, job searching, real-time job qualification and matching, and text-based communications.

|

We believe that the following elements give us a competitive advantage with respect to the NAPW Network:

| |

●

|

Exclusive Focus on Professional Women. As a result of NAPW Network’s exclusive focus on professional women, we believe that through NAPW Network we provide a secure and less intimidating environment within which our members can successfully network and establish new and lasting business relationships.

|

| |

●

|

Attractive Industry Demographic Trends. Favorable demographic trends regarding women’s participation in the labor force will further the growth in NAPW Network’s membership base and we have first-mover advantage with respect to generalized professional networking for women.

|

| |

●

|

Diverse National Membership Base. The membership base of the NAPW Network is diverse in terms of ethnicity, age, income, experience, industry and occupation. It includes members from small and large corporations, as well as entrepreneurs and business owners. We believe the diversity of the NAPW Network membership base is a key component of its value.

|

| |

●

|

Comprehensive Product and Service Offerings to Deliver Value to Members. We believe that our comprehensive product offerings provide women valuable tools to help them advance their careers and expand their businesses. Through networking opportunities online and at local chapter events in their communities, regional events and the NAPW Network national networking conference, discounts provided on seminars, webinars and educational certification courses, and opportunities to promote themselves and their businesses, NAPW members are provided the opportunities and tools for their professional development.

|

| |

●

|

Member Acquisition and Recurring Cash Flow. We believe that NAPW Network’s direct marketing lead generation efforts, which utilize a combination of digital strategies, are among the most efficient in the industry as measured by our internal response and click-through rates. Additionally, in addition to an evolving eCommerce model, the company has been actively growing a member-to-member acquisition model as we strive to move to an organic growth model. We have implemented web-based technologies to assist our members recruit colleagues and friends to the organization. Further, NAPW Network memberships renew annually, providing a valuable recurring stream of cash flow.

|

Intellectual Property

To protect our intellectual property rights, we rely on a combination of federal, state and common law rights, as well as contractual restrictions. We rely on trade secrets, copyright and trademark rights to protect our intellectual property. We pursue the registration of our domain names and trademarks in the United States. Our registered trademarks in the United States include the “iHispano” mark with stylized logo, the “Black Career Network” mark with stylized logo, the “Professional Diversity Network” mark with our tagline “the power of millions for the benefit of one,” the name “National Association of Professional Women” and “NAPW,” and the name “International Association of Women” and “IAW”, as well as others. We also own the copyrights to certain articles in NAPW publications. We strive to exert control over access to our intellectual property and customized technology by entering into confidentiality and invention assignment agreements with our employees and contractors and confidentiality agreements with third parties in the ordinary course of our business.

Our efforts to protect our proprietary rights may not be successful. Any significant impairment of our intellectual property rights could adversely impact our business or our ability to compete. In addition, protecting our intellectual property rights is costly and time-consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business and adversely affect our operating results.

Competition

We face significant competition in all aspects of our business. Specifically, with respect to our members and our recruitment consumer advertising and marketing solutions, we compete with existing general market online professional networking websites, such as LinkedIn, Indeed, Zip Recruiter, and Monster Worldwide, Inc., as well as ethnic minority focused social networking websites, such as Diversityjobs.com, Workplacediversity.com, and other companies such as Facebook, Google, Microsoft and Twitter that are developing or could develop competing solutions. We also generally compete with online and offline enterprises, including newspapers, television and direct mail marketers that generate revenue from recruiters, advertisers and marketers, and professional organizations. With respect to our hiring solutions, we also compete with traditional online recruiting companies such as Career Builder, talent management companies such as Taleo, and traditional recruiting firms.

Larger, more well-established companies may focus on professional networking and could directly compete with us. Other companies might also launch new competing services that we do not offer. Nevertheless, we believe that our focus on diverse online professional networking communities and the number of registered users or members, as the case may be, overall and within each affinity group that we serve, are competitive strengths in our market.

Government Regulation

We are subject to a number of federal, state and foreign laws and regulations that affect companies conducting business on the Internet. These laws are still evolving and could be amended or interpreted in ways that could be detrimental to our business. In the United States and abroad, laws relating to the liability of providers of online services for activities of their users and other third-parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement and other theories based on the nature and content of the materials searched, the advertisements posted or the content provided by users. Any court ruling or other governmental action that imposes liability on providers of online services for the activities of their users and other third parties could materially harm our business. In addition, rising concerns about the use of social networking technologies for illegal conduct, such as the unauthorized dissemination of national security information, money laundering or supporting terrorist activities may in the future produce legislation or other governmental action that could require changes to our products or services, restrict or impose additional costs upon the conduct of our business or cause users to abandon material aspects of our service.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security incident, or security breach for personal data, or requiring the adoption of minimum information security standards that are often unclear and difficult to implement. The costs of compliance with these laws are significant and may increase in the future. Further, we may be subject to significant liabilities if we fail to comply with these laws.

We are also subject to federal, state and foreign laws regarding privacy and protection of member data. We post on our websites our privacy policy and terms of use. Compliance with privacy-related laws may be costly. However, any failure by us to comply with our privacy policy or privacy-related laws could result in proceedings against us by governmental authorities or private parties, which could be detrimental to our business. Further, any failure by us to protect our members’ privacy and data could result in a loss of member confidence in us and ultimately in a loss of members and customers, which could adversely affect our business.

Because our services are accessible worldwide, certain foreign jurisdictions may claim that we are required to comply with their laws, including in jurisdictions where we have no local entity, employees or infrastructure.

Our direct marketing operations with respect to the NAPW Network are subject to various federal and state “do not call” list requirements. The Federal Trade Commission has created a national “do not call” registry. Under these federal regulations, consumers may have their phone numbers added to the national “do not call” registry. Generally, we are prohibited from calling anyone on that registry. Telemarketers are required to pay a fee to access the registry and are required to compare their call lists against the nation’s “do not call” registry at least once every 31 days. The rule provides for fines of up to $16,000 per violation and other possible penalties. These rules may be construed to limit our ability to market our products and services to new customers. Further, we may incur penalties if we do not conduct our telemarketing activities in compliance with these rules.

Seasonality

Our quarterly operating results are affected by the seasonality of employers’ businesses and hiring practices.

Employees

As of December 31, 2023, we had a total of 48 employees; 45 were full-time employees in various United States locations. We also regularly engage independent contractors to perform various services. As of December 31, 2023, we engaged 3 independent contractors. None of our employees are covered by a collective bargaining agreement. We believe that we have good relationships with our employees.

Corporate History

We were incorporated in Illinois in October 2003, under the name of IH Acquisition, LLC and changed our name to iHispano.com LLC in February 2004. In 2007, we changed our business platform and implemented technology to become the operator of communities of professional networking sites for diverse professionals. In March 2012, we changed our name to Professional Diversity Network, LLC. In March 2013, we completed our initial public offering and converted from an Illinois LLC to a Delaware corporation. We acquired the NAPW Network in September 2014.

Our principal executive office is located at 55 E. Monroe Street, Suite 2120, Chicago, Illinois, 60603 and our telephone number is (312) 614-0950. Our website address is www.ipdnusa.com. References to our website address in this prospectus are provided as a convenience and do not constitute, and should not be viewed as an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this prospectus.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves a high degree of risk. Additional risks not contained herein, incorporated herein by reference, or that we currently believe are immaterial, may also impair our business operations. Before deciding whether to invest in our securities, you should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also carefully read the section titled “Note Regarding Forward-Looking Statements” included in our most recent Annual Report on Form 10-K and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. When determining whether to invest, you should also refer to the other information contained or incorporated in this prospectus and in the applicable prospectus supplement and any applicable free writing prospectus.

Risks Related to Our Business and Financial Condition

We have incurred net losses, our liquidity has been significantly reduced and we could continue to incur losses and negative cash flow in the future.

We recorded a net loss from continuing operations of approximately $4.5 million for the year ended December 31, 2023, and $3.1 million for the year ended December 31, 2022. We recorded a net loss from continuing operations of approximately $1.4 million for the six month period ended June 30, 2024. Our revenues decreased from $8.3 million during 2022 to $7.7 million during 2023 and $3.4 million for the six month period ended June 30, 2024, and our costs and expenses increased from $11.4 million during 2022, to $12.2 million during 2023. Our costs and expenses for the six month period ended June 30, 2024 were approximately $4.8 million. In addition, we used approximately $3.0 million in cash flow from continuing operations during the year ended December 31, 2023 and approximately $0.8 million in cash flow from continuing operations in the six month period ended June 30, 2024. Our independent registered public accounting firm has included in its audit report for the year ended December 31, 2023, an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. We will need to continue to increase revenues, reduce our corporate operating expenses, raise capital through the issuance of common stock, issue capital in relation to our line of equity, or enter into a strategic merger or acquisition, to achieve profitability and positive cash flow from operations. Despite our efforts, we may not achieve profitability or positive cash flow in the future, and even if we do, we may not be able to sustain being profitable.

The market for online professional networks is highly competitive, and if we are unable to compete effectively our sales and results of operations will suffer.

We face significant competition in all aspects of our business, and we expect such competition to increase, particularly in the market for online professional networks.

Our industry is rapidly evolving and is becoming increasingly competitive. Larger and more established online professional networking companies, such as LinkedIn or Monster Worldwide, may focus on the online diversity professional networking market and could directly compete with us. Rival companies or smaller companies, including application developers, could also launch new products and services that could compete with us and gain market acceptance quickly. Individual employers have and may continue to create and maintain their own network of diverse candidates.

We also expect that our existing competitors will focus on professional diversity recruiting. A number of these companies may have greater resources than we do, which may enable them to compete more effectively. For example, our competitors with greater resources may partner with wireless telecommunications carriers or other Internet service providers that may provide Internet users, especially those that access the Internet through mobile devices, incentives to visit our competitors’ websites. Such tactics or similar tactics could decrease the number of our visits, unique visitors and number of users and members, which would materially and adversely affect our business, operating results and financial condition.

Additionally, users of online social networks, such as Facebook, may choose to use, or increase their use of, those networks for professional purposes, which may result in those users decreasing or eliminating their use of our specialized online professional network. Companies that currently do not focus on online professional diversity networking could also expand their focus to diversity networking. LinkedIn may develop its own proprietary online diversity network and compete directly against us. To the extent LinkedIn develops its own network or establishes alliances and relationships with others, our business, operating results and financial condition could be materially harmed. Finally, other companies that provide content for professionals could develop more compelling offerings that compete with us and adversely impact our ability to keep our members, attract new members or sell our solutions to customers.

Our business depends on strong brands, and any failure to maintain, protect and enhance our brands would hurt our ability to retain or expand our base of members, enterprises and professional organizations, or our ability to increase their level of engagement.

Maintaining, protecting and enhancing all of our brands is critical to expanding the base of members for the PDN Network and NAPW Network and increasing their engagement with the product and services offerings of the Company, and will depend largely on our ability to maintain member trust, be a technology leader and continue to provide high-quality offerings, which we may not do successfully in the future. We have devoted significant resources in developing our brands, particularly NAPW. That brand is predicated on the idea that professional women will trust it and find value in building and maintaining their professional identities and reputations on the NAPW Network platform. Despite our efforts to protect our brands and prevent their misuse, if others misuse any of our brands or pass themselves off as being endorsed or affiliated with the PDN Network or the NAPW Network, it could harm our reputation and our business could suffer. If members of any of our networks or potential members determine that they can use other platforms, such as social networks, for the same purposes as or as a replacement for the PDN Network or the NAPW Network, or if they choose to blend their professional and social networking activities, our brands and the business of the Company could be harmed. Members of any of our networks could find that new product or service offerings that are introduced are difficult to use or may feel that they degrade their experience with our organization, which could harm the reputation of the networks and the Company for delivering high-quality offerings. Our brands are also important in attracting and maintaining high performing employees. If we do not successfully maintain strong and trusted brands for our networks, our business can be materially and adversely affected.

If we do not continue to attract new members to the NAPW Network, or if existing NAPW Network members do not renew their subscriptions, renew at lower levels or on less favorable terms, or fail to purchase additional offerings, we may not achieve our revenue projections, and our operating results would be harmed.

Membership fees and related services from NAPW have declined in recent periods. In order to grow the NAPW Network, we must continually attract new members to the NAPW Network, sell additional product and service offerings to existing NAPW Network members and increase the level of renewals. Our ability to do so depends in large part on the success of our sales and marketing efforts. Unlike companies that provide more tangible products, the nature of our product and service offerings is such that members may decide to terminate or not renew their agreements because they do not see their cancellation as causing significant disruptions to their own businesses.

We must demonstrate to NAPW Network members that our product and service offerings provide them with access to an audience of influential, affluent and highly educated women. However, potential members may not be familiar with our product and service offerings or may prefer other more traditional products and services for their professional advancement and networking needs. The rate at which we expand the NAPW Network’s membership base or increase its members’ renewal rates may decline or fluctuate because of several factors, including the prices of product and service offerings, the prices of products and services offered by competitors or reductions in their professional advancement and networking spending levels due to macroeconomic or other factors and the efficacy and cost-effectiveness of our offerings. If we do not attract new members to the NAPW Network or if NAPW Network members do not renew their agreements for our product and service offerings, renew at lower levels or on less favorable terms or do not purchase additional offerings, our revenue from the segment may fall short of our projections.

We may not be able to successfully identify and complete sufficient acquisitions to meet our growth strategy, and even if we are able to do so, we may not realize the anticipated benefits of these acquisitions.

Part of our growth strategy is to acquire companies that we believe will add to and/or expand our service offerings.

Identifying suitable acquisition candidates can be difficult, time-consuming and costly, and we may not be able to identify suitable candidates or complete acquisitions in a timely manner, on a cost-effective basis or at all. Even if we complete an acquisition, we may not realize the anticipated benefits of such an acquisition. Actual cost savings and synergies which may be achieved from an acquired entity may be lower than expected and may take a longer time to achieve than we anticipate. Our acquisitions have previously required, and any similar future transactions may also require, significant efforts and expenditure, in particular with respect to integrating the acquired business with our historical business. We may encounter unexpected difficulties, or incur unexpected costs, in connection with acquisition activities and integration efforts, which include:

| |

●

|

conflicts and inconsistencies in information technology and infrastructures;

|

| |

●

|

inconsistencies in standards, controls, procedures and policies, business cultures and compensation structures between us and an acquired entity;

|

| |

●

|

difficulties in the retention of existing customers and attraction of new customers;

|

| |

●

|

overlap of users and members of an acquired entity and one of our websites;

|

| |

●

|

difficulties in retaining key employees;

|

| |

●

|

the identification and elimination of redundant and underperforming operations and assets;

|

| |

●

|

diversion of management’s attention from ongoing business concerns;

|

| |

●

|

the possibility of tax costs or inefficiencies associated with the integration of the operations; and

|

| |

●

|

loss of customer goodwill.

|

If we fail to successfully complete the integration of an acquired entity, or to realize the anticipated benefits of the integration of an acquired entity, our financial condition and results of operations could be materially and adversely affected.

We rely heavily on our information systems and if our access to this technology is impaired, or we fail to further develop our technology, our business could be significantly harmed.

Our success depends in large part upon our ability to store, retrieve, process and manage substantial amounts of information, including our database of our members. To achieve our strategic objectives and to remain competitive, we must continue to develop and enhance our information systems. Our future success will depend on our ability to adapt to rapidly changing technologies, to adapt our information systems to evolving industry standards and to improve the performance and reliability of our information systems. This may require the acquisition of equipment and software and the development, either internally or through independent consultants, of new proprietary software. Our inability to design, develop, implement and utilize, in a cost-effective manner, information systems that provide the capabilities necessary for us to compete effectively would materially and adversely affect our business, financial condition and operating results.

Our direct sales strategy, which requires personal interaction with employers and third-party recruiters, may limit our ability to grow recruitment revenue and recruitment advertising revenue.

As part of our strategy to market our products and services directly to employers and third-party recruiters, we rely on our direct sales force for recruitment revenue and recruitment advertising revenue. We currently employ professionals in sales, sales support and marketing who are trained in selling our products and services. We continuously attempt to optimize the direct sales team and refine the manner in which our products and services are sold. While the Company made progress in growing its direct sales, we have not matured the sales force to the point of predictability, nor have we sold enough services to achieve profitability. There is no assurance that our direct sales strategy will yield sufficient recruitment revenue and recruitment advertising revenue in the future.

We may not timely and effectively scale and adapt our existing technology and network infrastructure to ensure that our websites are accessible within an acceptable load time.

An element that is key to our continued growth is the ability of our members and other users that we work with to access any of our websites within acceptable load times. We call this website performance. We have experienced, and may in the future experience, website disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints due to an overwhelming number of users accessing our websites simultaneously, and denial of service or fraud or security attacks. In some instances, we may not be able to identify the cause or causes of these website performance problems within an acceptable period of time.

If any of our websites are unavailable when users attempt to access them or they do not load as quickly as users expect, users may seek other websites to obtain the information or services for which they are looking and may not return to our websites as often in the future, or at all. This would negatively impact on our ability to attract members and other users and increase engagement on our websites. To the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business, operating results and financial condition may be materially and adversely affected.

Our business involves higher risks associated with remote work.

RemoteMore’s business heavily relies on remote working with its customers, which means many contractors will use their own personal devices and home networks to perform work tasks. This presents some of the largest risks to the worker and the business. Many personal devices lack the hardened nature of a corporate device and other security capabilities, such as encryption, auto-backups, authentication and security monitoring, which may expose our business or our customers’ business to additional risk of cyber-attack. This remote working environment makes it more difficult to monitor contractor access to data, information sent and received online, and legitimacy of access.

Our systems are vulnerable to natural disasters, acts of terrorism and cyber-attacks.

Our systems are vulnerable to damage or interruption from catastrophic occurrences such as earthquakes, floods, fires, power loss, telecommunication failures, terrorist attacks, cyber-attacks and similar events. For systems which are not based in cloud storage, we have implemented a disaster recovery program, maintained by a third-party vendor, which allows us to move production to a back-up data center in the event of a catastrophe. Although this program is functional, it does not yet provide a real-time back-up data center, so if our primary data center shuts down, there will be a period of time that such website will remain shut down while the transition to the back-up data center takes place. Despite any precautions we may take, the occurrence of a natural disaster or other unanticipated problems at our hosting facilities could result in lengthy interruptions in our services. Although we carry cyber security insurance, our claims may exceed the insurance coverage, and we may not be fully compensated by third party insurers in the event of service interruption or cyber-attack. Furthermore, our business may never recover from such an event.

If our security measures are compromised, or if any of our websites are subject to attacks that degrade or deny the ability of members or customers to access our solutions, members and customers may curtail or stop use of our solutions.