0001388658FALSE00013886582024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 30, 2024

iRhythm Technologies, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Delaware | 001-37918 | 20-8149544 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

699 8th Street, Suite 600

San Francisco, California 94103

(Address of principal executive office) (Zip Code)

(415) 632-5700

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 Per Share | IRTC | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 30, 2024, iRhythm Technologies, Inc. issued a press release regarding its financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Item 2.02, including Exhibit 99.1 to this Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any other filing under the Exchange Act or under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | IRHYTHM TECHNOLOGIES, INC. |

| | | |

Date: October 30, 2024 | | By: | /s/ Daniel Wilson |

| | | Daniel Wilson |

| | | Chief Financial Officer |

iRhythm Technologies Announces Third Quarter 2024 Financial Results

SAN FRANCISCO, October 30, 2024 - iRhythm Technologies, Inc. (NASDAQ: IRTC), a leading digital health care company focused on creating trusted solutions that detect, predict, and prevent disease, today reported financial results for the three months ended September 30, 2024.

Third Quarter 2024 Financial Highlights

•Revenue of $147.5 million, an 18% increase compared to third quarter 2023

•Gross margin of 68.8%, a 260-basis point increase compared to third quarter 2023

•Unrestricted cash, cash equivalents and marketable securities of $522.0 million as of September 30, 2024

Recent Operational Highlights

•Strong quarterly registration volume driven by record demand from existing accounts combined with another record quarter of new account openings in the United States and record registrations in the United Kingdom

•Received FDA 510(k) clearance for updates previously made to the Zio AT device as letter to file

•Expanded global reach with commercial launch of Zio monitor in Austria, the Netherlands, Switzerland, and Spain, and received Japanese PMDA regulatory approval for Zio monitor, highlighting our continued commitment to bringing our innovative digital healthcare solutions to millions of people worldwide

•Entered into technology license agreement with BioIntelliSense to incorporate medical grade, connected, multi-sensor capabilities into our future ambulatory cardiac monitoring products, positioning us to expand the capabilities of our product platform

•Upcoming data at American Heart Association's Scientific Sessions 2024 in Chicago from November 16–18

"The third quarter of 2024 was an exceptional quarter of execution as our teams drove significant demand in our core business, made substantial progress in expanding our Zio services into global markets, and established an important licensing agreement with an external partner to drive future platform capabilities for long term growth," said Quentin Blackford, president and chief executive officer of iRhythm. "Third quarter revenue growth of over 18% year-over-year was driven by record volume demand from existing accounts, and our field teams were also able to open a record number of new accounts during the quarter while continuing our expansion into primary care channels. We were also very pleased to be able to celebrate one million patients having been registered for Zio monitor - our newest generation, long-term continuous monitoring system - in October and have officially launched our first commercial account using Aura - Epic’s specialty diagnostics and devices suite."

"We also made tangible progress towards long-term initiatives to drive future growth. For the first time ever, we have achieved more than 10,000 billable registrations in a single quarter in the UK, and we are excited that we have begun receiving physician orders following commercial launch in four additional European countries. Furthermore, we have recently received a FDA 510(k) clearance for updates to our Zio AT device associated with our FDA remediation efforts, an ongoing and critical priority for our teams to demonstrate our commitment to quality, compliance and performance. With strong execution across multiple growth levers and with additional catalysts on the horizon, we could not be more excited about the future of iRhythm."

Third Quarter Financial Results

Revenue for the third quarter of 2024 was $147.5 million, up 18% from $124.6 million during the same period in 2023. The increase was driven by growth in demand for Zio services.

Gross profit for the third quarter of 2024 was $101.5 million, up 23% from $82.5 million during the same period in 2023, while gross margin was 68.8%, up from 66.2% during the same period in 2023. The increase in gross profit was primarily due to increased volume of Zio services provided due to higher demand. The increase in gross margin was primarily due to operational efficiencies as well as the absence of increased reserves for excess Zio XT printed circuit board assembly (PCBA) components that were incurred during the prior year.

Operating expenses for the third quarter of 2024 were $151.8 million, compared to $110.1 million for the same period in 2023. Adjusted operating expenses for the third quarter of 2024 were $143.8 million, compared to $107.1 million during the same period in 2023. The increase in adjusted operating expenses was primarily driven by a $32.1 million charge for license consideration payable to BioIntelliSense that was recognized on iRhythm’s unaudited condensed consolidated statements of operations as acquired in-process research and development (“IPR&D”) expense during the third quarter of 2024. In alignment with SEC guidance around non-GAAP financial measures relating to acquired IPR&D expense, iRhythm does not exclude expenses related to acquired IPR&D from its non-GAAP results.

Net loss for the third quarter of 2024 was $46.2 million, or a diluted loss of $1.48 per share, compared with net loss of $27.1 million, or a diluted loss of $0.89 per share, for the same period in 2023. Adjusted net loss for the third quarter of 2024 was $39.2 million, or a diluted loss of $1.26 per share, compared with an adjusted net loss of $24.1 million, or a diluted loss of $0.79 per share, for the same period in 2023. The increase in net loss was primarily driven by a $32.1 million charge for license consideration payable to BioIntelliSense that was recognized on iRhythm’s unaudited condensed consolidated statements of operations as acquired IPR&D expense during the third quarter of 2024.

Unrestricted cash, cash equivalents, and marketable securities were $522.0 million as of September 30, 2024.

2024 Annual Guidance

iRhythm projects revenue for the full year 2024 to grow approximately 18% to 19% compared to prior year results, ranging from approximately $582.5 million to $587.5 million. Gross margin for the full year 2024 is expected to range from 68.5% to 69.0%. iRhythm now expects adjusted EBITDA margin for the full year 2024 to range from approximately negative 2% to negative 1.5% of full year revenues. Adjusted EBITDA guidance includes license consideration payable to BioIntelliSense that is recognized on iRhythm’s consolidated statements of operations as acquired IPR&D expenses, including a charge of approximately $32 million of expense incurred during the third quarter of 2024. In alignment with SEC guidance around non-GAAP financial measures relating to acquired IPR&D expense, iRhythm will not exclude expenses related to acquired IPR&D from its non-GAAP results, which include adjusted EBITDA.

Webcast and Conference Call Information

iRhythm’s management team will host a conference call today beginning at 1:30 p.m. PT/4:30 p.m. ET. Interested parties may access a live and archived webcast of the presentation on the “Events & Presentations” section of the company’s investor website at investors.irhythmtech.com.

About iRhythm Technologies, Inc.

iRhythm is a leading digital health care company that creates trusted solutions that detect, predict, and prevent disease. Combining wearable biosensors and cloud-based data analytics with powerful proprietary algorithms, iRhythm distills data from millions of heartbeats into clinically actionable information. Through a relentless focus on patient care, iRhythm’s vision is to deliver better data, better insights, and better health for all.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current year presentation. These reclassifications have no impact on previously reported results of operations or financial position.

Use of Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized under U.S. generally accepted accounting principles (GAAP) in this press release, including adjusted EBITDA, adjusted net loss, adjusted net loss per share and adjusted operating expenses. We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. See the schedules attached to this press release for additional information and reconciliations of such non-GAAP financial measures. We have not reconciled our adjusted operating expenses and adjusted EBITDA estimates for full year 2024 because certain items that impact these figures are uncertain or out of our control and cannot be reasonably predicted. Accordingly, a reconciliation of adjusted operating expenses and adjusted EBITDA estimates is not available without unreasonable effort.

Adjusted EBITDA excludes non-cash operating charges for stock-based compensation expense, changes in fair value of strategic investments, impairment and restructuring charges, business transformation costs, and loss on extinguishment of debt. Business transformation costs include costs associated with professional services, employee termination and relocation, third-party merger and acquisition, integration, and other costs to augment and restructure the organization, inclusive of both outsourced and offshore resources.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements include statements regarding financial guidance, market opportunity, ability to penetrate the market, anticipated productivity improvements and expectations for growth. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties, many of which are beyond our control, include risks described in the section entitled “Risk Factors” and elsewhere in our filings made with the Securities and Exchange Commission, including those on the Form 10-

Q expected to be filed on or about October 30, 2024. These forward-looking statements speak only as of the date hereof and should not be unduly relied upon. iRhythm disclaims any obligation to update these forward-looking statements.

Investor Contact

Stephanie Zhadkevich

investors@irhythmtech.com

Media Contact

Kassandra Perry

irhythm@highwirepr.com

IRHYTHM TECHNOLOGIES, INC.

Condensed Consolidated Balance Sheets

(In thousands, except par value)

(unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 519,535 | | | $ | 36,173 | |

| Marketable securities | 2,496 | | | 97,591 | |

| Accounts receivable, net | 77,427 | | | 61,484 | |

| Inventory | 15,032 | | | 13,973 | |

| Prepaid expenses and other current assets | 13,419 | | | 21,591 | |

| Total current assets | 627,909 | | | 230,812 | |

| Property and equipment, net | 122,390 | | | 104,114 | |

| Operating lease right-of-use assets | 45,570 | | | 49,317 | |

| Restricted cash, long-term | 8,358 | | | — | |

| Goodwill | 862 | | | 862 | |

| Long-term strategic investments | 59,059 | | | 3,000 | |

| Other assets | 45,540 | | | 45,039 | |

| Total assets | $ | 909,688 | | | $ | 433,144 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 7,593 | | | $ | 5,543 | |

| Accrued liabilities | 73,958 | | | 83,362 | |

| Deferred revenue | 3,031 | | | 3,306 | |

| Operating lease liabilities, current portion | 15,522 | | | 15,159 | |

| Total current liabilities | 100,104 | | | 107,370 | |

| Long-term senior convertible notes | 645,821 | | | — | |

| Debt, noncurrent portion | — | | | 34,950 | |

| Other noncurrent liabilities | 17,978 | | | 1,012 | |

| Operating lease liabilities, noncurrent portion | 74,019 | | | 79,715 | |

| Total liabilities | 837,922 | | | 223,047 | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value – 5,000 shares authorized; none issued and outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Common stock, $0.001 par value – 100,000 shares authorized; 31,516 shares issued and 31,287 shares outstanding at September 30, 2024, respectively; and 30,954 shares issued and outstanding at December 31, 2023 | 31 | | | 31 | |

| Additional paid-in capital | 854,363 | | | 855,784 | |

| Accumulated other comprehensive loss | (66) | | | (112) | |

| Accumulated deficit | (757,562) | | | (645,606) | |

Treasury stock, at cost; 229 and 0 shares at September 30, 2024 and December 31, 2023, respectively | (25,000) | | | — | |

| Total stockholders’ equity | 71,766 | | | 210,097 | |

| Total liabilities and stockholders’ equity | $ | 909,688 | | | $ | 433,144 | |

| | | |

IRHYTHM TECHNOLOGIES, INC.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue, net | | $ | 147,538 | | | $ | 124,604 | | | $ | 427,514 | | | $ | 360,170 | |

| Cost of revenue | | 46,062 | | | 42,130 | | | 135,051 | | | 115,790 | |

| Gross profit | | 101,476 | | | 82,474 | | | 292,463 | | | 244,380 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 15,694 | | | 16,309 | | | 52,378 | | | 44,828 | |

| Acquired in-process research and development | | 32,069 | | | — | | | 32,069 | | | — | |

| Selling, general and administrative | | 103,375 | | | 93,768 | | | 318,797 | | | 285,531 | |

| Impairment charges | | 641 | | | — | | | 641 | | | — | |

| Total operating expenses | | 151,779 | | | 110,077 | | | 403,885 | | | 330,359 | |

| Loss from operations | | (50,303) | | | (27,603) | | | (111,422) | | | (85,979) | |

| | | | | | | | |

| Interest and other income (expense), net: | | | | | | | | |

| Interest income | | 6,456 | | | 1,717 | | | 16,198 | | | 4,619 | |

| Interest expense | | (3,329) | | | (927) | | | (9,501) | | | (2,709) | |

| Loss on extinguishment of debt | | — | | | — | | | (7,589) | | | — | |

| Other income (expense), net | | 1,182 | | | (108) | | | 772 | | | (143) | |

| Total interest and other income (expense), net | | 4,309 | | | 682 | | | (120) | | | 1,767 | |

| | | | | | | | |

| Loss before income taxes | | (45,994) | | | (26,921) | | | (111,542) | | | (84,212) | |

| Income tax provision | | 188 | | | 195 | | | 414 | | | 495 | |

| Net loss | | $ | (46,182) | | | $ | (27,116) | | | $ | (111,956) | | | $ | (84,707) | |

| Net loss per common share, basic and diluted | | $ | (1.48) | | | $ | (0.89) | | | $ | (3.59) | | | $ | (2.78) | |

| Weighted-average shares, basic and diluted | | 31,262 | | | 30,607 | | | 31,147 | | | 30,470 | |

| | | | | | | | |

IRHYTHM TECHNOLOGIES, INC.

Reconciliation of GAAP to Non-GAAP Financial Information

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted EBITDA reconciliation* | | | | | | | | |

Net loss1 | | $ | (46,182) | | | $ | (27,116) | | | $ | (111,956) | | | $ | (84,707) | |

| Interest expense | | 3,329 | | | 927 | | | 9,501 | | | 2,709 | |

| Interest income | | (6,456) | | | (1,717) | | | (16,198) | | | (4,619) | |

| Changes in fair value of strategic investments | | (1,059) | | | — | | | (1,059) | | | — | |

| Income tax provision | | 188 | | | 195 | | | 414 | | | 495 | |

| Depreciation and amortization | | 5,135 | | | 4,067 | | | 15,426 | | | 11,434 | |

| Stock-based compensation | | 17,158 | | | 21,008 | | | 59,970 | | | 53,358 | |

| | | | | | | | |

| Impairment charges | | 641 | | | — | | | 641 | | | — | |

| Business transformation costs | | 7,360 | | | 2,999 | | | 8,656 | | | 14,094 | |

| Loss on extinguishment of debt | | — | | | — | | | 7,589 | | | — | |

| Adjusted EBITDA | | $ | (19,886) | | | $ | 363 | | | $ | (27,016) | | | $ | (7,236) | |

| | | | | | | | |

| Adjusted net loss reconciliation* | | | | | | | | |

Net loss, as reported1 | | $ | (46,182) | | | $ | (27,116) | | | $ | (111,956) | | | $ | (84,707) | |

| Impairment charges | | 641 | | | — | | | 641 | | — | |

| Business transformation costs | | 7,360 | | | 2,999 | | | 8,656 | | | 14,094 | |

| Changes in fair value of strategic investments | | (1,059) | | | — | | | (1,059) | | | — | |

| Loss on extinguishment of debt | | — | | | — | | | 7,589 | | | — | |

| Adjusted net loss | | $ | (39,240) | | | $ | (24,117) | | | $ | (96,129) | | | $ | (70,613) | |

| | | | | | | | |

| Adjusted net loss per share reconciliation* | | | | | | | | |

Net loss per share, as reported1 | | $ | (1.48) | | | $ | (0.89) | | | $ | (3.59) | | | $ | (2.78) | |

| | | | | | | | |

| Impairment charges per share | | 0.02 | | | — | | | 0.02 | | | — | |

| Business transformation costs per share | | 0.24 | | | 0.10 | | | 0.28 | | | 0.46 | |

| Changes in fair value of strategic investments per share | | (0.03) | | | — | | | (0.03) | | | — | |

| Loss on extinguishment of debt per share | | — | | | — | | | 0.24 | | | — | |

| Adjusted net loss per share | | $ | (1.26) | | | $ | (0.79) | | | $ | (3.09) | | | $ | (2.32) | |

| Weighted-average shares, basic and diluted | | 31,262 | | | 30,607 | | | 31,147 | | | 30,470 | |

| | | | | | | | |

| Adjusted operating expense reconciliation* | | | | | | | | |

| Operating expense, as reported | | $ | 151,779 | | | $ | 110,077 | | | $ | 403,885 | | | $ | 330,359 | |

| | | | | | | | |

| Impairment charges | | (641) | | | — | | | (641) | | | — | |

| Business transformation costs | | (7,360) | | | (2,999) | | | (8,656) | | | (14,094) | |

| Adjusted operating expense | | $ | 143,778 | | | $ | 107,078 | | | $ | 394,588 | | | $ | 316,265 | |

*Certain numbers expressed may not sum due to rounding.1 Net loss for the three and nine months ended September 30, 2024 includes $32.1 million of acquired in-process research and development expense.

v3.24.3

Cover

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

iRhythm Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37918

|

| Entity Tax Identification Number |

20-8149544

|

| Entity Address, Address Line One |

699 8th Street

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

415

|

| Local Phone Number |

632-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.001 Per Share

|

| Trading Symbol |

IRTC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001388658

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

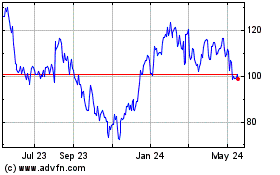

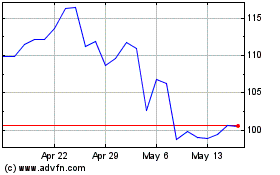

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Feb 2024 to Feb 2025