Innovative Solutions & Support, Inc. (Nasdaq: ISSC)

("IS&S" or the "Company"), a leading provider of advanced

avionic solutions for commercial, business aviation and military

markets, today reported financial results for the three- and

twelve-month periods ended September 30, 2024.

FOURTH QUARTER 2024 HIGHLIGHTS (all comparisons versus

the prior year period unless otherwise noted)

- Net revenue of $15.4 million, +18.4% over the comparable

quarter last year

- Gross profit of $8.5 million; gross margin of 55.4%

- Net Income of $3.2 million, or $0.18 per diluted share

- Adjusted EBITDA(1) of $5.6 million, +16.9% over the comparable

quarter last year

- Ratio of net debt to trailing twelve-month Adjusted EBITDA of

2.0x as of September 30, 2024

FULL YEAR 2024 HIGHLIGHTS (all comparisons versus the

prior year period unless otherwise noted)

- Net revenue of $47.2 million, +35.6% over the prior year

- Gross profit of $25.9 million; gross margin of 54.9%

- Net Income of $7.0 million, or $0.40 per diluted share

- Adjusted EBITDA(1) of $13.7 million, +42.5% over the prior

year

(1)

Adjusted EBITDA is a non-GAAP measure.

Reconciliation of adjusted EBITDA to net income, the most directly

comparable GAAP financial measure, is set forth in the

reconciliation table accompanying this release.

MANAGEMENT COMMENTARY

“IS&S continues to build an advanced avionics business

focused exclusively on high-value, ‘advanced avionics’ solutions

for commercial air transport, business aviation and military

customers,” stated Shahram Askarpour, Chief Executive Officer of

IS&S. “Our industry-unique products and systems integration

expertise has positioned IS&S as a preferred partner in the

fleet modernization and retrofit markets, where our in-house

design, manufacturing, installation and support capabilities

provide customers with safe, compliant, and cost-effective

solutions that enhance aircraft safety, compliance, and mission

readiness.”

“This was a transformative year for IS&S, which featured

significant year-over-year growth in revenue, net income, and

EBITDA,” continued Askarpour. “The successful integration of

several platforms recently acquired from Honeywell has served to

further advance our important autonomous flights initiative,

bringing us additional technologies that are stepping-stones on the

path to complete autonomy. IS&S is well-positioned for another

consecutive year of profitable growth in FY 2025.”

“During the fourth quarter, we delivered more than 18%

year-over-year revenue growth, driven by momentum from new military

programs and recently acquired product lines,” continued Askarpour.

“Demand across our military end-markets has increased in recent

quarters, evidenced by orders from both the U.S. Department of

Defense and allied foreign militaries.”

“New product development remains a key strategic priority for

IS&S,” continued Askarpour. “During 2025, we intend to launch

our next generation Utility Management System, or UMS2. Our UMS2

will be an AI-capable system with integrated neural network

capabilities making it a cutting-edge certifiable monitoring and

control system in the aviation market. We anticipate that the

system’s AI capabilities will serve to significantly enhance crew

efficiency, by enabling additional cockpit automation. As our UMS2

is platform agnostic and can be adapted to various aircraft, we see

significant growth potential for this product line over the next

several years.”

“We remain committed to a disciplined capital allocation

strategy, one that seeks to maximize our return on invested

capital, over the long-term,” stated Jeffrey DiGiovanni, Chief

Financial Officer of IS&S. “In FY 2024, we continued to

prioritize efficient free cash flow generation, while increasing

our financial flexibility in support of growth investments. During

the last 18 months, we’ve completed two strategic product line

acquisitions from Honeywell, even as we’ve reduced net leverage and

improved our liquidity profile. In September, we increased the

capacity of our credit facility to $35 million, which provides us

with financial flexibility to support our ongoing operations and

facility expansion.”

“Over this coming year, we expect further growth within our

retrofit markets via supporting the aging aircraft types with our

advanced solutions. We also remain highly focused on product

innovation and new product development, such as the upcoming launch

of our new UMS2. Finally, we intend to remain an opportunistic

acquiror of complementary product lines that expand our

capabilities for advanced avionics. Our collective focus on growth,

operational efficiency and disciplined capital allocation positions

IS&S for sustained value creation in the year ahead,” added

Askarpour.

FOURTH QUARTER 2024 PERFORMANCE

Fourth quarter revenue was $15.4 million, an increase of 18.4%

compared to the same period last year, driven by momentum in new

military programs and revenue synergies from the acquired Honeywell

product lines, as well as incremental revenues from recently

acquired platforms.

Gross profit was $8.5 million during the fourth quarter of 2024,

up 5.1% from gross profit of $8.1 million in the fourth quarter of

last year. The improvement was driven by strong revenue growth,

partially offset by higher depreciation and amortization expense

resulting from the Honeywell acquisitions and continued investments

in growth initiatives.

Fourth quarter 2024 gross margin was 55.4%, up from 53.4% during

the third quarter of fiscal 2024, as the Company enjoyed continued

efficiency gains from the integration of the acquired Honeywell

product lines over the course of the year. Fourth quarter gross

margin was down from the fourth quarter of 2023, primarily due to

an increase in acquisition-related depreciation and amortization

expense and a shift in product mix.

Fourth quarter 2024 operating expenses were $4.2 million,

compared to $4.5 million in the fourth quarter of last year

reflecting our ongoing focus on improving operational efficiency.

Operating expenses represented 27.1% of revenue during the fourth

quarter, down from 34.3% in the fourth quarter of last year, given

this focus as well as improved operating leverage from higher

consolidated revenues.

Adjusted EBITDA was $5.6 million during the fourth quarter, up

from $4.8 million in the fourth quarter of last year.

New orders in the fourth quarter of fiscal 2024 were $95.4

million, which includes $74.3 million of backlog acquired as part

of the product line acquisition on September 27, 2024, and backlog

as of September 30, 2024, was $89.2 million. The backlog includes

only purchase orders in-hand and excludes orders from the Company’s

OEM customers under long-term programs, including Pilatus PC-24,

Textron King Air, Boeing T-7 Red Hawk, Boeing KC-46A, and Lockheed

Martin.

BALANCE SHEET, LIQUIDITY AND FREE CASH FLOW

As of September 30, 2024, IS&S had total debt of $28.0

million. Cash and cash equivalents as of September 30, 2024, were

$0.5 million, resulting in net debt of $27.5 million. As of

September 30, 2024, IS&S had total cash and availability under

its credit line of approximately $7.5 million.

Cash flow from operations was $5.8 million during fiscal 2024

compared to $2.1 million in the same period last year. Capital

expenditures during fiscal 2024 were $0.7 million, versus $0.3

million in the year-ago period. Free cash flow increased to $5.1

million during fiscal 2024, up from $1.8 million in the same period

last year.

FOURTH QUARTER 2024 RESULTS CONFERENCE CALL

IS&S will host a conference call at 5:00 PM ET on Thursday

December 19, 2024, to discuss the Company’s fourth quarter and

full-year 2024 results.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

the IS&S website at

https://innovative-ss.com/iss-investor-relations/events-presentations/,

and a replay of the webcast will be available at the same time

shortly after the webcast is complete.

To participate in the live teleconference:

Domestic Live:

(844) 739-3798

International Live:

(412) 317-5714

To listen to a replay of the teleconference, which will be

available through January 2, 2025:

Domestic Replay:

(844) 512-2921

International Replay:

(412) 317-6671

Passcode:

10194980

NON-GAAP FINANCIAL MEASURES

EBITDA, Adjusted EBITDA, adjusted EBITDA margin, and adjusted

net cash provided by operating activities (“free cash flow”) are

not measures of financial performance under GAAP and should not be

considered substitutes for GAAP measures, net income (for EBITDA

and adjusted EBITDA), or net cash provided by operating activities

(for free cash flow), which the Company considers to be the most

directly comparable GAAP measures. These non-GAAP financial

measures have limitations as analytical tools, and when assessing

the Company’s operating performance, readers should not consider

these non-GAAP financial measures in isolation or as substitutes

for net income, net cash provided by operating activities, or other

consolidated income statement data prepared in accordance with

GAAP. Other companies in the Company’s industry may define or

calculate these non-GAAP financial measures differently than the

Company does, and accordingly, these measures may not be comparable

to similarly titled measures used by other companies.

The Company defines EBITDA as net income before interest, taxes,

depreciation, and amortization The Company believes that EBITDA is

an appropriate measure of operating performance because it

eliminates the impact of income and expenses that do not relate to

ongoing business performance, and that the presentation of this

measure enhances an investor’s understanding of its financial

performance.

The Company defines adjusted EBITDA as net income before

interest, taxes, depreciation, amortization, and certain items of

income and expense, transaction-related acquisition and integration

expenses, severance, and certain non-recurring items. The Company

believes that adjusted EBITDA is an appropriate measure of

operating performance because it eliminates the impact of income

and expenses that do not relate to ongoing business performance,

and that the presentation of this measure enhances an investor’s

understanding of its financial performance.

Adjusted EBITDA margin is adjusted EBITDA divided by total

revenue. Adjusted EBITDA margin is a key metric used by management

to assess the Company’s financial performance. The Company believes

that adjusted EBITDA margin is an appropriate measure of operating

performance because it eliminates the impact of income and expenses

that do not relate to ongoing business performance, and that the

presentation of this measure enhances an investor’s understanding

of the Company’s financial performance. The Company believes that

adjusted EBITDA margin is helpful in measuring profitability of

operations on a consolidated level.

Adjusted EBITDA and adjusted EBITDA margin have important

limitations as analytical tools. For example, adjusted EBITDA and

adjusted EBITDA margin:

- does not reflect any cash capital expenditure requirements for

the assets being depreciated and amortized that may have to be

replaced in the future;

- does not reflect changes in, or cash requirements for, the

Company’s working capital needs;

- excludes the impact of certain cash charges resulting from

matters the Company considers not to be indicative of its ongoing

operations;

- does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on the

Company’s debt; and

- excludes certain tax payments that may represent a reduction in

available cash.

Free cash flow is calculated as net cash provided by operating

activities less capital expenditures. The Company believes that

free cash flow is an important financial measure for use in

evaluating financial performance because it measures the Company’s

ability to generate additional cash from its business

operations.

A reconciliation of each non-GAAP measure to the most directly

comparable GAAP measure is set forth below.

ABOUT INNOVATIVE SOLUTIONS & SUPPORT

Headquartered in Exton, Pa., Innovative Solutions & Support

(IS&S) is a U.S.-based company specializing in the engineering,

manufacturing, and supply of advanced avionic solutions. Its

extensive global product reach and customer base span commercial,

business and aviation and military markets, catering to both

airframe manufacturers and aftermarket services for fixed-wing and

rotorcraft applications. IS&S offers cutting-edge,

cost-effective solutions while maintaining legacy product lines.

The company is poised to leverage its experience to create growth

opportunities in next-generation navigation systems, advanced

flight deck and special mission displays, precise air data

instrumentation, autothrottles, flight control computers, mission

computers and software based situational awareness targeting

autonomous flight. Supported by a robust portfolio of patents and

the highest aircraft certification standards, IS&S is at the

forefront of meeting the aerospace industry's demand for more

sophisticated and technologically advanced products. For more

information, please visit us at www.innovative-ss.com.

FORWARD-LOOKING STATEMENTS

In addition to the historical information contained herein, this

press release contains “forward-looking statements” within the

meaning of, and intended to be covered by, the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

In this press release, the words “anticipates,” “believes,” “may,”

“will,” “estimates,” “continues,” “anticipates,” “intends,”

“forecasts,” “expects,” “plans,” “could,” “should,” “would,” “is

likely”, “projected”, “might”, “potential”, “preliminary”,

“provisionally”, references to “fiscal 2025”, and similar

expressions, as they relate to the business or to its management,

are intended to identify forward-looking statements, but they are

not exclusive means of identifying them. All forward-looking

statements are based on management’s current expectations and

beliefs concerning future developments and their potential effects

on the Company including, without limitation, statements about:

future revenue; financial performance and profitability; future

business opportunities; the integration of the Honeywell product

lines, including statements regarding the ongoing integration;

plans to grow organically through new product development and

related market expansion, as well as via acquisitions; and the

timing of long-term programs remaining in production and continuing

to generate future sales. Forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made. Because forward-looking statements are subject to

assumptions, risks and uncertainties, actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause results to differ materially

from those expressed or implied by such forward-looking statements

include, but are not limited to, the Company’s ability to

efficiently integrate acquired and licensed product lines,

including the Honeywell product lines, into its operations; a

reduction in anticipated orders; an economic downturn; changes in

the competitive marketplace and/or customer requirements; an

inability to perform customer contracts at anticipated cost levels;

and other factors that generally affect the economic and business

environments in which the Company operates. Such factors are

detailed in the Company's Annual Report on Form 10-K for the fiscal

year ended September 30, 2023, and subsequent reports filed with

the Securities and Exchange Commission. Many of the factors that

will determine the Company’s future results are beyond the ability

of management to control or predict. Readers should not place undue

reliance on forward-looking statements. The Company undertakes no

obligation to revise or update any forward-looking statements, or

to make any other forward-looking statements, whether as a result

of new information, future events or otherwise.

INNOVATIVE SOLUTIONS AND

SUPPORT, INC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited)

September 30,

September 30,

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

538,977

$

3,097,193

Accounts receivable

12,612,482

9,743,714

Contract assets

1,680,060

487,139

Inventories

12,732,381

6,139,713

Prepaid inventory

5,960,404

12,069,114

Prepaid expenses and other current

assets

1,161,394

1,073,012

Assets held for sale

—

2,063,818

Total current assets

34,685,698

34,673,703

Goodwill

5,213,104

3,557,886

Intangible assets, net

27,012,292

16,185,321

Property and equipment, net

13,372,298

7,892,427

Deferred income taxes

1,625,144

456,392

Other assets

473,725

191,722

Total assets

$

82,382,261

$

62,957,451

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

Current portion of long-term debt

$

—

$

2,000,000

Accounts payable

2,315,479

1,337,275

Accrued expenses

4,609,294

2,918,325

Contract liability

340,481

143,359

Total current liabilities

7,265,254

6,398,959

Long-term debt

28,027,002

17,500,000

Other liabilities

451,350

421,508

Total liabilities

35,743,606

24,320,467

Commitments and contingencies

Shareholders’ equity

46,638,655

38,636,984

Total liabilities and shareholders’

equity

82,382,261

62,957,451

INNOVATIVE SOLUTIONS AND

SUPPORT, INC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited)

Three Months Ended September

30,

Twelve months ended September

30,

2024

2023

2024

2023

Net Sales:

Product

$

9,833,165

$

4,980,888

$

24,279,918

$

22,589,657

Services

5,551,641

8,011,708

22,918,102

12,218,856

Total net sales

15,384,806

12,992,596

47,198,020

34,808,513

Cost of sales:

Product

4,334,853

2,265,312

10,570,521

9,715,517

Services

2,521,708

2,614,813

10,713,908

3,781,925

Total cost of sales

6,856,561

4,880,125

21,284,429

13,497,442

Gross profit

8,528,245

8,112,471

25,913,591

21,311,071

Operating expenses:

Research and development

1,106,355

741,579

4,137,985

3,129,518

Selling, general and administrative

3,055,722

3,718,293

12,114,069

10,822,505

Total operating expenses

4,162,077

4,459,872

16,252,054

13,952,023

Operating income

4,366,168

3,652,599

9,661,537

7,359,048

Interest expense

(233,042)

(393,281)

(937,309)

(393,281)

Interest income

5,827

85,693

127,332

518,188

Other income

(57,040)

19,813

—

151,317

Income before income taxes

4,081,913

3,364,824

8,851,560

7,635,272

Income tax expense

901,719

730,202

1,853,180

1,607,517

Net income

$

3,180,194

$

2,634,622

$

6,998,380

$

6,027,755

Net income per common share:

Basic

$

0.18

$

0.15

$

0.40

$

0.35

Diluted

$

0.18

$

0.15

$

0.40

$

0.35

Weighted average shares outstanding:

Basic

17,471,548

17,400,659

17,459,823

17,411,684

Diluted

17,492,686

17,451,314

17,480,247

17,419,185

Reconciliation of Net Income to EBITDA

and Adjusted EBITDA

3 Months Ended

September

12 Months Ended

September

2023

2024

2023

2024

Net Income

$2,634,622

$3,180,194

$6,027,755

$6,998,379

Income tax expense

730,202

901,719

1,607,517

1,853,180

Interest expense

393,281

233,042

393,281

937,309

Depreciation and amortization

439,051

660,710

697,943

2,097,942

EBITDA

$4,197,156

$4,975,665

$8,726,496

$11,886,810

Acquisition related costs

464,506

655,011

710,705

1,172,363

CFO transition, ATM Costs and other

strategic initiatives

156,061

-

156,061

612,907

Adjusted EBITDA

$4,817,723

$5,630,676

$9,593,262

$13,672,080

Free Cash Flow

3 Months Ended

September

12 Months Ended

September

2023

2024

2023

2024

Operating Cashflow

$1,158,249

$593,288

$2,096,174

$5,796,223

Capital Expenditures

133,289

293,819

298,373

657,790

Free Cashflow

$1,024,960

$299,469

$1,797,801

$5,138,433

Net Debt and Net Debt Leverage

3 Months Ended

September

2023

2024

Total Debt

$

19,500,000

$

28,027,002

Cash

3,097,193

538,977

Net Debt

$

16,402,807

$

27,488,025

Leverage Ratio

1.3x

2.0x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219912536/en/

IR CONTACT Paul Bartolai or Noel Ryan

ISSC@val-adv.com

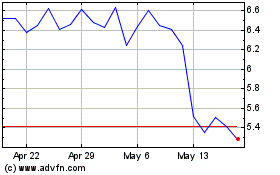

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Dec 2024 to Jan 2025

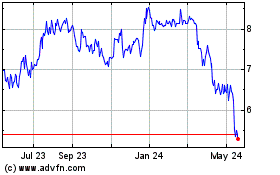

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Jan 2024 to Jan 2025