Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 October 2023 - 8:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-40145

Jowell Global Ltd.

2nd Floor, No. 285 Jiangpu Road

Yangpu District, Shanghai

China 200082

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

Jowell Global Ltd. |

| |

|

| Date: October 25, 2023 |

By: |

/s/ Haiting Li |

| |

Name: |

Haiting Li |

| |

Title: |

Chief Executive Officer |

Exhibit Index

Exhibit 99.1

Jowell Global Ltd. Announces Extraordinary General

Meeting Results and Share Consolidation

SHANGHAI, October 25, 2023

(PRNewswire) -- Jowell Global Ltd. (“Jowell Global” or the “Company”) (NASDAQ: JWEL), one of the leading cosmetics,

health and nutritional supplements, and household products e-commerce platforms in China, today announced that, at an extraordinary general

meeting of the Company held on October 25, 2023 (the “Meeting”), its shareholders have approved by an ordinary resolution

of a share consolidation (the “Share Consolidation”) that (i) every sixteen (16) issued and unissued ordinary shares of the

Company, par value $0.0001 each (the “Ordinary Shares”) be consolidated into one (1) ordinary share par value $0.0016 each

and (ii) every sixteen (16) issued and unissued preferred shares of the Company, par value $0.0001 each (the “Preferred Shares”)

be consolidated into one (1) preferred share, par value $0.0016 each. Immediately following the Share Consolidation, the shareholders

of the Company approved by an ordinary resolution of share capital increase that the authorized share capital of the Company be increased

to $800,000 divided into 500,000,000 shares of which (x) 450,000,000 shares are designated as ordinary shares with a nominal or par value

of $0.0016 per share, and (y) 50,000,000 shares are designated as preferred shares with a nominal or par value of $0.0016 per share (the

“Share Capital Increase”). At the Meeting, the shareholders of the Company also approved by a special resolution the third

amended and restated memorandum and articles of association of the Company to reflect the Share Consolidation and the Share Capital Increase.

The Company’s ordinary

shares will begin to trade on the NASDAQ Stock Market on the post-consolidation basis under the symbol “JWEL” on October 27,

2023. The new CUSIP number for the Company’s Ordinary Shares post-consolidation is G5194C 119.

The Share Consolidation

is primarily being effectuated to regain compliance with Nasdaq Marketplace Rule 5550(a)(2) related to the minimum bid price per share

of the Company’s ordinary shares.

The Company's shareholders

will receive one post-consolidation ordinary share or preferred share for every sixteen pre-consolidation ordinary shares or preferred

shares held by them. Immediately after the Share Consolidation, each shareholder’s percentage ownership interest in the Company

and proportional voting power will remain unchanged, except for minor changes and adjustments that will result from the treatment of fractional

shares. The rights of the holders of ordinary shares and preferred shares will be substantially unaffected by the Share Consolidation.

No fractional shares will be issued in connection with the Share Consolidation, and all such fractional shares will be round up to the

nearest whole number of shares following or as a result of the Share Consolidation. Shareholders who are holding their shares in electronic

form at brokerage firms do not need to take any action, as the effect of the Share Consolidation will automatically be reflected in their

brokerage accounts.

About Jowell Global Ltd.

Jowell Global Ltd. (the “Company”)

is one of the leading cosmetics, health and nutritional supplements and household products e-commerce platforms in China. We offer our

own brand products to customers and also sell and distribute health and nutritional supplements, cosmetic products and certain household

products from other companies on our platform. In addition, we allow third parties to open their own stores on our platform for a service

fee based upon sale revenues generated from their online stores and we provide them with our unique and valuable information about market

needs, enabling them to better manage their sales effort, as well as an effective platform to promote their brands. The Company also sells

its products through authorized retail stores all across China, which operate under the brand names of “Love Home Store” or

“LHH Store” and “Juhao Best Choice Store”. For more information, please visit http://ir.1juhao.com/

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act

of 1995. Statements that are not historical facts, including statements about the Company's beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to

differ materially from those contained in any forward-looking statement. In some cases, forward-looking statements can be identified by

words or phrases such as "may," "will," "expect," "anticipate," "target," "aim,"

"estimate," "intend," "plan," "believe," "potential," "continue," "is/are

likely to" or other similar expressions. The Company may also make written or oral forward-looking statements in its reports filed

with, or furnished to, the U.S. Securities and Exchange Commission, in its annual reports to shareholders, in press releases and other

written materials and in oral statements made by its officers, directors or employees to third parties. These statements are subject to

uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future

business development; financial condition and results of operations; product and service demand and acceptance; reputation and brand;

the impact of competition and pricing; changes in technology; government regulations; fluctuations in general economic and business conditions

in China and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with

the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this

press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov.

The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise

after the date hereof.

For investor and media inquiries, please contact:

Jowell Global Ltd.

Ms. Jessie Zhao

Email: IR@1juhao.com

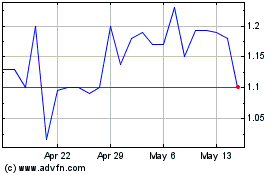

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jowell Global (NASDAQ:JWEL)

Historical Stock Chart

From Jan 2024 to Jan 2025