Katapult Holdings, Inc. (“Katapult” or the “Company”) (NASDAQ:

KPLT), an e-commerce-focused financial technology company, today

reported its financial results for the second quarter ended June

30, 2022.

Second Quarter 2022 Financial and Operational

Highlights:

- Recorded total revenue of $53.0 million in second quarter 2022

compared to $77.5 million in the prior year, a decrease of $24.5

million. $8.0 million of this decline was attributable to the

Company’s adoption of ASC 842 as of January 1, 2022.

- Added 42 new merchants in the second quarter 2022.

- Continued high customer satisfaction with Net Promoter Score of

60 as of June 30, 2022. More than 52% of gross originations for

second quarter 2022 came from repeat customers (customers who have

originated more than one lease with Katapult over their

lifetime).

- Continued targeted tightening of our underwriting processes in

Q2 2022.

- Ended Q2 2022 with $85.0 million of unrestricted cash on the

balance sheet and $69.3 million available on the asset-backed

revolving line of credit.

“Though our retailers and consumers continue facing near-term

macro headwinds, we are confident in our long-term ability to

weather these challenges. We continue to execute on the initiatives

that we committed to as part of our strategic growth plan and are

building momentum as it relates to capturing new volume

opportunities from a very large addressable market,” said Orlando

Zayas, CEO of Katapult.

Second Quarter 2022 Results

(Comparisons are to the respective periods of the prior year

unless otherwise noted.)

The Company recorded second quarter revenue of $53.0 million,

which was down $24.5 million compared to the second quarter of the

prior year. Gross originations for the second quarter were $46.4

million, a 28% decline from the prior year due to ongoing macro

challenges, including record levels of inflation, ongoing supply

chain headwinds and the end of government stimulus, which have led

to declining consumer confidence and spending, combined with the

Company proactively tightening lease underwriting in response to

credit performance normalizing.

Net loss was $9.7 million for the second quarter 2022, including

a $2.3 million revaluation gain related to our warrants. Adjusted

net loss was $10.2 million for the second quarter, which is down

from adjusted net income of $1.5 million in the prior year period.

Adjusted EBITDA was $(5.3) million for the second quarter 2022,

down from $3.9 million in the prior year period, which reflects

lower lease margins year-over-year and higher general and

administrative expense from public company costs and higher

marketing spend in the second quarter of 2022.

Katapult CEO, Orlando Zayas, Katapult CFO, Karissa Cupito, and

Katapult COO, Derek Medlin will discuss the Company’s performance,

outlook and overall growth strategy in greater detail on the

company's earnings conference call and webcast.

Conference Call and Webcast

Katapult will host a conference call and webcast at 8:00 AM ET

on August 9, 2022 to discuss these financial results, our current

outlook and our growth strategy.

A live audio webcast of the event will be available on the

Katapult Investor Relations website at

http://ir.katapultholdings.com/. A copy of the earnings call

presentation will also be posted to our website.

A live dial-in will be available at (800) 715-9871 (domestic) or

(646) 307-1963 (international). The conference ID number is

4225698. Shortly after the conclusion of the call, a replay of this

conference call will be available on the Katapult Investor

Relations website at

https://ir.katapultholdings.com/news-events/investor-calendar.

About Katapult

Katapult is a next generation platform for digital and

mobile-first commerce for the non-prime consumer. Katapult provides

point of sale lease purchase options for consumers challenged with

accessing traditional financial products who are seeking to obtain

everyday durable goods. The Company has developed a sophisticated

end-to-end technology platform that enables seamless integration

with merchants, underwriting capabilities that exceed the industry

standard, and exceptional customer experiences.

Forward-Looking Statements

Certain statements included in this Press Release that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook,” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding our ability to weather the macroeconomic

headwinds and our momentum in building volume opportunities in our

addressable market. These statements are based on various

assumptions, whether or not identified in this Press Release, and

on the current expectations of Katapult’s management and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the

control of Katapult. These forward-looking statements are subject

to a number of risks and uncertainties, including execution of

Katapult’s business strategy, including launching new product

offerings, new brand and expanding information and technology

capabilities; Katapult’s market opportunity and its ability to

acquire new customers and retain existing customers; the timing and

impact of our growth initiatives on our future financial

performance and the impact of our new executive hires and brand

strategy; anticipated occurrence and timing of prime lending

tightening and impact on our results of operations; general

economic conditions in the markets where Katapult operates, the

cyclical nature of consumer spending, and seasonal sales and

spending patterns of customers; failure to realize the anticipated

benefits of the business combination with FinServ Acquisition Corp.

(the “Merger”); risks relating to factors affecting consumer

spending that are not under Katapult’s control, including, among

others, levels of employment, disposable consumer income,

inflation, prevailing interest rates, consumer debt and

availability of credit, pandemics (such as COVID-19), consumer

confidence in future economic conditions and political conditions,

and consumer perceptions of personal well-being and security; risks

relating to uncertainty of Katapult’s estimates of market

opportunity and forecasts of market growth; risks related to the

concentration of a significant portion of our transaction volume

with a single merchant partner, or type of merchant or industry;

the effects of competition on Katapult’s future business; the

impact of the COVID-19 pandemic and its effect on Katapult’s

business; unstable market and economic conditions, including as a

result of the conflict involving Russia and Ukraine; reliability of

Katapult’s platform and effectiveness of its risk model; protection

of confidential, proprietary or sensitive information, including

confidential information about consumers, and privacy or data

breaches, including by cyber-attacks or similar disruptions;

ability to attract and retain employees, executive officers or

directors; meeting future liquidity requirements and complying with

restrictive covenants related to long-term indebtedness;

effectively respond to general economic and business conditions;

obtain additional capital, including equity or debt financing;

enhance future operating and financial results; anticipate rapid

technological changes; comply with laws and regulations applicable

to Katapult’s business, including laws and regulations related to

rental purchase transactions; stay abreast of modified or new laws

and regulations applying to Katapult’s business, including rental

purchase transactions and privacy regulations; maintain

relationships with merchant partners; respond to uncertainties

associated with product and service developments and market

acceptance; anticipate the impact of new U.S. federal income tax

law; that Katapult has identified material weaknesses in its

internal control over financial reporting which, if not remediated,

could affect the reliability of its consolidated financial

statements; successfully defend litigation; litigation, regulatory

matters, complaints, adverse publicity and/or misconduct by

employees, vendors and/or service providers; and other events or

factors, including those resulting from civil unrest, war, foreign

invasions (including the conflict involving Russia and Ukraine),

terrorism, or public health crises, or responses to such

events); and those factors discussed in greater detail

in the section entitled “Risk Factors” in Katapult’s periodic

reports filed with the Securities and Exchange Commission (“SEC”),

including Katapult’s Quarterly Report on Form 10-Q for the quarter

ended March 31, 2022 and the Quarterly Report on Form 10-Q Katapult

intends to file for the quarter ended June 30, 2022.

If any of these risks materialize or our assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Katapult does not presently know or that

Katapult currently believes are immaterial that could also cause

actual results to differ from those contained in the

forward-looking statements. Undue reliance should not be placed on

the forward-looking statements in this Press Release. All

forward-looking statements contained herein are based on

information available to Katapult as of the date hereof, and

Katapult does not assume any obligation to update these statements

as a result of new information or future events, except as required

by law.

Key Performance Metrics

Katapult regularly reviews several metrics, including the

following key metrics, to evaluate its business, measure its

performance, identify trends affecting our business, formulate

financial projections and make strategic decisions, which may also

be useful to an investor: Gross Originations, Total Revenue,

Unearned Revenue and Gross Profit.

Gross Originations are defined as the retail price of the

merchandise associated with lease-purchase agreements entered into

during the period through the Katapult platform. Gross Originations

do not represent revenue earned. However, we believe this is a

useful operating metric for both Katapult’s management and

investors to use in assessing the volume of transactions that take

place on Katapult’s platform.

Total revenue represents the summation of rental revenue and

other revenue. Unearned revenue represents the Company’s liability

for cash received from customers prior to the related revenue being

earned. Katapult measures these metrics to assess the total view of

paythrough performance of its customers. Management believes

looking at these components is useful to an investor as it helps to

understand the total payment performance of customers. In

connection with the adoption of ASU No. 2016-02, Leases (Topic

842), as amended (“ASC 842”), effective January 1, 2022, Katapult

recognizes revenue from customers (rental revenue) when the revenue

is earned and the cash is collected. Accordingly, the Company no

longer records rental revenue arising from lease payments earned

but not yet collected or any corresponding bad debt expense, or

disclose bad debt recoveries in its periodic reports starting in

the first quarter of 2022.

Gross profit represents total revenue less cost of revenue, and

is a measure presented in accordance with generally accepted

accounting principles in the United States ("GAAP"). See the

“Non-GAAP Financial Measures” section below for a presentation of

this measure alongside adjusted gross profit, which is a non-GAAP

measure utilized by management.

Non-GAAP Financial Measures

To supplement the financial measures presented in this press

release and related conference call or webcast in accordance with

GAAP, the Company also presents the following non-GAAP and other

measures of financial performance: adjusted gross profit, adjusted

EBITDA, and adjusted net (loss) income. The Company urges investors

to consider non-GAAP measures only in conjunction with its GAAP

financials and to review the reconciliation of the Company’s

non-GAAP financial measures to its comparable GAAP financial

measures, which are included in this press release.

Adjusted gross profit represents gross profit less variable

operating expenses, which are servicing costs, underwriting fees,

and bad debt expense. Management believes that adjusted gross

profit provides a meaningful understanding of one aspect of its

performance specifically attributable to total revenue and the

variable costs associated with total revenue.

Adjusted EBITDA is a non-GAAP measure that is defined as net

loss before interest expense and other fees, change in fair value

of warrant liability, (provision) benefit for income taxes,

depreciation and amortization on property and equipment and

capitalized software, impairment of leased assets, stock-based

compensation expense, and transaction costs associated with the

Merger.

Adjusted net (loss) income is a non-GAAP measure that is defined

as net loss before change in fair value of warrant liability,

stock-based compensation expense and transaction costs associated

with the Merger.

Adjusted gross profit, adjusted EBITDA and adjusted net (loss)

income are useful to an investor in evaluating the Company’s

performance because these measures:

• Are widely used to measure a company’s operating

performance;

• Are financial measurements that are used by rating agencies,

lenders and other parties to evaluate the Company’s credit

worthiness; and

• Are used by the Company’s management for various purposes,

including as measures of performance and as a basis for strategic

planning and forecasting.

Management believes the use of non-GAAP financial measures, as a

supplement to GAAP measures, is useful to investors in that they

eliminate items that are either not part of our core operations or

do not require a cash outlay, such as stock-based compensation

expense. Management uses these non-GAAP financial measures when

evaluating operating performance and for internal planning and

forecasting purposes. Management believes that these non-GAAP

financial measures help indicate underlying trends in the business,

are important in comparing current results with prior period

results, and are useful to investors and financial analysts in

assessing operating performance. However, these non-GAAP measures

exclude items that are significant in understanding and assessing

Katapult’s financial results or position. Therefore, these measures

should not be considered in isolation or as alternatives to

revenue, net (loss) income, cash flows from operations or other

measures of profitability, liquidity or performance under GAAP. You

should be aware that Katapult’s presentation of these measures may

not be comparable to similarly titled measures used by other

companies.

ASC 842 Adoption

The Company was required to adopt ASC 842 relating to lessor

accounting, effective January 1, 2022. The Company's lease-to-own

agreements, which comprise the majority of the Company’s revenue,

fall within the scope of ASC 842 and are impacted by this change.

As a result of the adoption, the Company now recognizes revenue

from customers when revenue is earned and cash is collected instead

of on an accrual basis, which it has done historically. The Company

has adopted ASC 842 using the transition method, which permits the

Company to not apply ASC 842 for comparative periods in the year of

adoption. As a result, the Company is not recasting or restating

2021 or prior periods to conform to ASC 842. The adoption of ASC

842 is reflected in the Company’s financial statements and related

notes and periodic reports filed with the SEC beginning with the

Company’s quarterly report on Form 10-Q for the quarter ended March

31, 2022.

For illustrative purposes only, the Company is disclosing total

revenue, bad debt expense (net of recoveries) and income (loss)

before provision for income taxes for each quarter during years

ended December 31, 2021 and 2020, respectively, as if the lessor

accounting impacts of ASC 842 were in effect for these periods.

“Total revenue”, “bad debt expense (net of recoveries)” and “income

before provision for income taxes” for 2021 and 2020 are

supplemental disclosures that are not calculated in accordance with

GAAP in place during these periods.

Management believes the supplemental information showing the

impact of ASC 842 for 2021 and 2020 provides relevant and useful

information for users of the Company’s financial statements, as it

provides comparability with the financial results the Company is

reporting beginning in 2022 when ASC 842 became effective and the

Company began to recognize revenue from customers when the revenue

is earned and cash is collected. Upon adoption, the Company no

longer records accounts receivable arising from lease receivables

due from customers incurred during the normal course of business

for lease payments earned but not yet received from the customer or

any corresponding allowance for doubtful accounts.

Contacts

Katapult Vice President of Investor RelationsBill

Wright917-750-0346bill.wright@katapult.com

Press Inquiries:Allison +

Partners908-566-2090katapult@allisonpr.com

KATAPULT HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(UNAUDITED)(amounts in thousands, except share and per

share amounts)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue |

|

|

|

|

|

|

|

|

Rental revenue |

$ |

53,020 |

|

|

$ |

77,237 |

|

|

$ |

112,851 |

|

|

$ |

157,862 |

|

|

Other revenue |

|

19 |

|

|

|

232 |

|

|

|

66 |

|

|

|

242 |

|

|

Total revenue |

|

53,039 |

|

|

|

77,469 |

|

|

|

112,917 |

|

|

|

158,104 |

|

| Cost of revenue |

|

44,849 |

|

|

|

55,922 |

|

|

|

92,962 |

|

|

|

108,804 |

|

| Gross profit |

|

8,190 |

|

|

|

21,547 |

|

|

|

19,955 |

|

|

|

49,300 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Servicing costs |

|

1,131 |

|

|

|

1,072 |

|

|

|

2,337 |

|

|

|

2,210 |

|

|

Underwriting fees |

|

423 |

|

|

|

477 |

|

|

|

910 |

|

|

|

944 |

|

|

Professional and consulting fees |

|

2,259 |

|

|

|

1,324 |

|

|

|

5,547 |

|

|

|

2,858 |

|

|

Technology and data analytics |

|

2,455 |

|

|

|

2,344 |

|

|

|

4,864 |

|

|

|

3,893 |

|

|

Bad debt expense |

|

— |

|

|

|

8,026 |

|

|

|

— |

|

|

|

12,913 |

|

|

Compensation costs |

|

6,470 |

|

|

|

14,755 |

|

|

|

11,847 |

|

|

|

17,337 |

|

|

General and administrative |

|

3,649 |

|

|

|

2,503 |

|

|

|

7,459 |

|

|

|

3,686 |

|

|

Total operating expenses |

|

16,387 |

|

|

|

30,501 |

|

|

|

32,964 |

|

|

|

43,841 |

|

| (Loss) income from

operations |

|

(8,197 |

) |

|

|

(8,954 |

) |

|

|

(13,009 |

) |

|

|

5,459 |

|

|

Interest expense and other fees |

|

(3,794 |

) |

|

|

(4,146 |

) |

|

|

(7,594 |

) |

|

|

(8,286 |

) |

|

Change in fair value of warrant liability |

|

2,323 |

|

|

|

3,169 |

|

|

|

5,412 |

|

|

|

2,811 |

|

| Loss before income taxes |

|

(9,668 |

) |

|

|

(9,931 |

) |

|

|

(15,191 |

) |

|

|

(16 |

) |

|

(Provision) benefit for income taxes |

|

(65 |

) |

|

|

1,828 |

|

|

|

(100 |

) |

|

|

3 |

|

| Net loss |

$ |

(9,733 |

) |

|

$ |

(8,103 |

) |

|

$ |

(15,291 |

) |

|

$ |

(13 |

) |

| Net loss per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.10 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.16 |

) |

|

$ |

— |

|

|

Diluted |

$ |

(0.10 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.16 |

) |

|

$ |

— |

|

| Weighted average shares used

in computing net loss per share: |

|

|

|

|

|

|

|

|

Basic |

|

97,944,724 |

|

|

|

46,989,376 |

|

|

|

98,036,263 |

|

|

|

39,274,794 |

|

|

Diluted |

|

97,944,724 |

|

|

|

46,989,376 |

|

|

|

98,036,263 |

|

|

|

39,274,794 |

|

KATAPULT HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(amounts in thousands, except share and per share

amounts)

| |

June 30, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| ASSETS |

(Unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash |

$ |

85,025 |

|

|

$ |

92,494 |

|

|

Restricted cash |

|

2,229 |

|

|

|

3,937 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$6,248 at December 31, 2021 |

|

— |

|

|

|

2,007 |

|

|

Property held for lease, net of accumulated depreciation and

impairment |

|

45,935 |

|

|

|

61,752 |

|

|

Prepaid expenses and other current assets |

|

4,646 |

|

|

|

4,249 |

|

|

Total current assets |

|

137,835 |

|

|

|

164,439 |

|

| Property and equipment,

net |

|

636 |

|

|

|

576 |

|

| Security deposits |

|

91 |

|

|

|

91 |

|

| Capitalized software and

intangible assets, net |

|

1,687 |

|

|

|

1,056 |

|

| Right-of-use assets |

|

960 |

|

|

|

— |

|

|

Total assets |

$ |

141,209 |

|

|

$ |

166,162 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,752 |

|

|

$ |

2,029 |

|

|

Accrued liabilities |

|

10,914 |

|

|

|

11,959 |

|

|

Unearned revenue |

|

1,623 |

|

|

|

2,135 |

|

|

Lease liabilities |

|

439 |

|

|

|

— |

|

|

Total current liabilities |

|

14,728 |

|

|

|

16,123 |

|

| Revolving line of credit |

|

55,183 |

|

|

|

61,238 |

|

| Long term debt |

|

42,461 |

|

|

|

40,661 |

|

| Other liabilities |

|

1,929 |

|

|

|

7,341 |

|

| Lease liabilities,

non-current |

|

600 |

|

|

|

— |

|

|

Total liabilities |

|

114,901 |

|

|

|

125,363 |

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

Common stock, $.0001 par value-- 250,000,000 shares authorized;

98,334,413 and 97,574,171 shares issued and outstanding at June 30,

2022 and December 31, 2021, respectively |

|

10 |

|

|

|

10 |

|

|

Additional paid-in capital |

|

80,394 |

|

|

|

77,632 |

|

|

Accumulated deficit |

|

(54,096 |

) |

|

|

(36,843 |

) |

|

Total stockholders' equity |

|

26,308 |

|

|

|

40,799 |

|

|

Total liabilities and stockholders' equity |

$ |

141,209 |

|

|

$ |

166,162 |

|

KATAPULT HOLDINGS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)(amounts in thousands)

| |

Six Months Ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from operating

activities: |

|

|

|

|

Net loss |

$ |

(15,291 |

) |

|

$ |

(13 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

|

62,438 |

|

|

|

73,160 |

|

|

Net book value of property buyouts |

|

19,040 |

|

|

|

22,836 |

|

|

Impairment expense |

|

7,490 |

|

|

|

7,721 |

|

|

Bad debt expense |

|

— |

|

|

|

12,913 |

|

|

Change in fair value of warrants liability |

|

(5,412 |

) |

|

|

(2,811 |

) |

|

Stock-based compensation |

|

2,946 |

|

|

|

9,766 |

|

|

Amortization of debt discount |

|

1,015 |

|

|

|

1,390 |

|

|

Amortization of debt issuance costs |

|

181 |

|

|

|

179 |

|

|

Accrued PIK Interest |

|

785 |

|

|

|

760 |

|

|

Amortization of right-of-use assets |

|

179 |

|

|

|

— |

|

|

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

— |

|

|

|

(13,475 |

) |

|

Property held for lease |

|

(72,844 |

) |

|

|

(105,251 |

) |

|

Prepaid expenses and other current assets |

|

(397 |

) |

|

|

(4,667 |

) |

|

Accounts payable |

|

(277 |

) |

|

|

5,813 |

|

|

Accrued liabilities |

|

(899 |

) |

|

|

(1,516 |

) |

|

Lease liabilities |

|

(201 |

) |

|

|

— |

|

|

Unearned revenues |

|

(512 |

) |

|

|

321 |

|

|

Net cash (used in) provided by operating activities |

|

(1,759 |

) |

|

|

7,126 |

|

| Cash flows from investing

activities: |

|

|

|

|

Purchases of property and equipment |

|

(153 |

) |

|

|

(198 |

) |

|

Additions to capitalized software |

|

(845 |

) |

|

|

(423 |

) |

|

Net cash used in investing activities |

|

(998 |

) |

|

|

(621 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Principal repayments on revolving line of credit |

|

(16,171 |

) |

|

|

(7,948 |

) |

|

Principal advances on revolving line of credit, net of issuance

costs |

|

9,935 |

|

|

|

5,809 |

|

|

Repurchases of restricted stock |

|

(244 |

) |

|

|

— |

|

|

Proceeds from exercise of stock options |

|

60 |

|

|

|

442 |

|

|

PIPE proceeds |

|

— |

|

|

|

150,000 |

|

|

Merger financing, net of redemptions |

|

— |

|

|

|

251,109 |

|

|

Consideration paid to selling shareholders |

|

— |

|

|

|

(329,560 |

) |

|

Transaction costs paid |

|

— |

|

|

|

(33,534 |

) |

|

Net cash (used in) provided by financing activities |

|

(6,420 |

) |

|

|

36,318 |

|

| Net (decrease) increase in

cash and restricted cash |

|

(9,177 |

) |

|

|

42,823 |

|

| Cash and restricted cash at

beginning of period |

|

96,431 |

|

|

|

69,597 |

|

| Cash and restricted cash at

end of period |

$ |

87,254 |

|

|

$ |

112,420 |

|

| |

|

|

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

Cash paid for interest |

$ |

5,200 |

|

|

$ |

5,868 |

|

|

Cash paid for income taxes |

$ |

362 |

|

|

$ |

— |

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities |

$ |

1,139 |

|

|

$ |

— |

|

|

Cash paid for operating leases |

$ |

254 |

|

|

$ |

— |

|

|

Assumed warrant liability in connection with the Merger |

$ |

— |

|

|

$ |

44,272 |

|

|

Exercise of common stock warrant accounted for as a liability |

$ |

— |

|

|

$ |

13,102 |

|

KATAPULT HOLDINGS,

INC.RECONCILIATION OF NON-GAAP MEASURES AND

CERTAIN OTHER DATA (UNAUDITED)(amounts in

thousands)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

53,039 |

|

$ |

77,469 |

|

$ |

112,917 |

|

$ |

158,104 |

|

Cost of revenue |

|

44,849 |

|

|

55,922 |

|

|

92,962 |

|

|

108,804 |

|

Gross profit |

|

8,190 |

|

|

21,547 |

|

|

19,955 |

|

|

49,300 |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Servicing costs |

|

1,131 |

|

|

1,072 |

|

|

2,337 |

|

|

2,210 |

|

Underwriting fees |

|

423 |

|

|

477 |

|

|

910 |

|

|

944 |

|

Bad debt expense |

|

— |

|

|

8,026 |

|

|

— |

|

|

12,913 |

|

Adjusted gross profit |

$ |

6,636 |

|

$ |

11,972 |

|

$ |

16,708 |

|

$ |

33,233 |

| (in thousands) |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net loss |

$ |

(9,733 |

) |

|

$ |

(8,103 |

) |

|

$ |

(15,291 |

) |

|

$ |

(13 |

) |

|

Add back: |

|

|

|

|

|

|

|

|

Interest expense and other fees |

|

3,794 |

|

|

|

4,146 |

|

|

|

7,594 |

|

|

|

8,286 |

|

|

Change in fair value of warrant liability |

|

(2,323 |

) |

|

|

(3,169 |

) |

|

|

(5,412 |

) |

|

|

(2,811 |

) |

|

Provision (benefit) for income taxes |

|

65 |

|

|

|

(1,828 |

) |

|

|

100 |

|

|

|

(3 |

) |

|

Depreciation and amortization on property and equipment |

|

186 |

|

|

|

70 |

|

|

|

308 |

|

|

|

118 |

|

|

Impairment of leased assets |

|

866 |

|

|

|

(15 |

) |

|

|

315 |

|

|

|

(640 |

) |

|

Stock-based compensation expense (1) |

|

1,857 |

|

|

|

10,140 |

|

|

|

2,946 |

|

|

|

10,221 |

|

|

Transaction costs associated with Merger (2) |

|

— |

|

|

|

2,675 |

|

|

|

— |

|

|

|

3,350 |

|

| Adjusted EBITDA |

$ |

(5,288 |

) |

|

$ |

3,916 |

|

|

$ |

(9,440 |

) |

|

$ |

18,508 |

|

(1) Includes employer payroll taxes.(2) Consists of

non-capitalizable transaction cost associated with the Merger

during the three and six months ended June 30, 2021.

| (in thousands) |

Three Months Ended June 30, |

Six Months Ended June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

| Net loss |

$ |

(9,733 |

) |

|

$ |

(8,103 |

) |

$ |

(15,291 |

) |

|

$ |

(13 |

) |

|

Add back: |

|

|

|

|

|

|

|

Change in fair value of warrant liability |

|

(2,323 |

) |

|

|

(3,169 |

) |

|

(5,412 |

) |

|

|

(2,811 |

) |

|

Stock-based compensation expense (1) |

|

1,857 |

|

|

|

10,140 |

|

|

2,946 |

|

|

|

10,221 |

|

|

Transaction costs associated with Merger (2) |

|

— |

|

|

|

2,675 |

|

|

— |

|

|

|

3,350 |

|

| Adjusted net (loss)

income |

$ |

(10,199 |

) |

|

$ |

1,543 |

|

$ |

(17,757 |

) |

|

$ |

10,747 |

|

(1) Includes employer payroll taxes.(2) Consists of

non-capitalizable transaction cost associated with the Merger

during the three and six months ended June 30, 2021.

CERTAIN KEY PERFORMANCE METRICS

| |

Three Months Ended June 30, |

Six Months Ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

2022 |

|

|

2021 |

| Total revenue |

$ |

53,039 |

|

$ |

77,469 |

$ |

112,917 |

|

$ |

158,104 |

If ASC 842 was effective for the three and six

months ended June 30, 2021, total revenue would have been

$69,472 and $147,030, respectively.

KATAPULT HOLDINGS,

INC.GROSS ORIGINATIONS BY QUARTER

| ($ millions) |

|

Gross Originations by Quarter |

| |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

FY 2022 |

|

$ |

46.7 |

|

$ |

46.4 |

|

$ |

— |

|

$ |

— |

|

FY 2021 |

|

$ |

63.8 |

|

$ |

64.4 |

|

$ |

61.0 |

|

$ |

58.9 |

|

FY 2020 |

|

$ |

37.2 |

|

$ |

77.6 |

|

$ |

60.5 |

|

$ |

61.1 |

KATAPULT HOLDINGS,

INCIMPACT OF ADOPTION OF ASC

842FOR ILLUSTRATIVE PURPOSES

ONLY(UNAUDITED)

| |

Three Months Ended |

| |

|

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

March 31, 2021 |

|

December 31, 2020 |

September 30, 2020 |

June 30, 2020 |

March 31, 2020 |

| As

Reported: |

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

73,299 |

$ |

71,710 |

$ |

77,469 |

|

$ |

80,635 |

|

$ |

73,358 |

$ |

71,194 |

$ |

60,014 |

$ |

42,634 |

| Bad debt expense (net of

recoveries) |

|

|

9,450 |

|

5,936 |

|

8,026 |

|

|

4,887 |

|

|

6,450 |

|

3,931 |

|

2,548 |

|

3,134 |

| Income (loss) before provision

for income taxes |

|

$ |

7,213 |

$ |

14,548 |

$ |

(9,931 |

) |

$ |

9,915 |

|

$ |

3,996 |

$ |

10,073 |

$ |

5,199 |

$ |

3,749 |

| |

|

|

|

|

|

|

|

|

|

|

| Supplemental

Information - Impact of ASC 842: |

|

|

|

|

|

|

|

|

|

|

| Total revenue under ASC

842 |

|

$ |

64,253 |

$ |

66,277 |

$ |

69,472 |

|

$ |

77,558 |

|

$ |

67,060 |

$ |

67,410 |

$ |

59,721 |

$ |

39,428 |

| Bad debt expense (net of

recoveries) under ASC 842 |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

— |

|

— |

| Income (loss) before provision

for income taxes under ASC 842 |

|

$ |

7,617 |

$ |

15,051 |

$ |

(9,902 |

) |

$ |

11,725 |

|

$ |

4,149 |

$ |

10,220 |

$ |

7,454 |

$ |

3,677 |

*Total revenue under ASC 842 also reflects the impact of the

change in recognizing revenue when it is earned and cash is

collected.

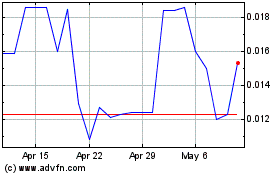

Katapult (NASDAQ:KPLTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Katapult (NASDAQ:KPLTW)

Historical Stock Chart

From Apr 2023 to Apr 2024