false000071973300007197332023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) October 31, 2023

Key Tronic Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| | | |

| Washington | | 0-11559 | 91-0849125 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | (IRS Employer

Identification No.) |

| |

| 4424 North Sullivan Road | Spokane Valley, | Washington | 99216 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (509) 928-8000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provision (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, no par value | KTCC | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

|

|

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On October 31, 2023, Key Tronic Corporation issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K including the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference into any filing of Key Tronic Corporation under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)Exhibits

| | | | | | | | |

| | |

| Exhibit Number | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SAFE HARBOR STATEMENT. Statements contained in the Exhibit to this report that state Key Tronic Corporation's or its management's expectations or predictions of the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. Key Tronic Corporation's actual results could differ materially from those projected in such forward-looking statements. Factors that could affect those results include those mentioned in the Exhibit to this report and the documents that Key Tronic Corporation has filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | KEY TRONIC CORPORATION (Registrant) |

| Date: October 31, 2023 | | | | | | |

| | | |

| | | | By: | | /s/ Brett R. Larsen |

| | | | | | Brett R. Larsen, Executive Vice President

of Administration, CFO and Treasurer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

| | | | | | | | | | | | | | |

| | | | |

| CONTACTS: | | Brett Larsen | | Michael Newman |

| | Chief Financial Officer | | Investor Relations |

| | Key Tronic Corporation | | StreetConnect |

| | (509) 927-5500 | | (206) 729-3625 |

KEY TRONIC CORPORATION ANNOUNCES RESULTS

FOR THE FIRST QUARTER OF FISCAL YEAR 2024

Year-over-Year Revenue Up 8%; New Program Wins

Spokane Valley, WA— October 31, 2023 — Key Tronic Corporation (Nasdaq: KTCC), a provider of electronic manufacturing services (EMS), today announced its results for the quarter ended September 30, 2023. These results are in line with the preliminary results announced on October 24, 2023.

For the first quarter of fiscal year 2024, Keytronic reported total revenue of $147.8 million, up 8% from $137.3 million in the same period of fiscal year 2023. The Company’s gross margin for the first quarter of 2024 was 7.4% and operating margin was 2.2%, compared to a gross margin of 7.6% and an operating margin of 2.4% in the same period of fiscal 2023. For the first quarter of fiscal 2024, net income was $0.3 million or $0.03 per share, compared to $1.2 million or $0.11 per share for the same period of fiscal 2023.

The year-over-year decline in earnings was primarily a result of unanticipated severance costs of $0.6 million, or approximately $0.04 to $0.05 per diluted share, as the Company reduced its workforce by over 100 employees in Mexico and the US. The workforce reduction reflects softening demand for a number of different programs and is expected to reduce operating expenses by more than $5 million annually. Keytronic also continued to be adversely impacted by high interest expense and the strength of the Mexican Peso, although the Mexican Peso has weakened during the second quarter.

“During first quarter of fiscal year 2024, we continued to ramp many new programs produced in our US facilities and remained profitable, despite a softening of customer demand for our Mexico-based programs,” said Craig Gates, President and Chief Executive Officer. “As previously announced, the large program with a leading power equipment company is now expected to resume materially in fiscal 2025 rather than 2024, with a redesigned product.”

“At the same time, we continued to expand our customer base during the first quarter and won new programs involving security equipment, sporting goods, environmental solutions, and industrial control systems. We’re also seeing some gradual improvement in our gross margins and have continued to reduce our inventories to be more in line with current revenue levels, as well as reducing our accounts payable, leasing obligations and overall debt in the quarter.”

“In the second half of fiscal year 2024, we expect increased demand for many of our Mexico-based programs. Overall, we continue to see the favorable trend of contract manufacturing returning to North America, as well as a growing number of potential customers evaluating a migration of their China-based manufacturing to our facility in Vietnam.”

The financial data presented for first quarter of fiscal year 2024 should be considered preliminary and could be subject to change, as the Company’s independent auditor has not completed their review procedures.

Business Outlook

For the second quarter of fiscal 2024, Keytronic expects to report revenue in the range of $135 million to $145 million and earnings in the range of $0.05 to $0.10 per diluted share. These expected results assume an effective tax rate of 20% in the coming quarter.

Conference Call

Keytronic will host a conference call to discuss its financial results at 2:00 PM Pacific (5:00 PM Eastern) today. A broadcast of the conference call will be available at www.keytronic.com under “Investor Relations” or by calling 888-254-3590 or +1-323-794-2551 (Access Code: 5128668). A replay will be available at www.keytronic.com under “Investor Relations”.

About Keytronic

Keytronic is a leading contract manufacturer offering value-added design and manufacturing services from its facilities in the United States, Mexico, China and Vietnam. The Company provides its customers full engineering services, materials

management, worldwide manufacturing facilities, assembly services, in-house testing, and worldwide distribution. Its customers include some of the world’s leading original equipment manufacturers. For more information about Keytronic visit: www.keytronic.com.

Forward-Looking Statements

Some of the statements in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to those including such words as aims, anticipates, believes, continues, estimates, expects, hopes, intends, plans, predicts, projects, targets, or will, similar verbs, or nouns corresponding to such verbs, which may be forward looking. Forward-looking statements also include other passages that are relevant to expected future events, performances, and actions or that can only be fully evaluated by events that will occur in the future. Forward-looking statements in this release include, without limitation, the Company’s statements regarding its expectations with respect to financial conditions and results, including revenue and earnings, demand for certain products and the effectiveness of some of our programs, business from customers and programs, and impacts from operational streamlining. There are many factors, risks and uncertainties that could cause actual results to differ materially from those predicted or projected in forward-looking statements, including but not limited to: the future of the global economic environment and its impact on our customers and suppliers; the availability of components from the supply chain; the availability of a healthy workforce; the accuracy of suppliers’ and customers’ forecasts; development and success of customers’ programs and products; timing and effectiveness of ramping of new programs; success of new-product introductions; the risk of legal proceedings or governmental investigations relating to the subject of the internal investigation by the Company’s Audit Committee and related or other unrelated matters; acquisitions or divestitures of operations or facilities; technology advances; changes in pricing policies by the Company, its competitors, customers or suppliers; impact of new governmental legislation and regulation, including tax reform, tariffs and related activities, such trade negotiations and other risks; and other factors, risks, and uncertainties detailed from time to time in the Company’s SEC filings.

KEYTRONIC CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| | Three Months Ended |

| | September 30, 2023 | | October 1, 2022 |

| Net sales | $ | 147,763 | | | $ | 137,263 | |

| Cost of sales | 136,901 | | | 126,884 | |

| Gross profit | 10,862 | | | 10,379 | |

| Research, development and engineering expenses | 2,241 | | | 2,296 | |

| Selling, general and administrative expenses | 5,784 | | | 5,656 | |

| | | |

| Gain on insurance proceeds, net of losses | (431) | | | (934) | |

| Total operating expenses | 7,594 | | | 7,018 | |

| Operating income | 3,268 | | | 3,361 | |

| Interest expense, net | 3,011 | | | 1,887 | |

| Income before income taxes | 257 | | | 1,474 | |

| Income tax (benefit) provision | (78) | | | 322 | |

| Net income | $ | 335 | | | $ | 1,152 | |

| Net income per share — Basic | $ | 0.03 | | | $ | 0.11 | |

| Weighted average shares outstanding — Basic | 10,762 | | | 10,762 | |

| Net income per share — Diluted | $ | 0.03 | | | $ | 0.11 | |

| Weighted average shares outstanding — Diluted | 11,003 | | | 10,832 | |

KEYTRONIC CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | July 1, 2023 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | 3,574 | | | 3,603 | |

| Trade receivables, net of allowance for doubtful accounts of $23 and $23 | | 141,442 | | | 150,600 | |

| Contract assets | | 32,903 | | | 29,925 | |

| Inventories, net | | 126,778 | | | 137,911 | |

| Other | | 22,930 | | | 27,510 | |

| Total current assets | | 327,627 | | | 349,549 | |

| Property, plant and equipment, net | | 28,085 | | | 28,870 | |

Operating lease right-of-use assets, net | | 15,928 | | | 16,202 | |

| Other assets: | | | | |

| Deferred income tax asset | | 13,205 | | | 12,254 | |

| | | | |

| | | | |

| Other | | 7,500 | | | 11,397 | |

| Total other assets | | 20,705 | | | 23,651 | |

| Total assets | | 392,345 | | | 418,272 | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | 101,638 | | | 115,899 | |

| Accrued compensation and vacation | | 11,860 | | | 13,351 | |

| Current portion of debt, net | | 6,196 | | | 7,849 | |

| Other | | 13,330 | | | 14,867 | |

| Total current liabilities | | 133,024 | | | 151,966 | |

| Long-term liabilities: | | | | |

| Term loans | | 6,272 | | | 6,726 | |

| Revolving loan | | 109,517 | | | 114,805 | |

| Operating lease liabilities | | 10,939 | | | 10,317 | |

| Deferred income tax liability | | 324 | | | 274 | |

| Other long-term obligations | | 1,201 | | | 3,567 | |

| Total long-term liabilities | | 128,253 | | | 135,689 | |

| Total liabilities | | 261,277 | | | 287,655 | |

| Shareholders’ equity: | | | | |

| Common stock, no par value—shares authorized 25,000; issued and outstanding 10,762 and 10,762 shares, respectively | | 47,786 | | | 47,728 | |

| Retained earnings | | 83,321 | | | 82,986 | |

| Accumulated other comprehensive income (loss) | | (39) | | | (97) | |

| Total shareholders’ equity | | 131,068 | | | 130,617 | |

| Total liabilities and shareholders’ equity | | 392,345 | | | 418,272 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

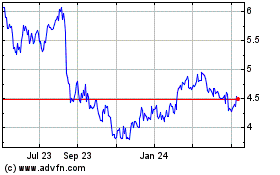

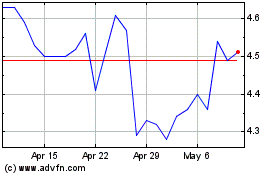

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Apr 2023 to Apr 2024