|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

At

the close of business on April 5, 2019 there were 17,851,664 shares of our common stock outstanding. On April 5, 2019, the closing price of our common stock as reported on the NASDAQ

Global Select Market was $10.21 per share.

Principal stockholders

The

following table provides, to the knowledge of management, information regarding the beneficial ownership of our common stock as of April 5, 2019, or as otherwise noted,

by:

-

•

-

each person known by us to be the beneficial owner of

more than five percent of our common stock;

-

•

-

each of our directors;

-

•

-

each executive officer named in the summary compensation table; and

-

•

-

all of our current directors and executive officers as a group.

|

|

|

|

|

|

|

22

|

|

KVH

Industries,

Inc.

2019

Proxy

Statement

|

|

|

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

persons named in this table have sole voting and investment power with respect to the shares listed, except as otherwise indicated. The inclusion of shares listed as beneficially owned does not

constitute an admission of beneficial ownership. Shares included in the "Right to acquire" column consist of shares that may be purchased through the exercise of options that are vested or will vest

within 60 days after April 5, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares beneficially owned

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding

|

|

Right to

acquire

|

|

Total

|

|

Percent

|

|

|

5% Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

Systematic Financial Management, LP

(1)

300 Frank W. Burr Blvd., Glenpointe East, 7 Floor

Teaneck, NJ 07666

|

|

1,749,727

|

|

|

—

|

|

|

1,749,727

|

|

9.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vintage Capital Management, LLC

(2)

4705 S. Apopka Vineland Road, Suite 206

Orlando, FL 32819

|

|

1,700,000

|

|

|

—

|

|

|

1,700,000

|

|

9.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dimensional Fund Advisors LP

(3)

Building One

6300 Bee Cave Road

Austin, TX 78746

|

|

1,302,048

|

|

|

—

|

|

|

1,302,048

|

|

7.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock, Inc.

(4)

55 East 52 Street

New York, NY 10055

|

|

1,209,227

|

|

|

—

|

|

|

1,209,227

|

|

6.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Needham Investment Management, L.L.C.

(5)

250 Park Avenue, 10th Floor

New York, NY 10117-1099

|

|

1,009,439

|

|

|

—

|

|

|

1,009,439

|

|

5.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin A. Kits van Heyningen

(6)

|

|

819,401

|

|

|

148,922

|

|

|

968,323

|

|

5.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanley K. Honey

(7)

|

|

146,875

|

|

|

2,500

|

|

|

149,375

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark S. Ain

(8)

|

|

143,246

|

|

|

2,500

|

|

|

145,746

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles R. Trimble

(9)

|

|

112,000

|

|

|

2,500

|

|

|

114,500

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce J. Ryan

|

|

100,000

|

|

|

2,500

|

|

|

102,500

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James S. Dodez

(10)

|

|

38,781

|

|

|

1,250

|

|

|

40,031

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Named Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

Brent C. Bruun

|

|

118,339

|

|

|

25,736

|

|

|

144,075

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald W. Reilly

|

|

32,070

|

|

|

—

|

|

|

32,070

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All current directors and executive officers as a group

(14 persons)

(11)

|

|

1,801,509

|

|

|

241,772

|

|

|

2,043,281

|

|

11.3

|

|

|

|

|

|

|

|

|

|

|

|

|

-

*

-

Less than one percent.

-

(1)

-

Information is based on a Schedule 13G filed by Systematic Financial Management, L.P. with the SEC on

February 12, 2019. The Schedule 13G states that Systematic Financial Management, L.P. has sole voting power for 1,220,940 shares and sole dispositive power for 1,749,727 shares.

-

(2)

-

Information is based on a Schedule 13G/A filed jointly by Vintage Capital Management, LLC, Kahn Capital

Management, LLC, and Brian R. Kahn with the SEC on January 29, 2018. The Schedule 13G/A indicates that Kahn Capital Management, LLC is a member and majority owner of

Vintage Capital Management, LLC and that Brian R. Kahn is the manager and a member of Vintage Capital Management, LLC and the manager and sole member of Kahn Capital

Management, LLC. The Schedule 13G/A states that each reporting person may be deemed to share voting and dispositive power for all 1,700,000 shares.

-

(3)

-

Information is based on a Schedule 13G/A filed by Dimensional Fund Advisors LP with the SEC on February 8,

2019. The Schedule 13G/A states that Dimensional Fund Advisors LP has sole voting power for 1,245,934 shares and sole dispositive power for 1,302,048 shares.

-

(4)

-

Information is based on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on February 6, 2019. The

Schedule 13G/A states that BlackRock, Inc. has sole voting power for 1,182,760 shares and sole dispositive power for 1,209,227 shares.

-

(5)

-

Information is based on a Schedule 13G/A filed jointly by Needham Investment Management L.L.C., Needham Asset

Management, LLC and George A. Needham with the SEC on February 14, 2019. The Schedule 13G/A indicates that Needham Asset Management, LLC is the managing member of Needham

Investment Management L.L.C. and that George A. Needham is a control person of Needham Asset Management, LLC. The Schedule 13G/A states that each reporting person may be deemed to share

voting and dispositive power for all 1,009,439 shares.

-

(6)

-

Includes 10,870 shares of common stock held by Martin A. Kits van Heyningen's spouse, who is our creative director.

-

(7)

-

Includes 138,000 shares of common stock held in trust for Stanley K. Honey and spouse.

-

(8)

-

Includes 43,000 shares of common stock held in trust for Mark S. Ain.

-

(9)

-

Includes 25,000 shares of common stock held by Charles R. Trimble's spouse.

-

(10)

-

Includes 1,400 shares of common stock held by James S. Dodez's spouse / child.

-

(11)

-

Includes 2,523 shares of common stock held by Daniel R. Conway's spouse.

|

|

|

|

|

|

|

|

|

KVH

Industries,

Inc.

2019

Proxy

Statement

|

|

23

|

Table of Contents

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

Section 16(a)

of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who beneficially own more than ten percent of our common stock to file reports of

ownership and changes in ownership with the SEC. SEC regulations require executive officers, directors and greater-than-ten-percent stockholders to furnish us with copies of all Section 16(a)

forms they file.

Based

solely upon a review of Forms 3, 4, and 5, and amendments thereto, furnished to us with respect to 2018, we believe that all Section 16(a) filing requirements applicable to our

executive officers, directors and greater than-ten-percent stockholders were fulfilled in a timely manner.

24

KVH Industries, Inc. 2019 Proxy Statement

Table of Contents

|

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

|

Director Independence

A majority of our directors are independent directors under the rules of the NASDAQ Stock Market. Our Board of Directors has determined that

our independent directors are Messrs. Ain, Honey, Ryan and Trimble.

Board Meetings

During 2018, our Board of Directors met five times. Each incumbent director attended at least 75% of the total number of meetings held by the

Board and the committees of the Board on which he served during 2018. To the extent reasonably practicable, directors are expected to attend Board meetings, meetings of committees on which they serve,

and our annual meeting of stockholders. Last year, one of the six individuals then serving as directors attended the annual meeting.

Board Leadership Structure

Martin A. Kits van Heyningen currently serves as our President, Chief Executive Officer and Chairman of the Board. The Board has determined

that, at present, combining the positions of Chairman of the Board and Chief Executive Officer serves the best interests of KVH and our stockholders. The Board believes that the CEO's extensive

knowledge of our businesses, expertise and leadership skills make him a more effective Chairman than an independent director.

The

functions of the Board are carried out by the full Board, and when delegated, by the Board committees. The Board has delegated significant authority to the Audit, Compensation and Nominating and

Corporate Governance Committees, each of which is comprised entirely of independent directors. The independent directors typically meet in an executive session at regularly scheduled Board meetings

and additional executive sessions may be convened at any time at the request of a director.

The

independent directors have designated Mr. Ain to serve as our Lead Independent Director. The Lead Independent Director will, among other functions, preside at all meetings of the Board at

which the Chairman is not present and will serve as a liaison between the CEO and the independent directors. The Lead Independent Director also presides at executive sessions of the independent

directors.

Risk Management

Our Board of Directors administers its risk oversight role both directly and through its Committee structure. The Board consists of only six

directors, four of whom are independent directors and one of whom is our President and CEO. Of the four independent directors, three serve on each of the three principal Board committees, which makes

them knowledgeable about the aspects of our business under the jurisdiction of those committees. The Board's Audit Committee meets frequently during the year and discusses with management, our CFO and

our independent auditor: (a) current business trends affecting us; (b) the major risk exposures that we face; (c) the steps management has taken to monitor and control these

risks; and (d) the adequacy of internal controls that could significantly affect our financial statements. The Board also receives regular reports from senior management about business plans

and opportunities, as well as the challenges and risks associated with implementing those plans and taking advantage of new opportunities.

Board Committees

Our Board of Directors has three standing committees: the Audit Committee, the Nominating and Corporate Governance Committee, and the

Compensation Committee. Each member of the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee meets the independence requirements of the NASDAQ Stock

Market for membership on the committees on which he serves. The Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee each have the authority to retain

independent advisors and consultants. We pay the fees and expenses of these advisors. Our Board of Directors has adopted a written charter for each of the Audit Committee, the Nominating and Corporate

Governance Committee and the Compensation Committee. We have made each of these charters available through the Investors Relations page of our website at http://kvh.com/ircharters.

Audit Committee

As of December 31, 2018, our Audit Committee was comprised of Messrs. Ain, Honey, Ryan, and Trimble. Our Audit Committee provides the

opportunity for direct contact between our independent registered public accounting firm and members of the Board of Directors; the auditors report directly to the Committee. The Committee assists the

Board

KVH Industries, Inc. 2019 Proxy Statement

25

Table of Contents

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

in

overseeing the integrity of our financial statements, our compliance with legal and regulatory requirements, our cybersecurity, our independent registered public accounting firm's qualifications

and independence, and the performance of our independent registered public accounting firm. The Committee is directly responsible for appointing, compensating, evaluating and, when necessary,

terminating our independent registered public accounting firm. Our Audit Committee has established procedures for the treatment of complaints regarding accounting, internal accounting controls or

auditing matters, including procedures for the confidential and anonymous submission by our employees of concerns regarding questionable accounting, internal accounting controls or auditing matters.

Our Board has determined that Mr. Ryan is an Audit Committee financial expert under the rules of the SEC. Our Audit Committee met four times during 2018. For additional information regarding

the Audit Committee, please see "Report of the Audit Committee."

Nominating and Corporate Governance Committee

As of December 31, 2018, our Nominating and Corporate Governance Committee was comprised of Messrs. Ain, Honey, Ryan and Trimble. Our Nominating

and Corporate Governance Committee's responsibilities include providing recommendations to our Board of Directors regarding nominees for director and membership on the committees of our Board. An

additional function of the committee is to develop corporate governance practices to recommend to our Board and to assist our Board in complying with those practices. Our Nominating and Corporate

Governance Committee met once during 2018.

Compensation Committee

As of December 31, 2018, our Compensation Committee was comprised of Messrs. Ain, Ryan and Trimble. The Compensation Committee's

responsibilities include providing recommendations to our Board regarding the compensation levels of directors, reviewing and approving the compensation levels of executive officers, providing

recommendations to our Board regarding compensation programs, administering our incentive-compensation plans and equity-based plans, authorizing grants under our stock option and incentive plans, and

authorizing other equity compensation arrangements. Our Compensation Committee met twice during 2018.

Compensation Committee Authority; Delegation

.

Our Board of Directors has delegated to the Compensation Committee of our Board of

Directors the authority to administer compensation programs for our executive officers and non-employee directors. All principal elements of compensation paid to our executive officers and directors

are subject to approval by the Compensation Committee.

Specifically,

our Board has delegated authority to the Compensation Committee to determine and approve (1) our compensation philosophy, including evaluating risk management and incentives that

create risk, (2) annual base salaries, cash-based incentive compensation and equity-based compensation for our executive officers, (3) equity-based compensation for our non-executive

employees and (4) the compensation of our non-employee directors, including cash and equity-based compensation. Under the terms of our 2016 Plan, the Compensation Committee may delegate

authority to one or more executive officers to grant awards at fair market value to persons who are not subject to Section 16 of the Exchange Act and who are not "covered persons" under

Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee must specify a limit on the number of awards that may be granted and establish guidelines for the

exercise price of any stock option, the conversion ratio or price of other awards and vesting criteria. The Compensation Committee has not delegated any such authority.

Compensation Committee Process; Role of Executives

.

The base salary and equity award for each executive, together with the annual

cash-based incentive compensation plan for all executives, are generally established within the first quarter of each fiscal year at meetings of the Compensation Committee held for this purpose. In

2018, equity awards were granted in the second quarter. These meetings generally follow one or more informal presentations or discussions of our financial performance, including achievement of

performance targets, for the prior fiscal year and an internal business plan for the then-current fiscal year for goal-setting purposes. In deciding the compensation to be awarded to the executive

officers other than the CEO, the Compensation Committee typically reviews and

evaluates recommendations from the CEO and the CFO. The members of the Compensation Committee discuss these recommendations with the CEO. In deciding the compensation to be awarded to the CEO, the

Compensation Committee typically receives a written self-assessment from the CEO and recommendations from the Chairman of the Compensation Committee. The members of the Compensation Committee then

discuss the Chairman's recommendations. The CEO is not present at the time of these deliberations. The Compensation Committee may accept or adjust any recommendations, and the Compensation Committee

makes all final compensation decisions.

Role of Compensation Consultant

.

Since 2005, the Compensation Committee has engaged Radford as its independent compensation consultant

to assist in creating an effective and competitive executive compensation program and to advise on related matters. Radford

26

KVH Industries, Inc. 2019 Proxy Statement

Table of Contents

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

periodically

provides comparative market data on compensation practices and programs based on an analysis of executive compensation data, including survey data. Radford also provides guidance on

industry best practices. In 2018, Radford advised the Compensation Committee in (1) determining base salaries for executives, (2) determining the targets for total cash-based incentive

compensation as a percentage of base salary, and (3) designing and determining individual equity grants for the long-term incentive plan for executives.

Radford's

competitive assessment with respect to base salary, cash-based incentive compensation and equity-based compensation for 2018 was taken into consideration by the Compensation Committee when

setting base salaries and making changes to the cash- based incentive compensation and equity-based compensation components of the executive compensation program for 2018. Neither Radford nor any of

its affiliates provided any services to us in 2018 other than Radford's services to the Compensation Committee.

Director Candidates and Selection Processes

The process followed by our Nominating and Corporate Governance Committee to identify and evaluate director candidates includes, as necessary,

requests to our Board members and others for recommendations, meetings from time to time to evaluate biographical information and background materials relating to potential candidates, and interviews

of selected candidates by members of the Committee and other members of our Board. The Committee may also solicit the opinions of third parties with whom the potential candidate has had a business

relationship. Once the committee is satisfied that it has collected sufficient information on which to base a judgment, the committee votes on the candidate or candidates under consideration.

In

evaluating the qualifications of any candidate for director, the Committee considers, among other factors, the candidate's depth of business experience, reputation for personal integrity,

understanding of financial matters, familiarity with the periodic financial reporting process, reputation, degree of independence from management, possible conflicts of interest and willingness and

ability to serve. The Committee also considers whether the candidate will add diversity to the Board, including the degree to which the candidate's skills, experience and background complement or

duplicate those of our existing directors and the long-term interests of our stockholders. In the case of incumbent directors whose terms are set to expire, the Committee also gives consideration to

each director's prior contributions to the Board. The minimum

qualifications

that each director must possess consist of general familiarity with fundamental financial statements, ten years of relevant business experience, no identified conflicts of interest, no

convictions in a criminal proceeding during the five years prior to the date of selection and the willingness to execute and comply with our code of ethics. Although the Committee considers diversity

as a factor in assessing any nomination, the Board does not have a formal policy with regard to diversity in identifying director nominees. In selecting candidates to recommend for nomination as a

director, the Committee abides by our company-wide non-discrimination policy.

The

Committee will consider director candidates recommended by stockholders and use the same process to evaluate candidates regardless of whether the candidates were recommended by stockholders,

directors, management or others. The Committee has not adopted any particular method that stockholders must follow to make a recommendation. We suggest that stockholders make recommendations by

writing to the Chairman of the Board who will in turn forward the nomination to the Nominating and Corporate Governance Committee, in care of our offices, with sufficient information about the

candidate, his or her work experience, his or her qualifications for director, and his or her references as will enable the Committee to evaluate the candidacy properly. We also suggest that

stockholders make their recommendations well in advance of the anticipated mailing date of our next proxy statement so as to provide our Nominating and Corporate Governance Committee an adequate

opportunity to complete a thorough evaluation of the candidacy, including personal interviews. We remind stockholders of the separate requirements set forth in our by-laws for nominating individuals

to serve as directors, which we discuss elsewhere in this proxy statement.

Corporate Governance

Our board believes that our corporate governance practices have been fundamental to our success. We seek to ensure that good governance and

responsible business principles and practices are part of our culture and values and the way we do business. To maintain and enhance our corporate governance, the Board of Directors and the Nominating

and Corporate Governance Committee periodically refine our corporate governance policies, procedures and practices.

Majority Voting in Uncontested Director Elections

Our by-laws provide for majority voting in uncontested director elections. A contested election is an election in which the number of director candidates

exceeds the number of available director positions. Our by-laws require that, in order for a nominee for election to the Board of

KVH Industries, Inc. 2019 Proxy Statement

27

Table of Contents

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Directors

in an uncontested election to be elected, he or she must receive a majority of the votes properly cast at the meeting. Ballots for uncontested elections, including the elections at the 2019

annual meeting, will allow stockholders to vote "FOR" or "AGAINST" each nominee and will also allow stockholders to abstain from voting on any nominee. Abstentions and broker non-votes will have no

effect on the outcome of any election for director. Under our by-laws and in accordance with Delaware law, an incumbent director's term extends until his or her successor is duly elected and

qualified, or until he or she resigns or is removed from office. Thus, an incumbent director who fails to receive the required vote for re-election at our annual meeting would continue serving as a

director (sometimes referred to as a "holdover director") until his or her term ends for one of the foregoing reasons. In order to address the situation where an incumbent director receives more votes

"AGAINST" his or her re-election than votes "FOR" his or her re-election, the Board has adopted a policy to the effect that, in order for an incumbent director in an uncontested election to be

nominated for re-election, that director should tender a resignation that would become effective only upon both (i) the failure to obtain the requisite majority vote and (ii) the

acceptance of the resignation by the Board of Directors. If an incumbent director were to fail to obtain the requisite majority vote for re-election, the Nominating and Corporate Governance Committee

(or another appropriate committee) and the Board would consider the resignation in light of the surrounding circumstances. The policy adopted by the Board states that the Board will publicly

announce its decision regarding the resignation within 90 days after certification of the results of the applicable annual meeting.

Communications with our Board of Directors

Our Board, including all of the independent directors, has established a process for facilitating stockholder communications with our Board.

Stockholders wishing to communicate with our Board should send written correspondence to the attention of our corporate secretary, Felise B. Feingold, KVH Industries, Inc., 50 Enterprise

Center, Middletown, RI 02842, USA, and should include with the correspondence evidence that the sender of the communication is one of our stockholders. Satisfactory evidence would include, for

example, contemporaneous correspondence from a brokerage firm indicating the identity of the stockholder and the number of shares held. Our secretary will forward all mail to each member of our Board

of Directors.

Code of Ethics

We have adopted a code of ethics that applies to all of our directors, executive officers and employees, including our principal executive

officer and principal financial and accounting officer. The code of ethics includes provisions covering compliance with laws and regulations, insider trading practices, conflicts of interest,

confidentiality, protection and proper use of our assets, accounting and record keeping, fair competition and fair dealing, business gifts and entertainment, payments to government personnel and the

reporting of illegal or unethical behavior.

You

can obtain a copy of our code of ethics through the Investor Relations page of our website at http://kvh.com/ircoe.

Certain Relationships and Related-Party Transactions

Pursuant to our Code of Ethics, our executive officers, directors and employees are to avoid conflicts of interest, except with the approval

of the Board of Directors. A related-party transaction would be a conflict of interest. Pursuant to its charter, the Audit Committee must review and approve in advance all related-party transactions.

It is our policy that the Audit Committee review and approve transactions involving us and "related parties" (which includes our directors, director nominees and executive officers and their immediate

family members, as well as stockholders known by us to own five percent or more of our common stock and their immediate family members). The policy applies to any transaction in which we are a

participant and any related party has a direct or indirect material interest, where the amount involved in the transaction exceeds $120,000 in a single calendar year, excluding transactions in which

standing pre-approval has been given. Pre-approved transactions include:

-

•

-

compensation of directors and executive officers provided that such compensation is approved by the Board of Directors or Compensation

Committee or such compensation plan or other arrangement is generally available to full-time employees in the same jurisdiction; and

-

•

-

transactions where the related party's interest arises solely from ownership of our common stock and such interest is proportionate to the

interests of stockholders. The Audit Committee is responsible for reviewing the material facts of all related-party transactions, subject to the exceptions described above. The Audit Committee will

either approve or disapprove the entry into the related-party transaction. If advance approval is not feasible, the transaction will be considered and, if the Audit Committee determines it to be

appropriate, ratified

28

KVH Industries, Inc. 2019 Proxy Statement

Table of Contents

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

at

the Audit Committee's next regularly scheduled meeting. In determining whether to approve or ratify a transaction with a related party, the Audit Committee will take into account, among other

factors that it determines to be appropriate:

-

•

-

whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar

circumstances;

-

•

-

the business reasons for the transaction;

-

•

-

whether the transaction would impair the independence of an outside director; and

-

•

-

the extent of the related party's interest in the transaction.

Except

as stated below, as of the date of this proxy statement there have been no reportable related-party transactions since January 1, 2018, nor are there any pending related-party

transactions.

Kathleen

Keating, the spouse of Mr. Martin A. Kits van Heyningen, serves as our senior director of creative and customer experience. For fiscal year 2018, total individual compensation for

Kathleen Keating, based on total salary,

bonus,

aggregate grant date fair value of stock option awards granted during the year and all other compensation, as calculated in a manner consistent with our Summary Compensation Table for 2018, was

approximately $245,516.

Siobhan

Kits van Heyningen, the daughter-in-law of Mr. Martin A. Kits van Heyningen, served as a summer intern. For fiscal year 2018, total individual compensation for Siobhan Kits van

Heyningen, as calculated in a manner consistent with our Summary Compensation Table for 2018, was approximately $20,880.

Mark

S. Ain, a director, is a minority owner of and advisor to ETS International, a ground transportation service company. In 2018, we paid ETS International $25,927 for services rendered in 2018. The

Audit Committee has determined such services are reasonable, in our best interest and on terms no less favorable than could be obtained from an unrelated third party. In assessing Mr. Ain's

independence, our Board of Directors was aware of this information and concluded that it had no impact on his independence as a director.

KVH Industries, Inc. 2019 Proxy Statement

29

Table of Contents

|

AUDIT COMMITTEE REPORT

(1)

|

The

Board of Directors appointed an Audit Committee to monitor the integrity of our company's consolidated financial statements, its system of internal control over financial

reporting and the independence and performance of our independent registered public accounting firm. The Audit Committee also selects our company's independent registered public accounting firm. Our

Board of Directors adopted a charter for the Audit Committee in February 2004, which was most recently revised in February 2017. The Audit Committee currently consists of four independent directors.

Each member of the Audit Committee meets the independence requirements of the NASDAQ Stock Market for membership on the Audit Committee.

Our

company's management is responsible for the financial reporting process, including the system of internal control over financial reporting, and for the preparation of consolidated financial

statements in accordance with generally accepted accounting principles. Our company's independent registered public accounting firm is responsible for auditing those consolidated financial statements

and auditing the effectiveness of internal control over financial reporting. Our responsibility is to monitor and review these processes. We have relied, without independent verification, on the

information provided to us and on the representations made by our company's management and independent registered public accounting firm.

In

fulfilling our oversight responsibilities, we discussed with representatives of Grant Thornton LLP, our company's independent registered public accounting firm, the overall scope and plans

for their audit of our company's consolidated financial statements for the year ended December 31, 2018 and critical audit matters such as the new revenue standard, ASC 606 and upcoming

accounting standards such as ASC 842, Leases. We met with them, with and without our company's management present, to discuss the results of their audits of our consolidated financial

statements and of our company's internal control over financial reporting and to discuss with them the overall quality of our company's financial reporting.

We

reviewed and discussed the audited consolidated financial statements for the year ended December 31, 2018 with management and the independent registered public accounting firm.

We

discussed with the independent registered public accounting firm the matters required to be discussed by Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 16,

Communications with Audit Committees,

as amended, codified at PCAOB AS 1301. In addition, we have discussed with the independent registered public

accounting firm its independence from our company and our company's management, including the matters in the written disclosures and letter which we received from the independent registered public

accounting firm under applicable requirements of the PCAOB. We also considered whether the independent registered public accounting firm's performance of non-audit services for our company is

compatible with the auditors' independence, and concluded that the performance of such non-audit services did not impair the auditors' independence.

Based

on our review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the Audit Committee charter, we recommended to

the Board of Directors that our company's audited consolidated financial statements for the year ended December 31, 2018 be included in our company's annual report on Form 10-K for that

year.

|

|

|

|

|

|

|

The Audit Committee

|

|

|

Bruce J. Ryan (Chairman)

Mark S. Ain

Stanley K. Honey

Charles R. Trimble

|

-

(1)

-

The material in this report is not soliciting material, is not deemed filed with the SEC

and is not incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made on, before, or after the date

of this proxy statement and irrespective of any incorporation language in such filing.

|

|

|

|

|

|

|

30

|

|

KVH

Industries,

Inc.

2019

Proxy

Statement

|

|

|

Table of Contents

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

We expect that representatives of Grant Thornton LLP, our independent registered public accounting firm, will be present at the annual meeting. They will have an opportunity to make a statement

if they wish and, if present, will be available to respond to appropriate questions from stockholders.

Fees for Professional Services

The following table provides a summary of the fees for professional services rendered by Grant Thornton LLP for 2018 and 2017.

|

|

|

|

|

|

|

|

|

|

|

|

Fees

|

|

|

|

|

|

|

|

|

|

Fee category

|

|

2018

|

|

2017

|

|

|

Audit fees

(1)

|

|

$

|

890,196

|

|

$

|

959,670

|

|

|

Audit-related fees

(2)

|

|

—

|

|

21,017

|

|

|

Tax fees

(3)

|

|

56,000

|

|

89,099

|

|

|

Total fees

|

|

$

|

946,196

|

|

$

|

1,069,786

|

|

|

|

|

|

|

|

|

-

(1)

-

Audit fees consist of amounts billed for professional services rendered for the integrated audit of our consolidated financial

statements, including compliance with Section 404 of the Sarbanes-Oxley Act of 2002, review of the interim condensed consolidated financial statements included in quarterly reports and the

statutory audits of our foreign locations and additional audit procedures associated with the new lease accounting standard, ASC 842. In 2017, audit fees also included additional audit procedures

associated with the new revenue accounting standard, ASC 606, and the new Tax Cuts and Jobs Act.

-

(2)

-

Audit-related fees for 2017 consist of amounts billed for services arising from the filing of a registration statement on

Form S-3.

-

(3)

-

Tax fees consist of amounts billed for services arising from tax compliance for our Denmark, Norway, Singapore, Cyprus, United

Kingdom and Hong Kong locations.

We did not engage Grant Thornton LLP to provide any other services during or with respect to 2018 or 2017.

Pre-Approval Policies and Procedures

Our Audit Committee approves each engagement for audit or non-audit services before we engage our independent registered public accounting

firm to provide those services.

Our

Audit Committee has not established any pre-approval policies or procedures that would allow our management to engage our independent registered public accounting firm to provide any specified

services with only an obligation to notify the Audit Committee of the engagement for those services.

|

|

|

|

|

|

|

|

|

KVH

Industries,

Inc.

2019

Proxy

Statement

|

|

31

|

Table of Contents

Stockholder

proposals for inclusion in our proxy materials relating to our 2020 annual meeting of stockholders must be received by us at our executive offices no later than December 28, 2019

or, if the date of that meeting is more than 30 calendar days before or after June 4, 2020, a reasonable time before we begin to print and mail our proxy materials with respect to that meeting.

In

addition, our by-laws provide that a stockholder desiring to bring business before any meeting of stockholders or to nominate any person for election to the Board of Directors must give timely

written notice to our secretary in accordance with the procedural requirements set forth in our by-laws. In the case of an annual meeting (including a special meeting in lieu of an annual meeting),

written notice must be delivered to or mailed and received at our principal executive offices not earlier than the 120

th

day prior to the "Specified Date" and not later than the

close of business on the 90

th

day prior to the "Specified Date," regardless of any postponements, deferrals or adjournments, must describe the nomination or other business to be

brought before the meeting and must provide specific information about, among other things, the stockholder, other supporters of the proposal, their stock ownership and their interest in the proposed

business. Under our

by-laws,

the "Specified Date" is the first Wednesday in May in each year (unless that day is a legal holiday in the meeting location, in which case it is the next succeeding day that is not a legal

holiday). For example, if we were to hold our 2020 annual meeting on May 6, 2020, in order to bring an item of business before the 2020 annual meeting in accordance with our by-laws, a

stockholder would be required to have delivered the requisite notice of that item of business to us not earlier than January 7, 2020 and not later than the close of business on

February 6, 2020. If we were to hold our 2020 annual meeting before May 6, 2020, and if we were to give less than 105 days' notice or prior public disclosure of the date of that

meeting, then the stockholder's notice must be delivered to or mailed and received at our principal executive offices not later than the close of business on the tenth day after the earlier of

(1) the day on which we mailed notice of the date of the meeting and (2) the day on which we publicly disclosed the date of the meeting.

Stockholders

of record on April 5, 2019 will receive a proxy statement and our annual report to stockholders, which contains detailed financial information about us. The annual report is not

incorporated herein and is not deemed a part of this proxy statement.

32

KVH Industries, Inc. 2019 Proxy Statement

MMMMMMMMMMMM MMMMMMMMMMMMMMM C123456789 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000000000.000000 ext 000004 ENDORSEMENT_LINE______________ SACKPACK_____________ Your vote matters – here’s how to vote! You may vote online or by phone instead of mailing this card. Votes submitted electronically must be MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6 received by 1:00 a.m. Central Time, on June 4, 2019. Online GIof ntoo welwewct.rinovneicstvoortviontge,.com/KVHI delete QR code and control # or scan the QR code — login details are located in the shaded bar below. Phone Call toll free 1-800-652-VOTE (8683) within the USA, US territories and Canada Save paper, time and money! Sign up for electronic delivery at www.investorvote.com/KVHI Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas. q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q + 1. To vote upon the election of two Class II directors to a three-year term: For Against Abstain For Against Abstain 01 - Martin A. Kits van Heyningen 02 - Charles R. Trimble For Against Abstain 2. To approve, in a non-binding “Say on Pay” vote, the compensation of our named executive officers 3. To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2019 Change of Address — Please print new address below. Comments — Please print your comments below. Please sign exactly as your name(s) appear(s) on the books of KVH Industries, Inc. Joint owners should each sign personally. Trustees and other fiduciaries should indicate the capacity in which they sign, and where more than one name appears, a majority must sign. If a corporation, this signature should be that of an authorized officer who should state his or her title. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box. MMMMMMM C 1234567890 J N T 1 5 0 2 3 MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND + 1 U P X 4 031WYF MMMMMMMMM C Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below B Non-Voting Items A Proposals — The Board of Directors recommends a vote FOR all the nominees listed and FOR Proposals 2 and 3. Annual Meeting Proxy Card1234 5678 9012 345

Dear Stockholder, Please take note of the important information enclosed with this proxy card. Your vote counts, and you are strongly encouraged to exercise your right to vote your shares. Please mark the boxes on this proxy card to indicate how you would like your shares to be voted. Then sign the card, detach it and return it in the enclosed postage-paid envelope. Alternatively, you can vote by Internet or telephone using the instructions on the back of this card. Your vote must be received prior to the Annual Meeting of Stockholders to be held on June 4, 2019. Thank you in advance for your prompt consideration of these matters. Sincerely, KVH Industries, Inc. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 4, 2019 The proxy statement for the 2019 annual meeting of stockholders of KVH Industries, Inc. and the related 2018 annual report to stockholders are available on the Internet at www.kvh.com/annual. You can read, print, download and search these materials at that website. The website does not use “cookies” or other tracking devices to identify visitors. You can obtain directions to be able to attend the meeting and vote in person at www.kvh.com/annual. q IF VOTING BY MAIL, SIGN, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE. q THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF KVH INDUSTRIES, INC. A STOCKHOLDER WISHING TO VOTE IN ACCORDANCE WITH THE RECOMMENDATIONS OF THE BOARD OF DIRECTORS NEED ONLY SIGN AND DATE THIS PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE. Proxy for Annual Meeting of Stockholders to be held on June 4, 2019. The undersigned, revoking all prior proxies, hereby appoints Donald W. Reilly and Felise Feingold, and each of them, proxy and attorney-in-fact, with power to act without the other and with full power of substitution, to vote all shares of Common Stock of KVH Industries, Inc., which the undersigned is entitled to vote at the Annual Meeting of Stockholders to be held at the offices of KVH Industries, Inc., 50 Enterprise Center, Middletown, RI 02842, on June 4, 2019, at 11:00 a.m. Eastern time, and at any adjournments or postponements thereof, upon matters set forth in the Notice of Annual Meeting and Proxy Statement dated April 26, 2019, a copy of which has been received by the undersigned, and in their discretion upon any business that may properly come before the meeting or any adjournments or postponements thereof. Attendance of the undersigned at the meeting or any adjourned or postponed session thereof will not be deemed to revoke this proxy unless the undersigned shall affirmatively indicate the intention of the undersigned to vote the shares represented hereby in person prior to the exercise of this proxy. The shares represented by this proxy will be voted as directed. If no voting direction is given on a proposal, the shares represented by this proxy will be voted as recommended by the Board of Directors. PLEASE VOTE, DATE AND SIGN ON REVERSE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. Proxy — KVH Industries, Inc. Small steps make an impact. Help the environment by consenting to receive electronic delivery, sign up at www.investorvote.com/KVHI

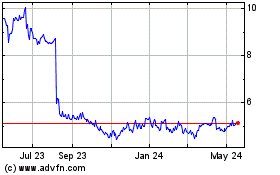

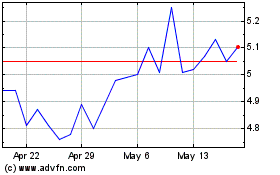

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Jul 2023 to Jul 2024