0001815442false00018154422024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 31, 2024

KYMERA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39460 |

|

81-2992166 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

Kymera Therapeutics, Inc.

500 North Beacon Street, 4th Floor

Watertown, Massachusetts 02472

(Address of principal executive offices, including zip code)

(857) 285-5300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trade Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.0001 par value per share |

KYMR |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 31, 2024, Kymera Therapeutics, Inc. announced its financial results for the quarter ended September 30, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Kymera Therapeutics, Inc. |

|

|

|

Date: October 31, 2024 |

|

By: |

|

/s/ Nello Mainolfi |

|

|

|

|

Nello Mainolfi, Ph.D. |

|

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Kymera Therapeutics Announces Third Quarter 2024 Financial Results and Provides a Business Update

KT-621 (STAT6) IND cleared by FDA and dosing in the Phase 1 clinical trial initiated, with data expected in the first half of 2025

Sanofi expanding KT-474/SAR444656 (IRAK4) Phase 2 clinical trials in HS and AD to dose ranging Phase 2b studies to accelerate overall development timelines; completion of both expanded trials expected by mid-2026

KT-295, a new TYK2 degrader, selected as the development candidate to advance into Phase 1 clinical trial in the first half of 2025, in line with prior program guidance

Company to shift focus and resources from oncology to its expanding immunology pipeline, and will only advance KT-333 (STAT3) and KT-253 (MDM2) beyond Phase 1 with a partner

Well-capitalized with $911 million in cash as of September 30, 2024, and runway into mid-2027

Company to hold call and webcast today at 8:30 a.m. ET

Watertown, Mass. (October 31, 2024) – Kymera Therapeutics, Inc. (NASDAQ: KYMR), a clinical-stage biopharmaceutical company advancing a new class of small molecule medicines using targeted protein degradation (TPD), today reported financial results for the third quarter ended September 30, 2024, and provided business highlights and updates on its pipeline of first- and best-in-class protein degraders.

“This has been an important year for Kymera with an increased focus on the exciting opportunities we have in immunology and programs that have the potential to transform the treatment landscape for millions of patients around the globe,” said Nello Mainolfi, PhD, Founder, President and CEO, Kymera Therapeutics. “We are particularly excited about the initiation of the Phase 1 trial for KT-621, our first-in-class STAT6 degrader. This is a target that perfectly fits the value proposition of oral degraders with biologics-like activity, and we are excited and proud to be the first company to advance a drug candidate for this mechanism into the clinic. The preclinical profile of KT-621 is compelling, particularly its ability to replicate the biology of upstream biologics like dupilumab, which we look forward to translating in the clinic with an initial Phase 1 data readout in the first half of 2025. In addition, Sanofi’s decision to expand both the HS and AD studies with KT-474 into dose ranging Phase 2b studies is a testament to their strong interest in exploring even more comprehensively the IRAK4 degradation mechanism and this drug candidate given all the supporting data generated so far.”

Dr. Mainolfi added, “Given the significant progress and potential of our immunology pipeline, we have made the decision to shift our resources toward our discovery and development efforts in immunology. As a result, we will advance our clinical stage oncology programs beyond Phase 1 only in the context of a partnership. Focusing our resources and efforts on our work in immunology reflects our financial discipline around program prioritization to address large patient populations with significant need and clear substantial commercial opportunities.”

Business Highlights, Recent Developments and Upcoming Milestones

STAT6 Degrader Program

KT-621 is an investigational, first-in-class, once daily, oral degrader of STAT6, the specific transcription factor responsible for IL-4/IL-13 signaling and the central driver of TH2 inflammation, currently in Phase 1 testing. In preclinical studies, KT-621 was well tolerated with exquisite selectivity and fully blocked IL-4/IL-13 functions in key human TH2 cellular assays and in in vivo models of TH2 inflammation with comparable or superior activity to dupilumab. KT-621 has the potential to address numerous TH2 diseases including atopic dermatitis, asthma and COPD, among others.

•In October, Kymera initiated dosing in the Phase 1 healthy volunteer clinical trial evaluating single and multiple ascending doses of KT-621, a potent and selective oral degrader of STAT6. The Phase 1 trial will evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of KT-621 compared to placebo. The Company expects to report Phase 1 data in the first half of 2025. More information on the KT-621 Phase 1 study will be available on www.clinicaltrials.gov.

•The Company presented preclinical data at the European Academy of Dermatology and Venereology (EADV) Congress and the American College of Asthma, Allergy, and Immunology (ACAAI) Annual Meeting. The new findings showed strong degradation of STAT6 in human sensory neurons resulted in inhibition of IL-13-induced itch- and pain-related gene transcripts, highlighting the potential of KT-621 to alleviate these symptoms in atopic dermatitis patients by effectively targeting and modulating the STAT6 pathway.

IRAK4 Degrader Program

KT-474 (SAR444656) is an investigational, first-in-class, once daily, oral degrader of IRAK4, a key protein involved in inflammation. Phase 2 clinical trials for hidradenitis suppurativa (HS) and atopic dermatitis (AD), in collaboration with Sanofi, are currently ongoing. In the Phase 1 study, KT-474 demonstrated robust degradation of IRAK4 in the blood and skin of healthy volunteers and patients with HS and AD, demonstrating a systemic anti-inflammatory effect and preliminary evidence of clinical activity.

•In July, Kymera announced that Sanofi had communicated to Kymera the intent to expand the ongoing KT-474 Phase 2 trials in HS and AD following an interim review of KT-474/SAR444656 safety and efficacy data by an independent data monitoring committee. The expansion of the ongoing HS and AD Ph2 studies to larger dose-ranging Phase 2b studies is intended to accelerate overall development timelines and enable a subsequent transition into registrational Phase 3 trials.

oHidradenitis Suppurativa (ZEN trial):The study has been expanded from 99 to 156 patients. Previously, the trial included one active dose of KT-474 as well as placebo. The study will now include an additional dose. The estimated primary completion date for the ZEN trial is now in the first half of 2026.

oAtopic Dermatitis (ADVANTA Trial): The study has been expanded from 115 to 200 patients. Previously, the trial included two active doses of KT-474 as well as placebo. The study will now include an additional dose. The estimated primary completion date for the ADVANTA trial is now in the middle of 2026.

•In July, results from the Company’s non-interventional trial evaluating IRAK4 expression in patients with HS were published in the Journal of Investigative Dermatology. The results support the role of IRAK4 signaling in HS and the potential of IRAK4 degradation to impact the clinical manifestations of HS, AD, and potentially other TLR/IL-1R-driven immuno-inflammatory diseases.

•In August, the Company published on the discovery of KT-474 in the Journal of Medicinal Chemistry highlighting the exploration of structure–activity relationships that ultimately led to the identification of the first-in-class oral IRAK4 degrader, KT-474, and reinforcing Kymera’s innovative molecular design strategies.

TYK2 Degrader Program

KT-295 is an investigational, first-in-class, once daily, oral degrader of TYK2, a member of the Janus kinase (JAK) family required for Type I IFN, IL-12 and IL-23 signaling. In preclinical studies, unlike traditional small molecule inhibitors, KT-295 has demonstrated picomolar degradation potency and potent inhibition of the IL-23, IL-12 and Type I IFN pathways while sparing IL-10, showing its potential to recapitulate the biology of human TYK2 loss-of-function mutations. KT-295 has the potential to be the first oral therapy to deliver biologics-like activity in diseases such as IBD and psoriasis, among others.

•The Company nominated a new TYK2 development candidate, KT-295, a potent, selective, once daily oral degrader, and has prioritized this compound for clinical evaluation. KT-295 has picomolar potency and is highly selective for TYK2, while also demonstrating greater in vivo activity in preclinical animal models compared to KT-294, the Company’s previously identified TYK2 degrader.

•Kymera intends to advance KT-295 into Phase 1 clinical testing in the first half of 2025, which is consistent with prior program guidance. The Company expects to report Phase 1 data later that year.

Oncology Degrader Programs

•Dose escalation and enrollment have been completed for both the KT-333 and KT-253 Phase 1 trials. Based on an overall assessment of its clinical oncology programs, and given progress across the immunology pipeline, the Company has made the strategic decision not to continue development of KT-333 (STAT3) and KT-253 (MDM2) beyond Phase 1. Kymera plans to present STAT3 Phase 1 data at a poster presentation at ASH in December. The Company is evaluating partnership opportunities to advance the oncology pipeline beyond its current stage.

Corporate Updates

•In August, the Company announced the closing of an upsized underwritten equity offering, resulting in net proceeds of approximately $247 million. With these proceeds, the Company extended its cash runway into mid-2027.

Program Background Information

For more information on Kymera’s pipeline visit our website.

Financial Results

Collaboration Revenues: Collaboration revenues were $3.7 million for the third quarter of 2024, compared to $4.7 million for the same period of 2023. Collaboration revenues in the third quarter of 2024 were allattributable to the Company’s Sanofi collaboration.

Research and Development Expenses: Research and development expenses were $60.4 million for the third quarter of 2024, compared to $48.1 million for the same period of 2023. This increase was primarily due to increased expenses related to the investment in the Company’s STAT6 degrader program, platform and discovery programs, as well as an increase in occupancy and related costs due to continued growth in the research and development organization. Stock based compensation expenses included in R&D were $7.6 million for the third quarter of 2024, compared to $5.8 million for the same period in 2023.

General and Administrative Expenses: General and administrative expenses were $15.5 million for the third quarter of 2024, compared to $14.1 million for the same period of 2023. The increase was primarily due to an increase in legal and professional service fees in support of the Company’s growth and an increase in personnel, facility, occupancy, and other expenses to support growth as a public company. Stock based compensation expenses included in G&A were $7.3 million for the third quarter of 2024 compared to $5.9 million for the same period in 2023.

Net Loss: Net loss was $62.5 million for the third quarter of 2024 compared to a net loss of $52.9 million for the same period of 2023.

Cash and Cash Equivalents: As of September 30, 2024, Kymera had $911 million in cash, cash equivalents, and investments. Kymera expects that its cash and cash equivalents will provide the Company with an anticipated cash runway into mid-2027. Its existing cash is expected to take the Company beyond the Phase 2 data for KT-474 and several clinical inflection points for its STAT6 and TYK2 programs while Kymera continues to identify opportunities to accelerate growth and expand its pipeline, technologies and clinical indications.

Conference Call

Kymera will host a conference call and webcast today, October 31, 2024, at 8:30 a.m. ET. To access the conference call via phone, please dial +1 (833) 630-2127 or +1 (412) 317-1846 (International) and ask to join the Kymera Therapeutics call. A live webcast of the event will be available under News and Events in the Investors section of the Company’s website at www.kymeratx.com. A replay of the webcast will be archived and available following the event for three months.

About Kymera Therapeutics

Kymera is a clinical-stage biotechnology company pioneering the field of targeted protein degradation (TPD) to develop medicines that address critical health problems and have the potential to dramatically improve patients’ lives. Kymera is deploying TPD to address disease targets and pathways inaccessible with conventional therapeutics. Having advanced the first degrader into the clinic for immunological diseases, Kymera is focused on building an industry-leading pipeline of oral small molecule degraders to provide a new generation of convenient, highly effective therapies for patients with these conditions. Founded in 2016, Kymera has been recognized as one of Boston’s top workplaces for the past several years. For more information about our science, pipeline and people, please visit www.kymeratx.com or follow us on X or LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, implied and express statements about our expectations regarding strategy, business plans and objectives on the clinical development of clinical and preclinical pipeline, Sanofi’s expansion of the Phase 2 clinical trials of KT-474/SAR444656, the initiation of a Phase 1 clinical trial of KT-621 and expected initial data readout of KT-621 in the first half of 2025, the declaration of KT-295 as a development candidate and the decision not to advance KT-333 and KT-253 beyond Phase 1 without a partner and Kymera’s financial condition and expected cash runway into mid-2027. The words "may," "might," "will," "could," "would," "should," "expect," "plan," "anticipate," "intend," "believe," "expect," "estimate," "seek," "predict," "future," "project," "potential," "continue," "target" and similar words or expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this press release are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from any forward-looking statements contained in this press release, including, without limitation, risks associated with: uncertainties inherent in the initiation, timing and design of future clinical trials, the availability and timing of data from ongoing and future clinical trials and the results of such trials, whether preliminary results of early clinical trials will be indicative of the results of later clinical trials, the ability to successfully demonstrate the safety and efficacy of drug candidates, the timing and outcome of planned interactions with regulatory authorities, the availability of funding sufficient for our operating expenses and capital expenditure requirements and other factors. These risks and uncertainties are described in greater detail in the section entitled "Risk Factors" in the most recent Quarterly Report on Form 10-Q and in subsequent filings with the Securities and Exchange Commission. In addition, any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. We explicitly disclaim any obligation to update any forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

|

|

|

|

|

|

KYMERA THERAPEUTICS, INC. Consolidated Balance Sheets (In thousands, except share and per share amounts) (Unaudited) |

|

|

September 30,

2024 |

|

December 31,

2023 |

Assets |

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ 911,005 |

|

$ 436,315 |

Property and equipment, net |

|

51,244 |

|

48,134 |

Right-of-use assets, operating lease |

|

48,065 |

|

52,945 |

Other assets |

|

24,528 |

|

38,365 |

Total assets |

|

$ 1,034,842 |

|

$ 575,759 |

Liabilities and Stockholders’ Equity |

|

|

|

|

Deferred revenue |

|

$ 20,024 |

|

$ 54,651 |

Operating lease liabilities |

|

85,144 |

|

82,096 |

Other liabilities |

|

36,744 |

|

44,041 |

Total liabilities |

|

141,912 |

|

180,788 |

Total stockholders’ equity |

|

892,930 |

|

394,971 |

Total liabilities and stockholders’ equity |

|

$ 1,034,842 |

|

$ 575,759 |

|

|

|

|

|

|

|

|

KYMERA THERAPEUTICS, INC. |

Consolidated Statements of Operations and Comprehensive Loss |

(In thousands, except share and per share amounts) |

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Collaboration Revenue |

$ 3,741 |

|

$ 4,728 |

|

$ 39,678 |

|

$ 30,707 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

$ 60,410 |

|

$ 48,117 |

|

$ 168,431 |

|

$ 136,111 |

General and administrative |

15,455 |

|

14,120 |

|

47,202 |

|

40,814 |

Impairment of long-lived assets |

— |

|

— |

|

4,925 |

|

— |

Total operating expenses |

75,865 |

|

62,237 |

|

220,558 |

|

176,925 |

Loss from operations |

(72,124) |

|

(57,509) |

|

(180,880) |

|

(146,218) |

Other income (expense): |

|

|

|

|

|

|

|

Interest and other income |

9,697 |

|

4,683 |

|

27,964 |

|

13,768 |

Interest and other expense |

(60) |

|

(41) |

|

(190) |

|

(144) |

Total other income |

9,637 |

|

4,642 |

|

27,774 |

|

13,624 |

Net loss attributable to common stockholders |

$ (62,487) |

|

$ (52,867) |

|

$ (153,106) |

|

$ (132,594) |

Net loss per share attributable to common

stockholders, basic and diluted |

$ (0.82) |

|

$ (0.90) |

|

$ (2.09) |

|

$ (2.27) |

Weighted average common stock outstanding,

basic and diluted |

76,125,975 |

|

58,421,859 |

|

73,330,338 |

|

58,312,813 |

|

Investor & Media Contact: Justine Koenigsberg Vice President, Investor Relations investors@kymeratx.com media@kymeratx.com 857-285-5300 |

v3.24.3

Document and Entity Information

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity File Number |

001-39460

|

| Entity Registrant Name |

KYMERA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001815442

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-2992166

|

| Entity Address, Address Line One |

500 North Beacon Street

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

857

|

| Local Phone Number |

285-5300

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

KYMR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

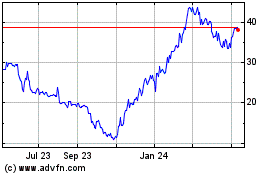

Kymera Therapeutics (NASDAQ:KYMR)

Historical Stock Chart

From Jan 2025 to Feb 2025

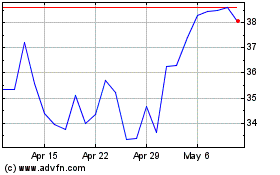

Kymera Therapeutics (NASDAQ:KYMR)

Historical Stock Chart

From Feb 2024 to Feb 2025