MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) ("LifeWallet,"

or the "Company"), a Medicare, Medicaid, commercial, and Secondary

Payer1 reimbursement recovery and technology leader, today

announced the Eleventh Judicial Circuit Court of Florida entered an

order memorializing its class certification2 in a case against USAA

Casualty Insurance Company and USAA General Indemnity Company

(collectively “USAA”), utilizing LifeWallet’s proprietary data

analytics system, extensive knowledge of the Medicare Secondary

Payer Act (“MSP Act”), and experience in healthcare reimbursement

recovery. The case directly benefits plaintiffs, which include: (1)

LifeWallet’s clients who assigned their claim rights to MSP

Recovery entities and any future assignor clients; as well as (2)

all Medicare Advantage Organizations (“MAO”), Medicaid Managed Care

Organizations (“MCO”), first-tier and downstream at risk entities,

and their assignees, that provided services on an at-risk basis in

the State of Florida to beneficiaries who were covered by USAA

under a Florida No-Fault Benefits policy, for which USAA under a

no-fault/personal injury protection(“PIP”) insurance policy had

primary coverage. The Court also entered an order approving class

notice, which was distributed to class members beginning June 10,

2024.

The Court noted during the evidentiary hearing that LifeWallet

and its team are, to the Court’s knowledge, “the only group that

could put this together with their proprietary system.”

LifeWallet developed a sophisticated data analytics system, that

in collaboration with Palantir Technologies Inc., captures and

manages data, demonstrating property and casualty insurer (“P&C

Insurer”) USAA’s failure to adequately coordinate benefits. This

system is an integral part of the evidence presented to the Court,

exemplifying the breadth and depth of the systemic issues plaguing

the healthcare system.

“LifeWallet utilizes its proprietary system to analyze data from

multiple sources, including civil litigation,” said LifeWallet

Founder and CEO, John H. Ruiz. “We employ I.T. personnel,

accountants, statisticians, physicians, data analysts, and

attorneys to identify when Primary Payers3 are responsible for

payment. Without the proper identification and notification, USAA

defendants and other Primary Payers could continue to evade their

primary payment obligations, leading to an ongoing cycle of

healthcare entities being unable to avoid paying costs they are not

responsible for,” Ruiz said.

The case, brought by MSP Recovery Law Firm on behalf of MSP

Recovery Claims, Series LLC and MSPA Claims 1, LLC, centers on

allegations that USAA’s inaction contravenes both state and federal

laws. This systemic and class-wide failure to identify benefits,

Plaintiffs assert, has caused and will continue to cause

Plaintiffs, and all similarly situated MAOs, MCOs, at-risk

first-tier and downstream entities, and their assignees, throughout

the state of Florida (the “Class”), to pay for accident-related

medical items and services for which USAA has a primary obligation

to pay.

As noted in today’s order granting Plaintiffs’ motion for class

certification:

“USAA’s failure to comply with its

duties under Section 627.736(4), Florida Statutes and the resulting

harm to Class Members now and in the future can be demonstrated

with evidence provided by Plaintiffs’ MSP System to identify

specific instances of Defendant’s failure to coordinate

benefits.”

“This problem is exacerbated by what

the MSP Recovery Entities have learned about the insurance

industry; namely, that insurers have made a deliberate business

decision to do nothing to identify and reimburse secondary payments

and sit on their hands until (and after) they are sued. The MSP

System exposes this business decision by matching beneficiaries and

assignor payments with third-party databases. However, Defendant’s

failure to provide the information prevents the Plaintiffs from

confirming the full scope of Defendant’s liability….”

“The MSP System captures data from

different sources to identify the Class Members’ insureds’ medical

expenses incurred as a result of an automobile accident and which

should have been paid for by Defendant. Specifically, the system

analyzes: Defendant’s data on whether it insured a particular Class

Member’s insured; Defendant’s reporting data indicating their

primary payer obligation for a Medicare beneficiary’s medical

expenses; Defendant’s data as to whether it reimbursed secondary

payments; Plaintiffs’ data as to what payments its assignors made

for Defendant’s insureds; and Class Members’ data as to what

secondary payments they made for Defendant’s insureds.”

Ruiz, who also argued on behalf of the Plaintiffs as lead

counsel for MSP Recovery Law Firm during the certification hearing,

quoted the deposition testimony of USAA’s corporate

representatives, revealing significant insights into the company's

practices. One corporate representative admitted, “Adjusters do not

ask” about Medicare Advantage coverage, highlighting a systemic

issue within USAA's processes. Another representative acknowledged,

“There is no process currently to reach out” to the health plan for

claims related to the underlying claim, which underscores USAA's

failure to coordinate benefits properly with Medicare Advantage

organizations.

The Court also issued an order to show cause as to why USAA’s

counsel should not be held in contempt, lack of candor to the

tribunal as alleged by Plaintiffs. The order set a hearing for June

28, 2024, requiring opposing counsel to show cause as to why it

should not be sanctioned for the substantial alleged

misrepresentations made by USAA’s counsel to the Court during the

certification hearing and delineated by Plaintiffs’ motion.

MSP Recovery Inc., and its affiliates also have

11 motions for class certification pending in the Circuit Court of

the Eleventh Judicial Circuit in Miami-Dade County, Florida against

41 other insurance companies on the same grounds. Those companies

include: Ace Property and Casualty Insurance Company, Ace Insurance

Company of The Midwest, Ace Fire Underwriters Insurance Company,

Ace American Insurance Company, MGA Insurance Company, Inc.,

Ascendant Commercial Insurance, Inc., Progressive Advanced

Insurance Company, Progressive American Insurance Company,

Progressive Bayside Insurance Company, Progressive Casualty

Insurance Company, Progressive Direct Insurance Company,

Progressive Express Insurance Company, Progressive Select Insurance

Company, Progressive Southeastern Insurance Company, Progressive

Specialty Insurance Company, First Acceptance Insurance Company,

Inc., Liberty Mutual Mid-Atlantic Insurance Company, Liberty Mutual

Fire Insurance Company, Liberty Mutual Insurance Company, Safeco

Insurance Company of America, Safeco Insurance Company of Illinois,

Safeco National Insurance Company, Hartford Accident and Indemnity

Company, Hartford Casualty Insurance Company, Hartford Fire

Insurance Company, Hartford Insurance Company of The Midwest,

Hartford Insurance Company of The Southeast, Hartford Underwriters

Insurance Company, Property & Casualty Insurance Company of

Hartford, The Travelers Casualty Company, The Travelers Indemnity

Company of Connecticut, The Travelers Indemnity Company, The

Travelers Indemnity Company Of America, Travelers Casualty and

Surety Company, Travelers Property Casualty Company Of America,

Travelers Property Casualty Insurance Company, Star Casualty

Insurance Company, Mercury Insurance Company of Florida, Mercury

Indemnity Company of America, Mercury Casualty Company, and

American Mercury Insurance Company.

Recent SettlementsThis court decision comes

after LifeWallet’s most successful quarter to date since becoming a

publicly traded company, achieving two previously announced

comprehensive settlements with multiple P&C insurers.

LifeWallet believes these settlements can establish a process to

collaboratively and timely resolve future claims that are owed to

LifeWallet from the Company’s portfolio of assigned claims. Through

collaborative data sharing, LifeWallet believes these settlements

can provide additional data that enhances its ability to identify

the parties responsible for unreimbursed medical liens owned by

LifeWallet. It also allows LifeWallet to identify any recoverable

claims for future business that pertain to the settling

counterparties.

LifeWallet continues making progress with settlement

negotiations involving other P&C Insurers to resolve pending

litigation under the same or similar framework. LifeWallet’s goal

is to bring additional P&C Insurers into a similar settlement

structure, building a potential revenue stream that is diversified

and predictable.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan" and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts, including for example statements

regarding potential future settlements. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. As a result, these statements are not

guarantees of future performance or results and actual events may

differ materially from those expressed in or suggested by the

forward-looking statements. Any forward-looking statement made by

the Company herein speaks only as of the date made. New risks and

uncertainties come up from time to time, and it is impossible for

the Company to predict or identify all such events or how they may

affect it. the Company has no obligation, and does not intend, to

update any forward-looking statements after the date hereof, except

as required by federal securities laws. Factors that could cause

these differences include, but are not limited to, the Company’s

ability to capitalize on its assignment agreements and recover

monies that were paid by the assignors; the inherent uncertainty

surrounding settlement negotiations and/or litigation, including

with respect to both the amount and timing of any such results; the

success of the Company's scheduled settlement mediations; the

validity of the assignments of claims to the Company; negative

publicity concerning healthcare data analytics and payment

accuracy; and those other factors included in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

reports filed by it with the SEC. These statements constitute the

Company’s cautionary statements under the Private Securities

Litigation Reform Act of 1995.

About LifeWalletFounded in 2014 as MSP

Recovery, LifeWallet has become a Medicare, Medicaid, commercial,

and secondary payer reimbursement recovery leader, disrupting the

antiquated healthcare reimbursement system with data-driven

solutions to secure recoveries from responsible parties. LifeWallet

innovates technologies and provides comprehensive solutions for

multiple industries including healthcare, legal, and sports NIL.

For more information, visit: LIFEWALLET.COM

Contact

Media:ICR, Inc.LifeWallet@icrinc.com

Investors:Investors@LifeWallet.com

1 “Secondary Payers” includes Medicare Part C plans, as well as

downstream entities. MSP Recovery Claims, Series LLC v. ACE Am.

Ins. Co., 974 F.3d 1305, 1316 (11th Cir. 2020).2 The case is MSP

Recovery Claims Series LLC et al. v. USAA Casualty Insurance

Company, No. 2018-042110-CA-01 (Fla. 11th Cir. Ct. filed Dec. 19,

2018).3 “Primary Plans” or “Primary Payers,” when used in the

Medicare Secondary Payer context, means “any entity that is or was

required or responsible to make payment with respect to an item or

service (or any portion thereof) under a primary plan. These

entities include, but are not limited to, insurers or

self-insurers, third party administrators, and all employers that

sponsor or contribute to group health plans or large group health

plans.” 42 C.F.R. § 411.21.

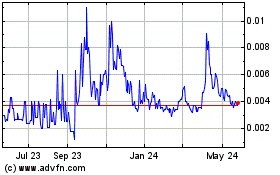

MSP Recovery (NASDAQ:LIFWW)

Historical Stock Chart

From Dec 2024 to Jan 2025

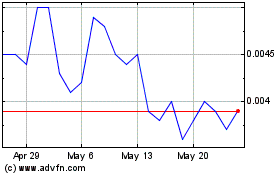

MSP Recovery (NASDAQ:LIFWW)

Historical Stock Chart

From Jan 2024 to Jan 2025