As filed with the U.S. Securities and Exchange

Commission on January 22, 2025.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LUOKUNG TECHNOLOGY

CORP.

(Exact name of registrant as specified in its charter)

| British Virgin Islands |

|

7371 |

|

Not Applicable |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(IRS Employer

Identification Number) |

Room 805, West Tower, Century Fortune Center

Guanghua Road, Chaoyang District, Beijing

People’s Republic of China 100020

+(86)10-6506-5217

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: 302-738-6680

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copy to:

|

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212)326-0199 |

Approximate date of commencement

of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following

box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act: Emerging growth company ☒

If an emerging growth company

that prepares its financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”),

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised

financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards

Codification after April 5, 2012. |

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to such

Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO

COMPLETION, DATED JANUARY 23, 2025 |

Up to 3,850,792

Ordinary Shares

LUOKUNG TECHNOLOGY

CORP.

This prospectus relates to

resale from time to time by certain selling shareholders, of up to 3,850,792 ordinary shares, par value US$0.0001 per share (the “Ordinary

Shares”) of Luokung Technology Corp. (the “Company”, or “Luokung”), including (i) up to 2,288,292 Ordinary

Shares issued by us to certain creditors (“Debt Investors”) pursuant to certain debt-to-equity conversion agreement (the “Conversion

Agreement”) entered into by and among the Company and certain creditors on July 8, 2024 and (ii) up to 1,562,500 Ordinary Shares

issued by us to certain investors (“New Investors”, with Debt Investors, each, a “Selling Shareholder”, collectively,

“Selling Shareholders”) pursuant to certain Ordinary Share Subscription Agreement (the “Subscription Agreement”)

entered into by and among the Company and the New Investors thereto on July 10, 2024.

We are registering the resale

of these securities by the Selling Shareholders named in this prospectus, or their transferees, pledgees, donees or assignees or other

successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. The Selling Shareholders

may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market

prices or at privately negotiated prices. The resale of these securities are being registered to permit the Selling Shareholders to sell

securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Shareholders may sell

these securities through ordinary brokerage transactions, directly to market makers of our shares or through any other means described

in the section titled “Plan of Distribution”. We will pay certain expenses associated with the registration of the

resale of these securities covered by this prospectus, as described in the section titled “Plan of Distribution”.

All of the Ordinary Shares

offered by the Selling Shareholders pursuant to this prospectus will be sold by the Selling Shareholders for their respective accounts.

We will not receive any of the proceeds from the sale of Ordinary Shares by the Selling Shareholders or the issuance of Ordinary Shares

by us pursuant to this prospectus.

The shares being registered

for resale by this registration statement will be considerable relative to the Company’s public float. As a result, sales of shares

on this registration statement could have significant negative impact on the public trading price of the Ordinary Share of the Company.

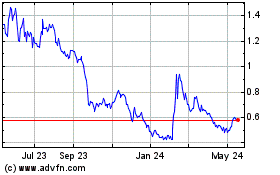

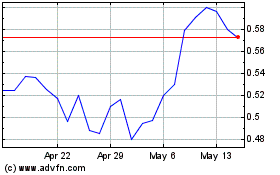

Our Ordinary Shares are currently traded on the Nasdaq Capital Market

(“Nasdaq”) under the symbol “LKCO.” The closing price of our Ordinary Shares on the Nasdaq on January 22, 2025

was $1.74 per ordinary share.

We are a British Virgin

Islands holding company with operations primarily conducted by our subsidiaries and the variable interest entities (the “VIEs”)

established in the People’s Republic of China (“PRC” or “China”). Therefore, the investors are buying shares

of a British Virgin Islands holding company and you will not hold any interests of our Chinese operating companies or the VIEs.

This

structure as referenced above involves unique risks to investors. The VIE structure enables investors to share economic interests in China-based

companies in sectors where foreign direct investment is prohibited or restricted under laws and regulations in the Chinese mainland, and

investors in our ordinary shares may never hold equity interests in the Chinese operating company. In addition, the legality and enforceability

of the contractual agreements between our PRC subsidiaries, the VIEs, and their nominee shareholders, as a whole, have not been tested

in court. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations

and/or a material change in the value of the securities we have listed, which could cause the value of such securities to significantly

decline or become worthless. See “Risk Factors – If the PRC government deems that our agreements with the VIEs do not comply

with PRC regulatory restrictions on foreign investment in the relevant industries or other laws or regulations of the PRC, or if these

regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to

relinquish our interests in those operations, which may materially reduce the value of our ordinary shares.” for a more detailed

discussion of risks we face as a result of our VIE structure.

The

contractual arrangements with the consolidated VIEs may not be as effective as ownership in ensuring receiving economic benefits from

the business operations in the PRC and we may incur substantial costs to enforce the terms of the arrangements. See “Risk Factors

- Risks Related to Our Corporate Structure – If the PRC government deems that our agreements with the VIEs do not comply with PRC

regulatory restrictions on foreign investment in the relevant industries or other laws or regulations of the PRC, or if these regulations

or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish

our interests in those operations, which may materially reduce the value of our ordinary shares.”

Our

corporate structure is subject to risks associated with our contractual arrangements with the VIEs. Investors may never directly hold

equity interests in the VIEs. If the PRC government finds that the agreements that establish the structure for operating our business

do not comply with the PRC laws and regulations, or if these regulations or their interpretations change in the future, we could be subject

to severe penalties or be forced to relinquish our interests in those operations. Our holding company, our PRC subsidiaries, the VIEs,

and our investors face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual

arrangements with the VIEs and, consequently, significantly affect the financial performance of the VIEs and our company as a whole.

As

an offshore holding company, we will be permitted under PRC laws and regulations to provide funding from the proceeds of our offshore

fund-raising activities to our subsidiaries in China only through loans or capital contributions, subject to the satisfaction of the applicable

government registration and approval requirements. Before providing loans to our PRC subsidiaries, we will be required to make filings

about details of the loans with the State Administration of Foreign Exchange of the PRC (the “SAFE”) in accordance with relevant

PRC laws and regulations. Our PRC subsidiaries that receive the loans are only allowed to use the loans for the purposes set forth in

these laws and regulations. Under regulations of the SAFE, Renminbi is not convertible into foreign currencies for capital account items,

such as loans, repatriation of investments and investments outside of China, unless the prior approval of the SAFE is obtained and prior

registration with the SAFE is made.

For

the fiscal year ended December 31, 2023, Luokung transferred $28,000 to MMB Limited, which is our wholly owned subsidiary. MMB Limited

transferred $1,000 to Luokung. For the six months ended June 30, 2024, Luokung transferred $nil to our subsidiaries, and our subsidiaries

transferred $nil to Luokung. Since July 1, 2024 and until the date of this prospectus, no such transactions occured. Other than

the transfers mentioned above, as of the date of this prospectus, Luokung has not made any other transfers, dividends or distributions

between the holding company, any of its subsidiaries or to investors. We do not have any current intentions to distribute further earnings.

If we determine to pay dividends on any of our Ordinary Shares in the future, as a holding company, we will be dependent on receipt of

funds from our subsidiaries by way of dividend payments. See “Risk Factors — Our holding company structure may limit the

payment of dividends” in the Company’s annual report on 20-F incorporated herein by reference for more information. The

company currently does not have any cash management policies that dictate how funds are transferred.

VIE Arrangements with

VIEs and Their Respective Shareholders

| (i) |

Contracts that give the Company effective control of the VIEs |

Exclusive Option

Agreement

Each

VIE equity holder has granted the Wholly Foreign-Owned Enterprises (“WFOEs”) exclusive call options to purchase the nominal

equity interest in the VIEs at an exercise price equal to (i) with regard to Zhong Chuan Shi Xun, the minimum price as permitted by applicable

PRC laws, or (ii) with regard to Beijing BotBrain, RMB10 in aggregate, or if appraisal is required as requested by relevant PRC laws,

the price as determined by the relevant parties, or (iii) with regard to eMapgo Technologies (Beijing) Co., Ltd (“EMG”), RMB

1 in aggregate or other price as determined by the relevant parties, provided that if required by relevant PRC laws, the minimum price

as permitted by PRC laws shall apply. The WFOEs may designate another entity or individual to purchase the nominal equity interests, if

applicable, under the call options. Each call option is exercisable subject to the condition that applicable PRC laws, rules and regulations

do not prohibit completion of the transfer of the nominal equity interests pursuant to the call option. The VIEs shall not declare any

dividend or other distribution to its equity holders without the approval of the WFOEs. With regard to Zhong Chuan Shi Xun and Beijing

BotBrain, the exclusive call option agreements remain in effect for ten (10) years and may be renewed at the election of the WFOEs. With

regard to EMG, the exclusive call option agreement shall remain in effect until all nominal equity interest under the call option has

been transferred to the WFOE or its designated entity or individual.

Equity Pledge Agreements

As

for Zhong Chuan Shi Xun and Beijing BotBrain, pursuant to the relevant equity pledge agreements, the relevant VIE equity holders have

pledged all of their interests in the equity of the VIEs as a continuing security interest in favor of the corresponding WFOEs to secure

the performance of obligations by the VIEs and/or the equity holders under the exclusive business cooperation agreements. Each WFOE is

entitled to exercise its right to dispose of the VIE equity holders’ pledged interests in the equity of the VIE in accordance with

applicable PRC laws in the event of any breach or default, and VIE equity holders shall cease to be entitled to any rights or interests

associated with their nominal equity interests in the VIEs. These equity pledge agreements remain in force until and unless the obligations

of the VIE equity holders to the WFOEs under the exclusive business cooperation agreements have been fulfilled.

As

for EMG, pursuant to the relevant equity pledge agreement, the relevant VIE equity holder has pledged all of its nominal equity interest

in the VIE as a continuing first priority security interest in favor of the corresponding WFOE to secure the performance of obligations

by the VIE as set forth in the relevant exclusive option agreement, proxy agreement, the equity pledge agreement and the VIE’s obligation

to repay the secured indebtedness. The VIE equity holder shall not be entitled to receive any dividend associated with its nominal equity

interest without the approval of the WFOE, and the dividend received by the VIE equity holder shall be deposited in the account designated

by the WFOE and subject to the supervision of the WFOE. In the event of any breach or default, the WFOE shall be entitled to all rights

to relief, including but not limited to disposing the nominal equity interest held by the VIE equity holder. The equity pledge agreement

shall remain in force until and unless the obligations of the VIE equity holder to the WFOE under the exclusive option agreement, proxy

agreement, the equity pledge agreement have been fulfilled or all the secured indebtedness has been paid off.

Power of Attorney

As

for Zhong Chuan Shi Xun and Beijing BotBrain, pursuant to the relevant power of attorney, each of the relevant VIE equity holders irrevocably

appoints the corresponding WFOE as its attorney-in-fact to exercise on its behalf any and all rights that such equity holder has in respect

of its nominal equity interests in the relevant VIE conferred by relevant laws and regulations and the articles of associate of such VIE.

The power of attorney shall remain effective as long as such VIE equity holder remains as a shareholder of Zhong Chuan Shi Xun or Beijing

BotBrain.

As

for EMG, pursuant to the relevant power of attorney, the relevant VIE equity holder irrevocably appoints certain the person designated

by the corresponding WFOE as its attorney-in-fact to exercise on its behalf any and all rights that such equity holder has in respect

of its nominal equity interest in the relevant VIE conferred by relevant laws and regulations and the articles of associate of such VIE.

The power of attorney of EMG shall remain effective until March 11, 2044, and will be renewed automatically for another ten (10) years

unless the parties to the power of attorney agree otherwise.

| (ii) |

Contracts that enable the Company to receive the certain benefits from the VIEs |

Exclusive business

cooperation agreements

As

for Zhong Chuan Shi Xun and Beijing BotBrain and EMG, each relevant VIE has entered into an exclusive business services agreement with

the corresponding WFOE, pursuant to which the relevant WFOE provides exclusive business services to the VIE. In exchange, (i) Zhong Chuan

Shi Xun pays a service fee to the corresponding WFOE which shall be no less than 80% of Zhong Chuan Shi Xun’s after-tax profits;

(ii) Beijing BotBrain pays a service fee to the corresponding WFOE which shall be reasonably determined by such WFOE based on certain

factors; (iii) EMG pays a service fee to the corresponding WFOE which shall be 20% of EMG’s annual income. Luokung exercises control

over the VIEs through a Call Option Agreement, an Equity Pledge Agreement, an Exclusive Business Cooperation Agreement and a Proxy Agreement.

The amount of service fees to be paid by EMG and BotBrain shall be determined solely by the WFOE or as mutually agreed by the WFOE and

the VIEs. Based on the control Luokung exercises through these agreements and based on its ability to determine the fees paid by EMG and

BotBrain, Luokung is considered the primary beneficiary of the VIEs.

Termination agreements

On

January 5, 2023, Zhong Chuan Shi Xun and certain shareholder of Beijing Wave Function Culture Development Co., Ltd. (“Wave Function”)

entered into certain termination of persons acting in concert agreement (“Wave Function Termination Agreement”). Pursuant

to the Wave Function Termination Agreement, both parties agreed not to act in concert of the business strategic operation and management,

and enjoyed the respective rights and obligation as shareholders.

Limitation of VIE

Structure Derived from the PRC Legal Systems

There

are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules

regarding the status of the rights of our British Virgin Islands holding company with respect to its contractual arrangements with the

VIEs and their respective shareholders. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structures

will be adopted or if adopted, what they would provide. If we or any of the VIEs is found to be in violation of any existing or future

PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities

would have broad discretion to take action in dealing with such violations or failures. See “Risk Factors - Risks Related to

Doing Business in China – PRC laws and regulations govern our businesses. If we are found to be in violation of such PRC laws and

regulations, we could be subject to sanctions. In addition, changes in and uncertainties with respect to such PRC laws and regulations

may materially and adversely affect our business.”

On

March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law of the PRC, (the “Foreign Investment

Law”), which came into effect on January 1, 2020. The Foreign Investment Law replaced the Law on Sino-Foreign Equity Joint Ventures,

the Law on Sino-Foreign Contractual Joint Ventures and the Law on Wholly Foreign-Owned Enterprises as the legal foundation for foreign

investments in China. The Foreign Investment Law stipulates certain forms of foreign investment, which do not include the contractual

arrangements as a form of foreign investment but stated that foreign investment includes “foreign investors invest through any other

methods under laws, administrative regulations or provisions prescribed by the State Council”. There are uncertainties in determining

whether our contractual arrangements constitute foreign investments and there is no guarantee that the VIE contractual arrangements and

the business of the VIEs and their subsidiaries will not be materially and adversely affected in the future.

Rules

and regulations in China can change quickly with little advance notice and the PRC government may intervene or influence a registrant’s

operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers.

It is uncertain whether any new PRC laws, rules or regulations affecting the VIE structure will be adopted or if adopted, what they would

provide. See “Risk Factors - Risks Related to Doing Business in China - PRC laws and regulations govern our businesses.

If we are found to be in violation of such PRC laws and regulations, we could be subject to sanctions. In addition, changes in and uncertainties

with respect to such PRC laws and regulations may materially and adversely affect our business.” There can be no assurance that

the VIE Arrangements will be deemed by the relevant governmental or judicial authorities to be in compliance with the existing or

future applicable PRC laws and regulations, or the relevant governmental or judicial authorities may in the future interpret the existing

laws or regulations with the result that the contractual arrangements will be deemed to be in compliance of the PRC laws and regulations.

Our

subsidiaries and the VIEs face various legal and operational risks and uncertainties associated with being based in or having our operations

primarily in China and under the complex and evolving PRC laws and regulations. For instance, PRC government has significant authority

in regulations and we face risks and uncertainties associated with regulatory approvals on offerings conducted overseas by and foreign

investment in China-based issuers, the use of the VIEs, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy.

In recent years, PRC government has been exerting more oversight and control over offerings conducted overseas by, and foreign investment

in, China-based issuers. Although we believe our operating structure is legal and permissible under the Chinese law and regulations currently

in effect, Chinese regulatory authorities could take a different position on the interpretation and enforcement of laws and regulations

and disallow our holding company structure. These legal and operational risks and uncertainties associated with being based in China may

materially and adversely change our operations, affect the value of our ordinary shares, significantly limit or completely hinder our

ability to offer or continue to offer securities to investors could cause the value of our securities to significantly decline or be worthless.

For a detailed description of risks related to doing business in China, see “Item 3. Key Information - D. Risk Factors - Risks Related

to Doing Business in China.”

As

of the date of this prospectus, neither we nor the VIEs have been involved in any investigations initiated by any PRC regulatory authority,

nor has any of them received any inquiry, notice or sanction for the business operation, accepting foreign investment or listing on the

Nasdaq Stock Market. However, since these statements and regulatory actions by China’s government are newly published, official

guidance and related implementation rules have not been issued. It is highly uncertain what future impact such modified or new laws and

regulations will have on our daily business operations, the ability to accept foreign investments and our continued listing on the Nasdaq

Stock Market. See “Risk Factors - Risks Related to Doing Business in China - PRC laws and regulations govern our businesses.

If we are found to be in violation of such PRC laws and regulations, we could be subject to sanctions. In addition, changes in and uncertainties

with respect to such PRC laws and regulations may materially and adversely affect our business.” These risks and uncertainties

arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules

and regulations in China, could result in a material adverse change in our operations and the value of our ordinary shares.

Permissions Required from the PRC Authorities

for Our Operations

We

conduct our business primarily through our subsidiaries, and the VIEs, in China. Our operations in China are governed by PRC laws and

regulations. As of the date of this prospectus, neither we nor the VIEs have been involved in any investigations initiated by any PRC

regulatory authority, nor has any of them received any inquiry, notice or sanction for our operations or our issuance of securities to

investors. Nevertheless, the Standing Committee of the National people’s Congress (the “SCNPC”) or PRC regulatory authorities

may in the future promulgate laws, regulations or implementing rules that requires us, our subsidiaries, the VIEs or their subsidiaries

to obtain permissions from PRC regulatory authorities to approve the VIE operations.

According

to Article 7 of the Measures of Cybersecurity Review (“the New CAC Measures”) which was promulgated by

the Cyber Administration of China, together with 12 other departments on December 28, 2021 and entered into force and effect

on February 15, 2022, a network platform operator that holds personal information of more than one million users shall report to Cybersecurity

Review Office for cybersecurity review when it seeks to list its securities overseas. During such reviews, the network platform operator

may be required to take measures to prevent and mitigate risk, and such measures could cause disruptions to our operations. Cybersecurity

review could also result in negative publicity with respect to the network platform operator and diversion of its managerial and financial

resources, which could materially and adversely affect its business, financial conditions, and results of operations. The

New CAC Measures do not apply to the Company or any of its subsidiaries or the VIEs as of the date of this annual report. The Company

and any of its subsidiaries or the VIEs are not critical information infrastructure operators purchasing network products and services

or online platform operators carrying out data processing activities that affect or may affect national security. We hold less than 1

million users’ personal information. We believe we are not subject to the cybersecurity review under the New CAC Measures. As of

the date of this report, we have not been involved in any investigations on cybersecurity review initiated by the CAC, and we have not

received any warning, sanction or penalty in such respect. We believe that we are compliant with the regulations or policies that have

been issued by the CAC as of the date of this prospectus. As of the date of this prospectus,

for entities that have been listed overseas before the implementation of the New CAC Measures and intend to issue additional shares rather

than doing a public listing, the New CAC Measures do not clearly stipulate that such entities or their subsidiaries, as network platform

operators, shall report to Cybersecurity Review Office for cybersecurity review. The New CAC Measures remain unclear on whether such requirements

will be applicable to companies which are already listed in the United States, such as us. It also remains uncertain whether any future

regulatory changes would impose additional restrictions on companies like us. The aforementioned policies and any related implementation

rules to be enacted may subject us to additional compliance requirements in the future. As these opinions were recently issued, official

guidance and interpretation of the opinions remain unclear in several respects at this time. Therefore, we cannot assure you that we will

remain fully compliant with all new regulatory requirements of these opinions or any future implementation rules on a timely basis, or

at all. Please see “Risk Factor - Recent greater oversight by the

CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business and our

offering” for more detailed discussion.

On

July 30, 2021, in response to the recent regulatory developments in China and actions adopted by the PRC government, the Chairman of the

Security and Exchange Commission (the “SEC”) issued a statement asking the SEC staff to seek additional disclosures from offshore

issuers associated with China-based operating companies before their registration statements will be declared effective. On August 1,

2021, the China Securities Regulatory Commission (the “CSRC”) stated in a statement that it had taken note of the new disclosure

requirements announced by the SEC regarding the listings of Chinese companies and the recent regulatory development in China, and that

both countries should strengthen communications on regulating China-related issuers. To the best of our knowledge, as of the date of this

annual report, current Chinese laws and regulations do not forbid us from issuing securities overseas. On December 24, 2021, the CSRC

published the Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Draft Administrative Provisions”)

and the Administration Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Draft Filing

Measures”). The Draft Administrative Provisions and the Draft Filing Measures lay out requirements for filing and include unified

regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. On February 17, 2023, the CSRC

promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”),

which took effect on March 31, 2023. On the same date, the CSRC circulated Supporting Guidance Rules No. 1 through No. 5, Notes on the

Trial Measures, Notice on Administration Arrangements for the Filing of Overseas Listings by Domestic Enterprises and relevant CSRC Answers

to Reporter Questions, or collectively, the Guidance Rules and Notice, on CSRC’s official website. The Trial Measures, together

with the Guidance Rules and Notice reiterate the basic principles of the Draft Administrative Provisions and Draft Filing Measures, and

clarified and emphasized several aspects, which include but are not limited to: (1) criteria to determine whether an issuer will be required

to go through the filing procedures under the Trial Measures; (2) exemptions from immediate filing requirements for issuers including

those that have already been listed in foreign securities markets, including U.S. markets, prior to the effective date of the Trial Measures,

but these issuers shall still be subject to filing procedures if they conduct refinancing or are involved in other circumstances that

require filing with the CSRC; (3) a negative list of types of issuers banned from listing or offering overseas, such as issuers whose

affiliates have been recently convicted of bribery and corruption; (4) issuers’ compliance with web security, data security, and

other national security laws and regulations; (5) issuers’ filing and reporting obligations, such as obligation to file with the

CSRC after it submits an application for initial public offering to overseas regulators, and obligation after offering or listing overseas

to file with the CSRC after it completes subsequent offerings and to report to the CSRC material events including change of control or

voluntary or forced delisting of the issuer; and (6) the CSRC’s authority to fine both issuers and their relevant shareholders for

failure to comply with the Trial Measures, including failure to comply with filing obligations or committing fraud and misrepresentation.

Specifically, we are not subject to the filing requirements as regulated by the Trial Measures, however, pursuant to the Trial Measures,

our future securities offerings in Nasdaq Capital Market where we currently list shall also be filed with the CSRC within 3 working days

after the offering is completed. As the Trial Measures are newly issued, there remain uncertainties regarding its interpretation and implementation.

Therefore, we cannot assure you that we will be able to complete the filings for our future offering and fully comply with the relevant

new rules on a timely basis, if at all. In addition, we cannot guarantee that we will not be subject to tightened regulatory review and

we could be exposed to government interference in China.

In

addition, as of the date of this prospectus, except for business license, foreign investment

information report to the commerce administrative authority and foreign exchange registration or filing, our consolidated subsidiaries

and the VIEs are not required to obtain any other licenses and permits from the PRC government authorities, and our holding company, our

Chinese subsidiaries and the VIEs have obtained all the licenses and permits that are requisite for the business operations in China.

However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by

government authorities, we may be required to obtain certain licenses, permits, filings, permissions or approvals for the functions and

services that we provided in the future, or to offer securities, in China.

If

we, our subsidiaries, or the VIEs (i) do not receive or maintain such permissions or

approvals, should the approval be required in the future by the PRC government, (ii) inadvertently conclude that such permissions or approvals

are not required, or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals

in the future, our operations and financial conditions could be materially adversely affected, our ability to offer securities to investors

could be significantly limited or completely hindered and our securities may substantially decline in value or be worthless. As of the

date of this annual report, based on Company’s management’s understanding of the current PRC laws and regulations, we will

not be required to submit an application to the CSRC for the approval under the M&A Rules for our offshore offerings because (i) the

CSRC currently has not issued any definitive rule or interpretation concerning whether our offshore offerings are subject to this regulation;

and (ii) no provision in the M&A Rules classifies the contractual arrangements under the VIE agreements as a type of acquisition transaction

falling under the M&A Rules. However, there remains some uncertainty as to how the M&A Rules will be interpreted or implemented

in the context of an overseas offering, and its opinions summarized above are subject to any new laws, rules and regulations or detailed

implementations and interpretations in any form relating to the M&A Rules. These regulatory agencies may impose fines and penalties

on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the

repatriation of the proceeds into China or take other actions that could have a material adverse effect on our business, financial condition,

results of operations, as well as the trading price of our securities. The CSRC, the Cyberspace Administration of China or other PRC regulatory

agencies also may take actions requiring us, or making it advisable for us, to halt any securities offering we may undertake in the future.

Consequently, if you engage in market trading or other activities in anticipation of and prior to settlement and delivery, you do so at

the risk that settlement and delivery may not occur. In addition, if the CSRC, the Cyberspace Administration of China or other regulatory

PRC agencies later promulgate new rules requiring that we obtain more approvals in the future, we may be unable to obtain such approvals

or a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative

publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities. These

legal and operational risks and uncertainties associated with being based in China may materially and adversely change our operations,

affect the value of our ordinary shares, significantly limit or completely hinder our ability to offer or continue to offer securities

to investors could cause the value of our securities to significantly decline or be worthless.

In addition, the Chinese government

has recently strengthened its anti-monopoly regulation and enforcement. In 2011, the State Council promulgated the Notice on Establishing

the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or Circular 6, and MOFCOM issued

related implementation regulations, officially establishing a security review system for mergers and acquisitions of domestic enterprises

by foreign investors. In July 2021, the Cyberspace Administration of China (“CAC”) opened cybersecurity probes into several

U.S.-listed technology companies focusing on anti-monopoly regulation and those companies’ practice to collect, store, process and

transfer data. On June 24, 2022, the Standing Committee of the National People’s Congress adopted the amended Anti-Monopoly Law,

which increases the fines for illegal concentration of business operators. On February 7, 2021, the Anti-Monopoly Committee of the State

Council promulgated the Anti-monopoly Guidelines for the Platform Economy Sector, or the Anti-monopoly Guideline, aiming to improve anti-monopoly

administration on online platforms and specifically prohibit certain acts of the platform economy operators that may have the effect of

eliminating or limiting market competition. As of the date of this prospectus, the Chinese government’s recent statements and regulatory

actions related to anti-monopoly concerns have not impacted our ability to conduct business, accept foreign investments, or list on Nasdaq

Capital Market because neither the Company, the Company’s subsidiaries, nor the VIEs have engaged in monopolistic acts that are

subject to these statements or regulatory actions.

Dividends

As a holding company, we may

rely upon dividends paid to us by our subsidiaries in the PRC, the contractual payment paid to us by the VIEs, or elsewhere to pay dividends

and to finance any debt we may incur. As of the date of this prospectus, none of our subsidiaries or the VIEs has issued any dividends

or distributions to us and we have not made any dividends or distributions to our shareholders. Our subsidiaries and the VIEs in the PRC

generate and retain cash generated from operating activities and re-invest it in the business.

Current PRC regulations permit

our subsidiaries in mainland China to pay dividends to us only out of their accumulated profits, if any, determined in accordance with

Chinese accounting standards and regulations. Under our current corporate structure, we rely on dividend payments or other distributions

from our subsidiaries and the VIEs to fund any cash and financing requirements we may have, including the funds necessary to pay dividends

and other cash distributions to our shareholders or to service any debt we may incur. If any subsidiary incurs debt on its own behalf

in the future, the instruments governing such debt may restrict its ability to pay dividends to us. In addition, under PRC laws and regulations,

each of our subsidiaries in mainland China is required to set aside a portion of their net income each year to fund a statutory surplus

reserve until such reserve reaches 50% of its registered capital. This reserve is not distributable as dividends. As a result, our PRC

subsidiaries are restricted in their ability to transfer a portion of its net assets to us in the form of dividends, loans or advances.

Further, the PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out

of the PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign

currency for the payment of dividends from our profits, if any. If we are unable to receive funds from our subsidiaries, we may be unable

to pay cash dividends on our ordinary shares.

Cash dividends, if any, on

our Ordinary Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we

pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate

of up to 10%. A 10% PRC withholding tax is applicable to dividends payable to investors that are non-resident enterprises. Any gain realized

on the transfer of ordinary shares by such investors is also subject to PRC tax at a current rate of 10% which in the case of dividends

will be withheld at source if such gain is regarded as income derived from sources within the PRC.

PCAOB

and the Holding Foreign Companies Accountable Act

The

Holding Foreign Companies Accountable Act (the “HFCAA”), recent regulatory actions taken by the SEC and PCAOB, and proposed

rule changes submitted by U.S. stock exchanges calling for additional and more stringent criteria to be applied to China-based public

companies could add uncertainties to our capital raising activities and compliance costs. The HFCAA requires a foreign company to certify

it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign

auditor not subject to PCAOB inspection. If the PCAOB determines that it is unable to inspect our auditors for three consecutive years,

our securities may be prohibited to trade on a national exchange. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating

Holding Foreign Companies Accountable Act, which, if enacted, would amend the HFCAA and require the SEC to prohibit an issuer’s

securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead

of three, and thus, would reduce the time before our securities may be prohibited from trading or delisted. On December 20, 2021, the

PCAOB issued a report on its determinations that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting

firms headquartered in mainland China or Hong Kong because of positions taken by PRC authorities in those jurisdictions. Our independent

registered public accounting firms that issued audit reports for our financial statements for 2023, 2022 and 2021, as auditors of companies

that are traded publicly in the United States and firms registered with the PCAOB, are subject to laws in the United States pursuant to

which the PCAOB conducts regular inspections to assess our auditors’ compliance with the applicable professional standards, and

thus our auditors are not subject to the determinations announced by the PCAOB on December 16, 2021. However, we cannot be certain whether

SEC or other U.S. regulatory authorities would apply additional and more stringent criteria to Chinese issuers including us as related

to the audit of our financial statements. Trading in our securities may be prohibited under the HFCAA if the PCAOB determines that it

cannot inspect or investigate completely our auditors, and that as a result an exchange may determine to delist our securities.

On

August 26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and the Ministry of Finance of the PRC (the “Statement

of Protocol”), which is intended to enable the PCAOB to inspect and investigate completely registered public accounting firms in

mainland China and Hong Kong. According to a statement released by the PCAOB, the Statement of Protocol (i) provides the PCAOB with

sole discretion to select the firms, audit engagements and potential violations it inspects and investigates without consultation with,

nor input from, Chinese authorities, (ii) puts procedures in place for PCAOB inspectors and investigators to view complete audit work

papers with all information included and for the PCAOB to retain information as needed and (iii) provides the PCAOB with direct access

to interview and take testimony from all personnel associated with the audits the PCAOB inspects or investigates. While the Chairs of

both the PCAOB and the SEC made statements supporting the Statement of Protocol, both emphasized that this is only the first step in the

process. On December 15, 2022, the PCAOB issued a new Determination Report which: (1) vacated the December 16, 2021 Determination Report;

and (2) concluded that the PCAOB has been able to conduct inspections and investigations completely in the PRC in 2022. The December 15,

2022 Determination Report cautions, however, that authorities in the PRC might take positions at any time that would prevent the PCAOB

from continuing to inspect or investigate completely. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act

was signed into law, which officially reduce the number of years auditor is not subject to

PCAOB inspections to two consecutive years. As such, uncertainties remain regarding how it will impact China-based issuers and

there is no assurance that the PCAOB will continue being able to execute, in a timely manner, its future inspections and investigations.

As required by the HFCAA, if in the future the PCAOB determines it no longer can inspect or investigate completely because of a position

taken by an authority in the PRC, the PCAOB will act expeditiously to consider whether it should issue a new determination, and upon that

time the Company will only have two years to comply with PCAOB audits.

Selected Financial Data

(Unit: US$)

Consolidating Statements of Income Information

| | |

Year ended December 31, 2023 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs and

their

subsidiaries | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| 23,174 | | |

| 10,121,605 | | |

| 849,506 | | |

| (758,050 | ) | |

| 10,236,235 | |

| Cost of Revenue | |

| - | | |

| - | | |

| 5,451,918 | | |

| 295,126 | | |

| (116,319 | ) | |

| 5,630,725 | |

| Gross profit (loss) | |

| - | | |

| 23,174 | | |

| 4,669,687 | | |

| 554,380 | | |

| (641,731 | ) | |

| 4,605,510 | |

| Operating expenses | |

| 10,644,763 | | |

| 5,751,034 | | |

| 12,779,770 | | |

| 2,806,880 | | |

| 153,917,318 | | |

| 185,899,765 | |

| Loss from operations | |

| (10,644,763 | ) | |

| (5,727,860 | ) | |

| (8,110,083 | ) | |

| (2,252,500 | ) | |

| (154,559,049 | ) | |

| (181,294,255 | ) |

| Other expenses, net | |

| (74 | ) | |

| 41,618 | | |

| 429,135 | | |

| (3,526,313 | ) | |

| 5,383,633 | | |

| 2,327,999 | |

| Provision for income tax | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,755,973 | ) | |

| (2,755,973 | ) |

| Loss before noncontrolling interest | |

| (10,644,837 | ) | |

| (5,686,242 | ) | |

| (7,680,948 | ) | |

| (5,778,813 | ) | |

| (151,931,389 | ) | |

| (181,722,229 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| - | | |

| 394,627 | | |

| (3,722 | ) | |

| (390,905 | ) |

| Net loss | |

| (10,644,837 | ) | |

| (5,686,242 | ) | |

| (7,680,948 | ) | |

| (5,384,186 | ) | |

| (151,935,111 | ) | |

| (181,331,324 | ) |

| | |

Year ended December 31, 2022 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs and

their

subsidiaries | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| 5,464,332 | | |

| 6,432,597 | | |

| 86,199,653 | | |

| (4,503,396 | ) | |

| 93,593,186 | |

| Cost of Revenue | |

| - | | |

| 271,313 | | |

| 3,239,958 | | |

| 74,629,562 | | |

| (199,168 | ) | |

| 77,941,665 | |

| Gross profit (loss) | |

| - | | |

| 5,193,019 | | |

| 3,192,639 | | |

| 11,570,091 | | |

| (4,304,228 | ) | |

| 15,651,521 | |

| Operating expenses | |

| 20,968,387 | | |

| 13,229,967 | | |

| 18,163,688 | | |

| 10,582,141 | | |

| (13,249,307 | ) | |

| 76,193,490 | |

| Loss from operations | |

| (20,968,387 | ) | |

| (8,036,948 | ) | |

| (14,971,049 | ) | |

| 987,950 | | |

| (17,553,535 | ) | |

| (60,541,969 | ) |

| Other expenses, net | |

| 327 | | |

| 124,606 | | |

| 711 | | |

| (2,944,089 | ) | |

| 9,207,349 | | |

| 6,388,904 | |

| Provision for income tax | |

| - | | |

| - | | |

| - | | |

| (8,878 | ) | |

| 3,950,202 | | |

| 3,941,324 | |

| Loss before noncontrolling interest | |

| (20,968,060 | ) | |

| (7,912,342 | ) | |

| (14,970,338 | ) | |

| (1,965,017 | ) | |

| (4,395,984 | ) | |

| (50,211,741 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| - | | |

| (2,702,185 | ) | |

| 374,244 | | |

| (2,327,941 | ) |

| Net loss | |

| (20,968,060 | ) | |

| (7,912,342 | ) | |

| (14,970,338 | ) | |

| (4,667,202 | ) | |

| (4,021,740 | ) | |

| (52,539,682 | ) |

| | |

Year ended December 31, 2021 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs and

their

subsidiaries | | |

Consolidation

Adjustments | | |

Consolidated | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| - | | |

| (15,851 | ) | |

| 2,636,562 | | |

| 171,503,642 | | |

| (29,056,388 | ) | |

| 145,067,965 | |

| Cost of Revenue | |

| 300,000 | | |

| - | | |

| 726,389 | | |

| 131,315,543 | | |

| (3,315,846 | ) | |

| 129,026,086 | |

| Gross profit (loss) | |

| (300,000 | ) | |

| (15,851 | ) | |

| 1,910,173 | | |

| 40,188,099 | | |

| (25,740,542 | ) | |

| 16,041,879 | |

| Operating expenses | |

| 29,415,319 | | |

| 35,544,319 | | |

| 3,561,420 | | |

| 21,074,461 | | |

| (7,935,069 | ) | |

| 81,660,450 | |

| Loss from operations | |

| (29,715,319 | ) | |

| (35,560,170 | ) | |

| (1,651,247 | ) | |

| 19,113,638 | | |

| (17,805,473 | ) | |

| (65,618,571 | ) |

| Other expenses, net | |

| 3,139 | | |

| (146,447 | ) | |

| 15,427 | | |

| (3,836,228 | ) | |

| (14,642 | ) | |

| (3,978,751 | ) |

| Provision for income tax | |

| - | | |

| - | | |

| - | | |

| (9,665 | ) | |

| 8,136,002 | | |

| 8,126,337 | |

| Loss before noncontrolling interest | |

| (29,712,180 | ) | |

| (35,706,617 | ) | |

| (1,635,820 | ) | |

| 15,267,745 | | |

| (9,684,113 | ) | |

| (61,470,985 | ) |

| Less: loss attributable to noncontrolling interest | |

| - | | |

| - | | |

| - | | |

| (7,330,267 | ) | |

| - | | |

| (7,330,267 | ) |

| Net loss | |

| (29,712,180 | ) | |

| (35,706,617 | ) | |

| (1,635,820 | ) | |

| 7,937,478 | | |

| (9,684,113 | ) | |

| (68,801,252 | ) |

Consolidating Balance Sheets Information

| | |

As of December 31, 2023 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs and

their

subsidiaries | | |

Consolidation

Adjustments | | |

Consolidated | |

| Cash | |

| 5,662 | | |

| 50,690 | | |

| 18,579 | | |

| 9,055 | | |

| - | | |

| 83,986 | |

| Accounts receivable | |

| - | | |

| 755,621 | | |

| 3,613,413 | | |

| 15,794,476 | | |

| (16,814,006 | ) | |

| 3,349,504 | |

| Intercompany receivables | |

| 73,328,477 | | |

| 65,501,167 | | |

| 200,489 | | |

| 21,721,734 | | |

| (160,751,867 | ) | |

| - | |

| Other current asset | |

| 20,812,423 | | |

| 5,930,409 | | |

| 831,568 | | |

| 14,695,064 | | |

| (38,554,230 | ) | |

| 3,715,234 | |

| Total current asset | |

| 94,146,562 | | |

| 72,237,887 | | |

| 4,664,049 | | |

| 52,220,329 | | |

| (216,120,103 | ) | |

| 7,148,724 | |

| Property and equipment, net | |

| - | | |

| 235,588 | | |

| 865,341 | | |

| 43,874 | | |

| (62,803 | ) | |

| 1,082,000 | |

| Investment in subsidiaries | |

| 63,677,883 | | |

| 62,740,824 | | |

| - | | |

| 53,472,741 | | |

| (179,891,448 | ) | |

| - | |

| Intangible asset, net | |

| - | | |

| - | | |

| 29,685 | | |

| - | | |

| 43,299,459 | | |

| 43,329,144 | |

| Right of use asset, net | |

| - | | |

| 167,092 | | |

| 414,603 | | |

| 197,212 | | |

| (34,697 | ) | |

| 744,210 | |

| Other-non-current asset | |

| 2,344,250 | | |

| 2,560,573 | | |

| - | | |

| 2,936,301 | | |

| (6,507,460 | ) | |

| 1,333,664 | |

| Total Non-current asset | |

| 66,022,133 | | |

| 65,704,077 | | |

| 1,309,629 | | |

| 56,650,128 | | |

| (143,196,949 | ) | |

| 6,489,018 | |

| Total Asset | |

| 160,168,695 | | |

| 137,941,964 | | |

| 5,973,678 | | |

| 108,870,457 | | |

| (359,317,052 | ) | |

| 53,637,742 | |

| Accounts payable | |

| - | | |

| 19,906,803 | | |

| 8,104,691 | | |

| 13,843,617 | | |

| (33,620,220 | ) | |

| 8,234,891 | |

| Lease liability | |

| - | | |

| 170,962 | | |

| 357,564 | | |

| 201,778 | | |

| - | | |

| 730,304 | |

| Other current liabilities | |

| 3,469,583 | | |

| 123,048,670 | | |

| 13,967,687 | | |

| 117,160,119 | | |

| (165,870,787 | ) | |

| 91,775,272 | |

| Total current liabilities | |

| 3,469,583 | | |

| 143,126,435 | | |

| 22,429,942 | | |

| 131,205,514 | | |

| (199,491,007 | ) | |

| 100,740,467 | |

| Lease liability-NC | |

| - | | |

| - | | |

| 62,528 | | |

| - | | |

| - | | |

| 62,528 | |

| Other non-current liabilities | |

| - | | |

| - | | |

| 847,135 | | |

| - | | |

| 5,011,566 | | |

| 5,858,701 | |

| Total non-current liabilities | |

| - | | |

| - | | |

| 909,663 | | |

| - | | |

| 5,011,566 | | |

| 5,921,229 | |

| Total liabilities | |

| 3,469,583 | | |

| 143,126,435 | | |

| 23,339,605 | | |

| 131,205,514 | | |

| (194,479,441 | ) | |

| 106,661,696 | |

| Accumulated deficit | |

| (61,548,167 | ) | |

| (123,851,265 | ) | |

| (63,594,248 | ) | |

| (47,028,999 | ) | |

| (120,558,603 | ) | |

| (416,581,282 | ) |

| Other equity | |

| 218,247,279 | | |

| 118,666,794 | | |

| 46,228,321 | | |

| 24,693,942 | | |

| (54,483,334 | ) | |

| 353,353,002 | |

| Total equity | |

| 156,699,112 | | |

| (5,184,471 | ) | |

| (17,365,927 | ) | |

| (22,335,057 | ) | |

| (175,041,937 | ) | |

| (633,228,280 | ) |

| Total Liability and stockholders’ equity | |

| 160,168,695 | | |

| 137,941,964 | | |

| 5,973,678 | | |

| 108,870,457 | | |

| (359,317,052 | ) | |

| 53,637,742 | |

| | |

As of December 31, 2022 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs and

their

subsidiaries | | |

Consolidation

Adjustments | | |

Consolidated | |

| Cash | |

| 12,874 | | |

| 336,846 | | |

| 59,293 | | |

| 531,534 | | |

| 324,334 | | |

| 1,264,881 | |

| Accounts receivable | |

| - | | |

| 1,161,641 | | |

| 4,399,643 | | |

| 18,646,214 | | |

| (16,923,932 | ) | |

| 7,283,566 | |

| Intercompany receivables | |

| 74,369,714 | | |

| 68,346,860 | | |

| 526,951 | | |

| 42,042,009 | | |

| (185,285,534 | ) | |

| - | |

| Other current asset | |

| 19,478,423 | | |

| 4,693,908 | | |

| 1,058,799 | | |

| 41,506,852 | | |

| (30,460,759 | ) | |

| 36,277,223 | |

| Total current asset | |

| 93,861,011 | | |

| 74,539,255 | | |

| 6,044,686 | | |

| 102,726,609 | | |

| (232,345,891 | ) | |

| 44,825,670 | |

| Property and equipment, net | |

| - | | |

| 630,565 | | |

| 2,678,272 | | |

| 214,973 | | |

| - | | |

| 3,523,810 | |

| Investment in subsidiaries | |

| 63,677,883 | | |

| 62,440,824 | | |

| - | | |

| 57,438,383 | | |

| (183,557,090 | ) | |

| - | |

| Intangible asset, net | |

| - | | |

| - | | |

| 50,926 | | |

| 158,833 | | |

| 87,449,960 | | |

| 87,659,719 | |

| Right of use asset, net | |

| - | | |

| 692,919 | | |

| 1,002,496 | | |

| 1,030,362 | | |

| - | | |

| 2,725,777 | |

| Other-non-current asset | |

| 2,366,978 | | |

| 2,567,396 | | |

| - | | |

| 3,005,359 | | |

| 86,962,466 | | |

| 94,902,199 | |

| Total Non-current asset | |

| 66,044,861 | | |

| 66,331,704 | | |

| 3,731,694 | | |

| 61,847,910 | | |

| (9,144,664 | ) | |

| 188,811,505 | |

| Total Asset | |

| 159,905,872 | | |

| 140,870,959 | | |

| 9,776,380 | | |

| 164,574,519 | | |

| (241,490,555 | ) | |

| 233,637,175 | |

| Accounts payable | |

| - | | |

| 20,189,728 | | |

| 6,133,610 | | |

| 16,758,506 | | |

| (34,990,085 | ) | |

| 8,091,759 | |

| Lease liability | |

| - | | |

| 358,612 | | |

| 614,077 | | |

| 692,721 | | |

| - | | |

| 1,665,410 | |

| Other current liabilities | |

| 1,062,668 | | |

| 111,980,444 | | |

| 19,730,024 | | |

| 143,844,642 | | |

| (191,543,335 | ) | |

| 85,074,443 | |

| Total current liabilities | |

| 1,062,668 | | |

| 132,528,784 | | |

| 26,477,711 | | |

| 161,295,869 | | |

| (226,533,420 | ) | |

| 94,831,612 | |

| Lease liability-NC | |

| - | | |

| 324,255 | | |

| 427,499 | | |

| 396,772 | | |

| - | | |

| 1,148,526 | |

| Other non-current liabilities | |

| - | | |

| - | | |

| 861,500 | | |

| - | | |

| 2,486,040 | | |

| 3,347,540 | |

| Total non-current liabilities | |

| - | | |

| 324,255 | | |

| 1,288,999 | | |

| 396,772 | | |

| 2,486,040 | | |

| 4,496,066 | |

| Total liabilities | |

| 1,062,668 | | |

| 132,853,039 | | |

| 27,766,710 | | |

| 161,692,641 | | |

| (224,047,380 | ) | |

| 99,327,678 | |

| Accumulated deficit | |

| (52,484,550 | ) | |

| (121,844,611 | ) | |

| (55,952,193 | ) | |

| (40,940,607 | ) | |

| 35,972,003 | | |

| (235,249,958 | ) |

| Other equity | |

| 211,327,754 | | |

| 129,862,531 | | |

| 37,961,863 | | |

| 43,822,485 | | |

| (63,619,504 | ) | |

| 359,355,129 | |

| Total equity | |

| 158,843,204 | | |

| 8,017,920 | | |

| (17,990,330 | ) | |

| 2,881,878 | | |

| (27,647,501 | ) | |

| 124,105,171 | |

| Total Liability and stockholders’ equity | |

| 159,905,872 | | |

| 140,870,959 | | |

| 9,776,380 | | |

| 164,574,519 | | |

| (241,490,555 | ) | |

| 233,637,175 | |

Consolidating Cash Flows Information

| | |

Year ended December 31, 2023 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs | | |

Elimination | | |

Consolidated | |

| Net cash (used in)/provided by operation activities | |

| (305,859 | ) | |

| 1,261,061 | | |

| (26,106 | ) | |

| (1,522,303 | ) | |

| 172,366 | | |

| (420,841 | ) |

| Net cash (used in)/provided by investing activities | |

| - | | |

| (260,903 | ) | |

| - | | |

| (505,398 | ) | |

| 329,720 | | |

| (436,581 | ) |

| Net cash (used in)/provided by financing activities | |

| 290,000 | | |

| 844,163 | | |

| - | | |

| (209,421 | ) | |

| (300,000 | ) | |

| 624,742 | |

| Effect of exchange rate changes on cash | |

| 8,647 | | |

| 68,241 | | |

| (366 | ) | |

| (318,559 | ) | |

| (243,878 | ) | |

| (485,915 | ) |

| Net increase in cash and cash equivalents | |

| (7,212 | ) | |

| 1,912,562 | | |

| (26,472 | ) | |

| (2,555,681 | ) | |

| (41,792 | ) | |

| (718,595 | ) |

| | |

Year ended December 31, 2022 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs | | |

Elimination | | |

Consolidated | |

| Net cash (used in)/provided by operation activities | |

| (13,187,296 | ) | |

| (4,363,034 | ) | |

| (2,753,716 | ) | |

| (3,599,661 | ) | |

| (31,058,507 | ) | |

| (17,870,525 | ) |

| Net cash (used in)/provided by investing activities | |

| - | | |

| (5,190,871 | ) | |

| (88,618 | ) | |

| (2,488,567 | ) | |

| 6,594,214 | | |

| (934,197 | ) |

| Net cash (used in)/provided by financing activities | |

| 7,420,000 | | |

| 3,838,243 | | |

| 2,342,047 | | |

| 2,257,470 | | |

| 28,620,214 | | |

| 7,093,542 | |

| Effect of exchange rate changes on cash | |

| 124,445 | | |

| (86,144 | ) | |

| (30,256 | ) | |

| (324,086 | ) | |

| (3,526,830 | ) | |

| (3,819,202 | ) |

| Net increase in cash and cash equivalents | |

| (5,642,851 | ) | |

| (5,801,806 | ) | |

| (530,543 | ) | |

| (4,154,844 | ) | |

| 629,091 | | |

| (15,530,382 | ) |

| | |

Year ended December 31, 2021 | |

| | |

Parent | | |

Subsidiaries | | |

WFOEs | | |

VIEs | | |

Elimination | | |

Consolidated | |

| Net cash (used in)/provided by operation activities | |

| (86,208,510 | ) | |

| (15,968,254 | ) | |

| 34,337,973 | | |

| 15,949,957 | | |

| (1,812,380 | ) | |

| (53,787,959 | ) |

| Net cash (used in)/provided by investing activities | |

| (72,449,477 | ) | |

| (52,884,803 | ) | |

| 151,027 | | |

| (13,979,925 | ) | |

| 60,766,693 | | |

| (78,396,485 | ) |

| Net cash (used in)/provided by financing activities | |

| 164,103,934 | | |

| 75,546,992 | | |

| (35,042,385 | ) | |

| 4,318,722 | | |

| (60,363,735 | ) | |

| 148,910,734 | |

| Effect of exchange rate changes on cash | |

| 209,778 | | |

| 109,208 | | |

| (6,586 | ) | |

| (1,595,463 | ) | |

| 1,540,705 | | |

| (2,820 | ) |

| Net increase in cash and cash equivalents | |

| 5,655,725 | | |

| 6,803,143 | | |

| (559,971 | ) | |

| 4,693,291 | | |

| 131,283 | | |

| 16,723,470 | |

We are an “emerging

growth company” and a “foreign private issuer” as defined under the federal securities laws and, as such, are subject

to reduced public company reporting requirements. See “Prospectus Summary - Implications of Being an Emerging Growth Company

and a Foreign Private Issuer” for additional information.

Investing in our securities

being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the risk factors beginning

on page 4 of this prospectus, as well as those included in the periodic and other reports we file with the Securities and Exchange Commission

before you make your investment decision.

Neither the U.S. Securities

and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

For investors outside the United

States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe

any restrictions relating to this offering and the distribution of this prospectus.

Neither we nor the selling

shareholder has authorized anyone to provide you with any information or to make any representations other than those contained in or

incorporated by reference into this prospectus, any amendment or supplement to this prospectus, or in any free writing prospectus we have

prepared, and neither we nor the selling shareholder takes responsibility for, and can provide no assurance as to the reliability of,

any other information others may give you. Neither we nor the selling shareholder is making an offer to sell, or seeking offers to buy,

these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus and any accompanying

prospectus supplement, as well as the information we previously filed with the SEC and incorporated herein by reference, is accurate as

of the date of those documents only, regardless of the time of delivery of this prospectus or the sale of ordinary shares. Our business,

financial condition, results of operations and prospects may have changed since such dates.

COMMONLY USED DEFINED TERMS

The following are abbreviations

and definitions of certain terms used in this document:

| · | the “Company”, “we”, “our” and “us” are to Luokung Technology

Corp. and its consolidated subsidiaries; |

| | | |

| · | “China” or the “PRC” are to the People’s Republic of China; |

| | | |

| · | “RMB” and “Renminbi” refer to the legal currency of China; |

| | | |

| · | “US$,” “U.S. dollars,” “$,”

and “dollars” refer to the legal currency of the United States; |

| | | |

| · | References to “variable interest entities” or “VIEs” refer to Beijing Zhong Chuan

Shi Xun Technology Limited, Beijing BotBrain AI Technology Co., Ltd. and eMapgo Technologies (Beijing) Co., Ltd. |

ABOUT THIS PROSPECTUS

This document, which forms

part of a registration statement on Form F-1 filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company,

constitutes a prospectus of the Company under Section 5 of the Securities Act. The Selling Shareholders may, from time to time, sell the

securities offered by them described in this prospectus. We are not offering any Ordinary Shares for sale under this prospectus and will

not receive any proceeds from the sale of the securities by such selling securityholders under this prospectus.

This document does not constitute

an offer to sell or the solicitation of an offer to buy securities in any jurisdiction or to any person to whom it would be unlawful to

make such offer.

We may also provide a prospectus

supplement or post-effective amendment to the registration statement to add information to, or update or change information contained

in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the

registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where

You Can Find More Information.”

MARKET AND INDUSTRY DATA

This prospectus contains estimates,

projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts

prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies

is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are

assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of

factors, including those described in the section entitled “Risk Factors.” Unless otherwise expressly stated, we obtained

this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research

firms and other third parties, industry and general publications, government data, and similar sources. In some cases, we do not expressly

refer to the sources from which this data is derived. When we refer to one or more sources of data in any paragraph, you should assume

that other data of the same type appearing in the same paragraph is derived from such sources, unless otherwise expressly stated or the

context otherwise requires. While we have compiled, extracted, and reproduced industry data from third-party sources (including any sources

that we may have paid for, sponsored, or conducted), we have not independently verified the data. Forecasts and other forward-looking

information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties

regarding the other forward-looking statements in this prospectus. See the section entitled “Cautionary Note Regarding Forward-Looking

Statements.”

PRESENTATION OF FINANCIAL INFORMATION

This prospectus incorporates

by reference our audited consolidated financial statements as of December 31, 2023 and 2022 and for the years ended December 31, 2023,

2022 and 2021 included in our annual report on Form 20-F for the year ended December 31, 2023, filed with the SEC on October 22, 2024,

which have been prepared in accordance generally accepted accounting principles in the United States (“U.S. GAAP”). Our financial

information is presented in U.S. dollars. Our fiscal year begins on January 1 and ends on December 31 of the same year.

TRADEMARKS AND TRADE NAMES

We have proprietary rights

to trademarks used in this prospectus or in the documents we incorporate by reference that are important to our business, many of which

are registered under applicable intellectual property laws. Solely for convenience, trademarks and trade names referred to in this prospectus

or in the documents we incorporate by reference may appear without the “®” or “™” symbols, but such

references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our

rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’

trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each

trademark, trade name or service mark of any other company appearing in this prospectus or in the documents incorporated by reference

is the property of its respective holder.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider

before deciding to invest in our ordinary shares. You should read the entire prospectus, including the information incorporated by reference

herein, carefully, including the section titled “Risk Factors” included in this prospectus and our consolidated financial

statements and related notes incorporated by reference herein before making an investment decision. Some of the statements in this summary

constitute forward-looking statements. See the section titled “Special Note Regarding Forward-Looking Statements.” Certain

figures included in this section have been rounded for ease of presentation and, as a result, percentages may not sum to 100%.

Business Overview

We are a spatial-temporal intelligent

big data services company, as well as a provider of interactive location-based services (“LBS”) and High Definition (“HD”)

Maps for various industries in China. Backed by our proprietary technologies and expertise in HD Maps and multi-sourced intelligent spatial-temporal

big data, we established city-level and industry-level holographic spatial-temporal digital twin systems and actively serves industries

including smart transportation with applications in autonomous driving, smart highway and vehicle-road collaboration, natural resource

asset management, covering carbon neutral and environmental protection remote sensing data service, and LBS smart industry applications,

including mobile Internet LBS, smart travel, smart logistics, new infrastructure, smart cities, emergency rescue, etc.

We believe that road-to-vehicle

coordination is the keystone for smart travel and autonomous driving in the future. Therefore, smart cars require smart roads. We are

actively deploying smart solutions for both vehicles and roads.

For vehicles, we are supporting

eMapgo’s position as an HD Map provider with continued investment in its technical R&D in the fields of autonomous driving data

services, simulation services, and full-cognition Artificial Intelligence (“AI”) services with a goal of continuing to optimize,

deepen and expand services for automakers and top-tier autonomous driving firms. We believe we have led the development of the industry