LKQ Corporation Announces $1 Billion Increase to its Stock Repurchase Program

24 October 2024 - 8:57PM

LKQ Corporation (Nasdaq: LKQ) today announced that its Board of

Directors has authorized a $1 billion increase and a one-year

extension to its stock repurchase program, raising the aggregate

authorization under the program to $4.5 billion and authorizing

repurchases through October 25, 2026. Since initiating the stock

repurchase program in late October 2018, the Company has

repurchased approximately 62 million shares of its common

stock for a total of $2.7 billion through September 30,

2024.

Under the repurchase program, the Company is

authorized to repurchase shares in the open market as well as in

privately negotiated transactions. The timing and the amount of any

repurchases of common stock will be determined by LKQ management

based on its evaluation of market conditions and other factors. The

repurchase program will be effected in compliance with SEC Rule

10b-18 and other applicable legal requirements. The repurchase

program does not obligate the Company to acquire any specific

number of shares and may be suspended or discontinued at any time.

Stock purchased as part of this program will be held as treasury

stock.

About LKQ Corporation

LKQ Corporation (www.lkqcorp.com) is a leading

provider of alternative and specialty parts to repair and

accessorize automobiles and other vehicles. LKQ has operations in

North America, Europe and Taiwan. LKQ offers its customers a broad

range of OEM recycled and aftermarket parts, replacement systems,

components, equipment, and services to repair and accessorize

automobiles, trucks, and recreational and performance vehicles.

Forward Looking Statements

Statements and information in this press release

that are not historical are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

are made pursuant to the “safe harbor” provisions of such Act.

Forward-looking statements include, but are not

limited to, statements regarding our outlook, guidance,

expectations, beliefs, hopes, intentions and strategies. These

statements are subject to a number of risks, uncertainties,

assumptions and other factors including those identified below. All

forward-looking statements are based on information available to us

at the time the statements are made. We undertake no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

You should not place undue reliance on our

forward-looking statements. Actual events or results may differ

materially from those expressed or implied in the forward-looking

statements. The risks, uncertainties, assumptions and other factors

that could cause actual events or results to differ from the events

or results predicted or implied by our forward-looking statements

include, among others, changes in our cash position or cash

requirements for other purposes, fluctuations in the price of our

common stock, general market conditions, and stockholder response

to the repurchase program; and other factors discussed in our

filings with the SEC, including those disclosed under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in our Annual

Report on Form 10-K for the year ended December 31,

2023 and in our subsequent Quarterly Reports on Form 10-Q.

These reports are available on our investor relations website at

lkqcorp.com and on the SEC website at sec.gov.

Contact:Joseph P. BoutrossVice President, Investor RelationsLKQ

Corporation(312) 621-2793jpboutross@lkqcorp.com

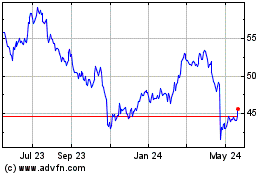

LKQ (NASDAQ:LKQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

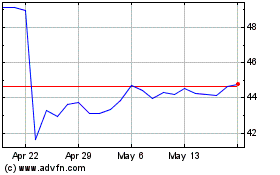

LKQ (NASDAQ:LKQ)

Historical Stock Chart

From Nov 2023 to Nov 2024