LAVA Therapeutics Provides Business Update and Reports Second Quarter 2023 Financial Results

22 August 2023 - 9:00PM

LAVA Therapeutics N.V. (Nasdaq: LVTX), a clinical-stage

immuno-oncology company focused on developing its proprietary

Gammabody® platform of bispecific gamma-delta T cell engagers,

today announced recent corporate highlights and financial results

for the quarter ended June 30, 2023.

“We are focused on driving forward our lead program, LAVA-1207

in patients with mCRPC and are pleased our Gammabody® platform

continues to receive the support of investigators and patients as

enrollment remains on track. In addition, we are pleased with the

progress of our partnered programs providing additional validation

as well as extending our cash runway,” said Steve Hurly, president

and chief executive officer of LAVA. “We remain well-positioned to

bring meaningful benefits to patients in areas of high unmet need

and deliver shareholder value.”

LAVA-1207

Gammabody® designed to target the prostate-specific membrane

antigen (PSMA) to trigger the potent and preferential killing of

PSMA-positive tumor cells in patients with metastatic

castration-resistant prostate cancer (mCRPC). The safety,

tolerability and preliminary efficacy of LAVA-1207 in patients with

mCRPC are being evaluated in an ongoing dose escalation phase 1/2a,

first-in-human study.

- Recruitment is on track and dose escalation continues across 10

sites in a globalized trial in Europe and the United States.

- Currently recruiting dose level 8 for monotherapy

treatment.

- Currently recruiting dose level 7 with low-dose

interleukin-2.

- The Company expects to report additional safety and efficacy

data for the dose escalation phase of the trial in the next twelve

months, which may inform the design of a future pivotal trial.

Partnered Programs

- An investigational new drug application

clearance for SGN-EGFRd2 (LAVA-1223) in advanced solid tumors was

received from the U.S. Food and Drug Administration. Seagen plans

to initiate the Phase 1 trial in 2023 (NCT05983133).

- A milestone payment from Janssen Biotech, Inc. (Janssen) was

triggered under the terms of the research collaboration agreement

(Janssen Agreement) entered in May 2020 when Janssen selected a

lead candidate aimed at an undisclosed tumor-associated antigen for

further development towards clinical settings. The milestone

payment was received in July 2023.

Portfolio Reprioritization and Cash Runway

- In June 2023, LAVA announced the discontinuation of the Phase

1/2a clinical trial of LAVA-051 in patients with

relapsed/refractory (R/R) CLL and MM based upon a review of the

competitive landscape. The discontinuation was not due to safety

concerns.

- Existing patients being evaluated in the Phase 1/2a clinical

trial will complete the course of their treatment.

- Portfolio reprioritization resulted in a 36% staff reduction

and significant cost savings associated with the discontinuation of

LAVA-051. The reduced operating costs align with the Company’s goal

of increasing investment in the LAVA-1207 program and extending

LAVA’s cash runway into 2026.

Second Quarter 2023 Financial Results

The financial information provided below reflects changes made

to previously issued consolidated financial statements to revise

immaterial prior-period misstatements. Further information

regarding the revision is included in LAVA’s consolidated financial

statements, "Note 12 — Revision of Immaterial Misstatements,"

included in Exhibit 99.1 to the report on Form 6-K to be filed with

the SEC on the date hereof.

- As of June 30, 2023, LAVA had cash, cash equivalents and

investments totaling $112.4 million compared to cash, cash

equivalents and investments of $132.9 million as of

December 31, 2022. The Company believes its current cash, cash

equivalents and investments will be sufficient to fund operations

into 2026.

- Revenue from contracts with customers was $5.1 million and $0.5

million for the quarters ended June 30, 2023 and 2022,

respectively, and $6.4 million and $1.5 million for the six months

ended June 30, 2023 and 2022, respectively. In connection with the

license agreement with Seagen, we recognized $2.6 million in

revenue for the three months ended June 30, 2023, related to

reimbursement for research activities and delivery of initial

supply. In connection with the Janssen Agreement, we recognized

$2.5 million in revenue for the three months ended June 30, 2023,

related to a triggered milestone payment. Revenue from contracts

with customers was $0.5 million for the three months ended June 30,

2022, related to the Janssen Agreement.

- Cost of providing services and sales of goods was $2.4 million

and $0 for the quarters ended June 30, 2023 and 2022, respectively,

and $3.3 million and $0 for the six months ended June 30, 2023 and

2022, respectively. The increase in cost was due to the cost of the

initial supply delivery to Seagen and related stability

studies.

- Research and development expenses were $12.6 million and $8.4

million for the quarters ended June 30, 2023 and 2022,

respectively, and $22.5 million and $15.9 million for the six

months ended June 30, 2023 and 2022, respectively. The increase for

both periods was primarily due to increased manufacturing scale-up

costs and ongoing activities of the clinical trials. In the three

months ended June 30, 2023, we have also included $1.4 million in

expenses for discontinuance of the activities for LAVA-051.

- General and administrative expenses were $3.7 million and $3.2

million for the quarters ended June 30, 2023 and 2022,

respectively, and $7.6 million and $7.4 million for the six months

ended June 30, 2023 and 2022, respectively. The increase for both

periods was primarily due to the reversal in 2022 of share-based

compensation expenses for unvested forfeited options partially

offset by lower personnel-related expenses in 2023 due to a

reduction in general and administrative headcount.

- Net losses were $12.7 million and $26.6 million for the

quarters ended June 30, 2023 and 2022, respectively, or $0.48 and

$0.31 net loss per share for the quarters ended June 30, 2023 and

2022, respectively, and $25.3 million and $26.8 million for the six

months ended June 30, 2023 and 2022, respectively, or $1.01 and

$0.70 net loss per share for the six months ended June 30, 2023 and

2022, respectively.

LAVA Therapeutics

N.V.Condensed Consolidated Interim Statements of

Lossand Comprehensive Loss(in

thousands, except share and per share amounts)

(unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

June 30, |

|

June 30, |

| |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue from contracts with customers |

|

|

$ |

5,139 |

|

|

$ |

468 |

|

|

$ |

6,363 |

|

|

$ |

1,490 |

|

|

Cost of sales of goods |

|

|

|

(2,361 |

) |

|

|

— |

|

|

|

(2,546 |

) |

|

|

— |

|

|

Cost of providing services |

|

|

|

(27 |

) |

|

|

— |

|

|

|

(772 |

) |

|

|

— |

|

| Gross

profit |

|

|

|

2,751 |

|

|

|

468 |

|

|

|

3,045 |

|

|

|

1,490 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

(12,599 |

) |

|

|

(8,371 |

) |

|

|

(22,542 |

) |

|

|

(15,868 |

) |

|

General and administrative |

|

|

|

(3,697 |

) |

|

|

(3,173 |

) |

|

|

(7,587 |

) |

|

|

(7,410 |

) |

| Total operating

expenses |

|

|

|

(16,296 |

) |

|

|

(11,544 |

) |

|

|

(30,129 |

) |

|

|

(23,278 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

|

|

(13,545 |

) |

|

|

(11,076 |

) |

|

|

(27,084 |

) |

|

|

(21,788 |

) |

| Interest income (expense),

net |

|

|

|

698 |

|

|

|

(90 |

) |

|

|

1,315 |

|

|

|

(253 |

) |

| Foreign currency exchange gain

(loss) net |

|

|

|

244 |

|

|

|

3,136 |

|

|

|

(703 |

) |

|

|

4,248 |

|

| Total non-operating

income |

|

|

|

942 |

|

|

|

3,046 |

|

|

|

612 |

|

|

|

3,995 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income

tax |

|

|

|

(12,603 |

) |

|

|

(8,030 |

) |

|

|

(26,472 |

) |

|

|

(17,793 |

) |

| Income tax expense |

|

|

|

(97 |

) |

|

|

(76 |

) |

|

|

(168 |

) |

|

|

(135 |

) |

| Loss for the

period |

|

|

$ |

(12,700 |

) |

|

$ |

(8,106 |

) |

|

$ |

(26,640 |

) |

|

$ |

(17,928 |

) |

| Items that may be reclassified

to profit or loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

|

(243 |

) |

|

|

(6,659 |

) |

|

|

1,303 |

|

|

|

(8,862 |

) |

| Total comprehensive

loss |

|

|

$ |

(12,943 |

) |

|

$ |

(14,765 |

) |

|

$ |

(25,337 |

) |

|

$ |

(26,790 |

) |

| Loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share, basic and

diluted |

|

|

$ |

(0.48 |

) |

|

$ |

(0.31 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.70 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

|

|

26,289,087 |

|

|

|

25,780,811 |

|

|

|

26,289,087 |

|

|

|

25,778,190 |

|

| |

|

|

|

|

|

|

|

|

LAVA Therapeutics N.V.Condensed

Consolidated Statements of Financial Position |

|

(in thousands) (unaudited) |

| |

|

|

June 30, |

|

December 31, |

| |

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

| Non-current

assets: |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

$ |

1,905 |

|

|

$ |

1,432 |

|

|

Right-of-use assets |

|

|

|

1,771 |

|

|

|

651 |

|

|

Other non-current assets and security deposits |

|

|

|

346 |

|

|

|

809 |

|

| Total non-current

assets |

|

|

|

4,022 |

|

|

|

2,892 |

|

| Current

assets: |

|

|

|

|

|

|

|

|

Receivables and other |

|

|

|

3,994 |

|

|

|

3,254 |

|

|

Prepaid expenses and other current assets |

|

|

|

1,738 |

|

|

|

4,411 |

|

|

Investments |

|

|

|

24,797 |

|

|

|

32,535 |

|

|

Cash and cash equivalents |

|

|

|

87,607 |

|

|

|

100,333 |

|

| Total current

assets |

|

|

|

118,519 |

|

|

|

140,533 |

|

| Total

assets |

|

|

$ |

122,541 |

|

|

$ |

143,425 |

|

| Equity and

Liabilities |

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

Share capital |

|

|

$ |

3,715 |

|

|

$ |

3,715 |

|

|

Equity-settled employee benefits reserve |

|

|

|

12,132 |

|

|

|

8,942 |

|

|

Foreign currency translation reserve |

|

|

|

(11,669 |

) |

|

|

(12,972 |

) |

|

Additional paid-in capital |

|

|

|

194,424 |

|

|

|

194,424 |

|

|

Accumulated deficit |

|

|

|

(134,709 |

) |

|

|

(108,069 |

) |

| Total

equity |

|

|

|

63,893 |

|

|

|

86,040 |

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

|

35,000 |

|

|

|

35,000 |

|

|

Lease liabilities |

|

|

|

1,316 |

|

|

|

431 |

|

| Total non-current

liabilities |

|

|

|

36,316 |

|

|

|

35,431 |

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

Trade payables and other |

|

|

|

5,067 |

|

|

|

3,965 |

|

|

VAT payable |

|

|

|

- |

|

|

|

45 |

|

|

Borrowings |

|

|

|

4,954 |

|

|

|

4,640 |

|

|

Lease liabilities |

|

|

|

682 |

|

|

|

379 |

|

|

License liabilities |

|

|

|

- |

|

|

|

4,732 |

|

|

Accrued expenses and other current liabilities |

|

|

|

11,629 |

|

|

|

8,193 |

|

| Total current

liabilities |

|

|

|

22,332 |

|

|

|

21,954 |

|

| Total

liabilities |

|

|

|

58,648 |

|

|

|

57,385 |

|

| Total equity and

liabilities |

|

|

$ |

122,541 |

|

|

$ |

143,425 |

|

About LAVA Therapeutics

LAVA Therapeutics N.V. is a clinical-stage immuno-oncology

company focused on developing its proprietary Gammabody® platform

to develop a portfolio of bispecific gamma-delta T cell engagers

for the potential treatment of solid and hematologic malignancies.

The Company utilizes bispecific antibodies engineered to

selectively kill cancer cells by triggering Vγ9Vδ2 (Vgamma9

Vdelta2) T cell antitumor effector functions upon cross-linking to

tumor-associated antigens. A Phase 1/2a dose escalation clinical

study to evaluate LAVA-1207 in patients with metastatic

castration-resistant prostate cancer (mCRPC) is actively enrolling

in Europe and the United States (NCT05369000). The Company’s

collaborations include a license agreement with Seagen for the

clinical development of SGN-EGFRd2 (LAVA-1223). For more

information, please visit www.lavatherapeutics.com, and follow

us on LinkedIn, X (formerly known as Twitter),

and YouTube.

LAVA’s Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements,

including with respect to the Company’s anticipated growth and

clinical development plans including the timing and results of

clinical trials. Words such as “anticipate,” “believe,” “could,”

“will,” “may,” “expect,” “should,” “plan,” “intend,” “estimate,”

“potential,” “suggests” and similar expressions (as well as other

words or expressions referencing future events, conditions or

circumstances) are intended to identify forward-looking statements.

These forward-looking statements are based on LAVA’s expectations

and assumptions as of the date of this press release and are

subject to various risks and uncertainties that may cause actual

results to differ materially from these forward-looking statements.

Forward-looking statements contained in this press release include

but are not limited to statements about the expected safety profile

of LAVA’s product candidates, preclinical data, clinical

development and the scope of clinical trials, including the

availability of data therefrom, our ability to expand our product

pipeline, the timing of initiation of clinical trials, including

expectations regarding regulatory filings, expectations regarding

enrollment in clinical trials, the number of Vγ9Vδ2-T cells

available for engagement by LAVA’s product candidates and the

ability to increase those cells, including but not limited to the

addition of low-dose interleukin-2, the potential use of the

Company’s product candidates to treat various tumor targets, any

payments to us under our license agreements with third parties the

Company's ability to deliver value to shareholders, LAVA’s

expectations regarding the consequences and effects of the

Company’s pipeline reprioritization and the Company’s ability to

recognize the expected benefits, and the Company’s expected cash

runway. Many factors, risks and uncertainties may cause differences

between current expectations and actual results including, among

other things, the timing and results of LAVA’s research and

development programs and preclinical and clinical trials, the risk

that results obtained in clinical trials to date may not be

indicative of results obtained in ongoing or future trials, the

Company’s ability to obtain regulatory approval for and

commercialize its product candidates, the Company’s ability to

leverage its initial programs to develop additional product

candidates using our Gammabody® platform, and the failure of LAVA’s

collaborators to support or advance collaborations or LAVA’s

product candidates. There may be adverse effects on the Company’s

business condition and results from general economic and market

conditions and overall fluctuations in the United States and

international equity markets, including as a result of inflation,

rising interest rates, recent and potential future pandemics and

other health crises, hostilities between Russia and Ukraine, and

recent and potential future disruptions in access to bank deposits

or lending commitments due to bank failures. These and other risks

are described in greater detail under the caption “Risk Factors”

and included in LAVA’s filings with the Securities and Exchange

Commission. LAVA assumes no obligation to update any

forward-looking statements contained herein to reflect any change

in expectations, even as new information becomes available.

CONTACTSInvestor

Relationsir@lavatherapeutics.com

Argot Partners (IR/Media)212-600-1902lava@argotpartners.com

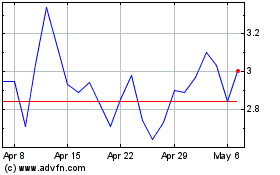

LAVA Therapeutics NV (NASDAQ:LVTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

LAVA Therapeutics NV (NASDAQ:LVTX)

Historical Stock Chart

From Apr 2023 to Apr 2024