0001056696false00010566962025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 10, 2025 |

MANHATTAN ASSOCIATES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Georgia |

0-23999 |

58-2373424 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2300 Windy Ridge Parkway Tenth Floor |

|

Atlanta, Georgia |

|

30339 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 955-7070 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock |

|

MANH |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

CEO Succession

On February 10, 2025, Manhattan Associates, Inc. (the “Company”) announced that, after a significant search process, the Board of Directors elected Mr. Eric A. Clark to succeed Mr. Eddie Capel as President and Chief Executive Officer of the Company, to be effective February 12, 2025. The Board also increased the size of the Board from eight to nine members and appointed Mr. Clark to serve as a Class II Board member. Mr. Capel will assume the office of Executive Vice-Chairman of the Board.

Most recently, since April 2024, Mr. Clark has served as Chief Executive Officer of NTT Data North America, a technology consulting, digital transformation and IT infrastructure company, and prior to that, since September 2022, as Chief Executive Officer of NTT Ltd. Americas, another NTT Data group technology services company that combined with NTT Data North America in 2024. Prior to that, he served as Chief Digital and Strategy Officer for NTT Data Services. Before joining NTT, Mr. Clark served as Senior Vice President and Managing Director, Global Services, at ServiceNow, a business management software company, from 2016 to 2018, and from 2012 to 2016 in various Vice President roles with IT services business Dell Services (acquired by NTT in 2016), including most recently as Vice President, Global Commercial Industries. Before joining Dell, he served in various leadership roles with IT company Hewlett-Packard, including most recently as Global Vice President, Application Innovation Services.

The Company expects Mr. Clark to enter into an employment agreement with the Company substantially in the form of the Company’s standard at-will executive employment agreement filed as Exhibit 10.1 and incorporated by reference into this Form 8-K (the “Agreement”). Mr. Clark’s compensation includes: an initial annual base salary of $800,000; a target opportunity under the Company’s annual cash bonus plan equal to $800,000; a cash signing bonus of $3 million payable in three equal installments on February 14, 2025, July 14, 2025 and February 14, 2026; and an initial grant of service-based restricted stock units under the Company’s equity incentive plan with a value at grant equal to $8 million, with $2.6 million vesting on February 14, 2025, $2.2 million vesting on each of February 14, 2026, and February 14, 2027, and the remaining $1 million vesting on February 14, 2028.

The following summary of certain other terms of the Agreement are standard terms and conditions of the Company’s form of at-will executive employment agreement.

Mr. Clark will be eligible for equity awards that reflect his position, duties, and responsibilities with the Company and will be eligible to participate in all other benefit plans, programs, and arrangements generally available to executives of the Company. The Company may increase his initial base salary and adjust his target cash bonus opportunity at the Board’s or the Board Compensation Committee’s discretion. The Board or Compensation Committee will determine the amount and type of any future equity incentives in their discretion.

Either the Company or Mr. Clark may terminate his employment under the Agreement at any time. If the Company terminates his employment for reasons other than death, disability or “cause” (as defined in the Agreement), or if Mr. Clark terminates his employment for “constructive termination” (as defined in the Agreement), he will be entitled to severance payments equal to continuation of his base salary for twelve months and twelve months of COBRA coverage for family medical and dental benefits. In addition, if his termination under the circumstances described in the preceding sentence occurs on or within 24 months following a “change of control” (as defined in the Agreement), he will be entitled to (i) a pro rata bonus for the year of termination and (ii) an additional bonus amount equal to the greater of his target bonus for the year of termination or for the prior year. If a change of control occurs, any unvested equity awards outstanding at the time of the change in control will remain in effect in accordance with their terms (or the Company may provide him with substantially equivalent substitute equity awards of the survivor or purchasing entity or its parent). If on or within 24 months following a change of control, the Company (or its successor) terminates him without cause, or he experiences a “constructive termination” (as defined in the Agreement), then any outstanding unvested equity awards (or the substituted equity awards) will fully vest. In general, the Agreement limits severance payments so that he will not receive any “parachute payment” as described in Section 280G of the Internal Revenue Code of 1986, as amended. The Agreement requires him to provide the Company with a general release of all claims to receive any severance payments or benefits.

The Agreement contains provisions requiring Mr. Clark to protect the Company’s proprietary and confidential information. In addition, through the twelve-month anniversary date of his termination of employment (or, if later, the last date any severance payments are due), he agrees not to (i) solicit or accept business from the Company’s customers or customer prospects with whom they had material contact for the purpose of performing a competing business, (ii) solicit or hire away the Company’s employees, (iii) perform, or supervise, manage or provide consulting or advice regarding the performance of, duties the same as or similar to those he performed for the Company during the 24 months prior to termination, for a competing business owned by any of a designated group of companies, or (iv) serve on the board of directors (or similar oversight body) for any of those same designated companies. Mr. Clark also agrees to assign to the Company all patents, inventions, copyrights and other intellectual property that he develops during his employment.

The Company also expects Mr. Clark to enter into the Company’s standard form of director and officer indemnification agreement, substantially in the form filed as Exhibit 10.2 and incorporated by reference to this Form 8-K, pursuant to which the Company will indemnify him to the fullest extent permitted by law with respect to claims against him arising out of his service as an officer, director or employee of the Company.

Reclassification of Existing Director

Also effective February 12, 2025, the Board has reclassified Class II Board member Ms. Linda T. Hollembaek as a Class I Board member, with a term expiring in 2026.

Item 7.01 Regulation FD Disclosure.

On February 10, 2025, the Company issued a press release announcing the succession of Mr. Clark as President and Chief Executive Officer of the Company. The press release is furnished with this Form 8-K as Exhibit 99.1. Pursuant to General Instruction B.2 of Form 8-K, this exhibit is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Manhattan Associates, Inc. |

|

|

|

|

Date: |

February 10, 2025 |

By: |

/s/ Bruce S. Richards |

|

|

|

Senior Vice President, Chief Legal Officer and Secretary |

|

|

|

|

|

Contact: |

|

Michael Bauer |

|

Devika Goel |

|

|

Senior Director, Investor Relations |

|

Senior Manager, Public Relations |

|

|

Manhattan Associates, Inc. |

|

Manhattan Associates, Inc. |

|

|

678-597-7538 |

|

678-597-6754 |

|

|

mbauer@manh.com |

|

dgoel@manh.com |

|

|

|

|

|

Manhattan Associates Announces CEO Succession

Eddie Capel retires as President & CEO; succeeded by Eric Clark

ATLANTA – February 10, 2025 –Today the Board of Directors of Manhattan Associates Inc. (NASDAQ: MANH) announced that Eddie Capel, Manhattan’s President and CEO, will retire from his position effective February 12, 2025. He will continue to serve Manhattan in the role of Executive Vice-Chairman of the Board, assisting with CEO transition and special projects. Mr. Capel will be succeeded by Eric Clark, who has been serving as CEO of NTT Data North America. Mr. Clark will also join the Manhattan Board.

Mr. Capel joined Manhattan in June 2000, and, after serving in various operations and technology roles, became its Chief Operating Officer in January 2011 and President and CEO in January 2013.

Mr. Clark joined NTT Data Services in 2018, leading the development of capabilities and insights to help clients modernize and transform their technology operations. In October 2022, he became CEO of NTT Ltd. Americas, a leading IT infrastructure and services company that combined with NTT DATA in April 2024, upon which Mr. Clark became CEO of the combined entity NTT Data North America. Earlier in his career, Mr. Clark held numerous global, senior leadership positions with ServiceNow, Dell, Hewlett Packard Enterprise, Arthur Andersen Business Consulting, Ernst & Young and Bank of America.

John Huntz, Manhattan’s Chairman, commented, “Eddie Capel has accomplished a great deal as CEO setting our strategic direction, building our winning team and creating shareholder value. During his tenure as CEO, Manhattan solidified its position as a leading global technology provider and innovator in both supply chain and omnichannel commerce. The Board thanks Eddie for his dedication to Manhattan over the last 25 years and for working diligently with the Board during our comprehensive CEO succession planning process over the last 24 months. We look forward to his continued involvement as Executive Vice-Chairman and as a member of the Board of Directors.”

Mr. Capel stated, “This is an ideal time for a CEO transition. Our company is in an exceptionally strong position strategically, competitively, operationally and financially. I want to thank our management team and our entire workforce, which is second to none, for their hard work and dedication to our mission of advancing global commerce through advanced technology. I look forward to working closely with Eric and continuing to contribute to our product vision, interacting with our customers and partners, and ensuring the growth and success of Manhattan Associates. And I have confidence that under Eric’s leadership, the team will continue to capitalize on our many market opportunities and extend our global leadership position.”

Regarding his appointment, Eric Clark commented, “Manhattan’s impact on global commerce continues to be considerable, and the greatest opportunities clearly are still in front of us. I could not be more excited to work with Eddie, the Board and the management team to build on Manhattan’s prior achievements and chart the course for our future success.”

Manhattan also announced that it will hold a live webinar hosted by Terry Tillman, Managing Director, Equity Research, at Truist Securities, on Wednesday, February 12, 2025, at 1:00 p.m. Eastern Time. Investors are invited to listen through the Investor Relations section of the Manhattan Associates website at ir.manh.com.

ABOUT MANHATTAN ASSOCIATES

Manhattan Associates is a global technology leader in supply chain and omnichannel commerce. We unite information across the enterprise, converging front-end sales with back-end supply chain execution. Our software, platform technology and unmatched experience help drive both top-line growth and bottom-line profitability for our customers.

Manhattan Associates designs, builds and delivers leading edge cloud solutions so that across the store, through your network or from your fulfillment center, you are ready to reap the rewards of the omnichannel marketplace. For more information, please visit www.manh.com.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

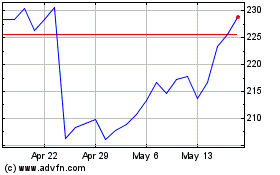

Manhattan Associates (NASDAQ:MANH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Manhattan Associates (NASDAQ:MANH)

Historical Stock Chart

From Feb 2024 to Feb 2025