FY'24 Net Revenues +1.2%, Organic Net

Revenues1 +4.3%, Volume/Mix -1.0%

FY'24 Diluted EPS declined -5.5% to $3.42

FY'24 Adjusted EPS1 on a constant currency basis up

+13.0% to $3.36

FY'24 Cash provided by operating activities was

$4.9 billion

FY'24 Free Cash Flow1 was $3.5 billion

FY'24 Return of capital to shareholders was $4.7 billion

Company provides FY'25 outlook

CHICAGO, Feb. 04, 2025 (GLOBE NEWSWIRE) --

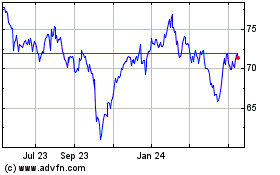

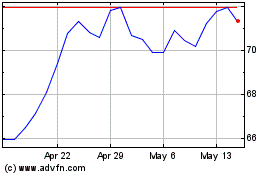

Mondelēz International, Inc. (Nasdaq: MDLZ) today reported its

fourth quarter and full year 2024 results.

“Fiscal 2024 was another strong year of

performance for our company. We delivered balanced top-line growth,

strong earnings, and robust free cash flow generation, while

returning significant capital back to shareholders," said Dirk Van

de Put, Chair and Chief Executive Officer. "As we transition into

2025, we remain focused on executing against our long-term growth

strategy and delivering on our chocolate business playbook to

navigate unprecedented cocoa cost inflation. Our teams are

well-equipped to stay agile and take the necessary actions to

navigate this challenging operating environment. We believe we are

solidly positioned for attractive long-term top- and bottom-line

growth."

Net Revenue

| $ in

millions |

Reported

Net Revenues |

|

Organic Net Revenue Growth |

| |

Q4 2024 |

|

% Chg

vs PY |

|

Q4 2024 |

|

Vol/Mix |

|

Pricing |

| Quarter

4 |

|

|

|

|

|

|

|

|

|

|

Latin America |

$ |

1,171 |

|

(7.2 |

)% |

|

4.9 |

% |

|

(1.5 |

)pp |

|

6.4 |

pp |

|

Asia, Middle East & Africa |

|

1,908 |

|

9.9 |

|

|

8.6 |

|

|

3.8 |

|

|

4.8 |

|

|

Europe |

|

3,744 |

|

5.8 |

|

|

7.4 |

|

|

(2.0 |

) |

|

9.4 |

|

|

North America |

|

2,781 |

|

0.1 |

|

|

0.4 |

|

|

1.3 |

|

|

(0.9 |

) |

|

Mondelēz International |

$ |

9,604 |

|

3.1 |

% |

|

5.2 |

% |

|

0.1 |

pp |

|

5.1 |

pp |

|

Emerging Markets |

$ |

3,640 |

|

1.7 |

% |

|

6.7 |

% |

|

0.2 |

pp |

|

6.5 |

pp |

|

Developed Markets |

$ |

5,964 |

|

4.0 |

% |

|

4.3 |

% |

|

0.1 |

pp |

|

4.2 |

pp |

| |

|

|

|

|

|

|

|

|

|

| Full

Year |

FY 2024 |

|

|

|

FY 2024 |

|

|

|

|

|

Latin America |

$ |

4,926 |

|

(1.6 |

)% |

|

4.6 |

% |

|

(2.4 |

)pp |

|

7.0 |

pp |

|

Asia, Middle East & Africa |

|

7,296 |

|

3.1 |

|

|

6.2 |

|

|

0.7 |

|

|

5.5 |

|

|

Europe |

|

13,309 |

|

3.5 |

|

|

5.7 |

|

|

(2.1 |

) |

|

7.8 |

|

|

North America |

|

10,910 |

|

(1.5 |

) |

|

1.5 |

|

|

— |

|

|

1.5 |

|

|

Mondelēz International |

$ |

36,441 |

|

1.2 |

% |

|

4.3 |

% |

|

(1.0) |

pp |

|

5.3 |

pp |

|

Emerging Markets |

$ |

14,163 |

|

1.1 |

% |

|

6.2 |

% |

|

(0.6) |

pp |

|

6.8 |

pp |

|

Developed Markets |

$ |

22,278 |

|

1.2 |

% |

|

3.2 |

% |

|

(1.1) |

pp |

|

4.3 |

pp |

Operating Income and Diluted EPS

| $ in millions, except

per share data |

Reported |

|

Adjusted |

| |

Q4 2024 |

|

vs PY

(Rpt Fx) |

|

Q4 2024 |

|

vs PY

(Rpt Fx) |

|

vs PY

(Cst Fx) |

| Quarter

4 |

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

$ |

3,711 |

|

|

6.9 |

% |

|

$ |

3,025 |

|

|

(14.4 |

)% |

|

(12.5) |

% |

|

Gross Profit Margin |

|

38.6 |

% |

|

1.3 |

pp |

|

|

31.5 |

% |

|

(6.5 |

)pp |

|

|

|

|

Operating Income |

$ |

1,611 |

|

|

35.0 |

% |

|

$ |

959 |

|

|

(31.6 |

)% |

|

(28.2) |

% |

|

Operating Income Margin |

|

16.8 |

% |

|

4.0 |

pp |

|

|

10.0 |

% |

|

(5.1 |

)pp |

|

|

|

|

Net Earnings 2 |

$ |

1,745 |

|

|

83.7 |

% |

|

$ |

868 |

|

|

(22.2 |

)% |

|

(17.7) |

% |

|

Diluted EPS |

$ |

1.30 |

|

|

85.7 |

% |

|

$ |

0.65 |

|

|

(20.7 |

)% |

|

(15.9) |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Full

Year |

FY 2024 |

|

|

|

FY 2024 |

|

|

|

|

|

|

Gross Profit |

$ |

14,257 |

|

|

3.6 |

% |

|

$ |

13,766 |

|

|

3.2 |

% |

|

5.1 |

% |

|

Gross Profit Margin |

|

39.1 |

% |

|

0.9 |

pp |

|

|

37.8 |

% |

|

0.3 |

pp |

|

|

|

|

Operating Income |

$ |

6,345 |

|

|

15.3 |

% |

|

$ |

5,899 |

|

|

4.7 |

% |

|

8.1 |

% |

|

Operating Income Margin |

|

17.4 |

% |

|

2.1 |

pp |

|

|

16.2 |

% |

|

0.3 |

pp |

|

|

|

|

Net Earnings 2 |

$ |

4,611 |

|

|

(7.0 |

)% |

|

$ |

4,521 |

|

|

7.1 |

% |

|

10.9 |

% |

|

Diluted EPS |

$ |

3.42 |

|

|

(5.5 |

)% |

|

$ |

3.36 |

|

|

9.1 |

% |

|

13.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year Commentary

- Net revenues

increased 1.2 percent as Organic Net Revenue growth of 4.3 percent

and incremental net revenue from our acquisition of Evirth was

partially offset by unfavorable currency-related items and the

impact of our 2023 divestiture of the developed market gum

business. Organic Net Revenue growth was driven by higher net

pricing, partially offset by unfavorable volume/mix.

- Gross profit

increased $493 million, and gross profit margin increased 90 basis

points to 39.1 percent primarily driven by favorable year-over-year

change in mark-to-market impacts from derivatives and an increase

in Adjusted Gross Profit1 margin, partially offset by

lapping the operating results from the developed market gum

business divested in 2023 and costs incurred for the ERP Systems

Implementation program. Adjusted Gross Profit increased $674

million at constant currency, and Adjusted Gross Profit margin

increased 30 basis points to 37.8 percent due primarily to higher

pricing and lower manufacturing costs driven by productivity,

partially offset by higher raw material and transportation

costs.

- Operating income

increased $843 million, and operating income margin was 17.4

percent, up 210 basis points primarily due to favorable

year-over-year change in acquisition integration costs and

contingent consideration adjustments, favorable year-over-year

change in mark-to-market gains/(losses) from currency and commodity

hedging activities, higher Adjusted Operating Income margin and

lower divestiture-related costs. These favorable items were

partially offset by higher intangible asset impairment charges,

lapping prior-year gain and operating results from the developed

market gum business divested in 2023 and costs incurred for the ERP

Systems Implementation program. Adjusted Operating Income increased

$456 million at constant currency while Adjusted Operating Income

margin increased 30 basis points to 16.2 percent, driven primarily

by higher net pricing, lower manufacturing costs driven by

productivity and overhead leverage, partially offset by higher

input cost inflation.

- Diluted EPS was

$3.42, down 5.5 percent, primarily due to lapping prior-year gain

on marketable securities, lapping prior-year gain on equity method

investment transactions, 2024 net loss on equity method

transactions including an impairment, lapping prior-year gain and

operating results from the developed market gum business divested

in 2023, higher intangible asset impairment charges and costs

incurred for the ERP Systems Implementation program. These

unfavorable items were partially offset by an increase in Adjusted

EPS, favorable year-over-year change in acquisition integration

costs and contingent consideration adjustments, favorable

year-over-year change in mark-to-market impacts from commodity and

currency derivatives, lower divestiture-related costs, favorable

year-over-year change in initial impacts from enacted tax law

changes and lapping prior-year impact from European Commission

legal matter.

- Adjusted EPS was

$3.36, up 13.0 percent on a constant currency basis driven by

strong operating gains, fewer shares outstanding, lower taxes,

lower interest expense and higher benefit plan non-service income,

partially offset by lapping prior year dividend income related to

our former KDP investment.

- Capital Return:

The company returned $4.7 billion to shareholders in cash dividends

and share repurchases.

Fourth Quarter Commentary

- Net revenues

increased 3.1 percent as Organic Net Revenue growth of 5.2 percent

and incremental net revenue from our acquisition of Evirth was

partially offset by unfavorable currency-related items and lapping

prior-year sales from a short-term distributor agreement related to

the developed market gum business divested in 2023. Organic Net

Revenue growth was driven by higher net pricing and favorable

volume/mix.

- Gross profit

increased $241 million, and gross profit margin increased 130 basis

points to 38.6 percent primarily driven by favorable year-over-year

change in mark-to-market impacts from derivatives, partially offset

by an decrease in Adjusted Gross Profit1 margin.

Adjusted Gross Profit decreased $440 million at constant currency,

and Adjusted Gross Profit margin decreased 650 basis points to 31.5

percent due primarily to higher raw material and transportation

costs, partially offset by higher pricing and lower manufacturing

costs driven by productivity.

- Operating income

increased $418 million, and operating income margin was 16.8

percent, up 400 basis points primarily due to favorable

year-over-year change in mark-to-market gains/(losses) from

currency and commodity hedging activities, favorable year-over-year

change in acquisition integration costs and contingent

consideration adjustments, lapping prior-year impact from the

European Commission legal matter, lower remeasurement loss of net

monetary position and lower divestiture-related costs. These

favorable items were partially offset by lower Adjusted Operating

Income margin, lapping prior-year gain from the developed market

gum business divested in 2023 and costs incurred for the ERP

Systems Implementation program. Adjusted Operating Income decreased

$396 million at constant currency while Adjusted Operating Income

margin decreased 510 basis points to 10.0 percent, driven primarily

by higher input cost inflation, partially offset by higher net

pricing, overhead leverage and lower manufacturing costs driven by

productivity.

- Diluted EPS was

$1.30, up 85.7 percent, primarily due to favorable year-over-year

change in mark-to-market impacts from currency and commodity

derivatives, gain on equity method investment transactions,

favorable year-over-year change in acquisition integration costs

and contingent consideration adjustments, favorable year-over-year

change in initial impacts from enacted tax law changes, lower

remeasurement loss on of net monetary position and lower

divestiture-related costs. These favorable items were partially

offset by a decrease in Adjusted EPS, lapping prior-year gain from

the developed market gum business divested in 2023 and costs

incurred for the ERP Systems Implementation program.

- Adjusted EPS was

$0.65, down 15.9 percent on a constant currency basis driven by a

decrease in operating results and lower equity method investment

earnings, partially offset by lower taxes and fewer shares

outstanding.

2025 Outlook

Mondelēz International provides its outlook on a

non-GAAP basis, as the company cannot predict some elements that

are included in reported GAAP results, including the impact of

foreign exchange. Refer to the Outlook section in the discussion of

non-GAAP financial measures below for more details.

For 2025, the company expects Organic Net

Revenue growth to be approximately 5 percent. The company expects

Adjusted EPS to decline approximately 10% on a constant currency

basis due to unprecedented cocoa cost inflation. The company also

expects 2025 Free Cash Flow of $3+ billion. The company estimates

currency translation would decrease 2025 net revenue growth by

approximately 2.5 percent3 with a negative $0.12 impact

to Adjusted EPS3.

Outlook is provided in the context of greater

than usual volatility, including due to geopolitical, trade and

regulatory uncertainty and commodity prices. This outlook does not

reflect any imposition of import tariffs by the U.S. and potential

retaliatory actions taken by other countries, as the tariff and

trade environment is uncertain and rapidly evolving at this

time.

Conference Call

Mondelēz International will host a conference

call for investors with accompanying slides to review its results

at 5 p.m. ET today. A listen-only webcast will be provided at

www.mondelezinternational.com. An

archive of the webcast will be available on the company’s web

site.

About Mondelēz

International

Mondelēz International, Inc. (Nasdaq: MDLZ)

empowers people to snack right in over 150 countries around the

world. With 2024 net revenues of approximately $36 billion, MDLZ is

leading the future of snacking with iconic global and local brands

such as Oreo, Ritz, LU, Clif Bar and Tate's

Bake Shop biscuits and baked snacks, as well as Cadbury

Dairy Milk, Milka and Toblerone chocolate.

Mondelēz International is a proud member of the Standard and Poor’s

500, Nasdaq 100 and Dow Jones Sustainability Index.

Visit www.mondelezinternational.com or follow the

company on Twitter at www.twitter.com/MDLZ.

End Notes

- Organic Net

Revenue, Adjusted Gross Profit (and Adjusted Gross Profit margin),

Adjusted Operating Income (and Adjusted Operating Income margin),

Adjusted EPS, Adjusted EPS incl. developed market gum, Free Cash

Flow and presentation of amounts in constant currency are non-GAAP

financial measures. Please see discussion of non-GAAP financial

measures at the end of this press release for more

information.

- Earnings

attributable to Mondelēz International.

- Currency

estimate is based on published rates from XE.com on January 28,

2025.

Additional Definitions

Emerging markets consist of the Latin America

region in its entirety; the Asia, Middle East and Africa region

excluding Australia, New Zealand and Japan; and the following

countries from the Europe region: Russia, Ukraine, Türkiye,

Kazakhstan, Georgia, Poland, Czech Republic, Slovak Republic,

Hungary, Bulgaria, Romania, the Baltics and the East Adriatic

countries.

Developed markets include the entire North

America region, the Europe region excluding the countries included

in the emerging markets definition, and Australia, New Zealand and

Japan from the Asia, Middle East and Africa region.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including any projections of

earnings, revenue or other financial items; any statements of the

plans, strategies and objectives of management, including for

future operations, capital expenditures or share repurchases; any

statements concerning proposed new products, services, or

developments; any statements regarding future economic conditions

or performance; any statements of belief or expectation; and any

statements of assumptions underlying any of the foregoing or other

future events. Forward-looking statements may include, among

others, the words, and variations of words, “will,” “may,”

“expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,”

“likely,” “estimate,” “anticipate,” “objective,” “predict,”

“project,” “drive,” “seek,” “aim,” “target,” “potential,”

“commitment,” “outlook,” “continue” or any other similar words.

Although we believe that the expectations

reflected in any of our forward-looking statements are reasonable,

actual results or outcomes could differ materially from those

projected or assumed in any of our forward-looking statements. Our

future financial condition and results of operations, as well as

any forward-looking statements, are subject to change and to

inherent risks and uncertainties, many of which are beyond our

control and are amplified by current and potential trade and tariff

actions affecting the countries where we operate. Important factors

that could cause our actual results or performance to differ

materially from those contained in or implied by our

forward-looking statements include, but are not limited to, the

following:

- weakness in macroeconomic

conditions in our markets, including as a result of inflation (and

related monetary policy actions by governments in response to

inflation) and the instability of certain financial

institutions;

- risks from operating globally

including geopolitical, trade, tariff and regulatory uncertainties

affecting developed and emerging markets;

- volatility of cocoa and other

commodity input costs, our ability to effectively hedge such costs

and the availability of commodities;

- geopolitical uncertainty, including

the impact of ongoing or new developments in Ukraine and the Middle

East, related current and future sanctions imposed by governments

and other authorities and related impacts, including on our

business operations, employees, reputation, brands, financial

condition and results of operations;

- competition and our response to

channel shifts and pricing and other competitive pressures;

- pricing actions and customer and

consumer responses to such actions;

- promotion and protection of our

reputation and brand image;

- weakness in consumer spending

and/or changes in consumer preferences and demand and our ability

to predict, identify, interpret and meet these changes;

- the outcome and effects on us of

legal and tax proceedings and government investigations;

- use of information technology and

third party service providers;

- unanticipated disruptions to our

business, such as malware incidents, cyberattacks or other security

breaches, and supply, commodity, labor and transportation

constraints;

- our ability to identify, complete,

manage and realize the full extent of the benefits, cost savings,

efficiencies and/or synergies presented by strategic acquisitions

and other transactions as well as other strategic initiatives, such

as our ERP System Implementation program;

- our investments and our ownership

interests in those investments;

- the impact of climate change on our

supply chain and operations;

- global or regional health pandemics

or epidemics;

- consolidation of retail customers

and competition with retailer and other economy brands;

- changes in our relationships with

customers, suppliers or distributors;

- management of our workforce and

shifts in labor availability or labor costs;

- compliance with legal, regulatory,

tax and benefit laws and related changes, claims or actions;

- perceived or actual product quality

issues or product recalls;

- failure to maintain effective

internal control over financial reporting or disclosure controls

and procedures;

- our ability to protect our

intellectual property and intangible assets;

- tax matters including changes in

tax laws and rates, disagreements with taxing authorities and

imposition of new taxes;

- changes in currency exchange rates,

controls and restrictions;

- volatility of and access to capital

or other markets, interest rates, the effectiveness of our cash

management programs and our liquidity;

- pension costs;

- significant changes in valuation

factors that may adversely affect our impairment testing of

goodwill and intangible assets; and

- the risks and uncertainties, as

they may be amended from time to time, set forth in our filings

with the U.S. Securities and Exchange Commission, including our

most recently filed Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q.

There may be other factors not presently known to us or which we

currently consider to be immaterial that could cause our actual

results to differ materially from those projected in any

forward-looking statements we make. We disclaim and do not

undertake any obligation to update or revise any forward-looking

statement in this press release except as required by applicable

law or regulation. In addition, historical, current and

forward-looking sustainability-related statements may be based on

standards for measuring progress that are still developing,

internal controls and processes that continue to evolve, and

assumptions that are subject to change in the future.

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Schedule 1 |

|

Mondelēz International, Inc. and Subsidiaries |

|

Condensed Consolidated Statements of Earnings |

|

(in millions of U.S. dollars and shares, except per share

data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months

Ended December 31, |

|

|

For the Twelve Months

Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Net revenues |

$ |

9,604 |

|

|

$ |

9,314 |

|

|

|

$ |

36,441 |

|

|

$ |

36,016 |

|

|

Cost of sales |

|

(5,893 |

) |

|

|

(5,844 |

) |

|

|

|

(22,184 |

) |

|

|

(22,252 |

) |

| |

Gross profit |

|

3,711 |

|

|

|

3,470 |

|

|

|

|

14,257 |

|

|

|

13,764 |

|

| |

Gross profit margin |

|

38.6% |

|

|

|

37.3% |

|

|

|

|

39.1% |

|

|

|

38.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

(1,980 |

) |

|

|

(2,259 |

) |

|

|

|

(7,439 |

) |

|

|

(8,002 |

) |

|

Asset impairment and exit costs |

|

(86 |

) |

|

|

(89 |

) |

|

|

|

(324 |

) |

|

|

(217 |

) |

|

Gain on acquisition and divestitures |

|

4 |

|

|

|

108 |

|

|

|

|

4 |

|

|

|

108 |

|

|

Amortization of intangible assets |

|

(38 |

) |

|

|

(37 |

) |

|

|

|

(153 |

) |

|

|

(151 |

) |

| |

Operating income |

|

1,611 |

|

|

|

1,193 |

|

|

|

|

6,345 |

|

|

|

5,502 |

|

| |

Operating income margin |

|

16.8% |

|

|

|

12.8% |

|

|

|

|

17.4% |

|

|

|

15.3% |

|

| |

|

|

|

|

|

|

|

|

|

|

Benefit plan non-service income |

|

20 |

|

|

|

22 |

|

|

|

|

96 |

|

|

|

82 |

|

|

Interest and other expense, net |

|

(34 |

) |

|

|

(52 |

) |

|

|

|

(180 |

) |

|

|

(310 |

) |

|

Gain on marketable securities |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

606 |

|

| |

Earnings before income taxes |

|

1,597 |

|

|

|

1,163 |

|

|

|

|

6,261 |

|

|

|

5,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision |

|

(216 |

) |

|

|

(257 |

) |

|

|

|

(1,469 |

) |

|

|

(1,537 |

) |

| |

Effective tax rate |

|

13.5% |

|

|

|

22.1% |

|

|

|

|

23.5% |

|

|

|

26.1% |

|

|

Gain/(loss) on equity method investment transactions |

|

332 |

|

|

|

- |

|

|

|

|

(337 |

) |

|

|

465 |

|

|

Equity method investment net earnings |

|

35 |

|

|

|

44 |

|

|

|

|

168 |

|

|

|

160 |

|

| |

Net earnings |

|

1,748 |

|

|

|

950 |

|

|

|

|

4,623 |

|

|

|

4,968 |

|

| |

|

|

|

|

|

|

|

|

|

| |

less: Noncontrolling interest earnings |

|

(3 |

) |

|

|

- |

|

|

|

|

(12 |

) |

|

|

(9 |

) |

| |

Net earnings attributable to Mondelēz International |

$ |

1,745 |

|

|

$ |

950 |

|

|

|

$ |

4,611 |

|

|

$ |

4,959 |

|

| |

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

| |

Basic earnings per share attributable to Mondelēz

International |

$ |

1.31 |

|

|

$ |

0.70 |

|

|

|

$ |

3.44 |

|

|

$ |

3.64 |

|

| |

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share attributable to Mondelēz

International |

$ |

1.30 |

|

|

$ |

0.70 |

|

|

|

$ |

3.42 |

|

|

$ |

3.62 |

|

| |

|

|

|

|

|

|

|

|

|

|

Average shares outstanding: |

|

|

|

|

|

|

|

|

| |

Basic |

|

1,336 |

|

|

|

1,358 |

|

|

|

|

1,341 |

|

|

|

1,363 |

|

| |

Diluted |

|

1,340 |

|

|

|

1,364 |

|

|

|

|

1,347 |

|

|

|

1,370 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

Schedule 2 |

|

Mondelēz International, Inc. and Subsidiaries |

|

Condensed Consolidated Balance Sheets |

|

(in millions of U.S. dollars) |

|

(Unaudited) |

| |

|

|

|

|

|

| |

December 31, |

|

December 31, |

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,351 |

|

|

$ |

1,810 |

|

|

|

|

Trade receivables |

|

3,874 |

|

|

|

3,634 |

|

|

|

|

Other receivables |

|

937 |

|

|

|

878 |

|

|

|

|

Inventories, net |

|

3,827 |

|

|

|

3,615 |

|

|

|

|

Other current assets |

|

3,253 |

|

|

|

1,766 |

|

|

|

|

Total current assets |

|

13,242 |

|

|

|

11,703 |

|

|

|

|

Property, plant and equipment, net |

|

9,481 |

|

|

|

9,694 |

|

|

|

|

Operating lease right-of-use assets |

|

767 |

|

|

|

683 |

|

|

|

|

Goodwill |

|

23,017 |

|

|

|

23,896 |

|

|

|

|

Intangible assets, net |

|

18,848 |

|

|

|

19,836 |

|

|

|

|

Prepaid pension assets |

|

987 |

|

|

|

1,043 |

|

|

|

|

Deferred income taxes |

|

333 |

|

|

|

408 |

|

|

|

|

Equity method investments |

|

635 |

|

|

|

3,242 |

|

|

|

|

Other assets |

|

1,187 |

|

|

|

886 |

|

|

|

|

TOTAL ASSETS |

$ |

68,497 |

|

|

$ |

71,391 |

|

|

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Short-term borrowings |

$ |

71 |

|

|

$ |

420 |

|

|

|

|

Current portion of long-term debt |

|

2,014 |

|

|

|

2,101 |

|

|

|

|

Accounts payable |

|

9,433 |

|

|

|

8,321 |

|

|

|

|

Accrued marketing |

|

2,558 |

|

|

|

2,683 |

|

|

|

|

Accrued employment costs |

|

928 |

|

|

|

1,158 |

|

|

|

|

Other current liabilities |

|

4,545 |

|

|

|

4,330 |

|

|

|

|

Total current liabilities |

|

19,549 |

|

|

|

19,013 |

|

|

|

|

Long-term debt |

|

15,664 |

|

|

|

16,887 |

|

|

|

|

Long-term operating lease liabilities |

|

623 |

|

|

|

537 |

|

|

|

|

Deferred income taxes |

|

3,425 |

|

|

|

3,292 |

|

|

|

|

Accrued pension costs |

|

391 |

|

|

|

437 |

|

|

|

|

Accrued postretirement health care costs |

|

98 |

|

|

|

124 |

|

|

|

|

Other liabilities |

|

1,789 |

|

|

|

2,735 |

|

|

|

|

TOTAL LIABILITIES |

|

41,539 |

|

|

|

43,025 |

|

|

|

| |

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Common Stock |

|

- |

|

|

|

- |

|

|

|

|

Additional paid-in capital |

|

32,276 |

|

|

|

32,216 |

|

|

|

|

Retained earnings |

|

36,476 |

|

|

|

34,236 |

|

|

|

|

Accumulated other comprehensive losses |

|

(12,471 |

) |

|

|

(10,946 |

) |

|

|

|

Treasury stock |

|

(29,349 |

) |

|

|

(27,174 |

) |

|

|

|

Total Mondelēz International Shareholders' Equity |

|

26,932 |

|

|

|

28,332 |

|

|

|

|

Noncontrolling interest |

|

26 |

|

|

|

34 |

|

|

|

|

TOTAL EQUITY |

|

26,958 |

|

|

|

28,366 |

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

68,497 |

|

|

$ |

71,391 |

|

|

|

| |

|

|

|

|

|

| |

December 31, |

|

December 31, |

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

Incr/(Decr) |

| |

|

|

|

|

|

|

Short-term borrowings |

$ |

71 |

|

|

$ |

420 |

|

|

$ |

(349 |

) |

|

Current portion of long-term debt |

|

2,014 |

|

|

|

2,101 |

|

|

|

(87 |

) |

|

Long-term debt |

|

15,664 |

|

|

|

16,887 |

|

|

|

(1,223 |

) |

|

Total Debt |

|

17,749 |

|

|

|

19,408 |

|

|

|

(1,659 |

) |

|

Cash and cash equivalents |

|

1,351 |

|

|

|

1,810 |

|

|

|

(459 |

) |

|

Net Debt (1) |

$ |

16,398 |

|

|

$ |

17,598 |

|

|

$ |

(1,200 |

) |

| |

|

|

|

|

|

|

(1) Net debt is defined as total debt, which includes

short-term borrowings, current portion of long-term debt and

long-term debt, less cash and cash equivalents. |

| |

|

|

Schedule

3 |

| Mondelēz

International, Inc. and Subsidiaries |

| Condensed

Consolidated Statements of Cash Flows |

| (in millions

of U.S. dollars) |

|

(Unaudited) |

| |

|

|

|

| |

For the Twelve Months

Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| CASH

PROVIDED BY/(USED IN) OPERATING ACTIVITIES |

|

|

|

|

Net earnings |

$ |

4,623 |

|

|

$ |

4,968 |

|

|

Adjustments to reconcile net earnings to operating cash flows: |

|

|

|

|

Depreciation and amortization |

|

1,302 |

|

|

|

1,215 |

|

|

Stock-based compensation expense |

|

147 |

|

|

|

146 |

|

|

Deferred income tax provision/(benefit) |

|

257 |

|

|

|

(37 |

) |

|

Asset impairments and accelerated depreciation |

|

267 |

|

|

|

128 |

|

|

Gain on acquisition and divestitures |

|

(4 |

) |

|

|

(108 |

) |

|

Loss/(gain) on equity method investment transactions |

|

337 |

|

|

|

(465 |

) |

|

Equity method investment net earnings |

|

(175 |

) |

|

|

(160 |

) |

|

Distributions from equity method investments |

|

115 |

|

|

|

137 |

|

|

Unrealized gain on derivative contracts |

|

(627 |

) |

|

|

(171 |

) |

|

Gain on marketable securities |

|

- |

|

|

|

(593 |

) |

|

Contingent consideration adjustments |

|

(389 |

) |

|

|

125 |

|

|

Other non-cash items, net |

|

26 |

|

|

|

38 |

|

|

Change in assets and liabilities, net of acquisitions and

divestitures: |

|

|

|

|

Receivables, net |

|

(519 |

) |

|

|

(628 |

) |

|

Inventories, net |

|

(458 |

) |

|

|

(193 |

) |

|

Accounts payable |

|

1,682 |

|

|

|

264 |

|

|

Other current assets |

|

(591 |

) |

|

|

(120 |

) |

|

Other current liabilities |

|

(932 |

) |

|

|

354 |

|

|

Change in pension and postretirement assets and liabilities,

net |

|

(151 |

) |

|

|

(186 |

) |

|

Net cash provided by operating activities |

|

4,910 |

|

|

|

4,714 |

|

| |

|

|

|

| CASH

PROVIDED BY/(USED IN) INVESTING ACTIVITIES |

|

|

|

|

Capital expenditures |

|

(1,387 |

) |

|

|

(1,112 |

) |

|

Acquisitions, net of cash received |

|

(240 |

) |

|

|

19 |

|

|

Proceeds from divestitures including equity method and marketable

security investments |

|

2,294 |

|

|

|

4,099 |

|

|

Proceeds from derivative settlements |

|

320 |

|

|

|

177 |

|

|

Payments for derivative settlements |

|

(199 |

) |

|

|

(81 |

) |

|

Contributions to investments |

|

(278 |

) |

|

|

(309 |

) |

|

Proceeds from sale of property, plant and equipment and other |

|

16 |

|

|

|

19 |

|

|

Net cash provided by investing activities |

|

526 |

|

|

|

2,812 |

|

| |

|

|

|

| CASH

PROVIDED BY/(USED IN) FINANCING ACTIVITIES |

|

|

|

|

Issuance of commercial paper, maturities greater than 90 days |

|

- |

|

|

|

67 |

|

|

Repayments of commercial paper, maturities greater than 90

days |

|

- |

|

|

|

(67 |

) |

|

Net (repayments)/issuances of short-term borrowings |

|

(343 |

) |

|

|

(1,869 |

) |

|

Long-term debt proceeds |

|

1,671 |

|

|

|

277 |

|

|

Long-term debt repayments |

|

(2,554 |

) |

|

|

(2,432 |

) |

|

Repurchases of Common Stock |

|

(2,334 |

) |

|

|

(1,547 |

) |

|

Dividends paid |

|

(2,349 |

) |

|

|

(2,160 |

) |

|

Other |

|

129 |

|

|

|

173 |

|

|

Net cash used in financing activities |

|

(5,780 |

) |

|

|

(7,558 |

) |

| |

|

|

|

| Effect of

exchange rate changes on cash, cash equivalents and restricted

cash |

|

(140 |

) |

|

|

(32 |

) |

| |

|

|

|

| Cash, Cash

Equivalents and Restricted Cash |

|

|

|

|

Decrease |

|

(484 |

) |

|

|

(64 |

) |

|

Balance at beginning of period |

|

1,884 |

|

|

|

1,948 |

|

|

Balance at end of period |

$ |

1,400 |

|

|

$ |

1,884 |

|

| |

|

|

|

Mondelēz International, Inc. and

Subsidiaries

Reconciliation of GAAP and Non-GAAP Financial

Measures

(Unaudited)

The company reports its financial results in

accordance with accounting principles generally accepted in the

United States (“U.S. GAAP”). However, management believes that also

presenting certain non-GAAP financial measures provides additional

information to facilitate the comparison of the company’s

historical operating results and trends in its underlying operating

results, and provides additional transparency on how the company

evaluates its business. Management uses these non-GAAP financial

measures in making financial, operating and planning decisions and

in evaluating the company’s performance. The company also believes

that presenting these measures allows investors to view its

performance using the same measures that the company uses in

evaluating its financial and business performance and trends.

The company considers quantitative and

qualitative factors in assessing whether to adjust for the impact

of items that may be significant or that could affect an

understanding of its ongoing financial and business performance and

trends. The adjustments generally fall within the following

categories: acquisition & divestiture activities, gains

and losses on intangible asset sales and non-cash impairments,

major program restructuring activities, constant currency and

related adjustments, major program financing and hedging activities

and other major items affecting comparability of operating results.

See below for a description of adjustments to the company’s U.S.

GAAP financial measures included herein.

Non-GAAP information should be considered as

supplemental in nature and is not meant to be considered in

isolation or as a substitute for the related financial information

prepared in accordance with U.S. GAAP. In addition, the company’s

non-GAAP financial measures may not be the same as or comparable to

similar non-GAAP measures presented by other companies.

DEFINITIONS OF THE COMPANY’S NON-GAAP

FINANCIAL MEASURES

The company’s non-GAAP financial measures and corresponding metrics

reflect how the company evaluates its operating results currently

and provide improved comparability of operating results. As new

events or circumstances arise, these definitions could change. When

these definitions change, the company provides the updated

definitions and presents the related non-GAAP historical results on

a comparable basis. When items no longer impact the company’s

current or future presentation of non-GAAP operating results, the

company removes these items from its non-GAAP definitions.

Beginning in Q1 2024, due to a significant devaluation of the

Argentinean peso that occurred in December 2023 and the resulting

distortion it would cause on our non-GAAP constant currency growth

rate measures, the company now excludes the impact of pricing in

excess of 26% year-over-year ("extreme pricing") in Argentina. The

benchmark of 26% represents the minimum annual inflation rate for

each year over a 3-year period which would result in a cumulative

inflation rate in excess of 100%, the level at which an economy is

considered hyperinflationary under U.S. GAAP. The company has

excluded the impact of extreme pricing in Argentina from its

calculation of Organic Net Revenue, Organic Net Revenue growth and

other non-GAAP financial constant currency growth measures with a

corresponding adjustment to changes in currency exchange rates. The

company made this change on a prospective basis due to the

distorting effect expected in the current period and future periods

following the Argentinian peso devaluation that occurred in

December 2023 and did not revise its historical non-GAAP constant

currency growth measures. Beginning in Q2 2024, the company added

to its non-GAAP definitions the exclusion of operating expenses

associated with its ERP System Implementation program as they

represent incremental transformational costs above the normal

ongoing level of spending on information technology to support

operations. These operating expenses will be excluded from the

company's non-GAAP financial measures as the company believes

excluding those costs will better facilitate comparisons of the

company's underlying operating performance across periods.

- “Organic Net

Revenue” is defined as net revenues (the most comparable

U.S. GAAP financial measure) excluding the impacts of acquisitions,

divestitures, short-term distributor agreements related to the sale

of a business and currency rate fluctuations. The company also

evaluates Organic Net Revenue growth from emerging markets and

developed markets.

- “Adjusted Gross

Profit” is defined as gross profit (the most comparable

U.S. GAAP financial measure) excluding the impacts of the Simplify

to Grow Program; acquisition integration costs; the operating

results of divestitures; operating results from short-term

distributor agreements related to the sale of a business;

mark-to-market impacts from commodity, forecasted currency and

equity method investment transaction derivative contracts;

inventory step-up charges; 2017 malware incident net recoveries;

and incremental costs due to the war in Ukraine. The company also

presents “Adjusted Gross Profit margin,” which is subject to the

same adjustments as Adjusted Gross Profit. The company also

evaluates growth in the company’s Adjusted Gross Profit on a

constant currency basis.

- “Adjusted Operating

Income” and “Adjusted Segment Operating

Income” are defined as operating income (the most

comparable U.S. GAAP financial measures) or segment operating

income excluding the impacts of the items listed in the Adjusted

Gross Profit definition as well as gains or losses (including

non-cash impairment charges) on goodwill and intangible assets;

divestiture or acquisition gains or losses, divestiture-related

costs, acquisition-related costs, and acquisition integration costs

and contingent consideration adjustments; remeasurement of net

monetary position; impacts from resolution of tax matters; the

European Commission legal matter; impact from pension participation

changes; and operating costs from the ERP System Implementation

program. The company also presents “Adjusted Operating Income

margin” and “Adjusted Segment Operating Income margin,” which are

subject to the same adjustments as Adjusted Operating Income and

Adjusted Segment Operating Income. The company also evaluates

growth in the company’s Adjusted Operating Income and Adjusted

Segment Operating Income on a constant currency basis.

- “Adjusted EPS” is

defined as diluted EPS attributable to Mondelēz International from

continuing operations (the most comparable U.S. GAAP financial

measure) excluding the impacts of the items listed in the Adjusted

Operating Income definition, as well as losses on debt

extinguishment and related expenses; gains or losses on interest

rate swaps no longer designated as accounting cash flow hedges due

to changed financing and hedging plans; mark-to-market unrealized

gains or losses and realized gains or losses from marketable

securities; initial impacts from enacted tax law changes; and gains

or losses on equity method investment transactions. Similarly,

within Adjusted EPS, the company’s equity method investment net

earnings exclude its proportionate share of its investee's

significant operating and non-operating items. The tax impact of

each of the items excluded from the company’s U.S GAAP results was

computed based on the facts and tax assumptions associated with

each item, and such impacts have also been excluded from Adjusted

EPS. The company also evaluates growth in the company’s Adjusted

EPS on a constant currency basis.

- “Free Cash Flow”

is defined as net cash provided by operating activities less

capital expenditures (the most comparable U.S. GAAP financial

measure). Free Cash Flow is the company’s primary measure used to

monitor its cash flow performance.

See the attached schedules for supplemental

financial data and corresponding reconciliations of the non-GAAP

financial measures referred to above to the most comparable U.S.

GAAP financial measures for the three and twelve months ended

December 31, 2024 and December 31, 2023. See Items Impacting

Comparability of Operating Results below for more information

about the items referenced in these definitions that specifically

impacted the company’s results.

SEGMENT OPERATING INCOME

The company uses segment operating income to evaluate segment

performance and allocate resources. The company believes it is

appropriate to disclose this measure to help investors analyze

segment performance and trends. Segment operating income excludes

unrealized gains and losses on hedging activities (which are a

component of cost of sales), general corporate expenses (which are

a component of selling, general and administrative expenses),

amortization of intangibles, gains and losses on divestitures and

acquisition-related costs (which are a component of selling,

general and administrative expenses) in all periods presented. The

company excludes these items from segment operating income in order

to provide better transparency of its segment operating results.

Furthermore, the company centrally manages benefit plan non-service

income and interest and other expense, net. The company does not

present the items above by segment because they are excluded from

the segment profitability measure that management reviews.

ITEMS IMPACTING COMPARABILITY OF

OPERATING RESULTS

The following information is provided to give qualitative and

quantitative information related to items impacting comparability

of operating results. The company identifies these based on how

management views the company’s business; makes financial, operating

and planning decisions; and evaluates the company’s ongoing

performance. In addition, the company discloses the impact of

changes in currency exchange rates on the company’s financial

results in order to reflect results on a constant currency

basis.

Divestitures, Divestiture-related

costs and Gains/(losses) on divestitures

Divestitures include completed sales of businesses, exits of major

product lines upon completion of a sale or licensing agreement. the

partial or full sale of an equity method investment and changes

from equity method investment accounting to accounting for

marketable securities. Divestiture-related costs, which includes

costs incurred in relation to the preparation and completion

(including one-time costs such as severance related to elimination

of stranded costs) for the company's divestitures as defined above,

also includes costs incurred associated with the company's publicly

announced processes to sell businesses.

- On November 29, 2024, the company

sold its remaining shares in JDE Peet’s to JAB Holdings Company. As

a result of this transaction, the company has fully exited its

investment in the company. Previously, due to the company's

reporting of JDEP’s results on a one-quarter lag basis, the company

considered the impact of the sale of shares in its JDEP investment

as a divestiture in the quarter following the sale of shares. As

the company no longer has an equity method investment in JDEP as of

the end of 2024, the company has considered the sale of its

remaining shares in JDE Peet's a divestiture beginning with its

fourth quarter ended December 31, 2024.

- On October 1, 2023, the company

completed the sale of its developed market gum business in the

United States, Canada, and Europe to Perfetti Van Melle Group,

excluding the Portugal business which the company sold on October

23, 2023 after obtaining regulatory approval. The company received

cash proceeds of $1.4 billion and recorded a pre-tax gain of $108

million on the sale. The divestiture of this business resulted in a

year-over-year reduction in net revenues of $1 million in the three

months and $484 million in the twelve months ended December 31,

2024. The company reversed previously recorded divestiture-related

costs no longer required of $1 million in the three months and

incurred divestiture-related costs of $1 million in the twelve

months ended December 31, 2024 and $17 million in the three months

and $83 million in the twelve months ended December 31, 2023.

- The company's 2023 divestitures,

impacting its historical results, also included the company's sales

of JDE Peet's shares during the three months ended September 30,

2023, the April 3, 2023 sale of JDE Peet's shares and the March 2,

2023 sale of KDP shares and the change from equity method

investment accounting to accounting for marketable securities for

the company's remaining equity interest in KDP. See the section on

gains/losses on equity method investment transactions and

marketable securities below for more information.

Operating results from short-term

distributor agreements

In the fourth quarter of 2023, the company began to exclude the

operating results from short-term distributor agreements that have

been executed in conjunction with the sale of a business. The

company excludes this item to better facilitate comparisons of

underlying performance across periods.

As part of the sale of the company's developed

market gum business on October 1, 2023, the company entered into a

short-term distribution agreement with the buyer, Perfetti Van

Melle Group, to distribute gum products in certain European markets

for up to six months. The company recorded net revenues of $25

million and operating income of $2 million in the first quarter of

2024 and net revenue of $22 million and operating income of $3

million in the fourth quarter of 2023.

Acquisitions, Acquisition-related

costs and Acquisition integration costs and contingent

consideration adjustments

Acquisition-related costs, which includes transaction costs such as

third party advisor, investment banking and legal fees, also

includes one-time compensation expense related to the buyout of

non-vested employee stock ownership plan shares and realized gains

or losses from hedging activities associated with acquisition

funds. Acquisition integration costs and contingent consideration

adjustments include one-time costs related to the integration of

acquisitions as well as any adjustments made to the fair market

value of contingent compensation liabilities that have been

previously booked for earn-outs related to acquisitions that do not

relate to employee compensation expense. The company excludes these

items to better facilitate comparisons of its underlying operating

performance across periods.

On November 1, 2024, the company acquired Evirth

(Shanghai) Industrial Co., Ltd. (“Evirth”), a leading manufacturer

of cakes and pastries in China. The acquisition will continue to

expand the company's growth in the cakes and pastries categories.

The acquisition added incremental net revenues of $72 million

(constant currency basis) during the three months and twelve months

ended December 31, 2024 and operating income of $10 million during

the three months and twelve months ended December 31, 2024. The

company incurred acquisition integration costs and contingent

consideration adjustments of $8 million and an inventory step-up

charge of $3 million in the three and twelve months ended December

31, 2024. In addition, the company incurred acquisition-related

costs of $1 million in the three months and $3 million in the

twelve months ended December 31, 2024.

On November 1, 2022, the company acquired 100%

of the equity of Grupo Bimbo's confectionery business, Ricolino,

located primarily in Mexico. The acquisition of Ricolino builds on

our continued prioritization of fast-growing snacking segments in

key geographies. The company recorded income due to final true-ups

related to the purchase agreement net of other charges within

acquisition integration costs of $7 million in the three months and

incurred acquisition integration costs of $21 million in the twelve

months ended December 31, 2024, and $20 million in the three months

and $50 million in the twelve months ended December 31, 2023.

On August 1, 2022, the company acquired 100% of

the equity of Clif Bar & Company (“Clif Bar”), a leading U.S.

maker of nutritious energy bars with organic ingredients. The

acquisition expands our global snacks bar business and complements

our refrigerated snacking and performance nutrition bar portfolios.

The company incurred acquisition integration costs and contingent

consideration adjustments resulting in income of $87 million in the

three months and $393 million in the twelve months ended December

31, 2024, and expense of $72 million in the three months and $164

million in the twelve months ended December 31, 2023.

On January 3, 2022, the company acquired 100% of

the equity of Chipita Global S.A. (“Chipita”), a leading croissants

and baked snacks company in the Central and Eastern European

markets. The acquisition of Chipita offers a strategic complement

to the company's existing portfolio and advances its strategy to

become the global leader in broader snacking. The company incurred

acquisition integration costs of $9 million in the three months and

$20 million in the twelve months ended December 31, 2024, and $2

million in the three months and $17 million in the twelve months

ended December 31, 2023.

On April 1, 2020, the company acquired a

majority interest in Give & Go, a North American leader in

fully-finished sweet baked goods and owner of the famous

two-bite® brand of brownies and the

Create-A-Treat® brand, known for

cookie and gingerbread house decorating kits. The acquisition of

Give & Go provides access to the in-store bakery channel and

expands the company's position in broader snacking. The company

incurred acquisition integration costs and contingent consideration

adjustments of $11 million in the three months and $28 million in

the twelve months ended December 31, 2024, and $9 million in the

three months and $20 million in the twelve months ended December

31, 2023.

Simplify to Grow

Program

The primary objective of the Simplify to Grow Program is to reduce

the company’s operating cost structure in both its supply chain and

overhead costs. The program covers severance as well as asset

disposals and other manufacturing and procurement-related one-time

costs.

Restructuring costs

The company incurred restructuring charges of $37 million in the

three months and $77 million in the twelve months ended December

31, 2024, and $58 million in the three months and $106 million in

the twelve months ended December 31, 2023. This activity was

recorded within asset impairment and exit costs and benefit plan

non-service income. These charges were for severance and related

costs, non-cash asset write-downs (including accelerated

depreciation and asset impairments) and other adjustments,

including any gains on sale of restructuring program assets.

Implementation costs

Implementation costs primarily relate to reorganizing the company’s

operations and facilities in connection with its supply chain

reinvention program and other identified productivity and cost

saving initiatives. The costs include incremental expenses related

to the closure of facilities, costs to terminate certain contracts

and the simplification of the company’s information systems. The

company recorded implementation costs of $32 million in the three

months and $72 million in the twelve months ended December 31,

2024, and $12 million in the three months and $25 million in the

twelve months ended December 31, 2023.

Intangible asset impairment

charges

During the company's 2024 annual testing of indefinite-life

intangible assets, the company recorded intangible asset impairment

charges of $153 million in the third quarter of 2024 related to two

biscuit brands in the Europe segment, one biscuit brand in the AMEA

segment and one candy and one biscuit brand in the Latin America

segment.

During the company's 2023 annual testing of

indefinite-life intangible assets, the company recorded intangible

asset impairment charges of $26 million in the third quarter of

2023 related to one chocolate brand in the North America segment

and one biscuit brand in the Europe segment.

Mark-to-market impacts from

commodity and currency derivative contracts

The company excludes unrealized gains and losses (mark-to-market

impacts) from outstanding commodity and forecasted currency and

equity method investment transaction derivative contracts from its

non-GAAP earnings measures. The mark-to-market impacts of commodity

and forecasted currency transaction derivatives are excluded until

such time that the related exposures impact the company's operating

results. Since the company purchases commodity and forecasted

currency transaction contracts to mitigate price volatility

primarily for inventory requirements in future periods, the company

makes this adjustment to remove the volatility of these future

inventory purchases on current operating results to facilitate

comparisons of its underlying operating performance across periods.

The company excludes equity method investment derivative contract

settlements as they represent protection of value for future

divestitures. The company recorded commodity, forecasted currency

and equity method transaction derivatives net unrealized gains of

$700 million in the three months and $544 million in the twelve

months ended December 31, 2024, and recorded net unrealized losses

of $51 million in the three months and net unrealized gains of $185

million in the twelve months ended December 31, 2023.

Remeasurement of net monetary

position

The company translates the results of operations of its

subsidiaries from multiple currencies using average exchange rates

during each period and translate balance sheet accounts using

exchange rates at the end of each period. The company records

currency translation adjustments as a component of equity (except

for highly inflationary currencies) and realized exchange gains and

losses on transactions in earnings.

Highly inflationary accounting is triggered when

a country’s three-year cumulative inflation rate exceeds 100%. It

requires the remeasurement of financial statements of subsidiaries

in the country, from the functional currency of the subsidiary to

our U.S. dollar reporting currency, with currency remeasurement

gains or losses recorded in earnings. The company excludes

remeasurement gains and losses of the monetary assets and

liabilities of its subsidiaries in highly inflationary economies

from its non-GAAP earnings measures.

At this time, within the company's consolidated

entities, Argentina, Türkiye, Egypt and Nigeria are accounted for

as highly inflationary economies. For Argentina, the company

recorded a remeasurement loss of $3 million in the three months and

$17 million in the twelve months ended December 31, 2024, and $38

million in the three months and $79 million in the twelve months

ended December 31, 2023 related to the revaluation of the

Argentinean peso denominated net monetary position over these

periods. For Türkiye, the company recorded a remeasurement loss of

$3 million in the three months and $15 million in the twelve months

ended December 31, 2024, and $19 million in the twelve months ended

December 31, 2023 related to the revaluation of the Turkish lira

denominated net monetary position over these periods. For Egypt,

the company recorded a remeasurement gain of $1 million in the

three months and twelve months ended December 31, 2024. For

Nigeria, the company recorded an immaterial remeasurement gain in

the three months and twelve months ended December 31, 2024. The

company recorded these charges for Argentina, Türkiye, Egypt and

Nigeria within selling, general and administrative expenses.

Impact from pension participation

changes

The impact from pension participation changes represent the charges

incurred when employee groups are withdrawn from multiemployer

pension plans and other changes in employee group pension plan

participation. The company excludes these charges from its non-GAAP

results because those amounts do not reflect the company’s ongoing

pension obligations.

On July 11, 2019, the company received a

withdrawal liability assessment from the Bakery and Confectionery

Union and Industry International Pension Fund and recorded a

discounted liability of $491 million requiring pro-rata monthly

payments over 20 years. The company began making monthly payments

during the third quarter of 2019. In connection with the discounted

long-term liability, the company recorded accreted interest of $3

million in the three months and $10 million in the twelve months

ended December 31, 2024 and $2 million in the three months and $10

million in the twelve months ended December 31, 2023 within

interest and other expense, net. As of December 31, 2024, the

remaining discounted withdrawal liability was $311 million, with

$16 million recorded in other current liabilities and $295 million

recorded in long-term other liabilities.

Incremental costs due to the war in

Ukraine

In February 2022, Russia began a military invasion of Ukraine and

the company closed its operations and facilities in Ukraine. In

March 2022, the company's two Ukrainian manufacturing facilities in

Trostyanets and Vyshhorod were significantly damaged. In the second

quarter of 2024, the company fully resumed production at both

facilities after completing targeted repairs. The company continues

to consolidate both its Ukrainian and Russian subsidiaries and

continues to evaluate its ability to control its operating

activities and businesses on an ongoing basis. The company

continues to evaluate the uncertainty of the ongoing effects of the

war in Ukraine and its impact on the global economic environment,

and the company cannot predict if it will have a significant impact

in the future. The company incurred costs of $1 million in the

three months and $3 million in the twelve months ended December 31,

2024. The company reversed $1 million during the twelve months of

2023 of previously recorded charges primarily as a result of higher

than expected collection of trade receivables and inventory

recoveries.

ERP System

Implementation

In July 2024, the company's Board of Directors approved funding of

$1.2 billion for a multi-year systems transformation program to

upgrade its global ERP and supply chain systems (the “ERP System

Implementation”). The ERP System Implementation spending comprises

both capital expenditures and operating expenses, of which a

majority is expected to relate to operating expenses. The ERP

System Implementation program will be implemented by region in

several phases with spending occurring over the next five years,

with expected completion by year-end 2028. The operating expenses

associated with the ERP System Implementation represent incremental

transformational costs above the normal ongoing level of spending

on information technology to support operations. These expenses

include third-party consulting fees, direct labor costs associated

with the program, accelerated depreciation of the company's

existing SAP financial systems and various other expenses, all

associated with the implementation of the company's information

technology upgrades. The company excludes these expenses from its

non-GAAP results as they are nonrecurring and will better

facilitate comparisons of the company's underlying operating

performance across periods.

The company recorded operating expenses of $40

million in the three months and $78 million in the twelve months

ended December 31, 2024.

Initial impacts from enacted tax law

changes

The company excludes initial impacts from enacted tax law changes

from its non-GAAP financial measures as they do not reflect its

ongoing tax obligations under the enacted tax law changes. Initial

impacts include items such as the remeasurement of deferred tax

balances and the transition tax from the 2017 U.S. tax reform.

The company recorded a net tax expense from the

increase of its deferred tax liabilities resulting from enacted tax

legislation of $12 million in the three months and $24 million in

the twelve months ended December 31, 2024, and recorded a net tax

expense from the increase of its deferred tax liabilities resulting

from enacted tax legislation of $68 million in the three months and

$83 million in the twelve months ended December 31, 2023.

Gains and losses on marketable

securities and equity method investment transactions (including

impairment charges)

Keurig Dr Pepper

During the first quarter of 2023, the company's reduction in

ownership in Keurig Dr Pepper Inc. (NASDAQ: "KDP") fell to below 5%

of the outstanding shares, resulting in a change of accounting for

its KDP investment, from equity method investment accounting to

accounting for equity interests with readily determinable fair

values ("marketable securities") as the company no longer had

significant influence over KDP. Marketable securities are measured

at fair value based on quoted prices in active markets for

identical assets (Level 1).

On July 13, 2023, the company sold

23 million shares, the remainder of its shares of KDP. The

company received proceeds of approximately $704 million.

On June 8, 2023, the company sold 23 million

shares of KDP, which reduced its ownership by 1.6 percentage

points, from 3.2% to 1.6% of the total outstanding shares. The

company received proceeds of approximately $708 million.

On March 2, 2023, the company sold

30 million shares of KDP, which reduced its ownership interest

by 2.1 percentage points, from 5.3% to 3.2% of the total

outstanding shares. The company received proceeds of approximately

$1.0 billion and prior to the change of accounting for its KDP

investment, recorded a pre-tax gain on equity method transactions

of $493 million ($368 million after-tax) during the first quarter

of 2023.

Pre-tax (losses)/gains for marketable securities

for the twelve months ended December 31, 2023 are summarized

below:

| |

|

Twelve Months Ended December 31, 2023 |

| |

|

|

(in millions) |

|

Gain on marketable securities sold during the period |

|

$ |

593 |