Marker Therapeutics Reports Q2 2022 Operating and Financial Results

12 August 2022 - 6:22AM

Marker Therapeutics, Inc. (Nasdaq: MRKR), a clinical-stage

immuno-oncology company specializing in the development of

next-generation T cell-based immunotherapies for the treatment of

hematological malignancies and solid tumor indications, today

provided a corporate update and reported financial results for the

second quarter ended June 30, 2022.

“We are proud of our progress this year in advancing our

Company-sponsored clinical program in AML, and early results

support the ability of MT-401, a multiTAA-specific T cell product,

to drive results for patients with AML,” said Peter L. Hoang,

Marker’s President and Chief Executive Officer. “This quarter, we

continued to dose patients in the Phase 2 AML study, and we expect

to provide a topline readout of active disease patients in Q3 2022.

The recent $8 million upfront cash payment to Marker by Wilson Wolf

has aided the efficient execution of Marker’s programs.”

Mr. Hoang continued: “In addition, we recently announced that

FDA cleared our IND investigating the safety and efficacy of MT-601

in patients with relapsed/refractory lymphoma, and that we are on

track to file another IND by year-end to investigate the safety and

efficacy of MT-601 in patients with pancreatic cancer, which has

already received FDA Orphan Drug Designation. We anticipate dosing

the first patients in these trials, in addition to dosing patients

in our off-the-shelf therapy for AML, next year.”

“We are very optimistic about the ability of MT-401 to drive

results for patients with measurable residual disease given the

results we have seen to date in the ARTEMIS study,” said Dr.

Mythili Koneru, Marker’s Chief Medical Officer. “Of note, we were

very pleased to note that the second patient we treated with MRD+

disease was found to be MRD- by that patient’s week 8 follow-up.

The ability to administer MT-401 without the need for

lymphodepletion, coupled with our improved accelerated

manufacturing process, enable us to treat patients who have MRD+

disease. We believe that the results observed to date support the

notion that patients with AML would have meaningful benefit from a

multi-antigen targeted T cell therapy approach.”

PROGRAM UPDATES AND EXPECTED MILESTONES

Acute Myeloid Leukemia (MT-401)

- Marker has enrolled 13 evaluable patients in total, including 6

in the Safety Lead-in cohorts.

- 5 patients have been treated with MT-401 manufactured by a

revised process and have completed dose-limiting toxicity (DLT)

periods with no DLTs reported.

- One additional MRD+ patient was treated and became MRD- at 8

weeks after the first infusion.

- Marker remains on track to dose the first patient in 2023 with

MT-401-OTS, a scalable, off-the-shelf product candidate with the

potential to match patients to treatment in under three days. The

Company is in the process of developing a patient cell bank

inventory.

Lymphoma (MT-601)

- On August 4, 2022, Marker announced that the U.S. Food and Drug

Administration (FDA) cleared the Company's Investigational New Drug

(IND) application for MT-601, a multi-tumor-associated antigen

(multiTAA)-specific T cell product targeting six antigens, for the

treatment of patients with relapsed/refractory non-Hodgkin lymphoma

who have failed or are ineligible to receive anti-CD19 CAR T cell

treatment.

- Marker expects to initiate a Phase 1 trial in 2023.

Pancreatic Cancer (MT-601)

- Marker is on track to file an IND for MT-601 for the treatment

of pancreatic cancer in 2022.

- The Company intends to initiate a Phase 1 multicenter study of

MT-601 administered in combination with front-line chemotherapy to

patients with locally advanced unresectable or metastatic

pancreatic cancer in 2023.

SECOND QUARTER 2022 FINANCIAL RESULTS

- Cash Position and Guidance: At June 30, 2022,

Marker had cash and cash equivalents of $25.8 million.

- R&D Expenses: Research and development

expenses were $6.6 million for the quarter ended June 30, 2022,

compared to $7.4 million for the quarter ended June 30, 2021.

- G&A Expenses: General and administrative

expenses were $3.5 million for the quarter ended June 30, 2022,

compared to $3.6 million for the quarter ended June 30, 2021.

- Net Loss: Marker reported a net loss of $9.2

million for the quarter ended June 30, 2022, compared to a net loss

of $10.9 million for the quarter ended June 30,

2021.

Organizational Restructuring

On August 10, 2022, the Company implemented changes to the

Company’s organizational structure as part of an operational cost

reduction plan to conserve the Company’s available capital. In

connection with these changes, the Company reduced headcount in its

general and administrative function by approximately 23.5%,

including the separation of the Company’s Chief Financial Officer.

The Company estimates that the severance and termination-related

costs will total approximately $0.7 million and will be recorded in

the third quarter of 2022. The Company expects that the payment of

these costs will be substantially complete in September of

2023.

About Marker Therapeutics, Inc.Marker

Therapeutics, Inc. is a clinical-stage immuno-oncology company

specializing in the development of next-generation T cell-based

immunotherapies for the treatment of hematological malignancies and

solid tumor indications. Marker’s cell therapy technology is based

on the selective expansion of non-engineered, tumor-specific T

cells that recognize tumor associated antigens (i.e. tumor targets)

and kill tumor cells expressing those targets. This population of T

cells is designed to attack multiple tumor targets following

infusion into patients and to activate the patient’s immune system

to produce broad spectrum anti-tumor activity. Because Marker does

not genetically engineer its T cell therapies, we believe that our

product candidates will be easier and less expensive to

manufacture, with reduced toxicities, compared to current

engineered CAR-T and TCR-based approaches, and may provide patients

with meaningful clinical benefit. As a result, Marker believes its

portfolio of T cell therapies has a compelling product profile, as

compared to current gene-modified CAR-T and TCR-based

therapies.

To receive future press releases via email, please visit:

https://www.markertherapeutics.com/email-alerts.

Forward-Looking Statements This

release contains forward-looking statements for purposes of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Statements in this news release concerning the

Company’s expectations, plans, business outlook or future

performance, and any other statements concerning assumptions made

or expectations as to any future events, conditions, performance or

other matters, are “forward-looking statements.” Forward-looking

statements include statements regarding our intentions, beliefs,

projections, outlook, analyses or current expectations concerning,

among other things: our research, development and regulatory

activities and expectations relating to our non-engineered

multi-tumor antigen specific T cell therapies; the effectiveness of

these programs or the possible range of application and potential

curative effects and safety in the treatment of diseases; the

timing, conduct and success of our clinical trials of our product

candidates; our ability to use our manufacturing facilities to

support clinical and commercial demand; and our future operating

expenses and capital expenditure requirements. Forward-looking

statements are by their nature subject to risks, uncertainties and

other factors which could cause actual results to differ materially

from those stated in such statements. Such risks, uncertainties and

factors include, but are not limited to the risks set forth in the

Company’s most recent Form 10-K, 10-Q and other SEC filings which

are available through EDGAR at www.sec.gov. Such risks and

uncertainties may be amplified by the COVID-19 pandemic and its

impact on our business and the global economy. The Company assumes

no obligation to update our forward-looking statements whether as a

result of new information, future events or otherwise, after the

date of this press release.

Marker Therapeutics,

Inc.Condensed Consolidated Balance

Sheets(Unaudited)

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| |

ASSETS |

|

|

|

| |

Current assets: |

|

|

|

| |

Cash and cash equivalents |

$ |

25,821,708 |

|

|

$ |

42,351,145 |

|

| |

Restricted cash |

|

- |

|

|

|

1,146,186 |

|

| |

Prepaid expenses and deposits |

|

2,826,699 |

|

|

|

2,484,634 |

|

| |

Other receivables |

|

627,629 |

|

|

|

237 |

|

| |

Total current assets |

|

29,276,036 |

|

|

|

45,982,202 |

|

| |

Non-current assets: |

|

|

|

| |

Property, plant and equipment, net |

|

13,740,158 |

|

|

|

10,096,861 |

|

| |

Construction in progress |

|

- |

|

|

|

2,225,610 |

|

| |

Right-of-use assets, net |

|

9,303,544 |

|

|

|

9,830,461 |

|

| |

Total non-current assets |

|

23,043,702 |

|

|

|

22,152,932 |

|

| |

|

|

|

|

| |

Total assets |

$ |

52,319,738 |

|

|

$ |

68,135,134 |

|

| |

|

|

|

|

| |

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| |

Current liabilities: |

|

|

|

| |

Accounts payable and accrued liabilities |

$ |

4,735,251 |

|

|

$ |

11,134,913 |

|

| |

Related party deferred revenue |

|

8,000,000 |

|

|

|

- |

|

| |

Lease liability |

|

738,389 |

|

|

|

620,490 |

|

| |

Deferred revenue |

|

- |

|

|

|

1,146,186 |

|

| |

Total current liabilities |

|

13,473,640 |

|

|

|

12,901,589 |

|

| |

Non-current liabilities: |

|

|

|

| |

Lease liability, net of current portion |

|

10,819,825 |

|

|

|

11,247,950 |

|

| |

Total non-current liabilities |

|

10,819,825 |

|

|

|

11,247,950 |

|

| |

|

|

|

|

| |

Total liabilities |

|

24,293,465 |

|

|

|

24,149,539 |

|

| |

|

|

|

|

| |

Stockholders' equity: |

|

|

|

| |

Preferred stock - $0.001 par value, 5 million shares authorized and

0 shares issued and outstanding at June 30, 2022 and December 31,

2021, respectively |

|

- |

|

|

|

- |

|

| |

Common stock, $0.001 par value, 300 million and 150 million shares

authorized, 83.6 million and 83.1 million shares issued and

outstanding as of June 30, 2022 and December 31, 2021,

respectively |

|

83,599 |

|

|

|

83,079 |

|

| |

Additional paid-in capital |

|

445,215,725 |

|

|

|

442,020,871 |

|

| |

Accumulated deficit |

|

(417,273,051 |

) |

|

|

(398,118,355 |

) |

| |

Total stockholders' equity |

|

28,026,273 |

|

|

|

43,985,595 |

|

| |

|

|

|

|

| |

Total liabilities and stockholders' equity |

$ |

52,319,738 |

|

|

$ |

68,135,134 |

|

| |

|

|

|

|

Marker Therapeutics,

Inc.Condensed Consolidated Statements of

Operations(Unaudited)

|

|

For the Three Months Ended |

|

For the Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Grant income |

$ |

790,508 |

|

|

$ |

- |

|

|

$ |

1,754,830 |

|

|

$ |

- |

|

|

Total revenues |

|

790,508 |

|

|

|

- |

|

|

|

1,754,830 |

|

|

|

- |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

6,555,299 |

|

|

$ |

7,350,035 |

|

|

|

13,581,365 |

|

|

|

12,993,064 |

|

|

General and administrative |

|

3,515,183 |

|

|

|

3,559,150 |

|

|

|

7,248,184 |

|

|

|

6,697,108 |

|

|

Total operating expenses |

|

10,070,482 |

|

|

|

10,909,185 |

|

|

|

20,829,549 |

|

|

|

19,690,172 |

|

|

Loss from operations |

|

(9,279,974 |

) |

|

|

(10,909,185 |

) |

|

|

(19,074,719 |

) |

|

|

(19,690,172 |

) |

|

Other income (expenses): |

|

|

|

|

|

|

|

|

Arbitration settlement |

|

- |

|

|

|

- |

|

|

|

(118,880 |

) |

|

|

- |

|

|

Interest income |

|

35,786 |

|

|

|

2,403 |

|

|

|

38,903 |

|

|

|

3,940 |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

$ |

(0.11 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.28 |

) |

|

Weighted average number of common shares outstanding, basic and

diluted |

|

83,592,043 |

|

|

|

83,030,470 |

|

|

|

83,351,184 |

|

|

|

69,823,729 |

|

|

|

|

|

|

|

|

|

|

Marker Therapeutics,

Inc.Condensed Consolidated Statements of Cash

Flows(Unaudited)

|

|

|

For the Six Months Ended |

|

|

|

June 30, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

Cash Flows from Operating Activities: |

|

|

|

|

|

Net loss |

$ |

(19,154,696 |

) |

|

$ |

(19,686,232 |

) |

|

|

Reconciliation of net loss to net cash used in operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

1,156,113 |

|

|

|

1,032,971 |

|

|

|

Stock-based compensation |

|

3,131,801 |

|

|

|

3,029,125 |

|

|

|

Amortization on right-of-use assets |

|

517,059 |

|

|

|

504,232 |

|

|

|

Changes in operating assets and liabilities: |

|

|

|

- |

|

|

|

Prepaid expenses and deposits |

|

(342,065 |

) |

|

|

(743,876 |

) |

|

|

Other receivables |

|

(627,392 |

) |

|

|

1,000,273 |

|

|

|

Accounts payable and accrued expenses |

|

(4,255,034 |

) |

|

|

108,230 |

|

|

|

Related party deferred revenue |

|

8,000,000 |

|

|

|

- |

|

|

|

Deferred revenue |

|

(1,146,186 |

) |

|

|

- |

|

|

|

Lease liability |

|

(300,368 |

) |

|

|

(130,503 |

) |

|

|

Net cash used in operating activities |

|

(13,020,768 |

) |

|

|

(14,885,780 |

) |

|

|

Cash Flows from Investing Activities: |

|

|

|

|

|

Purchase of property and equipment |

|

(1,229,298 |

) |

|

|

(842,048 |

) |

|

|

Purchase of construction in progress |

|

(3,489,130 |

) |

|

|

(958,965 |

) |

|

|

Net cash used in investing activities |

|

(4,718,428 |

) |

|

|

(1,801,013 |

) |

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

63,573 |

|

|

|

52,552,758 |

|

|

|

Proceeds from exercise of stock options |

|

- |

|

|

|

3,087 |

|

|

|

Net cash provided by financing activities |

|

63,573 |

|

|

|

52,555,845 |

|

|

|

Net (decrease) increase in cash, cash equivlants and restricted

cash |

|

(17,675,623 |

) |

|

|

35,869,052 |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of the

period |

|

43,497,331 |

|

|

|

21,352,382 |

|

|

|

Cash, cash equivalents and restricted cash at end of the

period |

$ |

25,821,708 |

|

|

$ |

57,221,434 |

|

|

|

|

|

|

|

Investors and Media

Contacts

Marker Therapeutics:

Neda SafarzadehVice President/Head of Investor

Relations, PR & Marketing(713)

400-6451Investor.Relations@markertherapeutics.com

Solebury Trout:

MediaAmy

BonannoAbonanno@soleburytrout.com

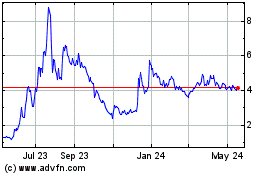

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

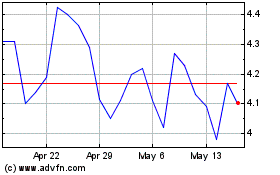

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Dec 2023 to Dec 2024