Current Report Filing (8-k)

25 May 2023 - 7:05AM

Edgar (US Regulatory)

0001512228

false

A1

0001512228

2023-05-24

2023-05-24

0001512228

NB:CommonSharesWithoutParValueMember

2023-05-24

2023-05-24

0001512228

NB:WarrantsEachExercisableFor1.11829212CommonSharesMember

2023-05-24

2023-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2023

NioCorp Developments Ltd.

(Exact name of registrant as specified in its charter)

British Columbia, Canada

(State or other jurisdiction

of incorporation) |

000-55710

(Commission File Number) |

(IRS Employer

Identification No.) |

7000 South Yosemite Street, Suite 115

Centennial, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area

code: (720) 334-7066

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares, without par value |

NB |

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for 1.11829212 Common Shares |

NIOBW |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 3.01 — Notice of Delisting

or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 24, 2023, NioCorp Developments Ltd. (“NioCorp” or the

“Company”) received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that, because the Company has not filed its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 (the

“Form 10-Q”) within the prescribed time period, the Company is not in compliance with the timely filing requirement for continued

listing under Nasdaq Listing Rule 5250(c)(1).

The Nasdaq notification letter has no immediate effect on the listing or

trading of the Company’s common shares on Nasdaq. While the notification letter provides the Company the opportunity to submit a

plan to regain compliance with Nasdaq Listing Rule 5250(c)(1) within 60 days from the date of the notification letter, the Company currently

expects to be in compliance with the listing rule in that timeframe.

The Company filed a Notification of Late Filing on Form 12b-25 with the

Securities and Exchange Commission (the “SEC”) on May 16, 2023, indicating that the filing of the Form 10-Q would be delayed

due to the high level of complexities in integrating GX Acquisition Corp. II (“GX”) and accounting for the recently consummated

business combination transaction with GX. Due to the time required to complete this process, the Company was not able to file the Form

10-Q within the five-day extension period provided by Rule 12b-25 under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”).

Item 7.01 — Regulation FD Disclosure.

The Company announced its receipt of the Nasdaq notification letter in

a press release issued on May 24, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or

otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 — Financial Statements

and Exhibits.

(d) Exhibits.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within

the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of

applicable Canadian securities laws (collectively, “forward-looking statements”). Forward-looking statements may include,

but are not limited to, statements regarding the Company’s expectations about the timing of filing the Form 10-Q and being in compliance

with the Nasdaq listing rule within the timeframe prescribed by the Nasdaq notification letter. Forward-looking statements are typically

identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “continue,” “could,”

“may,” “might,” “possible,” “potential,” “predict,” “should,”

“would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of the Company and are inherently subject to uncertainties

and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that

future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions,

including, without limitation, expectations, and assumptions relating to: the Company’s ability to complete its financial reporting

and closing process for the quarterly period ended March 31, 2023 within the anticipated timeframe; and the ability of the Company to

regain compliance with Nasdaq continued listing requirements. Such expectations and assumptions are inherently subject to uncertainties

and contingencies regarding future events and,

as such, are subject to change. Forward-looking statements involve a number

of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed

or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified

in public filings made by the Company with the SEC and the applicable Canadian securities regulatory authorities and the following: the

Company being unable to complete its financial reporting and closing process for the quarterly period ended March 31, 2023 and the Company

consequently not filing the Form 10-Q within the anticipated timeframe; and the Company’s inability to regain compliance with Nasdaq

continued listing requirements and becoming subject to delisting from Nasdaq. Should one or more of these risks or uncertainties materialize

or should any of the assumptions made by the management of the Company prove incorrect, actual results may vary in material respects from

those projected in these forward-looking statements. All subsequent written and oral forward-looking statements concerning the matters

addressed herein and attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to herein. Except to the extent required by applicable law or regulation, the Company undertakes no obligation

to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated

events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NIOCORP DEVELOPMENTS LTD. |

| |

|

|

| DATE: May 24, 2023 |

By: |

/s/ Neal S. Shah |

| |

|

Neal S. Shah

Chief Financial Officer |

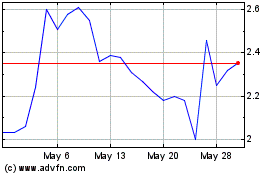

NioCorp Developments (NASDAQ:NB)

Historical Stock Chart

From Jan 2025 to Feb 2025

NioCorp Developments (NASDAQ:NB)

Historical Stock Chart

From Feb 2024 to Feb 2025