Federal securities regulators are intensifying a broad

investigation into trading of pre-IPO shares, zeroing in on

companies that help technology-firm employees and others resell

their shares.

In a Nov. 25 court filing, the Securities and Exchange

Commission ordered an unregistered brokerage firm under

investigation, NetCirq LLC, to comply with an SEC subpoena sent on

April 7.

NetCirq, which says on its website that it "resells private

securities and portfolio interests creating a secondary market for

private equity," couldn't be reached for comment.

The filing, in a San Francisco federal court, says the SEC

broadly is investigating whether trading of pre-IPO shares could

violate securities laws under the Dodd-Frank Act because some of

the transactions could be considered "swaps," or agreements whose

value is tied to a future event.

The SEC filing is the first public confirmation by the agency of

the investigation. In July, The Wall Street Journal reported on the

initiation of the probe, which followed a Journal page-one article

in March that delved into the role of middlemen in the growing

market for private shares.

"The staff of the Commission is investigating whether certain

entities may have violated the federal securities laws in

connection with secondary-market trading of shares of growth-stage

private companies that have not yet conducted an initial public

offering (IPO)," according to the Nov. 25 filing.

The SEC filing added: "Certain entities may have, among other

things, improperly engaged in transactions that constitute

security-based swaps in violation of the federal securities

laws."

Many high-profile technology firms haven't gone public—including

smartphone-based car service Uber Technologies Inc.,

disappearing-message provider Snapchat Inc. and home-rental service

Airbnb Inc. That means nearly all their stock is owned by

venture-capital investors and employees, who face tight limits on

selling their shares.

But some early investors are eager to cash in now, particularly

amid signs of cracks in the tech boom. To help them outmaneuver

company restrictions on stock sales, middlemen are designing

derivatives that deliver payments to employees based on a stock's

perceived value. Some financial firms let employees pledge their

shares as collateral for a loan.

The SEC action comes as the value of private company shares have

soared.

More than 125 privately held, venture-capital-backed firms now

are worth at least $1 billion each, with a total valuation of more

than $310 billion. Just 49 companies were worth $1 billion or more

a year ago.

No one knows the exact size of the secondary market for shares

of private companies that are held by employees and other

investors. Participants in pre-IPO trading estimate that $10

billion to $30 billion in stock changed hands last year.

In the past year, a number of marketplaces have launched or

grown sharply that facilitate the sale of shares by employees in

private technology companies, including EquityZen Inc. and Equidate

Inc.

Some markets feature direct selling and buying of the shares,

but some companies, such as Uber, typically have blocked such

transfers by individual employees.

A handful of firms, such as San Francisco-based advisory firm

Scenic Advisement, work directly with companies to facilitate sales

of big blocks of employee, executive and founder shares. One such

firm, SecondMarket, which makes software to manage employee sales,

was acquired by Nasdaq Inc. in October.

In the SEC court papers, the agency contends that NetCirq has

failed to produce the documents it requested and that the company's

chief executive, Kristen McRedmond Wade, has "ignored" recent SEC

attempts to contact her. The filing is an application for a court

order enforcing its subpoena to NetCirq.

NetCirq isn't currently registered as a broker-dealer, the

filing says, "as would be required by law" if it was effecting

securities transactions.

Ms. Wade couldn't be reached for comment. The SEC didn't return

calls for comment.

In June, the SEC brought a cease-and-desist order against

Silicon Valley-based Sand Hill Exchange, which operated a website

designed to allow people to buy and sell contracts related to the

value of private companies and their securities.

In an administrative proceeding, the SEC said the company's

business allegedly violated the Dodd-Frank Act.

Sand Hill, which declined to comment, settled the charges

without admitting or denying the finding and agreed to pay a

$20,000 penalty.

The Dodd-Frank Act added new rules that many securities

derivatives must be traded on a national exchange and that many

sellers need to register as dealers of derivatives.

Write to Susan Pulliam at susan.pulliam@wsj.com and Telis Demos

at telis.demos@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 22:55 ET (03:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

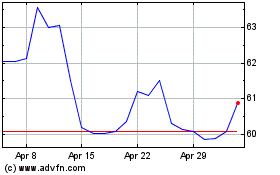

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Apr 2024 to May 2024

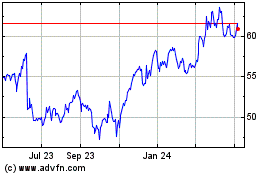

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2023 to May 2024