false000007233100000723312024-12-112024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2024

NORDSON CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Ohio | 000-07977 | 34-0590250 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | |

28601 Clemens Road Westlake, Ohio 44145 (Address of Principal Executive Offices, including Zip Code) |

Registrant’s Telephone Number, including Area Code: 440-892-1580

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange

On Which Registered |

| Common Shares, without par value | | NDSN | | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 11, 2024, Nordson Corporation issued a press release relating to its results of operations for the fourth quarter and full fiscal year 2024. A copy is attached as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure.

Nordson Corporation will provide additional commentary on fourth quarter and full year fiscal 2024 results and outlook during a webcast on Thursday, December 12, 2024 at 8:30 a.m. eastern time, which can be accessed at https://investors.nordson.com. For persons unable to listen to the live broadcast, a replay will be available after the event.

As provided in General Instruction B.2 of Form 8-K, the information contained in Items 2.02 and 7.01 of this Form 8-K shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall any such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.(d) Exhibits.

(d) Exhibits.

| | | | | | | | |

| | Press release of Nordson Corporation dated December 11, 2024. |

| | |

104 | | Cover Page Interactive Data File (embedded within the inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | NORDSON CORPORATION |

| | |

| Date: | December 11, 2024 | By: | /s/ Stephen Shamrock |

| | | Stephen Shamrock |

| | | Chief Accounting Officer |

Nordson Corporation Reports Fourth Quarter and Fiscal Year 2024 Results

Fourth Quarter:

•Sales were $744 million, a 4% increase over prior year

•Earnings per diluted share were $2.12

•Adjusted earnings per diluted share were $2.78

•Atrion Medical acquisition integration progressing well

Full Year:

•Record sales of $2.7 billion, reflecting 2% growth over last year’s record sales

•Earnings per diluted share were $8.11

•EBITDA was a record $849 million, up 4% over prior year and 32% of sales

•Adjusted earnings per diluted share were $9.73

Fiscal 2025 Guidance:

•Fiscal 2025 forecasted sales range between $2,750 to $2,870 million and adjusted earnings in the range of $9.70 to $10.50

WESTLAKE, Ohio--(BUSINESS WIRE)--December 11, 2024--Nordson Corporation (Nasdaq: NDSN) today reported results for the fiscal fourth quarter ended October 31, 2024. Sales were $744 million, a 4% increase compared to the prior year’s fourth quarter sales of $719 million. The increase in fourth quarter 2024 sales included the favorable 6% impact of acquisitions and favorable currency translation of 1%, offset by an organic sales decrease of 3%.

Net income was $122 million, or earnings per diluted share of $2.12, compared to prior year’s fourth quarter net income of $128 million, or earnings per diluted share of $2.22. Adjusted net income was $160 million, an increase from prior year adjusted net income of $156 million. Fourth quarter 2024 adjusted earnings per diluted share were $2.78 compared to prior year adjusted earnings per diluted share of $2.71.

EBITDA in the fourth quarter was $241 million, or 32% of sales, an increase of 4% compared to prior year EBITDA of $227 million, also at 32% of sales.

Commenting on the Company’s fiscal 2024 fourth quarter results, Nordson President and Chief Executive Officer Sundaram Nagarajan said, “I appreciate our team’s focus and commitment to our customers, which delivered results above our fourth quarter guidance expectations. Our Advanced Technology Solutions segment delivered year-over-year fourth quarter sales growth, as electronics demand continued to steadily improve at fiscal year-end. During the down electronics cycle, our ATS team holistically implemented the NBS Next growth framework, making them responsive to the needs of our customers while also delivering a strong incremental operating performance. Our industrial product lines performed well against record comparisons from prior year. I’m also pleased with the early integration of our Atrion Medical acquisition, which contributed positively to the quarter.”

Fourth Quarter Segment Results

Industrial Precision Solutions sales of $392 million decreased 3% compared to the prior year fourth quarter, driven by a 5% organic sales decrease, a favorable acquisition impact of 1%, and a favorable currency impact of 1%. The organic sales decrease, following record organic sales in prior year fourth quarter, was driven by our industrial coatings, polymer processing and precision agriculture product lines, partially offset by double-digit growth in nonwovens product lines. Operating profit was $126 million in the quarter, or 32% of sales, a decrease of 4% compared to the prior year operating profit. The decrease in operating profit was driven by lower sales. EBITDA in the quarter was $143 million, or 37% of sales, a 3% decrease from the prior year fourth quarter EBITDA of $148 million, which also was 37% of sales.

Medical and Fluid Solutions sales of $200 million increased 19% compared to the prior year fourth quarter, driven primarily by the acquisition of Atrion, which offset an organic sales decrease of 3% and a favorable currency impact of 1%. The organic sales decrease was driven by softness in medical interventional solutions product lines, partially offset by modest growth in our medical fluid components and fluid solutions product lines. Operating profit totaled $44 million in the quarter, or 22% of sales,

a decrease of 8% compared to the prior year operating profit. EBITDA in the quarter was $72 million, or 36% of sales, an increase versus the prior year fourth quarter EBITDA of $62 million, or 37% of sales.

Advanced Technology Solutions sales of $152 million increased 5% compared to the prior year fourth quarter, driven by an organic sales increase of 4% and a favorable currency impact of 1%. The organic sales increase was driven by double-digit growth in select test and inspection product lines and modest growth in our electronics processing product lines. Operating profit totaled $33 million in the quarter, or 22% of sales, an increase of 6% compared to the prior year operating profit due to higher sales and improved profit margins. EBITDA in the quarter was $41 million, or 27% of sales, an increase from the prior year fourth quarter EBITDA of $35 million, or 24% of sales.

Fiscal 2024 Full Year Results

Sales for the fiscal year ended October 31, 2024, were a record $2.7 billion, an increase of 2% compared to the prior year. This sales growth was driven by a favorable acquisition impact of 5%, partially offset by a 3% decrease in organic volume.

Net income was $467 million, or earnings per diluted share of $8.11, compared to prior year’s net income of $487 million, or earnings per diluted share of $8.46. Adjusted net income was $561 million, a decrease from prior year adjusted net income of $567 million. Adjusted earnings per diluted share were $9.73 compared to prior year adjusted earnings per diluted share of $9.85.

EBITDA was $849 million, or 32% of sales, compared to prior year EBITDA of $819 million, or 31% of sales. Free cash flow for the full-year was $492 million, which was a conversion rate of 105% of net income.

Reflecting on fiscal 2024, Mr. Nagarajan continued, “In 2021, we launched our Ascend strategy with the milestone of achieving $3 billion in annual sales and greater than 30% EBITDA margins by 2025. The strategy is delivering results and has ample runway to accelerate. Our diversified portfolio, built on our leadership in niche end markets with differentiated products, is delivering balanced results in the ever-changing macro environment. Our acquisition strategy is generating growth, and I am pleased with the integration and deployment of the NBS Next growth framework. We also continued to generate strong free cash flow in the year, allowing us to consistently reinvest in the business while returning cash to our shareholders.”

Outlook

Following four consecutive years of record-setting performance, we enter fiscal 2025 with approximately $580 million in backlog.

Based on the combination of order entry, backlog, current exchange rates and anticipated end market expectations, we anticipate delivering sales in the range of $2,750 to $2,870 million in fiscal 2025. Full year fiscal 2025 adjusted earnings are forecasted in the range of $9.70 to $10.50 per diluted share.

First quarter fiscal 2025 sales are forecasted in the range of $615 to $655 million with adjusted earnings in the range of $1.95 to $2.15 per diluted share.

Commenting on fiscal 2025 guidance, Nagarajan said, “Considering the evolving global macro-environment, we are entering 2025 with a conservative viewpoint. The fiscal first quarter is seasonally Nordson’s weakest quarter due to the holiday and calendar year-end slowdowns and cautious customer spending. While we remain confident about the long-term growth drivers of our end markets, we are being prudent about our expectations for end market recovery timing, particularly for our electronics and agricultural product lines. Even in uncertain times, our team delivers operational excellence and strong cash flow due to our close-to-the-customer business model, diversified niche end markets, differentiated products and the NBS Next growth framework.”

Nordson management will provide additional commentary on these results and outlook during its previously announced webcast on Thursday, December 12, 2024 at 8:30 a.m. eastern time, which can be accessed at https://investors.nordson.com. Information about Nordson’s investor relations and shareholder services is available from Lara Mahoney, vice president, investor relations and corporate communications at (440) 204-9985 or lara.mahoney@nordson.com.

Certain statements contained in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “anticipates,” “believes,” “projects,” “forecasts,” “outlook,” “guidance,” “continue,” “target,” or the negative of these terms or comparable terminology. These statements reflect management’s current expectations and involve a number of risks and uncertainties. These risks and uncertainties include, but are not limited to, U.S. and international economic conditions; financial and market conditions; currency exchange rates and devaluations; possible acquisitions, including the Company’s ability to successfully integrate acquisitions; the Company’s ability to successfully divest or dispose of businesses

that are deemed not to fit with its strategic plan; the effects of changes in U.S. trade policy and trade agreements; the effects of changes in tax law; and the possible effects of events beyond our control, such as political unrest, including the conflict between Russia and Ukraine, acts of terror, natural disasters and pandemics, including the recent coronavirus (COVID-19) pandemic and the other factors discussed in Item 1A (Risk Factors) in the Company’s most recently filed Annual Report on Form 10-K and in its Forms 10-Q filed with the Securities and Exchange Commission, which should be reviewed carefully. The Company undertakes no obligation to update or revise any forward-looking statement in this press release.

Nordson Corporation is an innovative precision technology company that leverages a scalable growth framework through an entrepreneurial, division-led organization to deliver top tier growth with leading margins and returns. The Company’s direct sales model and applications expertise serves global customers through a wide variety of critical applications. Its diverse end market exposure includes consumer non-durable, medical, electronics and industrial end markets. Founded in 1954 and headquartered in Westlake, Ohio, the Company has operations and support offices in over 35 countries. Visit Nordson on the web at www.nordson.com, linkedin/Nordson, or www.facebook.com/nordson.

NORDSON CORPORATION

CONSOLIDATED STATEMENT OF INCOME (Unaudited)

(Dollars in thousands except for per-share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| October 31, 2024 | | October 31, 2023 | | October 31, 2024 | | October 31, 2023 |

| | | | | | | |

| Sales | $ | 744,482 | | | $ | 719,313 | | | $ | 2,689,921 | | | $ | 2,628,632 | |

| Cost of sales | 341,658 | | | 335,220 | | | 1,203,792 | | | 1,203,227 | |

| Gross profit | 402,824 | | | 384,093 | | | 1,486,129 | | | 1,425,405 | |

| Gross margin % | 54.1 | % | | 53.4 | % | | 55.2 | % | | 54.2 | % |

| | | | | | | |

| Selling & administrative expenses | 223,932 | | | 199,054 | | | 812,128 | | | 752,644 | |

| | | | | | | |

| Operating profit | 178,892 | | | 185,039 | | | 674,001 | | | 672,761 | |

| | | | | | | |

| Interest expense - net | (27,282) | | | (25,921) | | | (84,011) | | | (56,825) | |

| Other income (expense) - net | (3,538) | | | 1,462 | | | (4,509) | | | (597) | |

| Income before income taxes | 148,072 | | | 160,580 | | | 585,481 | | | 615,339 | |

| | | | | | | |

| Income taxes | 25,904 | | | 32,802 | | | 118,197 | | | 127,846 | |

| | | | | | | |

| Net Income | $ | 122,168 | | | $ | 127,778 | | | $ | 467,284 | | | $ | 487,493 | |

| | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic | 57,188 | | | 57,020 | | | 57,176 | | | 57,090 | |

| Diluted | 57,603 | | | 57,552 | | | 57,616 | | | 57,631 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic earnings | $ | 2.14 | | | $ | 2.24 | | | $ | 8.17 | | | $ | 8.54 | |

| Diluted earnings | $ | 2.12 | | | $ | 2.22 | | | $ | 8.11 | | | $ | 8.46 | |

NORDSON CORPORATION

CONSOLIDATED BALANCE SHEET (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | |

| October 31, 2024 | | October 31, 2023 |

| | | |

| Cash and cash equivalents | $ | 115,952 | | | $ | 115,679 | |

| Receivables - net | 594,663 | | | 590,886 | |

| Inventories - net | 476,935 | | | 454,775 | |

| Other current assets | 87,482 | | | 67,970 | |

| | | |

| Total current assets | 1,275,032 | | | 1,229,310 | |

| | | |

| Property, plant & equipment - net | 544,607 | | | 392,846 | |

| Goodwill | 3,280,819 | | | 2,784,201 | |

| Other assets | 900,508 | | | 845,413 | |

| $ | 6,000,966 | | | $ | 5,251,770 | |

| | | |

| Notes payable and debt due within one year | $ | 103,928 | | | $ | 115,662 | |

| Accounts payable and accrued liabilities | 424,549 | | | 466,427 | |

| | | |

| Total current liabilities | 528,477 | | | 582,089 | |

| | | |

| Long-term debt | 2,101,197 | | | 1,621,394 | |

| Other liabilities | 439,100 | | | 450,227 | |

| Total shareholders' equity | 2,932,192 | | | 2,598,060 | |

| $ | 6,000,966 | | | $ | 5,251,770 | |

| | | |

NORDSON CORPORATION

CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | |

| Twelve Months Ended |

| October 31, 2024 | | October 31, 2023 |

| | | |

| Cash flows from operating activities: | | | |

| Net Income | $ | 467,284 | | | $ | 487,493 | |

| Depreciation and amortization | 136,175 | | | 111,898 | |

| | | |

| Other non-cash items | 5,883 | | | 16,105 | |

| Changes in operating assets and liabilities and other | (53,149) | | | 25,786 | |

| | | |

| | | |

| Net cash provided by operating activities | 556,193 | | | 641,282 | |

| | | |

| Cash flows from investing activities: | | | |

| Additions to property, plant and equipment | (64,410) | | | (34,583) | |

| Acquisitions of businesses, net of cash acquired | (789,996) | | | (1,422,780) | |

| Other - net | 10,008 | | | 20,484 | |

| Net cash used in investing activities | (844,398) | | | (1,436,879) | |

| | | |

| Cash flows from financing activities: | | | |

| Issuance (repayment) of long-term debt | 464,353 | | | 976,043 | |

| Repayment of finance lease obligations | (6,148) | | | (6,840) | |

| Dividends paid | (161,438) | | | (150,356) | |

| Issuance of common shares | 31,067 | | | 21,373 | |

| Purchase of treasury shares | (33,339) | | | (89,708) | |

| Net cash provided by financing activities | 294,495 | | | 750,512 | |

| | | |

| Effect of exchange rate change on cash | (6,017) | | | (2,693) | |

| Net change in cash and cash equivalents | 273 | | | (47,778) | |

| | | |

| Cash and cash equivalents: | | | |

| Beginning of period | 115,679 | | | 163,457 | |

| End of period | $ | 115,952 | | | $ | 115,679 | |

| | | |

NORDSON CORPORATION

SALES BY GEOGRAPHIC SEGMENT (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Sales Variance |

| October 31, 2024 | | October 31, 2023 | | Organic | | Acquisitions | | Currency | | Total |

| SALES BY SEGMENT | | | | | | | | | | | |

| Industrial precision solutions | $ | 392,150 | | | $ | 405,436 | | | (5.5) | % | | 1.2 | % | | 1.0 | % | | (3.3) | % |

| Medical and fluid solutions | 200,223 | | | 168,632 | | | (3.2) | % | | 21.4 | % | | 0.5 | % | | 18.7 | % |

| Advanced technology solutions | 152,109 | | | 145,245 | | | 3.9 | % | | — | % | | 0.8 | % | | 4.7 | % |

| Total sales | $ | 744,482 | | | $ | 719,313 | | | (3.0) | % | | 5.7 | % | | 0.8 | % | | 3.5 | % |

| | | | | | | | | | | |

| SALES BY GEOGRAPHIC REGION | | | | | | | | | | | |

| Americas | 323,170 | | | 315,635 | | | (6.0) | % | | 8.9 | % | | (0.5) | % | | 2.4 | % |

| Europe | 185,350 | | | 184,297 | | | (6.6) | % | | 4.6 | % | | 2.6 | % | | 0.6 | % |

| Asia Pacific | 235,962 | | | 219,381 | | | 4.2 | % | | 2.0 | % | | 1.4 | % | | 7.6 | % |

| Total sales | $ | 744,482 | | | $ | 719,313 | | | (3.0) | % | | 5.7 | % | | 0.8 | % | | 3.5 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Twelve Months Ended | | Sales Variance |

| October 31, 2024 | | October 31, 2023 | | Organic | | Acquisitions | | Currency | | Total |

| SALES BY SEGMENT | | | | | | | | | | | |

| Industrial precision solutions | $ | 1,484,249 | | | $ | 1,391,046 | | | 0.1 | % | | 6.6 | % | | — | % | | 6.7 | % |

| Medical and fluid solutions | 695,452 | | | 660,316 | | | (0.2) | % | | 5.4 | % | | 0.1 | % | | 5.3 | % |

| Advanced technology solutions | 510,220 | | | 577,270 | | | (11.4) | % | | — | % | | (0.2) | % | | (11.6) | % |

| Total sales | $ | 2,689,921 | | | $ | 2,628,632 | | | (2.5) | % | | 4.8 | % | | — | % | | 2.3 | % |

| | | | | | | | | | | |

| SALES BY GEOGRAPHIC REGION | | | | | | | | | | | |

| Americas | 1,178,626 | | | 1,149,760 | | | (1.9) | % | | 4.3 | % | | 0.1 | % | | 2.5 | % |

| Europe | 726,100 | | | 682,676 | | | (5.1) | % | | 10.2 | % | | 1.3 | % | | 6.4 | % |

| Asia Pacific | 785,195 | | | 796,196 | | | (1.0) | % | | 1.0 | % | | (1.4) | % | | (1.4) | % |

| Total sales | $ | 2,689,921 | | | $ | 2,628,632 | | | (2.5) | % | | 4.8 | % | | — | % | | 2.3 | % |

| | | | | | | | | | | |

NORDSON CORPORATION

RECONCILIATION OF NON-GAAP MEASURES - NET INCOME TO EBITDA (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| October 31, 2024 | | October 31, 2023 | | October 31, 2024 | | October 31, 2023 |

| Net income | 122,168 | | | 127,778 | | | 467,284 | | | 487,493 | |

| Income taxes | 25,904 | | | 32,802 | | | 118,197 | | | 127,846 | |

| Interest expense - net | 27,282 | | | 25,921 | | | 84,011 | | | 56,825 | |

| Other expense - net | 3,538 | | | (1,462) | | | 4,509 | | | 597 | |

| Depreciation and amortization | 36,528 | | | 31,261 | | | 136,175 | | | 111,898 | |

Inventory step-up amortization (1) | 4,759 | | | 4,556 | | | 7,703 | | | 8,862 | |

Severance and other (1) | 12,717 | | | — | | | 17,332 | | | 5,487 | |

Acquisition-related costs (1) | 8,200 | | | 6,244 | | | 13,957 | | | 19,966 | |

EBITDA (non-GAAP) (2) | 241,096 | | | 227,100 | | | 849,168 | | | 818,974 | |

(1) Represents severance as well as fees and non-cash inventory charges associated with acquisitions.

(2) EBITDA is a non-GAAP measure used by management to evaluate the Company's ongoing operations. EBITDA is defined as operating profit plus certain adjustments, such as severance, fees and non-cash inventory charges associated with acquisitions, plus depreciation and amortization.

NORDSON CORPORATION

RECONCILIATION OF NON-GAAP MEASURES - EBITDA (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| October 31, 2024 | | October 31, 2023 | | October 31, 2024 | | October 31, 2023 |

| SALES BY SEGMENT | | | | | | | | | | | | | | | |

| Industrial precision solutions | $ | 392,150 | | | | | $ | 405,436 | | | | | $ | 1,484,249 | | | | | $ | 1,391,046 | | | |

| Medical and fluid solutions | 200,223 | | | | | 168,632 | | | | | 695,452 | | | | | 660,316 | | | |

| Advanced technology solutions | 152,109 | | | | | 145,245 | | | | | 510,220 | | | | | 577,270 | | | |

| Total sales | $ | 744,482 | | | | | $ | 719,313 | | | | | $ | 2,689,921 | | | | | $ | 2,628,632 | | | |

| | | | | | | | | | | | | | | |

| OPERATING PROFIT | | | | | | | | | | | | | | | |

| Industrial precision solutions | $ | 126,254 | | | | | $ | 131,450 | | | | | $ | 470,559 | | | | | $ | 460,889 | | | |

| Medical and fluid solutions | 44,264 | | | | | 48,041 | | | | | 187,731 | | | | | 189,367 | | | |

| Advanced technology solutions | 33,464 | | | | | 31,526 | | | | | 94,231 | | | | | 101,662 | | | |

| Corporate | (25,090) | | | | | (25,978) | | | | | (78,520) | | | | | (79,157) | | | |

| Total operating profit | $ | 178,892 | | | | | $ | 185,039 | | | | | $ | 674,001 | | | | | $ | 672,761 | | | |

| | | | | | | | | | | | | | | |

OPERATING PROFIT ADJUSTMENTS (1) | | | | | | | | | | | | | | |

| Industrial precision solutions | $ | 2,899 | | | | | $ | 4,658 | | | | | $ | 8,976 | | | | | $ | 4,658 | | | |

| Medical and fluid solutions | 10,761 | | | | | — | | | | | 10,761 | | | | | 1,479 | | | |

| Advanced technology solutions | 3,816 | | | | | — | | | | | 5,895 | | | | | 14,304 | | | |

| Corporate | 8,200 | | | | | 6,142 | | | | | 13,360 | | | | | 13,874 | | | |

| Total adjustments | $ | 25,676 | | | | | $ | 10,800 | | | | | $ | 38,992 | | | | | $ | 34,315 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| DEPRECIATION & AMORTIZATION | | | | | | | | | | | | |

| Industrial precision solutions | $ | 14,035 | | | | | $ | 12,062 | | | | | $ | 56,856 | | | | | $ | 33,228 | | | |

| Medical and fluid solutions | 17,239 | | | | | 13,547 | | | | | 58,061 | | | | | 54,988 | | | |

| Advanced technology solutions | 3,340 | | | | | 3,529 | | | | | 13,433 | | | | | 15,185 | | | |

| Corporate | 1,914 | | | | | 2,123 | | | | | 7,825 | | | | | 8,497 | | | |

| Total depreciation & amortization | $ | 36,528 | | | | | $ | 31,261 | | | | | $ | 136,175 | | | | | $ | 111,898 | | | |

| | | | | | | | | | | | | | | |

EBITDA (NON-GAAP) (2) | | | | | | | | | | | | | | | |

| Industrial precision solutions | $ | 143,188 | | | 37 | % | | $ | 148,170 | | | 37 | % | | $ | 536,391 | | | 36 | % | | $ | 498,775 | | | 36 | % |

| Medical and fluid solutions | 72,264 | | | 36 | % | | 61,588 | | | 37 | % | | 256,553 | | | 37 | % | | 245,834 | | | 37 | % |

| Advanced technology solutions | 40,620 | | | 27 | % | | 35,055 | | | 24 | % | | 113,559 | | | 22 | % | | 131,151 | | | 23 | % |

| Corporate | (14,976) | | | | | (17,713) | | | | | (57,335) | | | | | (56,786) | | | |

| Total EBITDA | $ | 241,096 | | | 32 | % | | $ | 227,100 | | | 32 | % | | $ | 849,168 | | | 32 | % | | $ | 818,974 | | | 31 | % |

| | | | | | | | | | | | | | | |

(1) Represents severance as well as fees and non-cash inventory charges associated with acquisitions.

(2) EBITDA is a non-GAAP measure used by management to evaluate the Company's ongoing operations. EBITDA is defined as operating profit plus certain adjustments, such as severance, fees and non-cash inventory charges associated with acquisitions, plus depreciation and amortization.

NORDSON CORPORATION

RECONCILIATION OF NON-GAAP MEASURES - ADJUSTED NET INCOME AND EARNINGS PER SHARE (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| October 31, 2024 | | October 31, 2023 | | October 31, 2024 | | October 31, 2023 |

| GAAP AS REPORTED | | | | | | | |

| Operating profit | $ | 178,892 | | | $ | 185,039 | | | $ | 674,001 | | | $ | 672,761 | |

| Other / interest expense - net | (30,820) | | | (24,459) | | | (88,520) | | | (57,422) | |

| Net income | 122,168 | | | 127,778 | | | 467,284 | | | 487,493 | |

| Diluted earnings per share | $ | 2.12 | | | $ | 2.22 | | | $ | 8.11 | | | $ | 8.46 | |

| | | | | | | |

| Shares outstanding - diluted | 57,603 | | | 57,552 | | | 57,616 | | | 57,631 | |

| | | | | | | |

| OPERATING PROFIT ADJUSTMENTS | | | | | | | |

| Inventory step-up amortization | $ | 4,759 | | | $ | 4,556 | | | $ | 7,703 | | | $ | 8,862 | |

| Severance and other | 12,717 | | | — | | | 17,332 | | | 5,487 | |

| Acquisition costs | 8,200 | | | 6,244 | | | 13,957 | | | 19,966 | |

| | | | | | | |

| ACQUISITION AMORTIZATION OF INTANGIBLES | $ | 19,560 | | | $ | 17,880 | | | $ | 76,972 | | | $ | 59,719 | |

| | | | | | | |

| INTEREST | 908 | | | 6,817 | | | 908 | | | 6,817 | |

| | | | | | | |

| Total adjustments | $ | 46,144 | | | $ | 35,497 | | | $ | 116,872 | | | $ | 100,851 | |

| | | | | | | |

| Adjustments net of tax | $ | 38,071 | | | $ | 28,247 | | | $ | 93,278 | | | $ | 79,898 | |

| | | | | | | |

| EPS effect of adjustments and other discrete tax items | $ | 0.66 | | | $ | 0.49 | | | $ | 1.62 | | | $ | 1.39 | |

| | | | | | | |

| NON-GAAP MEASURES-ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE |

| | | | | | | |

| | | | | | | |

Adjusted net income (1) | $ | 160,239 | | | $ | 156,025 | | | $ | 560,562 | | | $ | 567,391 | |

Adjusted earnings per share (2) | $ | 2.78 | | | $ | 2.71 | | | $ | 9.73 | | | $ | 9.85 | |

(1) Adjusted net income is a non-GAAP measure defined as net income plus tax effected adjustments and other discrete tax items.

(2) Adjusted earnings per share is a non-GAAP measure defined as GAAP EPS adjusted for tax effected adjustments and other discrete tax items.

NORDSON CORPORATION

RECONCILIATION OF NON-GAAP MEASURES - OPERATING CASH FLOW TO FREE CASH FLOW (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| Year to Date |

| October 31, 2024 | July 31, 2024 | | April 30, 2024 | | January 31, 2024 |

| Net cash provided by operating activities | $ | 556,193 | | $ | 459,812 | | | $ | 294,964 | | | $ | 172,356 | |

| Additions to property, plant and equipment | (64,410) | | (43,786) | | | (21,907) | | | (7,530) | |

Free Cash Flow - Year to Date (1) | 491,783 | | 416,026 | | | 273,057 | | | 164,826 | |

| | | | | | |

Free Cash Flow - Quarter to Date (2) | 75,757 | | 142,969 | | | 108,231 | | | 164,826 | |

| | | | | | |

| Net Income - Year to Date | $ | 467,284 | | | | | | |

Free Cash Flow Conversion (3) | 105 | % | | | | | |

| | | | | | |

| Year to Date |

| October 31, 2023 | July 31, 2023 | | April 30, 2023 | | January 31, 2023 |

| Net cash provided by operating activities | $ | 641,282 | | $ | 478,072 | | | $ | 287,905 | | | $ | 123,337 | |

| Additions to property, plant and equipment | (34,583) | | (24,244) | | | (15,349) | | | (9,302) | |

Free Cash Flow (1) | 606,699 | | 453,828 | | | 272,556 | | | 114,035 | |

| | | | | | |

Free Cash Flow - Quarter to Date (2) | 152,871 | | 181,272 | | | 158,521 | | | 114,035 | |

| | | | | | |

(1) Free Cash Flow - Year to Date is a non-GAAP measure used by management to evaluate the Company's ongoing operations and is defined as Net cash provided by operating activities minus Additions to property, plant and equipment.

(2) Free Cash Flow - Quarter to Date is a non-GAAP measure used by management to evaluate the Company's ongoing operations and is equal to Free Cash Flow - Year to Date less prior period Free Cash Flow - Year to Date.

(3) Free Cash Flow Conversion - Year to Date is a non-GAAP measure used by management to evaluate the Company's ongoing operations and is defined as Free Cash Flow - Year to Date divided by Net Income - Year to Date.

Management uses certain non-GAAP measures, such as adjusted net income, adjusted EPS and EBITDA, internally to make strategic decisions, forecast future results, and evaluate the Company's current performance. Given management's use of these non-GAAP measures, the Company believes these measures are important to investors in understanding the Company's current and future operating results as seen through the eyes of management. In addition, management believes these non-GAAP measures are useful to investors in enabling them to better assess changes in the Company's core business across different time periods. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures to other companies' non-GAAP financial measures, even if they have similar names. Amounts may not add due to rounding.

Contact

Lara Mahoney

Vice President,

Investor Relations & Corporate Communications

440.204.9985

Lara.Mahoney@nordson.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

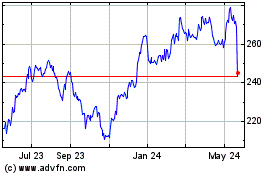

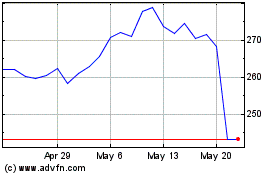

Nordson (NASDAQ:NDSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nordson (NASDAQ:NDSN)

Historical Stock Chart

From Dec 2023 to Dec 2024