National Research Corporation, dba NRC Health, (NASDAQ:NRC)

today announced results for the second quarter 2024 and several

other corporate developments.

Financial Results

Revenue for the quarter was approximately $35 million compared

with approximately $36 million in the 2023 quarter. Earnings per

diluted share were $0.26 compared with $0.29 for the 2023 quarter.

At June 30, 2024, the Company’s net indebtedness (total borrowing

minus cash and cash equivalents) was approximately $42 million.

Total recurring contract value (TRCV) was approximately $138

million at June 30, 2024.

Credit Agreement

Amendment

Effective August 5, 2024, the Company and its lender entered

into a Third Amendment to Amended and Restated Credit Agreement,

with material amendments including the following: (i) extended the

maturity of the revolving loan facility to May 28, 2027, (ii)

provided that all term loans will amortize over a ten-year

amortization schedule (rather than the prior seven-year schedule)

and bear interest at floating annual rate of SOFR + 235 basis

points, with the maturity date for all term loans remaining May 28,

2027, (iii) extended the commitment period for making delayed

draw-down term loans to May 28, 2026, (iv) expanded the permitted

uses of delayed draw-down term loans to include dividends, stock

repurchases, acquisitions, and capital expenditures as permitted by

the agreement, and (v) increased the amount of capital expenditures

to be excluded from fixed charge coverage ratio by $2.5

million.

Stock Repurchase Plan

The Company has approximately 1.1 million shares remaining under

its existing stock repurchase plan. The Company did not repurchase

any shares in the second quarter of 2024 pending the credit

agreement amendments discussed above. Management is authorized to

complete the plan in its discretion, credit agreement limitations,

and future capital allocation decisions.

Dividend

The Company’s Board of Directors has declared a quarterly cash

dividend of $0.12 (twelve cents) per share payable Friday, October

11, 2024, to stockholders of record as of the close of business on

Friday, September 27, 2024.

Portfolio and Strategy

Update

On July 15, 2024, the Company acquired NOBL Health, a leading

provider of patient rounding insights and workflow applications.

The enterprise value of the acquisition was approximately $6

million paid in cash at closing plus a potential earnout of up to

$1 million based on future performance of the acquired products.

NOBL had approximately $2 million of TRCV at the acquisition

date.

The Company’s has and will, over the next 30 days, release

acquired and internally developed products and features

including:

- Consumer experience (CX) capabilities designed to build loyalty

and growth for health systems.

- Employee experience (EX) capabilities powered by one of the

leading consumer experience technology platforms.

- NOBL Health’s rounding tool, which provides real time feedback

from patients and healthcare employees.

- A proprietary AI engine powering new products and

features.

In Lieu of Conference

Call

The Company has elected to include strategic updates normally

discussed in earning calls to a broader group of current and

potential stockholders via its quarterly earnings releases.

About NRC Health

For more than 40 years, NRC Health (NASDAQ: NRC) has led the

charge to humanize healthcare and support organizations in their

understanding of each unique individual. NRC Health’s commitment to

Human Understanding® helps leading healthcare systems get to know

each person they serve not as point-in-time insights, but as an

ongoing relationship. Guided by its uniquely empathic heritage, NRC

Health’s patient-focused approach, unmatched market research, and

emphasis on consumer preferences are transforming the healthcare

experience, creating strong outcomes for patients and entire

healthcare systems. For more information, email info@nrchealth.com,

or visit www.nrchealth.com.

This press release contains certain statements that may be

considered forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, and such

statements are subject to the safe harbor created by those sections

and the Private Securities Litigation Reform Act of 1995, as

amended. Such statements may be identified by their use of terms or

phrases such as “believes,” “expect,” “focus,” “potential,” “will,”

derivations thereof, and similar terms and phrases. In this press

release, the statements related to releasing new products and

features, future quarterly conference calls and other

communications, and stock repurchases are forward-looking

statements. Forward-looking statements are based upon the current

beliefs and expectations of our management and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified, which could cause future events and actual

results to differ materially from those set forth in, contemplated

by, or underlying the forward-looking statements, including those

risks and uncertainties as set forth in the Risk Factors section of

our Annual Report on Form 10-K for the year ended December 31,

2023, and various disclosures in our press releases, stockholder

reports, and other filings with the Securities and Exchange

Commission. We disclaim any obligation to update or revise any

forward-looking statements to reflect actual results or changes in

the factors affecting the forward-looking information.

NATIONAL RESEARCH CORPORATION

AND SUBSIDIARY

Unaudited Condensed

Consolidated Statements of Income

(In thousands, except per share

data)

Three months ended June 30

Six months ended June 30

2024

2023

2024

2023

Revenue

$

35,021

$

36,161

$

70,334

$

72,634

Operating expenses:

Direct

13,422

13,309

27,278

27,589

Selling, general and administrative

11,221

11,966

22,471

23,750

Depreciation and amortization

1,513

1,521

2,960

2,915

Total operating expenses

26,156

26,796

52,709

54,254

Operating income

8,865

9,365

17,625

18,380

Other income (expense):

Interest income

25

273

69

523

Interest expense

(555

)

(192

)

(1,160

)

(433

)

Other, net

(11

)

(2

)

(16

)

(15

)

Total other income (expense)

(541

)

79

(1,107

)

75

Income before income taxes

8,324

9,444

16,518

18,455

Provision for income taxes

2,149

2,171

3,984

4,219

Net income

$

6,175

$

7,273

$

12,534

$

14,236

Earnings Per Share of Common Stock:

Basic Earnings Per Share

$

0.26

$

0.30

$

0.53

$

0.58

Diluted Earnings Per Share

$

0.26

$

0.29

$

0.52

$

0.58

Weighted average shares and share

equivalents outstanding:

Basic

23,871

24,578

23,870

24,582

Diluted

23,915

24,716

23,934

24,727

NATIONAL RESEARCH CORPORATION

AND SUBSIDIARY

Unaudited Condensed

Consolidated Balance Sheets

(Dollars in thousands, except

share amounts and par value)

June 30,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

485

$

6,653

Accounts receivable, net

10,057

12,378

Other current assets

6,408

5,329

Total current assets

16,950

24,360

Property and equipment, net

33,741

28,205

Goodwill

61,614

61,614

Other, net

6,794

8,258

Total assets

$

119,099

$

122,437

Liabilities and Shareholders’ Equity

Current liabilities:

Current portion of notes payable, net of

unamortized debt issuance costs

$

7,566

$

7,214

Line of credit

9,000

--

Accounts payable and accrued expenses

6,675

6,194

Accrued compensation

4,370

3,953

Deferred revenue

14,514

14,834

Dividends payable

2,865

2,906

Other current liabilities

738

1,102

Total current liabilities

45,728

36,203

Notes payable, net of current portion and

unamortized debt issuance costs

25,655

29,470

Other non-current liabilities

7,518

7,809

Total liabilities

78,901

73,482

Shareholders’ equity:

Preferred stock, $0.01 par value,

authorized 2,000,000 shares, none issued

--

--

Common stock, $0.001 par value; authorized

110,000,000 shares, issued 31,072,144 in 2024 and 31,002,919 in

2023, outstanding 23,871,257 in 2024 and 24,219,887 in 2023

31

31

Additional paid-in capital

179,872

178,213

Retained earnings (accumulated

deficit)

(23,726

)

(30,530

)

Treasury stock

(115,979

)

(98,759

)

Total shareholders’ equity

40,198

48,955

Total liabilities and shareholders’

equity

$

119,099

$

122,437

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806354663/en/

Linda A. Stacy Principal Financial Officer

402-475-2525

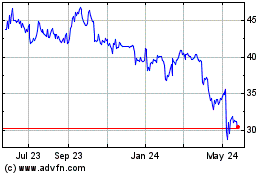

National Research (NASDAQ:NRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

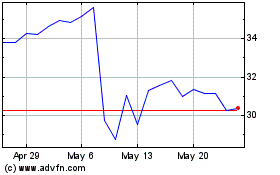

National Research (NASDAQ:NRC)

Historical Stock Chart

From Dec 2023 to Dec 2024