Ollie’s Bargain Outlet Holdings, Inc. (NASDAQ: OLLI) (the

“Company”) today reported financial results for the fourth quarter

and full-year fiscal 2022.

Fourth Quarter Summary:

- Total net sales

increased 9.7% to $549.8 million.

- Comparable store

sales increased 3.0% from the prior year decrease of 10.5%.

- The Company opened

5 new stores, ending the quarter with 468 stores in 29 states, a

year-over-year increase in store count of 8.6%.

- Operating income

increased 17.8% to $67.7 million. Adjusted operating income(1)

increased 16.5% to $66.8 million and adjusted operating margin(1)

increased 70 basis points to 12.1%.

- Net income totaled

$53.1 million, or $0.85 per diluted share, as compared with net

income of $44.7 million, or $0.71 per diluted share, in the prior

year.

- Adjusted net

income(1) was $52.4 million, or $0.84 per diluted share, as

compared with prior year adjusted net income of $43.9 million, or

$0.69 per diluted share.

- Adjusted EBITDA(1)

increased 16.8% to $77.2 million and adjusted EBITDA margin(1)

increased 80 basis points to 14.0%.

“We are pleased with our fourth quarter

performance, which reflects an improvement in our transaction

trends and a 3.0% increase in comparable store sales. Our team

executed well in a highly promotional environment and delivered a

110 basis point increase in gross margin compared to last year,”

said John Swygert, President and Chief Executive Officer. “For

2023, we are focused on offering great deals, expanding operating

margins, and growing our store base, all of which will position us

to deliver consistent, long-term growth for our shareholders. We

believe we are well positioned to thrive in the current environment

and our customers are responding to the tremendous values in our

stores. Our deal pipeline is strong, and we are excited about the

opportunities ahead of us.”

Fiscal Year Summary:

- Total net sales increased 4.2% to

$1.827 billion.

- Comparable store sales decreased 3.0%

from the prior year decrease of 11.1%.

- The Company opened 40 new stores and

closed 3 stores in fiscal 2022.

- Operating income decreased 36.0% to

$130.9 million. Adjusted operating income(1) decreased 36.3% to

$130.0 million and adjusted operating margin(1) decreased 450 basis

points to 7.1%.

- Net income totaled

$102.8 million, or $1.64 per diluted share, as compared with net

income of $157.5 million, or $2.43 per diluted share, in the prior

year.

- Adjusted net income(1) was $101.8

million, or $1.62 per diluted share, as compared with prior year

adjusted net income of $152.9 million, or $2.36 per diluted

share.

- Adjusted EBITDA(1)

decreased 28.8% to $168.9 million and adjusted EBITDA margin(1)

decreased 430 basis points to 9.2%.

(1) As used throughout this release,

adjusted operating income, adjusted operating margin, adjusted net

income, adjusted net income per diluted share, EBITDA, adjusted

EBITDA and adjusted EBITDA margin are not measures recognized under

U.S. generally accepted accounting principles (“GAAP”). Please see

the accompanying financial tables which reconcile our comparable

GAAP measures to these non-GAAP measures.

Fourth Quarter Results

Net sales in the fourth quarter of fiscal 2022

totaled $549.8 million, a 9.7% increase compared with net sales of

$501.1 million in the fourth quarter of fiscal 2021. The increase

in net sales was the result of new store unit growth in addition to

a comparable store sales increase of 3.0%.

Gross profit increased 12.8% to $206.5 million

in the fourth quarter of fiscal 2022 from $183.0 million in the

fourth quarter of fiscal 2021. Gross margin increased 110 basis

points to 37.6% in the fourth quarter of fiscal 2022 from 36.5% in

the fourth quarter of fiscal 2021. The increase in gross margin in

the fourth quarter of fiscal 2022 is primarily due to lower supply

chain costs.

Selling, general, and administrative expenses

increased 10.0% to $131.0 million in the fourth quarter of fiscal

2022 from $119.1 million in the fourth quarter of fiscal 2021.

Excluding the gains from the insurance settlements of $0.9 million

and $0.1 million in the fourth quarters of fiscal 2022 and fiscal

2021, respectively, adjusted SG&A increased 10.7% to $131.9

million in the fourth quarter of fiscal 2022 from $119.2 million in

the fourth quarter of fiscal 2021. This increase was primarily

driven by higher selling expenses associated with our new store

unit growth, as well as investments in wages and higher utility

costs. As a percentage of net sales, selling, general, and

administrative expenses, exclusive of the insurance settlement

gains, increased 20 basis points to 24.0% in the fourth quarter of

fiscal 2022 from 23.8% in the fourth quarter of fiscal 2021.

Operating income totaled $67.7 million in the

fourth quarter of fiscal 2022, a 17.8% increase from operating

income of $57.5 million in the fourth quarter of fiscal 2021.

Excluding the gains from the insurance settlements, adjusted

operating income(1) increased 16.5% to $66.8 million in the fourth

quarter of fiscal 2022 from $57.3 million in the fourth quarter of

fiscal 2021. Adjusted operating margin(1) increased 70 basis points

to 12.1% in the fourth quarter of fiscal 2022 from 11.4% in the

fourth quarter of fiscal 2021 primarily due to the increase in

gross margin driven by lower supply chain costs and new store unit

growth.

Net income increased 18.7% to $53.1 million, or

$0.85 per diluted share, in the fourth quarter of fiscal 2022

compared with net income of $44.7 million, or $0.71 per diluted

share, in the fourth quarter of fiscal 2021. Diluted earnings per

share in the fourth quarters of fiscal 2022 and fiscal 2021

included a benefit of $0.00 and $0.01, respectively, due to excess

tax benefits related to stock-based compensation. Adjusted net

income(1), which excludes these benefits and the after-tax gains

from the insurance settlements, increased 19.5% to $52.4 million,

or $0.84 per diluted share, in the fourth quarter of fiscal 2022

from $43.9 million, or $0.69 per diluted share, in the fourth

quarter of fiscal 2021.

Adjusted EBITDA(1) totaled $77.2 million in the

fourth quarter of fiscal 2022, increasing 16.8% from $66.1 million

in the fourth quarter of fiscal 2021. Adjusted EBITDA margin(1)

increased 80 basis points to 14.0% in the fourth quarter of fiscal

2022 from 13.2% in the fourth quarter of fiscal 2021. Adjusted

EBITDA excludes non-cash stock-based compensation expense and the

gains from the insurance settlements.

Fiscal 2022 Results

Net sales totaled $1.827 billion in fiscal 2022,

an increase of 4.2%, compared with net sales of $1.753 billion in

fiscal 2021. The increase in net sales was the result of new store

unit growth, partially offset by the decline in comparable store

sales of 3.0% compared to prior year.

Gross profit decreased 3.7% to $656.1 million in

fiscal 2022 from $681.2 million in fiscal 2021. Gross margin

decreased 300 basis points to 35.9% in fiscal 2022 from 38.9% in

fiscal 2021. The decrease in gross margin in fiscal 2022 is due to

increased supply chain costs, primarily the result of higher import

and trucking costs and, to a lesser extent, higher wage rates in

the Company’s distribution centers.

Selling, general, and administrative expenses

increased 9.6% to $490.6 million in fiscal 2022 from $447.6 million

in fiscal 2021. Excluding the gains from the insurance settlements

of $0.9 million and $0.4 million in fiscal 2022 and fiscal 2021,

respectively, adjusted SG&A increased 9.7% to $491.5 million in

fiscal 2022 from $448.0 million in fiscal 2021. This increase was

primarily driven by higher selling expenses associated with our new

store unit growth, as well as investments in wages and higher

utility costs, partially offset by tight expense controls

throughout the organization. As a percentage of net sales, selling,

general, and administrative expenses, exclusive of the insurance

settlement gains, increased 130 basis points to 26.9% in fiscal

2022 from 25.6% in fiscal 2021.

Operating income totaled $130.9 million in

fiscal 2022, a 36.0% decrease from operating income of $204.6

million in fiscal 2021. Adjusted operating income(1), which

excludes gains from insurance settlements of $0.9 million and $0.4

million in fiscal 2022 and fiscal 2021, respectively, decreased

36.3% to $130.0 million in fiscal 2022 compared with $204.2 million

in fiscal 2021. Adjusted operating margin(1) decreased 450 basis

points to 7.1% in fiscal 2022 from 11.6% in fiscal 2021 primarily

as a result of the decrease in gross margin and the de-leverage of

fixed expenses resulting from the decrease in comparable store

sales.

Net income decreased 34.7% to $102.8 million, or

$1.64 per diluted share, in fiscal 2022 from $157.5 million, or

$2.43 per diluted share, in fiscal 2021. Diluted earnings per share

in fiscal 2022 and fiscal 2021 included a benefit of $0.00 and

$0.06, respectively, due to excess tax benefits related to

stock-based compensation. Adjusted net income(1), which excludes

these benefits and the after-tax gains from the insurance

settlements, decreased 33.4% to $101.8 million, or $1.62 per

diluted share, in fiscal 2022 from $152.9 million, or $2.36 per

diluted share, in fiscal 2021.

Adjusted EBITDA (1) totaled $168.9 million in

fiscal 2022, a 28.8% decrease from $237.3 million in fiscal 2021.

Adjusted EBITDA margin(1) decreased 430 basis points to 9.2% in

fiscal 2022 from 13.5% in fiscal 2021.

Balance Sheet and Cash Flow

Highlights

The Company's cash and cash equivalents and

short-term investments were $270.8 million as of the end of fiscal

2022 compared with cash and cash equivalents of $247.0 million as

of the end of fiscal 2021. The Company had no borrowings

outstanding under its $100 million revolving credit facility and

$87.0 million of availability under the facility as of the end of

fiscal 2022. The Company ended the period with total borrowings,

consisting solely of finance lease obligations, of $1.3

million.

During the fourth quarter of fiscal 2022, the

Company invested $11.9 million of cash to repurchase 245,328 shares

of its common stock, resulting in $41.8 million invested in fiscal

2022.

Inventories as of the end of fiscal 2022

increased 0.7% to $470.5 million compared with $467.3 million as of

the end of fiscal 2021, driven by new store unit growth partially

offset by the impact of lower freight costs and a normalization of

lead times on our in-transit inventory.

Capital expenditures in fiscal 2022, primarily

for new and existing stores and the expansion of the Company’s

distribution center in York, PA, totaled $51.7 million compared

with $35.0 million in fiscal 2021.

Fiscal 2023

Outlook

The Company estimates the following for the

53-week fiscal year ending February 3, 2024:

For full-year fiscal 2023:

- Total net sales of

$2.036 billion to $2.058 billion;

- Comparable store

sales increase ranging from 1.0% to 2.0%;

- The opening of 45

new stores, less 1 closure;

- Full year gross

margin in the range of 39.1% to 39.3%;

- Operating income of

$205 million to $213 million;

- Adjusted net

income(2) of $156 million to $163 million and adjusted earnings per

share(2) of $2.49 to $2.58, both of which exclude excess tax

benefits related to stock-based compensation;

- An annual effective

tax rate of 25%, which excludes excess tax benefits related to

stock-based compensation;

- Diluted weighted

average shares outstanding of approximately 63 million; and

- Capital

expenditures of $125 million, primarily for the construction of our

fourth distribution center and the expansion of the Company’s York,

PA distribution center, as well as new stores, store-level

initiatives, and IT projects.

(2) The guidance ranges as provided for adjusted

net income and adjusted net income per diluted share exclude the

excess tax benefits related to stock-based compensation as the

Company cannot predict such estimates without unreasonable

effort.

Conference Call Information

A conference call to discuss fourth quarter and

full-year fiscal 2022 financial results is scheduled for today,

March 22, 2023, at 8:30 a.m. Eastern Time. To access the live

conference call, please pre-register here. Registrants will receive

a confirmation with dial-in instructions. Interested parties can

also listen to a live webcast or replay of the conference call by

logging on to the Investor Relations section on the Company’s

website at http://investors.ollies.us/. A replay of the conference

call webcast will be available at the investor relations website

for one year.

About

Ollie’s

We are America’s largest retailer of Closeout

merchandise and excess inventory, offering Real Brands and Real

Bargain prices®! We offer extreme value on brand name products in a

variety of departments, including housewares, food, books and

stationery, bed and bath, floor coverings, toys, health and beauty

aids, and more. We currently operate 475 stores in 29 states and

growing! For more information, visit www.ollies.us

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be

identified by words such as “could,” “may,” “might,” “will,”

“likely,” “anticipates,” “intends,” “plans,” “seeks,” “believes,”

“estimates,” “expects,” “continues,” “projects” and similar

references to future periods, or by the inclusion of forecasts or

projections, the outlook for the Company’s future business,

prospects, financial performance, including our fiscal 2023

business outlook or financial guidance, and industry outlook.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, capital market conditions,

the economy and other future conditions. Because forward-looking

statements relate to the future, by their nature, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. As a result, our actual results may

differ materially from those contemplated by the forward-looking

statements. Important factors that could cause actual results to

differ materially from those in the forward-looking statements

include regional, national or global political, economic, business,

competitive, market and regulatory conditions, including, but not

limited to, supply chain challenges, legislation, national trade

policy, and the following: our failure to adequately procure and

manage our inventory, anticipate consumer demand or achieve

favorable product margins; changes in consumer confidence and

spending; risks associated with our status as a “brick and mortar”

only retailer; risks associated with intense competition; our

failure to open new profitable stores, or successfully enter new

markets, on a timely basis or at all; fluctuations in comparable

store sales and results of operations, including on a quarterly

basis; factors such as inflation, cost increases and energy prices;

the risks associated with doing business with international

manufacturers and suppliers including, but not limited to,

potential increases in tariffs on imported goods; our inability to

operate our stores due to civil unrest and related protests or

disturbances; our failure to properly hire and to retain key

personnel and other qualified personnel; changes in market levels

of wages; risks associated with cybersecurity events and the timely

and effective deployment, protection and defense of computer

networks and other electronic systems, including email; our

inability to obtain favorable lease terms for our properties; the

failure to timely acquire, develop and open, the loss of, or

disruption or interruption in the operations of, our centralized

distribution centers; risks associated with our lack of operations

in the growing online retail marketplace; risks associated with

litigation, the expense of defense, and potential for adverse

outcomes; our inability to successfully develop or implement our

marketing, advertising and promotional efforts; the seasonal nature

of our business; risks associated with natural disasters, whether

or not caused by climate change; outbreak of viruses, global health

epidemics, pandemics, or widespread illness, including the

continued impact of COVID-19 and continuing or renewed regulatory

responses thereto; changes in government regulations, procedures

and requirements; and our ability to service indebtedness and to

comply with our financial covenants together with each of the other

factors set forth under the heading “Risk Factors” in our filings

with the United States Securities and Exchange Commission (“SEC”).

Any forward-looking statement made by us in this press release

speaks only as of the date on which it is made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them.

Ollie’s undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by law.

You are advised, however, to consult any further disclosures we

make on related subjects in our public announcements and SEC

filings.

Investor Contact: Lyn

WaltherICR646-200-8887Lyn.Walther@icrinc.com

Media Contact:Tom KuypersSenior Vice President

– Marketing & Advertising717-657-2300 tkuypers@ollies.us

Ollie’s Bargain Outlet Holdings,

Inc.Condensed Consolidated Statements of

Income

(In thousands except for

per share amounts)

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

|

Fiscal year ended |

|

|

|

|

January 28, |

|

|

January 29, |

|

January 28, |

|

|

January 29, |

|

|

|

|

|

2023 |

|

|

|

|

2022 |

|

|

|

|

2023 |

|

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

549,789 |

|

|

|

$ |

501,135 |

|

|

|

$ |

1,827,009 |

|

|

|

$ |

1,752,995 |

|

|

|

Cost of sales |

|

|

343,306 |

|

|

|

|

318,094 |

|

|

|

|

1,170,915 |

|

|

|

|

1,071,749 |

|

|

|

Gross profit |

|

|

206,483 |

|

|

|

|

183,041 |

|

|

|

|

656,094 |

|

|

|

|

681,246 |

|

|

|

Selling, general and administrative expenses |

|

|

131,020 |

|

|

|

|

119,078 |

|

|

|

|

490,569 |

|

|

|

|

447,615 |

|

|

|

Depreciation and amortization expenses |

|

|

6,209 |

|

|

|

|

5,255 |

|

|

|

|

22,907 |

|

|

|

|

19,364 |

|

|

|

Pre-opening expenses |

|

|

1,558 |

|

|

|

|

1,256 |

|

|

|

|

11,700 |

|

|

|

|

9,675 |

|

|

|

Operating income |

|

|

67,696 |

|

|

|

|

57,452 |

|

|

|

|

130,918 |

|

|

|

|

204,592 |

|

|

|

Interest (income) expense, net |

|

|

(2,085 |

) |

|

|

|

98 |

|

|

|

|

(2,965 |

) |

|

|

|

209 |

|

|

|

Income before income taxes |

|

|

69,781 |

|

|

|

|

57,354 |

|

|

|

|

133,883 |

|

|

|

|

204,383 |

|

|

|

Income tax expense |

|

|

16,693 |

|

|

|

|

12,627 |

|

|

|

|

31,093 |

|

|

|

|

46,928 |

|

|

|

Net income |

|

$ |

53,088 |

|

|

|

$ |

44,727 |

|

|

|

$ |

102,790 |

|

|

|

$ |

157,455 |

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.85 |

|

|

|

$ |

0.71 |

|

|

|

$ |

1.64 |

|

|

|

$ |

2.44 |

|

|

|

Diluted |

|

$ |

0.85 |

|

|

|

$ |

0.71 |

|

|

|

$ |

1.64 |

|

|

|

$ |

2.43 |

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

62,178 |

|

|

|

|

63,059 |

|

|

|

|

62,495 |

|

|

|

|

64,447 |

|

|

|

Diluted |

|

|

62,394 |

|

|

|

|

63,270 |

|

|

|

|

62,704 |

|

|

|

|

64,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of net sales(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

|

100.0 |

|

% |

|

100.0 |

|

% |

|

100.0 |

|

% |

|

100.0 |

|

% |

|

Cost of sales |

|

|

62.4 |

|

|

|

|

63.5 |

|

|

|

|

64.1 |

|

|

|

|

61.1 |

|

|

|

Gross profit |

|

|

37.6 |

|

|

|

|

36.5 |

|

|

|

|

35.9 |

|

|

|

|

38.9 |

|

|

|

Selling, general and administrative expenses |

|

|

23.8 |

|

|

|

|

23.8 |

|

|

|

|

26.9 |

|

|

|

|

25.5 |

|

|

|

Depreciation and amortization expenses |

|

|

1.1 |

|

|

|

|

1.0 |

|

|

|

|

1.3 |

|

|

|

|

1.1 |

|

|

|

Pre-opening expenses |

|

|

0.3 |

|

|

|

|

0.3 |

|

|

|

|

0.6 |

|

|

|

|

0.6 |

|

|

|

Operating income |

|

|

12.3 |

|

|

|

|

11.5 |

|

|

|

|

7.2 |

|

|

|

|

11.7 |

|

|

|

Interest (income) expense, net |

|

|

(0.4 |

) |

|

|

|

- |

|

|

|

|

(0.2 |

) |

|

|

|

- |

|

|

|

Income before income taxes |

|

|

12.7 |

|

|

|

|

11.4 |

|

|

|

|

7.3 |

|

|

|

|

11.7 |

|

|

|

Income tax expense |

|

|

3.0 |

|

|

|

|

2.5 |

|

|

|

|

1.7 |

|

|

|

|

2.7 |

|

|

|

Net income |

|

|

9.7 |

|

% |

|

8.9 |

|

% |

|

5.6 |

|

% |

|

9.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Components may not add to totals due to rounding. |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Ollie’s Bargain Outlet Holdings,

Inc.Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

|

|

|

January 28, |

|

January 29, |

|

Assets |

|

|

2023 |

|

|

|

2022 |

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

210,596 |

|

|

$ |

246,977 |

|

|

Short-term investments |

|

|

60,165 |

|

|

|

- |

|

|

Inventories |

|

|

470,534 |

|

|

|

467,306 |

|

|

Accounts receivable |

|

|

2,374 |

|

|

|

1,372 |

|

|

Prepaid expenses and other assets |

|

|

10,627 |

|

|

|

11,173 |

|

|

Total current assets |

|

|

754,296 |

|

|

|

726,828 |

|

|

Property and equipment, net |

|

|

175,947 |

|

|

|

147,164 |

|

|

Operating lease right-of-use assets |

|

|

436,326 |

|

|

|

420,568 |

|

|

Goodwill |

|

|

444,850 |

|

|

|

444,850 |

|

|

Trade name |

|

|

230,559 |

|

|

|

230,559 |

|

|

Other assets |

|

|

2,118 |

|

|

|

2,203 |

|

|

Total assets |

|

$ |

2,044,096 |

|

|

$ |

1,972,172 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

430 |

|

|

$ |

332 |

|

|

Accounts payable |

|

|

90,204 |

|

|

|

106,599 |

|

|

Income taxes payable |

|

|

3,056 |

|

|

|

2,556 |

|

|

Current portion of operating lease liabilities |

|

|

88,636 |

|

|

|

75,535 |

|

|

Accrued expenses and other |

|

|

76,959 |

|

|

|

78,246 |

|

|

Total current liabilities |

|

|

259,285 |

|

|

|

263,268 |

|

|

Revolving credit facility |

|

|

- |

|

|

|

- |

|

|

Long-term debt |

|

|

858 |

|

|

|

719 |

|

|

Deferred income taxes |

|

|

70,632 |

|

|

|

66,179 |

|

|

Long-term operating lease liabilities |

|

|

351,251 |

|

|

|

354,293 |

|

|

Other long-term liabilities |

|

|

1 |

|

|

|

3 |

|

|

Total liabilities |

|

|

682,027 |

|

|

|

684,462 |

|

|

Stockholders’ equity: |

|

|

|

|

|

Common stock |

|

|

67 |

|

|

|

67 |

|

|

Additional paid-in capital |

|

|

677,694 |

|

|

|

664,293 |

|

|

Retained earnings |

|

|

986,512 |

|

|

|

883,722 |

|

|

Treasury - common stock |

|

|

(302,204 |

) |

|

|

(260,372 |

) |

|

Total stockholders’ equity |

|

|

1,362,069 |

|

|

|

1,287,710 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,044,096 |

|

|

$ |

1,972,172 |

|

| |

|

|

|

|

Ollie’s Bargain Outlet Holdings,

Inc.Condensed Consolidated Statements of Cash

Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

January 28, |

|

January 29, |

|

January 28, |

|

January 29, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net cash provided by operating activities |

|

$ |

113,367 |

|

|

$ |

42,342 |

|

|

$ |

114,346 |

|

|

$ |

45,033 |

|

|

Net cash used in investing activities |

|

|

(72,828 |

) |

|

|

(5,317 |

) |

|

|

(111,454 |

) |

|

|

(31,830 |

) |

|

Net cash used in financing activities |

|

|

(12,047 |

) |

|

|

(19,774 |

) |

|

|

(39,273 |

) |

|

|

(213,352 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

|

28,492 |

|

|

|

17,251 |

|

|

|

(36,381 |

) |

|

|

(200,149 |

) |

|

Cash and cash equivalents at the beginning of the period |

|

|

182,104 |

|

|

|

229,726 |

|

|

|

246,977 |

|

|

|

447,126 |

|

|

Cash and cash equivalents at the end of the period |

|

$ |

210,596 |

|

|

$ |

246,977 |

|

|

$ |

210,596 |

|

|

$ |

246,977 |

|

|

|

|

|

|

|

|

|

|

|

Ollie’s Bargain Outlet Holdings,

Inc.Supplemental Information

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Dollars in thousands)

(Unaudited)

The Company reports its financial results in

accordance with GAAP. We have included the non-GAAP measures of

adjusted operating income, adjusted operating margin, EBITDA,

adjusted EBITDA, adjusted EBITDA margin, adjusted net income and

adjusted net income per diluted share in this press release as

these are key measures used by our management and our board of

directors to evaluate our operating performance and the

effectiveness of our business strategies, make budgeting decisions,

and evaluate compensation decisions. Management believes it is

useful to investors and analysts to evaluate these non-GAAP

measures on the same basis as management uses to evaluate the

Company’s operating results. We believe that excluding items that

may not be indicative of, or are unrelated to, our core operating

results, and that may vary in frequency or magnitude from net

income and net income per diluted share, enhances the comparability

of our results and provides a better baseline for analyzing trends

in our business.

The tables below reconcile the most directly

comparable GAAP measure to non-GAAP financial measures: operating

income to adjusted operating income, net income to adjusted net

income, net income per diluted share to adjusted net income per

diluted share, and net income to EBITDA and adjusted EBITDA.

Adjusted operating

income excludes gains associated with insurance settlements.

Adjusted net income and adjusted net income per diluted share

exclude the after-tax gain from the insurance settlements and

excess tax benefits related to stock-based compensation, which may

not occur with the same frequency or magnitude in future periods.

We define EBITDA as net income before net interest income or

expense, depreciation and amortization expenses and income taxes.

Adjusted EBITDA represents EBITDA as further adjusted for non-cash

stock-based compensation expense as well as the aforementioned

gains from insurance settlements.

Non-GAAP financial measures should be viewed as

supplementing, and not as an alternative to or substitute for, the

Company’s financial results prepared in accordance with GAAP.

Certain of the items that may be excluded or included in non-GAAP

financial measures may be significant items that could impact the

Company's financial position, results of operations and cash flows

and should therefore be considered in assessing the Company's

actual financial condition and performance. The methods used by the

Company to calculate its non-GAAP financial measures may differ

significantly from methods used by other companies to compute

similar measures. As a result, any non-GAAP financial measures

presented herein may not be comparable to similar measures provided

by other companies.

Reconciliation of GAAP operating income to adjusted

operating income

| |

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

|

January 28, |

|

|

|

January 29, |

|

|

|

January 28, |

|

|

|

January 29, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating income |

|

$ |

67,696 |

|

|

$ |

57,452 |

|

|

$ |

130,918 |

|

|

$ |

204,592 |

|

|

Gain from insurance settlements |

|

|

(897 |

) |

|

|

(104 |

) |

|

|

(897 |

) |

|

|

(416 |

) |

|

Adjusted operating income |

|

$ |

66,799 |

|

|

$ |

57,348 |

|

|

$ |

130,021 |

|

|

$ |

204,176 |

|

| |

|

|

|

|

|

|

|

|

Ollie’s Bargain Outlet Holdings,

Inc.Supplemental Information

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands except for per share

amounts)

(Unaudited)

Reconciliation of GAAP net income to adjusted net

income

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

January 28, |

|

|

January 29, |

|

|

January 28, |

|

|

January 29, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income |

|

$ |

53,088 |

|

|

$ |

44,727 |

|

|

$ |

102,790 |

|

|

$ |

157,455 |

|

|

Gain from insurance settlements |

|

|

(897 |

) |

|

|

(104 |

) |

|

|

(897 |

) |

|

|

(416 |

) |

|

Adjustment to provision for income taxes (1) |

|

|

208 |

|

|

|

26 |

|

|

|

208 |

|

|

|

106 |

|

|

Excess tax benefits related to stock-based compensation (2) |

|

|

25 |

|

|

|

(795 |

) |

|

|

(257 |

) |

|

|

(4,209 |

) |

|

Adjusted net income |

|

$ |

52,424 |

|

|

$ |

43,854 |

|

|

$ |

101,844 |

|

|

$ |

152,936 |

|

|

|

|

|

|

|

|

|

|

|

(1) The effective tax rate used for the

adjustment to the provision for income taxes was the normalized

effective tax rate in the quarter in which the related costs (gains

from insurance settlements) were incurred.

(2) Amount represents the impact from the

recognition of excess tax benefits pursuant to Accounting Standards

Update 2016-09, Stock Compensation.

Reconciliation of GAAP net income per diluted share to

adjusted net income per diluted share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

|

January 28, |

|

January 29, |

|

January 28, |

|

January 29, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income per diluted share |

|

$ |

0.85 |

|

|

$ |

0.71 |

|

|

$ |

1.64 |

|

|

$ |

2.43 |

|

|

Adjustments as noted above, per dilutive share: |

|

|

|

|

|

|

|

|

|

|

Gain from insurance settlements, net of taxes |

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

Adjustment to provision for income taxes (1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

Excess tax benefits related to stock-based compensation |

|

|

- |

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.06 |

) |

|

Adjusted net income per diluted share (1) |

|

$ |

0.84 |

|

|

$ |

0.69 |

|

|

$ |

1.62 |

|

|

$ |

2.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted-average common shares outstanding |

|

|

62,394 |

|

|

|

63,270 |

|

|

|

62,704 |

|

|

|

64,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Components may not add to totals due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ollie’s Bargain Outlet Holdings,

Inc.Supplemental Information

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Dollars in thousands)

(Unaudited)

Reconciliation of GAAP net income to EBITDA and adjusted

EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

January 28, |

|

January 29, |

|

January 28, |

|

January 29, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income |

|

$ |

53,088 |

|

|

$ |

44,727 |

|

|

$ |

102,790 |

|

|

$ |

157,455 |

|

|

Interest (income) expense, net |

|

|

(2,085 |

) |

|

|

98 |

|

|

|

(2,965 |

) |

|

|

209 |

|

|

Depreciation and amortization expenses |

|

|

7,780 |

|

|

|

6,704 |

|

|

|

28,903 |

|

|

|

25,114 |

|

|

Income tax expense |

|

|

16,693 |

|

|

|

12,627 |

|

|

|

31,093 |

|

|

|

46,928 |

|

|

EBITDA |

|

|

75,476 |

|

|

|

64,156 |

|

|

|

159,821 |

|

|

|

229,706 |

|

|

Gain from insurance settlements |

|

|

(897 |

) |

|

|

(104 |

) |

|

|

(897 |

) |

|

|

(416 |

) |

|

Non-cash stock-based compensation expense |

|

|

2,638 |

|

|

|

2,083 |

|

|

|

9,951 |

|

|

|

8,042 |

|

|

Adjusted EBITDA |

|

$ |

77,217 |

|

|

$ |

66,135 |

|

|

$ |

168,875 |

|

|

$ |

237,332 |

|

|

|

|

|

|

|

|

|

|

|

Key Statistics

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen weeks ended |

|

Fiscal year ended |

|

|

|

January 28, |

|

January 29, |

|

January 28, |

|

January 29, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Number of stores open at beginning of period |

|

|

463 |

|

|

|

426 |

|

|

|

431 |

|

|

|

388 |

|

|

Number of new stores |

|

|

5 |

|

|

|

5 |

|

|

|

40 |

|

|

|

46 |

|

|

Number of closed stores |

|

|

- |

|

|

|

- |

|

|

|

(3 |

) |

|

|

(3 |

) |

|

Number of stores open at end of period |

|

|

468 |

|

|

|

431 |

|

|

|

468 |

|

|

|

431 |

|

|

|

|

|

|

|

|

|

|

|

|

Average net sales per store (in thousands) (1) |

|

$ |

1,179 |

|

|

$ |

1,165 |

|

|

$ |

4,043 |

|

|

$ |

4,254 |

|

|

Comparable stores sales change |

|

|

3.0 |

% |

|

|

(10.5 |

)% |

|

|

(3.0 |

)% |

|

|

(11.1 |

)% |

|

Comparable store count – end of period |

|

|

417 |

|

|

|

376 |

|

|

|

417 |

|

|

|

376 |

|

|

|

|

|

|

|

|

|

|

|

(1) Average net sales per store

represents the weighted average of total net weekly sales divided

by the number of stores open at the end of each week for the

respective periods presented.

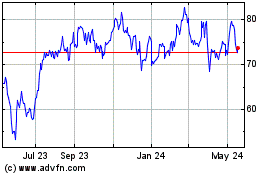

Ollies Bargain Outlet (NASDAQ:OLLI)

Historical Stock Chart

From Feb 2025 to Mar 2025

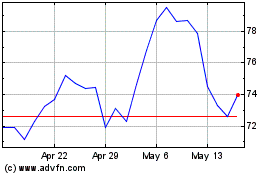

Ollies Bargain Outlet (NASDAQ:OLLI)

Historical Stock Chart

From Mar 2024 to Mar 2025