0001868726False00018687262024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

Olaplex Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-40860 | | 87-1242679 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Address Not Applicable1

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (310) 691-0776

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | OLPX | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1 Olaplex Holdings, Inc. is a fully remote company. Accordingly, it does not maintain a principal executive office.

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2024, Olaplex Holdings, Inc. (the “Company”) issued a press release announcing its results of operations for the fourth quarter and fiscal year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information furnished under Item 2.02 of this Current Report on Form 8-K, including the exhibit, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 29, 2024 | Olaplex Holdings, Inc. |

| | |

| By: | /s/ Amanda Baldwin |

| Name: | Amanda Baldwin |

| Title: | Chief Executive Officer |

OLAPLEX Reports Fourth Quarter and Fiscal Year 2023 Results

SANTA BARBARA, California – February 29, 2024 – Olaplex Holdings, Inc. (NASDAQ: OLPX) ("OLAPLEX" or the "Company") today announced financial results for the fourth quarter and fiscal year ended December 31, 2023.

For the fourth quarter 2023 compared to the fourth quarter 2022:

•Net sales decreased 14.5% to $111.7 million;

◦Net sales decreased 27.9% in the United States and decreased 0.7% internationally

◦By channel:

▪Professional decreased 22.7% to $42.5 million;

▪Direct-To-Consumer decreased 2.8% to $42.0 million;

▪Specialty Retail decreased 16.3% to $27.3 million;

•Net income decreased 58.1% and adjusted net income decreased 53.9%;

•Diluted EPS was $0.02 for the fourth quarter 2023, as compared to $0.05 for the fourth quarter 2022;

•Adjusted Diluted EPS was $0.03 for the fourth quarter 2023, as compared to $0.07 for the fourth quarter 2022

For fiscal year 2023 compared to fiscal year 2022:

•Net sales decreased 34.9% to $458.3 million;

◦Net sales decreased 47.8% in the United States and decreased 18.3% internationally

◦By channel:

▪Professional decreased 40.1% to $180.1 million;

▪Direct-To-Consumer decreased 15.0% to $143.1 million;

▪Specialty Retail decreased 42.6% to $135.1 million;

•Net income decreased 74.8% and adjusted net income decreased 65.3%;

•Diluted EPS was $0.09 for 2023, as compared to $0.35 for 2022;

•Adjusted Diluted EPS was $0.16 for 2023, as compared to $0.45 for 2022

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "Our fourth quarter results were in line with our expectations and represent another positive step towards stabilizing our demand trend. I am confident in the strong foundation of the OLAPLEX brand and believe that our priorities for the year ahead will position the company to return to consistent sales and profit growth."

Fourth Quarter 2023 Results

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in $000’s, except per share data) | | | | | | |

| | Q4 2023 | | Q4 2022 | | % Change |

| Net Sales | | $ | 111,717 | | | $ | 130,721 | | | (14.5)% |

| Gross Profit | | $ | 76,778 | | | $ | 92,090 | | | (16.6)% |

| Gross Profit Margin | | 68.7 | % | | 70.4 | % | | |

| Adjusted Gross Profit | | $ | 78,825 | | | $ | 94,735 | | | (16.8)% |

| Adjusted Gross Profit Margin | | 70.6 | % | | 72.5 | % | | |

| SG&A | | $ | 49,171 | | | $ | 34,645 | | | 41.9% |

| Adjusted SG&A | | $ | 44,514 | | | $ | 28,836 | | | 54.4% |

| Net Income | | $ | 14,101 | | | $ | 33,633 | | | (58.1)% |

| Adjusted Net Income | | $ | 22,301 | | | $ | 48,325 | | | (53.9)% |

| Adjusted EBITDA | | $ | 35,993 | | | $ | 67,626 | | | (46.8)% |

| Adjusted EBITDA Margin | | 32.2 | % | | 51.7 | % | | |

| Diluted EPS | | $ | 0.02 | | | $ | 0.05 | | | (60.0)% |

| Adjusted Diluted EPS | | $ | 0.03 | | | $ | 0.07 | | | (57.1)% |

| Weighted Average Diluted Shares Outstanding | | 667,243,477 | | | 686,036,091 | | | |

Fiscal Year 2023 Results

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in $000’s, except per share data) | | | | | | |

| Fiscal Year | | 2023 | | 2022 | | % Change |

| Net Sales | | $ | 458,300 | | | $ | 704,274 | | | (34.9)% |

| Gross Profit | | $ | 318,632 | | | $ | 519,553 | | | (38.7)% |

| Gross Profit Margin | | 69.5 | % | | 73.8 | % | | |

| Adjusted Gross Profit | | $ | 327,001 | | | $ | 533,247 | | | (38.7)% |

| Adjusted Gross Profit Margin | | 71.4 | % | | 75.7 | % | | |

| SG&A | | $ | 168,942 | | | $ | 113,877 | | | 48.4% |

| Adjusted SG&A | | $ | 153,439 | | | $ | 102,235 | | | 50.1% |

| Net Income | | $ | 61,587 | | | $ | 244,072 | | | (74.8)% |

| Adjusted Net Income | | $ | 108,276 | | | $ | 311,776 | | | (65.3)% |

| Adjusted EBITDA | | $ | 174,260 | | | $ | 429,120 | | | (59.4)% |

| Adjusted EBITDA Margin | | 38.0 | % | | 60.9 | % | | |

| Diluted EPS | | $ | 0.09 | | | $ | 0.35 | | | (74.3)% |

| Adjusted Diluted EPS | | $ | 0.16 | | | $ | 0.45 | | | (64.4)% |

| Weighted Average Diluted Shares Outstanding | | 677,578,245 | | | 691,005,846 | | | |

Adjusted gross profit, adjusted gross profit margin, adjusted SG&A, adjusted net income, adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS are measures that are not calculated or presented in accordance with generally accepted accounting principles in the United States ("GAAP"). For more information about how we use these non-GAAP financial measures in our business, the limitations of these measures, and a reconciliation of these measures to the most directly comparable GAAP measures, please see "Disclosure Regarding Non-GAAP Financial Measures" and the reconciliation tables that accompany this release.

Balance Sheet

As of December 31, 2023, the Company had $466.4 million of cash and cash equivalents, compared to $322.8 million as of December 31, 2022. Inventory at the end of the fourth quarter of 2023 was $95.9 million, compared to $144.4 million at December 31, 2022. Long-term debt, net of current portion and deferred debt issuance costs was $649.0 million as of December 31, 2023, compared to $654.3 million as of December 31, 2022.

Fiscal Year 2024 Guidance

The Company's fiscal year 2024 guidance outlined below incorporates management's expectations regarding consumer demand, and investments and actions aimed at driving sell-through, improving upon foundational capabilities, and building a healthier brand.

| | | | | | | | | | | |

| For Fiscal 2024: | | | |

(Dollars in millions) | 2024 | 2023 Actual | % change |

| Net Sales | $435-$463 | $458 | (5)% to 1% |

| Adjusted Net Income* | $87-$100 | $108 | (20)% to (8)% |

| Adjusted EBITDA* | $143-$159 | $174 | (18)% to (9)% |

| | | |

*Adjusted net income and adjusted EBITDA are non-GAAP measures. See “Disclosure Regarding Non-GAAP Financial Measures” for additional information.

In addition to providing fiscal year 2024 guidance, the Company has elected to provide guidance for net sales for the first quarter of 2024. However, the Company does not undertake to provide quarterly guidance in the future. The Company expects net sales in the range of $92 million to $97 million for the three months ending March 31, 2024.

The fiscal year 2024 net sales, adjusted net income and adjusted EBITDA guidance, and the first quarter 2024 net sales guidance, set forth above are approximations and are based on the Company’s plans and assumptions for the relevant period, including, but not limited to, the following, as applicable:

•Fiscal Year 2024 Net Sales:

◦The Company assumes that the absolute dollar sell-through trend experienced in the second half of 2023, adjusted for seasonality, represents the normalized base level of sell-through for fiscal year 2024. From there, the Company’s assumptions also incorporate reasonably expected volume drivers on a product and account level basis.

•Adjusted Gross Profit Margin:

◦The Company anticipates adjusted gross profit margin in the range of 72.5% to 73.1% in fiscal year 2024, compared to 71.4% in fiscal year 2023, due primarily to the lapping of actions taken by the Company to address excess inventory in fiscal year 2023, as well as anticipated efficiencies derived from an internal cost savings program in fiscal year 2024, which is expected to more than offset modestly higher product costs.

•Adjusted SG&A:

◦The Company expects Adjusted SG&A in the range of $172 million to $179 million, an increase of $19 million to $26 million as compared to fiscal year 2023. The increase is primarily attributed to higher sales and marketing expenses and higher organizational costs due to annualizing the expense of headcount additions made during fiscal 2023.

•Adjusted EBITDA Margin:

◦The Company expects Adjusted EBITDA margin in the range of 32.8% to 34.3%.

•Net Interest Expense:

◦The Company expects net interest expense to be approximately $32 million to $34 million during fiscal year 2024.

•Adjusted Effective Tax Rate:

◦The Company expects an adjusted effective tax rate of approximately 19.5% to 20.5% for fiscal year 2024.

Webcast and Conference Call Information

The Company plans to host an investor conference call and webcast to review fourth quarter and fiscal 2023 financial results at 9:00am ET/6:00am PT on February 29, 2024. The webcast can be accessed at https://ir.olaplex.com. The conference call can be accessed by calling (201) 689-8521 or (877) 407-8813 for a toll-free number. A replay of the webcast will remain available on the website for 90 days.

About OLAPLEX

OLAPLEX is an innovative, science-enabled, technology-driven beauty company with a mission to improve the hair health of its consumers. In 2014, OLAPLEX disrupted and revolutionized the prestige hair care category by creating innovative bond-building technology, which works by protecting, strengthening and relinking broken bonds in the hair during and after hair services. The brand’s proprietary, patent-protected ingredient works on a molecular level to protect and repair damaged hair. OLAPLEX’s award-winning products are sold through an expanding omnichannel model serving the professional, specialty retail, and direct-to-consumer channels.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain forward-looking statements and information relating to the Company that are based on the beliefs of management as well as assumptions made by, and information currently available to, the Company. These forward-looking statements include, but are not limited to, statements about: the Company’s financial position, operating results, sales and profitability; the Company's financial guidance for the fiscal year 2024 and the first quarter of 2024, including net sales, adjusted net income, adjusted EBITDA, adjusted gross profit margin, adjusted EBITDA margin, net interest expense, adjusted effective tax rate, adjusted SG&A and sales and marketing expense; demand for the Company’s products and sell-through trends; the Company’s product development pipeline and the impact of new product introductions, including the timing thereof; changes in

the Company’s distribution; the Company’s business plans, strategies, investments, priorities and objectives, including the impact and timing thereof; the impact of the Company's internal cost savings program; anticipated product costs; the Company’s sales, marketing and education initiatives and related investments, and the impact, focus and timing thereof; general economic and inventory trends; the Company's employees and culture; growth and expansion opportunities, including expansion in existing markets and into new markets; inventory rebalancing across certain of the Company's customers and the Company's management of excess inventory; and other statements contained in this press release that are not historical or current facts. When used in this press release, words such as "may," "will," “could," "should," "intend," "potential," "continue," "anticipate," "believe," "estimate," "expect," "plan," "target," "predict," "project," "forecast," "seek" and similar expressions as they relate to the Company are intended to identify forward-looking statements.

The forward-looking statements in this press release reflect the Company’s current expectations and projections about future events and financial trends that management believes may affect the Company’s business, financial condition and results of operations. These statements are predictions based upon assumptions that may not prove to be accurate, and they are not guarantees of future performance. As such, you should not place significant reliance on the Company’s forward-looking statements. Neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements, including any such statements taken from third party industry and market reports.

Forward-looking statements involve known and unknown risks, inherent uncertainties and other factors that are difficult to predict which may cause the Company’s actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements, including, without limitation: competition in the beauty industry; the Company’s ability to effectively maintain and promote a positive brand image, expand its brand awareness and maintain consumer confidence in the quality, safety and efficacy of its products; the Company’s ability to anticipate and respond to market trends and changes in consumer preferences and execute on its growth strategies and expansion opportunities, including with respect to new product introductions; the Company’s ability to accurately forecast customer and consumer demand for its products; the Company's dependence on the success of its long-term strategic plan; the Company’s ability to limit the illegal distribution and sale by third parties of counterfeit versions of its products or the unauthorized diversion by third parties of its products; the Company's dependence on a limited number of customers for a large portion of its net sales; the Company’s ability to develop, manufacture and effectively and profitably market and sell future products; the Company’s ability to attract new customers and consumers and encourage consumer spending across its product portfolio; the Company’s ability to successfully implement new or additional marketing efforts; the Company’s relationships with and the performance of its suppliers, manufacturers, distributors and retailers and the Company’s ability to manage its supply chain; impacts on the Company’s business from political, regulatory, economic, trade and other risks associated with operating internationally; the Company’s ability to manage its executive leadership change and to attract and retain senior management and other qualified personnel; the Company’s reliance on its and its third-party service providers’ information technology; the Company’s ability to maintain the security of confidential information; the Company’s ability to establish and maintain intellectual property protection for its products, as well as the Company’s ability to operate its business without infringing, misappropriating or otherwise violating the intellectual property rights of others; the outcome of litigation and regulatory proceedings; the impact of changes in federal, state and international laws, regulations and administrative policy; the Company’s existing and any future indebtedness, including the Company’s ability to comply with affirmative and negative covenants under its credit agreement; the Company’s ability to service its existing indebtedness and obtain additional capital to finance operations and its growth opportunities; volatility of the Company’s stock price; the Company’s “controlled company” status and the influence of investment funds affiliated with Advent International, L.P. over the Company; the impact of an economic downturn and inflationary pressures on the Company’s business; fluctuations in the Company’s quarterly results of operations; changes in the Company’s tax rates and the Company’s exposure to tax liability; and the other factors identified under the heading “Risk Factors” in Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the "SEC") and in the other documents that the Company files with the SEC from time to time.

Many of these factors are macroeconomic in nature and are, therefore, beyond the Company’s control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company’s actual results, performance or achievements may vary materially from those described in this press release as anticipated, believed, estimated, expected, intended, planned or projected. The forward-looking statements in this press release represent management’s views as of the date hereof. Unless required by law, the Company neither intends nor assumes any obligation to update these forward-looking statements for any reason after the date hereof to conform these statements to actual results or to changes in the Company’s expectations or otherwise.

Disclosure Regarding Non-GAAP Financial Measures

In addition to the financial measures presented in this release in accordance with GAAP, the Company has included certain non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted effective tax

rate, adjusted gross profit, adjusted gross profit margin, adjusted SG&A and adjusted diluted EPS. Management believes these non-GAAP financial measures, when taken together with the Company’s financial results presented in accordance with GAAP, provide meaningful supplemental information regarding the Company’s operating performance and facilitate internal comparisons of its historical operating performance on a more consistent basis by excluding certain items that may not be indicative of its business, results of operations or outlook. In particular, management believes that the use of these non-GAAP measures may be helpful to investors as they are measures used by management in assessing the health of the Company’s business, determining incentive compensation and evaluating its operating performance, as well as for internal planning and forecasting purposes.

The Company calculates adjusted EBITDA as net income, adjusted to exclude: (1) interest expense, net; (2) income tax provision; (3) depreciation and amortization; (4) share-based compensation expense; (5) non-ordinary inventory adjustments; (6) non-ordinary costs and fees; (7) non-ordinary legal costs; and (8) Tax Receivable Agreement liability adjustments. The Company calculates adjusted EBITDA margin by dividing adjusted EBITDA by net sales. The Company calculates adjusted net income as net income, adjusted to exclude: (1) amortization of intangible assets (excluding software); (2) non-ordinary costs and fees; (3) non-ordinary legal costs; (4) non-ordinary inventory adjustments; (5) share-based compensation expense; (6) Tax Receivable Agreement liability adjustment; and (7) tax effect of non-GAAP adjustments. The Company calculates adjusted effective tax rate as effective income tax rate, adjusted to exclude the tax effect of non-GAAP adjustments referenced in item (7) of the immediately preceding sentence. The Company calculates adjusted gross profit as gross profit, adjusted to exclude: (1) non-ordinary inventory adjustments and (2) amortization of patented formulations pertaining to the acquisition of the Olaplex, LLC business in 2020 by certain investment funds affiliated with Advent International, L.P. and other investors (the "Acquisition"). The Company calculates adjusted gross profit margin by dividing adjusted gross profit by net sales. The Company calculates adjusted SG&A as SG&A, adjusted to exclude: (1) share-based compensation expense; (2) non-ordinary legal costs; and (3) non-ordinary costs and fees. The Company calculates adjusted basic and diluted EPS as adjusted net income divided by weighted average basic and diluted shares outstanding, respectively. Please refer to "Reconciliation of Non-GAAP Financial Measures to GAAP Equivalents" located in the financial supplement in this release for further information regarding these adjustments for the periods presented.

Please refer to "Reconciliation of Non-GAAP Financial Measures to GAAP Equivalents" located in the financial supplement in this release for a reconciliation of these non-GAAP metrics to their most directly comparable financial measure stated in accordance with GAAP.

This release includes forward-looking guidance for adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted gross profit margin, adjusted effective tax rate and adjusted SG&A. The Company is not able to provide, without unreasonable effort, a reconciliation of the guidance for adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted gross profit margin, adjusted effective tax rate and adjusted SG&A to the most directly comparable GAAP measure because the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments included in the most directly comparable GAAP measure that would be necessary for such reconciliations, including (a) income tax related accruals in respect of certain one-time items, (b) costs related to potential debt or equity transactions, and (c) other non-recurring expenses that cannot reasonably be estimated in advance. These adjustments are inherently variable and uncertain and depend on various factors that are beyond the Company's control and as a result it is also unable to predict their probable significance. Therefore, because management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results in accordance with GAAP, it is unable to provide a reconciliation of the non-GAAP measures included in its fiscal 2024 guidance.

CONSOLIDATED BALANCE SHEETS

(in thousands, except shares)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 466,400 | |

| $ | 322,808 | |

Accounts receivable, net of allowance of $21,465 and $19,198 | 40,921 | | | 46,220 | |

| Inventory | 95,922 | | | 144,425 | |

| Other current assets | 9,953 | | | 8,771 | |

| Total current assets | 613,196 | | | 522,224 | |

| Property and equipment, net | 930 | | | 1,034 | |

| Intangible assets, net | 947,714 | | | 995,028 | |

| Goodwill | 168,300 | | | 168,300 | |

| | | |

| Other assets | 10,198 | | | 11,089 | |

| Total assets | $ | 1,740,338 | | | $ | 1,697,675 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 7,073 | |

| $ | 9,748 | |

| Sales and income taxes payable | 9,067 | | | 3,415 | |

| Accrued expenses and other current liabilities | 20,576 | | | 17,107 | |

| Current portion of long-term debt | 6,750 | | | 8,438 | |

| Current portion of Related Party payable pursuant to Tax Receivable Agreement | 12,675 | | | 16,380 | |

| Total current liabilities | 56,141 | | | 55,088 | |

| Long-term debt | 649,023 | | | 654,333 | |

| Deferred tax liabilities | 3,016 | | | 1,622 | |

| Related Party payable pursuant to Tax Receivable Agreement | 185,496 | | | 205,675 | |

| Other liabilities | 1,694 | | | — | |

| Total liabilities | 895,370 | | | 916,718 | |

| | | |

| Contingencies (Note 14) | | | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.001 par value per share; 2,000,000,000 shares authorized, 660,731,935 and 650,091,380 shares issued and outstanding as of December 31, 2023 and 2022, respectively | 671 | | | 649 | |

Preferred stock, $0.001 par value per share; 25,000,000 shares authorized and no shares issued and outstanding as of December 31, 2023 and 2022, respectively | — | | | — | |

Additional paid-in capital | 316,489 | | | 312,875 | |

| Accumulated other comprehensive income | 1,365 | | | 2,577 | |

Retained earnings | 526,443 | | | 464,856 | |

| Total stockholders’ equity | 844,968 | | | 780,957 | |

| Total liabilities and stockholders’ equity | $ | 1,740,338 | | | $ | 1,697,675 | |

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(amounts in thousands, except per share and share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 111,717 | | | $ | 130,721 | | | $ | 458,300 | | | $ | 704,274 | |

| Cost of sales: | | | | | | | |

| Cost of product (excluding amortization) | 32,892 | | | 36,222 | |

| 131,323 | | | 177,221 | |

| Amortization of patented formulations | 2,047 | | | 2,409 | | | 8,345 | | | 7,500 | |

| Total cost of sales | 34,939 | | | 38,631 | | | 139,668 | | | 184,721 | |

| Gross profit | 76,778 | | | 92,090 | | | 318,632 | | | 519,553 | |

| Operating expenses: | | | | | | | |

| Selling, general, and administrative | 49,172 | | | 34,645 | |

| 168,942 | | | 113,877 | |

| Amortization of other intangible assets | 10,443 | | | 10,392 | | | 41,468 | | | 41,282 | |

| Total operating expenses | 59,615 | | | 45,037 | | | 210,410 | | | 155,159 | |

| Operating income | 17,163 | | | 47,053 | | | 108,222 | | | 364,394 | |

| Interest expense | (14,671) | | | (12,658) | |

| (57,954) | | | (43,953) | |

| Interest income | 5,804 | | | 2,133 | | | 18,828 | | | 2,775 | |

| Other income (expense), net | | | | | | | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (18,803) | |

| Tax receivable agreement liability adjustment | 7,404 | | | 3,084 | | | 7,404 | | | 3,084 | |

Other income (expense), net | 1,548 | | | 1,596 | | | 220 | | | (2,256) | |

| Total other income (expense), net | 8,952 | | | 4,680 | | | 7,624 | | | (17,975) | |

Income before provision for income taxes | 17,248 | | | 41,208 | |

| 76,720 | | | 305,241 | |

| Income tax provision | 3,147 | | | 7,575 | | | 15,133 | | | 61,169 | |

| Net income | $ | 14,101 | | | $ | 33,633 | | | $ | 61,587 | | | $ | 244,072 | |

| | | | | | | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.02 | | | $ | 0.05 | | | $ | 0.09 | | | $ | 0.38 | |

| Diluted | $ | 0.02 | | | $ | 0.05 | | | $ | 0.09 | | | $ | 0.35 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 657,528,502 | | | 649,476,301 | | | 654,592,923 | | | 649,092,846 | |

| Diluted | 667,243,477 | | | 686,036,091 | | | 677,578,245 | | | 691,005,846 | |

| | | | | | | |

Other comprehensive (loss) income: | | | | | | | |

Unrealized (loss) gain on derivatives, net of income tax effect | $ | (1,441) | | | $ | 646 | | | $ | (1,212) | | | $ | 2,577 | |

Total other comprehensive (loss) income | (1,441) | | | 646 | | | (1,212) | | | 2,577 | |

| Comprehensive income | $ | 12,660 | | | $ | 34,279 | | | $ | 60,375 | | | $ | 246,649 | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

(amounts in thousands)

(Unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

Cash flows from operating activities | | | |

| Net income | $ | 61,587 | | | $ | 244,072 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | 115,945 | | | 11,252 | |

| Net cash provided by operating activities | 177,532 | | | 255,324 | |

| Net cash used in investing activities | (3,614) | | | (2,682) | |

| Net cash used in financing activities | (30,326) | | | (116,222) | |

| Net increase in cash and cash equivalents | 143,592 | | | 136,420 | |

| Cash and cash equivalents - beginning of period | 322,808 | | | 186,388 | |

| Cash and cash equivalents - end of period | $ | 466,400 | | | $ | 322,808 | |

Reconciliation of Non-GAAP Financial Measures to GAAP Equivalents

The following tables present a reconciliation of net income, gross profit and SG&A, as the most directly comparable financial measure stated in accordance with U.S. GAAP, to adjusted EBITDA, adjusted EBITDA margin, adjusted gross profit, adjusted gross profit margin, adjusted SG&A, adjusted net income and adjusted net income per share for each of the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Net Income to Adjusted EBITDA | | | | | | | |

| Net income | $ | 14,101 | | | $ | 33,633 | | | $ | 61,587 | | | $ | 244,072 | |

| Depreciation and amortization of intangible assets | 12,625 | | | 12,932 | | | 50,291 | | | 49,146 | |

| Interest expense, net | 8,867 | | | 10,525 | | | 39,126 | | | 41,178 | |

| Income tax provision | 3,147 | | | 7,575 | | | 15,133 | | | 61,169 | |

Loss on extinguishment of debt(1) | — | | | — | | | — | | | 18,803 | |

| Share-based compensation | 1,734 | | | 1,821 | | | 9,072 | | | 7,275 | |

One-time former distributor payment(2) | — | | | — | | | 3,500 | | | — | |

Inventory write off and disposal(3) | — | | | 249 | | | 24 | | | 4,573 | |

Executive reorganization cost(4) | 3 | | | 3,988 | | | 11 | | | 3,988 | |

Organizational realignment(5) | 2,920 | | | — | | | 2,920 | | | — | |

| | | | | | | |

Labelling stock write off and disposal(6) | — | | | (13) | | | — | | | 1,621 | |

Distribution start-up costs(7) | — | | | — | | | — | | | 379 | |

| Tax receivable agreement liability adjustment | (7,404) | | | (3,084) | | | (7,404) | | | (3,084) | |

| Adjusted EBITDA | $ | 35,993 | | | $ | 67,626 | | | $ | 174,260 | | | $ | 429,120 | |

| Adjusted EBITDA margin | 32.2 | % | | 51.7 | % | | 38.0 | % | | 60.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Gross Profit to Adjusted Gross Profit | | | | | | | |

| Gross profit | $ | 76,778 | | | $ | 92,090 | | | $ | 318,632 | | | $ | 519,553 | |

| Amortization of patented formulations | 2,047 | | | 2,409 | | | 8,345 | | | 7,500 | |

Inventory write off and disposal(3) | — | | | 249 | | | 24 | | | 4,573 | |

Labelling stock write off and disposal(6) | — | | | (13) | | | — | | | 1,621 | |

| Adjusted gross profit | $ | 78,825 | | | $ | 94,735 | | | $ | 327,001 | | | $ | 533,247 | |

| Adjusted gross profit margin | 70.6 | % | | 72.5 | % | | 71.4 | % | | 75.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of SG&A to Adjusted SG&A | | | | | | | | |

| SG&A | | $ | 49,171 | | | $ | 34,645 | | | $ | 168,942 | | | $ | 113,877 | |

| | | | | | | | |

| Share-based compensation | | (1,734) | | | (1,821) | | | (9,072) | | | (7,275) | |

Executive reorganization cost(4) | | (3) | | | (3,988) | | | (11) | | | (3,988) | |

Organizational realignment(5) | | (2,920) | | | — | | | (2,920) | | | — | |

One-time former distributor payment(2) | | — | | | — | | | (3,500) | | | — | |

Distribution start-up costs(7) | | — | | | — | | | — | | | (379) | |

| Adjusted SG&A | | $ | 44,514 | | | $ | 28,836 | | | $ | 153,439 | | | $ | 102,235 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Net Income to Adjusted Net Income | | | | | | | |

| Net income | $ | 14,101 | | | $ | 33,633 | | | $ | 61,587 | | | $ | 244,072 | |

| Amortization of intangible assets (excluding software) | 12,230 | | | 12,593 | | | 49,075 | | | 48,232 | |

Loss on extinguishment of debt(1) | — | | | — | | | — | | | 18,803 | |

| Share-based compensation | 1,734 | | | 1,821 | | | 9,072 | | | 7,275 | |

One-time former distributor payment(2) | — | | | — | | | 3,500 | | | — | |

Inventory write off and disposal(3) | — | | | 249 | | | 24 | | | 4,573 | |

Executive reorganization cost(4) | 3 | | | 3,988 | | | 11 | | | 3,988 | |

Organizational realignment(5) | 2,920 | | | — | | | 2,920 | | | — | |

Labelling stock write off and disposal(6) | — | | | (13) | | | — | | | 1,621 | |

Distribution start-up costs(7) | — | | | — | | | — | | | 379 | |

| | | | | | | |

Tax receivable agreement liability adjustment | (7,404) | | | (3,084) | | | (7,404) | | | (3,084) | |

Tax effect of adjustments | (1,283) | | | (862) | | | (10,509) | | | (14,083) | |

| Adjusted net income | $ | 22,301 | | | $ | 48,325 | | | $ | 108,276 | | | $ | 311,776 | |

| Adjusted net income per share: | | | | | | | |

| Basic | $ | 0.03 | | | $ | 0.07 | | | $ | 0.17 | | | $ | 0.48 | |

| Diluted | $ | 0.03 | | | $ | 0.07 | | | $ | 0.16 | | | $ | 0.45 | |

(1)On February 23, 2022, the Company refinanced its existing secured credit facility with a new credit agreement comprised of a $675 million senior secured term loan facility and a $150 million senior secured revolving credit facility. This refinancing resulted in recognition of loss on extinguishment of debt of $18.8 million which is comprised of $11.0 million in deferred financing fee write off, and $7.8 million of prepayment fees for the previously existing credit facility. Loss on extinguishment of debt is included as non-ordinary costs and fees in the reconciliations above.

(2)During the year ended December 31, 2023, the Company made a one-time $3.5 million payment to a former distributor in the United Arab Emirates, which enabled the Company to establish a partnership with another distributor in the region.

(3)The inventory write-off and disposal costs relate to unused stock of a product that the Company reformulated in June 2021 as a result of regulation changes in the E.U. In the interest of having a single formulation for sale worldwide, the Company reformulated on a global basis and is disposing of unused stock.

(4)Represents initial costs and ongoing benefit payments associated with the departure of the Company's Chief Operating Officer during the year ended December 31, 2022.

(5)Represents costs associated with the Company's CEO transition and other organizational realignment, recorded during the year ended December 31, 2023.

(6)Labelling stock write-off and disposal costs relate to disposal of unused product labels that the Company was required to update as a result of regulation changes in the E.U that become effective in the first quarter of 2023.

(7)The distribution start-up costs relate to one-time charges associated with the set-up of a new third party logistics provider.

Contacts:

Investors:

Patrick Flaherty

Vice President, Investor Relations

patrick.flaherty@olaplex.com

Financial Media:

Lisa Bobroff

Vice President, Global Communications & Consumer Engagement

lisa.bobroff@olaplex.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

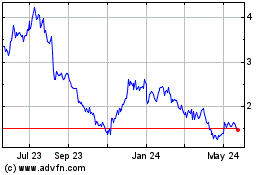

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

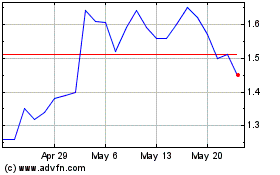

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Jan 2024 to Jan 2025