Oportun Completes $200 Million Asset Backed Securitization

14 February 2024 - 8:20AM

Oportun (Nasdaq: OPRT), a mission-driven fintech, today announced

the issuance of $200 million of fixed rate asset-backed notes

secured by a pool of unsecured and secured installment loans.

The offering included four classes of fixed rate notes: Class A,

Class B, Class C, and Class D. KBRA rated all classes of notes,

assigning ratings of AA-, A-, BBB-, and BB-, respectively. All

classes of notes were placed with four institutions as the initial

purchasers: Morgan Stanley, Goldman Sachs & Co. LLC, J.P.

Morgan Securities LLC, and Jefferies. Morgan Stanley also served as

the sole structuring agent and bookrunner. Goldman Sachs & Co.

LLC, J.P. Morgan Securities LLC, and Jefferies served as

co-managers.

The weighted average coupon on the transaction was 8.434%. The

Class A notes were priced with a coupon of 6.334% per annum; the

Class B notes were priced with a coupon of 6.546% per annum; the

Class C notes were priced with a coupon of 7.421% per annum; and

the Class D notes were priced with a coupon of 12.072% per

annum.

“The significant demand for and pricing of this securitization

reflects investor confidence in the credit quality of Oportun’s

consumer loans and our business model,” said Jonathan Coblentz,

Chief Financial Officer at Oportun. “The closing of this deal

positions Oportun to enhance its profitability in the current

environment while advancing our mission to help our hardworking

members build a better future.”

For more information visit oportun.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

About OportunOportun (Nasdaq: OPRT) is a

mission-driven fintech that puts its 2.1 million members' financial

goals within reach. With intelligent borrowing, savings, and

budgeting capabilities, Oportun empowers members with the

confidence to build a better financial future. Since inception,

Oportun has provided more than $17.2 billion in responsible and

affordable credit, saved its members more than $2.4 billion in

interest and fees, and helped its members save an average of more

than $1,800 annually. For more information, visit Oportun.com.

| |

|

| Oportun Investor

Contact Dorian Hare(650) 590-4323ir@oportun.com |

Oportun Media ContactUsher Lieberman(650)

769-9414usher.lieberman@oportun.com |

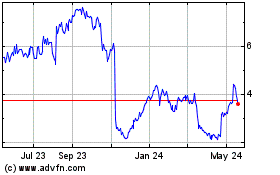

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

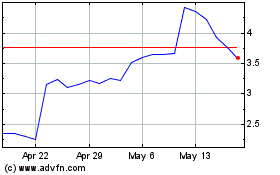

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025