Oportun Financial Corporation (“Oportun” or the “Company”) (Nasdaq:

OPRT), a mission-driven fintech, today announced certain

preliminary unaudited financial and operating metrics for the first

quarter ended March 31, 2024.

Preliminary Financial Results -

First Quarter 2024

Based upon management's current expectations,

the Company will report Total Revenue, Annualized Net Charge-Off

Rate, 30+ Day Delinquency Rate, Net Loss, Adjusted EBITDA and

Adjusted Net Income, for the first quarter as follows:

|

Metric |

Preliminary |

Guidance |

|

|

|

|

1Q24 |

1Q24 |

|

1Q23 |

|

Total Revenue |

$248 - $250 million |

$233 - $238 million |

|

$259.5 million |

|

Annualized Net Charge-Off Rate |

12.0% |

12.1% +/- 15 bps |

|

12.1% |

|

30+ Day Delinquency Rate |

5.2% |

5.1% - 5.3% 2 |

|

5.5% |

|

Net Income (Loss) |

$(30) - $(26) million |

N/A |

|

$(102.1) million |

|

Adjusted EBITDA 1 |

$0 - $4 million |

$(14) - $(12) million |

|

$(20.2) million |

|

Adjusted Net Income (Loss) 1 |

$0 - $4 million |

N/A |

|

$(57.7) million |

|

1 Our calculations of Adjusted EBITDA and Adjusted Net Income were

updated in Q1 2024 to more closely align with management’s internal

view of the performance of the business. The Q1 2023 values for

Adjusted EBITDA and Adjusted Net Income shown in the table above

have been revised and presented on a comparable basis. Prior to

these revisions the Q1 2023 values would have been $(24.5) million

and $(88.3) million, respectively. See About Non-GAAP Financial

Measures — Adjusted EBITDA and — Adjusted Net Income (Loss) for

more detail. |

|

2 As indicated on page 11 of the Company's 4Q 2023 Earnings

Presentation. |

|

|

“We are pleased to report preliminary

indications of a strong first quarter,” said Raul Vazquez, CEO of

Oportun. “We expect to deliver a resilient top-line performance

with Total Revenue exceeding the top end of our guidance range by

$10 to $12 million. Our tightened credit posture contributed to

delivering annualized net charge-offs in the bottom half of our

guidance range and below the net charge-off rate from last year.

Additionally, our 30+ Day Delinquency Rate is 21 basis points lower

than last year. On a GAAP basis, we expect Net Loss for the quarter

to have improved by $72 to $76 million compared to last year. Given

strong Total Revenue, improved credit performance and continued

expense discipline, we also expect to be break-even to profitable

on an Adjusted Net Income basis, an increase of $58 to $62 million

over last year. We expect Adjusted EBITDA to be positive and $12 to

$16 million above the top end of our guidance range, a $20 to $24

million increase compared to last year. As these results

demonstrate, we continue to make significant progress towards

driving sustainable, profitable earnings growth, and shareholder

value.”

Improving Credit Trends

In addition, following the Company's July 2022

credit tightening, quarterly vintages continue to outperform prior

vintages in net lifetime loss rate by month on book as set forth

below.

Post-July 2022 credit tightening quarterly

vintages are outperforming prior vintages in net lifetime loss rate

by month on book.

Note: 3Q22 vintage only includes August and

September 2022.

Earnings Release and Conference

Call

Oportun will report earnings for the first

quarter 2024 on Thursday, May 9, 2024 after market close.

Management will host a conference call to discuss first quarter

2024 results at 5:00 p.m. ET (2:00 p.m. PT) on the same today. A

live webcast of the call will be accessible from Oportun’s investor

relations website at investor.oportun.com, and a webcast replay of

the call will be available for one year. The dial-in number for the

conference call is 1-866-604-1698 (toll-free) or 1-201-389-0844

(international). Participants should call in 10 minutes prior to

the scheduled start time.

Preliminary

Information

Numbers are as of March 31, 2024, and are

unaudited, preliminary and subject to change upon completion of the

Company’s closing process. As a result, the Company's final results

may vary materially from the preliminary results included in this

press release. Oportun undertakes no obligation to update or

supplement the information provided in this press release until the

Company releases its financial statements for the three months

ended March 31, 2024. The preliminary financial information

included in this press release reflects the Company's current

estimates based on information available as of the date of this

press release. This preliminary financial and operational

information should not be viewed as a substitute for full financial

statements prepared in accordance with GAAP and is not necessarily

indicative of the results to be achieved for any future periods.

This preliminary financial information could be impacted by the

effects of financial closing procedures, final adjustments, and

other developments.

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven

fintech that puts its 2.2 million members' financial goals within

reach. With intelligent borrowing, savings, and budgeting

capabilities, Oportun empowers members with the confidence to build

a better financial future. Since inception, Oportun has provided

more than $17.8 billion in responsible and affordable credit, saved

its members more than $2.4 billion in interest and fees, and helped

its members save an average of more than $1,800 annually. For more

information, visit Oportun.com.

Forward-Looking

Statements

This press release contains forward-looking

statements. These forward-looking statements are subject to the

safe harbor provisions under the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

contained in this press release, including statements as to future

performance, results of operations and financial position; the

Company's preliminary financial results for the first quarter of

2024; the Company's expectations related to sustainable and

profitable earnings growth and the creation of shareholder value

are forward-looking statements. These statements can be generally

identified by terms such as “expect,” “plan,” “goal,” “target,”

“anticipate,” “assume,” “predict,” “project,” “outlook,”

“continue,” “due,” “may,” “believe,” “seek,” or “estimate” and

similar expressions or the negative versions of these words or

comparable words, as well as future or conditional verbs such as

“will,” “should,” “would,” “likely” and “could.” These statements

involve known and unknown risks, uncertainties, assumptions and

other factors that may cause Oportun’s actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Oportun has based these forward-looking

statements on its current expectations and projections about future

events, financial trends and risks and uncertainties that it

believes may affect its business, financial condition and results

of operations. These risks and uncertainties include those risks

described in Oportun's filings with the Securities and Exchange

Commission, including Oportun's most recent annual report on Form

10-K. These forward-looking statements speak only as of the date on

which they are made and, except to the extent required by federal

securities laws, Oportun disclaims any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events. In light of these risks and

uncertainties, there is no assurance that the events or results

suggested by the forward-looking statements will in fact occur, and

you should not place undue reliance on these forward-looking

statements.

About Non-GAAP Financial

Measures

This press release presents information about

the Company’s Adjusted EBITDA and Adjusted Net Income, which are

non-GAAP financial measures provided as a supplement to the results

provided in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). The Company

believes non-GAAP measures can be useful measures for

period-to-period comparisons of its core business and provide

useful information to investors and others in understanding and

evaluating its operating results. Non-GAAP financial measures are

provided in addition to, and not as a substitute for, and are not

superior to, financial measures calculated in accordance with GAAP.

In addition, the non-GAAP measures the Company uses, as presented,

may not be comparable to similar measures used by other companies.

Reconciliations of non-GAAP to GAAP measures can be found

below.

As previously announced on March 12, 2024,

beginning with the quarter ended March 31, 2024 the Company has

updated it's calculation of Adjusted EBITDA and Adjusted Net Income

for all periods. Comparable prior period Non-GAAP financial

measures are included in addition to the previously reported

metrics.

Adjusted EBITDA

The Company defines Adjusted EBITDA as net

income, adjusted to eliminate the effect of certain items as

described below. The Company believes that Adjusted EBITDA is an

important measure because it allows management, investors and its

board of directors to evaluate and compare operating results,

including return on capital and operating efficiencies, from period

to period by making the adjustments described below. In addition,

it provides a useful measure for period-to-period comparisons of

Oportun's business, as it removes the effect of income taxes,

certain non-cash items, variable charges and timing

differences.

- The Company

believes it is useful to exclude the impact of income tax expense,

as reported, because historically it has included irregular income

tax items that do not reflect ongoing business operations.

- The Company

believes it is useful to exclude depreciation and amortization and

stock-based compensation expense because they are non-cash

charges.

- The Company

believes it is useful to exclude the impact of interest expense

associated with the Company's corporate financing facilities,

including the senior secured term loan and the residual financing

facility, as it views this expense as related to its capital

structure rather than its funding.

- The Company

excludes the impact of certain non-recurring charges, such as

expenses associated with our workforce optimization, and other

non-recurring charges because it does not believe that these items

reflect ongoing business operations. Other non-recurring charges

include litigation reserve, impairment charges, debt amendment and

warrant amortization costs related to our corporate financing

facilities.

- The Company also

excludes fair value mark-to-market adjustments on its loans

receivable portfolio and asset-backed notes carried at fair value

because these adjustments do not impact cash.

Adjusted Net Income

The Company defines Adjusted Net Income as net

income adjusted to eliminate the effect of certain items as

described below. The Company believes that Adjusted Net Income is

an important measure of operating performance because it allows

management, investors, and the Company's board of directors to

evaluate and compare its operating results, including return on

capital and operating efficiencies, from period to period,

excluding the after-tax impact of non-cash, stock-based

compensation expense and certain non-recurring charges.

- The Company

believes it is useful to exclude the impact of income tax expense

(benefit), as reported, because historically it has included

irregular income tax items that do not reflect ongoing business

operations. The Company also includes the impact of normalized

income tax expense by applying a normalized statutory tax

rate.

- The Company

believes it is useful to exclude the impact of certain

non-recurring charges, such as expenses associated with our

workforce optimization, and other non-recurring charges because it

does not believe that these items reflect its ongoing business

operations. Other non-recurring charges include litigation reserve,

impairment charges, debt amendment and warrant amortization costs

related to our corporate financing facilities.

- The Company

believes it is useful to exclude stock-based compensation expense

because it is a non-cash charge.

- The Company also

excludes the fair value mark-to-market adjustment on its

asset-backed notes carried at fair value to align with the 2023

accounting policy decision to account for new debt financings at

amortized cost.

Reconciliation of Non-GAAP Financial

Measures

Adjusted

EBITDA

| |

Three Months Ended March 31, |

|

(dollars in millions) |

2024 |

|

2023* |

|

Net income (loss) |

$ (30) - (26) |

|

|

$ (102.1) |

|

Adjustments: |

|

|

|

|

Income tax expense (benefit) |

(5.1) - (4.0) |

|

|

(39.4) |

|

Interest on corporate financing (1) |

13.9 |

|

|

9.8 |

|

Depreciation and amortization |

13.2 |

|

|

13.4 |

|

Stock-based compensation expense |

4.0 |

|

|

4.5 |

|

Workforce optimization expenses |

0.8 |

|

|

6.8 |

|

Other non-recurring charges (1) |

3.5 |

|

|

2.3 |

|

Fair value mark-to-market adjustment |

(0.3) - (1.4) |

|

|

84.5 |

|

Adjusted EBITDA |

$ 0.0 - 4.0 |

|

$ |

(20.2) |

| |

|

|

|

|

(1) Certain prior-period financial information has been

reclassified to conform to current period presentation. |

|

* Our calculation of Adjusted EBITDA was updated in Q1 2024 to more

closely align with management’s internal view of the performance of

the business. The Q1 2023 value for Adjusted EBITDA shown in the

table above has been revised and presented on a comparable basis.

Prior to these revisions the Q1 2023 value would have been $(24.5)

million. |

|

|

Adjusted Net Income

(Loss)

| |

Three Months Ended March 31, |

|

(dollars in millions) |

2024 |

|

2023* |

|

Net income (loss) |

$ (30) - (26) |

|

|

$ (102.1) |

|

Adjustments: |

|

|

|

|

Income tax expense (benefit) |

(5.1) - (4.0) |

|

|

(39.4) |

|

Stock-based compensation expense |

4.0 |

|

|

4.5 |

|

Workforce optimization expenses |

0.8 |

|

|

6.8 |

|

Other non-recurring charges (1) |

3.5 |

|

|

2.3 |

|

Mark-to-market adjustment on ABS notes |

26.8 - 27.2 |

|

|

48.9 |

|

Adjusted income before taxes |

$0.0 - 5.5 |

|

|

(79.0) |

|

Normalized income tax expense |

0.0 - 1.5 |

|

|

(21.3) |

|

Adjusted Net Income (Loss) |

$0.0 - 4.0 |

|

$ |

(57.7) |

| |

|

|

|

|

(1) Certain prior-period financial information has been

reclassified to conform to current period presentation. |

|

* Our calculation of Adjusted Net Income (Loss) was updated in Q1

2024 to more closely align with management’s internal view of the

performance of the business. The Q1 2023 value for Adjusted Net

Income (Loss) shown in the table above has been revised and

presented on a comparable basis. Prior to these revisions the Q1

2023 value would have been $(88.3) million. |

|

|

Note: Numbers may not foot or cross-foot

due to rounding.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8d6d544f-423e-48a1-9824-96954d850d4b

Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Media Contact

Usher Lieberman

(720) 987-9538

usher.lieberman@oportun.com

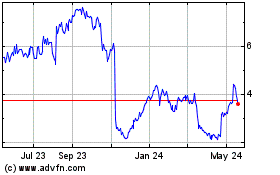

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

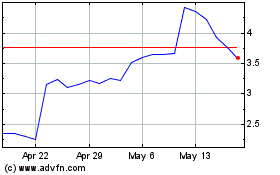

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025