Oportun Holiday Savings Report Reveals Consumers Saved More For This Holiday Season

21 November 2024 - 12:00AM

Oportun (Nasdaq: OPRT) today shared results from its 2024

Holiday Savings Report showing that annual holiday have been higher

than standard and people are now using set-aside funds to pay for

holiday expenses. The report analyzes member year-over-year savings

amounts and behaviors for those savings goals tagged as “holiday”

in its Set & SaveTM product.

“The 2024 Holiday Savings Report shows that setting goals and

saving towards them works,” said Oportun Head of Savings, Annie Ma.

“Our members have saved hundreds of dollars for holiday spending

this year – more than they have in recent years – and we believe

they are now withdrawing that to avoid taking on debt.”

Key findings from the 2024 report indicate:

- Members generally begin creating holiday savings goals each

summer.

- In summer 2024, members saved an average of $396 towards

holiday goals, an approximately 30% increase compared to summer

2023.

- As of Q3 2024, members had withdrawn an average of $325 from

their holiday savings, demonstrating the product’s support for

intentional, debt-free spending.

- In 2024, members saved an average of $150 within the first

30-days of creating a goal labeled as holiday savings.

- Hawaii, Washington, and California led in highest holiday

savings per user in 2024.

- Members who created more than one holiday savings goal in 2024

have saved 13% more on average than members with just one holiday

savings goal.

“Digging deeper, the report also holds a silver lining for those

who have yet to begin saving,” continued Ma. “With an average

savings of $150 in the first 30 days of creating a goal, there’s

still time to save for this holiday season or to have cash on hand

to pay off that first post-holiday credit card statement.”

Named the #1 savings app for 2024 by Bankrate, Set & Save

helps members automatically set aside money for an unlimited number

of savings goals. Using artificial intelligence (AI), its smart

savings feature learns member income and spending habits to

identify and then automatically transfers “safe-to-save” funds into

a separate savings account.

Oportun members have saved more than $11 billion in total using

Set & Save since 2015, with an average annual savings of $1,800

per member.

For more information about Oportun, visit

https://oportun.com.

About OportunOportun (Nasdaq: OPRT) is a

mission-driven fintech that puts its members' financial goals

within reach. With intelligent borrowing, savings, and budgeting

capabilities, Oportun empowers members with the confidence to build

a better financial future. Since inception, Oportun has provided

more than $18.2 billion in responsible and affordable credit, saved

its members more than $2.4 billion in interest and fees, and helped

its members save an average of more than $1,800 annually. For more

information, visit Oportun.com.

ContactsInvestor ContactDorian

Hare(650) 590-4323ir@oportun.com

Media ContactMichael

AzzanoCosmo PR for Oportun(415) 596-1978michael@cosmo-pr.com

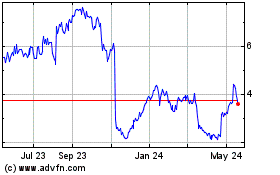

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

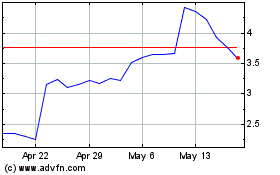

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025