Oatly Announces Further Progress on its Asset-Light Supply Chain Strategy

18 December 2024 - 8:00PM

Oatly Group AB (Nasdaq: OTLY) (“Oatly” or the “Company”), the

world’s original and largest oat drink company, today announced the

closure of its Singapore facility in the Europe & International

segment. This action aligns with the Company’s asset-light supply

chain strategy and is expected to improve the Company’s future cost

structure and reduce future capital expenditure needs.

Jean-Christophe Flatin, Oatly’s CEO, commented: “Over the past

two years, our supply chain teams have done a good job at improving

utilization, efficiency, and reliability while also finding

solutions to enable us to gradually expand capacity when needed to

support our growing business. These actions have led to strong

service rates and improved gross margins. Additionally, our prior

decision to separate our Greater China business from the rest of

the Asian business has enabled us to increase our local focus and

competitiveness, which has led to significant improvements in the

health of our Greater China segment.”

He continued, “We expect that the action we are announcing today

will capitalize on those collective improvements and further

strengthen our ability to ensure that we have the right amount of

capacity, when we need it, while being efficient with our capital

and costs. We also expect the continued simplification of our

operations to enable us to sharpen our focus on execution as we

drive toward consistent, structural profitable growth and

ultimately deliver on our Company’s mission. On behalf of the

entire Oatly team, I want to express my deep gratitude to the team

at the Singapore plant for the work they have done over the

years.”

Closure of Singapore FacilityAs part of the

Company’s ongoing evaluation of its Asian supply chain network, the

Company has decided to close its manufacturing facility in

Singapore, subject to any applicable lender approvals. The facility

is part of the Europe & International segment. Following the

closure of the facility, the expected growth in the segment’s

Asia-Pacific region will be supported by the segment’s existing

facilities in Europe. These actions are expected to further

increase capacity utilization of the European factories within the

Europe & International segment.

As part of the closure of the Singapore facility, the Company

expects to incur non-cash impairment charges of approximately $20

to $25 million in the fourth quarter 2024. In addition, the Company

estimates restructuring and other exit costs will result in $25 to

$30 million of net cash outflows through 2027, after taking into

consideration anticipated proceeds from selling certain equipment.

The Company expects to accrue for these costs in the fourth quarter

2024.

The closure of the facility is expected to improve the Company’s

future cost structure and reduce future capital expenditure

needs. The Company will discuss additional details on its

fourth quarter earnings call in early 2025.

About OatlyWe are the world’s original and

largest oat drink company. For over 25 years, we have exclusively

focused on developing expertise around oats: a global power crop

with inherent properties suited for sustainability and human

health. Our commitment to oats has resulted in core technical

advancements that enabled us to unlock the breadth of the dairy

portfolio, including alternatives to milks, ice cream, yogurt,

cooking creams, and spreads. Headquartered in Malmö, Sweden, the

Oatly brand is available in more than 20 countries globally.

For more information, please visit www.oatly.com.

Contacts Oatly Group AB +46 418 47 55 00investors@oatly.com

info@oatly.com

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Any express or

implied statements contained in this press release that are not

statements of historical fact may be deemed to be forward-looking

statements, including, without limitation, statements regarding our

financial outlook for 2024, profitability improvement, long-term

growth strategy, expected capital expenditures, anticipated returns

on our investments, anticipated supply chain performance,

anticipated impact of our improvement plans, anticipated impact of

our decision to discontinue construction of certain production

facilities, plans to achieve profitable growth and anticipated cost

savings as well as statements that include the words “expect,”

“intend,” “plan,” “believe,” “project,” “forecast,” “estimate,”

“may,” “should,” “anticipate,” “will,” “aim,” “potential,”

“continue,” “is/are likely to” and similar statements of a future

or forward-looking nature. Forward-looking statements are neither

promises nor guarantees, but involve known and unknown risks and

uncertainties that could cause actual results to differ materially

from those projected, including, without limitation: successful

exit and closure of the Singapore facility and receipt of any

applicable lender approvals, our history of losses and inability to

achieve or sustain profitability; including due to elevated

inflation and increased costs for transportation, energy and

materials; reduced or limited availability of oats or other raw

materials and ingredients that meet our quality standards; failure

to obtain additional financing to achieve our goals or failure to

obtain necessary capital when needed on acceptable terms, or at

all; failure of the financial institutions in which we hold our

deposits; damage or disruption to our production facilities; harm

to our brand and reputation as a result of real or perceived

quality or food safety issues with our products; food safety and

food-borne illness incidents or other safety concerns which may

lead to lawsuits, product recalls or regulatory enforcement

actions; our ability to successfully compete in our highly

competitive markets; reduction in the sales of our oat drink

varieties; failure to effectively navigate our shift to an

asset-light business model; failure to meet our existing or new

environmental metrics and other risks related to sustainability and

corporate social responsibility; litigation, regulatory actions or

other legal proceedings including environmental and securities

class action lawsuits and settlements; changes to international

trade policies, treaties and tariffs; global conflict, including

the ongoing wars in Ukraine and Israel; changes in our tax rates or

exposure to additional tax liabilities or assessments; supply chain

delays, including delays in the receipt of product at factories and

ports, and an increase in transportation costs; the impact of

rising commodity prices, transportation and labor costs on our cost

of goods sold; failure by our logistics providers to deliver our

products on time, or at all; our ability to successfully execute

our cost reduction activities in accordance with our expectations

and the impact of such actions on our company; failure to develop

and maintain our brand; our ability to introduce new products or

successfully improve existing products; failure to retain our

senior management or to attract, train and retain employees;

cybersecurity incidents or other technology disruptions; risks

associated with our operations in the People’s Republic of China;

the success of our strategic reset in Asia; failure to protect our

intellectual property and other proprietary rights adequately; our

ability to successfully remediate previously disclosed material

weaknesses or other future control deficiencies, in our internal

control over financial reporting; impairments of the value of our

assets; potential delisting from Nasdaq; our status as a foreign

private issuer; risks related to the significant influence of our

largest shareholder, Nativus Company Limited, entities affiliated

with China Resources Verlinvest Health Investment Ltd. has over us,

including significant influence over decisions that require the

approval of shareholders; and the other important factors discussed

under the caption “Risk Factors” in our Annual Report on Form 20-F

for the year ended December 31, 2023 filed with the U.S. Securities

and Exchange Commission (“SEC”) on March 22, 2024 and our other

filings with the SEC as such factors may be updated from time to

time. Any forward-looking statements contained in this press

release speak only as of the date hereof and accordingly undue

reliance should not be placed on such statements. Oatly disclaims

any obligation or undertaking to update or revise any

forward-looking statements contained in this press release, whether

as a result of new information, future events or otherwise, other

than to the extent required by applicable law.

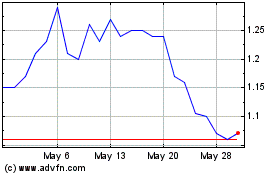

Oatly Group AB (NASDAQ:OTLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Oatly Group AB (NASDAQ:OTLY)

Historical Stock Chart

From Jan 2024 to Jan 2025