Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 September 2024 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 6-K

__________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File Number: 001-40401

__________________________

Oatly Group AB

(Translation of registrant’s name into English)

__________________________

Ångfärjekajen 8

211 19 Malmö

Sweden

(Address of principal executive office)

__________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Nasdaq Notification Regarding Minimum Bid Price Requirement

Oatly Group AB (“Oatly” or the “Company”) received a notification on September 5, 2024, from the Nasdaq Stock Market (“Nasdaq”) that the Company is not in compliance with the minimum bid price requirements of Nasdaq Listing Rule 5450(a)(1) (the “Notice”).

The Notice has no immediate effect on the listing of the Company’s American depositary shares (“ADSs”) or its business operations. The Company is currently considering its options, with the intention to remedy the noncompliance in due time.

The Company has received the Notice because, according to the Notice, for the 30 consecutive business days preceding September 4, 2024, the bid price of the Company’s ADSs had closed below the $1.00 per share minimum bid price required for continued listing on Nasdaq (the “Minimum Bid Price Requirement”). Under Nasdaq Listing Rule 5810(c)(3)(A), if during the 180 calendar day period following September 5, 2024 (the “Compliance Period”), the closing bid price of the Company’s ADSs is at least $1.00 for a minimum of 10 consecutive business days, the Company will regain compliance with the Minimum Bid Price Requirement and its ADSs will continue to be eligible for listing on Nasdaq absent noncompliance with any other requirement for continued listing.

If the Company does not regain compliance with the Minimum Bid Price Requirement by the end of the Compliance Period, under Nasdaq Listing Rule 5810(c)(3)(A)(ii), the Company may be eligible for an additional 180-day compliance period if it applies to transfer the listing of its ADSs to the Nasdaq Capital Market. To qualify, the Company would be required to meet the continued listing requirement for the market value of its publicly held ADSs and all other initial listing standards for the Nasdaq Capital Market, with the exception of the Minimum Bid Price Requirement, and provide written notice of its intention to cure the minimum bid price deficiency during the second compliance period.

If the Company does not regain compliance with the Minimum Bid Price Requirement by the end of the Compliance Period (or the Compliance Period as may be extended) the Company’s ADSs will be subject to delisting.

Forward looking statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any express or implied statements contained in this document that are not statements of historical fact may be deemed to be forward-looking statements, including statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate,” “will,” “aim,” “potential,” “continue,” “is/are likely to” and similar statements of a future or forward-looking nature. Forward-looking statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties that could cause actual results to differ materially from those projected, including, without limitation: general economic conditions including high inflationary cost pressures; our history of losses and inability to achieve or sustain profitability; any failure to obtain necessary capital when needed on acceptable terms; a cybersecurity incident or other technology disruptions; changing consumer preferences and our ability to adapt to new or changing preferences; and the other important factors discussed under the caption “Risk Factors” in Oatly’s Annual Report on Form 20-F for the year ended December 31, 2023 filed with the SEC on March 22, 2024, and other filings with the SEC as such factors may be updated from time to time. Any forward-looking statements contained in this document speak only as of the date hereof and accordingly undue reliance should not be placed on such statements. Oatly disclaims any obligation or undertaking to update or revise any forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

Oatly Group AB |

|

|

|

|

Date: September 6, 2024 |

|

By: |

/s/ Marie-José David |

|

|

|

Marie-José David |

|

|

|

Chief Financial Officer |

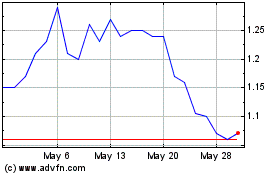

Oatly Group AB (NASDAQ:OTLY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Oatly Group AB (NASDAQ:OTLY)

Historical Stock Chart

From Nov 2023 to Nov 2024