false00018300330001830033us-gaap:CommonStockMember2024-08-082024-08-080001830033us-gaap:MemberUnitsMember2024-08-082024-08-080001830033us-gaap:WarrantMember2024-08-082024-08-0800018300332024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 8, 2024 |

PureCycle Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40234 |

86-2293091 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4651 Salisbury Road, Suite 400 |

|

Jacksonville, Florida |

|

32256 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 877 648-3565 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

PCT |

|

The Nasdaq Stock Market LLC |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share |

|

PCTTW |

|

The Nasdaq Stock Market LLC |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant |

|

PCTTU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, the Company issued a press release, attached hereto as Exhibit 99.1 and incorporated herein by reference, announcing the Company’s financial results for the second quarter ended June 30, 2024, and certain other information.

The information contained in Item 7.01 concerning the presentation to Company’s investors is hereby incorporated into this Item 2.02 by reference.

Item 7.01 Regulation FD Disclosure.

The slide presentation attached hereto as Exhibit 99.2, and incorporated herein by reference, will be presented to certain investors of the Company on August 8, 2024 and may be used by the Company in various other presentations to investors.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PureCycle Technologies, Inc. |

|

|

|

|

Date: |

August 8, 2024 |

By: |

/s/ Jaime Vasquez |

|

|

|

Jaime Vasquez, Chief Financial Officer |

Exhibit 99.1

PURECYCLE PROVIDES SECOND QUARTER 2024 UPDATE

Ironton, Ohio – August 8, 2024 – PureCycle Technologies, Inc. (Nasdaq: PCT), a U.S.-based company revolutionizing plastic recycling, today, announced a corporate update for the second quarter ending June 30, 2024.

Management Commentary

PureCycle CEO Dustin Olson said, “Our team made foundational progress in the second quarter, in terms of production, improving our reliability, and with higher levels of co-product 2 or CP2. All of this has provided a further understanding of how the plant behaves at higher rates. The many improvements made at the Ironton Facility during the planned outage in April resulted in our highest production month in June. We understand there is more work to be done, but we have taken significant steps forward.” Olson added, “On the commercial front, I’m excited about the work we’ve done with compounding. This approach should allow us to make a one-pellet-solution that customers need for their specific application. We have received the first orders for our compounded PureFive™ material.”

Ironton Facility Update

A significant portion of the second quarter was spent making improvements to the Ironton Facility. The upgrades led to greater reliability during the production runs from late-May through June with feedstocks low in CP2. During that time, the Ironton Facility had multiple days with more than 100,000 pounds of pellets produced. When the Company transitioned to a feedstock with higher levels of CP2 in late-June and July, the rates were limited principally by reliability issues and the CP2 recovery and handling system.

The upgrades to the front end of the CP2 removal system made in April are working as designed. The material removed from the system is now consistent in form and density. The current primary limiting factor is reducing the size of the end-product, so it can be removed through an automated process. The Company has begun implementing adjustments to the recovery and handling system and believes once this limitation is removed, production rates should improve throughout the rest of the year.

In the meantime, the Company is continuing to pursue higher throughput by purchasing feedstock low in CP2 and sorting feedstocks for higher quality material. The Company has already installed one optical flake-sorting line that helps to reduce the CP2 in the feed. PureCycle expects to have an additional, larger flake-sorting line installed by the end of September. The combined output for the two lines is expected to be more than four million pounds per month.

PureCycle Commercial Update

The production during the second quarter has provided PureCycle’s commercial team with the opportunity to introduce the Company’s recycled resin to more markets. One avenue that should provide greater flexibility is through compounding. By blending the PureCycle resin with post-industrial recycled material or virgin polypropylene, compounded material provides a more consistent product, should simplify the customer approval process, and is expected to increase the ability to bring higher levels of recycled product to the market.

PureCycle is working with several partners that specialize in the development and production of recyclate-based polymers with similar performance properties and consistency to virgin resin. PureCycle will be offering multiple PureFive grades to customers that include a blend of PureCycle resin and varying levels of post-industrial recycled material or virgin polypropylene.

PureCycle Financials Update

PureCycle ended the second quarter of fiscal 2024 with approximately $10.9 million of unrestricted cash. On August 7, PureCycle reached an agreement on the sale of $22.5 million notional amount of its Southern Ohio Port Authority Revenue Bonds that will provide cash proceeds of $18.0 million.

###

PureCycle Contact

Christian Bruey

cbruey@purecycle.com

+1 (352) 745-6120

About PureCycle Technologies

PureCycle Technologies LLC., a subsidiary of PureCycle Technologies, Inc., holds a global license for the only patented solvent-driven purification recycling technology, developed by The Procter & Gamble Company (P&G), that is designed to transform polypropylene plastic waste (designated as No. 5 plastic) into a continuously renewable resource. The unique purification process removes color, odor, and other impurities from No. 5 plastic waste resulting in an ultra-pure recycled (UPR) plastic that can be recycled and reused multiple times, changing our relationship with plastic. www.purecycle.com

Forward-Looking Statements

This press release contains forward-looking statements, including statements about the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability

and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia; (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT’s ability to procure, sort and process polypropylene plastic waste at its planned plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.

Second Quarter 2024�Corporate Update August 8, 2024 Exhibit 99.2

Forward-Looking Statements This press release contains forward-looking statements, including statements about the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia; (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT’s ability to establish, sort and process polypropylene plastic waste at its plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the current conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.

Q2 Highlights Record monthly production in June with low CP2 feedstock; continued progress in pushing unit production rates higher – reached 8,000 lbs./hr. feed rates and 11,000 lbs./hr. product rates. Lower production in July resulted principally from needed CP2 modifications Commissioned the outage reliability improvements during May to July Good progress with CP2 removal from high pressure system; indications of >20,000 lbs./day of removal capacity. Some bottlenecks in low pressure system – further improvements are slated for install 12-16 August At this time, we do not see any need for incremental outages in Ironton this year First orders secured for compounded PureFive material Received expanded FDA LNO to cover A-H Conditions of Use with broader range of food contact feedstock Strong interest from fiber customers; building a pipeline of sales into this commercial lane Expanded commercial operations to include compounding of PureFive with Virgin and/or PIR streams with three partners; plan to produce up to 2.8MM lbs./month of compounded material in Q4 PureCycle plans to offer multiple PureFive grades to customers; 100% Recycle and 50% Recycle/50% Virgin. The Recycle stream will be a mixture of PIR and PCR Agreement to sell $22.5MM revenue bonds to support ongoing operations Expect to market remaining bonds in Q4 this year; $117.5MM revenue bonds remain on balance sheet Operations Commercial Finance Overview Ironton Market Finance

Ironton Purification Facility Update Q2 Overview Q3 to Date Overview July production was delayed because we redesigned the low pressure CP2 system to alleviate handling constraints We did successfully commission the high pressure CP2 upgrades in July (level indication and piping arrangements); indications of >20k lbs./day removal capacity Q3 Plan Focus has shifted from outage and commissioning to increasing production and sales Team Goals: Feed Rate: 10k lbs./hr. Production: 200k lbs./day, 1MM lbs./week April Dedicated entirely to Reliability Improvement Outage May Restarted facility on 20-May; balance of month used to commission reliability improvement projects June Most successful operating month; 1.1MM lbs. production - stronger uptime with repeatable operational performance Overview Ironton Market Finance

Post-Outage Operations have Improved Core Production Support Operations June 2024 13 days in a row – Final product pelletization 25 out of 30 – Calendar days running 134k lbs – Peak daily production July 2024 Successful CP2 removal from system - Indications of >20k lbs./day 8,000 lbs./hr. – Max feed rate to system 11,000 lbs./hr. – Max pelletization Rate 2024 Solvent circ. reliability is >98%; Mid-2023 <40% Utility plant reliability is >98%; Mid-2023 <25% Overview Ironton Market Finance Outage Improvements are Working Well Rotating Equipment Added back-up power supply to multiple key seal systems Added liquid entrainment protection to prevent vacuum pump failures Product Transfer Valve New valve is installed and working better Commissioning setbacks impacted site reliability in July Co-Product 2 Instrumentation Settler level instrumentation is working reliably Piping adjustments to transition CP2 from high pressure to low pressure system is working well

Path to Removing CP2 Bottleneck % CP2 in Feed CP2 Removal (lbs./day) 3,000 6,000 9,000 12,000 18,000 24,000 Approximate rPP Production (lbs./day), Capacity = 325,000 lbs./day >10% 26,000 52,000 81,000 107,000 159,000 214,000 5% 55,000 114,000 168,000 227,000 CP2 removal no longer a bottleneck 2% 146,000 292,000 Reduce CP2 in Feedstock Increase CP2 Removal Goal Feedstock Availability Most available #5 bales contain 65-75% PP (i.e. 25-35% CP2) Some producers have invested to improve sortation to 90%+ Original Position Max of 3000 lbs./day removal and >10% CP2 in feed Current Position Demonstrated CP2 removal performance at 20-22k lbs./day Demonstrated CP2 reduction in feedstock to 3% with Flake sorting Operations Goals Working to move operations to “Green” production area Overview Ironton Market Finance

Reducing CP2 in Feed to Improve Overall Process Yield Average cost includes the cost of the #5 bale. Also assumes #5 bale pricing of 6 cents per pound at 70% PP concentration Feedstock Quality (%PP) Avg Feed Cost to PCT (cpp) Sourcing higher quality feedstock options Expensive option – not pursuing at this time 90-99 40-65 3rd party operators to advance sort #5 bales 1000-2000 lbs./hr. capacity usable today, 4000-7000 lbs./hr. estimated capacity in Q4 95 14-20 Implementing PCT-owned flake sortation 1000-1500 lbs./hr. capacity usable today, 5000-7500 lbs./hr. estimated capacity in Q4 97 12-15 Overview Ironton Market Finance

What is Compounding? Feeding Extrusion Cooling Pelletizing Combine PureFive resin with recycle or virgin resins and/or additives to achieve specific performance requirements Tailored to meet customer’s specific performance requirements by application Creates product uniformity and consistency Overview Ironton Market Finance

Why Compounding? Should accelerate adoption into a broader range of customer applications Opens new market channels and should increase near-term sales Attractive unit economics on higher volumes Pictures provided by Beverly Knits Tough fabric used for outdoor rugs Multiple designs with different color variations Overview Ironton Market Finance

Compounder Operations PureCycle intends to outsource all compounding operations; 47 compounders within 400 miles of Ironton Select compounder with specific application expertise; most compounders have their own customers Each compounder will have varying levels of capability and experience with recipe development Compounding Addresses Specific Customer Needs Customer Requirements Give customers exactly the product that they want Reduces the barrier to adoption for customers Built for specific customer application Expands MFI index Infrastructure constraints Timeline for adoption Recipe A Recipe B Recipe C PIR or Virgin Specific Additives PureFive PureCycle Operations Feedstock and operational variability drives variability in pellet characteristics Mechanical properties are improved as CP1 and CP2 are removed Good quality, but not perfect for customer applications MFI Color Opacity Overview Ironton Market Finance

Q2 2024 Liquidity Update Unrestricted Cash Uses: $30.0MM net proceeds from May/June Bond sales ($14.2MM) Ironton operations, outage repairs and maintenance ($13.8MM) general corp (non-payroll), legal settlement and other services ($6.7MM) Payroll/benefits ($6.6MM) Augusta and PreP August Revenue Bond Sale Agreement Agreement to sell $22.5MM of Series A Revenue Bonds at $800 per $1000 face value Summary of Liquidity Changes (in MM) Mar. 31, 2024 June 30, 2024 change Unrestricted Cash $25.0 $10.9 $(14.1) Restricted Cash and Investments Ironton Reserves 3.5 3.6 0.1 Augusta Construction Escrow 7.2 2.6 (4.6) Other Corporate Requirements 6.3 6.4 0.1 Total Restricted Cash and Investments $17.0 $12.6 (4.4) Total $42.0 $23.5 ($18.5) Overview Ironton Market Finance

Second Quarter 2024�Corporate Update August 8, 2024

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

PureCycle Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40234

|

| Entity Tax Identification Number |

86-2293091

|

| Entity Address, Address Line One |

4651 Salisbury Road,

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Jacksonville

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32256

|

| City Area Code |

877

|

| Local Phone Number |

648-3565

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001830033

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share

|

| Trading Symbol |

PCTTW

|

| Security Exchange Name |

NASDAQ

|

| Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant

|

| Trading Symbol |

PCTTU

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_MemberUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

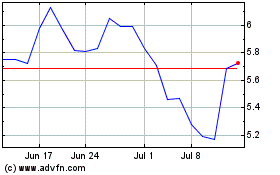

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Oct 2024 to Nov 2024

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Nov 2023 to Nov 2024