false

--12-31

0001356090

NASDAQ

0001356090

2024-12-27

2024-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 27, 2024

Precigen,

Inc.

(Exact name of registrant as specified in its

charter)

| Virginia |

|

001-36042 |

|

26-0084895 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

20374

Seneca Meadows Parkway, Germantown,

Maryland 20876

(Address of principal executive offices) (Zip

Code)

(301) 556-9900

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, No Par Value |

|

PGEN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

The information contained in Item 8.01 of this Report on Form 8-K (this

“Report”) is incorporated by reference into this Item 1.01.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The information contained in Item 8.01 of this Report is incorporated

by reference into this Item 3.02.

| Item 3.03 |

Material Modification to Rights of Security Holders. |

The information contained in Item 8.01 of this Report is incorporated

by reference into this Item 3.03.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The information contained in Item 8.01 of this Report is incorporated

by reference into this Item 5.03.

| Item 7.01 |

Regulation FD Disclosure. |

A copy of Precigen’s press release announcing the transactions

described in this Report is furnished as Exhibit 99.1 to this Report and is incorporated by reference into this Item 7.01.

On December 30, 2024, Precigen issued a press release titled “Precigen Completes Submission of BLA with Request for Priority Review

to the FDA for PRGN-2012 for the Treatment of Adults with Recurrent Respiratory Papillomatosis.” A copy of the press release is

furnished as Exhibit 99.2 to this Report and is incorporated by reference into this Item 7.01.

On December 27, 2024, Precigen, Inc. (“Precigen”)

announced that it had entered into a Securities Purchase Agreement dated December 27, 2024 (the “Purchase Agreement”) with

investors, including Randal J. Kirk, its executive chairman of the board of directors, affiliates of Patient Capital Management and Bill

Miller, as well as certain other investors (the “Investors”) for the sale of its 8.00% Series A Convertible Perpetual Preferred

Stock (“Preferred Stock”) and warrants (“Warrants”) to purchase 52,666,669 shares of its common stock, no par

value per share (“Common Stock”) at an exercise price of $0.75 per share (the “Exercise Price”) in a private placement.

Precigen sold an aggregate of 79,000 shares of Preferred Stock, with an initial liquidation preference and stated value of $1,000 per

share, together with the Warrants, for gross proceeds of $79.0 million, prior to deducting offering expenses. Precigen expects to use

the net proceeds of the offering for working capital and general corporate purposes. The offering closed on December 30, 2024.

On December 27, 2024, Precigen filed articles of amendment (the “Articles

of Amendment”) to its Amended and Restated Articles of Incorporation with the State Corporation Commission of the Commonwealth of

Virginia (the “SCC”), including a form of certificate for the Preferred Stock (the “Form of Certificate”), to

establish the preferences, limitations and relative rights of the Preferred Stock. The Articles of Amendment became effective following

the issuance of a Certificate of Amendment by the SCC to Precigen on December 30, 2024.

Dividends on the Preferred Stock will be paid annually

in cash when, as and if declared by the board of directors of Precigen, except that for the first two years following the issue date of

the Preferred Stock, such dividends will be paid in kind in the form of an increase to the stated value and the liquidation preference

of the Preferred Stock by the amount of such dividends, together with Warrants to acquire a number of additional shares of Common Stock

equal to 50% of the amount of such dividends divided by the Exercise Price, subject to Shareholder Approval (as defined below). The Preferred

Stock will be redeemable, in whole or in part, for cash at Precigen’s option at any time on or after the issue date. The redemption

price will be equal to the stated value of the Preferred Stock to be redeemed, plus accumulated and unpaid dividends, if any, to, but

excluding, the redemption date. If a “fundamental change” (as defined in the Articles of Amendment) occurs, then holders of

the Preferred Stock may require Precigen to repurchase their shares of Preferred Stock for cash. The repurchase price will be equal to

the stated value of the shares of Preferred Stock to be repurchased, plus accumulated and unpaid dividends, if any, to, but excluding,

the repurchase date.

The Preferred Stock will be convertible into Common

Stock at the option of the holders of the Preferred Stock at any time on or after the later of the six-month anniversary of the issue

date of the Preferred Stock and the date on which Precigen has, among other things, obtained Shareholder Approval. The Warrants are exercisable

for shares of Common Stock at any time after such Shareholder Approval. The Preferred Stock will also be convertible into Common Stock

at Precigen’s option at any time on or after the third anniversary of the issue date of the Preferred Stock, but only if the closing

sale price per share of Common Stock equals or exceeds $4.00 for a specified period of time and certain other conditions are satisfied.

The Preferred Stock is initially convertible into

shares of Common Stock at a conversion rate of 888.8888 shares of Common Stock per $1,000 of stated value, for an initial conversion price

of approximately $1.125 per share. However, if the arithmetic average of the closing sale prices of the Common Stock over the five trading

day period ending on, and including, the last trading day of the fiscal quarter immediately preceding any conversion date exceeds the

conversion price otherwise in effect on such conversion date, then the conversion rate for purposes of such conversion will be a number

of shares of Common Stock per $1,000 of stated value equal to $1,000 divided by such arithmetic average. The conversion rate is subject

to customary adjustments.

The Preferred Stock has no maturity date, ranks senior to the outstanding

shares of Common Stock with respect to the payment of dividends and distributions in liquidation and has a liquidation preference equal

to its stated value plus any accrued and unpaid dividends (whether or not declared). Subject to certain limited exceptions, the Preferred

Stock and the Warrants are not transferrable for six months.

Precigen has agreed that it will use its best efforts to hold a special

meeting or an annual meeting of shareholders to obtain (1) any shareholder approval that may be required under the listing rules of the

Nasdaq Global Select Market, (2) any shareholder approval that may be required to increase the number of authorized shares of Common Stock

sufficient to permit the exercise of the Warrants and to permit the conversion of the Preferred Stock into the maximum number of shares

of Common Stock deliverable upon conversion of all shares of Preferred Stock no later than 180 days after December 30, 2024 and (3) the

filing with the SCC and effectiveness of an amendment to Precigen’s Amended and Restated Articles of Incorporation evidencing such

shareholder approval (collectively, the “Shareholder Approval”). If such Shareholder Approval is not obtained at the first

such special meeting or annual meeting, Precigen has agreed that it will use its best efforts to call a special meeting or annual meeting

every 90 days following the date of the most recent such meeting to seek such approval until the earlier of the date such Shareholder

Approval is obtained or the Warrants and the Preferred Stock are no longer outstanding.

The Preferred Stock and the Warrants have not been registered under

the Securities Act of 1933, as amended (the “Securities Act”), or any state’s securities laws and were issued and sold

in a private placement pursuant to Section 4(a)(2) of the Securities Act. Neither the Preferred Stock nor the Warrants may be offered

or sold in the United States, except pursuant to an effective registration statement or an applicable exemption from the registration

requirements of the Securities Act. Precigen has entered into a registration rights agreement (the “Registration Rights Agreement”)

affording the Investors certain registration rights in respect of the Preferred Stock, the Common Stock issuable upon conversion of the

Preferred Stock and the Common Stock issuable upon exercise of the Warrants.

The foregoing summaries of the Articles of Amendment, the Form of Certificate,

the Purchase Agreement, the Form of the Warrant and the Registration Rights Agreement do not purport to be complete and are subject to

and qualified in their entirety by reference to the full text of each such document, which are attached hereto as Exhibits 3.1, 4.1, 10.1,

10.2, and 10.3 and incorporated by reference herein.

This Report shall not constitute an offer to sell or a solicitation

of an offer to buy the Preferred Stock, the Warrants or the Common Stock, nor shall there be any sale of the Preferred Stock or the Warrants

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of any such state or

jurisdiction.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

| 3.1 |

Articles of Amendment to the Amended and Restated Articles of Incorporation of Precigen, Inc., filed with the State Corporation Commission of the Commonwealth of Virginia and effective on December 30, 2024 |

| 4.1 |

Form of Certificate for the 8.00% Series A Convertible Perpetual Preferred Stock (included as Exhibit A to Exhibit 3.1) |

| 10.1 |

Securities Purchase Agreement, dated December 27, 2024 between Precigen Inc. and the Investors party thereto. |

| 10.2 |

Registration Rights Agreement, dated December 30, 2024 between Precigen Inc. and the Investors party thereto. |

| 10.3 |

Form of Common Stock Purchase Warrant. |

| 99.1 |

Press release of Precigen, Inc., dated December 27, 2024, announcing the private placement of convertible preferred stock and warrants to purchase common stock. |

| 99.2 |

Press release of Precigen, Inc., dated December 30, 2024, announcing completion of submission for a biologics license application

to the FDA for PRGN-2012. |

| 104 |

Cover Page Interactive Data File (formatted as inline XBRL with applicable

taxonomy extension information contained in Exhibits 101).

|

Forward Looking Statements

Some of the statements made in this Report are forward-looking

statements. These forward-looking statements are based upon Precigen’s current expectations and projections about future events,

including the intended use of proceeds of the private placement. Various factors may cause differences between Precigen’s expectations

and actual results. These risks and uncertainties include, without limitation, risks and uncertainties related to Precigen’s broad

discretion in the use of proceeds. For further information on potential risks and uncertainties, and other important factors, any of which

could cause Precigen’s actual results to differ from those contained in the forward-looking statements, see the section entitled

“Risk Factors” in Precigen’s most recent Annual Report on Form 10-K and subsequent reports filed with the Securities

and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Precigen, Inc. |

| |

|

| |

|

|

| |

By: |

/s/ Donald P. Lehr |

| |

|

Donald P. Lehr |

| |

|

Chief Legal Officer |

Dated: December 30, 2024

Exhibit

3.1

ARTICLES OF AMENDMENT

TO THE

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

PRECIGEN, INC.

1. Name

of Corporation. The name of the Corporation is Precigen, Inc.

2. Text

of Amendment. Article III of the Corporation’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation”)

shall be amended to add Article III.D. as set forth in Appendix A attached hereto, stating the terms, including the preferences,

rights and limitations, of the Corporation’s 8.00% Series A Convertible Perpetual Preferred Stock (the “Series A Preferred

Stock”).

3. Adoption

and Date of Adoption. Pursuant to Section 13.1-639A of the Virginia Stock Corporation Act (the “VSCA”), Article

III of the Articles of Incorporation permits the Corporation’s Board of Directors to amend the Articles of Incorporation in order

to establish the terms, including the preferences, rights and limitations, of one or more series of the Corporation’s authorized

class of preferred stock without the approval of the Corporation’s shareholders.

The

Corporation certifies that the foregoing amendment was adopted on December 27, 2024, by the Corporation’s Board of Directors without

shareholder approval pursuant to the above-referenced section of the VSCA and the Articles of Incorporation. The Corporation has not

issued any shares of the Series A Preferred Stock as of the date hereof.

4. Effective

Date and Time. Pursuant to Section 13.1-606 of the VSCA, the effective time and date of these Articles of Amendment shall be 9:15

a.m. Eastern Time on December 30, 2024.

[Signature

page follows]

IN

WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be signed by its authorized officer on December 27, 2024.

| |

PRECIGEN,

INC. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Donal P. Lehr |

| |

|

Name: |

Donald P. Lehr |

| |

|

Title: |

Chief Legal Officer |

APPENDIX

A

D. 8.00%

Series A Convertible Perpetual Preferred Stock

There

shall be a series of Preferred Stock having the designation and the powers, preferences and relative, participating, optional and other

special rights and the qualifications, limitations and restrictions thereof as follows:

1.

Designation and Amount; Ranking.

(a)

There shall be created from the 25,000,000 shares of preferred stock, no par value per share, of the Corporation authorized to

be issued pursuant to the Articles of Incorporation, a series of preferred stock, designated as “8.00% Series A Convertible Perpetual

Preferred Stock” no par value per share (the “Preferred Stock”), and the authorized number of shares of Preferred

Stock shall be 81,000. Shares of Preferred Stock that are purchased or otherwise acquired by the Corporation, or that are converted into

shares of Common Stock, shall be cancelled and shall revert to authorized but unissued shares of Preferred Stock.

(b)

The Preferred Stock, with respect to dividend rights and rights upon the liquidation, winding-up or dissolution of the Corporation,

ranks: (i) senior to all Junior Stock; (ii) on a parity with all Parity Stock; and (iii) junior to all Senior Stock, in each case as

provided more fully herein.

2.

Definitions. As used in this Article III.D with respect to the Preferred Stock, the following terms shall have the following

meanings:

(a)

“Accumulated Dividends” shall mean, with respect to any share of Preferred Stock, as of any date, the aggregate

accumulated and unpaid dividends (excluding any Accumulated PIK Dividend Amount by which the Stated Value has been increased on a PIK

Dividend Payment Date pursuant to Section 3(a)) on such share from the Issue Date until such date. There shall be no Accumulated Dividends

with respect to any share of Preferred Stock prior to the Issue Date.

(b)

“Accumulated PIK Dividend Amount” shall mean, as of any PIK Dividend Payment Date, the amount of dividends

per share of Preferred Stock calculated at the Dividend Rate for the period from, and including, the immediately preceding PIK Dividend

Payment Date (or, if there is no immediately preceding PIK Dividend Payment Date, from, and including, the Issue Date) to, but excluding,

such PIK Dividend Payment Date.

(c)

“Additional Conversion Amount” shall have the meaning specified in Section 11.

(d)

“Affiliate” shall have the meaning ascribed to it, on the date hereof, under Rule 144 of the Securities Act.

(e)

“Agent Members” shall have the meaning specified in Section 13(a)(ii).

(f)

“Articles of Incorporation” shall mean the Amended and Restated Articles of Incorporation of the Corporation,

as they may be further amended, modified or restated from time to time.

(g)

“Board of Directors” shall mean the board of directors of the Corporation or, with respect to any action to

be taken by the Board of Directors, any committee of the Board of Directors duly authorized to take such action.

(h)

“Business Day” shall mean any day other than a Saturday, Sunday or other day on which the Federal Reserve Bank

of New York is authorized or required by law or executive order to close or be closed.

(i)

“Capital Stock” shall mean, for any entity, any and all shares, interests, rights to purchase, warrants, options,

participations or other equivalents of or interests in (however designated) stock issued by that entity (excluding, for the avoidance

of doubt, any convertible or exchangeable debt securities, which, prior to conversion or exchange rank senior in right of payment to

the Preferred Stock).

(j)

“Certificated Preferred Stock” shall mean physical Preferred Stock in fully registered, certificated form.

(k)

“close of business” shall mean 5:00 p.m. (New York City time).

(l)

“Closing Sale Price” of the Common Stock on any date shall mean the closing sale price per share (or if no

closing sale price is reported, the average of the closing bid and ask prices or, if more than one in either case, the average of the

average closing bid and the average closing ask prices) on such date as reported in composite transactions for the principal United States

national or regional securities exchange on which the Common Stock is traded or, if the Common Stock is not listed for trading on a United

States national or regional securities exchange on the relevant date, the last quoted bid price for the Common Stock in the over-the-counter

market on the relevant date, as reported by OTC Markets Group Inc. or a similar organization. In the absence of such a quotation, the

Closing Sale Price shall be the average of the mid-point of the last bid and ask prices for the Common Stock on the relevant date from

each of at least three nationally recognized independent investment banking firms selected by the Corporation for this purpose.

(m)

“Common Stock” shall mean the common stock, no par value per share, of the Corporation, subject to Section

9(g).

(n)

“Common Equity” of any Person shall mean Capital Stock of such Person that is generally entitled (i) to vote

in the election of directors of such Person or (ii) if such Person is not a corporation, to vote or otherwise participate in the selection

of the governing body, partners, managers or others that will control the management or policies of such Person.

(o)

“Conversion Date” shall have the meaning specified in Section 9(b).

(p)

“Conversion Price” shall mean, at any time, $1,000 divided by the Conversion Rate in effect at such

time.

(q)

“Conversion Rate” shall mean a number of fully paid and nonassessable shares of Common Stock equal to 888.8888

per $1,000 of Stated Value.

(r)

“Corporation” shall mean Precigen, Inc., a Virginia corporation.

(s)

“Distributed Property” shall have the meaning specified in Section 9(d)(iii).

(t)

“Dividend Payment Date” shall mean January 15 of each year, commencing on January 15, 2026.

(u)

“Dividend Period” shall mean the period from, and including, each Dividend Payment Date to, but excluding,

the next succeeding Dividend Payment Date, except for the initial “Dividend Period,” which shall be the period from,

and including, the Issue Date to, but excluding, January 15, 2026.

(v)

“Dividend Rate” shall mean the rate per annum of 8.00% per share of Preferred Stock on the Stated Value.

(w)

“Dividend Record Date” shall mean, with respect to any Dividend Payment Date, the January 1, immediately preceding

such Dividend Payment Date.

(x)

“DTC” or “Depository” shall mean The Depository Trust Company, or any successor depository.

(y)

“Effective Date” shall mean the first date on which the shares of the Common Stock trade on the applicable

exchange or market, regular way, reflecting the relevant share split or share combination, as applicable.

(z)

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

thereunder.

(aa)

“Ex-Date,” when used with respect to any issuance, dividend or distribution on the Common Stock (or other

applicable security), shall mean the first date on which the Common Stock (or other applicable security) trades on the applicable exchange

or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution from the Corporation or,

if applicable, from the seller of the Common Stock (or other applicable security) on such exchange or market (in the form of due bills

or otherwise) as determined by such exchange or market.

(bb)

“Form of Series A Preferred Stock Certificate” means the “Form of Series A Preferred Stock Certificate”

attached hereto as Exhibit A.

(cc)

“Fundamental Change” shall be deemed to have occurred at any time after the Preferred Stock is originally issued

if any of the following occurs:

(i)

a “person” or “group” within the meaning of Section 13(d) of the Exchange Act, other than the Corporation,

the Corporation’s Subsidiaries, the employee benefit plans of the Corporation and its Subsidiaries, the Permitted Holders and any

group that includes the Permitted Holders, files a Schedule TO (or any successor schedule, form or report) or any other schedule, form

or report under the Exchange Act that discloses that such person or group has become the direct or indirect “beneficial owner,”

as defined in Rule 13d-3 under the Exchange Act, of the Corporation’s Common Equity representing more than 50% of the voting power

of the Corporation’s Common Equity;

(ii)

the consummation of:

(A)

any recapitalization, reclassification or change of the Common Stock (other than changes resulting from a subdivision or combination)

as a result of which the Common Stock would be converted into, or exchanged for, cash, securities or other property or assets;

(B)

any share exchange, consolidation or merger of the Corporation pursuant to which the Common Stock will be converted into cash,

securities or other property or assets;

(C)

any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated

assets of the Corporation and its Subsidiaries, taken as a whole, to any Person other than one of the Corporation’s Subsidiaries;

or

(D)

any sale of assets of the Corporation or its Subsidiaries in any single or numerous transaction(s) together representing more

than 35% of the value of the consolidated assets of the Corporation and its Subsidiaries, taken as a whole, as determined in good faith

by the Board of Directors, to any Person other than one of the Corporation’s Subsidiaries; or

(iii)

the shareholders of the Corporation approve any plan or proposal for the liquidation or dissolution of the Corporation;

provided,

however, that a transaction or series of transactions that is solely for the purpose of re-domiciling or otherwise changing the

jurisdiction of incorporation or formation of the Corporation shall not constitute a Fundamental Change.

If

any transaction described above in which the Common Stock is replaced by the Common Equity of another Person occurs, following completion

of any related Fundamental Change Period, references to the Corporation in this definition shall instead be references to such other

Person.

(dd)

“Fundamental Change Company Notice” shall have the meaning specified in Section 5(c).

(ee)

“Fundamental Change Period” shall mean, for any Fundamental Change, the period beginning at the open of business

on the relevant Fundamental Change Effective Date and ending at the close of business on the related Fundamental Change Repurchase Date.

(ff)

“Fundamental Change Repurchase Date” shall have the meaning specified in Section 5(a).

(gg)

“Fundamental Change Repurchase Notice” shall have the meaning specified in Section 5(b).

(hh)

“Fundamental Change Repurchase Price” shall have the meaning specified in Section 5(a).

(ii)

“Fundamental Change Effective Date” shall mean, with respect to any Fundamental Change, the date on which

such Fundamental Change occurs or becomes effective.

(jj)

“Global Preferred Stock” shall have the meaning specified in Section 13(a)(i).

(kk)

“Holder” or “holder” shall mean a holder of record of the Preferred Stock.

(ll)

“Issue Date” shall mean December 30, 2024, the original date of issuance of the Preferred Stock.

(mm)

“Junior Stock” shall mean the Common Stock, all classes of the Corporation’s common stock and each other

class of the Corporation’s Capital Stock or series of preferred stock established after the Issue Date the terms of which do not

expressly provide that such class or series ranks senior to or on a parity with the Preferred Stock as to dividend rights or rights upon

the liquidation, winding-up or dissolution of the Corporation.

(nn)

“Liquidation Preference” shall mean $1,000 per share of Preferred Stock.

(oo)

“Mandatory Conversion Date” shall have the meaning specified in Section 10(b).

(pp)

“Officer” shall mean the Chief Executive Officer, the Chief Financial Officer, the Chief Legal Officer, and

the Chief Operating Officer of the Corporation.

(qq)

“Officers’ Certificate” shall mean a certificate signed by two Officers.

(rr)

“open of business” shall mean 9:00 a.m. (New York City time).

(ss)

“Optional Redemption” shall have the meaning specified in Section 4(a).

(tt)

“Parity Stock” shall mean any class of the Corporation’s Capital Stock or series of preferred stock established

after the Issue Date, the terms of which expressly provide that such class or series will rank on a parity with the Preferred Stock as

to dividend rights and rights upon the liquidation, winding-up or dissolution of the Corporation.

(uu)

“Permitted Holder” means (i) Randal J. Kirk, (ii) the spouse and lineal descendants and spouses of lineal descendants

of Randal J. Kirk, (iii) the estates or legal representatives of any person named in clauses (i) or (ii), (iv) trusts established for

the benefit of any person named in clauses (i) or (ii) and (v) any entity solely owned or controlled, directly or indirectly, by one

or more of the foregoing.

(vv)

“Person” shall mean any individual, corporation, general partnership, limited partnership, limited liability

partnership, joint venture, association, joint-stock company, trust, limited liability company, unincorporated organization or government

or any agency or political subdivision thereof.

(ww)

“PIK Dividend Payment Date” shall mean each of January 15, 2026 and January 15, 2027.

(xx)

“Preferred Stock” shall have the meaning specified in Section 1(a).

(yy)

“Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which

the holders of the Common Stock (or other applicable security) have the right to receive any cash, securities or other property or in

which the Common Stock (or such other security) is exchanged for or converted into any combination of cash, securities or other property,

the date fixed for determination of holders of the Common Stock (or such other security) entitled to receive such cash, securities or

other property (whether such date is fixed by the Board of Directors, statute, contract or otherwise).

(zz)

“Redemption Date” shall have the meaning specified in Section 4(b).

(aaa)

“Redemption Notice” shall have the meaning specified in Section 4(b).

(bbb)

“Redemption Price” shall mean an amount in cash per share of Preferred Stock equal to 100% of the Stated Value,

plus Accumulated Dividends to, but excluding, such Redemption Date.

(ccc)

“Reference Property” shall have the meaning specified in Section 9(g).

(ddd)

“Reorganization Event” shall have the meaning specified in Section 9(g).

(eee)

“Resale Restriction Termination Date” shall have the meaning specified in Section 14(b).

(fff)

“Restricted Securities” shall have the meaning specified in Section 14(a).

(ggg)

“Rule 144” shall mean Rule 144 as promulgated under the Securities Act.

(hhh)

“Scheduled Trading Day” shall mean a day that is scheduled to be a Trading Day on the principal U.S. national

or regional securities exchange or market on which the Common Stock is listed or admitted for trading. If the Common Stock is not so

listed or admitted for trading, “Scheduled Trading Day” means a Business Day

(iii)

“Securities Act” shall mean the Securities Act of 1933, as amended, and the rules and regulations promulgated

thereunder.

(jjj)

“Securities Purchase Agreement” shall mean that certain Securities Purchase Agreement, dated December 27, 2024

between Precigen, Inc. and the investors party thereto, as may be amended, supplemented, restated or otherwise modified from time to

time.

(kkk)

“Senior Stock” shall mean any class of the Corporation’s Capital Stock or series of preferred stock established

after the Issue Date, the terms of which expressly provide that such class or series will rank senior to the Preferred Stock as to dividend

rights or rights upon the liquidation, winding-up or dissolution of the Corporation.

(lll)

“Shareholder Approval Date” shall mean the earliest date on which the Corporation (i) has obtained shareholder

approval (x) to increase the number of authorized shares of Common Stock sufficient to permit the conversion of the Preferred Stock into

the maximum number of shares of Common Stock deliverable upon conversion of all shares of Preferred Stock and (y) to the extent necessary

under the rules of The Nasdaq Global Select Market in order to permit the transactions contemplated by the Securities Purchase Agreement

including the exercise

of the Warrants (as defined therein) and the conversion of the Preferred Stock, and (ii) has filed with the State Corporation Commission

of the Commonwealth of Virginia an amendment to the Articles of Incorporation evidencing such shareholder approval with respect to clause

(i)(x) and which has been declared effective.

(mmm)

“Spin-Off” shall have the meaning specified in Section 9(d)(iii).

(nnn)

“Stated Value” shall mean, initially, an amount per share of the Preferred Stock equal to the Liquidation Preference,

as increased on each PIK Dividend Payment Date by the Accumulated PIK Dividend Amount pursuant to Section 3(a), and as decreased by any

payment of the Accumulated PIK Dividend Amount pursuant to the fourth sentence of Section 3(a).

(ooo)

“Subsidiary” shall mean, with respect to any Person, any corporation, association, partnership or other business

entity of which more than 50% of the total voting power of shares of its Capital Stock or other interests (including partnership interests)

entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers, general partners or trustees

thereof is at the time owned or controlled, directly or indirectly, by (i) such Person, (ii) such Person and one or more Subsidiaries

of such Person or (iii) one or more Subsidiaries of such Person.

(ppp)

“Trading Day” shall mean a day during which trading in the Common Stock generally occurs on The Nasdaq Global

Select Market or, if the Common Stock is not listed on The Nasdaq Global Select Market, on the principal other U.S. national or regional

securities exchange on which the Common Stock is then listed or, if the Common Stock is not listed on a U.S. national or regional securities

exchange, on the principal other market on which the Common Stock is then listed or admitted for trading. If the Common Stock is not

so listed or traded, “Trading Day” shall mean a Business Day.

(qqq)

“Transfer Agent” shall mean Equiniti Trust Company, LLC, acting as the Corporation’s duly appointed transfer

agent, registrar, conversion agent and dividend disbursing agent for the Preferred Stock. The Corporation may, in its sole discretion,

remove the Transfer Agent with 10 days’ prior notice to the Transfer Agent and Holders; provided that the Corporation shall

appoint a successor Transfer Agent who shall accept such appointment prior to the effectiveness of such removal.

(rrr)

“unit of Reference Property” shall have the meaning specified in Section 9(g).

(sss)

“VSCA” shall mean the Virginia Stock Corporation Act.

3.

Dividends.

(a)

Except as provided in the proviso to the immediately succeeding sentence, holders of shares of Preferred Stock shall be entitled

to receive, when, as and if declared by the Board of Directors out of funds of the Corporation legally available for payment, cumulative

dividends in cash at the Dividend Rate.

Dividends

on the Preferred Stock shall be payable annually in arrears at the Dividend Rate, and shall accumulate, whether or not earned or declared,

from the most recent date to which dividends have been paid or added to the Stated Value, as the case may be, or, if no dividends have

been paid or added to the Stated Value, from the Issue Date (whether or not in

any Dividend Period

or Periods any agreements of the Corporation prohibit the current payment of dividends, there shall be funds of the Corporation legally

available for the payment of such dividends or the Corporation declares the payment of dividends), and shall be paid in cash; provided,

however, that on each PIK Dividend Payment Date, the Stated Value shall automatically be increased by the Accumulated PIK Dividend

Amount on such PIK Dividend Payment Date, and holders of the shares of Preferred Stock shall not be entitled to receive dividends in

cash for accumulated dividends added to the Stated Value in accordance with this proviso except upon (1) a payment made at the election

of the Corporation pursuant to the second immediately succeeding sentence, (2) an Optional Redemption, (3) a repurchase upon a Fundamental

Change or (4) the liquidation, winding-up or dissolution of the Corporation, in each case as set forth in this Article III.D. Dividends

other than dividends described in the proviso of the immediately preceding sentence shall be payable in arrears on each Dividend Payment

Date to the holders of record of Preferred Stock as they appear on the Corporation’s stock register at the close of business on

the relevant Dividend Record Date. Accumulations of dividends on shares of Preferred Stock for any past Dividend Periods (including,

at the Corporation’s election, any Accumulated PIK Dividend Amount) may be declared and paid at any time to holders of record of

Preferred Stock not more than 40 nor less than 20 calendar days immediately preceding any Dividend Payment Date and shall not bear interest.

The Corporation shall provide not less than 20 calendar days’ notice prior to any such Dividend Payment Date.

Dividends for any

period shall be computed on the basis of a 360-day year consisting of twelve 30-day months (or for any period less than a full month,

the number of elapsed days).

(b)

No dividend shall be declared or paid upon, or any sum set apart for the payment of dividends upon, any outstanding share of the

Preferred Stock with respect to any Dividend Period unless all dividends for all preceding Dividend Periods (other than Dividend Periods

preceding a PIK Dividend Payment Date) have been declared and paid, or declared and a sufficient sum has been set apart for the payment

of such dividend, upon all outstanding shares of Preferred Stock.

(c)

Except as set forth in the two immediately succeeding paragraphs, no cash dividends or other distributions may be declared, made

or paid, or set apart for payment upon, any Parity Stock or Junior Stock at any time after the last PIK Dividend Payment Date unless

all Accumulated Dividends shall have been or contemporaneously are declared and paid, or are declared and a sum sufficient for the payment

thereof is set apart for such payment, on the Preferred Stock and any Parity Stock for all dividend payment periods ending on or prior

to the date of such declaration, payment, redemption, purchase or acquisition.

Notwithstanding

the immediately preceding paragraph, if full dividends have not been paid on the Preferred Stock and any Parity Stock, dividends may

be declared and paid on the Preferred Stock and such Parity Stock so long as the dividends are declared and paid pro rata so that

the amounts of dividends declared per share on the Preferred Stock and such Parity Stock shall in all cases bear to each other the same

ratio that accumulated and unpaid dividends per share on the shares of Preferred Stock (excluding, for the avoidance of doubt, accumulated

dividends for which the Stated Value has been increased on a PIK Dividend Payment Date pursuant to Section 3(a)) and such Parity Stock

bear to each other at the time of declaration.

In

addition, the limitations set forth in the second immediately preceding paragraph shall not apply to (1) any dividend or distribution

payable in shares of Common Stock or other Junior

Stock; (2) any

dividends or distributions of rights in connection with a shareholders’ rights plan or any redemption or repurchase of rights pursuant

to any shareholders’ rights plan; or (3) the exchange or conversion of Junior Stock for or into other Junior Stock or of Parity

Stock for or into other Parity Stock (with the same or lesser aggregate liquidation preference) or Junior Stock and, in each case, the

payment of cash solely in lieu of fractional shares.

(d)

Holders of shares of Preferred Stock shall not be entitled to any dividend in excess of full cumulative dividends, except as set

forth in Section 9(d).

(e)

If any Dividend Payment Date falls on a day that is not a Business Day, the required payment will be made on the next succeeding

Business Day and no interest or additional dividends on such payment will accrue or accumulate, as the case may be, in respect of the

delay.

(f)

The Holders of shares of Preferred Stock at the close of business on a Dividend Record Date shall be entitled to receive the dividend

payment on those shares on the corresponding Dividend Payment Date notwithstanding the conversion of such shares in accordance with Section 9

following such Dividend Record Date. Shares of Preferred Stock surrendered for conversion pursuant to Section 9 during the period from

the close of business on any Dividend Record Date to the open of business on the immediately following Dividend Payment Date must be

accompanied by funds equal to the amount of dividends (if any) payable on the shares of Preferred Stock so converted on such Dividend

Payment Date to Holders of record on such Dividend Record Date; provided that no such payment need be made if the Corporation

has specified a Redemption Date that is after a Dividend Record Date and on or prior to the Business Day immediately following the corresponding

Dividend Payment Date. Except as provided in the immediately preceding sentence and Sections 10 and 11, the Corporation shall make no

payment or allowance for unpaid dividends, whether or not in arrears, on converted shares of Preferred Stock or for dividends on the

shares of Common Stock issued upon conversion.

4.

Optional Redemption.

(a)

No sinking fund is provided for the Preferred Stock. Subject to Section 4(b), on or after the Issue Date, the Corporation may

redeem (an “Optional Redemption”) for cash all, or any whole number of shares, of the Preferred Stock, at the Redemption

Price in accordance with this Section 4.

(b)

In case the Corporation exercises its Optional Redemption right to redeem all, or any whole number of shares, of the Preferred

Stock pursuant to Section 4(a), it shall fix a date for redemption (each, a “Redemption Date”) and it

or, at its written request received by the Transfer Agent not less than 55 calendar days prior to the Redemption Date (or such shorter

period of time as may be acceptable to the Transfer Agent), the Transfer Agent, in the name of and at the expense of the Corporation,

shall mail or cause to be mailed a notice of such Optional Redemption (a “Redemption Notice”) not less than 30 days

prior to the Redemption Date to each Holder of Preferred Stock at its last address as the same appears on the Corporation’s stock

register; provided, however, that, if the Corporation shall give such notice, it shall also give written notice of the

Redemption Date to the Transfer Agent. The Redemption Date must be a Business Day.

(c)

The Redemption Notice, if mailed in the manner herein provided, shall be conclusively presumed to have been duly given, whether

or not the Holder receives such notice. In any case, failure to give such Redemption Notice by mail or any defect in the Redemption Notice

to the Holder of any share of Preferred Stock designated for redemption shall not affect the validity of the proceedings for the redemption

of any other share of Preferred Stock.

(d)

Each Redemption Notice shall specify:

(i)

the Redemption Date;

(ii)

the Redemption Price;

(iii)

that on the Redemption Date, the Redemption Price will become due and payable upon each share of Preferred Stock, and that any

dividends thereon shall cease to accumulate on and after the Redemption Date;

(iv)

the place or places where such shares of Preferred Stock are to be surrendered for payment of the Redemption Price;

(v)

that Holders may surrender their shares of Preferred Stock for conversion at any time prior to the close of business on the second

Business Day immediately preceding the Redemption Date;

(vi)

the procedures a converting Holder must follow to convert its Preferred Stock;

(vii)

the Conversion Rate;

(viii)

the CUSIP, ISIN or other similar numbers, if any, assigned to such Preferred Stock; and

(ix)

in the case the Preferred Stock is to be redeemed in part only, the number of shares of Preferred Stock to be redeemed and on

and after the Redemption Date, upon surrender of a certificate for any Preferred Stock to be redeemed in part only, a new certificate

for Preferred Stock evidencing a number of shares of Preferred Stock representing the unredeemed portion thereof shall be issued.

A Redemption

Notice shall be irrevocable.

(e)

If any Redemption Notice has been given in respect of the Preferred Stock in accordance with Section 4(b), Holders

of the Preferred Stock shall surrender any shares of Preferred Stock that are to be redeemed and that have not been converted prior to

the related Redemption Date to the Corporation on the Redemption Date at the place or places stated in the Redemption Notice. Prior to

11:00 a.m., New York City time, on the Redemption Date, the Corporation shall deposit with the Transfer Agent an amount of cash (in immediately

available funds if deposited on the Redemption Date), sufficient to pay the Redemption Price of all of the shares of Preferred Stock

to be redeemed on such Redemption Date.

On

the later of the Redemption Date and the date of presentation and surrender by the relevant Holder of the Preferred Stock to be redeemed

at the place or places stated in the

Redemption Notice,

the Corporation shall pay the Redemption Price to such Holder of the Preferred Stock to be redeemed by mailing checks for the amount

payable to the Holders of such shares of Preferred Stock entitled thereto as they shall appear in the share register of the Corporation;

provided, however, that payments to the Depository shall be made by wire transfer of immediately available funds to the

account of the Depository or its nominee. The Transfer Agent shall, promptly after such payment and upon written demand by the Corporation,

return to the Corporation any funds in excess of the Redemption Price.

(f)

If less than all the shares of Preferred Stock then outstanding are to be redeemed, then (x) the shares of Preferred Stock to

be redeemed will be selected by the Transfer Agent as follows: (1) in the case of Global Preferred Stock, in accordance with the applicable

procedures of the Depository; and (2) in the case of Certificated Preferred Stock, by lot or pro rata and (y) if only a portion of a

certificate evidencing Preferred Stock is subject to redemption and some but not all of the shares of Preferred Stock represented by

such certificate are converted, then the shares of Preferred Stock so converted shall be deemed to be from the portion of such certificate

evidencing Preferred Stock that was subject to the redemption. In addition, in the case of a certificate evidencing Preferred Stock

to be redeemed in part only, on and after the Redemption Date, upon surrender by the relevant Holder of such certificate, a new certificate

for Preferred Stock evidencing a number of shares of Preferred Stock representing the unredeemed portion thereof shall be issued

to such Holder.

(g)

From and after the Redemption Date (unless the Corporation shall default in providing for the payment of the Redemption Price),

dividends will cease to accrue on the Preferred Stock that is subject to redemption, the Preferred Stock that is subject to redemption

shall no longer be deemed outstanding and all rights of the Holders of the Preferred Stock that is subject to redemption will terminate,

except the right to receive the Redemption Price payable upon redemption.

(h)

The Corporation shall not be entitled to exercise its right to make an Optional Redemption unless the Redemption Price is paid

solely in cash on the Redemption Date, including with respect to any Accumulated Dividends as of the Redemption Date.

5.

Repurchase Upon a Fundamental Change.

(a)

If a Fundamental Change occurs at any time, each Holder shall have the right, at such Holder’s option, to require the Corporation

to repurchase for cash all of such Holder’s shares of Preferred Stock, or any portion thereof, on the date (the “Fundamental

Change Repurchase Date”) specified by the Corporation that is not less than 15 Scheduled Trading Days nor more than 30 Scheduled

Trading Days following the date of the Fundamental Change Company Notice at a repurchase price equal to 100% of the Stated Value thereof,

plus Accumulated Dividends thereon to, but excluding, such Fundamental Change Repurchase Date (the “Fundamental Change

Repurchase Price”), unless the Fundamental Change Repurchase Date falls after a Dividend Record Date but on or prior to the

Dividend Payment Date to which such Dividend Record Date relates, in which case the Corporation shall instead pay the full amount of

Accumulated Dividends to Holders of record as of such Dividend Record Date, and the Fundamental Change Repurchase Price shall be equal

to 100% of the Stated Value of the Preferred Stock to be repurchased pursuant to this Section 5.

(b)

Repurchases of Preferred Stock under this Section 5 shall be made, at the option of the Holder thereof, upon:

(i)

delivery to the Transfer Agent by a Holder of a duly completed notice (the “Fundamental Change Repurchase Notice”)

in the form set forth in Attachment 2 to Exhibit A hereto, if the Preferred Stock is represented by Certificated Preferred Stock, or

in compliance with the Depository’s procedures for surrendering interests in Preferred Stock, if the Preferred Stock is represented

by Global Preferred Stock, in each case on or before the close of business on the second Business Day immediately preceding the Fundamental

Change Repurchase Date; and

(ii)

delivery of the Preferred Stock, if the Preferred Stock is represented by Certificated Preferred Stock, to the Transfer Agent

at any time after delivery of the Fundamental Change Repurchase Notice (together with all necessary endorsements for transfer) at the

office of the Transfer Agent, or book-entry transfer of the Preferred Stock, if the Preferred Stock is represented by Global Preferred

Stock, in compliance with the procedures of the Depository, in each case such delivery being a condition to receipt by the Holder of

the Fundamental Change Repurchase Price therefor.

The

Fundamental Change Repurchase Notice in respect of any Preferred Stock to be repurchased shall state:

(i)

in the case of Preferred Stock represented by Certificated Preferred Stock, the certificate numbers of the Preferred Stock to

be delivered for repurchase;

(ii)

the number of shares of Preferred Stock to be repurchased; and

(iii)

that the shares of Preferred Stock are to be repurchased by the Corporation pursuant to the applicable provisions hereof;

provided,

however, that if the Preferred Stock is represented by Global Preferred Stock, the Fundamental Change Repurchase Notice must comply

with appropriate Depository procedures.

Notwithstanding

anything herein to the contrary, any Holder delivering to the Transfer Agent the Fundamental Change Repurchase Notice contemplated by

this Section 5(b) shall have the right to withdraw, in whole or in part,

such Fundamental Change Repurchase Notice at any time prior to the close of business on the second Business Day immediately preceding

the Fundamental Change Repurchase Date by delivery of a written notice of withdrawal to the Transfer Agent in accordance with Section

5(d).

The

Transfer Agent shall promptly notify the Corporation of the receipt by it of any Fundamental Change Repurchase Notice or written notice

of withdrawal thereof.

(c)

The Corporation must give notice (a “Fundamental Change Company Notice”) of each Fundamental Change and of

the repurchase right at the option of the Holders arising as a result thereof to all Holders of the Preferred Stock no later than the

Business Day immediately preceding the relevant Fundamental Change Effective Date. In the case of Preferred Stock represented by Certificated

Preferred Stock, such notice shall be by first class mail or, in the case of Preferred Stock represented by Global Preferred Stock, such

notice shall be delivered in accordance with the applicable procedures of the Depository. Simultaneously with providing

such notice, the

Corporation shall publish such information on the Corporation’s website or through such other public medium as the Corporation

may use at that time. Each Fundamental Change Company Notice shall specify:

(i)

the events causing the Fundamental Change;

(ii)

the date of the Fundamental Change;

(iii)

the last date on which a Holder may exercise the repurchase right pursuant to this Section 5;

(iv)

the Fundamental Change Repurchase Price;

(v)

the Fundamental Change Repurchase Date;

(vi)

the name and address of the Transfer Agent and the conversion agent, if applicable;

(vii)

that the shares of Preferred Stock with respect to which a Fundamental Change Repurchase Notice has been delivered by a Holder

may be converted only if the Holder withdraws the Fundamental Change Repurchase Notice in accordance with the terms hereof (unless the

Corporation defaults in the payment of the Fundamental Change Repurchase Price); and

(viii)

the procedures that Holders must follow to require the Corporation to repurchase their Preferred Stock in connection with the

Fundamental Change.

No

failure of the Corporation to give the foregoing notices and no defect therein shall limit the Holders’ repurchase rights or affect

the validity of the proceedings for the repurchase of the Preferred Stock pursuant to this Section

5(c).

At

the Corporation’s request, the Transfer Agent shall give such notice in the Corporation’s name and at the Corporation’s

expense; provided, however, that, in all cases, the text of such Fundamental Change Company Notice shall be prepared by

the Corporation.

(d)

A Fundamental Change Repurchase Notice may be withdrawn (in whole or in part) by means of a written notice of withdrawal delivered

to the office of the Transfer Agent in accordance with this Section 5(d) at any time prior to the close of business on the second Business

Day immediately preceding the Fundamental Change Repurchase Date, specifying:

(i)

the number of shares of Preferred Stock with respect to which such notice of withdrawal is being submitted,

(ii)

if Certificated Preferred Stock has been issued, the certificate number(s) of the shares of Preferred Stock in respect of which

such notice of withdrawal is being submitted, and

(iii)

the number of shares of Preferred Stock represented by such Certificated Preferred Stock that remains subject to the original

Fundamental Change Repurchase Notice;

provided,

however, that if the Preferred Stock is represented by Global Preferred Stock, the notice must comply with appropriate procedures

of the Depository.

(e)

The Corporation will deposit with the Transfer Agent (or other paying agent appointed by the Corporation) prior to 11:00 a.m.,

New York City time, on the Fundamental Change Repurchase Date (in immediately available funds if deposited on the Fundamental Change

Repurchase Date) an amount of money sufficient to repurchase all of the shares of Preferred Stock to be repurchased at the appropriate

Fundamental Change Repurchase Price. Subject to receipt of funds and/or shares of Preferred Stock by the Transfer Agent (or such paying

agent), payment for shares of Preferred Stock surrendered for repurchase (and not withdrawn prior to the close of business on the second

Business Day immediately preceding the Fundamental Change Repurchase Date) will be made on the later of:

(i)

the Fundamental Change Repurchase Date (provided the Holder has satisfied the conditions in Section 5(b)); and

(ii)

the time of book-entry transfer or the delivery of such Preferred Stock to the Transfer Agent by the Holder thereof in the manner

required by Section 5(b) by mailing checks for the amount payable to the Holders of such shares of Preferred Stock entitled thereto as

they shall appear in the share register of the Corporation;

provided,

however, that payments to the Depository shall be made by wire transfer of immediately available funds to the account of the Depository

or its nominee. The Transfer Agent shall, promptly after such payment and upon written demand by the Corporation, return to the Corporation

any funds in excess of the Fundamental Change Repurchase Price.

(f)

If by 11:00 a.m., New York City time, on the Fundamental Change Repurchase Date, the Transfer Agent (or other paying agent appointed

by the Corporation) holds money sufficient to make payment on all the shares of Preferred Stock that are to be repurchased on such Fundamental

Change Repurchase Date, then, with respect to the shares of Preferred Stock that have been properly surrendered for repurchase and have

not been validly withdrawn, such shares will cease to be outstanding, dividends will cease to accumulate on such shares (whether or not

book-entry transfer of such shares has been made or the shares have been delivered to the Transfer Agent) and all other rights of the

Holders of such shares of Preferred Stock will terminate (other than the right to receive the Fundamental Change Repurchase Price and,

if applicable, Accumulated Dividends).

(g)

Upon surrender of shares of Preferred Stock represented by Certificated Preferred Stock to be repurchased in part pursuant to

this Section 5, the Corporation shall execute and the Transfer Agent shall authenticate and deliver to the Holder new certificate(s)

representing such Preferred Stock in an authorized denomination equal in number to the unrepurchased number of shares so surrendered.

(h)

If the Corporation does not have legally available funds sufficient to pay the Fundamental Change Repurchase Price in cash, the

Corporation will, as soon as the Corporation is legally able to do so, pay such unpaid amount in cash.

6.

[Reserved.]

7.

Voting. (a) Holders of the Preferred Stock will not have voting rights except those described in Section 7 below and as

specifically required by the VSCA or by the Articles of Incorporation.

(b)

So long as any shares of Preferred Stock are outstanding, in addition to any other vote or consent of shareholders required by

law or by the Articles of Incorporation, the affirmative vote or consent of the holders of at least a majority of the outstanding shares

of Preferred Stock, voting as a single class, given in person or by proxy, either in writing without a meeting or by vote at any meeting

called for the purpose, shall be necessary for effecting or validating:

(i)

any amendment or alteration of the Articles of Incorporation so as to authorize or create, or increase the authorized amount of,

any class or series of Senior Stock or any class or series of Parity Stock;

(ii)

any amendment, alteration or repeal of any provision of the Articles of Incorporation so as to materially and adversely affect

the rights, preferences, privileges or voting powers of the Preferred Stock; or

(iii)

any consummation of a binding share exchange or reclassification involving the Preferred Stock, or of a merger or consolidation

of the Corporation with or into another Person, unless, in each case:

(x) the

shares of Preferred Stock remain outstanding and are not amended in any respect (except to the extent required pursuant to the terms

of the Articles of Incorporation) or

(y) in

the case of any such merger or consolidation with respect to which the Corporation is not the surviving or resulting entity, the shares

of Preferred Stock are converted into or exchanged for preference securities of the surviving or resulting entity or its ultimate parent,

and such preference securities have such rights, preferences, privileges and voting powers, taken as a whole, that are not materially

less favorable to the holders thereof than the rights, preferences, privileges and voting powers of the Preferred Stock immediately prior

to such consummation, taken as a whole;

provided,

however, that for all purposes of this Section 7(b), any increase in the amount of the Corporation’s authorized Preferred

Stock or the creation or issuance of any shares of Parity Stock or Junior Stock, or any increase in the amount of authorized shares of

Parity Stock or Junior Stock, shall not be deemed to materially and adversely affect the rights, preferences, privileges or voting powers

of Holders of shares of Preferred Stock specified herein and shall not require the affirmative vote or consent of Holders of the Preferred

Stock.

(c)

Without the consent of the Holders of the Preferred Stock, the Corporation may amend, alter, supplement or repeal any terms of

the Preferred Stock by amending or supplementing the Articles of Incorporation or any stock certificate representing shares of the Preferred

Stock:

(i)

to cure any ambiguity, omission, inconsistency or mistake in any such agreement or instrument (including any provision contained

in this Article III.D); or

(ii)

to make any other change that does not adversely affect the rights, preferences, privileges or voting powers of any Holder in

any material respect (other than any Holder that consents to such change).

8.

Liquidation Rights.

(a)

In the event of any liquidation, winding-up or dissolution of the Corporation, whether voluntary or involuntary, each Holder of

shares of Preferred Stock shall be entitled to receive and to be paid out of the assets of the Corporation available for distribution

to its shareholders the Stated Value plus Accumulated Dividends to the date fixed for liquidation, winding-up or dissolution in

preference to the holders of, and before any payment or distribution is made on, any Junior Stock, including, without limitation, the

Common Stock.

(b)

Neither the sale (for cash, shares of stock, securities or other consideration) of all or substantially all the assets or business

of the Corporation (other than in connection with the liquidation, winding-up or dissolution of the Corporation) nor the merger or consolidation

of the Corporation into or with any other Person shall be deemed to be a liquidation, winding-up or dissolution, voluntary or involuntary,

for the purposes of this Section 8.

(c)

After the payment to the Holders of the shares of Preferred Stock of full preferential amounts provided for in this Section 8,

the Holders of Preferred Stock as such shall have no right or claim to any of the remaining assets of the Corporation.

(d)

In the event the assets of the Corporation available for distribution to the Holders of shares of Preferred Stock and holders

of shares of Parity Stock upon any liquidation, winding-up or dissolution of the Corporation, whether voluntary or involuntary, shall

be insufficient to pay in full all amounts to which such Holders are entitled pursuant to this Section 8, no such distribution

shall be made on account of any shares of Parity Stock upon such liquidation, dissolution or winding-up unless proportionate distributable

amounts shall be paid on account of the shares of Preferred Stock, equally and ratably, in proportion to the full distributable amounts

for which holders of all Preferred Stock and of any Parity Stock are entitled upon such liquidation, winding-up or dissolution.

9.

Conversion.

(a)

The shares of Preferred Stock shall not be convertible by any Holder at any time prior to the later of the Shareholder Approval

Date and the six-month anniversary of the Issue Date. On or after the later of the Shareholder Approval Date and the six-month anniversary

of the Issue Date, each Holder of Preferred Stock shall have the right at any time, at its option, to convert, subject to the terms and

provisions of this Section 9, any or all of such Holder’s shares of Preferred Stock into Common Stock at the Conversion

Rate. Upon conversion of any share of Preferred Stock, the Corporation shall deliver to the converting Holder, in respect of each $1,000

of Stated Value of each share of Preferred Stock being converted, a number of shares of Common Stock equal to the Conversion Rate, together

with a cash payment in lieu of any fractional share of Common Stock in accordance with Section 12, on the second Business Day immediately

following the relevant Conversion Date, subject to Section 9(d)(iii) and Section 9(d)(v). Notwithstanding anything to the contrary herein,

if as of the Conversion Date (or

Mandatory Conversion

Date, as applicable) for any conversion the arithmetic average of the Closing Sale Prices of the Common Stock for each Trading Day during

the period of five consecutive Trading Days ending on, and including, the last Trading Day of the immediately preceding fiscal quarter

(subject to appropriate adjustment for any event described in Section 9(d)(i) that has occurred during or subsequent to such period)

exceeds the Conversion Price otherwise in effect on such Conversion Date (or Mandatory Conversion Date, as applicable), then the Conversion

Rate for purposes of such conversion for each $1,000 of Stated Value shall be deemed to be equal to $1,000 divided by such arithmetic

average (as adjusted, if applicable).

(b)

Before any Holder shall be entitled to convert a share of Preferred Stock as set forth above, such Holder shall:

(i)

in the case of a beneficial interest in a Global Preferred Stock, comply with the procedures of the Depository in effect at that

time; and

(ii)

in the case of Certificated Preferred Stock:

(1)

complete, manually sign and deliver an irrevocable notice to the office of the conversion agent as set forth in the Form of Notice

of Conversion (or a facsimile thereof) in the form set forth in Attachment 1 to Exhibit A hereto (a “Notice of Conversion”)

and state in writing therein the number of shares of Preferred Stock to be converted and the name or names (with addresses) in which

such Holder wishes the certificate or certificates for any shares of Common Stock to be delivered to be registered,

(2)

surrender such shares of Preferred Stock, at the office of the conversion agent; and

(3)

if required, furnish appropriate endorsements and transfer documents. The conversion agent shall notify the Corporation of any

conversion pursuant to this Section 9 on the Conversion Date for such conversion.

The date on which

a Holder complies with the procedures in this Section 9(b) is the “Conversion Date.” If more than one share

of Preferred Stock shall be surrendered for conversion at one time by the same Holder, the number of shares of Common Stock to be delivered

upon conversion of such shares of Preferred Stock shall be computed on the basis of the aggregate number of shares of Preferred Stock

so surrendered.

(c)

Immediately prior to the close of business on the Conversion Date with respect to a conversion, a converting Holder of Preferred

Stock shall be deemed to be the holder of record of the Common Stock issuable upon conversion of such Holder’s Preferred Stock

notwithstanding that the share register of the Corporation shall then be closed or that certificates representing such Common Stock shall

not then be actually delivered to such Holder. On any Conversion Date, all rights with respect to the shares of Preferred Stock so converted,

including the rights, if any, to receive notices, will terminate, excepting only the rights of holders thereof to:

(i)

receive certificates for the number of whole shares of Common Stock into which such shares of Preferred Stock have been converted

(with a cash payment in lieu of any fractional share of Common Stock in accordance with Section 12); and

(ii)

exercise the rights to which they are thereafter entitled as holders of Common Stock.

(d)

The Conversion Rate shall be adjusted, without duplication, upon the occurrence of any of the following events, except that the

Corporation shall not make any adjustments to the Conversion Rate if Holders of the Preferred Stock may participate (other than in the

case of (x) a share split or share combination or (y) a tender or exchange offer), at the same time and upon the same terms as holders

of the Common Stock and solely as a result of holding the Preferred Stock, in any of the transactions described in this Section 9(d),

without having to convert their Preferred Stock, as if they held a number of shares of Common Stock equal to the Conversion Rate, multiplied

by the number of shares of Preferred Stock held by such Holder:

(i)

If the Corporation exclusively issues shares of Common Stock as a dividend or distribution on all shares of its Common Stock,

or if the Corporation effects a share split or share combination, the Conversion Rate shall be adjusted based on the following formula:

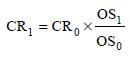

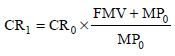

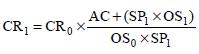

where,

| |

CR0 |

= |

the Conversion Rate in effect immediately prior to the close of business on the Record Date for such dividend or distribution, or immediately prior to the open of business on the Effective Date of such share split or share combination, as the case may be; |

| |

|

|

|

| |

CR1 |

= |

the Conversion Rate in effect immediately after the close of business on the Record Date for such dividend or distribution, or immediately after the open of business on the Effective Date of such share split or share combination, as the case may be; |

| |

|

|

|

| |

OS0 |

= |

the number of shares of Common Stock outstanding immediately prior to the close of business on the Record Date for such dividend or distribution, or immediately prior to the open of business on the Effective Date of such share split or share combination, as the case may be (in each case, before giving effect to any such dividend, distribution, split or combination); and |

| |

|

|

|

| |

OS1 |

= |

the number of shares of Common Stock outstanding immediately after giving effect to such dividend or distribution, or such share split or share combination, as the case may be. |

Any

adjustment made under this Section 9(d)(i) shall become effective immediately after the close of business on the Record Date for such

dividend or distribution, or immediately after the open of business on the Effective Date for such share split or share combination,

as the case may be. If any dividend or distribution of the type described in this Section 9(d)(i) is declared but not so paid or made,

the Conversion Rate shall be immediately readjusted, effective as of the date the Board of Directors determines not to pay such dividend

or distribution, to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

(ii)

If the Corporation distributes to all or substantially all holders of its Common Stock any rights, options or warrants entitling

them, for a period expiring not more than 60 days immediately following the announcement date of such distribution, to purchase or subscribe

for shares of its Common Stock at a price per share that is less than the average of the Closing Sale Prices of the Common Stock over

the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the announcement date of such distribution,

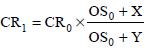

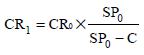

the Conversion Rate shall be increased based on the following formula:

where,

| |

CR0 |

= |

the Conversion Rate in effect immediately prior to the close of business on the Record Date for such distribution; |

| |

|

|

|

| |

CR1 |

= |

the Conversion Rate in effect immediately after the close of business on the Record Date for such distribution; |

| |

|

|

|

| |

OS0 |

= |

the number of shares of Common Stock outstanding immediately prior to the close of business on the Record Date for such distribution; |

| |

|

|

|

| |

X |

= |

the total number of shares of Common Stock issuable pursuant to such rights, options or warrants; and |

| |

|

|

|

| |

Y |

= |

the number of shares of Common Stock equal to the aggregate price payable to exercise such rights, options or warrants, divided by the average of the Closing Sale Prices of the Common Stock over the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the announcement date of such distribution. |

Any

increase made under this Section 9(d)(ii) shall be made successively whenever any such rights, options or warrants are distributed and

shall become effective immediately after the close of business on the Record Date for such distribution.

To

the extent that shares of Common Stock are not delivered after the expiration of such rights, options or warrants, the Conversion Rate

shall be readjusted, effective as of the date of such expiration, to the Conversion Rate that would then be in effect had the increase

with respect to the distribution of such rights, options or warrants been made on the basis of delivery of only the number of shares

of Common Stock actually delivered. If such rights, options or warrants are not so distributed, the Conversion Rate shall be decreased,

effective as of the date the Board of Directors determines not to make such distribution, to be the Conversion Rate that would then be

in effect if such Record Date for such distribution had not occurred.

For

purposes of this Section 9(d)(ii), in determining whether any rights, options or warrants entitle the holders to subscribe for or purchase

shares of Common Stock at less than such average of the Closing Sale Prices of the Common Stock for the 10 consecutive Trading Day period

ending on, and including, the Trading Day immediately preceding the announcement date of such distribution, and in determining the aggregate

offering

price

of such shares of Common Stock, there shall be taken into account any consideration received by the Corporation for such rights, options

or warrants and any amount payable on exercise or conversion thereof, the value of such consideration, if other than cash, to be determined

by the Corporation.

(iii)

If the Corporation distributes shares of its Capital Stock, evidences of its indebtedness or other assets, securities or property

of the Corporation or rights, options or warrants to acquire its Capital Stock or other securities, to all or substantially all holders

of Common Stock, excluding (a) dividends, distributions or issuances described in Section 9(d)(i) or Section 9(d)(ii), (b) dividends