false000109814600010981462025-02-142025-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2025

PATRIOT NATIONAL BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Connecticut | | 000-29599 | | 06-1559137 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

900 Bedford Street

Stamford, Connecticut 06901

(Address of Principal Executive Offices) (Zip Code)

(203) 252-5900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | PNBK | | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Effective as of February 14, 2025, Patriot National Bancorp, Inc., a Connecticut corporation (the “Company”), amended its 8.5% Senior Notes Due 2026 (the “Notes”) to extend the grace period for the interest payment due January 15, 2025 to April 1, 2025 (the “Amendment”). The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the form of the Amendment, which will be filed as an exhibit to the Annual Report on Form 10-K for the year ended December 31, 2024 to be filed with the Securities and Exchange Commission.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated by reference in this Item 2.03.

Item 2.02. Results of Operations and Financial Condition.

The Company is providing the following financial results, on a preliminary unaudited basis, for the quarter ended December 31, 2024.

The Company expects its net loss to be approximately $9.5 million, or approximately $(2.40) basic and diluted loss per share for the quarter ended December 31, 2024, compared to the net income of $0.9 million, or $0.23 basic and diluted earnings per share for the quarter ended December 31, 2023. Book value per share, which is shareholders’ equity divided by outstanding shares, is expected to be approximately $1.07 as of December 31, 2024, compared to $11.16 per share as of December 31, 2023. Financial results for the quarter ended December 31, 2024 are expected to be adversely impacted by an expected provision for credit losses of approximately $7.7 million primarily related to two large commercial real estate loans.

The information contained in this Item 2.02 of the Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as otherwise expressly stated in such filing.

Item 7.01 Regulation FD Disclosure.

The Company has previously announced an evaluation process to consider its strategic alternatives, including a capital raise, sale or merger. The Company has received non-binding term sheets from investors seeking to purchase shares of common stock and preferred stock for an aggregate purchase price of approximately $60 million at the per share purchase price of the lower of $0.75 per share or the NASDAQ closing price on the day immediately preceding the signing of the definitive agreements (the “Proposed Transaction”). The Company is in the process of negotiating the Proposed Transaction, and there is no assurance that the Proposed Transaction will occur or, if undertaken, what the final form, terms or timing of such a transaction will be. If the Proposed Transaction is completed, the Company intends to use the net proceeds to: (i) invest additional capital into its subsidiary Patriot Bank, N.A. (the “Bank”) so that the Bank returns to well-capitalized status and has sufficient capital for stability and growth; (ii) make scheduled interest payments prior to the expiration of the grace period on the Notes pursuant to the Amendment; and (iii) provide the Company with additional capital to, among other things, maintain cash reserves for future debt payments.

The securities that the Company intends to offer and sell in the Proposed Transaction will not be registered under the Securities Act, or any state securities laws and may not be offered or sold without registration under, or an applicable exemption from the registration requirements of, the Securities Act. This Current Report on Form 8-K is neither an offer to sell nor the solicitation of an offer to buy these securities or any other securities of the Company, and no offer, solicitation or sale will be made in any jurisdiction in which, or to any persons to whom, such an offer, solicitation or sale is unlawful. Any offers of these securities will be made only by means of applicable disclosure documents.

The information contained in this Item 7.01 of the Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the Company’s plans, objectives, goals, strategies, business plans, future events or performance. Words such as “anticipates," “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “targets,” “designed,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements.

Because forward-looking statements relate to future results and occurrences, they are subject to inherent risks, uncertainties, changes in circumstances and other factors that are difficult to predict. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding its business, plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Many possible events or factors could affect the Company’s future financial results and performance and could cause its actual results, performance or achievements to differ materially from any anticipated results expressed or implied by such forward-looking statements.

Certain financial data presented in this Current Report on Form 8-K is preliminary, based on the Company’s estimates and projections, has been prepared on the basis of information available to management as of the date of this Form 8-K, and is subject to the review of the Company’s independent registered public accounting firm. Such estimates and projections are based on significant assumptions and subjective judgment concerning anticipated results. These assumptions and judgments are inherently subject to risks, variability and contingencies, many of which are beyond the Company’s control. These assumptions and judgments may or may not prove to be correct and the Company’s actual results could vary significantly from this preliminary financial data due to the completion of the Company’s standard reporting process and preparation of its financial statements as of, and for the period, ended December 31, 2024, as well as other adjustments and developments. In addition, this preliminary financial data does not constitute a comprehensive statement of the Company’s financial results as of, and for the period ended, December 31, 2024, and its final numbers for this period may differ significantly from the data presented above. This preliminary financial data should not be viewed or relied on as a substitute for full financial data, and such preliminary financial data is not necessarily indicative of the final financial results as of, and for the period ended, December 31, 2024 or any financial results to be achieved for any future period.

Given these factors, you should not place undue reliance on these forward-looking statements. All information set forth in this Form 8-K is as of the date of this Form 8-K. The Company undertakes no duty or obligation to update any forward-looking statements contained in this release, whether as a result of new information, future events or changes in its expectations or otherwise, except as may be required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PATRIOT NATIONAL BANCORP, INC. |

| | | |

| February 21, 2025 | By: | /s/ David Lowery |

| | | David Lowery |

| | | Chief Executive Officer |

| | | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

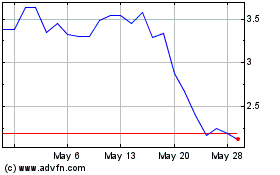

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Patriot National Bancorp (NASDAQ:PNBK)

Historical Stock Chart

From Feb 2024 to Feb 2025