Form SC 13G - Statement of acquisition of beneficial ownership by individuals

01 July 2023 - 6:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. )*

Praxis Precision Medicines, Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of

Securities)

74006W108

(CUSIP Number)

June 21, 2023

(Date of Event

Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

¨

x

¨ |

Rule 13d-1(b)

Rule 13d-1(c)

Rule 13d-1(d) |

*The remainder of this cover page shall

be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of

this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 74006W108 | Page 2

of 17 |

| 1. |

Names of Reporting Persons

Venrock Healthcare Capital Partners III, L.P. |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC

Use Only

|

| 4. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

PN |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable warrants (“Warrants”)

held by Venrock Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415

shares issuable upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC;

and (iii) 3,770,375 shares and 5,011,140 shares issuable upon the exercise of Warrants

held by Venrock Healthcare Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 3

of 17 |

| 1. |

Names of Reporting Persons

VHCP Co-Investment Holdings III, LLC |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC Use Only

|

| 4. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain

Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

OO |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 4

of 17 |

| 1. |

Names of Reporting Persons

Venrock Healthcare Capital Partners EG, L.P. |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC Use Only

|

| 4. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain

Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

PN |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 5

of 17 |

| 1. |

Names of Reporting Persons

VHCP Management III, LLC |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC Use Only

|

| 4. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

OO |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 6

of 17 |

| 1. |

Names of Reporting Persons

VHCP Management EG, LLC |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC

Use Only

|

| 4. |

Citizenship or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

OO |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 7

of 17 |

| 1. |

Names of Reporting Persons

Shah, Nimish |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC Use Only

|

| 4. |

Citizenship or Place of Organization

United States |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 8

of 17 |

| 1. |

Names

of Reporting Persons

Koh, Bong |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) x (1)

(b) ¨ |

| 3. |

SEC

Use Only

|

| 4. |

Citizenship

or Place of Organization

United States |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5. |

Sole Voting Power

0 |

| 6. |

Shared Voting Power

12,354,410 (2) |

| 7. |

Sole Dispositive Power

0 |

| 8. |

Shared Dispositive Power

12,354,410 (2) |

| 9. |

Aggregate Amount Beneficially Owned by Each Reporting Person

12,354,410 (2) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes Certain

Shares (See Instructions) ¨

|

| 11. |

Percent of Class Represented by Amount in Row (9)

9.11% (3) |

| 12. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Venrock Healthcare Capital Partners III,

L.P., VHCP Co-Investment Holdings III, LLC, Venrock Healthcare Capital Partners EG, L.P.,

VHCP Management III, LLC, VHCP Management EG, LLC, Nimish Shah and Bong Koh are members of

a group for the purposes of this Schedule 13G. |

| (2) | Consists of (i) 1,394,530 shares and

1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held by Venrock

Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares issuable

upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and (iii) 3,770,375

shares and 5,011,140 shares issuable upon the exercise of Warrants held by Venrock Healthcare

Capital Partners EG, L.P. |

| (3) | This percentage is calculated based upon

the sum of (i) 128,538,030 shares of Common Stock outstanding as of June 21, 2023

upon the closing of the Issuer’s public offering, as reported in the prospectus supplement

dated June 15, 2023 filed by the Issuer with the Securities and Exchange Commission

on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of the Warrants

described in Footnote 2 above. |

| CUSIP No. 74006W108 | Page 9

of 17 |

| Item 1. |

| |

(a) |

Name of Issuer

Praxis Precision Medicines, Inc. |

| |

| |

(b) |

Address of Issuer’s Principal Executive Offices

99 High Street, 30th Floor, Boston, MA 02110 |

| |

| Item 2. |

| |

(a) |

Name of Person Filing

Venrock Healthcare Capital Partners III, L.P.

VHCP Co-Investment Holdings III, LLC

Venrock Healthcare Capital Partners EG, L.P.

VHCP Management III, LLC

VHCP Management EG, LLC

Nimish Shah

Bong Koh |

| |

(b) |

Address of Principal Business Office or, if none, Residence |

| |

|

|

| |

|

New York Office: |

Palo Alto Office: |

| |

|

|

|

| |

|

7 Bryant Park |

3340 Hillview Avenue |

| |

|

23rd Floor |

Palo Alto, CA 94304 |

| |

|

New York, NY 10018 |

|

| |

(c) |

Citizenship

All of the Venrock Entities were organized

in Delaware. The individuals are both United States citizens. |

| |

| |

(d) |

Title of Class of Securities

Common Stock, par value $0.0001 per share |

| |

| |

(e) |

CUSIP Number

74006W108 |

| |

| Item 3. |

If this statement is filed pursuant to §§240.13d-1(b) or

240.13d-2(b) or (c), check whether the person filing is a: |

| |

|

| |

Not applicable |

| CUSIP No. 74006W108 | Page 10

of 17 |

| Item 4. |

Ownership |

|

| |

|

|

| |

(a) |

Amount beneficially owned: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

12,354,410 (1) |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Management III, LLC |

12,354,410 (1) |

|

| |

|

VHCP Management EG, LLC |

12,354,410 (1) |

|

| |

|

Nimish Shah |

12,354,410 (1) |

|

| |

|

Bong Koh |

12,354,410 (1) |

|

| |

|

| |

(b) |

Percent of class: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

9.11% (2) |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

9.11% (2) |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

9.11% (2) |

|

| |

|

VHCP Management III, LLC |

9.11% (2) |

|

| |

|

VHCP Management EG, LLC |

9.11% (2) |

|

| |

|

Nimish Shah |

9.11% (2) |

|

| |

|

Bong Koh |

9.11% (2) |

|

| |

|

| |

(c) |

Number of shares as to which the person has: |

|

| |

|

|

|

| |

|

(i) Sole power to vote or to direct the vote: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

0 |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

0 |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

0 |

|

| |

|

VHCP Management III, LLC |

0 |

|

| |

|

VHCP Management EG, LLC |

0 |

|

| |

|

Nimish Shah |

0 |

|

| |

|

Bong Koh |

0 |

|

| |

|

| |

|

(ii) Shared power to vote or to direct the vote: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

12,354,410 (1) |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Management III, LLC |

12,354,410 (1) |

|

| |

|

VHCP Management EG, LLC |

12,354,410 (1) |

|

| |

|

Nimish Shah |

12,354,410 (1) |

|

| |

|

Bong Koh |

12,354,410 (1) |

|

| CUSIP No. 74006W108 | Page 11

of 17 |

| |

|

(iii) Sole power to dispose or to direct the disposition of: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

0 |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

0 |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

0 |

|

| |

|

VHCP Management III, LLC |

0 |

|

| |

|

VHCP Management EG, LLC |

0 |

|

| |

|

Nimish Shah |

0 |

|

| |

|

Bong Koh |

0 |

|

| |

|

| |

|

(iv) Shared power to dispose or to direct the disposition of: |

|

| |

|

|

|

| |

|

Venrock Healthcare Capital Partners III, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Co-Investment Holdings III, LLC |

12,354,410 (1) |

|

| |

|

Venrock Healthcare Capital Partners EG, L.P. |

12,354,410 (1) |

|

| |

|

VHCP Management III, LLC |

12,354,410 (1) |

|

| |

|

VHCP Management EG, LLC |

12,354,410 (1) |

|

| |

|

Nimish Shah |

12,354,410 (1) |

|

| |

|

Bong Koh |

12,354,410 (1) |

|

| (1) | Consists of (i) 1,394,530 shares

and 1,853,445 shares issuable upon the exercise of immediately exercisable Warrants held

by Venrock Healthcare Capital Partners III, L.P.; (ii) 139,505 shares and 185,415 shares

issuable upon the exercise of Warrants held by VHCP Co-Investment Holdings III, LLC; and

(iii) 3,770,375 shares and 5,011,140 shares issuable upon the exercise of Warrants held

by Venrock Healthcare Capital Partners EG, L.P. VHCP Management III, LLC is the general partner

of Venrock Healthcare Capital Partners III, L.P. and the manager of VHCP Co-Investment Holdings

III, LLC. VHCP Management EG, LLC is the general partner of Venrock Healthcare Capital Partners

EG, L.P. Messrs. Shah and Koh are the voting members of VHCP Management III, LLC and

VHCP Management EG, LLC. |

| | | |

| | (2) | This percentage is calculated based upon the sum of (i) 128,538,030 shares

of Common Stock outstanding as of June 21, 2023 upon the closing of the Issuer’s public offering,

as reported in the prospectus supplement dated June 15, 2023 filed by the Issuer with the Securities

and Exchange Commission on June 20, 2023 and (ii) 7,050,000 shares issuable upon the exercise of

the Warrants described in Footnote 1 above. |

| Item 5. |

Ownership of Five Percent or Less of a Class |

| |

|

| |

If this statement is being filed to report the fact that as of the date hereof the reporting person

has ceased to be the beneficial owner of more than five percent of the class of securities, check the following ¨ |

| |

| Item 6. |

Ownership of More than Five Percent on Behalf of Another Person |

| |

|

| |

Not applicable |

| |

| Item 7. |

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company

or Control Person |

| |

|

| |

Not applicable |

| CUSIP No. 74006W108 | Page 12

of 17 |

| Item 8. |

Identification and Classification of Members of the Group |

| |

|

| |

Not applicable |

| |

| Item 9. |

Notice of Dissolution of Group |

| |

|

| |

Not applicable |

| |

| Item 10. |

Certification |

| |

By signing below I certify that, to the best of my knowledge and belief, the securities referred

to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer

of the securities and were not acquired and are not held in connection with or as a participant in any transaction having such purpose

or effect. |

| CUSIP No. 74006W108 | Page 13

of 17 |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: June 30, 2023

| Venrock Healthcare Capital Partners III, L.P. |

|

Venrock Healthcare Capital Partners EG, L.P. |

| |

|

|

| By: |

VHCP Management III, LLC |

|

By: |

VHCP Management EG, LLC |

| Its: |

General Partner |

|

Its: |

General Partner |

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| |

|

|

|

|

| VHCP Co-Investment Holdings III, LLC |

|

|

|

| |

|

|

|

| By: |

VHCP Management III, LLC |

|

|

|

| Its: |

Manager |

|

|

|

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

|

|

| |

Name: Sherman G. Souther |

|

|

|

| |

Its: Authorized Signatory |

|

|

|

| |

|

|

|

|

| VHCP Management III, LLC |

|

VHCP Management EG, LLC |

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| |

|

|

|

|

| Nimish Shah |

|

|

|

| |

|

|

|

| /s/ Sherman G. Souther |

|

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

|

| |

|

|

|

| Bong Koh |

|

|

|

| |

|

|

|

| /s/ Sherman G. Souther |

|

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

|

| CUSIP No. 74006W108 | Page 14

of 17 |

EXHIBITS

| A: |

Joint Filing Agreement |

| |

|

| B: |

Power of Attorney for Nimish

Shah |

| |

|

| C: |

Power of Attorney for Bong Koh |

| CUSIP No. 74006W108 | Page 15

of 17 |

EXHIBIT A

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under

the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of each of them of a statement on

Schedule 13G (including amendments thereto) with respect to the Common Stock of Praxis Precision Medicines, Inc. and further agree

that this agreement be included as an exhibit to such filing. Each party to the agreement expressly authorizes each other party to file

on its behalf any and all amendments to such statement. Each party to this agreement agrees that this joint filing agreement may be signed

in counterparts.

In evidence whereof, the undersigned have caused

this Agreement to be executed on their behalf this 30th day of June, 2023.

| Venrock Healthcare Capital Partners III, L.P. |

|

Venrock Healthcare Capital Partners EG, L.P. |

| |

|

|

| By: |

VHCP Management III, LLC |

|

By: |

VHCP Management EG, LLC |

| Its: |

General Partner |

|

Its: |

General Partner |

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| |

|

|

|

|

| VHCP Co-Investment Holdings III, LLC |

|

|

|

| |

|

|

|

| By: |

VHCP Management III, LLC |

|

|

|

| Its: |

Manager |

|

|

|

| |

|

|

|

|

| By: |

/s/ Sherman G. Souther |

|

|

|

| |

Name: Sherman G. Souther |

|

|

|

| |

Its: Authorized Signatory |

|

|

|

| |

|

|

|

|

| VHCP Management III, LLC |

|

VHCP Management EG, LLC |

| |

|

|

| By: |

/s/ Sherman G. Souther |

|

By: |

/s/ Sherman G. Souther |

| |

Name: Sherman G. Souther |

|

|

Name: Sherman G. Souther |

| |

Its: Authorized Signatory |

|

|

Its: Authorized Signatory |

| |

|

|

|

|

| Nimish Shah |

|

|

|

| |

|

|

|

| /s/ Sherman G. Souther |

|

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

|

| |

|

|

|

| Bong Koh |

|

|

|

| |

|

|

|

| /s/ Sherman G. Souther |

|

|

|

| Sherman G. Souther, Attorney-in-fact |

|

|

|

| CUSIP No. 74006W108 | Page 16

of 17 |

EXHIBIT B

POWER OF ATTORNEY FOR NIMISH SHAH

KNOW ALL BY THESE PRESENTS, that the undersigned

hereby constitutes and appoints each of David L. Stepp, Sherman G. Souther and Lisa D. Harris signing individually, the undersigned’s

true and lawful attorney-in fact and agent to:

| (i) | prepare execute and file, for and on

behalf of the undersigned, any and all documents and filings that are required or advisable

to be made with the United States Securities and Exchange Commission, any stock exchange

or similar authority, under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the rules and regulations promulgated thereunder, including without

limitation (a) any Joint Filing Agreement under Rule 13d-1(k) of the Exchange

Act (or any successor provision thereunder), Schedule 13D and Schedule 13G (or any successor

schedules or forms adopted under the Exchange Act ) and any amendments thereto in accordance

with Section 13 of the Exchange Act and the rules thereunder, and (b) Forms

3, 4 and 5 and any amendments thereto in accordance with Section 16(a) of the Exchange

Act and the rules thereunder; and |

| (ii) | take any other action of any nature

whatsoever in connection with the foregoing which, in the opinion of such attorney-in-fact,

may be of benefit, in the best interest of, or legally required by, the undersigned, it being

understood that the documents executed by such attorney-in-fact on behalf of the undersigned

pursuant to this Power of Attorney shall be in such form and shall contain such terms and

conditions as such attorney-in-fact may approve in such attorney-in-fact’s discretion. |

The undersigned hereby grants to such attorney-in-fact

full power and authority to do and perform any and every act and thing whatsoever requisite, necessary, or proper to be done in the exercise

of any of the rights and powers herein granted, as fully to all intents and purposes as the undersigned might or could do if personally

present, with full power of substitution or revocation, hereby ratifying and confirming all that such attorney-in-fact, or such attorney-in-fact’s

substitute or substitutes, shall lawfully do or cause to be done by virtue of this power of attorney and the rights and powers herein

granted. The undersigned acknowledges that the foregoing attorney-in-fact, in serving in such capacity at the request of undersigned,

is not assuming, nor is Venrock assuming, any of the undersigned’s responsibilities to comply with the Exchange Act, including

without limitation Sections 13 and 16 of the Exchange Act.

This power of Attorney shall remain in full force

and effect until the earliest to occur of (a) the undersigned is no longer required to file any form or document with respect to

the undersigned’s holdings of and transactions in securities issued by a company, (b) revocation by the undersigned in a signed

writing delivered to the foregoing attorney-in-fact, or (c) until such attorney-in-fact shall no longer be employed by VR Management,

LLC (or its successor).

IN WITNESS WHEREOF, the undersigned has caused

this Power of Attorney to be executed as of this 30th day of June, 2023.

| CUSIP No. 74006W108 | Page 17

of 17 |

EXHIBIT C

POWER OF ATTORNEY FOR BONG KOH

KNOW ALL BY THESE PRESENTS, that the undersigned

hereby constitutes and appoints each of David L. Stepp, Sherman G. Souther and Lisa D. Harris signing individually, the undersigned’s

true and lawful attorney-in fact and agent to:

| (i) | prepare execute and file, for and on

behalf of the undersigned, any and all documents and filings that are required or advisable

to be made with the United States Securities and Exchange Commission, any stock exchange

or similar authority, under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the rules and regulations promulgated thereunder, including without

limitation (a) any Joint Filing Agreement under Rule 13d-1(k) of the Exchange

Act (or any successor provision thereunder), Schedule 13D and Schedule 13G (or any successor

schedules or forms adopted under the Exchange Act ) and any amendments thereto in accordance

with Section 13 of the Exchange Act and the rules thereunder, and (b) Forms

3, 4 and 5 and any amendments thereto in accordance with Section 16(a) of the Exchange

Act and the rules thereunder; and |

| (ii) | take any other action of any nature

whatsoever in connection with the foregoing which, in the opinion of such attorney-in-fact,

may be of benefit, in the best interest of, or legally required by, the undersigned, it being

understood that the documents executed by such attorney-in-fact on behalf of the undersigned

pursuant to this Power of Attorney shall be in such form and shall contain such terms and

conditions as such attorney-in-fact may approve in such attorney-in-fact’s discretion. |

The undersigned hereby grants to such attorney-in-fact

full power and authority to do and perform any and every act and thing whatsoever requisite, necessary, or proper to be done in the exercise

of any of the rights and powers herein granted, as fully to all intents and purposes as the undersigned might or could do if personally

present, with full power of substitution or revocation, hereby ratifying and confirming all that such attorney-in-fact, or such attorney-in-fact’s

substitute or substitutes, shall lawfully do or cause to be done by virtue of this power of attorney and the rights and powers herein

granted. The undersigned acknowledges that the foregoing attorney-in-fact, in serving in such capacity at the request of undersigned,

is not assuming, nor is Venrock assuming, any of the undersigned’s responsibilities to comply with the Exchange Act, including

without limitation Sections 13 and 16 of the Exchange Act.

This power of Attorney shall remain in full force

and effect until the earliest to occur of (a) the undersigned is no longer required to file any form or document with respect to

the undersigned’s holdings of and transactions in securities issued by a company, (b) revocation by the undersigned in a signed

writing delivered to the foregoing attorney-in-fact, or (c) until such attorney-in-fact shall no longer be employed by VR Management,

LLC (or its successor).

IN WITNESS WHEREOF, the undersigned has caused

this Power of Attorney to be executed as of this 30th day of June, 2023.

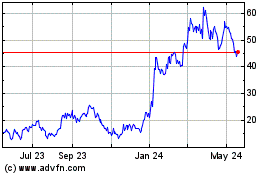

Praxis Precision Medicines (NASDAQ:PRAX)

Historical Stock Chart

From Oct 2024 to Nov 2024

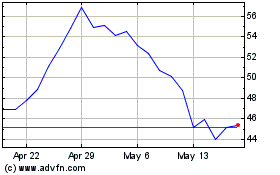

Praxis Precision Medicines (NASDAQ:PRAX)

Historical Stock Chart

From Nov 2023 to Nov 2024