0001588978false00015889782024-10-282024-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2024

PROCEPT BIOROBOTICS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40797 | | 26-0199180 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

900 Island Drive

Redwood City, California 94065

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (650) 232-7200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share | | PRCT | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 28, 2024, PROCEPT BioRobotics Corporation (the "Company") issued a press release announcing its financial results for the quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PROCEPT BIOROBOTICS CORPORATION |

| | | |

Date: October 28, 2024 | | By: | /s/ Alaleh Nouri |

| | | Alaleh Nouri |

| | | Chief Legal Officer and Secretary |

PROCEPT BioRobotics® Reports Third Quarter 2024 Financial Results and

Increases 2024 Revenue and Adjusted EBITDA Guidance

SAN JOSE, Calif., October 28, 2024 -- PROCEPT BioRobotics Corporation (Nasdaq: PRCT) (the “Company”), a surgical robotics company focused on advancing patient care by developing transformative solutions in urology, today reported unaudited financial results for the quarter ended September 30, 2024.

Recent Highlights

•Total revenue of $58.4 million for the third quarter of 2024, an increase of 66% compared to the prior period in 2023

•U.S. handpiece and consumables revenue of $29.6 million for the third quarter of 2024, an increase of 74% compared to the prior period in 2023

•Sold 45 robotic systems in the U.S. in the third quarter of 2024 at an average selling price of approximately $432,000

•U.S. system and rental revenue of $19.6 million for the third quarter of 2024, an increase of 46% compared to the prior period in 2023

•International revenue of $6.2 million, for the third quarter of 2024, an increase of 122% compared to the prior period in 2023

•Reported record gross margin of 63.2% in the third quarter of 2024

•Increased fiscal year 2024 total revenue guidance range to $222.5 million to $223.0 million

•Increased fiscal year 2024 gross margin guidance to 61%

•Increased fiscal year 2024 Adjusted EBITDA guidance to a loss of $60.0 million

“I’m extremely proud of the entire PROCEPT team for their collective effort and execution in launching HYDROS in the third quarter,” said Reza Zadno, Chief Executive Officer. “After receiving HYDROS FDA clearance in August, we successfully converted the third quarter capital pipeline, manufactured sufficient quantities of commercial product, trained our clinical teams while mitigating downside pressure on procedures, and effectively managed customer relationships during this critical phase of our Company's growth. As a result, we delivered another successful quarter with annual revenue growth of 66% and record gross margins of 63.2%.”

Third Quarter 2024 Financial Results

Total revenue for the third quarter of 2024 was $58.4 million, an increase of 66% compared to the prior year period. U.S. revenue was $52.2 million, representing growth of 62% compared to the prior year period. The increase was primarily driven by increased system sales, higher system average selling prices, and increased handpiece and other consumable revenue. U.S. handpiece and consumable revenue for the third quarter of 2024 was $29.6 million, an increase of 74% compared to the prior year period. U.S. system revenue for the third quarter of 2024 was $19.6 million, an increase of 46% compared to the prior year period. As of September 30, 2024, the install base of robotic systems in the U.S. was 445 systems. International revenue was $6.2 million for the quarter, an increase of 122% compared to the prior year period.

Gross margin for the third quarter 2024 was 63.2% compared to 53.8% in the prior year period. Gross margin improvement was primarily due to improved overhead absorption and increased U.S. robotic system average selling prices.

Operating expenses in the third quarter of 2024 were $59.3 million, compared with $44.5 million in the prior year period. The increase was driven by increased sales and marketing expenses primarily to expand the commercial organization and increased research and development expenses.

Net loss was $21.0 million for the third quarter of 2024, compared to a loss of $24.6 million in the prior year period. Adjusted EBITDA was a loss of $12.4 million for the third quarter of 2024, compared to a loss of $19.4 million in the prior year period.

Cash, cash equivalents and restricted cash as of September 30, 2024, totaled $199.8 million.

Full Year 2024 Financial Guidance

•The Company projects revenue for the full year 2024 to be in the range of $222.5 million to $223.0 million, which represents 63% and 64% growth respectfully over the Company’s prior year revenue. This compares to previous revenue guidance of $217.0 million.

•The Company projects full year 2024 gross margin to be approximately 61%. This compares to previous guidance of approximately 59%.

•The Company projects full year 2024 total operating expense of approximately $231.5 million, which is unchanged from previously issued guidance.

•The Company projects full year 2024 Adjusted EBITDA loss to be ($60.0) million. This compares to previous guidance of ($67.5) million.

Adjusted EBITDA is a financial measure that is not prepared in accordance with generally accepted accounting principles in the United States (GAAP). For more information about the Company’s use of non-GAAP financial measures, please see the section below titled “Use of Non-GAAP Financial Measures (Unaudited).”

Webcast and Conference Call Information

PROCEPT BioRobotics will host a conference call to discuss the third quarter 2024 financial results on Monday, October 28, 2024, at 8:00 a.m. Eastern Time.

Investors interested in listening to the conference call may do so by following one of the below links:

•Webcast link for interested listeners:

◦https://edge.media-server.com/mmc/p/yhamkcsz

•Dial-in registration for sell-side research analysts:

◦https://register.vevent.com/register/BI271ff7de75a342d8941d642d1900ba40

About PROCEPT BioRobotics Corporation

PROCEPT BioRobotics is a surgical robotics company focused on advancing patient care by developing transformative solutions in urology. PROCEPT BioRobotics manufactures the AQUABEAM® and HYDROS™ Robotic Systems. The HYDROS Robotic System is the only AI-Powered, robotic technology that delivers Aquablation therapy. PROCEPT BioRobotics designed Aquablation therapy to deliver effective, safe, and durable outcomes for males suffering from lower urinary tract symptoms or LUTS, due to BPH that are independent of prostate size and shape or surgeon experience. BPH is the most common prostate disease and impacts approximately 40 million men in the United States. The Company has developed a significant and growing body of clinical evidence with over 150 peer-reviewed publications, supporting the benefits and clinical advantages of Aquablation therapy.

Use of Non-GAAP Financial Measures (Unaudited)

This press release references Adjusted EBITDA, a financial measure that is not prepared in accordance with generally accepted accounting principles in the United States (GAAP). The Company defines Adjusted EBITDA as earnings before interest expense, taxes, depreciation and amortization and stock-based compensation. Non-GAAP financial measures are not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to any other performance measures derived in accordance with GAAP.

The Company believes that presenting Adjusted EBITDA provides useful supplemental information to investors about the Company in understanding and evaluating its operating results, enhancing the overall understanding of its past performance and future prospects, and allowing for greater transparency with respect to key financial metrics used by its management in financial and operational decision making. However, there are a number of limitations related to the use of non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore any non-GAAP measures the Company uses may not be directly comparable to similarly titled measures of other companies.

Forward Looking Statements

This release contains forward‐looking statements within the meaning of federal securities laws, including with respect to the Company’s projected financial performance for full year 2024, statements regarding the potential utilities, values, benefits and advantages of Aquablation® therapy performed using PROCEPT BioRobotics’ products, including AquaBeam® Robotic System, which involve risks and uncertainties that could cause the actual results to differ materially from the anticipated results and expectations expressed in these forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements are only predictions based on our current expectations, estimates, and assumptions, valid only as of the

date they are made, and subject to risks and uncertainties, some of which we are not currently aware. Forward-looking statements may include statements regarding financial guidance, market opportunity and penetration, the Company’s possible or assumed future results of operations, including descriptions of the Company’s revenues, gross margin, profitability, operating expenses, installed base growth, commercial momentum and overall business strategy. Forward‐looking statements should not be read as a guarantee of future performance or results and may not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. These forward‐looking statements are based on the Company’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward‐looking statements as a result of these risks and uncertainties. These risks and uncertainties are described more fully in the section titled “Risk Factors” in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the Company’s annual report on Form 10-K filed with the SEC on February 28, 2023. PROCEPT BioRobotics does not undertake any obligation to update forward‐looking statements and expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward‐looking statements contained herein. These forward-looking statements should not be relied upon as representing PROCEPT BioRobotics’ views as of any date subsequent to the date of this press release.

Important Safety Information

All surgical treatments have inherent and associated side effects. For a list of potential side effects visit https://aquablation.com/safety-information/

Investor Contact:

Matt Bacso

VP, Investor Relations and Business Operations

m.bacso@procept-biorobotics.com

PROCEPT BioRobotics Corporation

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 58,370 | | | $ | 35,102 | | | $ | 156,262 | | | $ | 92,610 | |

| Cost of sales | | 21,459 | | | 16,228 | | | 62,835 | | | 42,816 | |

| Gross profit | | 36,911 | | | 18,874 | | | 93,427 | | | 49,794 | |

| Operating expenses: | | | | | | | | |

| Research and development | | 16,647 | | | 11,600 | | | 47,232 | | | 33,950 | |

| Selling, general and administrative | | 42,691 | | | 32,883 | | | 123,099 | | | 95,457 | |

| Total operating expenses | | 59,338 | | | 44,483 | | | 170,331 | | | 129,407 | |

| Loss from operations | | (22,427) | | | (25,609) | | | (76,904) | | | (79,613) | |

| Interest expense | | (1,140) | | | (1,019) | | | (3,215) | | | (2,870) | |

| Interest and other income, net | | 2,593 | | | 2,006 | | | 7,562 | | | 4,090 | |

| Net loss | | $ | (20,974) | | | $ | (24,622) | | | $ | (72,557) | | | $ | (78,393) | |

| Net loss per share, basic and diluted | | $ | (0.40) | | | $ | (0.51) | | | $ | (1.41) | | | $ | (1.70) | |

| Weighted-average common shares used to | | | | | | | | |

| Compute net loss per share attributable to | | | | | | | | |

| Common shareholders, basic and diluted | | 52,011 | | | 48,310 | | | 51,550 | | | 46,131 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

PROCEPT BioRobotics Corporation

RECONCILIATION OF GAAP NET LOSS TO ADJUSTED EBITDA

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | | $ | (20,974) | | | $ | (24,622) | | | $ | (72,557) | | | $ | (78.393) | |

| Depreciation and amortization expense | | 1,328 | | | 1,054 | | | 3,781 | | | 2.489 | |

| Stock-based compensation expense | | 8,512 | | | 5,326 | | | 22,755 | | | 14.153 | |

| Interest (income) and interest expense, net | | (1,296) | | | (1,126) | | | (4,694) | | | (1.477) | |

| Adjusted EBITDA | | $ | (12,430) | | | $ | (19,368) | | | $ | (50,715) | | | $ | (63.228) | |

PROCEPT BioRobotics Corporation

RECONCILIATION OF GAAP NET LOSS TO ADJUSTED 2024 EBITDA Guidance

(Unaudited, in thousands)

| | | | | | | | |

| | |

| | |

| | 2024 |

| Net loss | | $ | (90,500) | |

| Depreciation and amortization expense | | 5,100 | |

| Stock-based compensation expense | | 31,300 | |

| Interest (income) and interest expense, net | | (5,900) | |

| Adjusted EBITDA | | $ | (60,000) | |

PROCEPT BioRobotics Corporation

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands)

| | | | | | | | | | | | | | |

| | |

| | September 30, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 196,762 | | | $ | 257,222 | |

| Accounts receivable, net | | 69,048 | | | 48,376 | |

| Inventory | | 50,850 | | | 39,756 | |

| Prepaid expenses and other current assets | | 6,321 | | | 5,213 | |

| Total current assets | | 322,981 | | | 350,567 | |

| Restricted cash, non-current | | 3,038 | | | 3,038 | |

| Property and equipment, net | | 26,605 | | | 28,748 | |

| Operating lease right-of-use assets, net | | 19,267 | | | 20,241 | |

| Intangible assets, net | | 1,000 | | | 1,204 | |

| Other assets | | 1,251 | | | 919 | |

| Total assets | | $ | 374,142 | | | $ | 404,717 | |

| | | | |

Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 15,088 | | | $ | 13,499 | |

| Accrued compensation | | 18,834 | | | 16,885 | |

| Deferred revenue | | 7,989 | | | 5,656 | |

| Operating leases, current | | 1,839 | | | 1,683 | |

| Loan facility derivative liability | | 2,000 | | | 1,886 | |

| Other current liabilities | | 7,896 | | | 6,318 | |

| Total current liabilities | | 53,646 | | | 45,927 | |

| Long-term debt | | 51,438 | | | 51,339 | |

| Operating leases, non-current | | 27,361 | | | 26,182 | |

| Other liabilities | | 479 | | | 517 | |

| Total liabilities | | 132,924 | | | 123,965 | |

| | | | |

| Stockholders’ equity: | | | | |

| Additional paid-in capital | | 768,365 | | | 735,240 | |

| Accumulated other comprehensive gain (loss) | | (18) | | | 84 | |

| Accumulated deficit | | (527,129) | | | (454,572) | |

| Total stockholders’ equity | | 241,218 | | | 280,752 | |

| Total liabilities and stockholders’ equity | | $ | 374,142 | | | $ | 404,717 | |

PROCEPT BioRobotics Corporation

REVENUE BY TYPE AND GEOGRAPHY

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| U.S. | | | | | | | | |

| System sales and rentals | | $ | 19,643 | | | $ | 13,467 | | | $ | 50,978 | | | $ | 37,065 | |

| Handpieces and other consumables | | 29,620 | | | 17,047 | | | 81,217 | | | 42,418 | |

| Service | | 2,952 | | | 1,811 | | | 7,888 | | | 4,545 | |

| Total U.S. revenue | | 52,215 | | | 32,325 | | | 140,083 | | | 84,028 | |

| Outside of U.S. | | | | | | | | |

| System sales and rentals | | 3,155 | | | 828 | | | 7,974 | | | 3,896 | |

| Handpieces and other consumables | | 2,616 | | | 1,651 | | | 7,230 | | | 3,826 | |

| Service | | 384 | | | 298 | | | 975 | | | 860 | |

| Total outside of U.S. revenue | | 6,155 | | | 2,777 | | | 16,179 | | | 8,582 | |

| Total revenue | | $ | 58,370 | | | $ | 35,102 | | | $ | 156,262 | | | $ | 92,610 | |

| | | | | | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

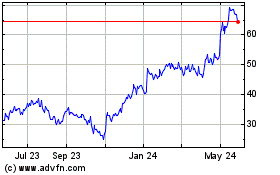

PROCEPT BioRobotics (NASDAQ:PRCT)

Historical Stock Chart

From Nov 2024 to Dec 2024

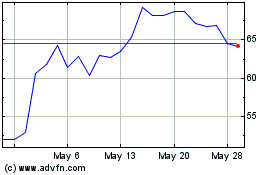

PROCEPT BioRobotics (NASDAQ:PRCT)

Historical Stock Chart

From Dec 2023 to Dec 2024