Qifu Technology Provides Updates on Share Repurchase Plans

31 December 2024 - 9:00AM

Qifu Technology, Inc. (NASDAQ: QFIN; HKEx: 3660) (“Qifu Technology”

or the “Company”), a leading Credit-Tech platform in China, today

provided updates on its share repurchase plans.

On March 12, 2024, the Company’s board of

directors (the “Board”) approved a share repurchase plan (the “2024

Share Repurchase Plan”), whereby the Company is authorized to

repurchase its American depositary shares (“ADSs”) or Class A

ordinary shares with an aggregate value of up to US$350 million

during the 12-month period from April 1, 2024. As of December 30,

2024, the Company had utilized substantially all of the total

authorized value for the 2024 Share Repurchase Plan. Specifically,

the Company had in aggregate purchased 15,110,617 ADSs in the open

market for a total amount of US$349,997,661 (inclusive of

commissions) at an average price of US$23.14 per ADS. The Company

intends to cancel all of the repurchased shares in accordance with

applicable rules and regulations.

On November 19, 2024, the Board approved a new

share repurchase plan (the “2025 Share Repurchase Plan”), whereby

the Company is authorized to repurchase up to US$450 million worth

of its ADSs or Class A ordinary shares over the next 12 months

starting from January 1, 2025. The share repurchases may be

effected from time to time on the open market at prevailing market

prices, in privately negotiated transactions, in block trades

and/or through other legally permissible means, depending on market

conditions and will be implemented in accordance with all

applicable rules and regulations, including the requirements of

Rule 10b-18 and/or Rule 10b5-1 under the U.S. Securities Exchange

Act of 1934, as amended (the "Exchange Act"). The Company has

entered into a trading plan in accordance with Rule 10b5-1 under

the Exchange Act to facilitate repurchases under the 2025 Share

Repurchase Plan during the Company’s quarterly blackout period that

begins on January 2, 2025.

About Qifu Technology

Qifu Technology is a leading Credit-Tech

platform in China that provides a comprehensive suite of technology

services to assist financial institutions and consumers and SMEs in

the loan lifecycle, ranging from borrower acquisition, preliminary

credit assessment, fund matching and post-facilitation services.

The Company is dedicated to making credit services more accessible

and personalized to consumers and SMEs through Credit-Tech services

to financial institutions.

For more information, please visit:

https://ir.qifu.tech.

Safe Harbor Statement

Any forward-looking statements contained in this

announcement are made under the “safe harbor” provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things,

the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. Qifu Technology may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (“SEC”), in

announcements made on the website of The Stock Exchange of Hong

Kong Limited (the “Hong Kong Stock Exchange”), in its annual report

to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

the Company’s business outlook, beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, which factors include but not limited to

the following: the Company’s growth strategies, the Company’s

cooperation with 360 Group, changes in laws, rules and regulatory

environments, the recognition of the Company’s brand, market

acceptance of the Company’s products and services, trends and

developments in the credit-tech industry, governmental policies

relating to the credit-tech industry, general economic conditions

in China and around the globe, and assumptions underlying or

related to any of the foregoing. Further information regarding

these and other risks and uncertainties is included in Qifu

Technology’s filings with the SEC and announcements on the website

of the Hong Kong Stock Exchange. All information provided in this

press release is as of the date of this press release, and Qifu

Technology does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

For more information, please

contact:

Qifu Technology E-mail: ir@360shuke.com

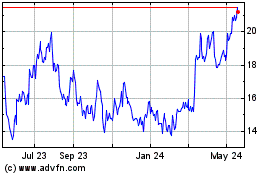

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

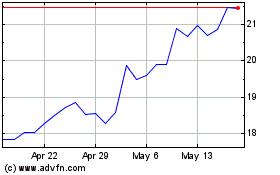

Qifu Technology (NASDAQ:QFIN)

Historical Stock Chart

From Jan 2024 to Jan 2025